How to register with a Forex Broker – A step by step guide

Table of Contents

Forex trading is popular since many forex traders on the internet claim to make millions of forex trading. It has created huge traffic of people who want to join forex trading to create profits.

The reality is different from what many new forex traders think the forex market takes time to master. Forex trading is difficult, especially for new traders. Before you start trading, you have to start by opening an account with a forex broker. The process is simple as long as you have all the documents required.

What is a Forex account?

It is an online portal where people who want to trade forex register as forex brokers. You can open an account with the forex broker of your choice. It is crucial to ensure that you check the type of forex broker that you want.

The forex industry has many reviews of forex traders who lost their investments to fraudulent forex brokers. It is why new forex traders should check for licensing and registration of a forex broker before opening an account.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Why do you need to register for a Forex trading account?

There are many benefits of having a forex account. Some of them are:

A forex account helps a forex trader to buy and hold foreign currencies. The forex account is specifically designed to allow traders to buy other currencies with their local. It is also like a digital wallet that you can hold foreign currencies when you want to trade.

It is an account where traders conduct forex transactions. The forex account allows forex traders to deposit and withdraw from their bank accounts. They can use wire transfer, debit and credit cards and other payment methods.

Forex accounts allow forex traders to access trading platforms like Meta Trader 4 and 5. These trading platforms provide access to the forex market and other markets. They also have tools forex traders use to trade the forex market examples are charting software and indicators.

Forex accounts are convenient to novice traders because they can get free educational tools for trading. Some materials are like online webinars and trading courses as well as blogs and tests. There is the demo account where traders practice the trading strategies.

Where do you register with a Forex broker?

Once you have settled on a forex broker of your choice, there are three places where you can register.

On a website

It is on the website of the forex broker that you have chosen. It is online and they have a link or a button that will direct a new forex trader on how to start the registration.

A desktop version

At times, the forex broker website has a desktop version that traders can open on their desktop. You have to download the application, install it and then start registration.

A mobile application

The mobile application is a version that is easy to use. It is created as an app where traders download and install the application. After this, you can start the registration process.

How to register with a Forex broker

In recent years, registering with a forex broker has become easy. There are a few steps to follow before you open a forex account.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

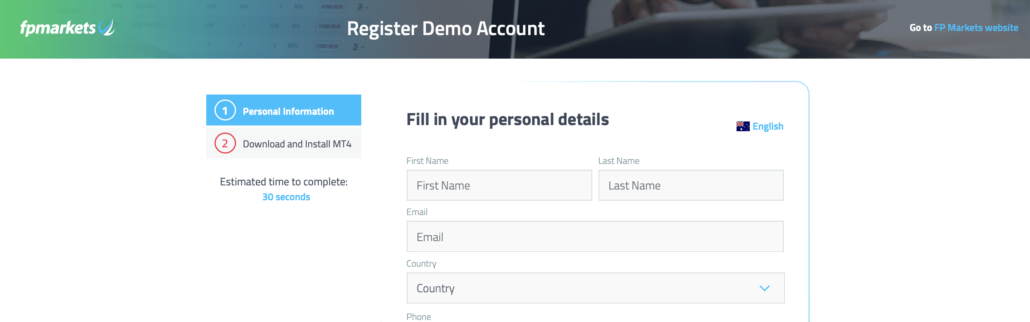

Step 1: Fill in your details

Once you click the registration button, it will direct you to a page you have to fill in some personal details. Here is a list of what you may need;

- Full names

- Email Address

- Town/home address

- Date of birth/ Age

- Citizenship/ Country of residence

- Phone number

- Social security number/Tax ID

- Income type/ Employment

- Account type

- A password for your trading account

You have to fill in these details truthfully because a forex account deals with real money. That means, in case of a problem during the transaction, they have all the details they need. It is also a way for the forex broker to ensure the protection of their traders.

The forex industry regulation measures call for all these details. This is for the forex brokers to account for all the forex traders. It is easy to settle any problems with all the details of the traders available. You don’t need to worry about the security of your details if you have a licensed and regulated forex broker.

Step 2: Fill in details of your financial record

Here are some details that you have to give about your financial history;

- How much you make annually

- How much your assets and liquidity are worth or your net worth

- The number of years you have traded forex

- Your expectations in forex trading

The forex trading industry is a risky market to join. Forex brokers have to understand if you are financially capable of trading. It is hard to profit in forex than it is to lose. It is why the forex industry requires financial discipline.

If you get any problem when filling in your details, you can contact the customer support team to help. Most forex brokers have a customer care team ready to assist traders through the registration process.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Step 3: Read and understand the terms and conditions and the financial risk of forex trade

This step is crucial for any forex trader since they need to understand forex trading. It is specifically for new forex traders since they will experience some losses and profits.

The forex broker has placed rules that you need to follow before trading using their software. Go through all these rules to help you comply with some, and have an easy time with your forex broker.

If you have read and understood the risks, you can agree to these terms and submit your registration form.

Step 4: Verification of your details

The verification tab comes after you have submitted your details. There is some information a forex broker requires to verify if you are a registered citizen of a country.

You should have documents such as your national identity card or passport and a utility statement. Take a clear picture of these documents or scan them to submit them.

They will send a confirmation email that indicates you are the owner, to confirm your email. You will also verify your mobile number through a text with a code that you fill in on the verification blanks.

The verification team of forex brokers has a different length of time to verify the documents. Some brokers can take three days to a week, it depending on the number of registrations that take place. Most forex brokers verify details within an average of three days.

Verification is a crucial step because it is one of the rules of forex broker regulations. It is a way of protecting forex traders and ensuring that the forex market is safe to trade. In any case of transactional disputes, the forex broker can settle the issue fast. Since it has the basic details of the traders registered under it.

Step 5: Choose a payment method and deposit the minimal deposit

For some forex brokers, the registration includes paying a minimum deposit indicated. In this case, you will get directed to a page to choose a payment method to use. Forex brokers offer various payment methods.

The payment methods depend on the location of the forex broker and the forex trader. There are countries where some wire transfer methods are not available. The payment methods that most forex brokers accept are debit and credit cards.

However, there are other types such as digital wallets. These are like PayPal, Neteller, Skrill, Webmoney, Giropay, Apple pay, Sofort and others. Other forex brokers accept bank cheques and bank wires. You have to choose a safe forex broker, and you are comfortable.

Some forex brokers have low minimum deposits, and some have no minimum deposit. The minimal deposit depends on the type of account you have registered to use. Standard, mini, and micro-accounts mostly have no or low minimum deposits.

The premium and professional accounts have higher minimum deposits. It is because these accounts are for those with experience trading.

Make sure you have a payment platform that you are comfortable using. Proceed to link these accounts and deposit your funds.

Conclusion

Registering a forex account is easy and fast for many forex brokers. Ensure before you register for an account, you have done a background check on the forex broker you want to use. Other than that, this is the first step toward starting a trading journey.

Forex trading is hard and requires patience. We recommend new traders take time to learn the basics. More so, how to conduct a detailed technical and fundamental analysis. Another tip is to use the demo account to practice their strategies.

It is crucial to practice how to control their emotions before forex traders start transacting. The forex market could go against traders on most days. It leads many forex traders to give up trading. But, if they follow some of these ideas they can succeed in a lucrative career in forex trading.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about register & sign up with a forex broker :

Are the forex brokers required to have a license?

If you are planning to take a step ahead and start as a new forex broker or planning to make a start within the forex brokerage business, make sure to obtain the forex license as part of the foremost step. Note that traders today are getting conscious, and in order to decrease their concerns and doubts, it is better to have a license as to have a license in your hands does make you trustworthy in their eyes.

How can one register with a forex broker trading platform?

There is only one thing you have to do in order to sign up for a forex broker trading platform:

Establish an account on the firm’s official site. Make sure to fill up the standard form that requires personal data, including the client’s name, phone number, and email address, correctly.

After that, use the username and password to access the user account.

Select the real account type from the list and then click on the option ‘open account.’

What are some crucial details to understand before beginning to trade forex?

One must make sure to know about the currency pairs, the significance of bid-ask spreads, leverage, forex trading strategies, the trading plan, and personal emotions and biases.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)