CMC Markets minimum deposit: How to deposit money?

Table of Contents

Are you planning to trade with CMC Markets? CMC market is a leading and regulated forex broker. Since 1989, it has adapted to the changing online forex trading landscape.

The trading platform has many impressive features and offers a “Next Generation” online platform to enjoy a safe and hassle-free trading experience. Besides, it also has the ubiquitous MT4 platform and comes with a well-developed mobile application.

They easily access various offerings, spreads, and CFDs betting throughout different assets using this. Another great thing about this platform that you need to consider is the CMC Markets minimum deposit.

Some forex brokers want their traders to deposit a minimum amount to open a trading account, but CMC Markets doesn’t have such requirements. As a result, the minimum deposit to open your account with CMC Markets is zero.

You can open stockbroking, spread betting, corporate, or CFD accounts without depositing money. But the broker advises a deposit of around USD 200 to enjoy the potential forex trading opportunities.

This feature has attracted customers and increased interest in forex trading. You can make transactions through wire transfer, debit or credit cards, and more. There are no deposit fees/charges. Let’s talk about how one can make the deposit.

Who can use this platform?

This online trading platform is suitable for beginners to experienced forex traders. If you are low on budget and want to get into forex trading, CMC Markets can be a good option. The broker’s fees are competitive within the industry.

Understanding the costs

Most of the trading fees/charges at this platform are very competitive and are charged through the spread. You will not find the broker charging any hidden fees. Well, spread a way that this platform makes money.

GSLO- Guaranteed Stop Loss feature is only available in the “Next Generation,” The users will have to pay an added premium for that. However, the cost will be refunded if the GSLO remains untriggered.

CMC Markets also charges a small percentage of a commission when you trade shares and ETFs. Advertised minimum spreads range between 0.7 pips to 0.9 to 1.0 pips. On the other hand, the overnight holding or margin costs are also very competitive.

As per the information given on the site, the broker doesn’t have any minimum deposit requirements. So, you can open a live account without depositing money. But you will have to add sufficient funds if you want to execute a trade.

Users with high account balances can enjoy premium services, such as rewards, rebates, a personal account manager, better trading leverage, segregated accounts, and more.

Now let’s talk about non-trading-related fees for CMC Markets. First, the online broker will charge £10 inactivity fees per month, meaning if you don’t trade for 12 months, the account will be inactive. Besides, it also charges a market data fee for some CFD shares.

Even though it is a great platform for forex trading, every trader must understand the minimum amount they need to begin trading. So make sure that you have adequate funds to meet the trading requirements of CMC Markets.

Besides, it is advisable to remain updated about the exchange rate between the USD and ZAR or the South African Rand or the US Dollar. You should also know about other accepted deposit currencies. And don’t forget to check the fees/charges of the platform.

This is an online broker regulated and authorized by some well-known global entities, such as IIROC, FMA, ASIC, and more. One of the crucial requirements of a licensed broker is that the traders’ funds should be kept in segregated accounts.

What is the minimum deposit?

One of the major reasons behind the increasing popularity of this online broker is CMC Markets minimum deposit. Well, it doesn’t require any minimum deposit. That means you can create an account at $0.

However, the traders will have to maintain the required margin in the trading account to open positions. But you can open a live account with any amount of initial deposit.

This is a huge advantage for an online broker of this caliber to function with such a great level of flexibility. But some experts suggest having a minimum amount of USD 5 to begin the trading process.

Available deposit methods

When it comes to offering a pleasant customer experience during trading, every broker needs to make sure that they offer different payment methods that the traders demand—for example, PayPal, card payment, and more.

By offering multiple gateways, brokers have managed to attract more users. Besides, this approach also offers a great backup to them if the primary payment gateway faces any technical issues.

Talking about payment methods, CMC Markets provides the users with different ways to add funds into the trading account. For example, the users can easily deposit money through debit cards, credit cards, PayPal, Wire transfer, and more.

You may note that all the deposits are charges-free, and you can don’t through the Client Portal of CMC Market. Both the deposit and withdrawal methods are industry standard and simple regardless of whether you are doing commodity, stock, or currency trading.

Apart from different payment methods, the platform also accepts ten different currencies in terms of deposits. If you want, you can also go for live wire transfers. Unfortunately, the broker doesn’t accept Dinner cards or AMEX cards.

If the users add funds from outside of the United Kingdom, they will be charged bank transfer fees. In addition, cards the users want to register to their account will have to be enrolled with the 3D secret for successful payments.

There is something that you need to keep in mind while depositing the money. To keep up with the international banking law, the users may be asked to submit the banking information and personal ID information while withdrawing the money.

All the traders need to ensure that the account they are making the deposits matches the name used for the live trading account. As per the information, CMC Markets don’t prefer any third-party payments.

Depositing money through debit and credit cards

One of the easiest ways to make payment while using CMC Markets is using your credit or debit cards. Through this, you will enjoy an instant fund transfer. But, well, sometimes, the depositing process may take time.

So, you don’t have to worry about this and can also get in touch with CMC Markets’ customer support team if the process takes more time.

Depositing money through wire transfer

This deposit method allows the traders to deposit money electronically across the globe, and it doesn’t require physical contact. However, based on your bank, you may need to pay a transaction fee for this.

To make the payment through the Wire Transfer, the traders may need to provide the recipient’s BIC, SWIFT, or IBAN codes. It may take a few hours to complete the process. However, sometimes, it can take around seven days.

Depositing money through e-payment gateways

Looking at the increasing popularity of e-payment methods, CMC Markets also has added different e-payment methods to the platform. Under the e-payment methods offered by CMC Markets, you will get Skrill, Webmoney, Neteller, and more.

This depositing money to the trading account is fast and highly secure. The money will reflect in the account within 24 hours.

How to deposit – Tutorial

As discussed above, the traders don’t need to make any minimum deposit to activate their live trading account. However, they will not be able to trade until they have deposited sufficient funds into your account.

Even though there is zero CMC Markets minimum deposit, the online broker has advised the users to deposit around USD 100 to start trading. So, how to make your deposits?

CMC Markets provides its users with simple deposit methods, and the process is also very simple. However, here are some important steps you need to follow to complete the process.

