Pepperstone fees and costs – Spread comparison

Table of Contents

When you want to trade forex or whatever instruments, you do so through an online broker. A broker serves as the intermediary between you and the market. It goes the extra mile to ensure that you make trades seamlessly. For doing this, the broker has to be compensated because it is a profit-making entity.

One of the ways the broker generates revenue is via fees and charges. Pepperstone fees and spreads are charged so that the broker can provide you with stellar services. We have to note that they are amongst the most affordable in the industry.

Introduction to Pepperstone:

Pepperstone is an Australian forex broker that also offers CFDs. It was established in 2010 and has a heavy presence in the European Union. The broker is considered safe because it’s regulated by three top-tier financial authorities: the UK’s Financial Conduct Authority (FCA), Germany’s Federal Financial Supervisory Authority, popularly referred to as BaFin as well as the Australian Securities and Investments Commission (ASIC).

Pepperstone currently has its corporate headquarters in Melbourne, Australia. It provides traders access to trading on more than 72 currency pairs, metals, and commodities. The brokerage firm has made a name with its revolutionary market-making approach as well as other unique features. As a result, the platform has spread its tentacles all over the globe and continually grown its trading volume to unprecedented levels.

These trading fees can occur with Pepperstone:

- Spreads

- Commission

- Overnight fee (swap)

- Deposit and withdrawal fees

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Pepperstone fees and spreads explained:

Pepperstone fees spread and commissions start from AUD 3.5 per standard lot with spreads from 0.0 pips. We have to note that the broker has a low and incredibly competitive spread when compared to what other brokers offer by offering a spread list that starts from 0.0 pip along with commissions charged from AUD 3.5 per standard lot using the Razor Account.

Pepperstone trading fees are according to the type of account that the trader chooses. Here, we outline the spread, leverage, minimum deposit required, and commissions that are attached to each account type:

- The Edge Standard Account – minimum deposit of AUD 200, leverage up to 1:500, zero commissions, and spreads from 1.0 pip.

- Razor Account – minimum deposit of AUD 200, leverage up to 1:500, US Dollar 3.5 commissions per standard lot, variable spreads from 0.0 pip.

- Edge Swap-Free Account – minimum deposit of AUD 200, leverage up to 1:500, zero commissions and spreads from 1.0 pip.

- Edge Active Traders – minimum deposit of AUD 200, leverage up to 1:500, US Dollar 3.5 commissions per standard lot, variable spreads from 0.0 pips, and 10% rebate.

Other fees

Traders should note that certain financial instruments can only be traded during a certain time of the day, especially when considering different time zones, and additional fees may be charged should they hold these positions after they have closed. Traders should always note that Overnight Fees, otherwise known as Swap Fee or Rollover Fee, may be charged for positions held open for longer than a day (we will address these below).

Pepperstone offers the Edge Swap-Free Account to traders using Islamic accounts. The broker does not offer traders spread betting and therefore spread betting fees are not applicable to it.

Deposit and withdrawal fees

Pepperstone does not charge any deposit fees but withdrawal fees are charged based on the payment method the trader chooses to use.

Fees apply to the following payment methods:

- Bank Wire Transfer – USD 20

- E-wallets such as Neteller and Skrill – USD 1.

For cards like MasterCard and Visa, there are no charges, but your bank may deduct some from their own end. Pepperstone does not charge any additional broker fees such as inactivity fees or fees pertaining to account maintenance and management.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Swap rates

Swap rates are one of the most common fees paid in forex. A forex swap rate is a rollover interest rate (that’s earned or paid) for holding positions overnight in foreign exchange trading. Swap rates are released weekly by financial institutions and they are calculated based on risk-management analysis and market conditions. Each currency pair has its own swap rate and is measured on a standard size of 1.0 lot (100,000 base units).

When you trade forex, you express a bet on the direction of a currency pair by buying or selling the base currency. In effect, you agree with the broker as the counterparty to take a view in one currency before swapping it back at a date of your choosing with any running profits or losses cash-adjusted to the account.

