The 5 best Forex Brokers & platforms in Azerbaijan – Comparison & reviews

Table of Contents

Choosing a forex broker is not an easy task. After all, there are a huge number of available brokers out there. If you’re having difficulty deciding which broker is best for you, you have come to the right place. Below is a comprehensive review of the five best forex brokers in Azerbaijan.

See the list of the best Forex Brokers in Azerbaijan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the 5 best forex brokers in Azerbaijan:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com was founded in 2016, and its headquarters is in England. Other locations include Australia, Seychelles, Cyprus, and Gibraltar. Regarding forex trading, they are widely regarded and having low trading fees.

Traders may be certain that Capital.com is secure and trustworthy. The Financial Conduct Authority, the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the National Bank of the Republic of Belarus have jurisdiction over it.

The initial deposit required by Capital.com is $20. However, if you prefer to add funds through bank transfer, the broker requires a minimum investment of $250. You may pick from five different base currencies. These currencies are GBP, EUR, USD, AUD, and PLN.

Capital.com offers just one kind of account. This is referred to as the Standard Account. You can easily open an account in under five minutes. To verify your account, you only need to supply basic details like your date of birth, full name, address, etc., and produce any acceptable ID.

The broker’s website has a plethora of training courses and tutorials for beginning FX traders. It also provides a free demo account where clients can access the trading platform and practice trading with virtual cash.

Capital.com’s trading platform is available on mobile devices for individuals who like to trade on the move. Clients may trade using their tablets or mobile phones. The trading site is available in over 25 languages, including Finnish, Polish, Arabic, Thai, and Russian.

Customer service is provided 24 hours a day, seven days a week, and you may contact them through email, phone, or live chat on the trading platform.

Summary:

- $20 is the minimum deposit required by the broker.

- The broker is regulated by the FCA, CySEC, and NBRB.

- Clients don’t have to pay a withdrawal and inactivity fee.

- Clients don’t have to pay commission.

- Spreads start at 0.6 pips.

- The broker accepts payments made via bank transfer, MasterCard, Visa, iDeal, Skrill, Neteller, Qiwi, and WebMoney.

Disadvantages of trading with Capital.com

Suppose you fail to provide a valid ID within 15 days of filling out the registration form. In that case, the broker will automatically close your account. Also, you can only choose between five base currencies.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets, founded in 2014, is well-known in the forex trading world. Although its headquarters are in New Zealand, it also has offices in Indonesia, Malaysia, the United Kingdom, and New York.

This broker is regulated by both the Financial Services Authority of Seychelles and the Financial Markets Authority of New Zealand. Many traders use BlackBull due to its minimal costs and consumer-friendly platform.

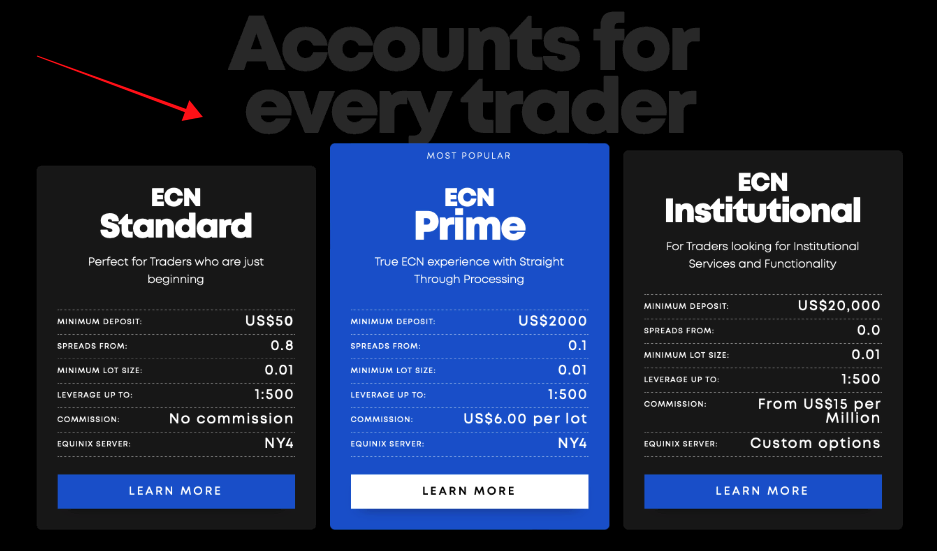

Clients may establish either a Standard Account or a Prime Account with BlackBull Markets. The minimum deposit spreads and commission amount vary between these two account types.

The minimum deposit for a Standard Account is only $200, while a Prime Account requires a deposit of $2,000. For the spreads, Prime Accounts are eligible for spreads as low as 0.01, while Standard Account spreads begin at 0.8. Finally, although there is no commission cost for Standard Accounts, Prime account holders are charged $6 per lot traded.

There are a total of nine basic currencies to choose from. USD, GBP, EUR, AUD, SGD, NZD, JPY, ZAR, and CAD are among them. When you withdraw money from BlackBull Markets, you will be charged a $5 fee. If you withdraw using an overseas bank, the cost is increased to $20.

The website includes a number of instructive lectures and articles. There is also a trading platform training video to assist you in navigating the platform. The demo account is completely free to use and includes virtual money given by the broker.

The online trading platform also has a mobile version, allowing you to trade anywhere you go. It supports over 40 languages, including Thai, Serbian, English, Chinese, Portuguese, Spanish, Uzbek, and more.

Customer service at the broker may be reached by phone, live chat, or email. They are, however, not accessible around the clock. Instead, it is only accessible 24 hours a day, five days a week.

Summary:

- $200 is the minimum deposit required by the broker.

- The FMA and FSA regulate this broker.

- Clients will have to pay a commission rate of $3.

- Spreads start at 0.8 pips.

- The broker accepts payments made via bank transfer, credit card, debit card, FasaPay, China Union Pay, Skrill, and Neteller.

Disadvantages of trading with BlackBull Markets

Unlike most brokers, BlackBull Markets charges a withdrawal fee. Additionally, the minimum deposit required for Prime Accounts is too high for almost all new forex brokers.

(Risk Warning: Your capital can be at risk)

3. RoboForex

This firm is a well-known broker in the forex industry. It was created in 2009, with its headquarters in Belize. The International Financial Services Centers Authority oversees this broker.

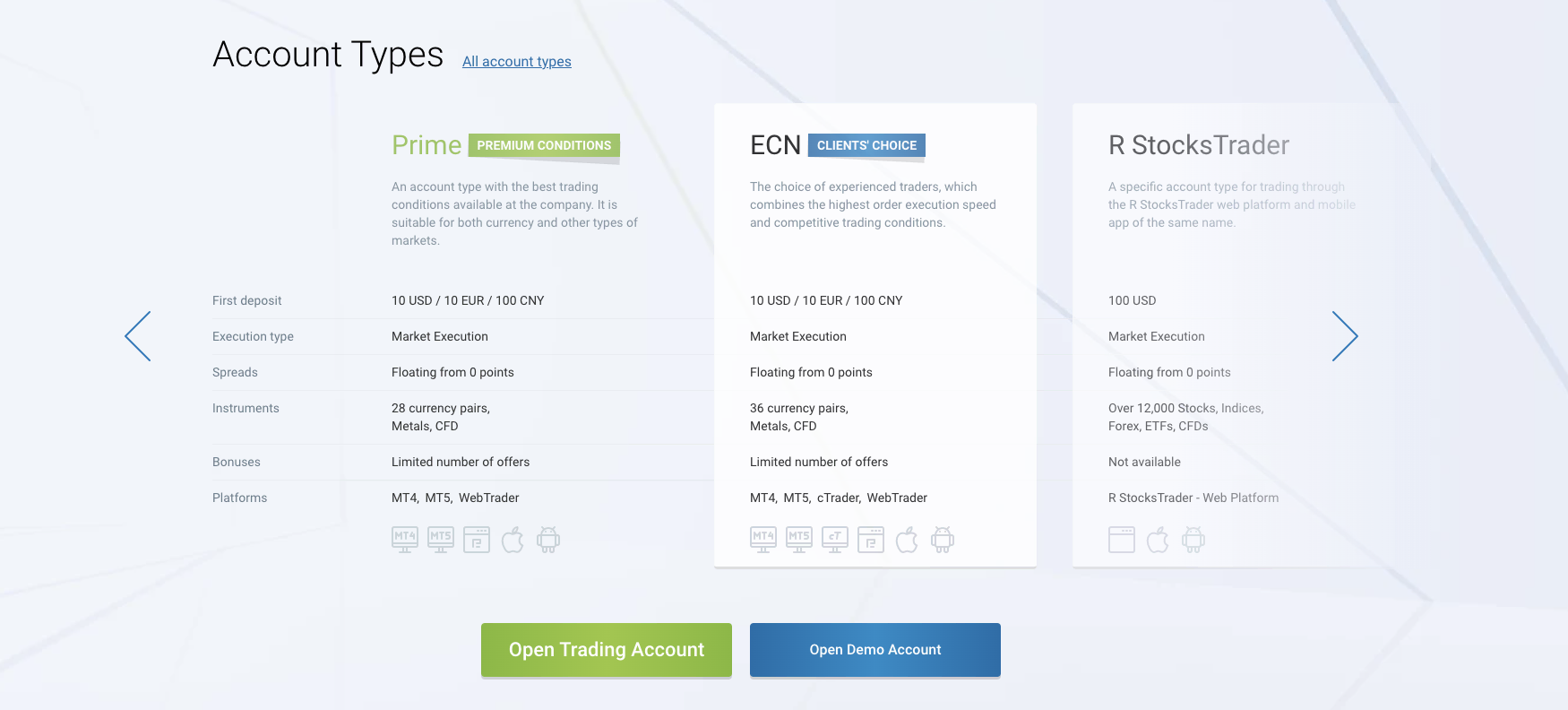

There are six different kinds of accounts to select from. The R Trader, ECN-Pro, Pro-Cent, Prime, and Pro-Standard are among them. For both novices and experts, the Pro-Standard and Pro-Cent accounts are suggested. However, we suggest the Pro-Cent account for novices because it is a micro account. Micro accounts are great for beginners who want to test the waters but also want to invest real money.

The broker charges no deposit or withdrawal fees. They do, however, impose an inactivity fee. There are six basic currencies to choose from: USD, EUR, BTC, Gold, CNY, and RUB.

The website has a plethora of videos, news stories, and instructive publications that provide all of the knowledge that novices need. The demo account is an excellent feature. The broker hosts monthly and weekly competitions to motivate clients to practice and hone their trading skills.

Both desktop and mobile devices may use the web-based trading platform. It also includes copy trading, which allows you to see the activity of other traders.

Customer service is accessible in over ten languages. They are available 24 hours a day, seven days a week by email and phone. Live chat is also available on the trading platform or the broker’s website.

Summary:

- The minimum deposit required is $10.

- The broker holds licenses issued by IFSC and CySEC.

- The broker charges a commission fee that starts at $2.

- Spreads are as low as1.3 pips.

- The broker accepts payments made via bank transfer, debit card, credit card, Perfect Money, Skrill, Neteller, and Advcash.

Disadvantages of trading with RoboForex

There is a limited number of forex pairs to trade with RoboForex. Thirty-six pairs are good enough for traders who are just starting out. However, professionals might opt to choose a different broker because of this low number.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

This Australia-based forex brokerage was established in 2010 and is headquartered there as well. In order to expand their service to European customers, they opened a branch office in the UK in 2015.

Pepperstone is regulated and overseen by the Financial Conduct Authority and the Australian Securities and Investments Commission. Most of their customers also benefit from a negative balance protective measure.

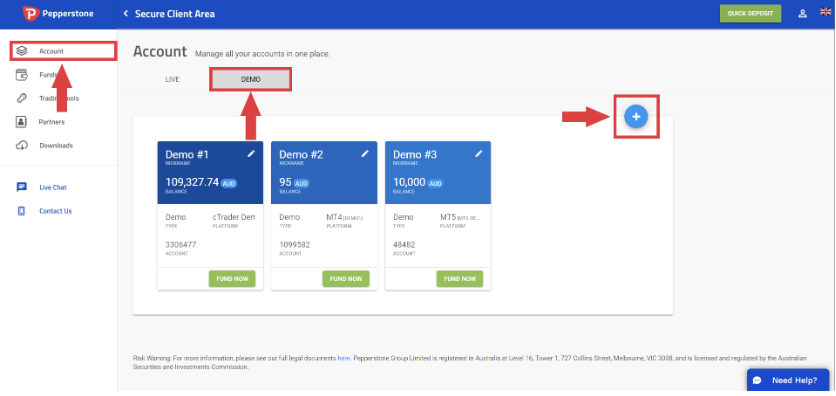

Pepperstone has just one active account type, and there is no minimum deposit required. Furthermore, there is no inactivity or withdrawal fee charged by the broker. If you are not ready for live trading, you may practice with a free demo account.

Any device may access the trading platform. Individuals who do not wish to download the program also include a web-based platform. It is also available in a variety of languages.

Customer care is only available 24/7, and may be reached via phone or live chat. The broker claims that its customer service provides a timely and effective response time. You can be certain that they will answer your question or address your concern promptly.

- The broker does not have a minimum deposit requirement.

- ASIC, FCA, and CySEC regulate this broker.

- Clients have to pay a $3 commission rate.

- Spreads are as low as 0.0 pip.

- The broker accepts payments made via bank transfer, credit card, debit card, Union Pay, Skrill, Neteller, Bpay, PayPal, and Poli.

Disadvantages of Trading with Pepperstone

Customer service is not available 24/7.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

This Cyprus-based forex broker first opened its doors in 2013 and now serves clients in more than 190 different countries worldwide. It is well-known across the world as forex and binary options broker (only for professional traders and those outside of EAA countries), and the Cyprus Securities and Exchange Commission oversees its operations.

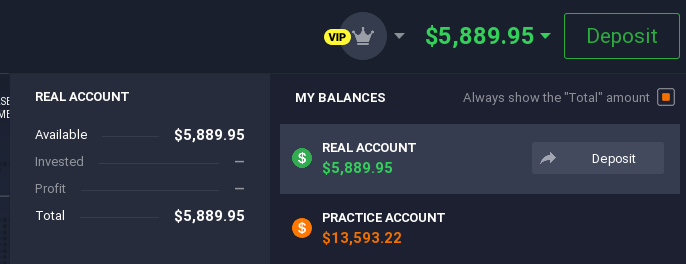

With this broker, you can choose between two different account options: Standard and VIP. You simply need $10 to open a Standard account, and you may begin trading immediately. However, to be upgraded to a VIP account, you must first deposit a specific sum of money. The actual amount is not set, and the broker modifies it regularly.

EUR, GBP, and USD are the three base currencies that are offered. The broker charges no withdrawal fees. However, when withdrawing money via a bank transfer, you can expect to pay a processing charge.

The free demo account, which comes with a simulated balance of $10,000, can be used to practice before opening a permanent account. The trading platform is accessible on both desktop and mobile platforms, and it is available in more than ten different languages.

Customer support is available through email and live chat on the website or platform and over the phone. With more than 80 people on hand, you can anticipate any complaint or inquiry to be resolved within a few minutes, at the very least.

- $10 is the minimum deposit required by this broker.

- CySEC regulates this broker.

- Clients have to pay a commission rate of $3 per trade.

- Spreads are as low as 0.6 pips.

- The broker accepts payments made via wire transfer, debit card, credit card, Cash U, Neteller, Skrill, Web Money, Moneybookers, and Maestro.

Disadvantages of trading with IQ Option.

You are forced to trade on their proprietary trading platform when trading with this specific broker. This is a huge problem for traders who are used to the Meta Trader platform.

But this doesn’t mean IQ Option’s platform is not as good. You can ask a customer service representative to assist you in navigating the trading platform.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Azerbaijan?

Trading forex is popular among clients in Azerbaijan. More and more Azerbaijan citizens have joined the forex trading trend during the past couple of years.

In Azerbaijan, various banks, financial institutions, insurance companies, financial markets, payment systems, and pension systems are part of the financial regulation. They are responsible for improving and developing the country’s financial system.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Azerbaijan

Although it is safe and legal to trade forex in Azerbaijan, keep in mind that you can’t trust all the brokers there. When deciding on a broker, you have to make sure that reputable regulatory bodies regulate them. Additionally, take some time to read honest user reviews to gauge whether you should trust that broker or not.

Some brokers offer insurance or extra protection to their clients. They often have a system that prevents your funds from going down to zero, but this is not offered to all clients.

Another thing that you should look out for is where the broker stores your funds. You know you can trust that broker if your funds are held in a segregated account. This ensures that only you can access your funds and earnings.

Is it legal to trade Forex in Azerbaijan?

Trading forex in Azerbaijan is 100% legal. However, make sure that you are trading with globally regulated brokers by reputable regulatory bodies.

How to trade Forex in Azerbaijan – Quick tutorial

1. Open account for Azerbaijan traders

The account opening process for all the brokers mentioned above is very straightforward. The same can be said for other brokers that are not on this list. Each broker has a signup sheet that you have to fill out. It typically asks for your full name, address, phone number, email address, and other basic information.

Next, you will have to verify your account. Some brokers send you an email with a link for you to click on. Others will ask you to send a valid government-issued ID to verify your identity. Some even simply give you a call to finish setting up your live trading account.

2. Start with a demo account or “real” account

It’s understandable why some traders immediately jump into live trading. But this is not the most practical way to start trading forex. A lot of professionals highly recommend starting out with a demo or trial account.

Demo accounts are completely free to use, and anyone can sign up for one. It’s a great place for beginners to familiarize themselves with how the market moves. Professionals also take advantage of this free feature to help them form new strategies and hone their trading skills.

A demo account gives you access to the broker’s trading platform. It even mirrors the movement of the live market to better prepare you for when you decide to start trading with real money.

There is no limit to what you can do with a demo account. The only difference between a demo and a live account is with a demo account, you’re trading with simulated money. This means you can’t actually keep your earnings.

However, some brokers host trading contests on demo accounts. Usually, the price translates to real money that is deposited into your live trading account, assuming that you have one.

3. Deposit money

As soon as you are ready to start trading with real money, the broker will prompt you to deposit funds into your account. The deposit methods vary per broker, but the most common methods are bank transfer, debit or credit card, and some online wallets like Skrill, Neteller, and PayPal.

Keep in mind that some brokers charge a deposit fee. Make sure to read up on the terms and conditions before you top up your live trading account.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Once you deposit money into your account, we understand that opening up a position is very tempting. However, doing this is very risky. Set aside some time to analyze the market’s movement. This way, you can devise a strategy that is appropriate to the market’s movement, which could translate to a much higher chance of turning a profit.

It’s also important for you to study different trading strategies. If the broker features copy trading, take advantage of this and take a look at how other clients are executing their trades.

An example of a popular forex trading strategy is the scalping strategy. This is commonly used by traders who have the luxury of time to monitor the market for long periods. This strategy focuses on making small profits while minimizing losses.

5. Make a profit

Suppose you successfully implement a risk management system and analyze the market properly. In that case, the chances of you turning a profit are increased.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Azerbaijan

Trading forex is a great way to earn money. Some trade forex as a full-time job. But it takes a lot of practice and research to reach that point. However, the first step to becoming a forex trader is choosing the best forex broker for you.

FAQ – The most asked questions about Forex Broker Azerbaijan:

What is special about forex trading in Azerbaijan?

Traders in Azerbaijan are making a lot of money by trading forex. It is what makes forex trading special for traders in Azerbaijan. They are at par with world investors. They can specialize their trading skills by signing up on various online platforms that simplify their trading journey.

Can beginner traders trade forex in Azerbaijan?

Yes, beginner traders can trade forex in Azerbaijan. However, new traders should try to pick forex trading as their preferred arena. It is because forex trading is simple and does not involve as much research as other kinds of trading. Traders only need to keep an eye on the price movement of an asset. Then, they can enjoy trading with profits.

What forex trading strategies should a trader in Azerbaijan follow?

There are several trading strategies traders in Azerbaijan can follow to trade with profit. These trading strategies are easy to build, and traders can always expect these strategies to work wonders. For instance, traders can follow the news trading strategy. In addition, they can follow trends. The use of a demo account in helping you build trading strategies is paramount. You can always use all the available trading charts and tools to develop a perfect forex strategy. It will help you place winning trades and make profits while trading forex.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)