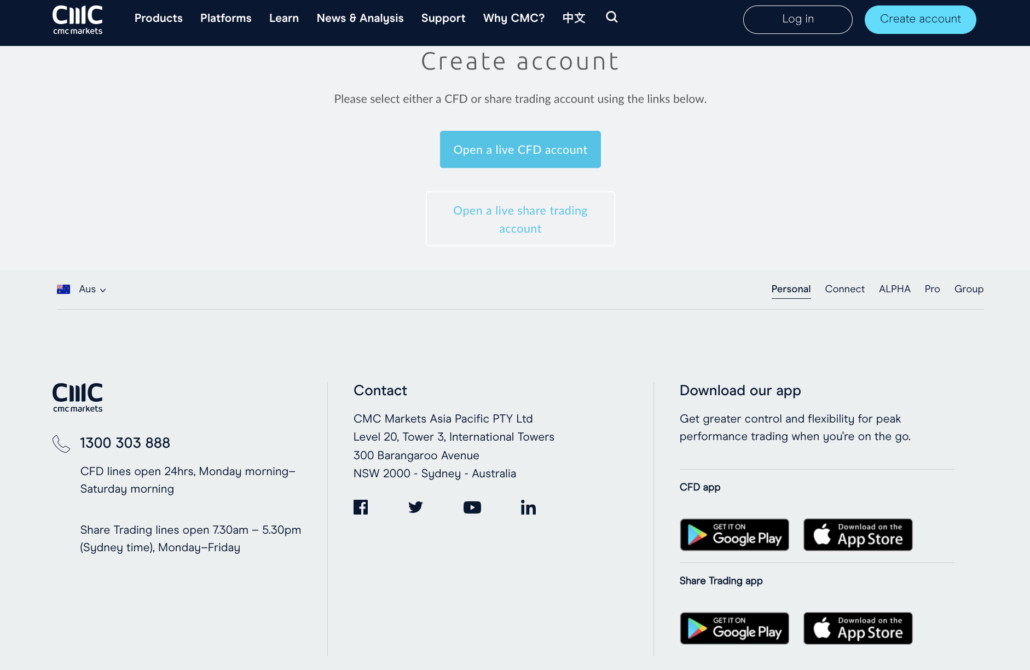

Open your CMC Markets trading account

First of all, you need to open your CMC Markets account using your login ID and password. If you don’t have an account, you can easily create one online within a few seconds. Then, all you need to do is fill out the online form with all the required data. Then you need to complete the identity and residency verification process, and you are ready to use the account.

Account creation at CMC Markets is straightforward and intuitive

Locate the payment option

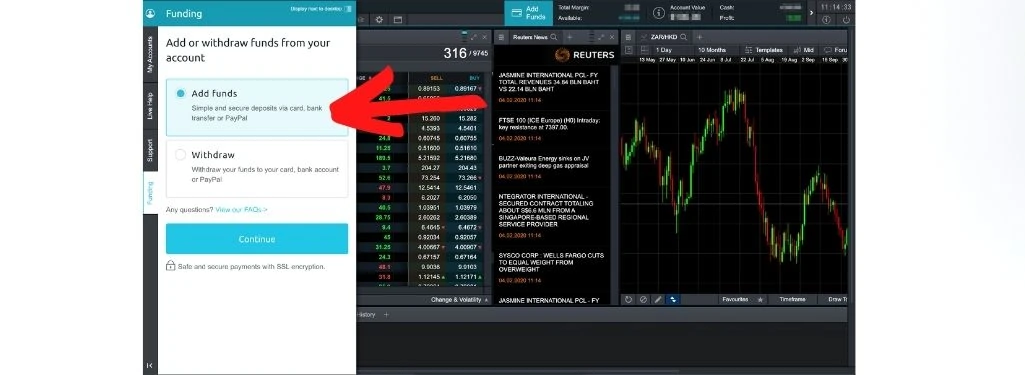

After login into your CMC Markets trading account, you need to find the payment icon on the platform. You can find that icon at the top of the CMC Markets platform. Click on that to begin the process of depositing money.

The broker has advised you to allow “Pop-ups” so that you can view the payment windows to begin the process.

Choosing the deposit methods

After clicking the Payment icon, you will see your account details. You need to choose a deposit method from the available options based on your preference. You should understand the chargeable fund transfer fees before making the payment. You can go for:

Bank transfer or Wire transfer

You need to add the bank account number in the appropriate box on the deposit screen. First, ensure that the bank account you want to use is in your name. After that, you can start a wire transfer.

CMC Markets will provide you with a transaction reference number, and you need to enter that number as a comment in your transaction. It will help in identifying the deposit.

Debit or credit cards

To make a deposit using your debit or credit card, you must enter the card details—for example, card type, expiry date, name on the card, and more. However, sometimes, the traders may need to verify their cards by scanning and then sending that to CMC Markets.

Online wallets

You can use Neteller, Skrill, or PayPal as a deposit method based on your preference. When you choose this option, a pop-up will appear on the screen to put the credentials, like user ID and password, to carry out the transactions.

Enter the desired amount

Put the amount you want to deposit into your CMC Markets trading account. To enjoy all the trading platform features, you should deposit more than USD 100.

Complete the process

You can see a proceed button on the window. Just click on that, and the deposit process will get completed within a few seconds.

Don’t forget to review your transaction

It is always advisable to review the deposit transaction. Based on the payment methods you choose; it will take time for the deposit to reflect on the trading account. Once done, the broker will notify you through an email.

Make sure that the broker has sent you a valid deposit receipt. If it takes more time, then contact the customer support team of CMC Markets to know the current status of your transaction.

How can one cancel a deposit transaction with CMC Markets?

