Plus500 minimum deposit: How to deposit money

Table of Contents

To begin investing through an online trading account, a trader should deposit funds into his account. He can deposit funds in his live trading account and start live trading. Plus500 is a trading platform that offers its clients access to the best securities in the market online.

If you are a beginner and skeptical about trading with Plus500, you can start and learn with a Plus500 demo account. A demo account will let you experience the world of trading and gather information and knowledge about the market.

With a demo account, you can also look at the operating practices of the broker. It will help you decide if you would like to shift to the live trading account. In other words, a demo account can be convenient in choosing a broker for yourself.

Once you have had an experience with a demo account, you can shift to your Plus500 live account. You can sign up for a live trading account on the broker’s website. If you are ready to invest some capital through your Plus500 trading account, you can begin with a minimum deposit amount.

Plus500 minimum deposit is $100. However, the minimum deposit can vary according to the payment method that you choose. Some payment options involve a low minimum deposit. Some payment methods require raising the bar for your Plus500 minimum deposit.

You can choose a payment method for your Plus500 minimum deposit according to the amount you want to invest. Also, while selecting a payment method for depositing funds into your account, you must keep the time frame in mind. For instance, deposits made through bank transfers can take up a few days. On the other hand, you can use your credit or debit card or an electronic wallet to fund your account within a matter of a few hours.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

