The 5 best Forex Brokers and platforms in Kuwait – Comparison and reviews

Table of Contents

Kuwait is a small Persian Gulf country. For its vast oil reserves, valuable currency, and robust financial industry, it is one of the wealthiest countries in the Middle East. Forex trading has been increasingly popular worldwide, and Kuwait is no exception.

Like many others throughout the world, Kuwaiti investors want to enhance their savings. This is why forex trading has become increasingly popular in Kuwait. Choosing the most OK forex broker and platform is crucial, but few people know how to do it.

See the list of the best Forex Brokers in Kuwait:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Here is a list of the five best forex brokers & platforms in Kuwait:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

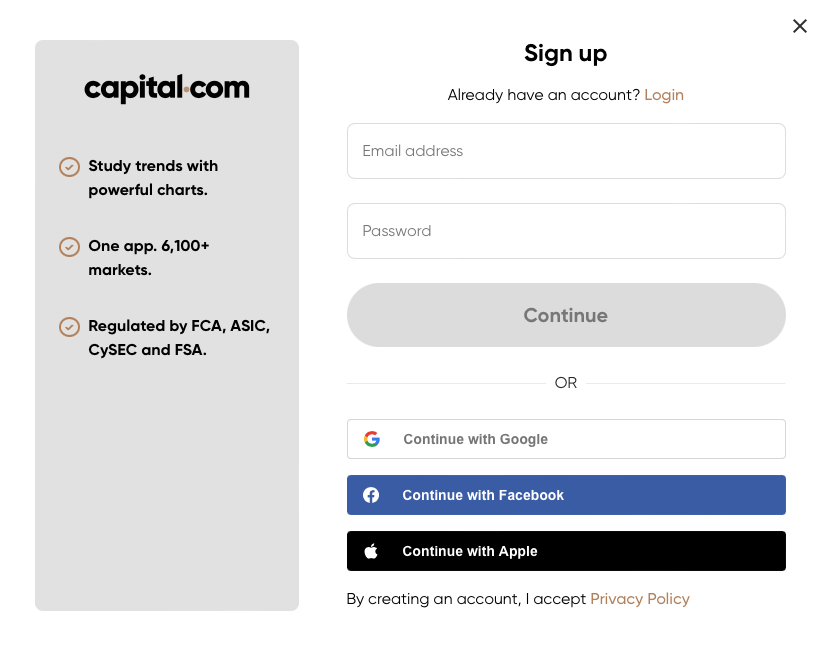

1. Capital.com

In 2016, Capital.com began in the UK. Capital.com. It was founded by a group of tech individuals and bankers and uses a unique way of transaction processing that increases market stability and allows for a zero-commission platform. Due to this, traders on the brokers’ platform enjoy a similar trading experience.

Some crucial investors support Capital.com, and it is under the license of the FCA in the United Kingdom and other international financial regulators in Europe. The brokerage company offers a variety of instruments to traders with low trading fees. These instruments include Forex pairs and commodities.

Except for the United States, Taiwan, Belgium, and a few island states, Capital.com has traders in almost all the countries globally, including India, Germany, the UK, and Cyprus.

A demo account is available that traders can use to practice trading strategies. The live accounts available are two. These accounts are the standard account and the plus account. The standard account allows traders to deposit at least $30. The plus account’s minimum deposit is $3000. Capital.com traders do not get any commission whether you are a plus account user or a standard account user.

The broker gives education to their traders. This education is provided through an article that traders can read, videos can watch, or an entire course that they can go through. Capital.com cares about the improvement of its trader.

Advantages of Capital.com

- Zero Trading Fees

- Trade Stocks and Crypto are available on the platform

- Dedicated account manager for traders

- Available on Mobile and desktop

- Availability of a non-expiring demo account

Disadvantages of Capital.com

- The trading symbols are not so much on the platform

- The brokerage company does not accept customers from Mexico and the United States of America.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets started in Auckland, New Zealand, in 2014, combining years of institutional Forex knowledge with an emphasis on providing resources to retail traders. Since then, the broker has used unique technologies to offer different trading solutions as a financial services provider, aggregating powerful trading performance with competitive prices.

Black Bull Group Limited is regulated under the license number FSP403326, usually holding an FMA Derivative Issuer License. This brokers’ platform is best for traders who prefer trading with little amounts of money. It would be best to choose a broker to trade index, commodities, and essential currency pairs.

In addition, BlackBull Markets, which began as a prime broker, now offers retail trading solutions and maintains translation facilities in world trading centers such as London, the UK, and Malaysia, providing global exposure. There are numerous options, including various circumstances and assets to trade and learning resources and programs for professional traders.

Benefits of BlackBull Markets

- Deposits at BlackBull Markets are free of charge.

- API trading is available, and a VPS.

- The entire MetaTrader suite.

Drawbacks of BlackBull Markets

- Customer service isn’t always available.

- Withdrawal is subject to a charge.

(Risk Warning: Your capital can be at risk)

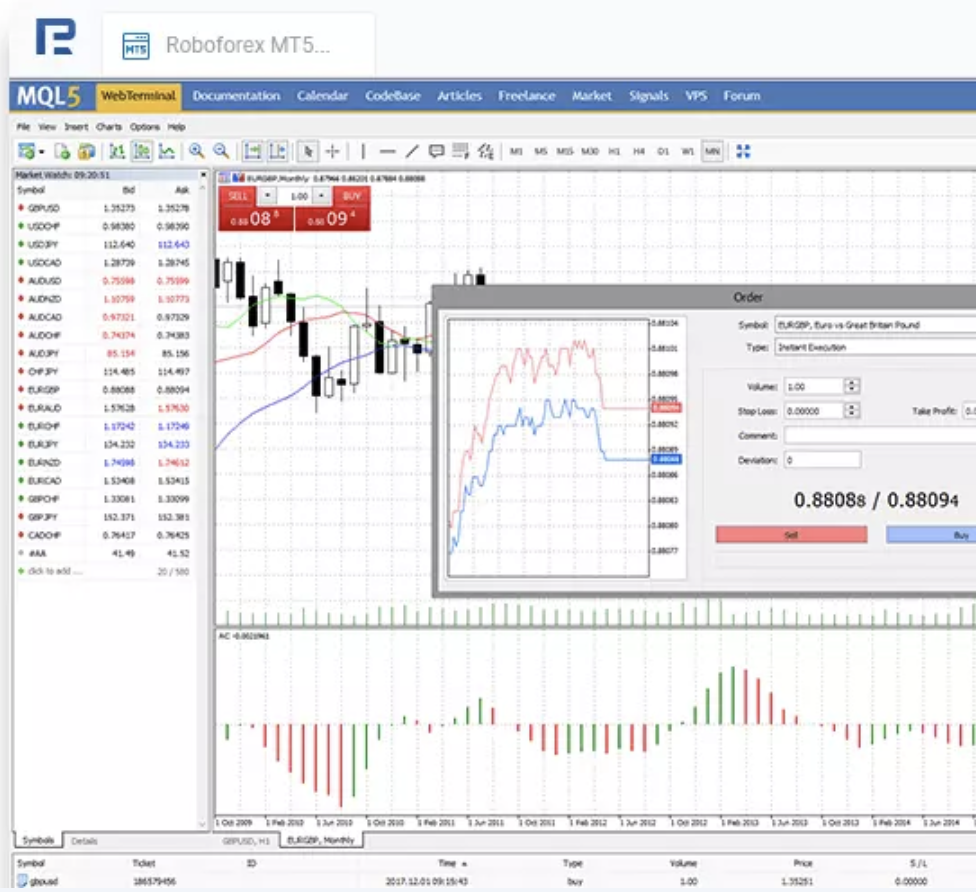

3. RoboForex

RoboForex is a brokerage firm that began operations in 2009. It provides financial market services in 169 countries. RoboForex has around 3.5 million registered users. In the Forex industry, RoboForex is the leading software developer. Minimum deposits are available in different locations. RoboForex, on the other hand, provides several alternatives to help users better learn how to trade forex using this platform.

RoboForex is making strenuous efforts to ensure that its platform is a risk-free investment environment for anyone. This enhances their credibility and makes them more dependable. In recent years, their popularity has skyrocketed to unprecedented levels.

Members get access to market analysis, technical analysis, expert trade analytics, and numerous tools in the Members section.

The most reputable financial market professionals see RoboForex as a trustworthy partner. Several significant accolades have been bestowed upon the company. The RoboForex group of enterprises is licensed to conduct services internationally by the IFSC in Belize.

It has more than eight hundred traders from more than 120 countries that use the platform. The broker supports 18 languages, and the language barrier is significantly reduced. RoboForex has made every effort to remove all barriers between clients.

The RoboForex Group, founded in 2009, consists of two major RoboForex groups. One of these groups provides services to different countries. While the other serves just traders in the European Union and EEA. The IFSC manages this organization.

RoboForex offers a variety of options and an opportunity to refine your skills and participate in forex trading competitions, all of which will increase your abilities and knowledge.

RoboForex offers MetaTrader 4, MT5, and even the cTrader as trading platforms. Every year, many traders continue to utilize MT4 because it is a popular platform, and traders can do multi-functional trading. Despite its superior functionality, MT5 is not as used as MT4. Both platforms provide excellent trading features. The most popular platform used by traders is still the cTrader.

