5 best Forex Brokers and platforms in Ecuador – Comparison and reviews

Table of Contents

With the constant buzz surrounding trading, it is natural to have your interest piqued. The growth of the forex market has extended to a great many parts of the world, including Ecuador, with several forex brokers offering their services in the country. The potential for making ample profit is limitless and is entirely legal.

See the list of the best Forex Brokers in Ecuador:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

If you are an Ecuadorian looking to explore the forex market to begin trading and securing profits, figuring out the best platforms to use is a good foot forward to cut the chase short.

Here is a detailed list of the five best forex brokers in Ecuador:

- Capital.com

- Blackbull Markets

- Roboforex

- Pepperstone

- IQ Option

1. Capital.com

This is an award-winning trading platform that began operations in the UK in 2016 and now has its roots set in more than fifty countries worldwide. Artificial Intelligence powers Capital.com with an impressive interface that makes trading smooth and seamless.

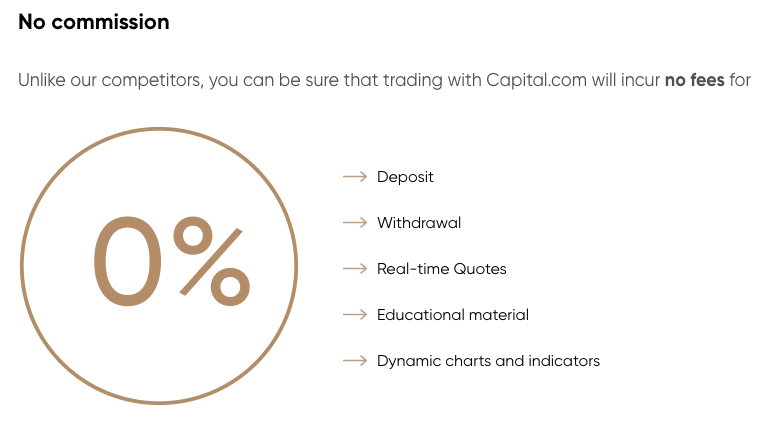

It processes transactions using methods that maximize the efficiency of the market and permits them to run a zero-commission trading system. The only payments required are to sort out the low leverage interest (overnight fees) if you trade with leverage and the transaction costs (buy-sell spread). This makes the trading environment fair and friendly and slightly levels out the playing field.

Capital.com abides by the standards of a couple of the strictest financial regulating bodies worldwide, including, but not limited to, the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC).

To open a Capital.com account, all that is needed is a valid means of identification and proof of your address. The process is pretty straightforward, and support is readily available.

Deposits can be made on the platform in euros and dollars, and the funds can also be converted into the local currency of the traders at no additional cost. Funds are deposited by the traders utilizing debit cards, credit cards, and bank transfers.

Besides Capital.com being versatile in that it allows you to trade on both the web and on smartphones, it is also worthy of note that it provides traders with access to more than six thousand markets. Traders can make investments in globally available stocks as well as ETFs. They can also trade CFDs all on the Capital.com platform.

Benefits of trading with Capital.com

- A broad market base including indices, forex, equities, and stocks, all in one place.

- Capital.com provides its users with excellent customer support to ensure all their questions are promptly answered and their problems resolved.

- The Capital.com platform is user-friendly whether the trader uses the web or mobile version. This makes for an all-around excellent user experience.

- An excellent demo account that users can use for testing strategies without fear of risks. A plus is that the demo account does not expire.

Drawbacks of trading with Capital.com

- There are zero earnings upon referrals regardless of how many people you get to sign up on the platform.

- There is no avenue for the use of mini forex accounts.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

Founded in 2014, BlackBull Markets is an accomplished CFD, commodities, and forex broker and a Financial Technology platform. It is an award-winning broker based in Auckland, New Zealand. BlackBull Markets is managed by New Zealand’s top-rated Financial Markets Authority (FMA) and Seychelles’ Financial Services Authority (FSA).

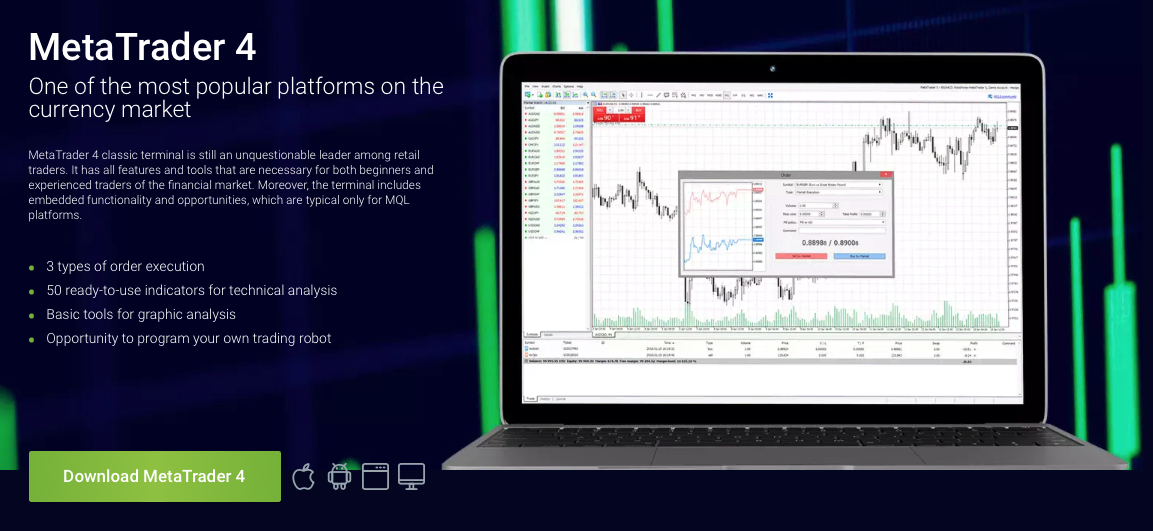

BlackBull is a great place to start as they offer MetaTrader 4 and MetaTrader 5 platforms if you are looking to trade energy, commodities, CFDs, and metals. They use API trading solutions to trade algorithms of high-frequency and an advanced low latency system.

Using the BlackBull Markets platform, you can trade with up to 1:500 leverage, and it makes quite a number of highly liquid and high-volume trading instruments with prices rivaling that of the competition. While you can access significant US shares, including Microsoft, Apple, and Google, via MT5, BlackBull lacks all-inclusive options for trading products.

The company portrays itself as an Electronic Communication Network (ECN) and No-Dealing Desk (NDD) with deep liquidity. It also boasts an institutional-standard pricing system for retail traders, price accumulations, and deep liquidity.

Advantages of BlackBull Markets

- It provides social trading services via two third-party providers, Myfx book Autotrade and Zulutrade.

- Upon deposits, Blackbull requires no additional fees.

- It permits leverage of up to 1:500.

- The full MetaTrader suite is available (MT4 and MT5)

Disadvantages of BlackBull Markets

- Plugins for MT4/MT5 are not available.

- They are not as many research tools on the platform.

- Traders are charged a certain fee upon withdrawal.

(Risk Warning: Your capital can be at risk)

3. RoboForex

A leading developer of software in the Foreign Exchange industry, RoboForex is regarded as a dependable partner by many of the most respected experts in the industry. It is an award-winning brokerage company founded in 2009 and currently serves the financial markets of one hundred and sixty-nine countries.

The RoboForex group, which includes RoboForex and Robomarkets LTE, is internationally licensed to offer its services by the International Financial Services Commission in Belize. Language is not an obstacle for this broker, as eighteen languages are available on the platform.

Regardless of the trader’s level of expertise, the platform is highly recommended for novices and seasoned traders and investors. More than 12,000 products are available across various categories, including indices, forex, metals, stocks, cryptocurrencies, commodities, and ETFs.

Trading platforms used by RoboForex include MetaTrader 4, MetaTrader 5, R stocks Trader, and cTrader. Social trading is also available via the CopyFX platform. While the MT 5 platform has far better features than the MT 4 platform, the former is still more widely used as it is the most functional. While still a market maker broker, they offer decent trading commissions on ECN accounts. They have seven classes of assets and boast over 12,000 trading instruments.

Pros of RoboForex

- Withdrawal of funds is close to instant with this broker.

- It provides free trading signals and tools for research.

- Users can choose whatever trading platform is most suitable for them.

- Extraordinary trading abilities are ideal for skillful traders.

- Trading conditions are favorable to the users and have a minimum deposit.

Cons of RoboForex

- They offer a limited number of currency pairs.

- Unavailability of constant customer support.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone Limited was established in Melbourne, Australia, in 2010 and has been on quite a steady slope of growth ever since. It currently has offices located in Dubai, Limassol Melbourne, Nairobi, London, Düsseldorf, and Nassau.

With a list of tradable markets, significant research, and support for diverse copy trading platforms, it has made a name as a leading broker in the sector.

This platform is as simplified as possible and gives traders one less thing to worry about as they trade on the platform. MetaTrader and cTrader are available on the platform and other third-party trading instruments and plugins.

Pepperstone is appropriately licensed and is regulated by ASIC, CMA, FCA, BaFin, SCB, and DFSA as it operates in the relevant regions.

Advantages of Pepperstone

- Multiple copy trading platforms are available to be used with this broker.

- It offers very competitive rates for commission in the industry.

- Trading fees for retail traders are not as competitive for retail traders as they are for active traders on their Razor accounts.

Disadvantages of Pepperstone

- Traders are unable to reach their progress on the platform.

- Educational products available on the platform are not as great as the best in the industry.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option may not have age on its side compared to other brokers in the industry, but accolades should be accorded to them to keep up with the times. They are consistent with their platform updates, ensuring that trading is a smooth and pleasant occasion for traders.

The pleasant user experience doesn’t stop there for the award-winning broker. The web platform and its mobile application guarantee that traders and investors can evaluate the market through their preferred medium.

IQ Option is after their traders and investors maximize the profit potential available, creating a trading instrument called IQ Option trade patterns. This instrument can likely impact the outcome of the trade.

This platform also provides a demo account option to give users the confidence and practice experience to go live.

Merits of IQ Option

- A user-friendly interface and experience

- Excellent customer care and support

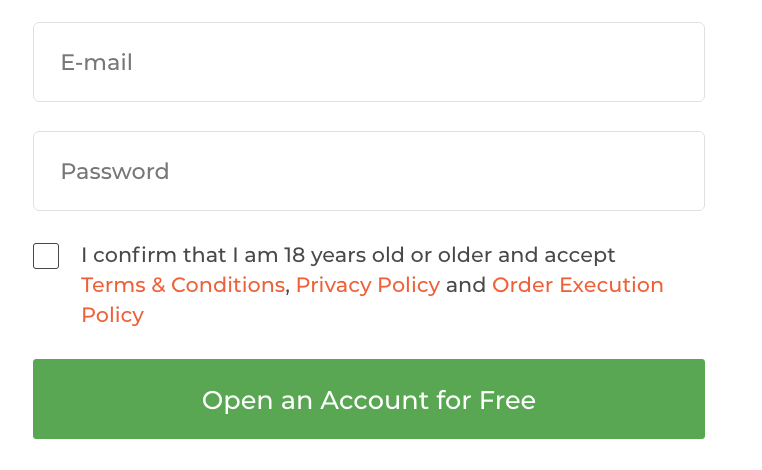

- Opening an account is made short and easy.

Demerits of IQ Option

- There is a possibility of a fee for withdrawing.

- MetaTrader 4 and MetaTrader 5 trading platforms are not available.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Ecuador?

While trading forex in Ecuador is legal, the forex market is still relatively new to the country as the economy is still developing. Also, it heavily depends on commodities, including agriculture and oil and gas, so placing a regulation on forex trading can eventually cause the economy to crumble.

This means that it does not have as many operating standards as other countries, which require brokers to be registered appropriately. Before opening a forex account, it is highly advised that every trader do proper research on the best and most legitimate brokers to be used.

With so much profit potential and the amount of leverage available, it is straightforward to get starry-eyed and carried away. To experienced traders, the potential profits to be made would see that their wildest dreams come true. However, if you are a beginner or amateur in trading, it would only be wise to take precautions to ensure your assets and investments are well protected before taking any hasty steps.

As a beginner, your best bet is to work with only registered and licensed brokers to prevent being a victim of a forex scam. Research widely and ensure you pay close attention to the broker’s reviews and licenses before opening an account.

Another thing worthy of mention is the importance of profit tracking, as traders are required to pay 5% of whatever profits they make from trading as taxes. This is where every trader’s record-keeping skills are put into practice. You do not want to be caught in the middle of tax fraud.

Profit compounding is practically the norm with forex traders, so they use whatever leverage is available to them. Newbie traders mustn’t get carried away as leverages can also incur compound losses. To be safe, amateur traders should restrict the number of leverages they use.

(Risk warning: 75% of retail CFD accounts lose money)

What are the financial regulations in Ecuador?

The country’s largest banks are Banco Pichincha with assets worth about USD 10 billion, Banco del Pacifico with assets worth about USD 5.2 billion, and Banco Produbanco with assets worth about USD 4 billion, and Banco Guayaquil with assets of about USD 3.9 billion are the largest banks in Ecuador. These banks are responsible for regulating the financial sector of the country.

The Constitution of Ecuador states that “the goal of the monetary, credit, exchange financial policy defines the levels to which the overall liquidity that guarantees sufficient financial safety lanes and direct excess liquidity toward investment needed for the development of the country.

Between the years 2012 and 2013, the country’s financial sector underwent many restrictions. In 2012, most Ecuadorian banks sold their mutual funds, insurance companies, and brokerage firms following the changes in the constitution after a referendum in May 2010.

An amendment made to Article 312 of the Ecuadorian constitution made it compulsory for banks, their senior managers, and shareholders with equity worth over 6% in financial entities to expropriate entirely from any interest incurred from non-financial companies by July of 2012. These amendments were included in the Anti-Monopoly Law that was passed in September 2011.

How to trade Forex in Ecuador – An overview

Though North Korea is a communist state, it has developed its forex market to enable trade with other countries. The market functions somewhat differently than traditional forex markets and presents unique opportunities (and risks) for traders. In this blog post, we’ll discuss how to trade forex in North Korea, including the market basics and how to use it to your advantage.

As most trades are made live, a secure and constant connection to the internet is required. Ensure that you do adequate research on the broker you want to trade with. Ensure that the broker is recognized internationally and registered by reputable bodies.

Open an account

To open an account with a broker, you will be asked to provide some documents.

Two documents in particular; proof of residency and proof of identity. Your proof of residence can be either your bank statement or your utility bills. And proof of identity is your valid identity card, either your driver’s license or voter’s card.

Start with a demo account or a real account

Before starting to trade live on a real account, use a demo account as your testing ground. Try out whatever strategy you want on the demo account before you start using a real account. This would help you build more confidence and experience while minimizing the risks of incurring losses.

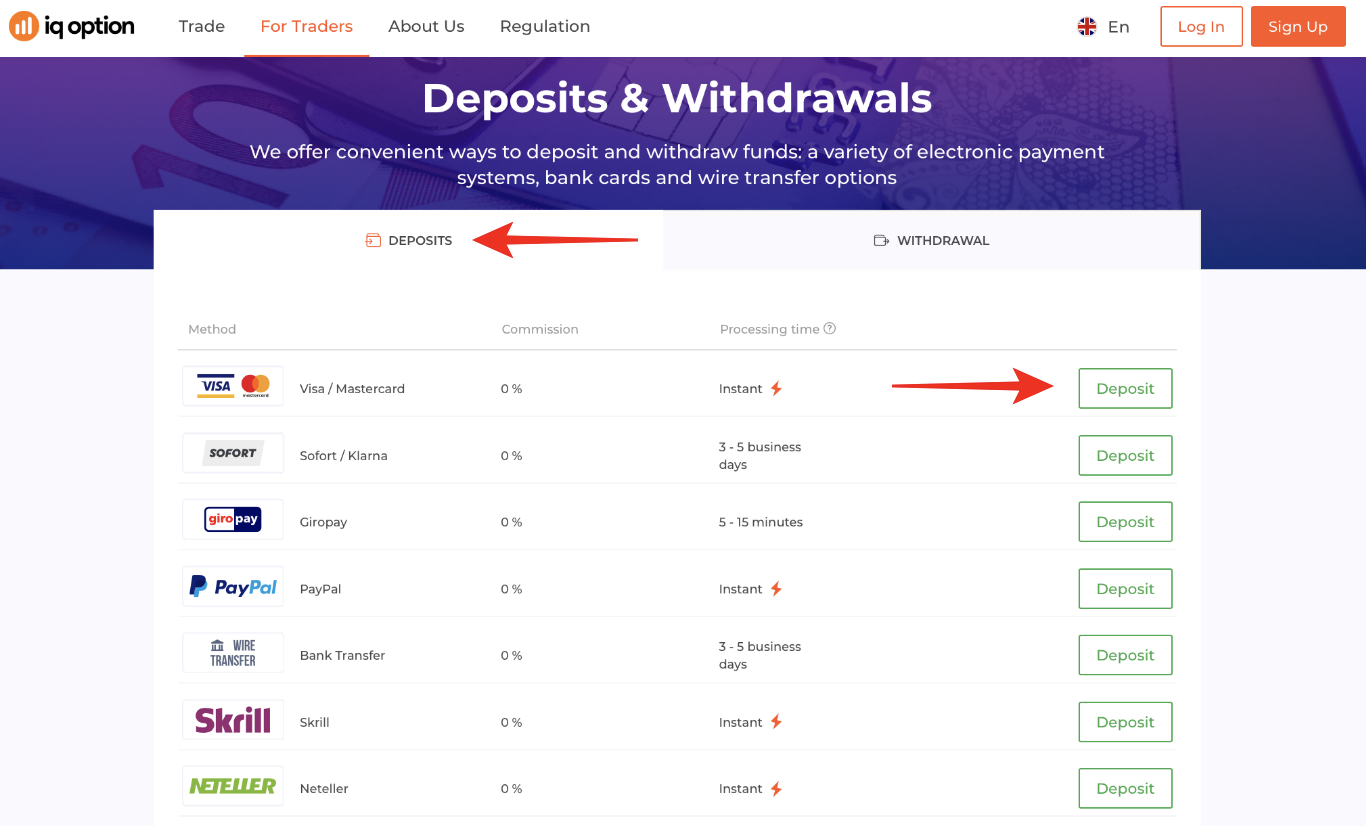

Deposit funds

Once your account is up and running, you can now deposit funds in it. In Ecuador, an acceptable payment method is via bank transfers. Most Ecuadorian traders link their accounts to their banks and transfer funds. You should note that it may take days before the funds are cleared.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis and strategies are essential for forex traders when deciding whether or not to buy or sell currency pairs.

A couple of the strategies traders use include:

Position trading

This technique for trading involves traders holding their positions for an extended period, the length of which varies between a few weeks and a couple of years. This approach requires the trader to, in simple terms, keep their sight of the bigger picture of the market and play blind to the minor changes the market would undergo within short periods.

Scalping

Unlike the technique above, scalping is a forex trading method involving the trader focusing on minute market changes and gathering profits. The trader leaves multiple trades open and records the profits on each. This strategy is quite popular given how unstable the forex market is.

Make profit

Once your account is open, you can place your first trade with your carefully selected broker. Ensure to consider all risks involved in the trade as this decides whether you make a profit or loss. Using the right strategy also significantly affects how much profit you make when trading forex.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Ecuador

Forex trading is not for the light-hearted and the impatient. While profits are the end goal, losses will undoubtedly be incurred every once in a while. Every trader needs to hone their risk management skills and be very patient when studying the market. Make your demo account your stomping ground and build the confidence and experience you would need to make your profits.

While the journey ahead of every amateur trader is neither short nor easy, it definitely would be worth it.

FAQ – The most asked questions about forex Brokers in Ecuador

Which forex brokers in Ecuador charge no commission from traders?

Few forex brokers in Ecuador do not charge any fees and commissions from traders. Among all brokers, Capital.com and IQ Option are two brokers that have barely any stipulated commission rates. It means you will not have to pay them any commission when you trade forex on these two trading platforms in Ecuador. Thus, it is a plus point for forex traders.

What are the MT4 and MT5 trading platforms that forex brokers in Ecuador offer?

Leading brokers such as BlackBull Markets, RoboForex, etc., offer MT4 and MT5 trading platforms to traders. These trading platforms make trading simple for traders as they can customize them according to their trading needs. MT4 and MT5 allow traders to customize all trading tools and technical indicators. Thus, trading becomes more fun for traders.

Which forex brokers in Ecuador should a trader choose if he wishes to start trading with a low initial investment?

Forex brokers in Ecuador should choose IQ Option, Capital.com, RoboForex, Pepperstone, and BlackBull Markets if they wish to start forex trading with a low initial investment. These brokers allow traders to begin forex trading with an amount as low as $10.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)