The 5 best Forex Brokers and platforms in Cameroon – Comparison and reviews

Table of Contents

In the past ten years, forex trading has been done effortlessly in Cameroon; this has mainly contributed to the tremendous growth of the county’s economy and the increased income for her citizens.

Cameroon has strict control over its currency, but Cameroonians get to trade on trading platforms that accept them as clients. If you want to start trading, the first thing you need to do is find out which trading platforms are reliable for you to trade with.

See the list of the best Forex Brokers in Cameroon:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Getting to know the Cameroon market’s top forex brokers and platforms can be hectic, most notably when you do not know which platforms you come across are reliable. This write-up will give you an in-depth knowledge of Cameroon’s top 5 best forex brokers and platforms.

The list of the top 5 best forex brokers and platforms in Cameron includes the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Captial.com

Capital.com is a worldwide CFD broker which was set up in 2016. Currently, they have over 500,000 users. Their offices are situated in Cyprus, Australia, the United Kingdom, Gibraltar, and Seychelles.

Local authorities approve offices present in each country; many regulatory bodies authorize the United Kingdom office. Including the Cyprus Securities and Exchange Commission (CySEC), FCA, and the Australian Securities and Investment Commission (ASIC) for the Australia office and the Financial Services Authority of Seychelles for the Seychelles office.

Capital.com provides:

- A well-detailed training program and articles,

- Educative and informative videos, and

- An extensive detailed training syllabus for starters.

The course is split into 28 lectures divided into five sections and an assessment to evaluate your understanding of the course.

Capital.com is regarded as one of the best brokers in Cameroon because of its technology platform that is user-friendly for every trader. The Capital.com platform allows traders to make appropriate investments by providing necessary information to traders.

Several asset options are available on Capital.com for traders to select from, including indices, stocks, commodities, cryptocurrencies, and foreign exchange.

Capital.com is a famous trading site mainly because it protects its customers by law. Capital.com provides CFD and Forex trading at an affordable cost. The procedure involved in setting up an account is straightforward; the amount required to be deposited is a minimum of $20.

Pros of Capital.com

- The account opening process is seamless.

- The forex CFD fees are low.

- Capital.com has excellent support, both email and chat support

- No withdrawal fee charge

Cons of Capital.com

- Capital.com only has CFD, real stock, and spread betting for United States clients.

- Capital.com doesn’t have the option for small currency accounts.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is one of Cameroon’s top best trading platforms; it was started in 2014. It is a forex and CFD broker. BlackBull Markets headquarters is in New Zealand.

The Financial Markets Authority (FMA) has been controlling the BlackBull Markets since 2020 in New Zealand. BlackBull Markets registered on Financial Services Provider Register (FSPR) in 2014. Besides, the platform possesses a license from the Financial Services Authority (FSA) in Seychelles.

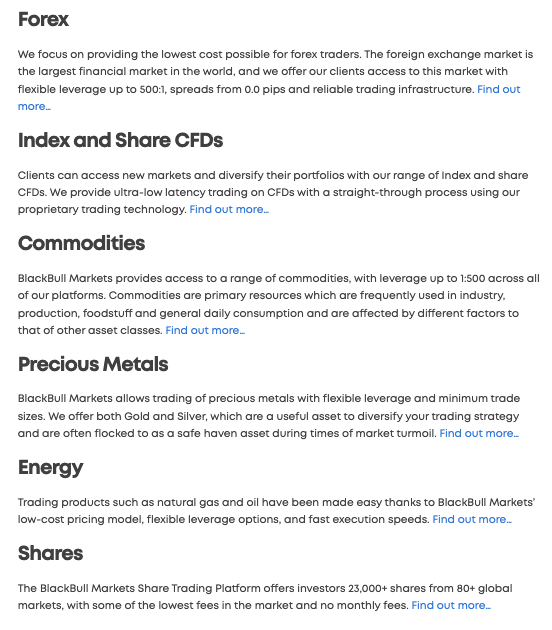

BlackBull Markets provides a total number of 281 trade-able symbols. BlackBull Markets offer Forex trading, CFD trading, and social trading but do not offer cryptocurrency trading.

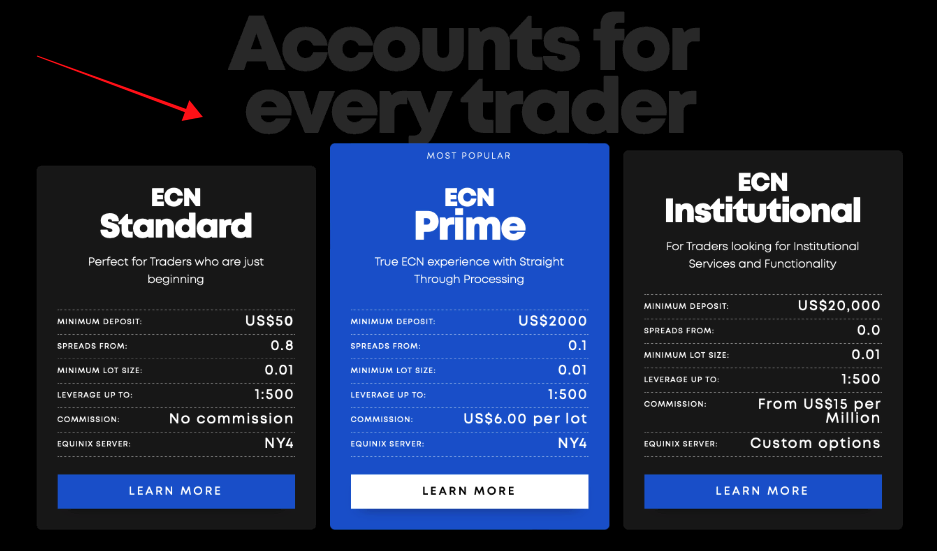

BlackBull Markets offer an average amount for trading costs compared to other trading platforms in the industry. The amount you are charged as a trading cost depends on your account type with BlackBull Markets. The types of accounts include the standard account, ECN Prime account, and the ECN institutional account.

On the standard account on the BlackBull Markets platform, you have to deposit a minimum of $200, and the account is commission-free. The ECN Institutional account is offered mainly to active traders, and you have to deposit a minimum of $20,000 with a commission fee.

The commission fee is negotiable. The ECN Prime account provides lower spreads; although you must deposit a minimum of $2,000, you get a commission of $3 per side.

Pros of BlackBull Markets

- BlackBull Markets possesses an FMA license, which allows them to offer service to New Zealand residents, unlike most brokers.

- BlackBull encourages third-party trading on its platform.

- Give a full Meta Trader suite.

- From 2021, BlackBull Market offers combined with the TradingView web platform.

Cons of BlackBull Markets

- Tier-one regulatory licenses are available on the trading platform, especially within the EU.

- Customer service is not available all the time.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is licensed to carry out forex trading activities internationally; it enables traders access to the online financial market worldwide. You have access to 7 types of trading assets: stocks, currency pairs, ETFs, metals, energies, indices, and commodities. It also provides popular trading platforms such as MetaTrader 5, MetaTrader 4, and cTrader.

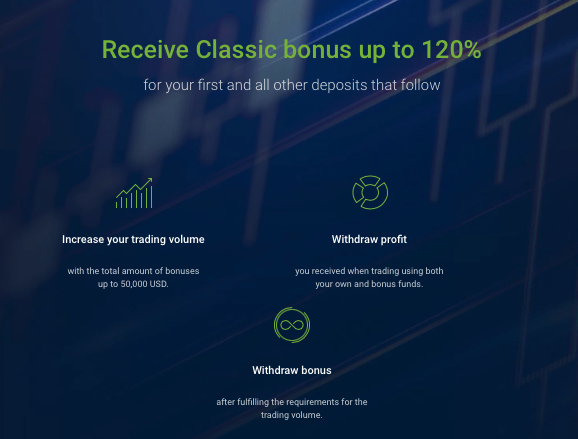

RoboForex customers are given bonuses on a timely basis; new clients enjoy a welcome bonus referred to as Welcome Bonus 30; when a customer deposits into their account, they get a profit share bonus of about 60%, as well as a 120% classic bonus. RoboForex provides a free ‘VPS-server’ service for their customers to trade without being interrupted.

RoboForex was established in 2009. Since then, they have been awarded plenty of financial awards. RoboForex headquarters is located at 2118 Guava Street, Belama Phase 1, Belize City, Belize. It provides services to financial markets in 169 countries. When trading on RoboForex, you don’t have to worry about language barriers as it supports over 18 languages.

Merits of RoboForex

- The trading conditions RoboForex provides are favorable to their clients.

- Also, to trade on RoboForex minimum deposit is required.

- You can withdraw your funds immediately.

- If you are affiliated with the website, you get a high payment starting from $5 per lot.

Demerits of RoboForex

- The Cryptocurrency tool is not available on RoboForex.

- To trade on RoboForex, you have to deposit $10.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was founded in 2010 and is a reputable brokerage firm. Pepperstone, as a trading platform, focuses on stocks, cryptocurrencies, forex, and metals.

Pepperstone is said to have a low-risk trading outcome; it has an overall Trust Score of 93 out of 99.

Both ASIC and FCA regulate Pepperedstone. On the Pepperstone trading platform, cryptocurrency is available through CDs, but it is available through the underlying asset. The crypto CFDs are not available to residents and brokers in the United Kingdom.

Merits of Pepperstone

- Pepperstone is a safe broker because it is regulated in two tier-1 jurisdictions.

- Pepperstone provides brokers with multiple platform add-ons, which improve the trader’s experience.

- Pepperstone gives you good research material, which is higher than average than other trading platforms.

- You are provided with a growing selection of tradable markets on the Pepperstone platform.

Demerits of Pepperstone

- The provided research material on the platform is close to average.

- Interactive courses or assessments are not provided on the platform.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is one of Cameroon’s best top trading platforms; it is a reliable binary options (only for professional traders and outside EAA countries) broker and is well known for its automotive trading platform. As a trader looking for CFD and binary options (only for professional traders and outside EAA countries) broker with affordable fees, IQ Option is your best bet.

IQ Option was founded in 2013. The platform requires you to make a low deposit of about $10 before you start trading. IQ Option uses trading platforms such as Mobile (iOS, Android) and Desktop (macOS, Windows). It currently operates under IQ Option Ltd and IQ Option LLC.

Merits of IQ Options

- IQ Options is a trusted and reliable platform to trade on.

- The trading platform has a user-friendly interface.

- IQ Options is regulated for traders inside the EEA.

- Low minimum investment.

Demerits of IQ Options

- Traders are required to pay withdrawal fees when withdrawing from the bank.

- If you withdraw from a bank, it also takes a longer time.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Cameroon?

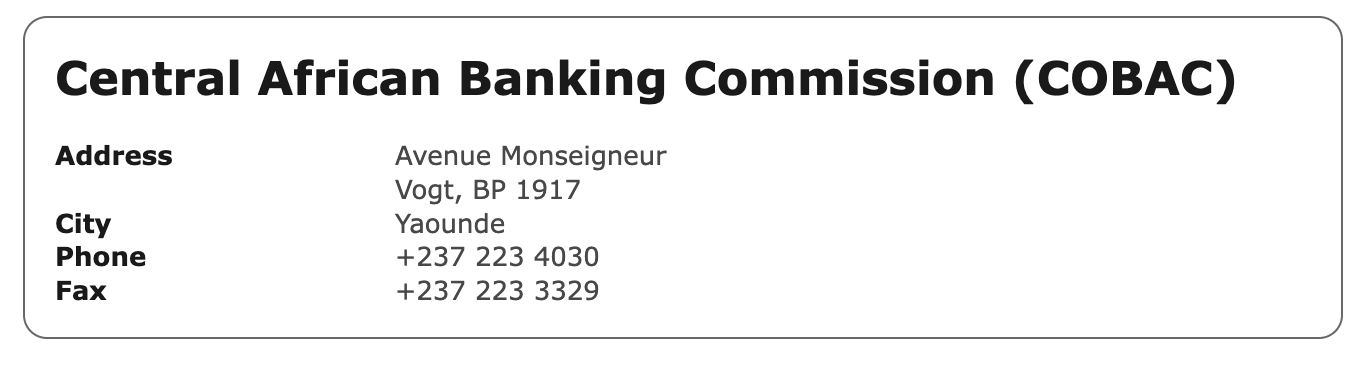

The Cameroon banking system is generally monitored, controlled, and supervised by all activities through the French treasury. The supervision of the French people was to ensure that the country’s local currency was converted to Euro to have it saved with their colonial master’s external reserves. About 60 percent of the Cameroon foreign reserve is held in an account in Paris, managed by the French.

Besides, all the banking activities conducted in the country are effectively managed and controlled by the Central African banking Committees located in the country’s capital Yaoundé. The government has 13 operational licensed and regulated commercial banks whose total assets stood at 1,700 billion CFA francs, estimated to be about $3 billion. The Interest rate on deposits and other financial trading is controlled by the BEAC, a central bank branch.

The banking sector in Cameroon remained pretty formidable throughout the 2008 and 2009 financial crisis, while regulatory authorities continued to restructure the commercial banks falling below performance and expectations.

With that being said, corporate organizations in Cameroon are still pretty disturbed about the strict regulations, laws, and low lending volumes coupled with poor services they experience in the banking industry in the country. Although the banking sector is heavily regulated, there is a consistent low performance of the institutions.

The ownership of banks in Cameroon is divided into three branches: the Cameroon government owning about 10 percent, forging nationals holding about 57 percent, and the Cameroon nationals cutting away with the leftover 33 percent. The likes of Oceanic banks, Moroccan banking group, Atlantic bank, and many others have helped the banking sector in Cameroon to diversify its portfolio quickly.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Cameroon – Some facts

Generally, there aren’t any significant security measures applicable to the traders in Cameroon. All traders are expected to watch out for themselves and are supposed to take charge all the time. Forex investors can easily open an account with the brokers on the internet, make deposits, and kick start their transactions.

The primary thing is that you should ensure that the broker that you are working with is regulated and licensed by recognized international bodies. However, if you come across a platform that does not have visibility outside Cameroon, it will be in your best interest to avoid such platforms.

Read about previous users’ reviews about the platform and their performance. Check out for details like the commission paid out for the last three years, how reputable the platform is, and do they offer quality customer service if there is an issue in the long run.

Is it legal to trade Forex in Cameroon?

Yes, you can trade forex in Cameroon as it is entirely legal. Forex traders should be vigilant of the platform they are trading at and ensure all the transactions are appropriately guided. Also, it is in the best interest of the forex trader to avoid trading with unregulated brokers who can swindle them of their trading funds at the end of the day. Carefully choose the brokers you prefer to trade with and carry out critical reviews about the platform performance and how best to trade on such platforms.

Besides, being effectively informed about the trading platforms you have chosen would help you understand the necessary concept of forex trading and how you can achieve your trading goals.

You should consider some factors whenever you decide to start trading in Cameroon. Such factors include the means of payment, the laws and regulations guiding the forex trading activities, the limits to which you can fund your forex account, and the trusted platforms widely acceptable to Cameroon traders.

Generally, before you can achieve success as a forex trader in Cameroon or anywhere you are located globally, you need first to acquire the basic knowledge of the forex market and kick start with a demo trading account.

You might lose quite some money if you fail to understand what forex trading looks like and have comprehensive knowledge. Also, it would help if you got prepared to incorporate yourself into a trading plan that is advantageous and contains most of the necessary information about forex trading.

Note that the broker you are choosing to trade forex on must be licensed and regulated in Cameroon by the financial regulatory authorities in the country. The first step is to search for reputable forex broker platforms and get to know their license status before settling down with them.

Besides, there are tons of forex brokers you can work with to ensure you have a successful trading experience in Cameroon. In October 2021, the government of Cameroon published detailed information about the foreign exchange controls as the country began to work with the IMF.

The controlling organization BEAC now requires that banks work with the apex bank in the country to ensure they appropriately consolidate the increasing demand of customers’ foreign exchange requests.

How to trade Forex in Cameroon – Tutorial

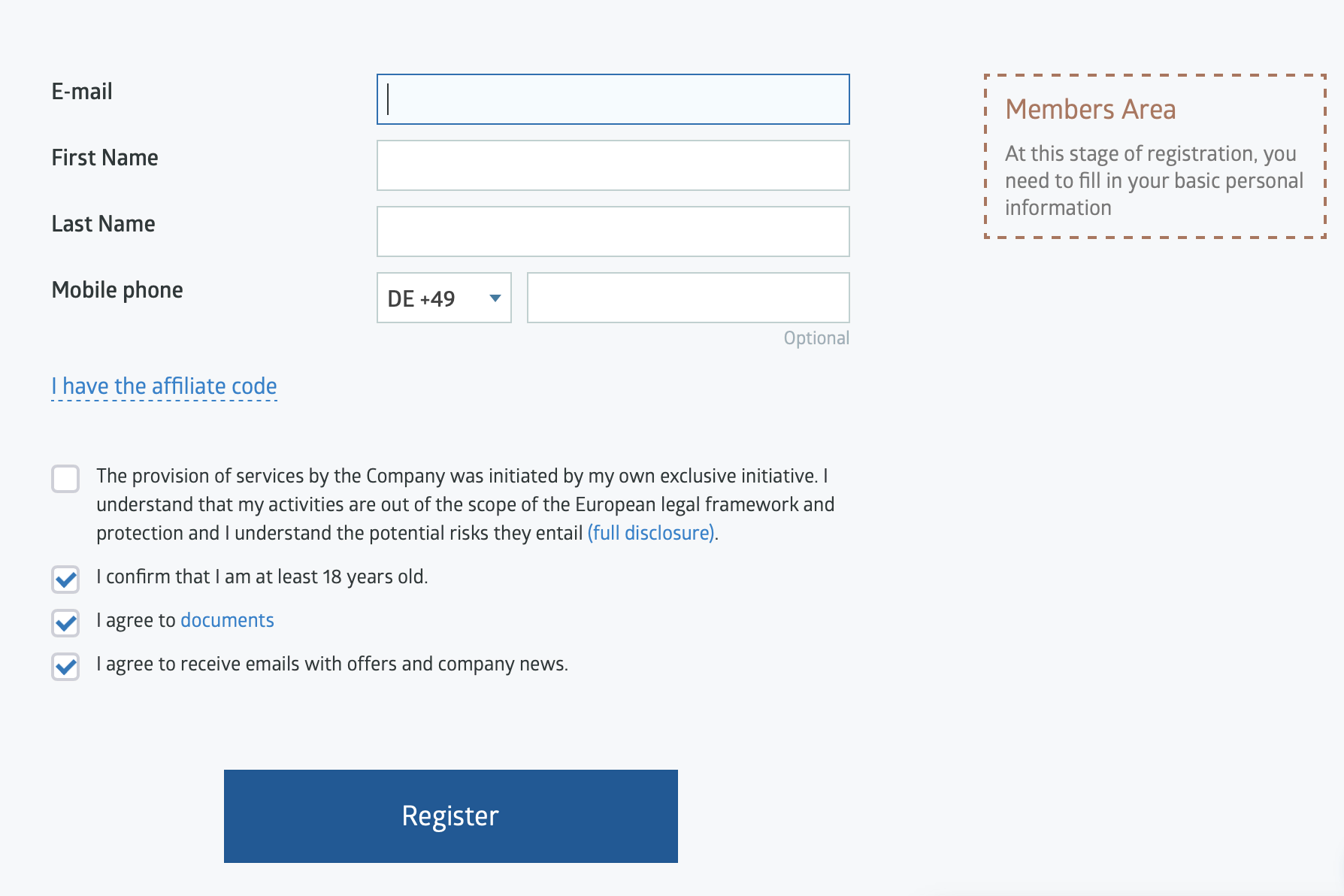

Open account for Forex traders

To start trading forex in Cameron, visit any brokers’ websites you have researched and verified. You can then deposit the minimum amount required by the broker to open an account.

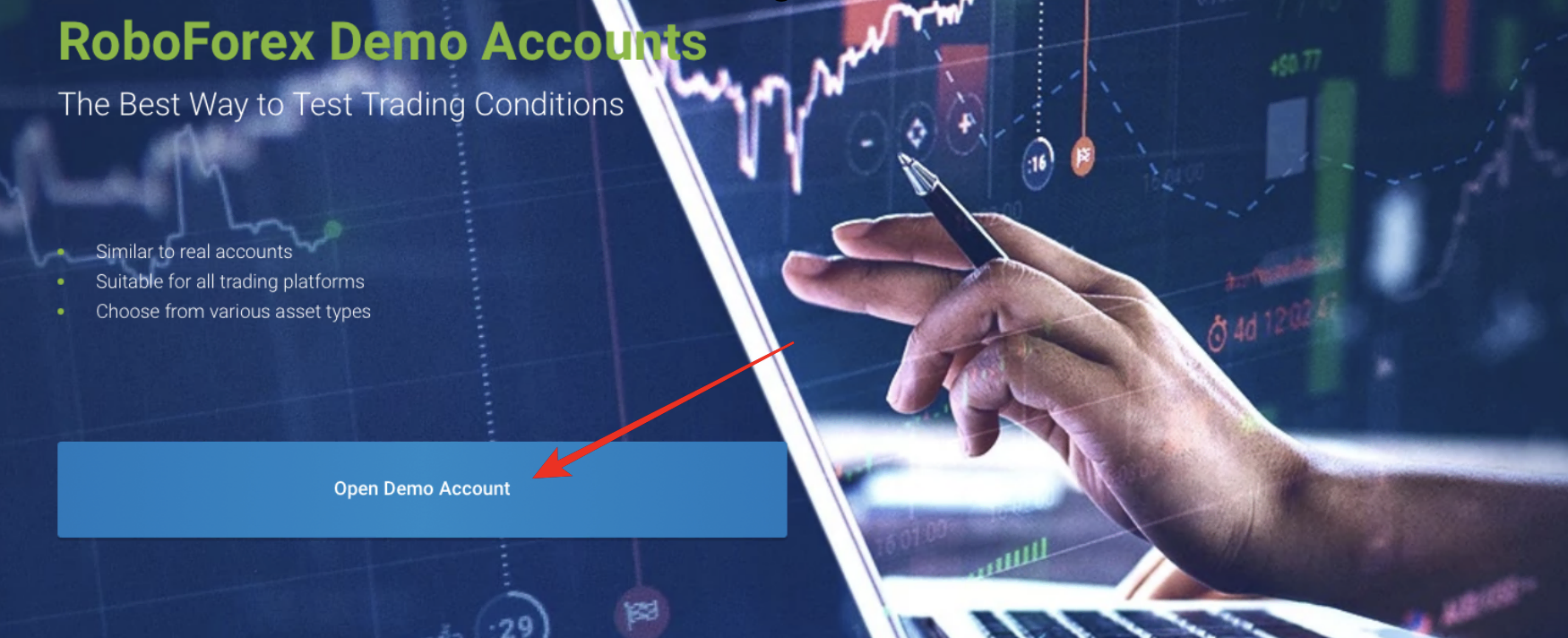

You can open an account with any of your preferred forex platforms. You can choose to create a real or demo account, where you practice understanding how the platform works fully.

Start with a demo account or real account

As a trader, you either practice with demo accounts and get familiar with the trading platform without risking losing your money, and you can then start using your money.

You have to create a new account on the Forex broker’s website. To do such, you have to deposit a minimum amount into the account for the majority of the brokers. There are many types of accounts available, and each has its minimum deposit and spread width.

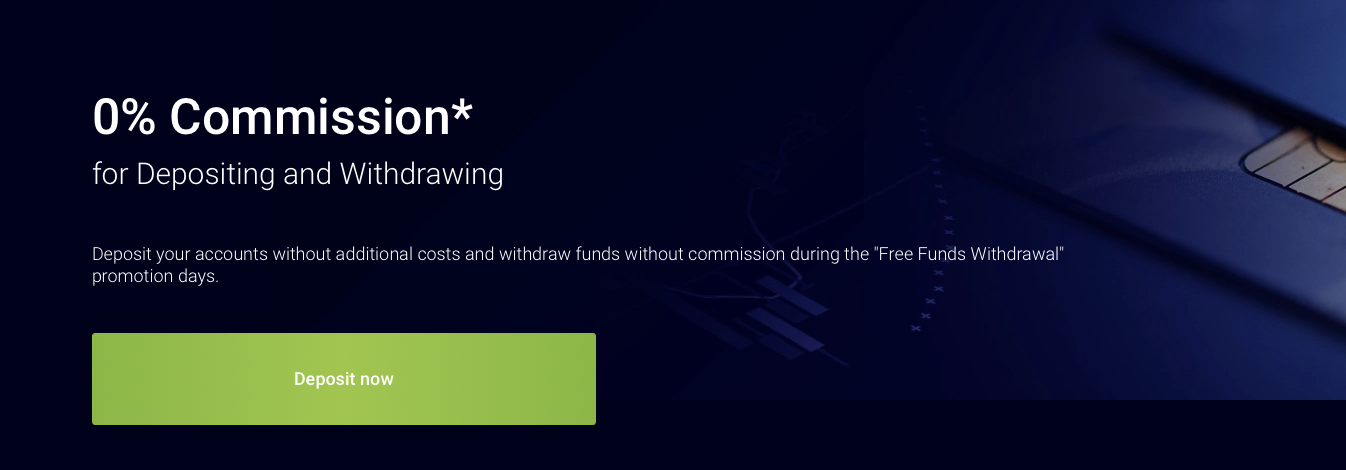

Deposit money

When you are done opening your account, you have to deposit some money into the account. There are many ways to deposit money into your account as well as to choose your preferred currency you want to trade in.

The means and method to use are highly dependent on the broker. Popular brokers’ payment methods include but are not limited to wire transfer, electronic payment, debit cards, and payment systems such as Skrill or PayPal.

Input the broker’s credit card information into the forex trading accounts, and the money will be available within the next working day.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

To trade forex in Cameroon, you must be familiar with the analysis methods and determine when to buy a forex exchange and when it is best to sell it off. The underlying determining factor is to ensure you make use of reliable software that captures the performance of the market and the general economic statistics of the currency you are trading in.

You can easily be successful in trading by developing a profitable strategy and incorporating data and market performance. Most forex traders make use of some of the following systems include;

Day trading

This strategy can be considered a combination of various methods combined into a single strategy. Day traders always ensure they close out all the positions of their trading activities at the end of the day. This means that the trader avoids getting into trading sessions that can be open at night, which might also involve higher risks. The forex market is a 24-hour open session, while it closes by Friday. As a forex trader, you can choose whenever you want to trade.

Position trading

Most often, the traders in the section of the forex market have maintained such a market position for a long time. They might have held such a position for years, weeks, or months, as the case might be. The approach used is to ensure the market fluctuation does not affect their performance, and often, they might slightly miss their positions a few times a month or a month.

Experts usually utilize this approach to the forex market, and they adopt a broad view of predictive analysis where they tend to determine what the market would look like. A significant shift in the market can often affect their position, but if properly maintained, that can be back in quite a short period.

Scalping

Scalping is a short-term trading strategy that involves profiting from many but small market moves. The person scalping is referred to as a scalper. The scalper gets in and closes down positions quickly, intending to make small profits at every given time.

Make profit

The primary goal of these forex traders is to transact and make enough profit. As a trader in this section, your plan is to use the market risk to your advantage and ensure you aren’t caught up with the negative market performance. Also, whenever the market seems to fluctuate, it is best to close your shop and avoid losing your investments. Always stick to a trading plan working for you and close up your market as soon as you have achieved your predetermined gain.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Cameroon

Beginner Forex traders can be particularly nervous when the trade does not go as they intended it to go or in the case where the profit made is meager. The majority of them start thinking of pulling off trading for good. But it is essential to have a vivid knowledge of how the industry works and then try a different approach to trading which can help you make a good profit.

It is essential you tread with caution, making sure that you have extensive knowledge about the trading market and technical know-how. Also, make sure you have a working trading strategy.

FAQ – The most asked questions about Forex Broker Cameroon:

How does a trader execute his forex trades with a forex broker in Cameroon?

A trader can execute his forex trades with a forex broker in Cameroon by signing up for a trading account. A trader can choose an account type depending on his forex trading expertise. He can finally place his forex trades by funding his trading account and picking the forex pair for trading.

What kind of forex trading accounts do forex brokers in Cameroon offer traders?

Forex brokers in Cameroon allow several kinds of account types at a trader’s disposal. Most brokers allow traders to choose between the basic account type and the professional account type. The basic account has a low minimum deposit amount stipulation. On the other hand, a professional forex trading account has a high minimum deposit amount stipulation. Besides, some brokers might also offer expert help.

What amount does a trader in Cameroon need to start forex trading?

The amount of deposit that any trader would need depends upon the forex broker in Cameroon that he chooses. Mostly, the brokers allow traders to place a trade for an amount beginning with $1. However, a trader still needs to fund his trading account with the minimum deposit amount.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)