FBS Broker minimum deposit tutorial and payment methods

Table of Contents

FBS is an international Forex and CFD broker that serves clients from over 190 countries. Since 2009, it has proven and demonstrated excellence as evidenced in its numerous prestigious awards and the number of partnerships and endorsements the broker has been able to bag. It has its main headquarters in Belize and other headquarters in Cyprus as well as in the Marshall Islands.

This means that it is a European broker. Being a European derivatives broker subjects a broker to thorough regulation and supervision by designated authorities. In just a short time of operations, FBS has been able to bag numerous awards – over 40 to be precise. Particularly, it has been awarded for transparency and great customer service. It has also been noted to be one of the most beloved brands in the forex brokerage space.

In this article, we want to discuss the minimum deposit when opening an account with FBS. We will show you all the details and payment methods.

Facts about the FBS minimum deposit:

- The minimum deposit is at least $ 1

- The minimum deposit is depending on the account type

- Multiple payment methods are available

- Instant deposits

- No fees for deposits

(Risk warning: Your capital can be at risk)

Payment methods for the minimum deposit

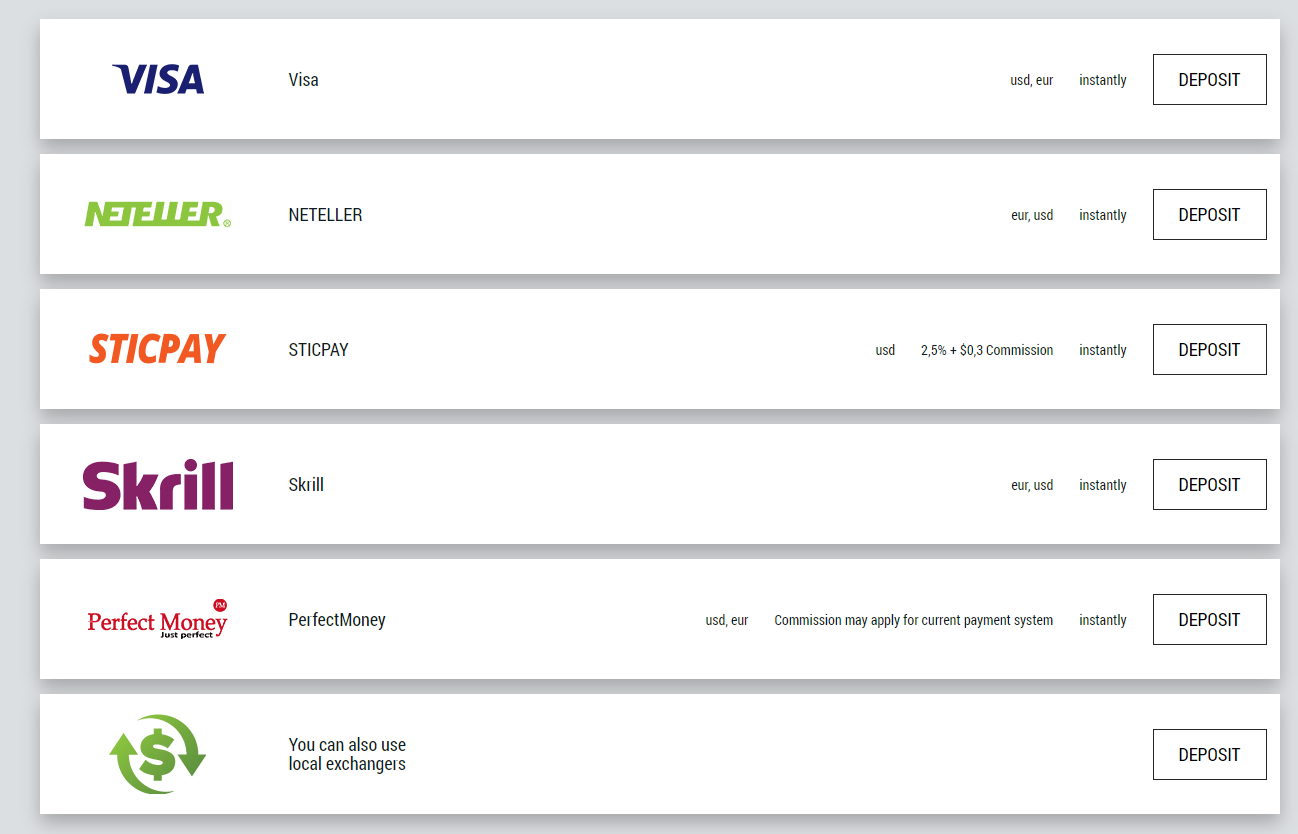

To deposit funds into a live trading account, FBS offers a range of the most convenient payment options, featuring over 100 payment systems. The payment systems are depending on your country of residence. For example, people in Europe can not use UnionPay but Chinese people can do it. They are neatly grouped into:

- Wire Transfer

- E-wallets such as Skrill and Neteller.

- Bank cards such as MasterCard and Visa.

However, this might be applicable for FBS International only, since the EU regulator puts in place a strict money transfer policy.

The most popular deposit methods with FBS:

- Credit Cards

- Neteller

- Sticpay

- Skrill

- Perfect Money

- Bank transfer

Are there fees for minimum deposits?

FBS does not charge any fees when you are depositing money. Most payment methods are free. From our research, Sticpay is the only method where fees of 2,5% + $0.3 commission apply.

What is the FBS minimum deposit?

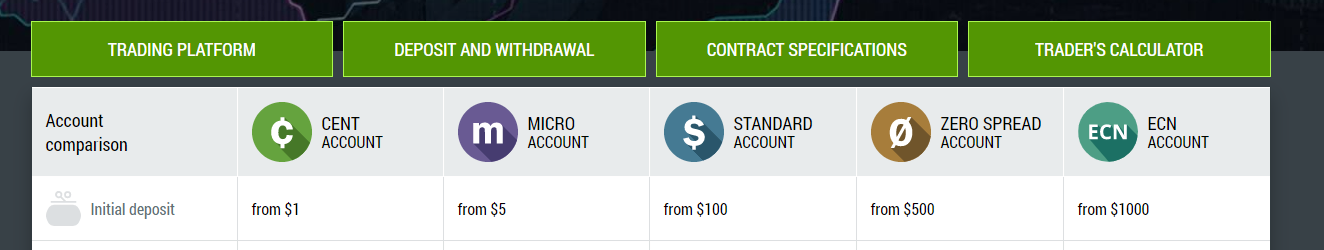

FBS offers multiple account types. For the live account, we have the Cent Account and the Standard Account. Each has its own features and perks. As for the minimum deposit amount, FBS allows trading through a Cent account only with 10$ at the start, which is a fantastic option for beginner traders. Standard Account, on the other hand, requires a deposit of 100$ initial deposit.

- Cent account – $ 1 minimum deposit – best for beginners with small amounts of money

- Micro account – $ 5 minimum deposit – best for beginners

- Standard account – $ 100 minimum deposit – average trading account

- Zero spread account – $ 500 minimum deposit – best for news trading

- ECN account – $ 1000 – best trading account overall

On our page FBS account types, we compared the trading accounts in detail. You should visit it before signing up.

(Risk warning: Your capital can be at risk)

FBS regulation and safety of customer funds

As mentioned, being a European broker subject a trader to some thorough regulations that they have to adhere to. As such, FBS is a heavily licensed and regulated broker – and it is registered in numerous jurisdictions. It is licensed by the Cyprus Securities and Exchange Commission (CySEC), one of the most prominent and trusted regulators of derivatives brokers which has been known to be thorough in its supervisory activities with forex, CFDs, and binary options brokers.

It is as well registered under the International Financial Service Commission, which is the financial regulatory authority of Belize. By far, the most important point in this is the fact that by being a European broker, FBS is subjected to the Markets in Financial Instruments Directive (MiFID). The MiFID is the European Union (EU) regulation that oversees and supervises the work of financial brokers. MiFID puts brokers under heavy regulation to comply with strict guidelines and rules.

For one, under no circumstance can the broker breach any terms of agreement against the trader. If they do so and the broker makes that known to the authorities, not only will the broker be fined, but it also has to compensate the trader. Such compensation can be very heavy at times. Furthermore, one of the regulations is that the broker must keep the funds deposited by traders separate from its own internal running funds. In fact, authorities expect that brokers keep such funds with third parties. Hence, if there is an issue with the broker, especially as regards insolvency or bankruptcy, the traders will not be affected. Nothing will happen to the traders’ funds. In fact, mostly they will have their funds given back to them.

If these do not convince anyone, one fact that proves the credibility of FBS is the partnerships that it has developed. FBS is the official trading partner of the Barcelona Football Club. Popularly referred to as FC Barca, Barcelona FC is one of the biggest football clubs not only in Spain and Europe but around the entire globe. Both on the pitch and away from the pitch, Barcelona FC is huge. It features some of the world’s very best players. It is also one of the richest clubs. All these confirm the authenticity of FBS as a broker.

However, some facts are notable. One of the downsides to trading with FBS is that it operates in the form of a double entity. This means that it somewhat offers different services to different people. The services that FBS offers to traders in the EU area are also somewhat different from the ones that it offers to traders in other parts of the world. As such, it appears we have FBS Europe and FBS International. However, this is not due to any faults of the broker. Signing up to be an EU-registered broker makes them liable to a lot of regulations. They have a lot of restrictions as to which type of services they can offer to traders. Many of such offers, however, cannot offer to traders from other parts of the world.

(Risk warning: Your capital can be at risk)

What you get when you trade with FBS

FBS offers traders a lot of premium services that you may not find with other brokers. They include:

- Better and much bigger leverage

Leverage is one of the most wonderful concepts in forex trading. In forex trading, it means borrowing to add to your trading account so that you can take more risks and take more trading positions. Normally, entering positions and trading in the financial markets is quite expensive. It is not for the average individual trader. For instance, investing in a stock like Amazon might require a trader putting up at least $2,400 per share.

To trade Gold (XAU/USD), you need to put up a similar amount. This is just for one single unit. Most traders cannot put up with this amount to trade. The concept of leverage however comes to their rescue. In essence, their broker assists them by helping them increase the power of their trading capital via leverage. FBS provides its traders in the EU with leverage as high as 1:30 for trading major currencies. Although this is small, it is entirely due to caps placed by EU regulators.

However, the case is entirely different for international traders. FBS offers leverage as high as 1:1000 and even 1:3000 in some cases. This gives traders all the space in the world to carry out trades and take up risks which can lead to more bountiful profits. However, as high leverage can benefit a trader, it can also hurt a trader’s account substantially.

- Social Trading

Social trading involves copying the trades of other experienced and veteran traders directly. Social trading was one of FBS’s creations to help traders start earning from the day they start trading by copying others. It saves them a lot of stress and time that would have been spent learning.

Trading Platforms

FBS provides traders access to trading via multiple channels. They include the popular MetaTrader 4 and its more advanced version, the MetaTrader5. However, traders can also choose to go for the proprietary trading software known as the FBS Trader.

All the above platforms are accessible via web trading and mobile apps on the Google Play and Apple App stores.

(Risk warning: Your capital can be at risk)

Web Trading

Web Trading is very comfortable since you don’t need to download or install any software. You simply login online through a browser and you start to trade instantly. You can access both the MT4/MT5 and the FBS Trader via web trading.

MT4/MT5

MT4 delivers a wealth of features, advanced charting, and customization along with auto-trading capabilities while being available for PC/ Mac, Android, and iOS devices. In addition to the stellar features and functions of the MT4, you can enjoy daily technical and fundamental analysis data that is made available in the news section. Other features include over 50 technical indicators, one-click trading, the possibility to create and use EAs with no limitations, and even trade with VPS service support.

Moreover, in case you will be trading with FBS International, you will be offered access to the upgraded version, the MetaTrader5. This comes with more capabilities, features, and opportunities.

FBS Trader

FBS Trader functions as a CopyTrade app for social trading platforms. It allows the following trading professionals or strategies, which is a great option for beginner traders to learn and earn.

Available Markets

FBS gives you access to many markets to trade CFDs. However, the range of instruments is still rather limited as there are around 40 currency pairs including exotic ones that are offered and 6 indices based on CFD trading, along with Metals and Energies. If you prefer trading Stocks, Futures, or any other instruments, FBS does not provide those.

FBS Customer Support

We have to note that FBS provides top-notch customer support services. Highlights of their customer support services include 24/7 accessibility via any live chat, international phone lines, email, or even social media. FBS customer support gives relevant and quick answers to questions and concerns and they are definitely client-oriented.

Conclusion on the FBS minimum deposit

FBS is undoubtedly one of the best online brokers out there and one that you would really want to do business with. We have to note that its minimum required deposit, especially for the Cent Account, is a very trader-friendly one, when you consider the services offered. It is one of the lowest you find amongst quality forex brokers.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about FBS minimum deposit :

Are there any fees charged on the minimum deposits on FBS?

FBS does not charge any Commission or transaction fees when the trader or investor deposits money into the account. If any Commission is charged, it will be from the third-party payment gateway where the deposit is made.

What are the minimum deposits for different FBS accounts?

The minimum deposits for the FBS accounts depend on the type. For instance, the sent account requires a minimum deposit of $1; the Micro version requires a minimum deposit of $5. Similarly, the minimum guarantees for standard and zero-spread accounts are $100 and $500, respectively. On the other hand, for the CN account, the minimum deposit should be $1000.

Which are the regulatory authorities for FBS?

FBS belongs to the European sector, which is why it is under the regulations of the Cyprus Securities and Exchange Commission. In addition, it is also registered under International Financial Service Commission. This is why it is considered to be one of the most reliable trading platforms around the world.

What are the advantages of trading on FBS with a minimum deposit?

As a trader or investor, you will be able to enjoy a plethora of benefits while trading on FBS. These are better leverage on your trade, the advantage of social trading, and access to over 190 different trade markets.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller