How much does it cost to trade with CMC Markets? – Spreads & fees explained

Table of Contents

When it comes to trading, every trader should look at the spread and different fees charged by the online broker. And it will be better for you to choose one that offers the lowest spreads in the industry so that you can make more profits.

While some brokers charge fees for different activities like depositing and withdrawing money, some offer cost-free services to their customers. And one such online trading broker is CMC Markets.

Speaking about CMC Markets, it has become one of the most popular brokers and offers more than 11,000 instruments through the traditional CFD assets. The broker is well-known for offering fully developed spread betting solutions.

Based on your preference, you can trade indices, shares, forex, cryptocurrencies, commodities, and treasuries. While offering a well-designed proprietary trading platform, CMC Markets also offers a Metatrader 4 platform.

Now, let’s talk about the most important thing about this platform, i.e., spreads and fees. CMC Markets guarantees reliable and competitive pricing. So when it comes to enjoying a low-cost trading experience, you can always trust CMC Markets.

The official site says the platform offers better spreads across and charges very nominal fees for its products. For example, just 1 point on major indices, such as Germany 40, and UK 100, 0.7 points on EUR/USD and on Gold, the spread is only 0.3 points.

What’s more? The broker claims to offer the lowest online rate, and it starts from 0.075 percent or USD 9.90. So, looking at this statistic, it can be said that compared to other major trading platforms, CMC Markets fees are very low and attractive. Let’s discuss this in detail.

Fees of CMC markets

As per the experts, it can be said that CMC Markets generates its revenue through spreads, commissions, and different fees, based on the types of assets traded by the traders. For forex trading, the spreads begin with 0.7 pips.

This is quite competitive, and commissions are also charged. On the other hand, in the case of equity trading, the spreads begin from 0.10 percent. On the other hand, you will also have to pay other trading costs.

For example, the broker may charge a small premium on features like Guaranteed Stop Loss. However, the money will get refunded if your trade order is not executed. Besides, there are also some other fees, like swap rates, market data feeds, holding costs, and more than the broker charges.

List of fees that can occur when you trade with CMC markets

In general, online trading brokers charge quite a lot of brokerage fees compared to the traditional brokerage as such businesses can be scaled much better. Well, from a technical point of view, it will not make a huge difference for them if they have 10000 or 100 clients.

But you can’t say that they don’t charge any fees at all and there are no costs related to trading. They generally make money by charging the traders at different events for different rates. Well, here are different types of costs a trader may incur based on the trading activities.

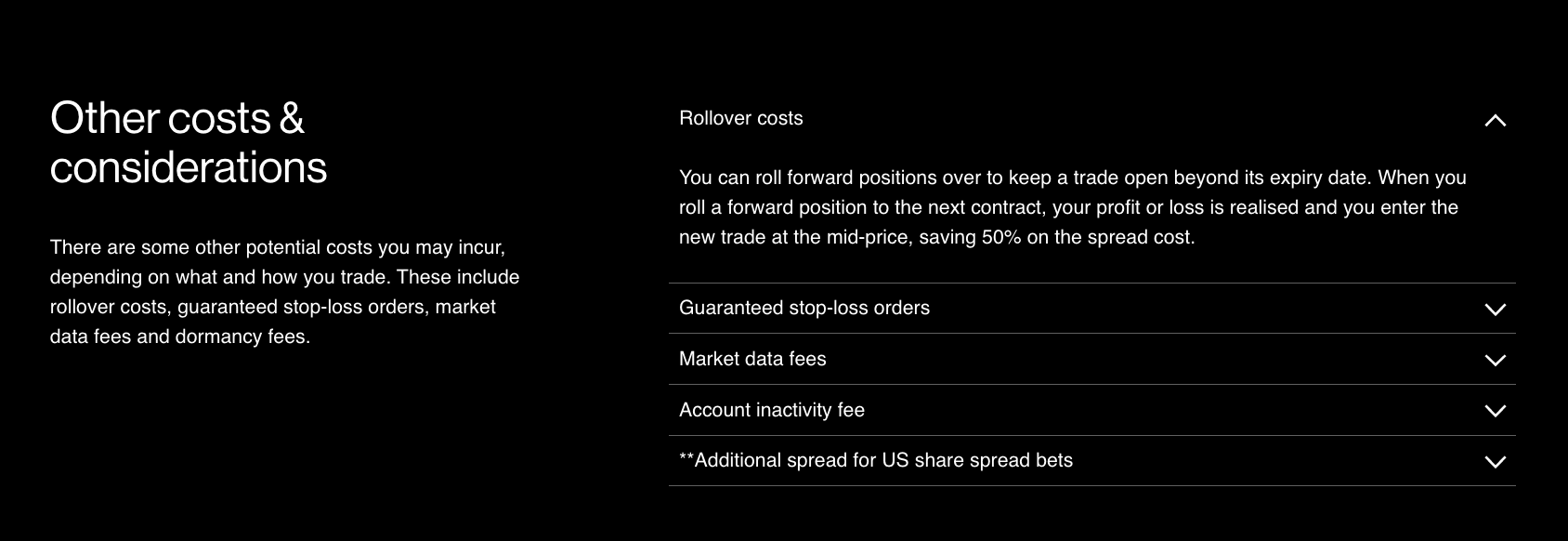

Rollover costs

The rollover cost in CMC Markets is the total interest return on a trade position held by the traders overnight. By paying a certain percentage of rollover rate, you can roll forward the opened position and keep trading beyond its expiry date.

The interest earned or paid while holding the trade overnight is called rollover cost. In general, if the position is open after 5 PM, that should be held overnight. When you move the position to a new contract, your loss or profit will be realized, and you will enter into a new trade but pay the mid-price.

As per the experts, with this type of trading, one can save around 40 to 50 percent on the total spread cost. CMC Markets will calculate the rollover interest fee considering the difference between the currencies’ interest rates. If there is a positive rollover rate, then you will make a profit. If it is negative, then that will be a cot for you.

Guaranteed stop-loss orders

The platform also charges for using its advanced and effective GSLO – Guaranteed Stop Loss Order feature, which is risk management. Well, this tool functions just like the traditional stop-loss feature, but in the case of CMC Markets, you will have to pay a fee.

It is quite more powerful than the regular stop-loss and guarantees to close the trade at the price you have specified. No matter what is the market gapping or volatility, the tool will execute the order.

The company also says if the feature is not triggered, then they will refund 100 percent of the GSLO charge. Wondering how the GSLO charge is calculated? Well, it is generally calculated by multiplying your premium rate by your bet size.

However, you should always keep in mind that the GSLO can be used only during trading hours. And you need to place it near the current market price. All the modifications are free, and you can also switch to a regular stop-loss or cancel it based on your requirements.

Market data fees

By activating the market data subscriptions offered by CMC Markets, the traders can view the price data of different CFD instruments. The cost of the monthly subscription will vary based on the market data classification and the type of account you are using.

Once activated, the subscription will be renewed automatically on the month’s first day. However, make sure that you have an order or position under the market data subscription. If there is no position, then the trade will be unsubscribed automatically.

The details of the subscription charges can be located in the Market Data section under the Under Preference menu. The platform also offers a market data rebates facility to professional clients.

If you are a private investor and have executed multiple trades under the same subscription during a particular period, then the broker will refund that fee to the account. However, the rule is a little different for non-private investors.

To get qualified for a refund, the non-private investors need to execute at least five trades under the subscription. However, they should keep in mind that they are subjected to higher fee charges.

Currency conversions fees

As per the rules of the CMC Markets platform, the profit or loss realized through trading will get converted into the respective account currency automatically. And for that, the broker will charge a nominal current conversion fee.

The official site says the currency conversion rate is the mid-price of the foreign exchange cash product for the respective currency pair +/- 0.5 percent.

Account inactivity fees

Your trading account will be considered inactive or dormant if there is no open position or if you have not carried out any trading activity for one year. After that, CMC Markets will charge £10 inactivity fees per month.

The monthly charge will be deducted from the account until either:

- The account balance is lowered to zero.

- Trading activities carried out on that account: or

- The trading account is closed by CMC Markets or the clients.

Well, if you want to reactivate the account for trading, then you will have to pay fees for up to 3 previous months or £30.