About Plus500

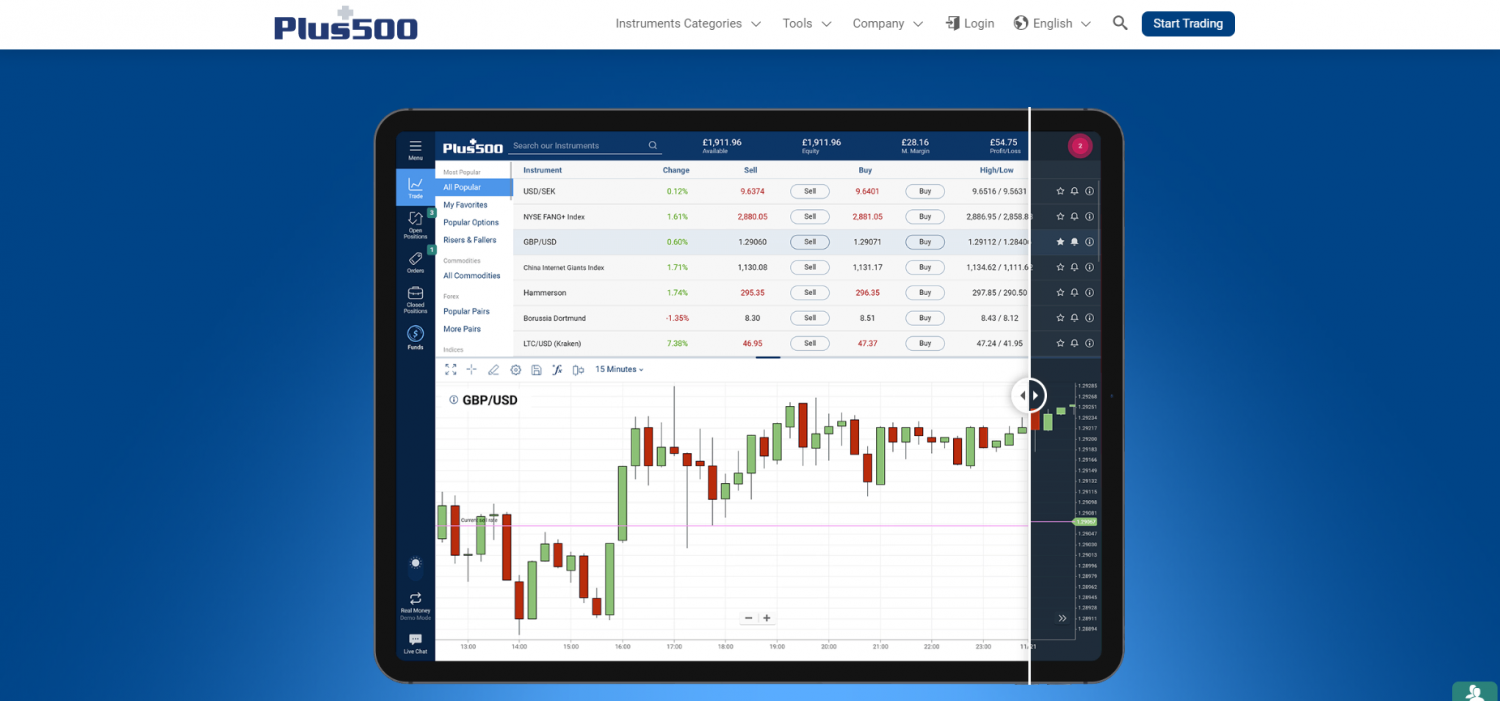

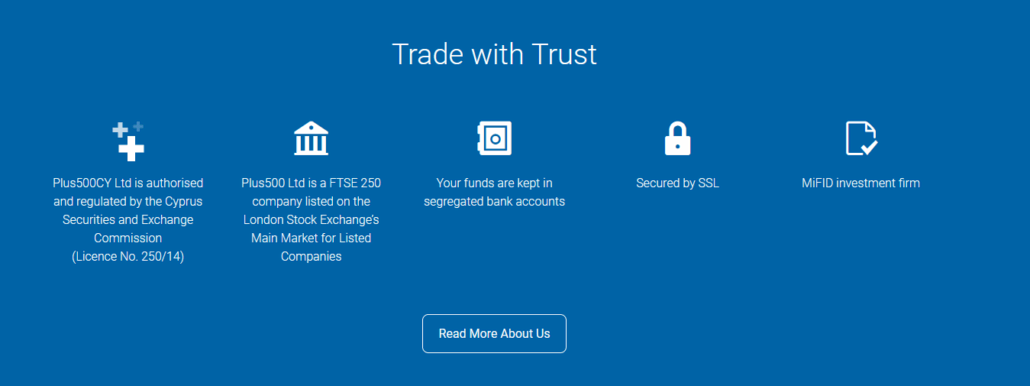

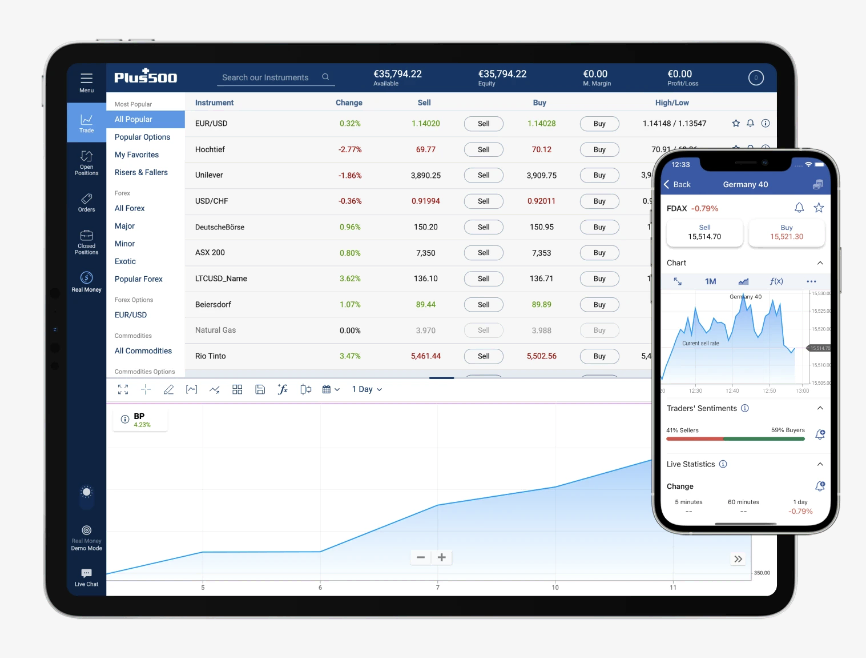

Found in 2008, Plus500 is a well-rounded broker publicly traded on the London Stock Exchange. It is a part of the FTSE 250 index and regulated in three tier-1 and four tier-2 jurisdictions.

For years, Plus500 has proved to be a loved online trading platform. Many investors trade with Plus500, and new investors join the broker every day. It falls under the category of a reputable broker because of its regulations.

Plus500 provides users with a secure online trading platform with a user-friendly interface. Though currently, Plus500 has limited education material for beginners, it is still the choice of many beginners.

If you are at the beginning stage of your investment journey, you can look up to this online trading platform without any doubt. It lets you sign up for a trading account without much trouble. You can deposit or withdraw funds from your Plus500 trading account anytime.

We will look at the process of depositing funds in your Plus500 trading account. But first, let us understand the meaning of a minimum deposit.

What is a minimum deposit?

A minimum deposit is an amount you should fund in your Plus500 account to trade with the broker. It is the kind of initial funding that lets you invest in real-world securities. With the help of these funds, you can start trading on the live market and withdraw them whenever you want to.

All online trading platforms have a different minimum deposit amount. Sometimes, it also varies according to the payment option a trader selects. At Plus500, a minimum deposit differs for various payment options. Let us know about the Plus500 minimum deposit.

How much is the Plus500 minimum deposit?

To start trading with Plus500, you can start with a minimum of 100 USD. However, this is a Plus500 minimum deposit if you use your credit/debit card or electronic wallet. If you want to transfer funds into your Plus500 account with a bank or wire transfer, the minimum deposit is $500.

Payment Method | Minimum Deposit |

Bank transfer | 500 USD |

Credit/debit card | 100 USD |

E-wallet | 100 USD |

However, if you have experience trading online and a niche for building investment strategies, you can invest more than $100 and earn profits with Plus500.

So, depending upon your experience, you can choose a Plus500 minimum deposit amount for yourself. You can deposit funds into your Plus500 trading account using the payment methods available with the broker. Below is a description of these deposit methods.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

Available deposit methods

All online trading platforms provide their users with a variety of payment options. If the users can choose a payment method they want to use, it makes things convenient. To make a Plus500 minimum deposit, you can choose from these deposit methods.

- Bank or wire transfers

- Credit or debit cards

- Electronic wallets

Let us discuss these deposit methods in detail.

Bank or wire transfers

Bank transfers, also called wire transfers, are the most common deposit methods that investors use to fund their Plus500 trading account. Like all the other online trading platforms, Plus500 also gives its clients an option to make a Plus500 minimum deposit through a wire transfer.

You can select this as your preferred deposit method while funding your trading account. Just like you pay for something online through your bank account, you can deposit funds to your Plus500 trading account by entering your bank account details.

However, while using this option, you should remember that you cannot use a third-party account to deposit funds to your Plus500 trading account. You can use a bank account that only belongs to you.

Credit/Debit cards

Card payments are another common deposit method preferred by many investors. Payments made through credit and debit cards offer the clients convenience as they can make a Plus500 minimum deposit without any trouble. Selecting credit or debit cards as their preferred deposit method is all a trader must do.

After this, they can enter their card details like card number, name on the card, CVV, etc., on the window that appears on their screen. Once a trader approves the payment, it gets credited into his online trading account. He can use this balance to invest in the securities of his choice.

Electronic wallets

Another deposit method that one can use to fund his Plus500 account with a minimum deposit is an electronic wallet or an e-wallet. Deposits made through electronic wallets are quick, sometimes instant. You can use this deposit method if you don’t miss investing in any security up for investment.

Deposits made with electronic wallets get credited into your trading account within a few hours. At most, it can take 24 hours for the funds to reflect into your trading account. You can fund your account through your electronic wallet by clicking on this payment option.

How long do these deposits take?

The time involved for the funds to credit into your trading account depends upon the payment method that you choose. Bank or wire transfers usually take more time than credit or debit cards. Electronic wallets, however, prove to be an instant method for the Plus500 minimum deposit.

Payment Method | Processing time |

Bank transfer | 4-5 business days |

Credit or debit card | Up to 24 hours |

Electronic wallet | Instant or might involve a few hours |

Deposits made through bank transfers involve a period of 4-5 business days. Credit cards, debit cards, and electronic wallets can help you transfer funds into your trading account within a few hours or a day.

Hence, you can choose a payment option that fits your needs in the best possible way. If you wish to fund your account instantly, you can select the option of an electronic wallet or deposit through card payment. However, if it does not bother you to wait for a long time, you can make a Plus500 minimum deposit with the help of a bank transfer.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

How to deposit – Tutorial

If you want to start trading with Plus500, you need to sign up for a live trading account. If you use a demo account, you can shift to a live trading account to experience real market trading.

To begin trading with Plus500, you need to make a Plus500 minimum deposit in your live trading account. You can follow the steps below to fund your trading account.

Sign up for a Plus500 online trading account

Signing up for a live trading account is the first step to adding funds to your account. You cannot add funds to your demo account. If you want to experience the volatilities of the market and try to earn through investing online, you can signup for a plus500 online trading account.

Enter all the relevant details into your account

After signing up, you can enter the relevant details to help Plus500 verify your identity. You can upload your identity card that verifies your name and identity. You will also need to upload residence proof to begin trading with Plus500.

Add funds to your account

After signing up and completing your account verification, you can make a Plus500 minimum deposit to your online trading account. You can click on the ‘Add funds’ option and add any amount of your choice. The minimum deposit for credit/debit cards or an electronic wallet is 100 USD. For payments made through bank transfers, you need to deposit a minimum of 500 USD.

Select a deposit method to enter the amount

You can select a deposit method that is comfortable for you. Plus500 offers its clients the option to choose from bank transfers, card payments, or electronic wallets. You can select a payment method keeping in mind the minimum deposit and the time involved in transferring funds. After this, you can enter the amount you want to fund into your account, starting with $100.

Approve and review the transaction

After completing this step, you can approve the payment process and wait for your Plus500 account to get credited with funds. If you used your card or electronic wallet to deposit funds, you should expect a fund transfer within a few hours. However, if you used the option of bank transfer, it might take 4-5 business days.

Problems that can occur while depositing funds

You may sometimes face problems while making a Plus500 minimum deposit into your live trading account. Here is a description of a few issues that can occur while funding your account.

Third-party deposits

As we said before, you cannot use someone else’s bank account or credit/debit card to fund your account. You must use only your bank account or credit cards. Plus500 does not accept deposits from a third party because it is against the regulations.

While depositing funds into your account, Plus500 can prompt you to verify your account. For this, you can upload your bank statement which the details of your bank account. These details should clearly show that the bank account belongs to you. So, if you are trying to fund your account through someone else’s bank account, you can quit trying it.

Using a corporate credit/debit card

You cannot use your corporate credit or debit because it is not registered in your name. You cannot use a payment method that does not have your name on it. You can use your credit or debit card to make a Plus500 minimum deposit.

Deposit limits

You should also keep in mind the maximum amount you can deposit to your Plus500 account. The maximum limit differs according to the country in which you reside. Sometimes, there is a limit on your deposit because of credit reasons. So, if you cannot funds into your Plus500 account, you might have reached the deposit limit.

Deposit currencies

All online trading platforms offer their clients a variety of deposit currencies. Every trading account has a base currency, and the online trading platform holds the money deposited by the client in that currency. For example, you can deposit funds into your Plus500 trading account in USD or GBP.

| Available deposit currencies | 16 |

It is crucial to check the availability of the deposit currencies on any trading platform to avoid any conversion fees. Fortunately, Plus500 offers its clients many deposit currencies, including the major ones.

It offers its clients the convenience of depositing funds in 16 base currencies. It includes USD, GBP, EUR, etc. If you wish to deposit funds in any currency other than USD, you can take a look at the list of deposit currencies on Plus500’s website.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

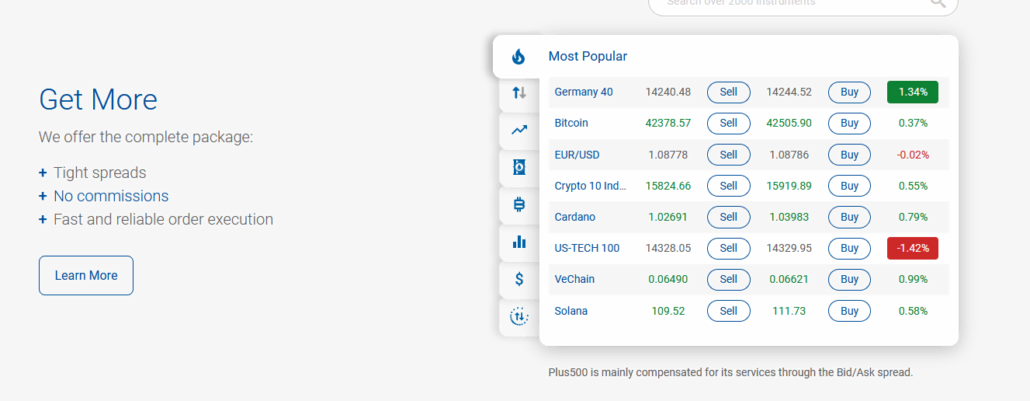

Fees/Charges for depositing funds

Plus500 does not burden its clients with hefty deposit fees to fund their online trading account. As a matter of fact, Plus500 does not charge any deposit fees from its clients.

| Deposit fee/charges | 0 USD |

So, you don’t have to bother spending a lot of money to fund your account to start investing. You can begin trading with Plus500 at a zero cost. It is one factor that tempts many investors to join the community of Plus500.

Conclusion

Plus500 is a suitable online trading website for experienced traders. An investor can test the working of the broker through a demo account. After this, he can switch to a live trading account with only a click of the mouse.

The Plus500 minimum deposit is a very nominal amount of $100. However, if you want to fund your account through bank or wire transfers, you can start with a minimum of $500. The deposit process is straightforward as there is not much problem involved. The broker also offers numerous deposit methods to its clients.

You can make a Plus500 minimum deposit using a bank transfer, credit/debit card, or an electronic wallet. To sum it up, Plus 500 can be an ideal online trading website for you.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

FAQ – The most asked questions about Plus500 minimum deposit :

How can I deposit funds into my Plus500 online trading account?

You can deposit funds into your Plus500 trading account after shifting to a live trading account. You only need to click on the ‘Add Funds’ option to fund your account. A list of payment methods will appear on your screen. You can select any one payment method and continue with the process of making a Plus500 minimum deposit.

What is the minimum amount needed to fund my account?

To fund your account with a Plus500 minimum deposit, you can start with $100 if you use your credit/debit card or an electronic wallet. If you want to fund your account through a bank transfer, you can begin with $500.

Which payment method can you use to deposit funds into my Plus500 account?

Plus500 offers three payment methods to deposit funds in one’s trading account. These methods include card payments, bank transfers, and electronic wallets. You can use an option that suits you the best and fund your account to invest across different CFDs and forex.

Does Plus500 charge any fee for depositing funds?

You can deposit funds to your PLus500 account without any stress of paying a deposit fee to the broker. All deposits are free of any charge on Plus500. So, you don’t have to pay any deposit fee for funding your Plus500 trading account.

Is there any maximum limit on Plus500 deposits?

There can be a maximum limit on your Plus500 deposit. This limit depends upon the area in which you reside. The maximum limit varies from country to country. If you want to know the maximum limit on your deposits, you can check it on Plus500’s website.

What is the process for the Plus500 minimum deposit from my Plus500 account?

Follow these instructions to start trading by funding your trading account with the Plus500 minimum deposit:

Go to the fund’s option.

Choose ‘deposit.’

Then, select a deposit method to fund your account from the options given.

Enter all the necessary pieces of information. Then click on the deposit option.

You can begin with your deposit on Plus500.

Which payment methods does Plus 500 offer to make the Plus500 minimum deposit?

You can use one of the below-mentioned Plus500 minimum deposit methods.

Bank transfers

Cryptocurrency

Electronic wallets

Card payments

So, trading on Plus500 is convenient for any trader as he has a lot of payment methods at his disposal.

In which countries is the Plus500 minimum deposit available highest?

This broker has a similar Plus500 minimum deposit for traders everywhere. Your trading account can be funded with any amount starting at $100. Besides, the services of this trading platform are the best. Plus500 is a multinational fintech company that provides online trading services. You can start with contracts for difference (CFDs), futures trading, share dealing, and options on futures. The company has associates in Australia, Bulgaria, Estonia, Israel, the UK, Cyprus, Seychelles, Singapore, the United States, and Japan.

See more articles about forex trading here:

Last Updated on October 27, 2023 by Andre Witzel