The best Ethereum trading guide for investors and beginners

Table of Contents

To fully understand the potential of Ethereum, you need to know the concept of blockchain. Blockchain is one of the major innovations that made Bitcoin possible in 2009. Through technology, parties can interact without knowing or trusting each other. It also makes open storage of the details of all transactions possible and makes it easy for everyone to manage them. Blockchain promotes decentralization, an important function of cryptocurrency.

Besides using the blockchain to facilitate the transfer of value like Bitcoin, thanks to its original coding language and token, ether, Ethereum makes it easy for developers to build decentralized applications (dApps) on its network. The ecosystem is not much different from the App Store, but it does not have a central authority. Anyone can build a dApp on Ethereum, and anyone with an internet connection can use the app. There is no dapp approval procedure. The network itself does not collect revenue from developers.

See the price of Ethereum at the moment:

Another interesting feature of the Ethereum network is smart contracts. Smart contracts are managed by code and executed when basic conditions are met. No third parties or intermediaries are required for a large number of transactions. A good real-life application of Ethereum is a set of legal and financial contracts that can be automated with the logic of Ethereum. This makes the market opportunities for Ethereum enormous.

What is Ethereum? – Cryptocurrency explained

Ethereum is the second most valuable digital currency after Bitcoin. However, although the Ethereum market is supported by many of the same exchanges and infrastructure on which the Bitcoin network is built, important differences remain.

Unlike Bitcoin, ether was not created as a global digital currency. It is designed to pay only for certain operations on the Ethereum network using blockchain technology. Anonymous payments can be sent globally, and transactions are stored on a decentralized ledger, blockchain. As a result, Ethereum has been adopted by online and physical stores around the world.

There are more than 100 cryptocurrencies that sell for over a dollar, but as you can see in the table below, Ethereum is one of the biggest players offering attractive financial opportunities for weekly traders.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Which factors influence the price of ETH?

Now, we’ve discussed the overview of Ethereum, we will look next at what drives the daily price movement? There are four groups of consumers in the Ethereum ecosystem, all of which affect the price. Specifically, these include speculators, investors, developers, and users of various applications that have been built on Ethereum.

Speculators are often responsible for the volatility of ETH prices as they often use leverage to open and close trading positions. Investors have long believed in technology and have long held ETH. They try to stabilize prices and often increase their assets as they sell. For example, according to a study by Cointelegraph Consulting, the total assets of the 100 largest Ethereum addresses increased by 886 560 ETH during the last sale in September.

For example, see here the buying power in Ethereum:

Developers and DApp users must have ETH to pay for gas to interact with the Ethereum blockchain. In other words, gas is used to pay for computational power. All transactions, like a smart contract developer, for instance, require computational power. As the number of decentralized applications and their users increases, the demand for ETH increases.

Why buy and sell Ethereum (trading)?

In the next points, we will give you examples of why you should start with Ethereum trading:

1. Cost

You can pay at least 0.25% if you choose to trade wisely compared to traditional exchanges. If you don’t have a lot of capital, I recommend starting Ethereum Day Trading.

2. Availability

Ethereum business hours are 24 hours a day, 356 days a year, and you can shop anywhere in the world. All you need is an internet connection.

3. Leverage

Some exchanges offer leverage trading. This means that there is a greater risk of increasing or lowering prices than the trading budget generally allows. The greater the risk, the greater the potential benefit.

4. Lack of complexities

If you’re engaged in day-trading, you don’t need a deep technical knowledge of how Ethereum works. There is no need to maintain a long position on these experimental cryptocurrencies.

Our comparison between Ethereum brokers

There are many cryptocurrency online brokers, including the most famous Capital.com and Coinbase that allow you to trade Ether in real-time. So, what do you look for in a good Ethereum broker? The following points will show you how to find a good trading platform for ETH trading.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

These factors are important for a reliable platform. On the internet, you often will find scam websites that should be avoided. Check the platform for regulation and if it is a real company.

1. Commissions

Commissions for Ethereum transactions vary greatly from broker to broker. Unlike buying stocks or bonds, brokers are likely to charge a certain percentage. Look for a broker that charges a fixed rate instead of an interest rate model.

2. Regulation

Trading Ethereum in Pakistan can be riskier than trading Ethereum in the UK. This is because you need a well-regulated broker. Regulatory authorities protect the markets and traders from a wide range of potential risks.

There is no such thing as a “perfect regular broker” because everyone has different needs for daily trading. Instead, decide which of the above factors is most important to you and do your research bearing them in mind.

3. Margin

You can find brokers that offer generous trading returns on Ethereum. These brokers allow you to borrow capital while maximizing your potential profits on the go. Find a broker that offers low-interest rates on margin trading.

4. Account types

The type of Ethereum trading account can seriously affect your success. Many brokers offer multiple account options. Find a broker that offers adaptability, competitive spreads, and easy withdrawals. Choosing the cheapest account can be profitable in the long run.

5. Liquidity

In the Ethereum market, day traders tend to trade, so it is important to consider how much liquidity the Ethereum exchange can have. Liquidity allows you to sell without significantly affecting the price.

6. Trading robot

Using the Ethereum trading bot can save you a lot of time and prevents you from constantly looking at your computer screen. More and more brokers are offering these automation services, and once you program the rules, your bot will do all the work. If you go this way, you will find brokers that offer updated Ethereum trading algorithms. Their bot calculator changes according to market conditions.

7. Customer service

Ethereum trading works 24 hours a day, so you should always choose a broker that is ready to solve your problems. Before registering, check out the broker’s customer service reviews. Some even promise to take less than a minute to get phone help.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

8. Trading platform

The Ethereum trading platform you use is the door to the market. Choose a broker with a convenient and powerful platform. You can test your broker first to see if the Ethereum trading software does or doesn’t help. But before that, take a look at the review of Ethereum’s trading platform.

9. Mobile application

Successful day traders are always connected to the market but may not always be on the computer. Many Ethereum trading brokers offer smart and easy-to-use trading applications. This can save you serious money someday when the boiler starts to boil and the market starts to crumble.

Steps for Ethereum trading

In the next steps, we will show you exactly how to trade Ethereum.

1. Open an account

Open a trading account with a broker and move on to the second step below. For opening a trading account you will need your email and password first. The sign up is very easy to do. After that, you get access to the platform in practice mode. It is possible to test every function for free and without risk.

If you want to trade with real money, you should complete the account application. The broker will show you what you have to fulfill. It is important to verify your data and identity because the platforms are regulated. There is a high standard for security and anti-money laundering. Upload the requested documents and fill out the questions. After that, you can start trading.

2. Develop a trading plan.

At this point, you can consider developing a trading plan. The trading system helps alleviate unwanted feelings while working in the marketplace by deciding when to open and close jobs.

Here are some tips to help you plan your first trading:

- Think about what you want to achieve and set daily weekly and monthly goals.

- Decide which markets to trade and study in detail.

- Find out how ready you are for each trading position and how much risk you’re willing to take.

- Use this information to determine your risk/return.

You may also have the opportunity to learn Ethereum trading strategies. Swing trading, for example, is about keeping an open position until the trends are over and identifying ether trends when they pick up. Otherwise, scalping means trading constantly and taking advantage of smaller price movements.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

3. Do your research

You are almost ready to open your first trade position. But before that, it’s a good idea to make sure you are fully aware of the latest developments related to Ethereum and Ether. Take a look at the News and Analytics section of the website to see what analysts have to say about cryptocurrency.

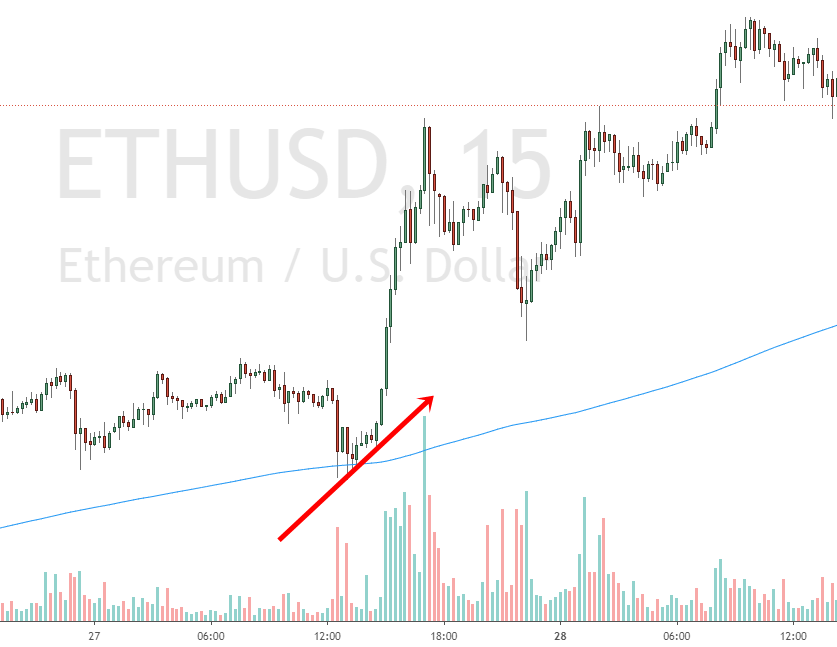

You can also do a technical analysis to help you decide when to enter your job. Technical analysis involves studying Ether’s previous price movements on a map and predicting which direction it might go using a variety of tools. On the IG trading platform, you can find a wide range of commodities including Bollinger Band, MACD, RSI, and more.

4. Start buying and selling

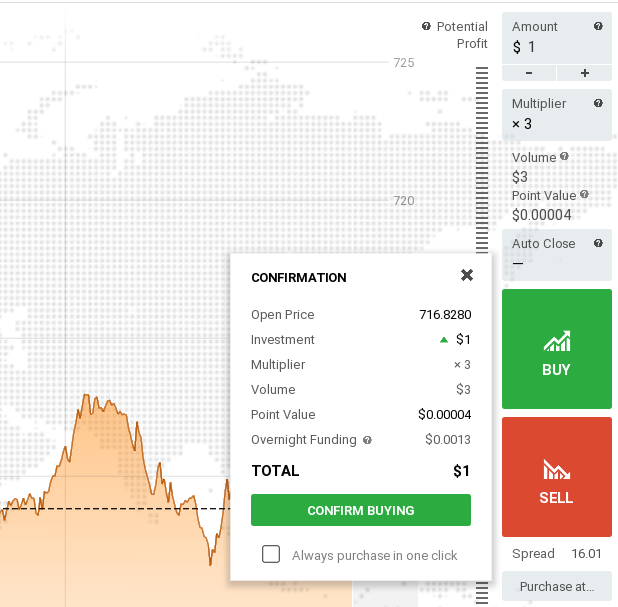

Search Ether and open a ticket to make your first trade on the broker’s platform. Choose a trade size, specify a stop or limit, then click on the buy to sell or sell button to open your trading position.

See in the picture below the order mask:

And if you’re trading with a good broker, you’ll get more liquidity when you open a trade, giving you a greater potential to close your position at a price or rate you desire. This equally means higher profit potential. However, you must know how to profitably trade volatile markets.

To close your trading position, you need to move in the opposite direction to when you opened a trade. So, if you opened a trade by buying Ether, you should close the trade by selling. If you sold your ether when you opened a trading position, you can buy ether to close your position.

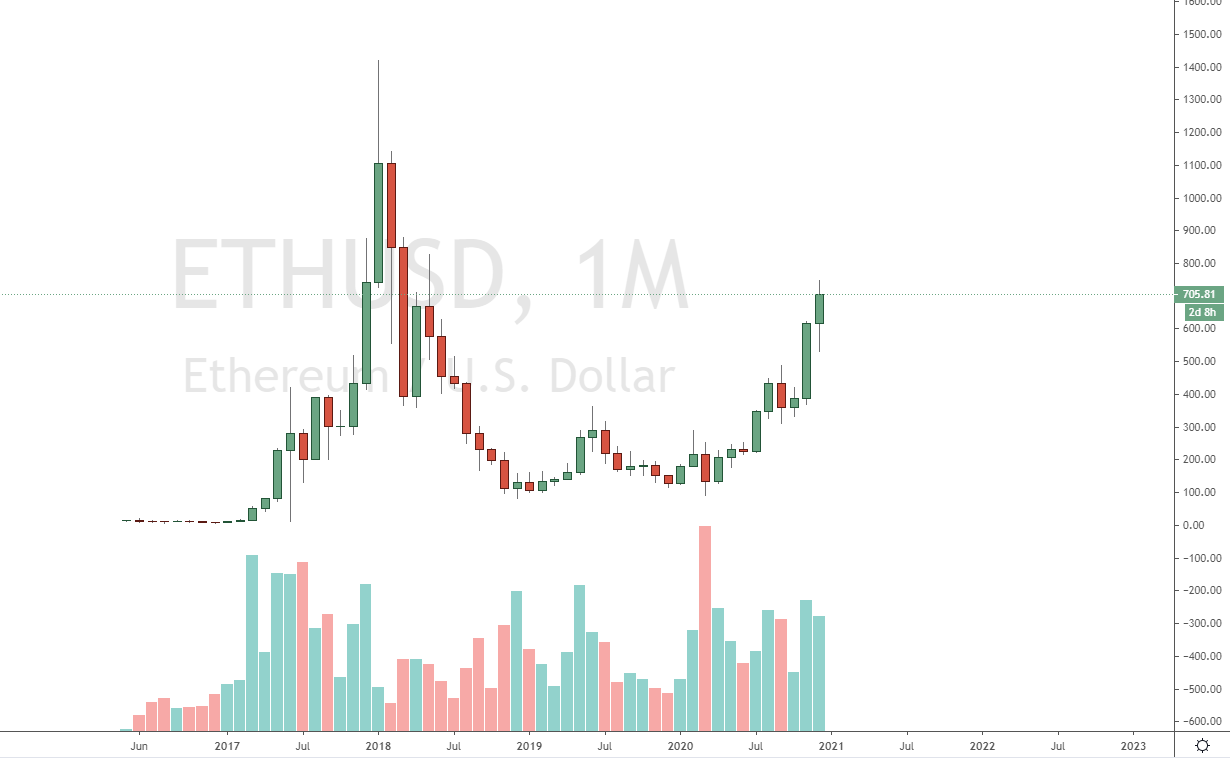

Ethereum transaction prediction

Ethereum has flourished as a result of the cryptocurrency boom in recent years. After the massive profits of some of the early users of Bitcoin, cryptocurrency has gained a lot of attention. Ethereum’s market capitalization increased to $4 billion in 18 months after launching Ethereum in the fall of 2015.

Everyone wants a share, and this has created a special market value that some people find difficult to justify. Due to the unpredictable future of Ethereum and other cryptocurrencies, it remains a relatively risky asset to trade.

As venture capitalist, Tim Draper said, “This is very similar to what happened when the Internet was invented. It could be more than we’ve seen. On the other hand, JP Morgan’s CEO, Jamie Morgan, maybe closer to the goal when he said cryptocurrency is more than “fraud” (which led to a 10% drop in bitcoin prices).

Who among these two financial experts is right will be decided in the next few years as governments and businesses try to find a place and regulate cryptocurrency in the modern world. While this makes long-term investments in Ethereum risky, Ethereum’s outstanding trading volatility and volume make it a rich hunting ground for day traders.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Our Ethereum trading tips

The price hike associated with Ethereum’s success means that mistakes can be costly. One piece of advice for Ethereum day traders is to keep speed in mind.

Ethereum is gaining momentum quickly, and if it doesn’t react quickly, it can lose more than it loses from rising prices. Timing is everything. You can jump $6 and buy it again for $3 lower, but before you jump $10 it only drops to $4. Then you can’t even drop at the price you sold. So, if you want the next price increase, you’ll have to buy again a few dollars more than what you sold.

Trade News and Forum

The virtual currency world is fragile, so you need to catch up with new developments. When shopping during the day with Ethereum, you should do your best to find and maintain the benefits. Here are some of the news resources and discussion forums to help you stay up to date with all the latest information related to Ethereum.

- Business Insider

- Coin Desk

- Street

- Coin Telegraph

- Cryptocoin News

- CNBC

- Quora

- Brave new coin

- Crypto Insider

Practical education for new traders

In a highly competitive marketplace, it is no longer merely enough to follow the news. You will have to look for benefits elsewhere. Use Ethereum trading forums and blogs to guide you as you learn the trading protocols. You can also find a chat website where experienced traders will explain everything.

Factors to look for in an Ethereum trading strategy

From our experience, a trading strategy is not only following some trend lines in the chart. There are more important factors to consider. Volatility and also news are a very big factor for the price movements.

1. Volatility

Volatility measures the difference in the price of a specific financial instrument (e.g. Ethereum) over time. According to history, the price of Ethereum fluctuated by more than 31% during the day. Ethereum and other cryptocurrencies are known for their high volatility. This means more risk, but it offers smart traders a great opportunity to make money. So, look at the data, which are signal patterns that show signs of a volatile market.

2. Technical analysis

Day trading is great for traders who hone their competitive edge To incorporate these benefits, you need to be able to make market decisions primarily based on price charts. Mastering Ethereum transaction analysis takes time and practice. Create a demo account to familiarize yourself with basic and pattern mapping. This simulator is funded with virtual currency so you can eliminate mistakes before placing real money.

3. Managing your risks

Money management should be an important part of your Ethereum trading strategy. You cannot fully predict what will happen in the market, so you always need an effective money management strategy. This reduces losses if you make a mistake and maximizes profits if you trade rightly.

4. Price

Ethereum’s price rises and falls vary widely, which is one of the reasons that make trading a dynamic and exciting tool. Find Ethereum’s trading symbol in the price chart and see the transaction price and interest rate of Ethereum before starting the day trading.

Regional differences: Regulation for Ethereum trading

Buying and selling Ethereum in India and Singapore may differ from buying and selling Ethereum in Australia and the Philippines. It’s primarily about regulation. Crypto coins become vulnerable to big hits when countries and businesses urgently respond to growing markets. For example, in September 2017, the Chinese government announced a ban on the collection of funds for crypto projects through initial coin offerings (ICOs). As a result, Ether trading fell 23%.

Despite the ban on ICOs in China and South Korea, ether trade continues to increase in Malaysia, South Africa, the UAE, the UK, and Europe. Japan is playing an important role in this revival. Resellers, airlines, and hotels have started using cryptocurrency as a payment method. No other region on Earth is close to adopting cryptocurrency like Japan.

So, before you buy Ethereum in Canada, Dubai, or anywhere else, you’ll find out what is happening in the country and how it plans to regulate virtual currency. Otherwise, you may be in an expensive situation.

When you get a green light, take a look at specialized trading platforms. For example, some Ethereum markets and platforms in India are optimized for Ether trading. If you want to make Ethereum your main trading choice, you can find a custom platform that offers faster speeds and more competitive spreads.

Taxation on Ethereum

Another factor to consider is taxes. Buying and selling Ethereum in Hong Kong can cost you much more than buying and selling Ethereum in other countries of the world. To start Ethereum’s day trading, you must first study your country’s tax rules. Otherwise, you may lose some profits unnecessarily due to unfavorable tax rules. Find out what taxes and amounts you need to pay depending on the country where you are located.

Conclusion on our Ethereum trading tutorial for beginners

Ethereum is a volatile and unpredictable asset class for day trading. While what will happen going forward is still uncertain, there are many opportunities for significant profits. With technical analysis, news, and effective money management strategies, you can start trading Ethereum today.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Ethereum trading :

How can I begin trading Ethereum?

Ether can be traded by purchasing it directly from cryptocurrency exchanges. For this, you’ll have to register for a trading account and fund it with the entire asset’s valuation. This will let you keep Ethereum in your digital wallet up until you end up selling it.

How can I buy Ethereum?

How to make investments in Ethereum? You can purchase Ethereum using a cryptocurrency exchange, a securities brokerage, or simply a payments app if you are interested in investing in it directly. Since Ether is among the most valuable coins, it can be purchased on practically all sites that deal in cryptos.

Is a $200 investment in Ethereum worthwhile?

$200 invested in Ether now would be able to purchase 0.1052 ETH at the present pricing. The $200 purchase will be approximately $514.60, or a profit of 157%, if Ethereum rises to its all-time peak of USD 4,891.70.

How can novice investors buy Ethereum?

Purchasing ETH via cryptocurrency exchanges is arguably the simplest and most used method. Choosing an online crypto exchange that works in your area and deals in ETH shouldn’t be too challenging because Ether is indeed the 2nd largest cryptocurrency by market capitalization after Bitcoin.

Read more about crypto trading here:

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)