Five best Forex Brokers and platforms in Algeria – Comparison and reviews

Table of Contents

You have come to the right place if you are actively looking for a reliable forex broker in Algeria. We have compiled a list of trading brokers based on crucial factors that expert traders consider when searching for forex brokers.

See the list of the best Forex Brokers in Algeria:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

These forex brokers have the industry-leading regulation to ensure that traders have trading resources that fit trading standards from wherever they are.

List of the five best Forex Brokers in Algeria:

1. RoboForex

It is a forex broker established in 2009 with over one million forex traders in 169 countries globally.

Financial instruments – metals, forex, ETFs, commodities, cryptocurrencies, stocks, indices, ETFs, and CFDs.

Regulation – it has regulated by the Financial Services Commission (FSC).

Account types – traders can choose from Prime, ECN, Pro, and Pro-cent with a $10 minimum deposit, while the Restocks trader account has $100.

Fees – the Pro and Pro-cent have forex spreads from 1.3 pips. The Prime and ECN accounts have forex spreads that start at 0.0 pips, while the R stocks trader charges from 0.01 USD since it traders stocks only.

Trading costs – It has overnight fee rates depending on the position size. It also has an inactivity fee of $10 after 12 months without any activity; deposits and withdrawals are free.

Leverage – the highest leverage traders, can access is 1:2000 from the Pro and Pro-cent account. The ECN has a leverage of 1:500, while the Prime and R-stocks trader have a maximum of 1:300.

The demo account – It has a free demo account as long as traders have a registered account under them.

The Islamic account – It is available as the Pro-cent, Pro, and affiliate accounts and uses the MT4 trading platform.

Trading platforms – it has integrated MT4, MT5,c Trader, and its proprietary platform, the R stocks trader.

Payment methods – traders, can use Bank transfers, credit/debit cards, and electronic wallets such as Neteller, Skrill, AdvCash, Perfect Money, AstroCash, and NganLuong.

Customer care – customer support is available 24/7 via email, live chat, and phone calls.

Pros

- High leverage rates

- Low trading costs

- Fats account registration

- Low initial deposits

- Fast order processing rates

Cons

- It is not available in most regions

(Risk Warning: Your capital can be at risk)

2. Pepperstone

It is a forex broker established in 2010, with 9.2 billion of volume traded regularly, and has served over three hundred thousand clients globally.

Financial markets – it offers more than 2000 assets ranging from forex, commodities, ETFs, Indices, Shares, and currency indices.

Regulation – it has regulations from the ASIC, and the FCA.

Account types – it has Standard and Razor accounts, with $200 as the initial deposit.

Fees – the Standard account has forex spreads from 1.0 pips while the Razor account starts at 0.0 pips.

Trading costs – It has no Inactivity costs and deposit/withdrawal fees. The Razor account has commissions of $7 per round turn for every $100 000.

Leverage – The highest leverage is at 1:400.

Demo account – its demo account is free for registered traders and has up to $50,000 virtual funds.

Islamic account – it has the Razor and Standard accounts of the swap-free accounts.

Trading platforms – it has integrated MT5, MT4, and cTrader.

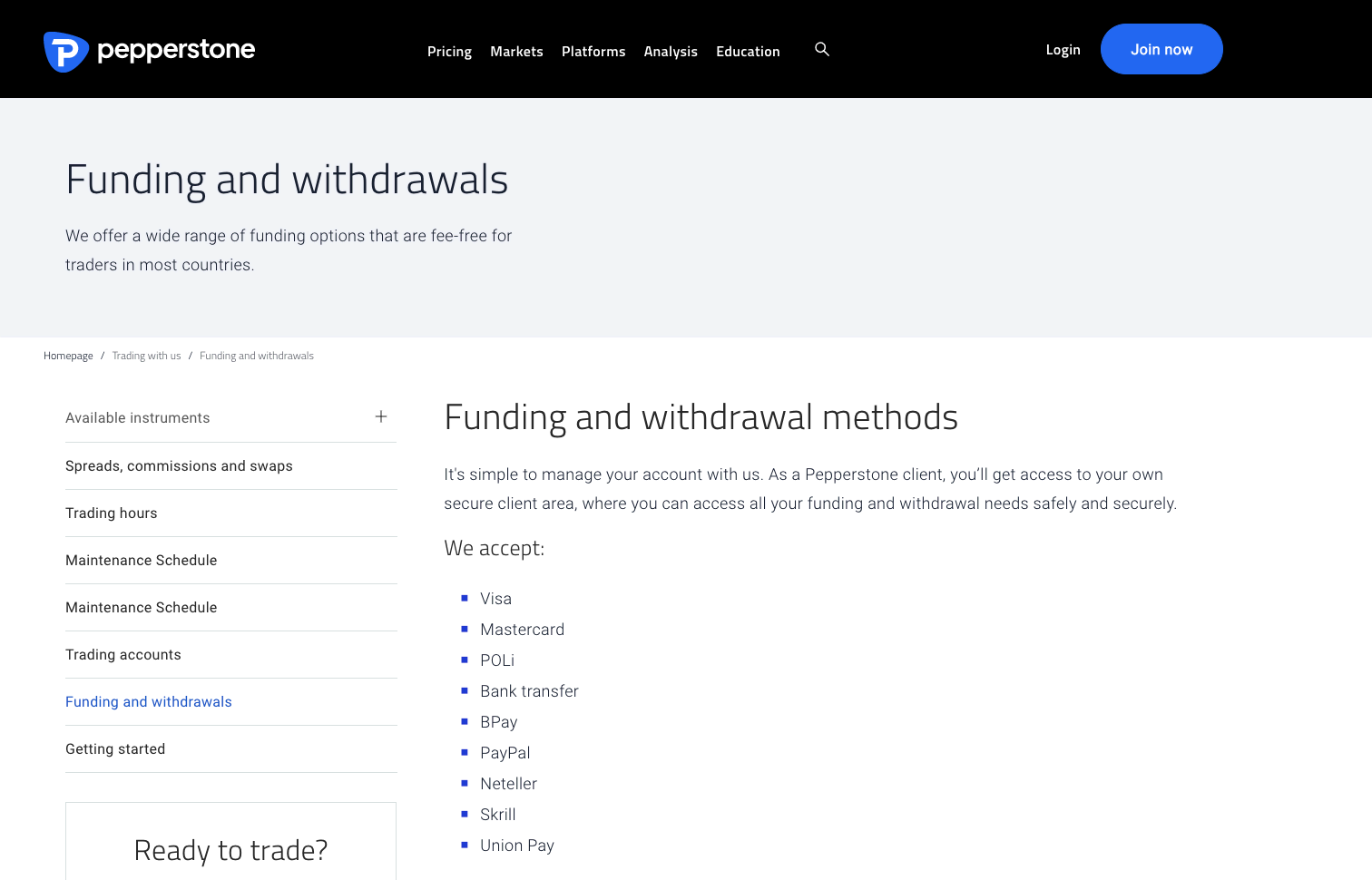

Payment methods – it supports a variety of payment methods such as bank transfer, credit/debit cards, and electronic wallets such as Neteller, Paypal, Skrill, Union pay, Bpay, and POLi.

The customer care – the support team is available 24/5 via live chat, email, and phone calls.

Pros

- Low trading costs

- Advanced trading tools

- Fast order processing speeds

Cons

- Limited educational resources

- Customer support is only present 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

3. BlackBull Markets

It has served thousands of traders from all over the world since it got founded in 2014.

Financial instruments – CFDs, indexes, shares, commodities, forex, metals, and energies.

Regulation – it has a trading license from Financial Services Authority (FSA) based in Seychelles.

Account types – It offers three types: ECN Standard with an initial deposit of $200, ECN Prime with $2000, and ECN Institutional at $20,000.

Trading costs – it has no commission for the ECN Standard account, but the ECN Prime has a commission of $6 per every $100,000, and the ECN Institutional has commission rates depending on the asset. It has no inactivity costs, and the deposit and withdrawals are free.

Leverage – all three accounts have the highest leverage at 1:500.

Demo account – it has a free demo account for registered accounts.

The Islamic account – it has a variation of all the three accounts of the Islamic account.

Trading platforms – it offers the MT4 AND MT5.

Payment methods – traders can transfer funds using bank accounts, debit/credit cards, and digital wallets such as Webmoney, Skrill, Neteller, and QIWI.

Customer care – the support team is available 24/6 through email, live chat, and phone calls.

Pros

- Fast order processing rates

- Quality trading resources

- High leverage rates

- Low trading costs

- Wide range of payment methods

Cons

- Limited educational resources

- Customer care is only available 24/6

(Risk Warning: Your capital can be at risk)

4. Capital.com

It is a forex broker that has been in the market for more than five years since its inception in 2016 and has grown to serve over half a million clients.

Financial instruments – indices, stocks, commodities, shares, cryptocurrencies, and stocks.

Regulation – it has regulations from FCA, CySEC, ASIC, and the NBRB.

Account types – It offers three types: The Standard with an initial deposit of $20, the Plus has a minimum deposit of $2000, and the Premier account has a minimum deposit of $10,000.

Fees – the average forex spreads for the currency markets start at 0.8 pips.

Trading costs – it has no account maintenance or inactivity costs. It has overnight fees. The rates vary with the size of the positions. It is also a commission-free broker, and most assets are free of commissions.

Leverage – due to ESMA rules, the EU clients can only access 1:30, but other traders can access up to 1:500.

A demo account – It is available for registered users and is free with virtual funds up to $10,000.

Trading platforms – it offers two types, MT4, and the web trader.

Payment methods – traders can deposit or withdraw funds through bank transfers, credit/debit cards, and electronic wallets such as Trustly, Multibanko, ApplePay, PalPal, and Sofort.

Customer care – The support team is available in 13 languages 24/7 through SMS, emails, phone calls, and live chat.

Pros

- Fast order processing speeds

- Fast deposit and withdrawal

- Low initial deposits

- Low trading costs

- Negative balance protection

Cons

- The high minimum deposit for the Premier account

- Limited research tools

(Risk warning: 75% of retail CFD accounts lose money)

5. IQ Option

It is a forex broker founded in 2013; since then, it has registered over 87 million traders worldwide.

Financial markets – Binary options (only for professional traders and those outside of EAA countries), CFDs, cryptocurrencies, stocks, commodities, ETFs, and forex.

Regulation – its parent company has a trading license from the CySec.

Account types – traders can choose from the Standard account, which has a minimum deposit of $10, and the VIP with a minimum of $1900.

Fees – the forex spreads range with the trading asset, liquidity, and account you are using.

Trading costs – it has overnight fees ranging from0.1 to 0.5. It also has commissions of 0.29% for cryptocurrencies; other assets are commission-free and an inactivity fee of $10 after three months of inactivity. It has no deposit fee but attracts a withdrawal charge of $31 for bank transfers.

Leverage – traders within the European Union have a leverage limit of 1:30, but those in other regions can access rates of up to 1:500.

The demo account– It has a free demo account with $10,000 worth of virtual funds.

Islamic account – it has an Islamic account for Muslim traders that is swap-free.

Trading platforms – it has its IQ Option proprietary trading platform.

Payment methods – traders can deposit or withdraw using bank transfers, credit/debit cards, and e-wallets such as AdvCash, Skrill, Neteller, Webmoney, Line Naira, and Perfect money.

Customer care – The support team is available 24/7 through email and live chat.

Pros

- A fast account registration process

- Low trading costs

- Low minimum deposit

- High leverage

- Fast order processing rates

Cons

- Limited educational content

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Algeria?

There are no forex brokers based in Algeria, although international brokers are regulated in other jurisdictions that forex traders can access in Algeria. The majority of the population in Algeria is of the Muslim faith.

The major problem forex traders face is limitations due to the Sharia laws affecting the transfer of funds in banks and the trading process. Algeria is among the largest countries in Africa and has strict policies for the securities and exchange markets.

The Commission organization et de Surveillance de Bourse (COSOB) is an independent organization mandated to regulate the securities market in Algeria. It was established in 1993 to ensure the financial markets in Algeria are secure, transparent, and fair for all entities.

Some of the functions of COSOB are:

- It works with the finance ministry to create financial policies that enhance the security of the financial markets in Algeria.

- It sets the scope of the rules that traders, brokers, financial agencies, and market participants operate under when trading securities.

- It creates the limits for which traders or investors can buy or sell to allow fairness in stock trading.

- Creating a list of illegal activities banned and punishable when trading securities in Algeria. Listing the fine and penalties imposed for committing those offenses.

- Stating the market conditions for trading forex or other securities which forex brokers and investors need to adhere to when trading the forex industry.

- Monitors and ensures market participants such as forex brokers and traders comply with the policies.

- Companies offering financial services ensure that they provide all transactional details of their clients to ensure transparency.

- They investigate any illegal activities reported and punish any entity, person, or trading entity found guilty of breaching the financial policies.

- They act as a third party and settle issues related to forex brokers, traders, and other market participants in case a dispute occurs.

- Following on client’s responsibility to follow the measure to combat money laundering or using proceeds from trading to fund illegal activities such as terrorism.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Algeria

CONSOB had the finance law implemented in 2018 to allow it to consult other regulatory bodies on other methods it can use to ensure that forex traders have a secure environment when trading.

It has also set other financial laws and monitors forex brokers within its regulation so that traders have a secure trading process in Algeria.

Traders also have the responsibility of choosing reliable brokers to work with and checking the registration before registering a trading account.

How to trade Forex in Algeria – Tutorial

Find a suitable Forex Broker to trade with

It is crucial to search for a reliable forex broker and ensure that they are regulated. A good forex broker is compatible with your trading objectives. The Algerian securities and exchange industry is regulated, and although it is regulated, there are forex scams targeting new forex traders in Algeria.

It requires forex traders to be careful when choosing a forex broker. Besides that, other factors to consider when choosing a forex broker. Some factors to consider include; financial instruments, trading tools, execution rates, trading fees, transfer methods, and credibility.

Open a trading account for Algeria forex traders

Register a trading account with a forex broker through the online registration form available on the website of the forex broker you have chosen. The online registration form requires some details to help build your profile as a forex trader.

They will also require you to verify the information you offer them about yourself; this process enables transparency of forex traders. After successful registration, you can download the trading platforms supported by the forex broker according to your preference.

Practice trading on a demo account

The demo account allows traders to practice trading security with virtual funds. It has the same trading conditions as the live account, and traders can access various trading assets to practice trading. It is risk-free, and traders can use it to practice their trading strategies before applying them with real funds.

Novice traders are often recommended to start with this account, although other traders are free to use it too. It is a crucial tool a forex trader should start with to prepare them well before they can risk their real funds.

Deposit money

After practicing on the demo account, you can deposit it into your trading account if you feel ready to start trading with your funds. Different forex brokers in Algeria have payment methods that forex traders can access and link their trading accounts.

Select a payment method you are comfortable using which is available with your forex broker. It is a reason why it is imperative to research the payment methods before registering a trading account with a broker. The linking process with a payment method is simple and fast for most forex brokers.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

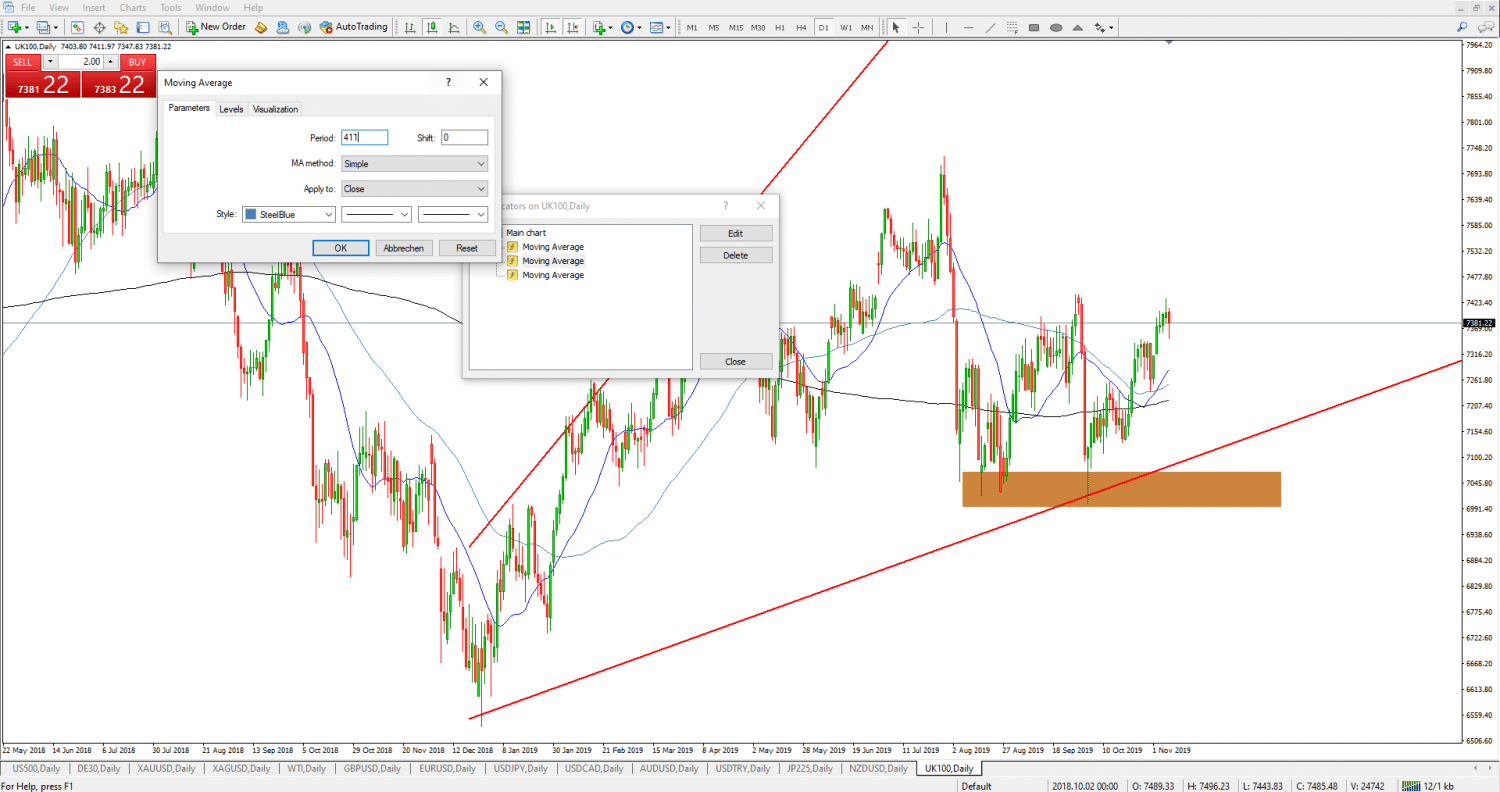

Use analysis and trading strategies

Forex traders have to conduct an in-depth analysis before opening a trading position. It enables them to know where the market prices are moving. The analysis is one of the fundamental activities to do when trading any securities in forex.

There are two types of analysis, technical and fundamental, and both are crucial in the preparation process. Technical analysis uses technical tools, historical price charts, and market patterns to predict price action.

Fundamental analysis is when forex traders follow upcoming financial events, news, and announcements to know when the market will be volatile. Other than analysis, traders can also develop and sharpen their trading strategies on the demo account to increase their chances of profits.

Make profit

Forex trading is not as simple as many new forex traders think. A forex trader must invest money, time, and other learning resources. It needs a forex trader to have a trading strategy they trust which can take a long period to develop and use.

It also requires emotional and financial discipline, patience, and proper timing. It is possible to profit from the financial markets, and many forex traders have succeeded. It also needs the forex trader to be cautious when trading as it also has significant risks to investments.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Algeria

The strict regulations in Algeria are some factors that discourage many forex traders from investing in the securities markets in Algeria. However, forex traders can open a trading account and increase their sources of income if they want to.

International brokers regulated by industry-leading forex regulators offer Islamic accounts that even Muslim traders in Algeria can use to access the financial markets. Forex traders have to invest in education and research resources to learn how to profit from the financial markets.

FAQ – The most asked questions about Forex Broker Algeria :

Can I trade the Algerian Dinar in Forex?

Forex traders in Algeria can trade the Algerian dinar in forex against the US dollar USD/DZD. The Algerian Dinar has the currency code DZD, and its current exchange rate is 144.75. Forex traders trade by taking advantage of the different interest rates of the USD/DZD.

Which Forex strategies can I use when trading Forex in Algeria?

Depending on the asset and time frame used, there are many trading strategies to apply when trading. They include breakout strategy, trend reversals, position trading, scalping, and carry trading.

You need to find which trading strategy works for you and practice until you master it such that it becomes easy to enter and exit the market.

How to choose a forex broker in Algeria?

Traders in Algeria must choose a forex broker keeping in mind many factors. They must first ensure that the forex broker they will sign up with is fully regulated. Besides this, the broker must offer such features that make forex trading feasible. Their trading platform should also have excellent customer support. So, if a trader encounters any problem while trading forex, he can sort it out then and there.

Can traders in Algeria trade international forex pairs?

Yes, as long as you are trading in Algeria, you can trade any forex pair capable of fetching your profits. You must choose a forex pair after careful research and consideration. Most forex brokers in Algeria offer traders with all the leading forex pairs. You can pick any pair of your preference and place your forex trade.

Can traders in Algeria trade forex?

Yes, traders in Algeria can trade forex as it is a fully legal affair. Traders can access a wide range of underlying assets and earn money. Thus, traders can enjoy trading forex to build their wealth. Besides, several forex brokers in Algeria offer traders a top-notch trading platform. Thus, they have all the facilities that help them trade forex in Algeria.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)