Exploring spread in the CFDs trading on CMC markets platform

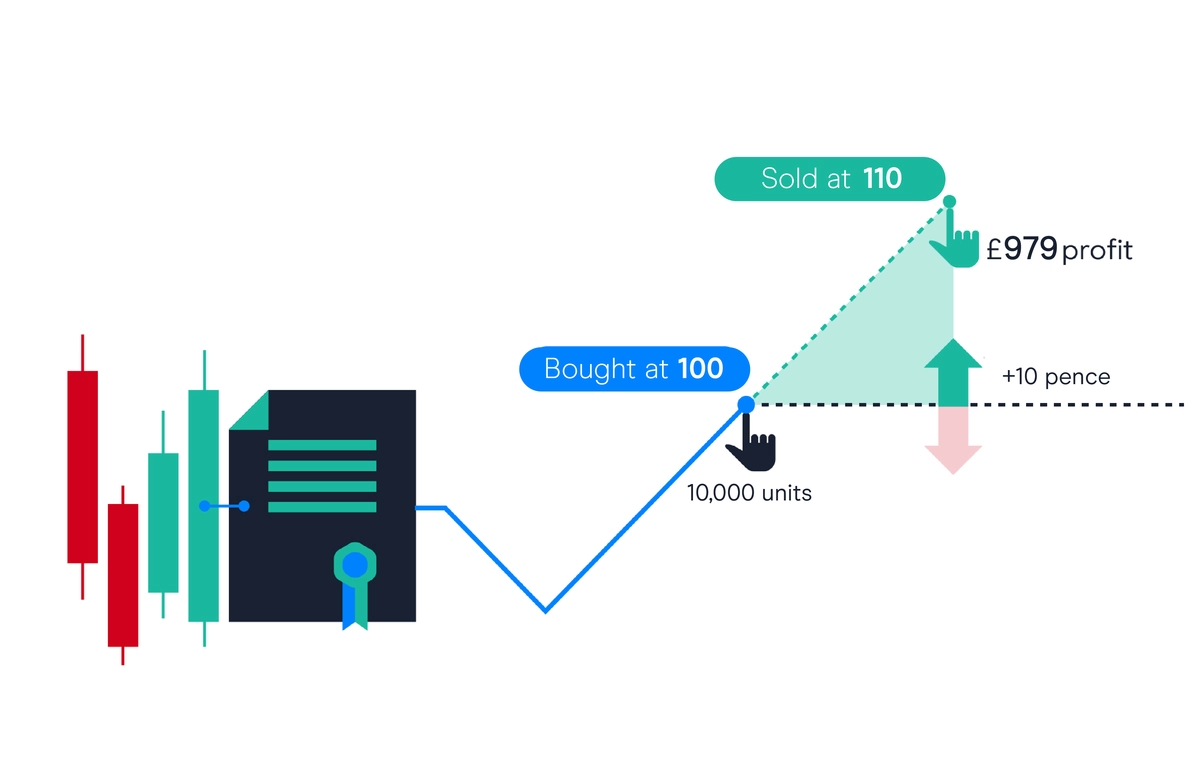

Speaking about the spread, it is the difference between the asking price and bid price or the buy and sell price of the currency pairs. When you look at any currency pairs, you will see two different prices.

The bid price is the price at which a trader can sell the currency, and the asking price is the price that you need to pay to buy the currency. Even though CMC Markets offers very low spreads, sometimes, it can vary based on different factors, like the size of the trade, currency pair you want to trade, volatile levels, and more.

Let’s understand this with an example. Let’s imagine you want to buy trade on the EUR/USD currency pair, and the price chart shows 1.2000. However, your broker will give you two pricing options, i.e., 1.2002 and 1.2000.

If you click on the buy option, you will buy the position at 1.2000. Well, when you exit it, you will still have to pay the spread. The reason behind this is no matter whatever the costs show during the time of exit; you will get two pipes above the cost. If you want to exist at 1.5570, you will actually exit at 1.5572.

The spread is the cost of trading that you pay to the broker. The bid price will be higher, and the asking price will be lower. To make a profit from this, make sure the price is enough to cover up the costs of the spread.

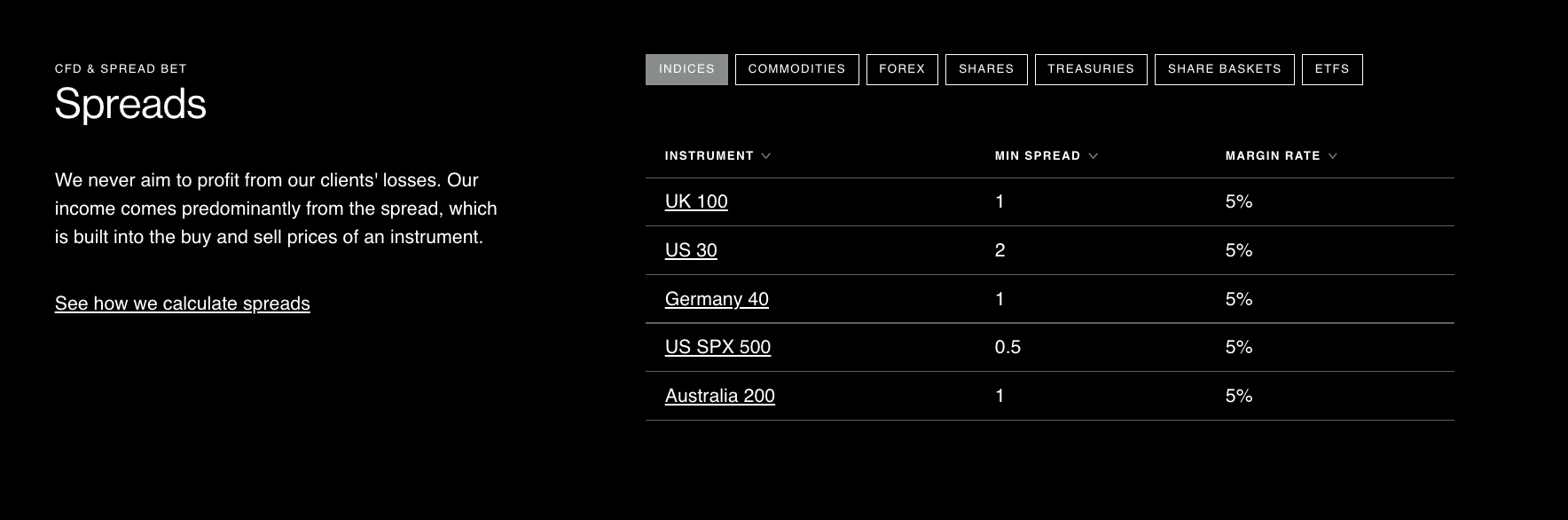

Tables of fees & spreads

INSTRUMENT | MIN SPREAD | MARGIN RATE |

|---|---|---|

US 30 | 2 | 5% |

UK 100 | 1 | 5% |

Germany 40 | 1 | 5% |

Australia 200 | 1 | 5% |

US SPX 500 | 0.5 | 5% |

CFD commission

Talking about a commission, it is just like a spread and is generally charged to you on every trade you make. To cover the cost of the commission, you should attain sufficient profit in your trade order.

There are generally two types of commissions that you may need to pay. These are:

Relative fee

This is the most common way to calculate the commission. Here, the amount is charged on the basis of trade size. The trade volume is high, then the cash value of the commission will be higher.

Fixed-Rate

The broker will charge a fixed amount without considering the volume or size of the trade. For example, you may be charged USD 1 per trade.

The commission, in the case of CMC Markets, can vary based on the type of share you want to trade. Here are some examples to consider.

Spanish share examples

As per the information mentioned on the official site, CMC Markets will charge a 0.10 percent commission on the Spanish share. And the minimum charge is €9.00. So, if you go for a 2500-unit trade at a price of 5.20, then you will have to pay a commission of €13.00.

2500 x 5.30= €13,000. Now the commission of 0.10 percent will be calculated at €13,000. That means, it is €13,000 x 0.10 percent= €13.00. If you are buying less, the commission will be low.

US share example

CMC Markets charges 2 US percent per share if you are buying a US share. On the other hand, the minimum commission charge is USD 10.

S, if you are going for a 600-unit trade listed at a price of 80.95, then the commission will be USD 12. Here is the calculation. 600 x USD 0.02= USD 12.00. Have a look at the below-given table for commission charges on different shares.

Country/market | Commission Charge | Currency | Minimum Commission Charge |

UK | 0.10% | GBP | GBP 9.00 |

US | 2 cents per unit | USD | USD 10.00 |

Australia | 0.10% | AUD | AUD 7.00 |

Austria | 0.10% | EUR | EUR 9.00 |

Belgium | 0.10% | EUR | EUR 9.00 |

What about CMC Market’s non-trading fees?

In terms of the non-trading fees, CMC Markets can be listed as an average online trading broker. That means CMC Markets charges higher non-trading fees in some cases, but the others are not charged at all.

Speaking about the non-trading fees, such fees cover different brokerage charges and fees of CMC Markets that are not related to buying or selling an asset. For example, the deposit and withdrawal fees.

Deposit fees are applicable when you transfer money to the trading account from the bank account. Generally, legit brokers don’t charge anything for this, and CMC Markets also doesn’t charge for this.

No matter what type of deposit method you use, you can deposit funds for free. You can use electronic wallets, debit or credit cards, or bank transfers to start depositing money into the trading account.

What about the withdrawal charges? As per some CMC Markets reviews, the broker doesn’t ask for a withdrawal fee. That means you can easily transfer your profit or funds to your bank account without paying anything to the broker. However, it may charge a certain amount while doing the international transfer.

Conclusion

There are a lot of factors to consider while choosing the right trading partner to enjoy a smooth trading experience. And one of the major factors to consider is the fees, commission, and spreads of the platform.

CMC Markets is here to provide the traders with the best and ultimate trading experience. And that’s why it is constantly improving and innovating. And the broker’s CFD accounts provide you with attractive spreads.

The unique thing about CMC Markets is it allows the users to choose a spread or fee for every opened position. It doesn’t charge anything for the positions. Instead of that, CMC Markets has added a very small spread to the asset price.

It can be said that CMC Markets’ trading fees are quite low. In fact, they don’t charge a fee for the things other popular brokers do charge for. And on certain trading activities, they charge a very small amount.

It has been seen that some traders prefer to trade with no fees, and some prefer to trade with a small fee. Well, both types of traders can use CMC Markets. Just keep in mind the above information mentioned in this article and start trading now. CMC Markets can be the right option for you if you trade very frequently.

FAQ – The most asked questions about cost to trade with CMC markets :

Do the traders have to pay a tax while doing CFD trading?

As per the rules mentioned on the official site, when doing CFDs trading, the traders may need to pay CGT- Capital Gains Tax on the profit. But different from share dealing or other traditional forms of trading, you don’t need to pay the stamp duty for this.

The traders can utilize CFDs to offset any losses against profit. As it has various tax benefits, CFDs are generally used as ideal hedging too. But you should remember that the tax rate will depend on individual circumstances.

Does CMC Markets charge a commission?

While discussing CMC Markets fees, you can’t ignore the share commission. As per the information mentioned on the official site, CMC Markets charges a certain percentage as commission on share CFDs.

The commission is chargeable when the traders enter and exit a trade. However, the commission rate will vary based on the origin country of the share. For example, the broker will charge 0.10 percent of commission on a Spanish share, and the minimum commission charge is €9.00.

The platform also has a minimum commission charge feature. If the actual commission does not meet this required threshold, the broker will apply the minimum commission rate.

Is CMC Markets free?

Just like other forex and CFDs trading platforms or brokers, CMC Markets also charges fees on every trade. But the best part is that you will find those costs very low compared to other brokers. So, you can give this platform a try.

However, it may be noted that CMC Markets doesn’t charge any fees while depositing and withdrawing funds. And it is completely free to create a live account with this broker.

What is the CMC Markets rollover fee?

The rollover cost is the overall interest yield on a trade position held overnight by traders at CMC Markets. The term “rollover cost” refers to the interest accrued or paid while holding the deal overnight. Generally, if a post remains open after 5 PM, it should be filled the following day. Your loss or gain will be realized once the position is transferred to a new contract, and you will then start a new trade at the mid-price.

Are the CMC Market’s non-trading fees very high?

In some circumstances, CMC Markets levies greater non-trading costs, but not in others. When we talk about non-trading fees, we mean CMC Markets’ various brokerage fees and costs that have nothing to do with buying or selling assets. For instance, the withdrawal and deposit costs.

What is the CMC Markets withdrawal fee for international transfers?

Yes, the broker might impose a fee while making the international transfer. Albeit, there is no withdrawal charge requested by the broker. That implies you can do so without paying the broker anything and transfer your earnings or funds to your bank account.

What are the CMC Markets fees for trading US Shares?

If you want to purchase a US share, CMC Markets charges 2% per share. Contrarily, the minimal commission fee is USD 10. However, this is different for shares from European countries.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller