The 5 best online trading platforms for new traders – Comparison and reviews

Table of Contents

Looking for the right broker with the best online trading platform can be a chore. There are so many options to choose from, and it may not be easy to compare each of the brokers on your own. Here is a list of the 5 best online trading platforms for new traders.

The list of the 5 best online trading platforms for new traders includes:

Trading platform: | Review: | demo account: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. XTB | Available | Starting 0.1 pips | 3,000+ | + More than 3,000 different markets + Very good trading conditions + Direct market access + Bonus Programm | Free demo account(Risk warning: 72% of retail CFD accounts lose money) | |

2. Markets.com | Available | Starting 0.6 pips | 250+ | + Accepts international traders + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: 67% of retail CFD accounts lose money) | |

3. Capital.com | Available | Starting 0.5 Pips | 6,000+ | + Multi-regulated broker + Free demo account + Low spreads and no commissions + Trade CFDs on more than 6,000+ markets + Personal support | Free demo account(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Vantage Markets | Available | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: Your capital can be at risk) | |

5. Libertex | Available | Starting 0.0 pips | 250+ | +Multifunctional and user-friendly platform + No deposit fees and reasonable trading fees +Popular trading platform +The minimum deposit is € 100 + Over 5 different languages customer support | Free demo account(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

See the list of the 5 best online trading platforms for new traders here:

- XTB – Excellent trading conditions

- Markets.com – Over 8,200 markets to trade

- Capital.com – Multi-regulated broker

- Vantage Markets – Reliable support and service

- Libertex – Multifunctional and user-friendly platform

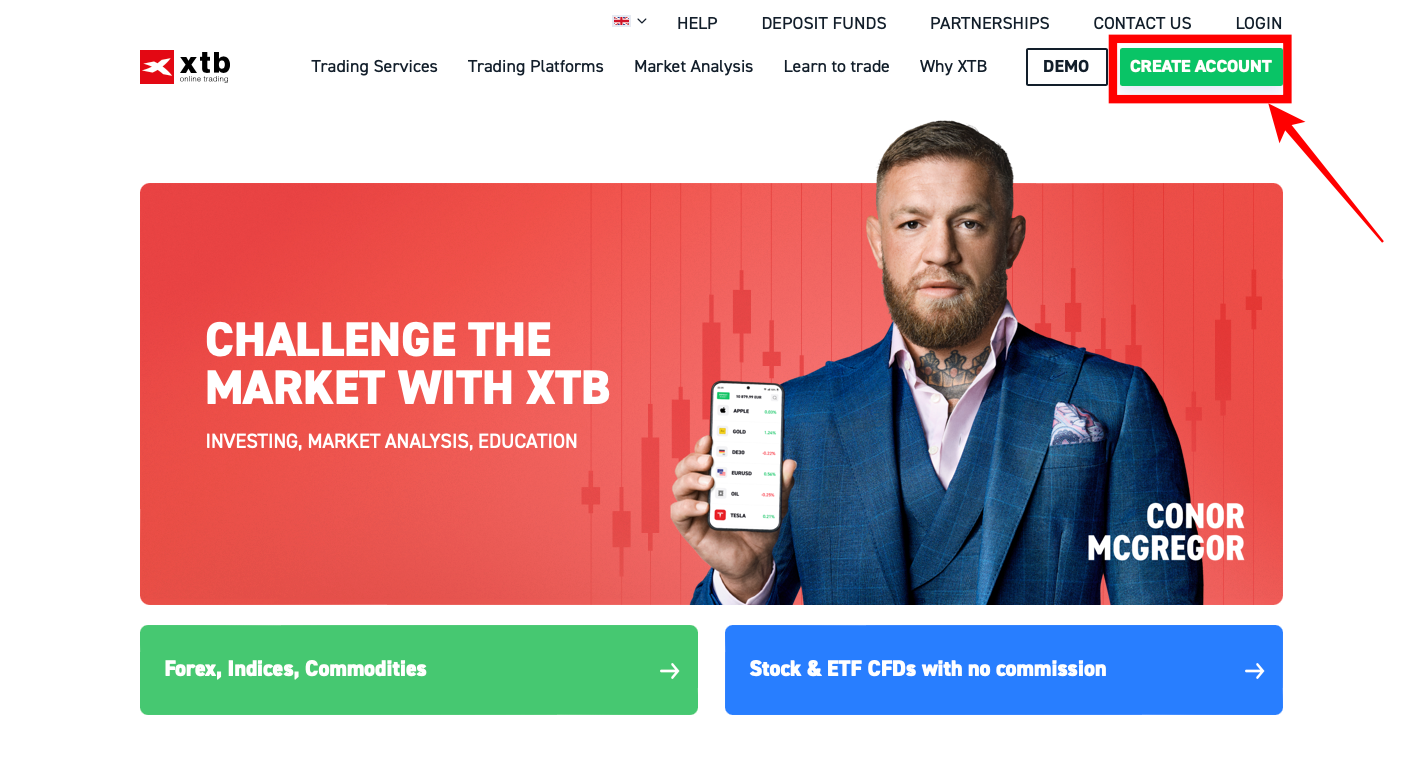

1. XTB – Good trading conditions

XTB is known as one of the largest global forex and CFD exchange. It was founded in 2002 and is based in Warsaw and London, with principal offices located in more than ten countries, including Germany, Poland, Chile, France, and the United Kingdom.

Various financial authorities regulate this broker. It is supervised and regulated by the Cyprus Securities and Exchange Commission, the Financial Conduct Authority, the Dubai Financial Services Authority, the Belize International Financial Services Commission, and the Comisión Nacional del Mercado de Valores.

Along with its top-notch services, XTB’s innovative online trading platform has earned this company numerous awards, including Best Financial Educator, Best Trading Platform, Best CFD Broker, and many more.

XTB offers a wide range of assets for its clients to trade. There are 5 cryptocurrencies, 135 ETF CFDs, 1844 Stock CFDs, 23 commodities, 35 indices, and 57 forex pairs. You can view the complete list of assets on the website.

These assets can be traded on the xStation 5, XTB’s proprietary online trading platform. This award-winning platform is famous for its fast execution speeds and user-friendly interface. The web trade platform can be accessed via Chrome, Safari, Opera, or Firefox. Additionally, you can download the desktop app from XTB’s website.

If sitting in front of a desktop all day is not in the cards for you, XTB’s online trading platform can be downloaded from the Google Play Store or Apple App Store. It is compatible with any iOS or Android mobile device.

With XTB, you can create an account within a couple of minutes. The first step is typing in your email address and choosing your country of residence from the drop-down box. Next, basic personal information like your address and date of birth are needed.

After that, select which trading platform you want to use, your desired account type, and the currency you wish to trade with. A couple more questions are asked after this, including your financial status and trading experience. Once you send in the form, XTB will send you a verification email so you can activate your trading account.

XTB does not require a minimum deposit. You can add funds using Skrill, PayPal, Paydoo, Neteller, PayU, SafetyPay, and BlueCash. ECOMMPAY, Sofort, bank transfer, and Blik. Remember that when adding funds, using a bank transfer may take a couple of days. The rest of the methods are instant.

You can only withdraw your profits using a bank transfer. XTB does not charge any fees if you withdraw $100 or more. Withdraw anything below that number, and you will incur a fee. Withdrawals are often processed within one business day.

If the process takes longer than a day, XTB has a dedicated customer support system available 24/5. You can contact them via telephone or the live chat window on the website. Traders from Australia, Israel, Slovakia, Singapore, Mauritius, Japan, Canada, Ethiopia, Bosnia and Herzegovina, Pakistan, India, Turkey, Uganda, Cuba, Syria, Iran, Iraq, Romania, Kenya, and the United States can not use XTB’s trading platform.

Benefits of XTB:

- Regulated by four well-known regulatory bodies

- XTB demo account is free for one month

- No minimum deposit required

- 57 forex pairs, 1846 stock CFDs, 30 indices, 10 commodities, and 15 cryptocurrencies

- Has its own trading platform known as xStation 5

- Competitive spreads that start from 0.01 pips

- Commissions as low as 0.08%

- 24/5 multilingual chat and phone support

- Has a trading academy, articles, price tables, market analysis, and a market calendar

(Risk warning: 72% of retail CFD accounts lose money)

2. Markets.com – Over 8,200 markets to trade

Markets.com was founded in 2008 and is known as the trading arm of a former TradeTech Group, Finalto Limited. In 2020, this broker won the award for Best Trading Platform with its cutting-edge trading terminal.

The Financial Services Commission, or the FSC, regulates and monitors Markets.com to ensure that this broker provides the best service to all its clients. You can also access Markets.com’s risk disclosure statement, privacy policy, and other important documents so you can review them before you sign up for an account.

With Markets.com, you gain access to more than 2,000 market shares from countries like the United Kingdom, the United States, Italy, Spain, Sweden, Australia, Denmark, Finland, Germany, Netherlands, Hong Kong, Norway, Greece, South Africa, and many more. Additionally, there are 67 tradeable forex pairs, including seven major pairs, minor pairs, and even exotic pairs. Lastly, 60 ETFs are tradeable on Markets.com’s online trading platform.

Markets.com has two proprietary online trading platforms. These are Marketsx and Marketsi. Markets.com offers a wide range of trading tools, including a hedge funds confidence tool and over 50,000 blog posts with market insights.

Alternatively, you can trade using either the MetaTrader 4 or MetaTrader 5 online trading platform. All these platforms are available on desktop and mobile devices. If you’re trading on a tablet or smartphone, you can download the app from Google Play Store or Apple App Store.

When opening an online trading platform account with Markets.com, you will need to fill out the registration form asking for your email address and password. You will then need to take a test to determine how much you know about trading. Once you’re through with the test, you will be asked to verify your billing address and ID.

The minimum deposit required to trade live is $100, and you can add funds using your debit or credit card, Skrill, Neteller, bank wire transfer, PayPal, Sofort, and Ideal. To withdraw funds, you can use your credit or debit card, Skrill, Neteller, PayPal, or bank transfer. If you want to test out the platform or broaden your knowledge first, you can use Markets.com’s free demo online trading platform.

Markets.com’s customer support representatives can be reached 24/5 via phone or live chat. For ease of use, the website supports three languages, English, Arabic, and Spanish. Traders from the Russian Federation, the United States, Brazil, Japan, Belgium, Canada, Turkey, Israel, New Zealand, Iran, Iraq, Puerto Rico, Hong Kong, India, and Singapore are not eligible to use Markets.com.

Benefits of Markets.com:

- Regulated by FCA, CySEC, ASID, FSC, and FSCA

- Free demo account

- Markets.com minimum deposit is $100

- 64 forex pairs, more than 2,000 shares, 25 cryptocurrencies, 40 major stock indices, 28 commodities, 60 ETFs, 4 bonds, and 21 stock blends

- Has two proprietary trading platforms known Marketsi and Marketsx, but MT4 and MT5 are also supported.

- Average spreads start at 0.70 pips.

- Low commission on some stock CFDs

- 24/5 chat and phone support

- Has a knowledge center and helpful trading tools

(Risk warning: 67% of retail CFD accounts lose money)

3. Capital.com – Multi-regulated broker

Capital.com was established in 2016 and is known for having competitive spreads. It has only been around for 5 years, but this broker already caters to over a million clients from 50 countries around the globe. Its main offices are located in Londo, Cyprus, and Gibraltar, and the Financial Conduct Authority and the Cyprus Securities and Exchange Commission regulate this broker.

This broker offers various asset classes that can be traded on its proprietary online trading platform or on the MetaTrader 4 platform. There are multiple indices, 29 cryptocurrencies, 1,600+ stocks, 68 forex pairs, and 18 commodities. Some of these asset classes can also be traded as CFDs.

When using Capital.com’s award-winning online trading platform, you get access to more than 60 technical indicators, a wide range of drawing tools, and various chart types. Included in the chart types are candlestick, bar, Heikin-Ashi, area, or line charts.

It also comes with risk management tools, price alerts, and the option to trade using leverage. The online trading platform can be accessed through your web browser. You can also download the desktop application if you prefer having a separate software.

For traders who prefer working on a tablet or mobile phone, you can download the online trading platform application from the Apple App Store or Google Play Store. The application offers an interface that is perfect for mobile devices.

Capital.com requires you to type in your email address and password to create an online trading platform account. On the other hand, you can link your Google, Apple ID, or Facebook account to create an account easily.

Live trading has a minimum deposit of $20. Capital.com supports multiple payment methods such as Sofort, iDeal, bank wire transfer, Multibanko, Webmoney, QIWI, Przelewy24, Trustly, ApplePay, 2c2p, or AstropayTEF. The amount you deposited should instantly reflect on your account. When withdrawing funds, you can use the same method you used to add funds to your account.

If you encounter any problem, Capital.com’s online trading platform has a built-in live chat system where you can contact a customer support representative to assist you. They can also be reached via phone and Facebook Messenger.

It’s important to note that Capital.com is only available to a few countries. These countries are Argentina, Armenia, Austria, Bahrain, Bulgaria, Chile, Cyprus, Croatia, Czech Republic, Estonia, Germany, Georgia, Greece, Finland, Gibraltar, Iceland, Ireland, Italy, Indonesia, Latvia, Liechtenstein, Kuwait, Lithuania, Monaco, Mali, Mexico, Oman, Norway, Netherlands, Philippines, Pakistan, Portugal, Romania, Qatar, Sierra Leone, Slovakia, Sweden, Spain, Switzerland, Thailand, the United Kingdom, and the United Arab Emirates.

Benefits of Capital.com

- Regulated by CySEC and FCA

- Capital.com demo account

- Capital.com minimum deposit of $20

- 138 forex, 31 commodities, 202 cryptocurrencies, 26 indices, and 3616 shares

- Uses MT4 and its own trading platform

- Tight and competitive spreads

- Zero commission

- 16/7 phone and live chat support

- Trading guides for the different asset classes

(Risk warning: 78.1% of retail CFD accounts lose money)

4. Vantage Markets – Reliable support and service

Vantage Markets is an international broker for Forex (currency pairs) and CFDs (Contracts for Difference). The company has existed since 2009 and knows exactly how to respond to the wishes of its customers. The broker is mainly based in Level 29, 31 Market Street, Sydney NSW 2000, Australia, and accepts traders from almost every country. But they also got business addresses in the Cayman Islands and Vanuatu.

Vantage stands for transparent trading on the financial markets. This can only be said of some brokers and is very difficult to recognize, especially for the beginner. The strengths of Vantage Markets are transparent order execution and liquidity delivery. It is one of the few actual ECN brokers. The broker is connected to a network of large liquidity providers. These accept the order of the traders. The liquidity providers are transparently visible on the homepage. Large, well-known banks (HSBC, Bank of America, UBS, and more) are among them.

Vantage Markets has more than 180 different tradable assets. These include forex (currencies), indices (Dax, SP500, etc.), commodities, precious metals, energies, and cryptocurrencies. The selection here is very large, and every trader should find his matching asset to trade. The broker is constantly striving to expand the offer and to implement new markets.

Vantage Markets also offers 3 different account models (STP, RAW ECN, and PRO ECN – more on that below). The leverage can be up to 1:500 high for all accounts, and the spreads start depending on the account model from 1.4 pips or 0.0 pips. The commission per traded 1 lot is either $ 3 or $ 2 high. This is, from my experience a minimal and cheap value. Therefore, Vantage Markets is among the cheapest forex brokers.

Generally, the minimum deposit at Vantage Markets is $ 200. From this amount, a Standard STP account can be opened. You must deposit at least $ 500 for the RAW ECN account and at least $ 20,000 for the PRO ECN account. The capitalization of the trading account is elementary and works through proven methods.

Vantage Markets is undoubtedly not a market maker broker. This means no conflict of interest between the broker and the trader. Some brokers only earn on the loss of traders and do not sell the orders to the markets. This is very untransparent in most cases. As you can see on the homepage of Vantage Markets, there is high transparency. The broker is an actual ECN broker (see Liquidity Provider) and only earns on spread and paid trades commissions. An interesting conflict can be excluded.

Benefits of Vantage Markets:

- Regulated and safe Forex Broker

- Real ECN Trading

- The best trading conditions for Forex

- Very fast execution

- Reliable support and service

- No hidden fees

- Low trading fees

- Supports MetaTrader 4/5

- Free bonus available

(Risk warning: Your capital can be at risk)

5. Libertex – Multifunctional and user-friendly platform

Established in 1997, Libertex has become one of the biggest online trading platforms in the financial world. They operate under Indication Investments Ltd., registered and regulated by the CySEC or the Cyprus Securities and Exchange Commission.

In 2020 alone, Libertex Group has been awarded the Best Trading Platform by the European CEO Awards, FX Report Awards, and the World Finance Awards.

Libertex prides itself on its transparency, and interested clients can access their privacy policy at any time on Libertex’s website. With over 30 awards under their belt, they provide the best service to 2.9M clients located in over 120 countries.

With 23 years in the market, they now offer more than 250 tradable assets that include selections from Forex, Cryptocurrencies, Metals, indices, Stocks, Oil and Gas, Agriculture, ETFs, and Options. You can view a full list of all the assets they offer on their website without the need to log in.

Clients may opt to use Libertex’s proprietary online trading platform to trade different assets in hopes of making a profit. With all of the assets they have on their web-based platform, you will have endless opportunities as long as the markets remain open.

Libertex also has a proprietary mobile app that has all the same features and assets for traders on the go. With this, clients are able to set up trades and make a profit wherever they are. You can download this on the Apple App Store, Google Play Store, or the Huawei AppGallery.

Although their award-winning platform might be enough for some clients, Libertex has gone the extra mile to offer its services through MetaTrader 4 and MetaTrader 5. Both of these trading platforms offer a modern take on retail trading, and they both feature customizable interfaces which you can use to your advantage.

It only takes a few minutes to set up your Libertex account. You would need to provide your email and a password. When signing back in, you could even use your AppleID or Google Account to create an account.

Interested clients may also try out their features through a Libertex demo account. Through this, users may be able to practice their skills while enjoying everything Libertex has to offer.

With this online trading platform, depositing is very easy since clients would be able to deposit through numerous channels. You can add funds using Paypal, Skrill, Jeton, Neteller, bank transfer, or even credit cards. Depositing is completely free, and the funds will reflect immediately in your account unless you choose to deposit through a bank wire transfer.

Unlike other brokers that only allow bank transfers when withdrawing, Libertex also allows eWallet withdrawals through PayPal, Skrill, Jeton, and Neteller. Clients can also withdraw using credit or debit cards.

Libertex requires a minimum deposit of 100 EUR to enter your first trade, but succeeding deposits could be as low as 10 EUR.

To contact Libertex, you can use their live chat system on their website. Alternatively, you can send them an email at [email protected]. This online trading platform supports multiple languages, such as Dutch, English, French, German, Italian, Polish, Portuguese, Russian, Spanish, and Turkish.

Benefits of Libertex

- Regulated by CySEC

- Free demo account with €50,000 in virtual funds

- Libertex minimum deposit is €100

- 50+ forex pairs, 100 stocks, 18 indices, 10 ETFs16 commodities, and more than 50 cryptocurrencies

- Has its own trading platform but also supports MT4 and MT5.

- No charge for spreads

- Commissions as low as 0.1% and can reach up to 2.5%

- Customer support is available in 11 languages

- Offers free trading signals

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

What is an online trading platform?

As the name suggests, online trading accounts allow millions of traders to trade and invest in thousands of assets. Clients of online trading accounts get to participate in the market movement without having to go directly to wall street or any other location to make their transactions. With technological advancements, even retail traders can purchase or sell assets with a click of a button directly from the comfort of their homes or a mobile device.

Unlike in the past, trades do not need to go through calls or texts to traditional brokers. Instead, all trades go through automatically to the brokers’ system and then to the network where all other trades are executed and matched. With this system, trading has become low-cost and sometimes even charges zero commission.

Creating an online trading account is easy as well. The account only requires a few details, such as your email, password, and mobile number. To access all services, clients will be asked to provide banking details and proof of identity.

With internet speeds improving with no latency or lag time, orders are processed immediately to reduce slippage and ensure orders’ accuracy. Liquidity providers and market makers to provide volume are also present if your broker is affiliated with a legit exchange. No matter where you are in the world, as long as you are a client of a specific broker, you will have access to all of their features and assets as long as you trade these assets within their available market time.

As mentioned earlier, these online trading accounts can be accessed on almost all modern devices. Sometimes, brokers provide their own proprietary software for different operating systems. Others use the standard MetaTrader 4 or MetaTrader 5, as these are already good enough for clients.

The best online brokers nowadays do not only offer one to two asset classes, but instead, they offer multiple such as stocks, forex, commodities, indices, and even cryptocurrencies. They have also evolved to provide derivatives of offered assets, including futures, CFDs, and options.

Depending on your chosen broker, you can also freely change your leverage levels, or you could even request a margin. With these, you could increase the amount of working capital you have and probably earn even more.

Demo accounts are also provided and can be freely used to practice and create strategies. These are risk-free and easy to make. Some brokers even allow the creation of more than one demo account that can be used for different strategies or in case of a wipeout.

With both demo and live accounts, clients would have access to features offered by their chosen broker. It is standard to have an easy-to-use client, but the features need to be valuable and accessible for both veteran and newbie traders. features include charting software, a dedicated section for news, and an organized portfolio of all your assets.

For the benefit of clients, most brokers now give out free research that applies both technical and fundamental analysis. Higher-tiered clients may even be given their own dedicated advisor that will help them out on their trades.

Online trading is for everyone as well. Clients do not need to conform to a single strategy, but they can try out and adopt which suits them most. Aside from day trading, clients may opt to swing trade or hold assets as long-term investments.

With brokers becoming competitive to gain clients, many strive to put out the best promos and perks for clients. These bonuses include deposit bonuses, risk-free trades, and access to top-tier third-party analytics. Additionally, brokers would often boast that they have low spreads to minimize the loss incurred by clients.

Tips and tricks for trading

Beginners and new clients of brokers should always try out their demo accounts first. This is to practice your trading skills with the available assets and features. This is especially beneficial to new users since trading conditions might differ from what they’re used to. They might accidentally use higher leverage, or the asset they want might not be available on their new broker.

We suggest researching a particular asset before trading it. Trading blindly causes more harm than good. Preparing yourself for the fundamental and technical aspects of an asset you’re interested in will allow you to know the critical price points you can buy or sell optimally.

The essential price points can be marked so you can be alerted through your broker. Although this feature is unavailable on all brokers, you can get free alerts using TradingView, the world’s leading charting software. These price points may also be set to act as your automatic stop-loss points, take profit points, or even entry points.

Trading, in general, is a difficult thing to do. Clients, to get the upper hand, must develop an edge in the market. This edge can come from being selective with the assets you trade or even being meticulous in your research.

Aside from knowing what asset they want to trade, traders should also know the amount of time they are willing to hold a specific position. Long-term investors may hold positions for years until it reaches their desired price, while swing traders may hold their open positions from a few days to a few weeks. All these depend on your mentality and strategy as a trader.

We suggest diversifying your portfolio with different assets from different asset classes. For beginners, this will protect them from an unforeseen market crash. Having diversified, only a portion of your portfolio will suffer a loss.

Traders must also know the amount of risk they’re taking per trade. It is suggested that each trade should only have a risk of about 1% of your total portfolio value. This is to avoid a massive drawdown in case a specific asset is hit with a double-digit loss.

How to open an account at an online trading platform

Each broker listed above asks for basic personal information such as your complete name, email address, phone number, and more. However, the steps may vary. Also, you may need to answer a test to gauge your trading experience and knowledge regarding this profession.

(Risk warning: 72% of retail CFD accounts lose money)

Verification process

The verification process is often quick and easy. Brokers will send you a confirmation email containing instructions on how to verify your account if need be. Additionally, some withdrawal methods require verification as well. A government-issued ID and proof of address are usually required for this.

Demo online trading platform account

The lack of a demo account could sometimes be a deal-breaker for some traders. This is why it’s important that the broker you partner with offers this feature. Demo accounts are used to test the trading platform and the features and services offered by the broker. It comes with virtual funds, so you can trade risk-free while getting used to the online trading platform.

Deposits and withdrawals

Depositing funds to your online trading platform account can be done directly from the broker’s trading platform. A wide range of payment methods is supported to ensure that you can add funds with ease. Typically, the amount will reflect on your account instantly. But if there is a delay, you can send the broker an email or get in touch with a customer support representative via the live chat window.

On the other hand, withdrawals may take a couple of hours to a few days to process. Withdrawal requests can be made from the online trading platform, and the methods also vary depending on the broker.

Fees for an online trading platform account

Brokers charge fees in the form of commissions or spreads. These vary depending on your broker and the asset being traded. Also, deposit and withdrawal fees may exist. You must read the terms and conditions of the broker before making your first deposit. However, signing up for an online trading platform account is completely free.

Conclusion – Start trading with one of 5 best online trading platforms for new traders!

Although this list covered all the important information on each broker, we suggest you test out each of the platforms first to get a better idea of how they differ from each other. It is also ideal for you to do a bit of research as well before you decide to partner with a specific broker.

(Risk warning: 72% of retail CFD accounts lose money)

Frequently asked questions (FAQs) about trading platforms:

What is the most profitable trading platform?

It’s common for traders to assume that the cheapest trading platform is the most profitable one. In reality, fees and minimum deposits only play a small role in this situation. This all depends on how well and efficiently you manage your trades. Make sure to hone your skills before you start investing real money to increase your chances of making a profit.

What is the cheapest trading platform?

The cheapest trading platform on this list is Capital.com. It charges zero commissions with very low spreads. Additionally, it only requires $20 as a minimum deposit.

Last Updated on February 16, 2023 by Arkady Müller

(5 / 5)

(5 / 5)