What is leverage on a Forex broker?

Table of Contents

For anybody who wants to start forex trading, you need to know how to use leverage. At times, traders want to open bigger positions to trade an asset like forex. Forex brokers came up with the concept of leverage.

It allows traders to open positions with more money than what they have in their cash accounts. Both new and experienced traders use leverage. It is a reason why there has been an increase in the number of forex traders. Traders use leverage to trade many assets, and it has its given advantages and disadvantages.

What is leverage?

Leverage is a type of loan that forex brokers give forex traders when they want to open a position worth more than what they have. An example is you want to open a position worth $ 10,000, and you only have $100 in your account.

In this case, you can get leverage from the forex broker worth $10,000. To get the leverage, you have to know the ratio that the broker offers. This ratio is known as the margin ratio.

What is a margin in Forex?

A margin is what the forex broker requires a forex trader to deposit to access the leverage. At times it is known as the faith deposit. It is a percentage of the total amount of leverage you want to open a position.

Forex brokers have different rates that they offer as a percentage or ratio. For example, if your broker offers a 5% margin, it means that you have a margin ratio of 1:20. Using this ratio, you can calculate how much leverage you will get with the cash you have in your account.

How does leverage and margin work?

Leverage is a way a trader can open a position after borrowing the forex broker for some amount. For example, if your forex broker has a 100:1 leverage then if you have $100, you can get $10,000. It is because they require a margin of 1% of the total leverage you want.

So if you open a position of $10,000 with a margin of $100, your broker has a limit for the loss you can take. It is to protect your broker and you from taking any loss. If you happen to get losses on an open position with leverage, and the loss reaches the same amount as your margin, the broker closes your open position.

If you have opened multiple positions, the forex broker closes some to mitigate the losses. Similarly, if you happen to profit, then you get the entire profit made. For example, if you open a position worth $10,000 using leverage. You make a profit of $200, you will receive it as $200.

Various forex brokers give margin ratios according to the type of currency. More volatile currencies attract higher margins compared to those that are less volatile. The margin rates also depend on the type of account you are using.

A professional account has higher leverage. Compared to the standard trading accounts meant for beginners. The forex brokers allow forex brokers to open positions on the risky currency pairs with a higher margin because of the risk exposure.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

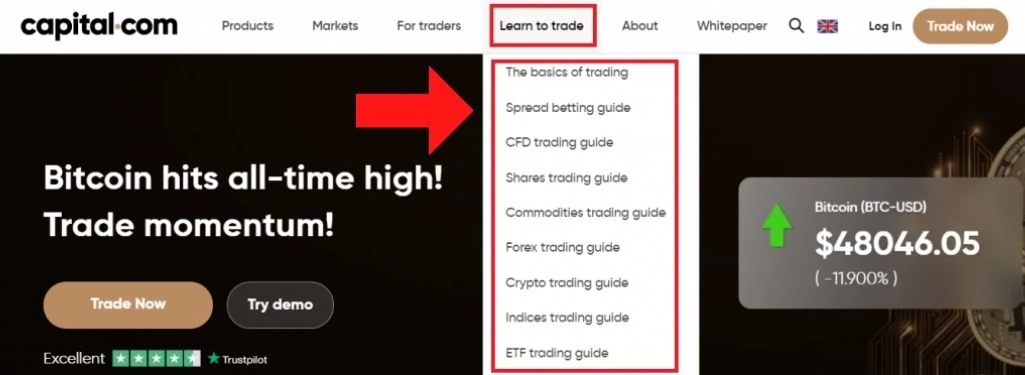

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Which market can you access using leverage?

When trading Forex

Many traders trade foreign exchange in the market. Many forex traders prefer to use margin when trading forex. It is also one asset that forex brokers offer a high leverage ratio.

Indices

It is a group of stocks from companies in a country that gets monitored. Indices monitor the prices of these assets where traders can use them to make decisions when trading. You can use leverage to trade indices using Contracts For Difference and Exchange Traded Funds.

Cryptocurrency

These are digital currencies developed using cryptography technology. They are not affected by economic factors, which means they increase in value with time. They include bitcoin, etherium and litecoin. Traders use leverage to buy and sell cryptocurrency.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Advantages of using leverage

Increased profits

Trading any asset like forex is profitable when you apply leverage. The profits get amplified because you open a position using a low margin. If you trade forex using $200 you can make a $50 profit.

If another person in the same trade uses a leverage of 1:100, which means they trade $20,000. The profits made is $5000. It is one reason why many new traders are attracted to forex trading. Therefore they can make more profit.

Diversify portfolio

Many traders would like to open different positions when they are trading forex. The limiting factor is that they cannot get enough funds to open multiple positions. Leverage can solve that issue because forex traders can open many trading positions.

Forex traders can buy more currency pairs and reduce the exposure to losses by buying a single currency pair. It means that if one currency pair does not do well and another asset is doing well, the losses can balance.

It is a good instrument when the market has low volatility

When trading an asset in a forex market, some currencies are volatile. Which allows traders to make profits from the movement. But, some markets have low volatility and high liquidity.

For example, in the EUR/USD, in periods where there are financial announcements, then the volatility will increase. Experts approximate the direction of the currency and, they can choose to long sell or short sell pair. At this time, most traders take advantage of leverage to increase profits.

Allows traders to trade at any time

Markets close in the evening until the following morning except for forex and cryptocurrency markets. Forex traders can use leverage to open long positions throughout the night. It allows traders to access the market at any time during the day or night.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Disadvantages of leverage

Although using leverage is profitable, some drawbacks come with using leverage in forex.

Increase chances of loss

Just as much as leverage magnifies the profits made in forex, there is also a high risk of increased losses. Let us take an example of forex leverage of 1:100 which means that with$100 you can trade with $10,000. If you happen to get a loss of $100, you have lost all your margin.

In some cases, you could get a negative account balance. It means that you have made more losses than when you use $100. Leverage multiplies the losses just as it multiplies the profits.

Margin call

If you open a forex position and get losses, most of your deposit gets depleted leads to a margin call. You get a margin call when the funds on your margin account reduce beyond the required minimum.

In this case, the forex trader has to deposit more funds on their margin account to counter the effects of the loss. If the trader fails to deposit fast they continue losing funds. The forex broker automatically closes the open position to mitigate the loss.

Increased funding costs

When you open a position using leverage, you still have to pay for the costs of the open position. The trading costs increase if you have a long-term open position. It is because the costs of keeping the open position could outweigh the profits that you make.

Another cost is keeping an open position overnight. The forex broker will charge you a fee for the open position.

How to use leverage effectively when Forex trading

Thorough fundamental and technical analysis

If you are using leverage, you have to understand the risk involved. Therefore, it means that all the decisions you make have to be from accurate predictions. It is the point where technical and fundamental analysis help traders.

There are many technical indicators created to improve the predictions of the market direction. These include the forex indicators, the moving average, the forex volatility calculator and many others. It is critical to pay attention to the economic calendar and price alerts. They help to be aware of the events that could lead to a change in the prices.

Apply the appropriate risk management strategies

There are various ways forex traders can use risk management to reduce exposure to losses. They can use stop-loss procedures or use a limited risk account. A stop-loss order is a point that your position has to get closed automatically with the forex broker.

Forex traders place these points which the asset prices exceed means that the trader is heading towards losses. The stop loss is a crucial action to take when using leverage. Limited risk accounts have automatic stop-loss points that reduce the chances of losses.

Set a profit target

A profit target allows a trader to take profits at a certain point. They are like a stop-loss order, but they get placed where the forex trader has set the highest profit point. They are important because they limit the trader from emotional trading.

Emotional trading is when a trader makes decisions based on greed, fear and anxiety. The profit target enables a trader to trade with discipline.

Using leverage can be lucrative if you have mastered the skill and have enough practice. That is why forex traders have to get enough experience trading before using the leverage.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQ – The most asked questions about leverage on a Forex broker :

What is the good leverage on the forex broker?

One of the common leverage rates that get used within Forex is 100:1. However, it is recommended to begin with 50:1. It is of the lower risk level. It needs the full 2% price movement for emptying the initial investment. This initial investment is very uncommon with currency movements.

What is 1/100 leverage on a forex broker?

To understand it, let’s take an example. Think of depositing the $500, which would allow you to trade amounts up to $25,000 on the market. The leverage of 100:1: 100:1 means that every dollar within the account can be used for placing the trade up to the amount of $100. The ratio is the typical leverage amount offered on the standard lot account.

What would be the safest leverage on a forex broker account?

1:1 is the safest leverage on a forex broker account. As a new trader, one must consider limiting the leverage to the max of 10:1 or for being safe 1:1. To trade with too high a leverage ratio is an important error that is made by the new forex traders. So, until the time you have gained more experience, it is strongly recommended that you just trade with the lower ratio.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)