Can you deposit money in your trading account with the help of a 3rd person?

When engaging in stock market trading, an investor or trader must take into account several considerations. Transferring money to the trading account is a necessary initial step before investing in the stock markets.

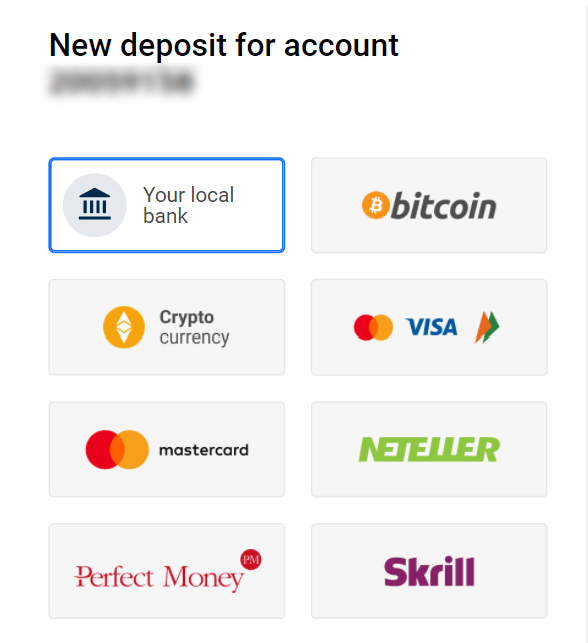

Many different methods exist for depositing money into a trading account. Selecting an appropriate one, however, can have a significant impact on your trading results.

Before transferring funds into a trading account, one must determine the most appropriate technique, considering the associated fees. Thus, in this post, we will acknowledge whether you can deposit money by a 3rd person in your trading account.

Can you deposit money with the help of a 3rd person in your trading account?

No, you cannot transfer from a 3rd person’s bank account not associated with your trading account.

Any funds deposited into a trading account that are not the account holder’s own are considered third-party deposits. This rule extends to corporate funds transferred to personal accounts and other comparable circumstances.

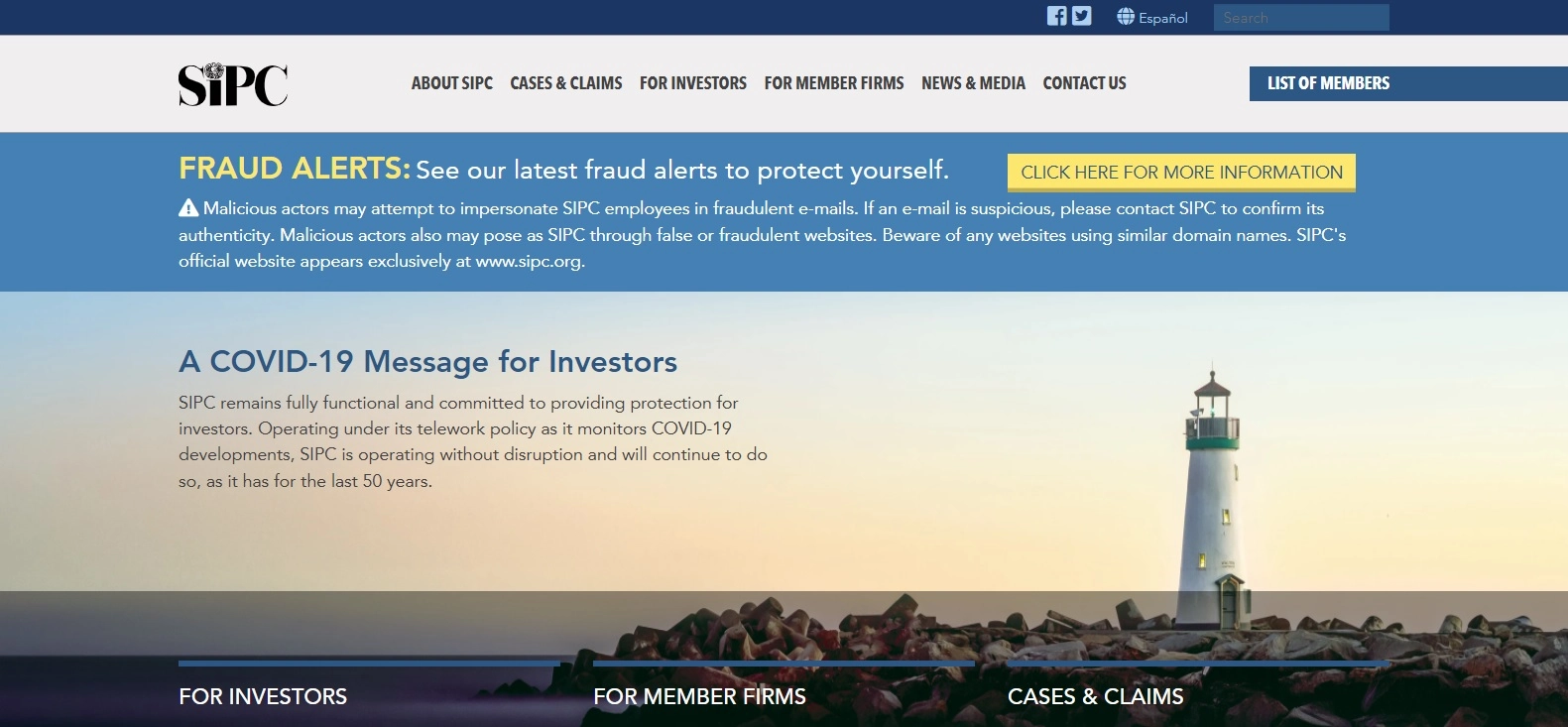

Most major banks now forbid consumers who are not joint account holders or authorized users to deposit cash in trading accounts, citing security concerns. SIPC has implemented similar limitations on deposits to combat fraud and money laundering.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Aspects to consider while depositing money in your trading account

The brokerage industry has made it easier than ever for common people to invest safely, cheaply, and efficiently. However, there are still cases of fraud committed by con artists who prey on the greedy or naive.

The legitimacy of your broker can be verified in several different ways. Make sure you’ve done your homework before you start anything new.

Be wary of cold calls, and keep an eye on your bank and credit card transactions to be sure nothing fishy is happening.

- Verify Securities Investor Protection Corporation (SIPC) membership

- Check statements regularly

- Conduct research

1. Verify Securities Investor Protection Corporation (SIPC) membership

The Securities Investor Protection Corporation (SIPC) protects investors up to $500,000 (including $250,000 for cash) in case of a brokerage firm’s insolvency.

When investing, it’s best to write cheques to the SIPC member firm rather than a broker personally.

2. Check statements regularly

Putting your money on autopilot is the worst thing you can do. If you receive your statements in print or online, it is essential to double-check them for accuracy.

It would be best if you investigated further when the returns on your investments are lower than you anticipated or when there are sudden shifts in your portfolio.

Don’t believe complex guarantees you don’t fully grasp. If you’re having trouble getting replies, you should escalate your request.

You should not worry about coming across as stupid or annoying.

3. Conduct research

Check the information provided by the financial authorities in each state: brokers, brokerage firms, and registered investment advisors may all have a license, registration, and disciplinary history records with your state’s regulators.

You should also consult investor education materials provided by your state, such as those provided by the New Jersey Bureau of Securities, while looking into a broker or financial advisor.

Conclusion about depositing money with help of a 3rd person

Money can be deposited into a trading account in several ways. There are benefits and drawbacks to each of the methods mentioned above. Traders and investors must make the best decision based on how it will affect their lifestyle.

All transfer information must be logged and reviewed regularly to maintain complete command over one’s money while depositing in the trading account. We hope you have acknowledged whether you can deposit money with the help of a 3rd person in your trading account.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Last Updated on June 18, 2023 by Yuriy Kunets