Does an online broker charge withdrawal fees?

A broker allows buyers and sellers to enter the trading money. It helps facilitate smooth trading so both parties can perform exceptionally well in the market. In simple terms, brokers are a gateway to safe and efficient trade.

But have you ever wondered how trading brokers make money? Simple. Each registered trade pays a fixed amount of money to facilitate the trade through the platform. Depending on the policy, a trading broker charges a flat fee or a small percentage of the transaction.

Besides the amount paid for performing trade through the platform, traders sometimes have to pay brokerage fees, like withdrawal.

This article will discuss the withdrawal fee, why brokers charge it, and more.

What is a brokerage fee?

A brokerage fee refers to the amount of money one needs to pay to use the trading services. These services and features help to perform successful trades and manage investments.

Common brokerage fee includes withdrawal fee, annual fee, transaction fee, inactivity fee, and more.

Before registering with a broker, always read the terms and conditions to know what fee it charges. Each broker has different policies, so knowing the accurate fee structure can make a difference.

Withdrawal Fee

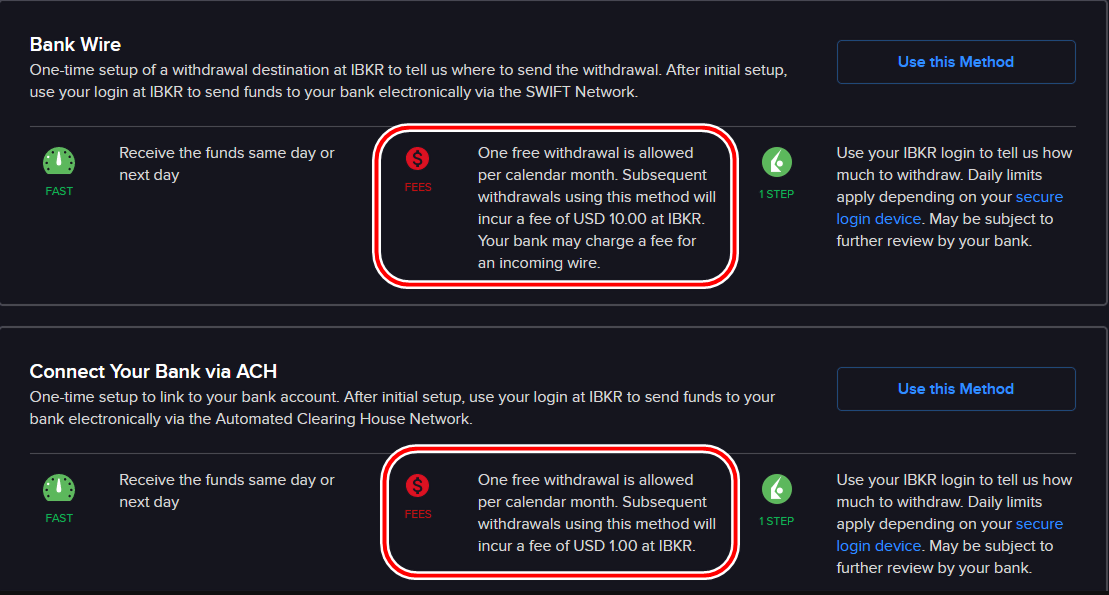

The withdrawal fee is a small amount you pay to withdraw money from your trading account. Many brokers have minimum withdrawal criteria that registered traders need to follow.

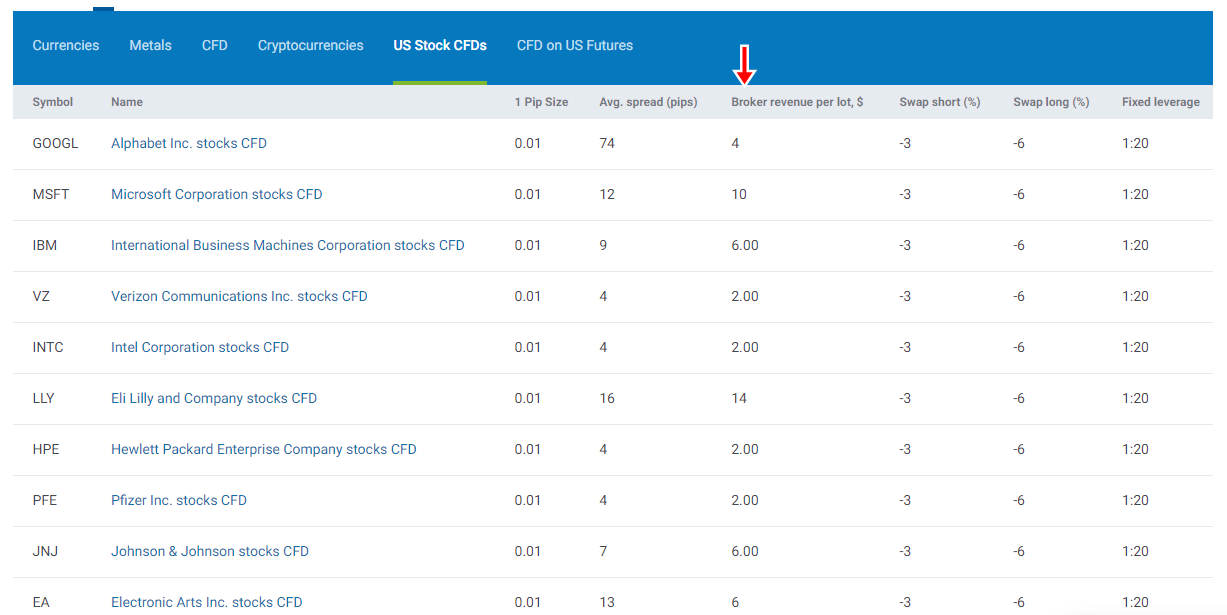

Depending on their policy, brokers may or may not charge a withdrawal fee. The fee you pay generally varies depending on the broker’s policy and the method you select for withdrawing the money.

Certain payment methods charge more processing fees than others. Thus, it’s better to know about it in advance to avoid paying heavy fees for each withdrawal and earn more money.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Why do brokers charge withdrawal fees?

If not all, some brokers charge withdrawal fees. Why? The answer is to make money. They charge fees so their firm can make a profit and continue offering the best trading services.

But how do brokers that do not charge a withdrawal fee make money? Well, they charge other sorts of fees for using their platform. For instance, such brokers can charge a commission per charge, inactivity fee, maintenance fee, deposit fee, or more.

Can you avoid withdrawal fees?

Avoiding certain types of brokerage fees, like inactivity fees, is fairly simple. All you need to do is log in to your trading account, or you can trade within the timeframe.

But avoiding brokerage fees like withdrawal fees is not possible. Even if the broker does not charge it, the payment method you use for withdrawing the money might charge a processing fee.

So, before committing to the trading broker, check the conditions that come with each fee. It can save you from unwanted surprises later.

Brokers with zero withdrawal fee

Here’s a list of brokers that charges zero withdrawal fees:

RoboForex

RoboForex is one of the best low-cost online brokers. That’s because it doesn’t charge its customers any trading fees when using pro accounts.

RoboForex does not charge any additional fees and you can withdraw your funds without commission.

It is ideal for experienced traders and novices alike thanks to its user-friendliness and educational content. For example, beginners can enjoy demo accounts and various tutorials that help them to enhance their trading skills.

Exness

Exness is a well-known trading broker with zero withdrawal fees on payment methods. It offers a variety of withdrawal methods, including e-payment, wire transfers, and credit cards.

Exness allows traders of certain regions to make withdrawals even from local banks. But you need to remember that deposits and withdrawals are activated through credit cards. Also, there is a minimum transaction limit. So, if you make a transaction less than the limit, Exness charges a small commission.

XM

XM is a reliable broker with zero fees. It focuses on offering the best services to traders with 0% deposit and withdrawal for every transaction. So, no matter whether you use a credit card, wire transfer, or e-currency, there is no charge.

But while depositing money to your XM trading account, you should follow the minimum deposit criteria.

Conclusion about withdrawal fees of an online broker

Trading brokers may or may not charge a withdrawal fee, depending on their terms and conditions. Besides the broker, the payment method you have selected for withdrawing the money also charges a small fee for the transaction.

Even if a trader does not charge a withdrawal fee, it charges other sorts of fees like inactivity fees, maintenance fees, annual fees, transaction fees, and more.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel