The 5 best Forex Brokers and platforms in Cambodia – Comparison and reviews

Table of Contents

Forex remains one of the best ways to grow your wealth. High liquidity and lax trade times make it much easier for regular joes to trade and turn a profit.

Also, in recent times, accessibility to the forex market has become mainstream and digitized. This has, in turn, allowed anyone with access to a laptop or a smart mobile device to access good online brokers and turn a profit.

See the list of the best Forex Brokers in Cambodia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

If you live in Cambodia and are interested in forex trading, this article is definitely for you.

Here is a list of some top brokers you should look out for when you are located in Cambodia.

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com’s mission statement is to “make the world of finance more accessible, engaging and useful”

The firm started in 2016 and has grown since then. Currently, they have a user base of 500,000 people and growing.

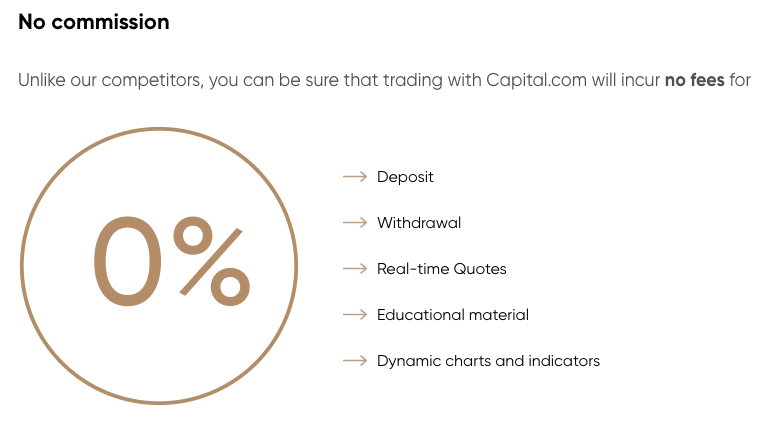

Capital.com prides itself as a fair broker, offering 0% commission. Night traders would be delighted to know that Capital.com offers low overnight trading fees.

The firm offers a lot of portfolios and cryptocurrencies to choose from and invest in, not just forex alone. Capital.com clients can choose from a range of global stocks, ETFs ( Exchange Traded Fund), or CFDs ( Contract for Differences).

That’s not all the platform provides its clients to some of the more popular stocks, such as Apple, Facebook, and more.

Pros of Capital.com

- It is one of the fastest-growing online brokerage firms, making it easier for newbies to jump onboard

- Free demo account which you can use forever as it never expires

- 24/7 customer support

- Sales of Popular stocks

Cons of Capital.com

- Clients from the United States are not allowed

- Their offices are spread only among a few European Nations.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a CFD and Forex broker that offers traders the ability to trade over 7,000 markets, including Forex, commodities, stocks, and indices. The company is based in Auckland, New Zealand, founded in 2014. The company also offers a wide range of account types, including a demo account for beginners.

BlackBull Markets is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. This regulation ensures that the company is compliant with the strictest standards in the industry.

Advantages of BlackBull Markets

- On the BlackBull Markets trading platform, the process involved in opening an account is straightforward and fast.

- BlackBull Markets provide its traders with low forex and CFD rates.

- You do not need to have a web trader installed on your phone or personal computer before you can trade with BlackBull Markets.

Disadvantages of BlackBull Markets

- The withdrawal fee applies to BlackBull Markets whenever you withdraw.

- Customer support is not available round the clock.

(Risk Warning: Your capital can be at risk)

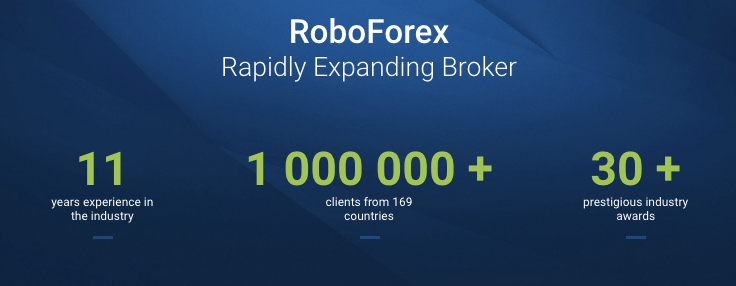

3. RoboForex

RoboForex is a well-known Forex and CFD broker operating since 2009. The company is regulated by the FCA, giving it a strong reputation in the industry.

RoboForex offers CFDs and Forex trading with over 70 currency pairs and commodities, indices, and stocks. RoboForex also provides a wide variety of order types, tight spreads from 0 pips, negative balance protection, and powerful analytical tools. They are one of the most popular brokers, with over 1 million accounts opened.

The broker also offers a comprehensive education center that covers everything from Forex basics to advanced technical analysis.

The main RoboForex website is available in English, Russian, Spanish, Italian, German, French, Turkish, and Chinese. The website is easy to navigate, and all the information you need is easily accessible. RoboForex also offers a wide range of educational materials to help you learn more about forex trading and strengthen your trading skills.

Merits of RoboForex

- RoboForex provides its traders with favorable trading conditions.

- RoboForex has a low minimum deposit.

- You can withdraw your money immediately on RoboForex. There is no delay at all.

Demerits of RoboForex

- RoboForex does not have enough cryptocurrency tools when trading on the R Trader platform.

- The stock CFD trading fee is high compared to the amount charged by brokers.

(Risk Warning: Your capital can be at risk)

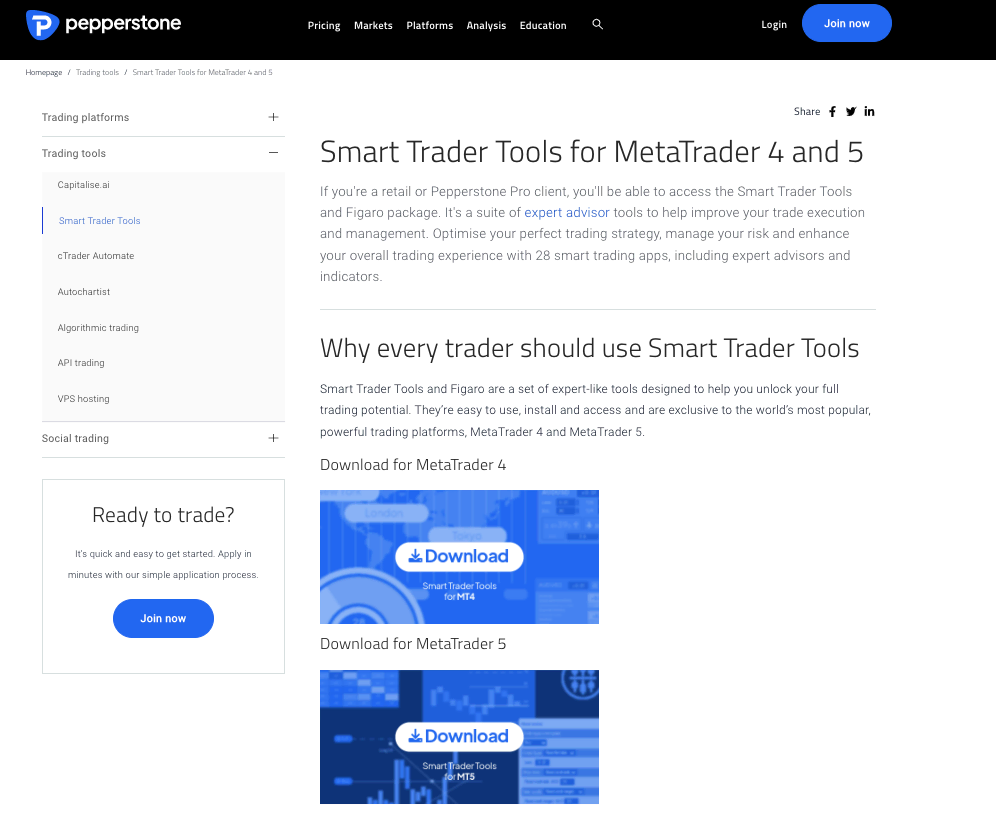

4. Pepperstone

Pepperstone is an online Forex and CFD broker founded in 2010 by traders who wanted to provide traders access to the global financial markets. The company is headquartered in Melbourne, Australia, and has offices in London and Shanghai. Pepperstone‘s clients have access to more than 70 currency pairs and commodities, indices, and shares. The company has been awarded Best FX Broker (Australia) by the International Finance Magazine (IFM).

Pepperstone is regulated by the Australian Securities and Investments Commission (ASIC). Pepperstone offers a wide range of trading products, including Forex, CFDs on shares, indices, commodities, metals, and leveraged trading.

The company also offers a range of features and tools to help traders succeed in the markets. These include a wide range of analytical tools, execution with no rejections or re-quotes, and low spreads.

Pros of Pepperstone

- Traders that trade on the Pepperstone trading platform is provided with various platform add-ons.

- Pepperstone provides its active traders with competitive pricing.

- On the Pepperstone trading platform, there are various social copy trading you can pick from.

Cons of Pepperstone

- The educational materials Pepperstone provides for its traders are average in quality and quantity.

- Pepperstone course doesn’t have an assessment section.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a broker that offers binary options trading (only for professional traders and outside EAA countries), Forex, stocks, and ETFs. They are one of the most popular brokers globally and have over 9 million users. IQ Option offers a demo account, so you can practice trading before you risk any real money.

They offer two types of accounts: a standard account and a VIP account. The Standard account requires a minimum deposit of $10 and has a payout of 92%. VIP account requires a minimum deposit of $3,000.

IQ Option is regulated by CySEC and has a license to operate in the EU. IQ Options offers a wide range of assets for you to trade and a variety of trading tools and features. You can also use the demo account to practice before you start trading with real money.

IQ Option is a great broker for both novice and experienced traders. The minimum deposit amount for a standard account is just $10, and you can start trading with as little as $1. The customer support is excellent, and you can contact them 24/7 via email and phone

Merits of IQ Option

- Opening an account on the IQ Options trading platform is easy and fast.

- IQ Option has many trading tools available for its traders to trade with.

Demerits of IQ Option

- IQ Option doesn’t provide sector traders in the United States, Canada, Australia, Japan, etc.

- MT4 and MT5 trading platforms are not available on the IQ Option trading platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Cambodia?

The Cambodian financial sector is still in its early developmental stages. Due to this, the country’s financial regulators are still learning how to best carry out their functions. There are several Banks and Microfinance Institutions (MFIs) currently operating in Cambodia, but there are also many people who remain unbanked.

Since the early 2000s, Cambodia has been working to develop its financial regulatory framework. This process has been shaped by external factors such as foreign investment, global developments in financial regulation, and membership in various international organizations.

The Cambodian financial sector is regulated by the National Bank of Cambodia (NBC). The NBC is responsible for issuing licenses to financial institutions, regulating and supervising the banking system, maintaining monetary stability, and promoting financial inclusion.

The banking system in Cambodia comprises both commercial banks and microfinance institutions. Commercial banks offer a wide range of products and services. On the other hand, microfinance institutions focus on micro and small enterprises.

After years of waiting, the National Bank of Cambodia has released directives regulating the country’s banking and finance sectors. This is excellent news for businesses in Cambodia, as it provides clarity and certainty about the rules that apply to them.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Cambodia – Important facts

The Cambodian stock market is still in its early development stages, with a limited number of listed companies and trade volume. Despite this, the Cambodia Securities Exchange (CSX) is seeing more and more foreign investors entering the market, attracted by the opportunity for high returns. This growing interest in the Cambodian stock market has led to concerns about the safety of traders’ investments and questions about how well CSX is equipped to deal with security threats.

With a population of over 15 million and a GDP growth rate of 7%, Cambodia is an attractive destination for foreign investors. In recent years, the country has seen a surge in trade as businesses have taken advantage of its strategic location between China and India and its burgeoning young population. While this growth is good news for the economy, it also brings new security challenges for traders doing business in Cambodia.

Cambodia is a rapidly growing economy, and with that growth comes an increase in opportunities for traders. However, as Cambodia is still a developing country, the security of traders is not always guaranteed.

Traders can do a few things to protect themselves while doing business in Cambodia. The most important thing is to be aware of the risks and take precautions to reduce the likelihood of being targeted by criminals. Ensure the broker is licensed and recognized internationally by doing adequate research about the trading platform you want to trade on.

Is it legal to trade Forex in Cambodia?

Forex (foreign exchange) is the simultaneous purchase of one currency and sale of another. In Cambodia, forex trading is legal, but there are several restrictions. For example, it’s not allowed to trade in currencies not listed on the Bank of Cambodia’s official website. Furthermore, forex traders must be registered with the National Bank of Cambodia (NBC). Penalties can be severe.

However, it is crucial to be aware of the risks involved in trading currencies and only trade with reputable brokers. The Cambodian authorities have introduced several measures to protect investors, including new regulations on forex trading, which came into effect in January 2017.

The Cambodian government has also put in place several measures to protect traders and investors and ensure the forex market’s integrity. These measures include licensing requirements for forex brokers and a ban on the use of leverage.

How to trade Forex in Cambodia – An understandable tutorial

Open your account

When looking to open a Forex account, you must take the time to find the right broker. Not all brokers are created equal, and you will want to make sure that you are working with a company with a good reputation and offers a wide range of services. Here is some information on the account opening process and how to find the best Forex broker for your needs.

When you are ready to open a forex trading account, you will need to complete the account opening process. This will involve providing your personal and contact information and your financial information. You will also need to choose the account type and funding method.

The account opening process will vary depending on the broker you choose. Some brokers allow you to open an account online, while others require you to complete a paper application. In most cases, you will be able to start trading once your account is opened and funded.

Start with a demo account or a real account

As a new trader on any trading platform, you must first trade with a demo account before you start trading with real money.

A demo account is an account that is just like a real account, but you are not trading with real money in this account.

Using a demo account to trade first will help you get familiar with the trading platform. You can also use a demo account to practice the strategies and decide which approach works best for you.

Deposit money

There are various ways to deposit money into your forex broker account. The most common methods are wire transfers and credit cards, but some brokers also offer PayPal, Skrill, and Neteller as deposit methods. Wire transfers are the most common, mainly because they are the cheapest and most secure method of depositing money into a broker account. Credit card deposits are quick and easy to make, but they tend to be more expensive than other methods.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Forex trading, or foreign exchange trading, is a form of investment that allows traders to bet on the future movement of currency prices. It is one of the most popular and lucrative forms of trading today, with a global daily turnover of over $5 trillion.

Several different strategies can be used when trading forex, and each trader will have their preferred approach. However, there are some basic principles that all successful forex traders adhere to. Below are some of the strategies explained in detail.

Position trading

Forex position trading is a strategy that can make profits in the Forex market. It is a long-term strategy that focuses on taking advantage of market movements. This type of trading allows you to hold trades for weeks or even months, making big profits from small price changes.

There are several things that you need to consider when using this strategy. Firstly, you need to identify a market trend and then find a trade that aligns with that trend. You also need to have a clear exit strategy in place.

Scalping

Forex scalping is a strategy that traders use to profit by buying and selling currencies on a short-term basis. Forex scalping usually involves special software that analyzes price action and provides traders with buy and sell signals.

Forex scalping is not for everyone. It requires a lot of patience and can be pretty stressful. However, if you can successfully scalp the Forex market, you can make money.

Day trading

Forex day trading is buying and selling currencies on the foreign exchange market to make a profit on the same day. Many people attempt to day trade to make a living, but few are successful. To be successful in forex day trading, you need to have a strategy, remain disciplined, and manage your risk.

Make profit

You need to do a few things to start trading forex and making a profit. The most important of these is to find a good Forex broker. A broker is an intermediary between you and the foreign exchange market, and they will charge fees for their services. It’s essential to shop around for a broker that offers low spreads and commission-free trades, which will save you money in the long run. You should also look for one with a good reputation and is regulated.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Cambodia

This article looked at the best forex brokers and platforms in Cambodia. If you are looking to profit in the currency market, choosing a reputable and reliable broker is crucial. This article provides a list of the best brokers and platforms in Cambodia to make an informed decision about where to invest your money.

FAQ – The most asked questions about Forex Broker Cambodia :

Which forex brokers in Cambodia are highly accessible for traders?

You might find a lot of forex brokers in Cambodia that is highly accessible. However, the services of the brokers also matter. So, a forex trader in Cambodia should choose forex brokers known for their quality services. For the best trading experience, you can choose one of the following forex brokers.

BlackBull Markets

Capital.com

RoboForex

Pepperstone

IQ Option

Which forex pairs do the best forex brokers in Cambodia offer traders?

Since forex trading in Cambodia is picking pace, traders can access all the leading forex pairs that can fetch them high profits. For instance, you can choose among the following currency pairs.

GBP/USD

USD/JPY

USD/EUR

SGD/USD

Apart from these, the forex brokers in Cambodia offer several other forex pairs that you can trade to make money.

Which forex brokers in Cambodia offer traders the best customer support?

Trading is not all sunshine, and a trader can encounter problems online. Thus, you would need a forex broker in Cambodia that offers you highly efficient customer support. If so, you can choose BlackBull Markets, IQ Option, Pepperstone, Capital.com, and RoboForex, as they offer the best services to traders.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)