It has been seen that some traders make mistakes while making the payments. However, when using the CMC Markets platform, you don’t have to worry about this as the broker allows the traders to cancel the transaction.

With this option, you can rectify the deposit and make a correct transaction. How to cancel the process? All you need to do is send an email to the CMC Markets customer support team.

After receiving your mail regarding the cancelation of the deposit transaction, the team will cancel it immediately.

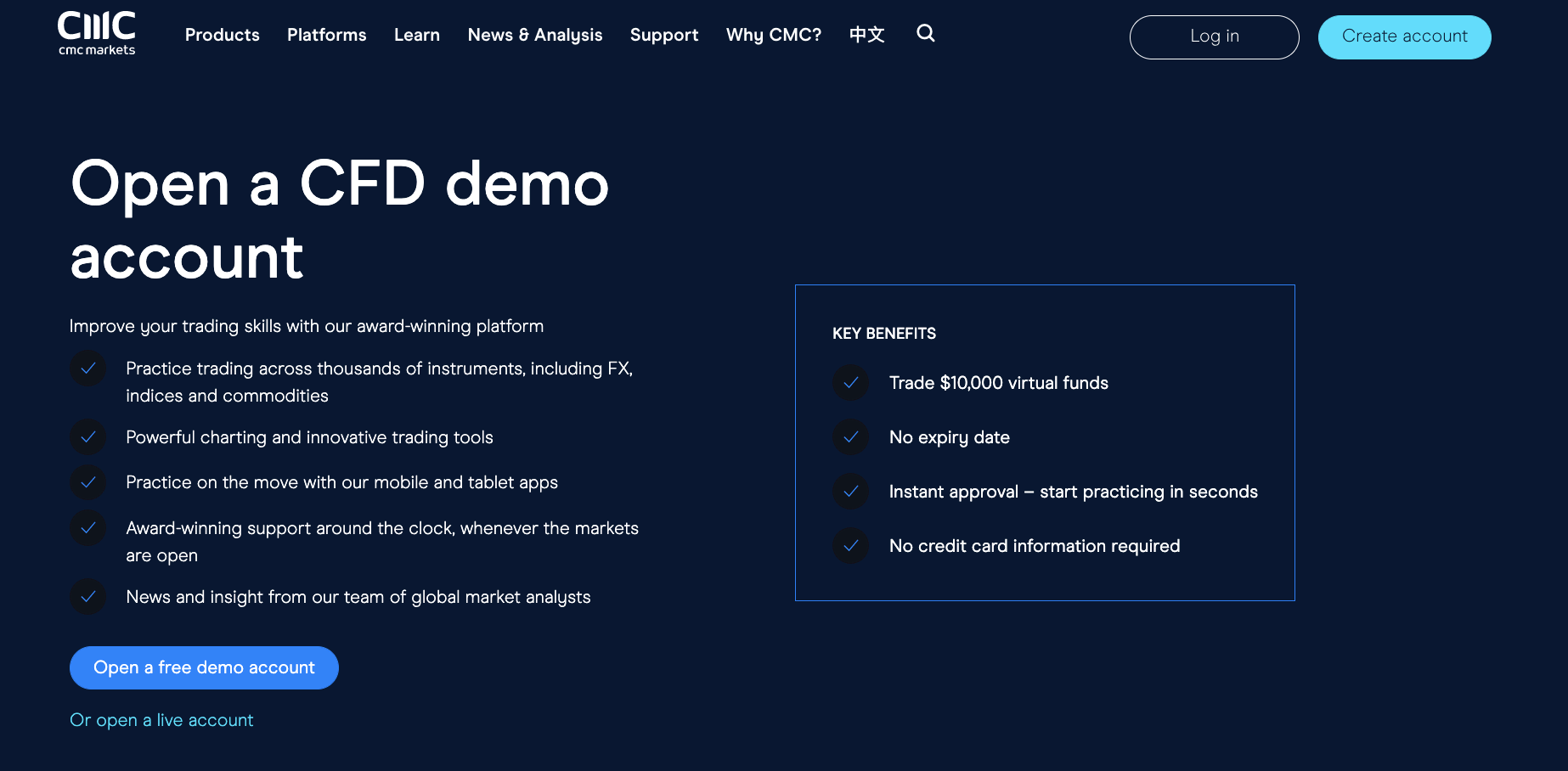

Before depositing money for trading, take advantage of its demo account

Most traders prefer to use this broker because the platform supports a zero CMC Markets minimum deposit and different easy payment methods. This feature has attracted a lot of users across the world.

However, if you are new to it, you should understand everything about the platform before making your deposit. It is where you can use its free demo account. Using this account, you can understand the trade and charting tools offered by the platform.

Besides, you will also get around £10,000 of virtual cash, and you can use this account for an unlimited time to sharpen your trading skill. The best part is that you don’t have to put your debit or credit card information to use it.

Once you get familiar with the trading process and tools, you can add funds to your trading account through any payment methods mentioned above and begin trading.

Conclusion

If you are new to this market and looking for a reliable online trading platform to begin your journey, then CMC Markets can be the best option for you. It is a licensed and well-regulated broker with different accounts.

The accounts feature no minimum deposit and have competitive spreads. The users will access the largest range of financial assets available in the industry through the account. If you search for the lowest deposit broker, give CMC Markets a try.

The innovative and advanced proprietary platform comes with various fundamental and technical analysis tools. Besides, it also offers education as well as market analysis materials.

The best part is that the broker offers a fast and easy way to deposit money so that you can get started with the platform immediately. In addition, it supports different deposit methods, as mentioned above. So, go on, deposit the money now and enjoy smooth and safe trading.

FAQ – The most asked questions about CMC Markets minimum deposit :

Is CMC Markets a legit broker?

Yes, CMC Markets is a legit broker that offers different assets to invest and earn money. Besides, CMC Markets’ platform, trading costs, mobile apps, education, ease of use, advanced trading tools, and range of markets are quite good. So, you can give it a try.

Does one need to deposit funds activate the account?

Once you are done with the account verification process, you can sign in and start using your CMC Markets trading account. But you can’t carry on a trade without depositing sufficient funds in the account. So even though this legit online broker doesn’t have any minimum deposit, you need to ensure that you have sufficient funds to cover the margin requirement when you open positions or enter the trades.

Does the broker charge any withdrawal fees?

As per the information mentioned on the official site, CMC Markets doesn’t charge fees for withdrawing money from the trading account. However, it is advisable to verify whether your bank or financial institution charges fees for transactions or not.

How much is the CMC Markets minimum deposit?

Well, CMC Markets doesn’t require any minimum deposit, but the account holders need to add sufficient funds to begin trading. However, the broker suggests the traders make USD 100 to USD 200 of the initial deposit to enjoy all the available services of the platform.

Is there a minimum value for CMC markets minimum deposit?

No minimum deposit is required when creating an account. Being a better CFD trader is our goal for you. To help you get the most out of the financial markets and CFD trading, we constantly innovate our platform and product line. This is because we are passionate about online CFD trading.

What are the different methods for CMC Market’s minimum deposit?

Regarding payment options, CMC Markets offers a variety of ways for customers to deposit money into their trading accounts. Users can effortlessly deposit money using a variety of methods, including debit cards, credit cards, PayPal, wire transfers, and more.

You should be aware that all deposits are free of charge, and you may make them using the CMC Market client portal. Whether you trade commodities, stocks, or currencies, the deposit and withdrawal procedures are both straightforward and industry standard.

Is there a commission fee on CMC markets minimum deposit?

The broker does not have a minimum deposit requirement, according to the information provided on the website. Therefore, opening a live account is possible without making a deposit. However, if you want to perform a trade, you must add enough money.

When you trade shares and ETFs, CMC Markets additionally levies a tiny proportion of a commission. The minimum spreads advertised range from 0.7 pips to 0.9 pips to 1.0 pips. On the other hand, the overnight holding or margin fees are relatively affordable.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller