How to deposit money into your trading account?

Depositing money into your trading account is among the first things you are going to need to do when starting to trade on the financial markets. If you’re unfamiliar with the world of trading, this may be a challenging task. However, once you are aware of the various methods offered by your broker, the process of depositing money is fairly simple.

We will cover the most popular methods of funding your trading account in this guide, including wire transfers, credit and debit cards, and e-wallets. To assist you in choosing the best approach for your needs, we’ll also go over crucial factors like transaction fees, processing times, and security measures.

How to deposit from e-wallets into your trading account?

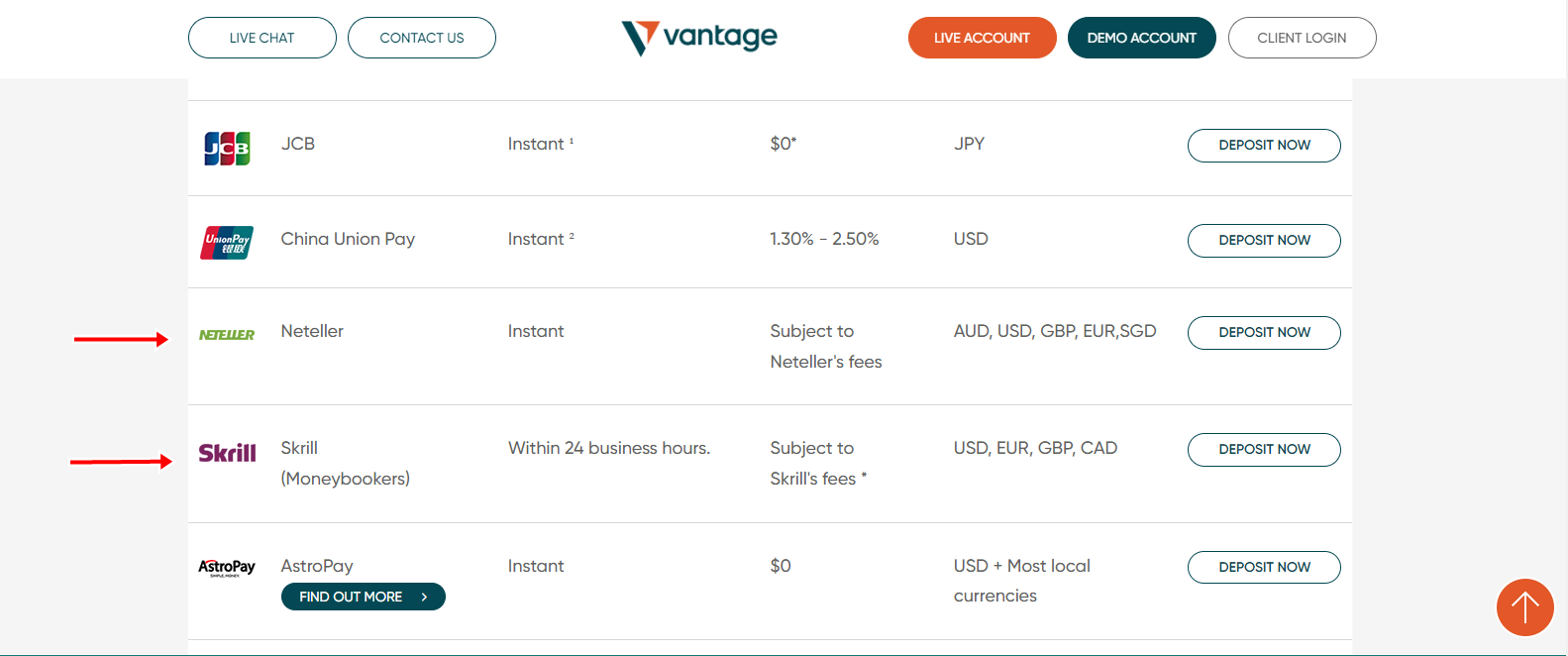

A few simple actions can be taken to quickly and conveniently deposit money into your trading account utilizing an e-wallet. Online transactions, particularly deposits into trading accounts, are becoming more and more popular thanks to e-wallets like PayPal, Skrill, and Neteller.

A step-by-step tutorial for using an e-wallet to add money to your trading account is provided below:

Step #1

Access your trading account by logging in, then go to the deposit area. Log into your account, then go to the deposit section after logging in, which is typically found in the settings menu of the account or the main menu.

Step #2

From the list of accepted deposit methods, pick ‘e-wallet’. You will get a list of the various deposit methods after you enter the deposit area. Choose the e-wallet choice you want to use to make the deposit.

Step #3

Click the “Deposit” button after entering the desired deposit amount. As a result, you will proceed to the following step, where you are going to be asked to enter your e-wallet account.

Step #4

Verify the deposit in your e-wallet account by logging in. You will be brought to the e-wallet’s website, where you must access your account by logging in with your e-wallet credentials. You will be prompted to verify the deposit amount as well as any associated costs once you have logged in. Examine the details carefully, then confirm the deposit.

Step #5

Allow time for the funds to be deposited. The money will be moved from the e-wallet account to the trading account after you’ve approved the deposit. Based on the e-wallet and platform you use; this procedure may take several minutes.

Step #6

To verify the deposit, check your trading account. You will get a notification that the money has been deposited in your trading account once it has been sent. The money will either be accessible for trading right away or just after a brief clearing period.

Be cautious about reading the terms and conditions of the site carefully before making a deposit because certain platforms may have varying deposit limitations and fees for various e-wallets.

Additionally, some platforms might not allow specific e-wallets, so make sure to confirm that the platform you’re using supports your preferred e-wallet.

It’s crucial to utilize just e-wallets that you have checked out and that you have faith in while utilizing them. When utilizing e-wallets, be cautious about taking all essential security steps because they might be subject to fraud and hacking. It’s vital to examine the limitations before making a deposit because some e-wallets also have caps on how much you may deposit or withdraw in a specific period.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How to deposit by credit cards/debit cards into your trading account?

Adding money to your trading account with a credit or debit card is a simple process that can be finished in a few quick steps. Credit and debit cards are a well-liked method for online transactions, including deposits into trading accounts, because they are generally accepted as a form of payment.

Here is a step-by-step guide on making deposit money into your trading account using credit cards/debit cards:

Step #1

Upon logging in, go to the deposit area of your trading account. Enter your account information to log in and go to the deposit page.

Step #2

Among the list of deposit options, pick credit or debit cards. You will get a list of the various deposit methods after you enter the deposit area. Choose the choice for your credit or debit card which you intend to utilize to make the deposit.

Step #3

To make a deposit, enter the amount and select “Deposit.” After entering your desired deposit amount, select “Deposit” from the menu. You will then be directed to the following step, where you will be asked to input the details of your credit or debit card.

Step #4

Confirm the deposit by entering your credit or debit card information. Your credit or debit card details, including the card number, CVV code, and expiration date, will need to be entered. Examine the details carefully, then confirm the deposit. Some platforms could additionally need extra verification, such as a picture of the card or a copy of an ID from the government.

Step #5

Allow time for cash to be transferred. Your credit or debit card will then send the money to your trading account after you have approved the deposit. Based on the platform you’re using and the rules of your bank, this process could take a couple of minutes to a few days.

Step #6

For proof that the deposit was made, check your trading account. You will get a notification that the money has been deposited in your trading account once it has been sent. The money will either be accessible for trading right away or just after a brief clearing period.

Before making a deposit, it’s vital to keep in mind that various platforms may have different deposit limitations and fees for deposits made with credit and debit cards. Additionally, some platforms might not accept specific credit or debit card types, so make sure to confirm that the site you’re using accepts your card before using it.

It’s crucial to use only credit or debit cards that you have validated and that you trust while using them. When using credit and debit cards, be cautious about taking all essential security measures because they can be targets for fraud.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

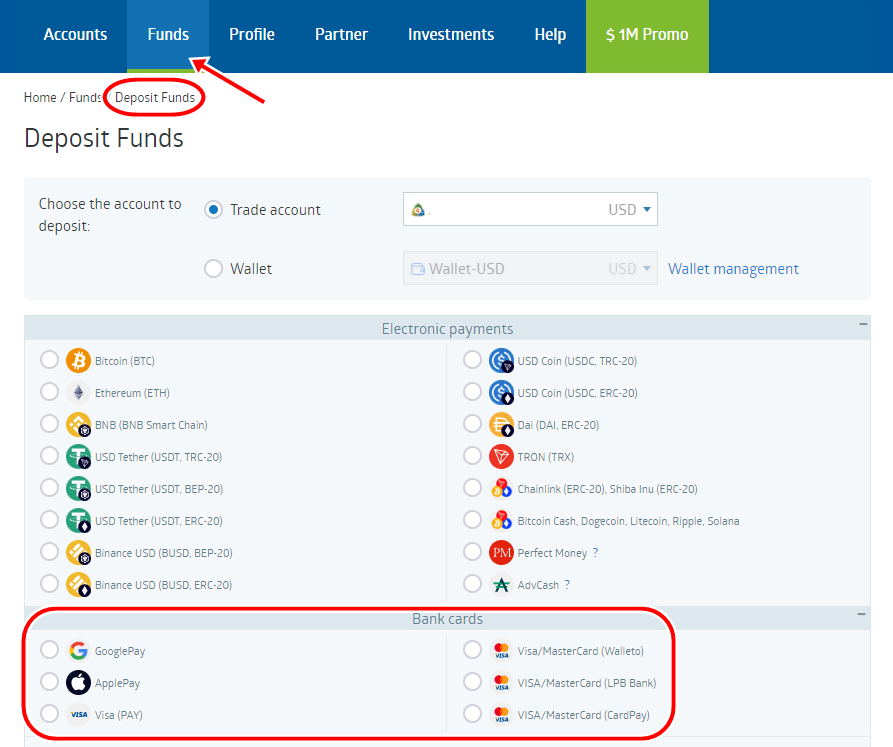

How to deposit cryptocurrency into your trading account?

Cryptocurrency deposits into trading accounts are quick, straightforward processes that may be finished in a few short steps. Cryptocurrency uses encryption to keep users safe. Numerous trading platforms now allow cryptocurrency as a deposit method due to the rising popularity of cryptocurrencies.

Here is a step-by-step tutorial on using cryptocurrencies to deposit money into your trading account:

Step #1

Access your trading account by logging in, then go to the deposit area. Log into your account is the initial step in depositing money into your trading account. Once logged in, go to the deposit section, which is typically found in the account settings or the main menu.

Step #2

Choose the cryptocurrency choice from the list of acceptable techniques for deposits. You will get a list of the various deposit methods after you enter the deposit area. Make your deposit choice by clicking the cryptocurrency option. Prominent cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are generally accepted by most platforms.

Step #3

Click the “Deposit” button after entering the deposit amount. By selecting the “Deposit” option, you can deposit any amount you choose. You will then be directed to the following step, where you must enter your cryptocurrency details.

Step #4

Provide the cryptocurrency wallet address. Your cryptocurrency wallet address—the special code that uniquely identifies the wallet on the blockchain network will be required. Before submitting, make careful to check the address twice because typos can cost you money.

Step #5

Transfer the cryptocurrency to the specified address. After submitting the cryptocurrency wallet address, you can transfer cryptocurrency to the given address. To accomplish this, log into your bitcoin wallet and transfer the necessary amounts to the given address. Based on the cryptocurrency network and the number of confirmations needed by the trading platform, the procedure could take a few minutes to a few hours.

Step #6

To verify the deposit, check your trading account. You will get a notification that the money has been deposited in your trading account once it has been sent.

It’s crucial to remember that some platforms could have varying deposit limitations and fees for cryptocurrency deposits, so be sure to verify the platform’s terms and conditions before making a deposit. Verify if the platform you’re using accepts your cryptocurrency because certain services might not.

It’s crucial to utilize only wallets that you have confirmed and that you trust when depositing money using cryptocurrencies. Because cryptocurrency transactions are final, make sure to verify the recipient’s address and the amount before sending any money. Additionally, it’s crucial to keep in mind that the value of cryptocurrencies can be extremely unstable, so monitoring the exchange rate is essential before making a deposit.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

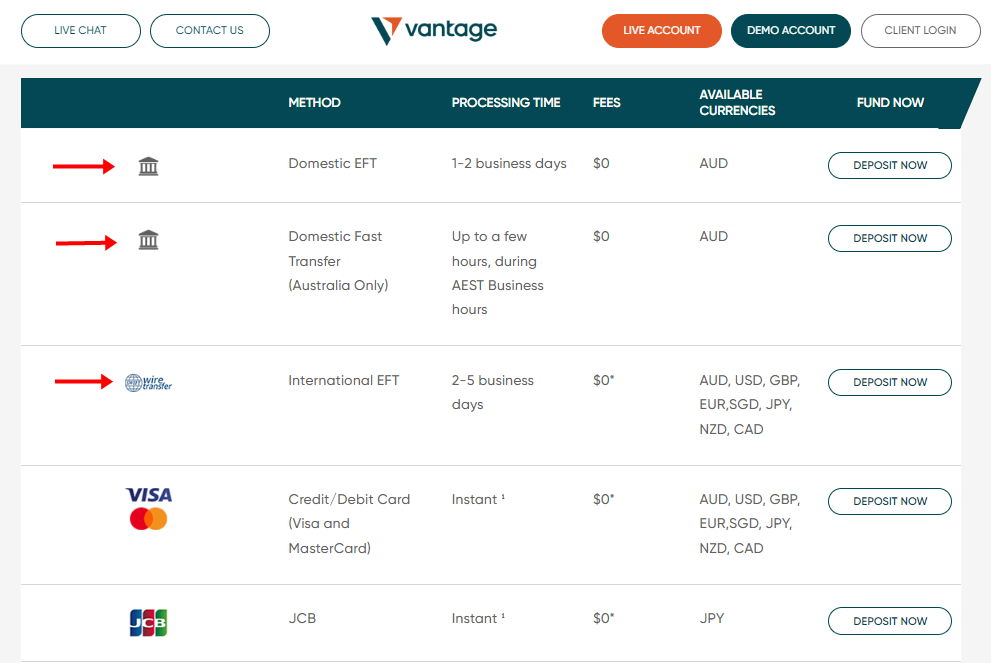

How to deposit by bank transfer into your trading account?

Bank transfers are a popular way for traders to finance their accounts. Most trading platforms offer it as a safe and dependable method of money transmission.

Here’s a step-by-step tutorial for adding money to your trading account using a bank transfer:

Step #1

Access your trading account by logging in, then go to the deposit area. Logging onto your account is the initial step in adding money to your trading account. Once logged in, go to the deposit section, which is typically found in the account settings or the main menu.

Step #2

Pick a bank transfer from the list of possible deposit options. You will get a list of the various deposit methods after you enter the deposit area. Choose the bank transfer option and provide the appropriate details, including the amount and currency you want to deposit.

Step #3

Give details about your bank account. You will be asked for information about your bank account, such as the account number, the account holder’s name, and the routing number. Prior to submission, make sure all the information is correct because any mistakes could cause the deposit to be delayed or rejected.

Step #4

Start the bank transfer. You can now start the bank transfer after providing the details of your bank account. You can accomplish this by visiting a nearby bank office or logging into your online banking account. Give the bank representative the essential information, including the bank account information for the trading platform and the amount you want to send.

Step #5

For proof that the deposit was made, check your trading account. You will get a notification that the money has been deposited in your trading account once it has been sent. The money will either be accessible for trading right away or just after a brief clearing period. Be cautious about reading the terms and conditions of the platform carefully before making a deposit because some may have varying deposit limitations and fees for bank transfer deposits.

Furthermore, certain platforms could demand further verification procedures for bank transfer deposits, such as submitting identification documentation or a copy of the latest bank statement.

It’s crucial to use only bank accounts that you have checked and that you trust when depositing money via bank transfer. Before starting a bank transfer, be sure to verify the account information and the transfer amount. Bank transfers can be reversed, but it may take some time.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Advantages and disadvantages of the different payment methods

When choosing the method to choose when depositing money on a broker, weigh in their advantages and disadvantages.

They include the following:

- Card Payments

- Bank Transfers

- Electronic Wallets

- Cryptocurrency

Card payments

Here are the advantages and disadvantages of using card payments.

Advantages:

- Bank cards help traders access their funds whenever necessary, thus being great for funding their trading accounts

- Most cards are also highly acceptable; hence hard to find a broker rejecting yours if you use it to deposit money

- When using a credit card, you don’t need to have a bank account balance; hence ideal when you run out of money but want to place a trade

- The payment method is relatively cheap, with low and reasonable charges

- Its convenience is also indisputable because you don’t need to do any physical work for a successful transaction

- Lastly, it is fast, and time is of the essence when trading

Disadvantages:

- Unfortunately, cards are prone to fraud and responsible for massive losses, especially when using them over an insecure platform

- Its convenience makes many traders overspend or accumulate a lot of debt

Bank transfers

Here are the advantages and disadvantages of using bank transfers.

Advantages:

- You won’t have to do manual work, including carrying the money to the bank, paperwork, and queueing

- The cost you incur per transaction is reasonable

- It is convenient since you can transact regardless of the time or place

- It is also flexible to accommodate various banks and currencies

- The method is safe and secure

Disadvantages:

- It is not instant; hence essential to wait for a while before reflecting

- In case of a wrong transaction, one can’t reverse

Electronic wallets

Here are the advantages and disadvantages of using electronic wallets.

Advantages:

- This payment method doesn’t charge traders a lot of money to make deposits

- It promotes safe transactions because of its enhanced security

- Since data is in the cloud, you can access your wallet across your devices, and even after changing your gadget

- It is compatible with various cards, and you can also use them with coupons, loyalty cards, reward cards, and gift cards

- Consequently, you don’t have to carry around a bunch of cards yet make many payments

- Digital receipts per transaction help boost your financial management

- It is an instant way of depositing a broker

- It is also flexible and convenient

Disadvantages:

- Whereas it is compatible in most cases, some are an exception

- Cyberattacks also threaten the security of e-wallets

- It is hard to control your expenditure when using this payment

- It will be disappointing if you experience a connectivity problem

Cryptocurrency

Here are the advantages and disadvantages of using cryptocurrency.

Advantages:

- The payment method makes fund transfers easy

- Since the transactions are hard to decode, the payment method is private and secure

- The transaction fee is also fair, thus, a cost-effective payment method

- Due to lack of control by the government, its value is usually stable

- Its records are continuously updated, thus promoting your integrity

- Due to their limited and controlled production, they are protected from the adverse effects of cryptocurrency

Disadvantages:

- It is impossible to cancel a transaction or ask for a refund

- Losses of your wallet’s private key will lead to the loss of all your cryptocurrencies

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion about how to deposit money into your online trading account

Gone are the days when depositing money in a broker was daunting. On the contrary, the adjectives associated with these transactions include fast, instant, convenient, and cheap.

You may choose the ideal way for your needs by being aware of the various options, including wire transfers, credit and debit cards, and e-wallets, as well as the particular requirements for each. To ensure a seamless and secure deposit experience, keep in mind crucial factors, including transaction fees, processing times, and security measures.

Always remember to confirm any specific deposit instructions or criteria with your broker or trading platform before starting a deposit. It’s also crucial to think about the security of your money and to make sure you’re placing it into a trustworthy and authorized trading platform.

You can confidently and easily deposit money into your trading account by adhering to these rules.

Last Updated on June 17, 2023 by Andre Witzel