Holding a position depends on your trading strategy and plan. Swing traders might hold a position for days or even weeks, while scalpers might hold it for a few seconds. When holding a position, the price of the currency pair you’re trading isn’t the only price you need to watch; you should also be aware of the swap rate or charge.

See this example for calculation of the Swap rate:

- Currency pair: EURUSD

- One point: 0.00001

- Account base: EUR

- Exchange rate: 1.2290

- Trade size: 1 lot (€100,000)

- Pepperstone’s long swap rate: -11.49, short swap rate: +7.02

- Swap value to be debited from the account: (0.00001/1.2290) * (100,000 *-11.49) = €-9.34

- If you were a short contract of EURUSD, you’d receive €5.71 a day.

Intraday traders won’t need to worry about swap charges, as they’ll naturally close their positions before the daily rollover point. But for anyone else holding a position overnight or longer, you need to consider this in your trading considerations. Pepperstone is quite transparent with the swap rates that it charges traders.

You can find Pepperstone’s latest swap rates directly on its trading platforms. Swap rates posted on its platforms are indicative rates and are subject to change based on market volatility.

Overnight charges

An overnight charge is a fee that you pay in order to hold a position open overnight. The charge will be applied to your account each day (including weekend days) that you hold an open position on indices CFDs, stocks CFDs, and commodities. Pepperstone overnight rates are set at the benchmark regional interest rates for the underlying product, plus (or minus) our fixed charge of 2.5%

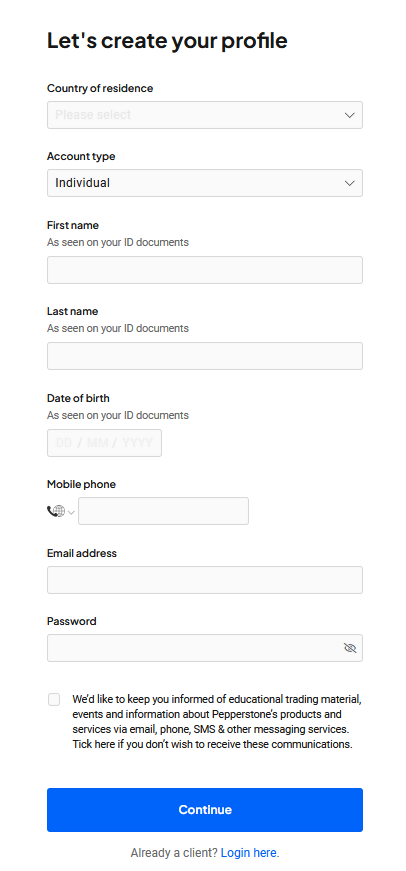

Opening an Account with Pepperstone

The account opening process is easy and fully digital. An application to open a trading account with Pepperstone should take roughly 10-15 minutes. Pepperstone trading account opening takes four steps:

Pepperstone demo account registration:

- Register your email and password; confirm your email; then proceed to the Secure Client Area.

- In the Secure Client Area, fill in your personal information and set the base currency of your account.

- Complete a trading expertise survey. Pepperstone is one of the few brokers that administer this.

- Upload a copy of your passport/ID and a utility bill or some other proof of address and identity. This verification process is not usually convenient for many traders but it is quite necessary to ensure the security of trader accounts as well as their information.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Deposit & withdrawal

There are multiple options for depositing funds:

- Bank transfer

- Credit/debit cards

- E-wallets

The availability of payment options depends on which regulator under which you are. The time it takes for the deposit to be processed is dependent on the payment channel you make use of. For instance, bank transfers can take several business days, while payment with a credit/debit card is instant. You should, however, note that you can only deposit money from accounts that are in your name.

Base currencies

At Pepperstone, you can choose from 9 base currencies: the Australian Dollar (AUD), the United States Dollar (USD), the Singaporean Dollar (SGD), the Hong Kong Dollar (HKD), the Japanese Yen (JPY), the New Zealand Dollar (NZD), the Euro (EUR), the Swiss Franc (CHF), and the Great Britain Pound (GBP).

Why does this issue of base currencies matter? Because of currency conversion issues. If you fund your account in the same currency as your bank account or you trade instruments in the same currency as your account base currency, you don’t have to pay a conversion fee. But if you do so in other currencies, you might have to pay conversion fees which may be quite exorbitant at times.

A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. Examples are TransferWise and Revolut. You can get great currency exchange rates as well as free or cheap international bank transfers via them. Opening an account only takes a few minutes on your phone.

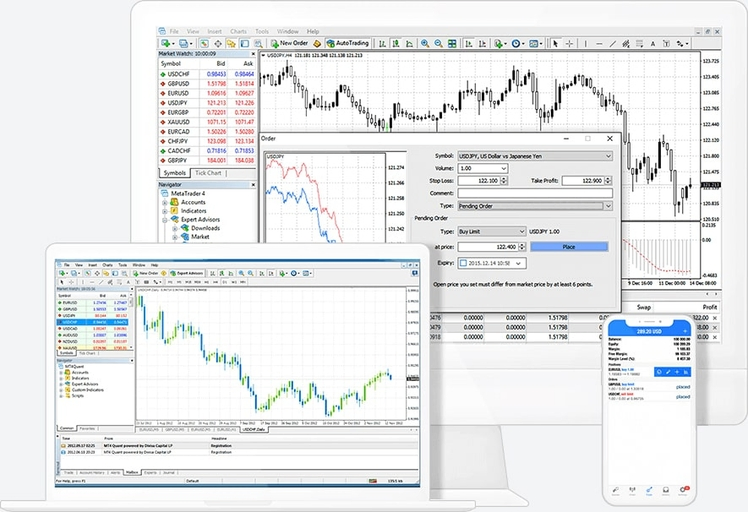

Which trading platforms are available?

Pepperstone doesn’t have its own self-developed or proprietary trading platform. It, however, offers three third-party trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

This is quite commendable as it gives traders access to a lot of variety to choose from. The above trading platforms are simply the best and most popular in the industry. And they come with great features. For instance, MetaTrader 4 is available in an exceptionally high number of languages.

Conclusion on the Pepperstone fees

When just starting out, the trader should be aware that they will be charged by the broker for the services they get from the broker. These charges can come in the form of spreads and other forms of fees. Overall, Pepperstone is a very cheap forex broker with low spreads and commissions. Especially for scalping and day trading, you should use this provider.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

FAQ – The most asked questions about Pepperstone fees :

What are the Pepperstone charges or fees?

A summary of Pepperstone’s service charges and costs

$3.50 commission for every lot for each trade + spread charge for MT4/MT5 Razor accounts. During peak market hours, the mean spread fee is 0.8 pips.

Does Pepperstone impose charges or fees for an inactive account?

Pepperstone does not impose an inactivity charge for inactive accounts, which is excellent since your account won’t be required to pay any charges even if you refrain from trading for a prolonged period of time (months or years).

Is there an overnight fee at Pepperstone?

An overnight charge is a fee for keeping a trade position open in equities, commodity markets, cryptocurrencies, metals, or index markets, as well as a swap for forex positions after rollover at 5 p.m. NYT (23:59 Server Time). While your bank might impose a mediator charge, Pepperstone does not impose funding or withdrawal charges.

What are the different fees charged on Pepperstone?

Although Pepperstone is a trustworthy and reliable forex platform, it charges traders and investors certain fees. These are the spreads charged on the open trades, the commission for a successful trade, and the overnight fee for long position trades, and it has no deposit and withdrawal fees.

See other articles about online brokers:

Last Updated on April 19, 2023 by Res Marty

Leave a Reply

Want to join the discussion?Feel free to contribute!