5 best Forex Brokers & platforms in Egypt – Comparisons and reviews

Table of Contents

Are you looking for the best raw spread or low-fees broker in Egypt?

See the list of the best Forex Brokers in Egypt:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We reviewed a hundred online trading platforms and selected the best 5 with the most competitive fees.

They are:

1. RoboForex

RoboForex is an online forex and CFD broker based in Belize. The company was established in 2009 and has experienced continuous growth since then. They now boast over 800000 active accounts worldwide.

RoboForex holds a license from the International Financial Service Commission of Belize.

This broker is among the trusted and well-liked brokers in this industry. The reasons for this are its low fees and comfortable trading conditions.

RoboForex requires a $10 minimum deposit to start trading. And the broker offers a welcome bonus to new customers.

A free demo account is available so that newcomers can test the platform before trading live. The broker also offers a non-swap-fee Islamic account for those seeking full Sharia-compliant accounts.

There are multiple account types to accommodate every trading style and level. Egyptian traders can access various market instruments, including over 35 currency pairs.

Its trading services are available on the famous MT4, MT5, and cTrader. Its proprietary platform, the rTrader, is also part of its offering. Traders can access their forex accounts on mobile phones and computers.

RoboForex is a flexible broker that allows peculiar trading styles, including hedging and scalping. The company accommodates all levels of traders.

Its customer service is readily available and can be reached through a call-back request, email, phone, and live chat. They are also reachable on social media, such as Facebook, Skype, WhatsApp, and Telegram.

Cons of RoboForex

- Forex pairs are not many

Egyptian traders will only be able to access 30+ forex pairs. Other competitors offer a wider selection of currency pairs than this.

(Risk Warning: Your capital can be at risk)

2. Capital.com

Capital.com is a global online broker founded in 2016. The company is based in the United Kingdom and has offices in Cyprus, Gibraltar, Seychelles, and Australia.

Capital.com operates under several licenses, including the FCA, ASIC, and CySEC. They are among the most trustworthy brokerages and accept clients from many parts of the world, including Egypt.

The broker provides access to a wide range of instruments, such as 138 forex pairs, hundreds of CFDs, and stocks. Egyptian clients can trade at competitive costs here, with an average spread of 0.8 pips on major crosses.

Its account types are:

- Standard

- Plus

- Premier

All these are commission-free. The broker also added a new account type called Invest. The account is designed for stock trading at extremely low costs.

Trading services are offered on the broker’s proprietary web and downloadable app. The MetaTrader 4 is also available for traders’ use, with all indicators, charts, and helpful trading tools.

Capital.com provides among the top-rated educational materials on its platforms. These contents provide valuable information for all levels of traders. However, beginners will benefit much more from the content offered.

The broker accepts a minimum deposit of $20. Most of the accounts run on the Capital.com platform and the MT4. Mobile trading is available with full features.

Multilingual quality support service is available 24 hours a day, Mondays to Fridays. Egyptian traders can reach Capital.com support via phone, email, or live chat on its website.

Cons of trading with Capital.com

Islamic accounts are meant for Muslims who strictly follow Sharia laws. The broker does not offer this account type.

- High Index CFDs fees

The cost of investing in Index CFDs is higher than its competitors.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. BlackBull Markets

BlackBull Markets was established in 2014 as an institutional broker. But it has now extended its services to retail customers.

The brokerage firm has its headquarters in New Zealand and other head offices in New York, London, and Malaysia.

BlackBull Markets have licenses from the Financial Markets Authority of New Zealand (FMA) and the Financial Service Authority of Seychelles (FSA).

The company is a non-dealing desk broker offering online forex, commodities, and CFDs trading services. Egyptians can access various market instruments, including varieties of currency pairs and CFDs.

The broker requires a $200 minimum deposit for trading. But the trading fees here are highly competitive, with floating spreads starting from 0.0 pip on its prime account. Two types of accounts are available to choose from. That’s the Standard and Prime. Both enjoy STP and ECN executions, respectively. That is, traders’ orders are executed without delays or slippages, and they get the best price in the market.

The broker provides its trading services on the MetaTrader 4. The platform comes with 85+ technical indicators, various charts, and full support for algorithm trading.

Social and copy trading is also offered through MyFxbook. And the broker is developing a feature called Money Management. Customers will be able to earn money without trading by themselves using the feature.

BlackBull Market’s customer service is among the best and most effective. They are quick to respond and very helpful. Egyptian traders can reach them through phone, email, or live chat.

Demerit of trading with BlackBull Markets

- High minimum deposit

A $200 minimum deposit is comparably high. Competitors accept much less from new traders. Some brokers do not demand a fixed amount to trade on their platform.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an internationally known brokerage firm based in Australia. The company came into being in 2010 and has continued to grow since then.

Pepperstone has offices in various parts of the world, including Dubai, the United Kingdom, Kenya, the Bahamas, and Cyprus. The broker holds several tier-1 and tier-2 licenses.

The licenses include the following:

They are also regulated in other smaller jurisdictions. Pepperstone recommends a minimum deposit of $200 to start trading. But they allow lower deposits according to the trader’s capacity.

The broker offers several account types, all with STP and ECN execution methods. So, traders can expect speed in order executions and tight spreads. The average spread on its Standard account is 0.7 pips. This fee is highly competitive and below the market average.

With these accounts, traders can use MetaTrader 4, MetaTrader 5, or cTrader. Mobile trading is available, allowing easy trading wherever you are.

The broker offers a special Active Traders account for volume and institutional traders. This account comes with many benefits, including advanced professional services.

Pepperstone also provides an Interest-free Islamic account for those who wish to comply with Sharia requirements fully.

The disadvantage of trading with Pepperstone

- Free demo access for 1 Month

The broker offers only 30 days of access to its free demo.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a forex and binary options brokerage firm founded in 2013. The company has offices in Saint Vincent and the Grenadines.

IQ Option provides forex, CFDs, and binary options trading services.

With a minimum deposit of $10, Egyptian forex traders can access more than 30 currency pairs and forex CFDs. Other market instruments are available, including cryptocurrencies, indices, metals, stocks, and ETF CFDs.

The broker offers two account types on its proprietary trading platform. The accounts are classified based on the customers’ deposits. There is a standard and a VIP account. The VIP status requires a minimum deposit of $600.

Its proprietary web-based platform allows forex, binary options (Only for professional traders and for those that are located outside of EAA countries), and CFD trading on the same interface.

The disadvantage of trading with IQ Option

- No MetaTrader platforms

The broker does not provide the MetaTrader platforms for traders. Instead, it offers ONLY its in-house platform, the IQ Option app, for trading.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Egypt?

Forex trading continues to pick up steam among Egypt’s young population, who seek ways to increase their income. The sector remains largely unregulated.

Forex brokers do not need to have the country’s license to operate with its citizens.

The Egyptian Financial Supervisory Authority (EFSA) regulates the activities in the country’s capital markets. But it does not pay much attention to retail forex trading.

The body introduced some regulations to curb illegal (black market) forex trading in the country. For instance, people can only exchange foreign currencies with approved forex bureaus. But this refers to offline forex activities.

A few laws were also devised that set a limit to the trading amount for individuals in online forex trading. Forex traders in Egypt must also pay a 10% tax on their earnings. The profits from this activity are classed under Egypt’s “Capital Gains tax.”

Egyptians can trade forex with any online broker as long as Egyptians adhere to these regulations. The trader bears the risks with no protection from the country’s regulatory bodies. Seeing as such, brokers do not need approval or license to accept Egyptian traders.

Security for Egyptian traders

Traders must protect themselves by adhering strictly to the country’s regulations on forex trading.

More importantly, traders must select brokers that hold one or more valid and well-known international licenses. The trader can confirm the licenses by checking the broker’s and the regulatory body’s websites for information.

Popular regulatory bodies to look for include:

- Financial Conduct Authority, FCA.

- Australia Securities and Investments Commission, ASIC.

- Cyprus Securities and Exchange Commission, CySEC.

- Commodities Futures Trading Commission, CFTC.

- Dubai Financial Service Authority, DFSA.

- Financial Sector Conduct Authority, FSCA.

- Financial Markets Authority of New Zealand, FMA.

- Financial Service Authority of Seychelles, FSA.

Some of these bodies are situated in Africa and may offer some protection to traders on the continent.

Since there is no regulation on leverage, Egyptians should also seek brokers offering negative balance protection.

Is it legal to trade forex in Egypt?

Yes, It is legal to trade in Egypt. But traders must abide by the country’s trading amounts and tax regulations.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade forex in Egypt – An overview

The first thing to consider before trading forex online is the broker.

Many brokers are accepting Egypt-based traders. So, making a choice might be tough.

We have recommended some brokers above. But if you are not satisfied with their offerings, there are many more to choose from.

Ensure you check these boxes when selecting a broker:

- Regulated by a well-known international body.

- Competitive spreads and commission.

- Free demo.

- 24-5 customer support.

- Common payment methods are available in Egypt.

- Easy funds withdrawal.

- Education and research content.

Follow these steps to trade forex:

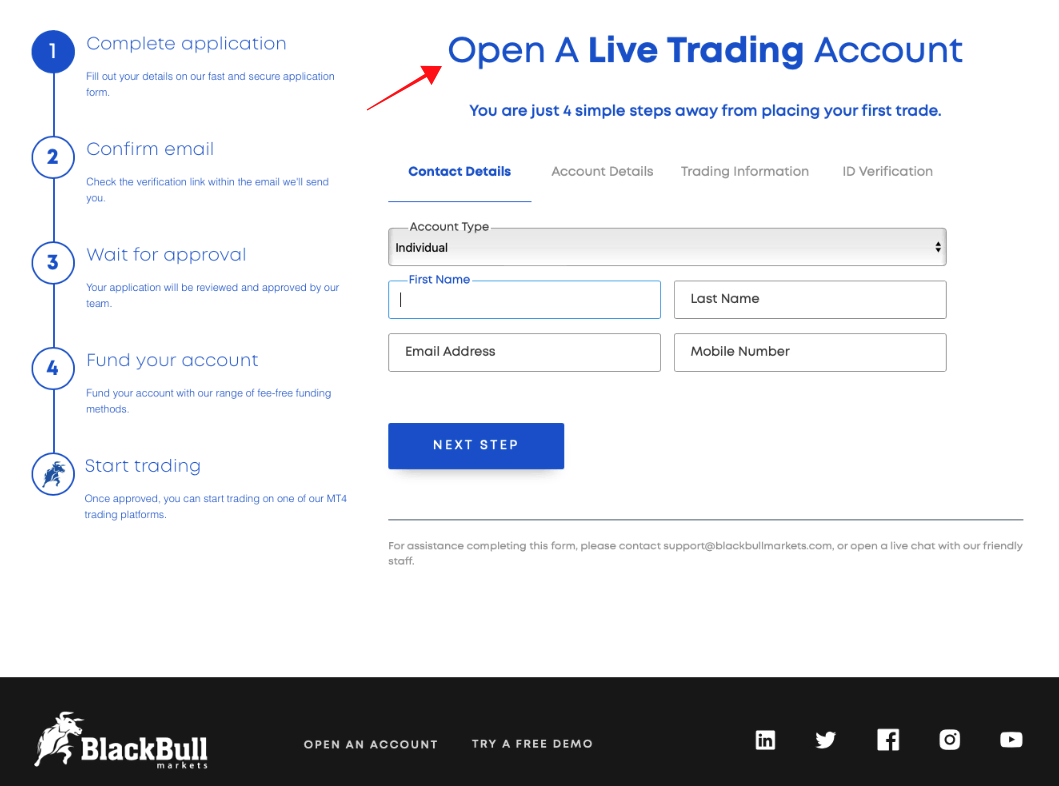

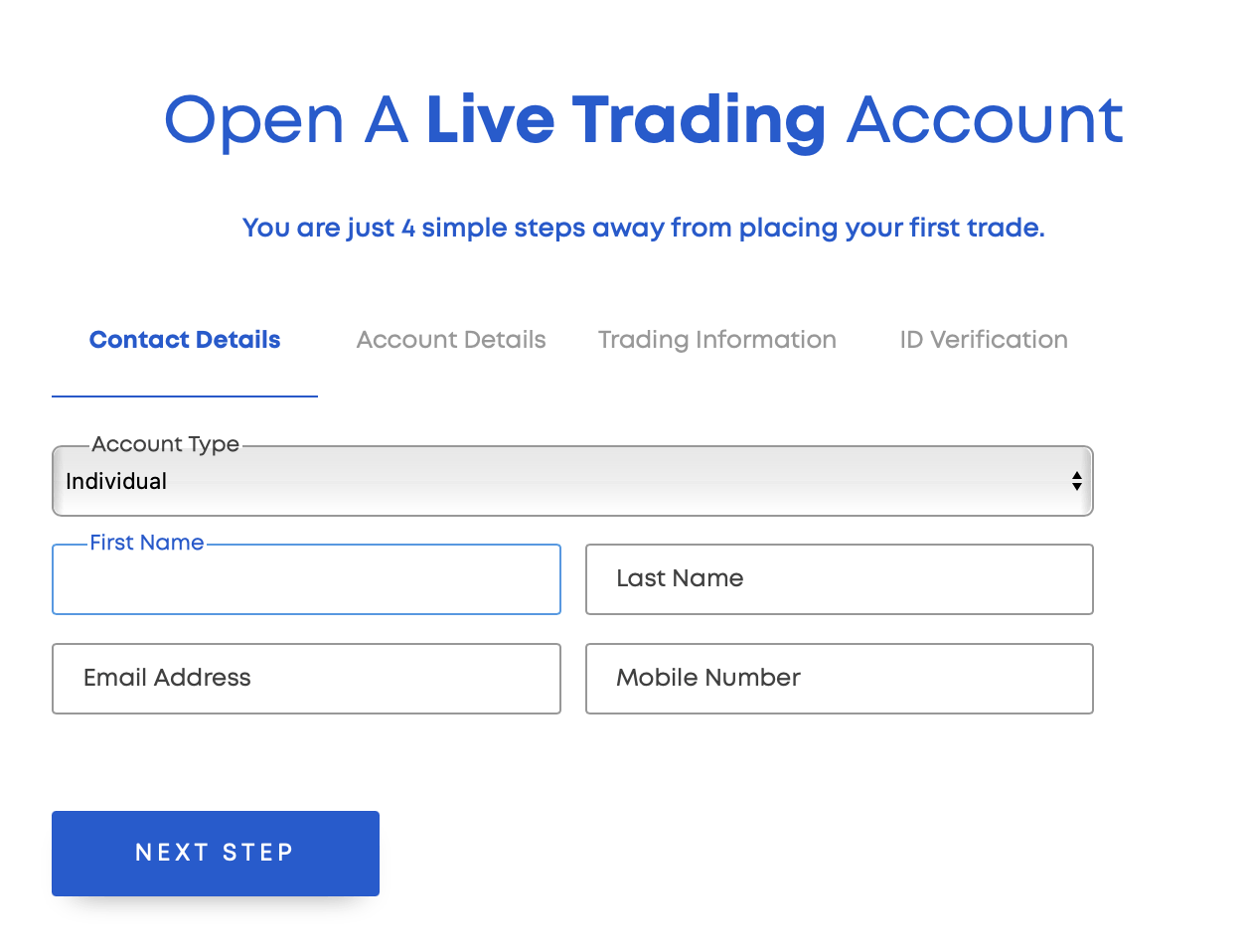

1. Open an account for Egyptian traders

Once you find a broker, visit their website to open an account.

Many good brokers offer multilingual websites catering to customers from different regions. Services for different countries vary according to local regulations.

The broker will request your details to set up an account for you. These may include an ID card and utility bill to prove your address.

Once you have uploaded all necessary documents and requested information, the broker should activate your trading account within 24 hours.

2. Start with a demo account or “real” account

The broker should provide a free demo account with which you can test its trading platform before trading.

The demo will come with free fake money to trade. This account is a replica of the live trading environment and shows you what to expect in the forex market if you’re new.

Most traders like to skip to a live account since it offers a real trading experience. We always recommend trading with the required minimum deposit in this case.

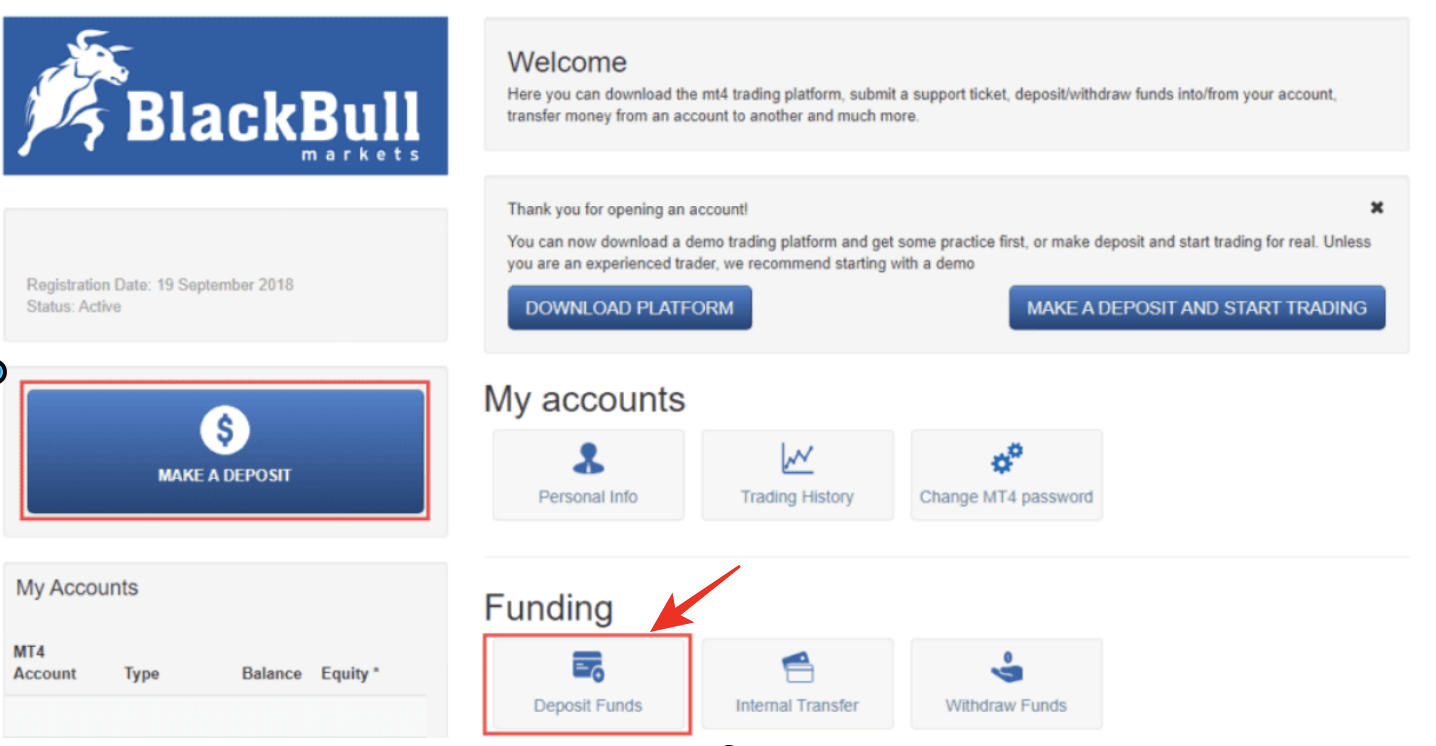

3. Deposit funds to trade

Once you have satisfactorily tested the demo, it is time to trade live.

Egypt should have at least one common payment method, making it easy to fund your accounts.

Good brokers often appoint dedicated staff to new customers to assist them in the beginning stages. The staff usually guides new clients through the account funding process.

Once you transfer the funds, the whole amount should appear in the trading wallet balance. Brokers usually do not charge deposit fees. However, the third-party payment service provider may charge you. But the amount is usually tiny. It may be charged separately, not taken from the amount you wish to transfer.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

Before trading, you must conduct some market analysis to understand price movements.

Through analyses, you can see all the factors that affect the exchange rate of the forex pair you wish to trade. You also gain insight into the price history and can predict future movements.

Equally important are the trading strategies. Many effective strategies contain crucial analyses so that the user may not need to carry out a separate one before trading.

Here are common forex trading strategies:

Range trading strategy

The range trading strategy is effective with currency pairs that neither increase nor fall in prices.

The prices move within a specific range. Traders find opportunities within the highs and lows of the range.

Fundamental analysis is an effective analysis that helps you use this strategy successfully. News about economic or political events can cause the market to move within the range. Allowing entering trades and earning profit. But the trader needs to understand how such news impacts the price. And they need to anticipate market movement to place winning trades.

Day trading strategy

This strategy involves conducting and closing all trades within the day. Not leaving any position open until the next day.

Day trading is among the most common strategies. Traders combine different strategies and indicators to find opportunities to earn within a business day.

Traders use this approach to avoid overnight fees and unexpected price moves that they’re unable to monitor. It is less risky and saves costs.

The strategy is more common among customers who trade forex for a living. They constantly monitor their trades and make necessary adjustments during the day. They exit all positions before the close of business each day.

Scalping

Scalping is another type of day trading. It involves leaving positions open for a few minutes to 1 hour.

In this case, the trader tries to make small gains from tiny price movements. They exit and reopen trades, often within their trading period.

Hopefully, the small gains add up to a considerable amount once they close for the day.

Scalping requires constant checking of the account. Traders sometimes miss out on huge profits because positions are not left open long enough.

5. Make a profit

Combining a quality brokerage service with an effective trading strategy will have you earning profits soon enough.

You can then choose to increase your capital with the profits or withdraw from the account.

Withdrawal should be as easy as funding the account. Although, it may take longer to process, usually up to 48 hours.

Ensure you complete the signup process by uploading all the required documents to the broker. Also, stick to the same payment method you used while depositing funds into the account.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Egypt

Forex trading in Egypt is easy if you choose the right broker and trade within the country’s regulations.

With this guide and the brokers recommended above, we hope choosing platforms will be easier.

FAQ – The most asked questions about Forex Broker Egypt:

Which forex brokers are available to Egyptian traders?

Egyptian traders must refrain from trusting every random broker they encounter while trading. Choosing only a regulated broker will allow the traders several benefits in the long run. First, it will help you derive the maximum fruits of forex trading. You can rely on the services of IQ Option, Pepperstone, BlackBull Markets, RoboForex, and Capital.com. These brokers have a large clientele that supports their credibility.

How can an Egyptian trader utilize a demo account to trade forex?

Traders in Egypt can use a demo trading account for forex trading by choosing a broker that offers them one. Most brokers in Egypt that allow you to trade forex let you test their trading platform with the help of a demo account. You can go to the individual forex broker’s homepage and tap the “try demo” button. After that, you may enter your information and either explore the platform or learn how to trade forex.

Which brokers in Egypt allow you to sign up for a forex trading account free of charge?

To open a live trading account, you don’t need to pay money to most forex brokers that operate in Egypt. However, when you make your live trading account functional, you must fund it with a stipulated minimum deposit amount to begin trading. For instance, this minimum deposit amount for forex traders on IQ Option is only $10.

Last Updated on January 4, 2024 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)