Advantages of RoboForex

- The minimum deposit is low

- MetaTrader platforms are available to traders

- Trade can be opened for as low as $5.

- Instant money withdrawal

Disadvantages of RoboForex

- Currency pairs available for accounts is small

- Trading on its R Trader platform does not offer enough cryptocurrency tools.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian firm founded in 2010. It is owned by the subsidiary of Pepperstone Group, which has quickly risen to become a significant asset provider in the world—having a lot of traders that also trade on the platform.

Pepperstone Limited began operations in the United Kingdom in 2015, and has since expanded its offerings to include the United Kingdom and European forex traders through remote access. The group has offices in most European countries and even some Arabian countries.

Pepperstone is trustworthy because it is under the regulation of the FCA and the Australian Securities and Investment Commission. Opening an account on the platform is easy as it is done online. Pepper stone also carries out market research that will prove helpful to clients. The education portion is of top quality, and the customer service is outstanding.

Pros of Pepperstone

- It has many third-party trading platforms for traders.

- To help you get the best MT experience.

- Pepperstone offers several platform add-ons.

Cons of Pepperstone

- The customer support works only six days a week

- The demo account lasted for only 30 days

- Limited trading instruments.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is not so old; they built the first office in 2013 in Cyprus. The company started by providing just binary options (only for professional traders and outside EAA countries) to traders. But in later years, they began to give their clients more than just binary. The broker included other tradable instruments, including forex.

Besides, it is a flexible platform for traders because it is available on both phones and computers. Traders even have the same trading features on both devices. The platforms are the same and allow the best experience.

Many industry leaders recognize the broker company has many awards to its name. There is a flexible interface to customize the chart to color type to meet your requirements.

IQ Option patterns present video lessons for most trading methods that are available. The classes are so suitable that they will impact the trader within a short time. You will get to know everything that needs to be known about using such tactics.

The forex broker is famous for trading. It features a simple interface and can cater to even the pickiest traders’ needs.

Merits of IQ Option

- It has a customer service team that replies in various languages and works 24 hours a.

- Interactive webinars are available for better discussion.

- Opening an account is entirely on the internet.

Demerits of IQ Option

- Withdrawals made by bank transfers take longer.

- You may be charged a fee if you withdraw directly into your bank.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Kuwait?

Kuwait has numerous financial organizations and rules that aren’t bound by Sharia law, despite its location in the heart of the Arabian country. Most banks and brokerage institutions offer Islamic accounts, but ordinary trading accounts are also readily available.

Several recognized bodies govern Kuwait’s financial sector and Forex trading. The Central Bank of Kuwait regulates Forex trading in most cases. Kuwait’s Ministry of Commerce and Industry also regulates forex brokers. The Kuwait Chamber of Commerce and Industry is another regulatory body in the industry (KCCI).

You must be careful to choose a forex broker, especially local brokers. CBK-regulated brokers’ platforms in Kuwait are standard and a reliable choice. After picking your trading platform, you must research whether the broker is regulated.

Many brokers operate without regulation or licenses. Not all such brokers may want to scam you, but you should keep on your toes by not trading on such platforms.

However, if you choose a reputable and regulated broker company in Kuwait, you can be assured that your assets will be safe. Additionally, traders who trade on local forex platforms under the regulation of CBK are compensated. With Capital.com, for example, you can be sure to have a regulated and trusted broker.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Kuwait

The forex market is closely controlled, and several agencies regulate brokers. This demonstrates that trading in the Foreign Exchange market is safe and secure. However, this is only true for registered forex brokers.

There are a few factors to consider when looking for the best forex brokers in Kuwait. One of these factors is whether or not the forex brokers you are choosing have a license and are properly regulated.

Is it legal to trade Forex in Kuwait?

According to some reports, so many Kuwaitis are trading forex in 2019, with the number continuing to rise across the Middle East. Kuwaitis are free to sign up to any worldwide forex broker because forex is deemed lawful in Kuwait.

Kuwait is a small but prosperous country that has built an economy around petroleum and finance. Forex trading is allowed in the country and is very popular.

As an Islamic state, Kuwait uses a civil law system, which implies that Shaira law exclusively applies to Muslims.

As a result, unlike other Islamic countries, Kuwait’s limitations are not excessive, with both Islamic and conventional banks available. Muslims in Kuwait can participate in Forex trading through Islamic financial institutions (swap-free accounts).

How to trade Forex in Kuwait – A guideline for traders

Open an account for Kuwait traders

On any forex broker’s website, you can create an account. Several FX brokers require traders to deposit a certain amount. The brokers also offer rent account alternatives with different spreads and most minor deposit amounts.

Accounts for forex trading are frequently divided between the commission and noncommission variants. Low spreads and speedier trading are expected benefits of commission accounts. Choose the account type that best suits your needs.

Once you have opened an account, you should start trading with the existing account or demo account.

Start with a demo account or real account

The demo account is suitable for practicing how to trade. The demo account helps you plan strategies you want to use on your real or live account.

On the broker’s website, you can open an account. Several FX brokers state the minuscule amount a trader can deposit to start an account. These brokers provide other account types that may or may not have different spreads and the minimum deposit.

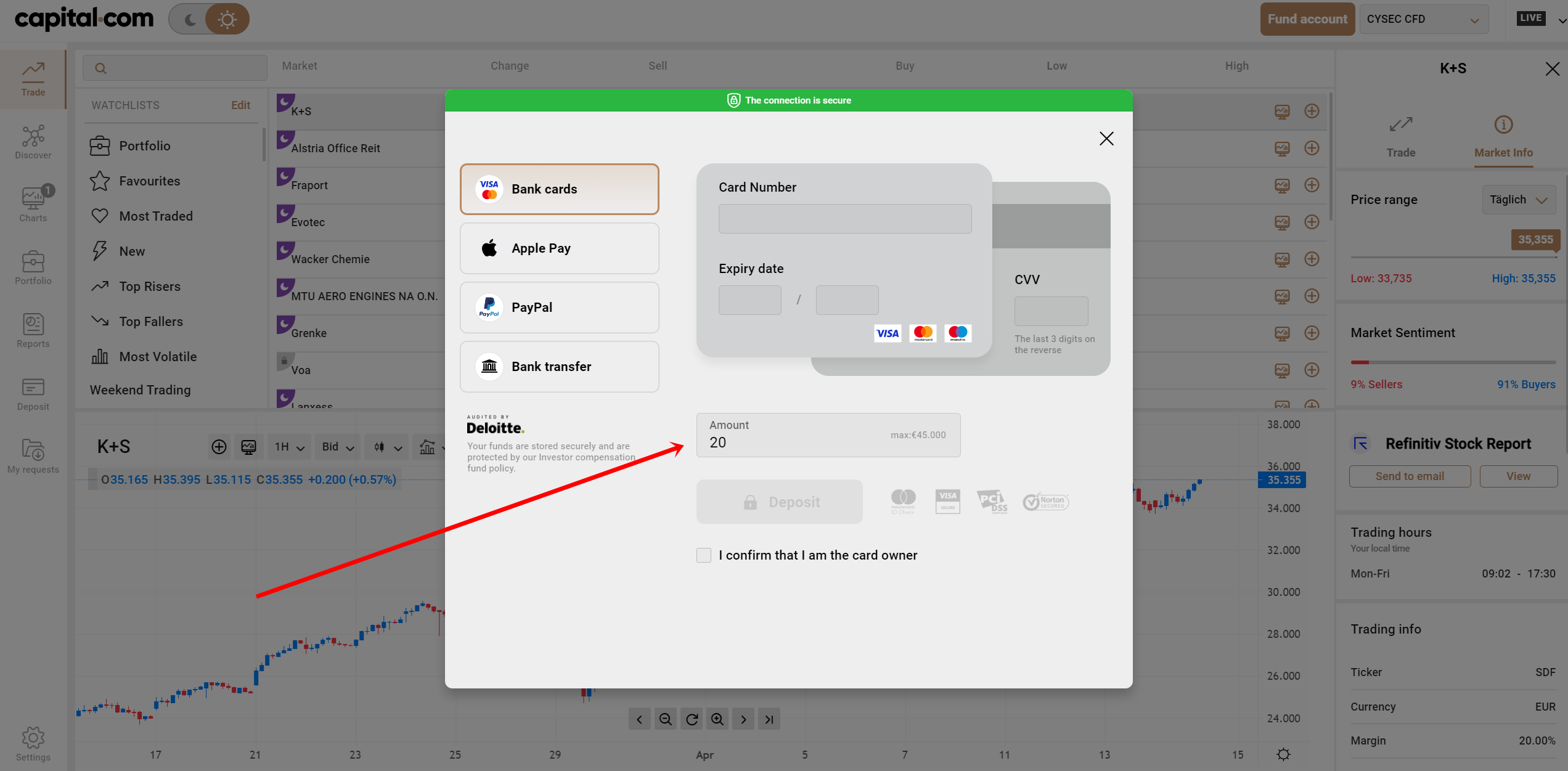

Deposit money

Haven decided to start trading with your real account; the next thing you need to do is to deposit money into your trading account. You cannot trade except if you deposit money into your forex account. The broker platform provides you with a payment method that you can use to fund your account.

The cash will be available within one business day after users enter their credit card information into their FX trading accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

There are different strategies that traders use during the trade. This helps you as a trader know how to go about trading forex. Strategies are helpful, and even the most professional forex traders have a process. These strategies include the following.

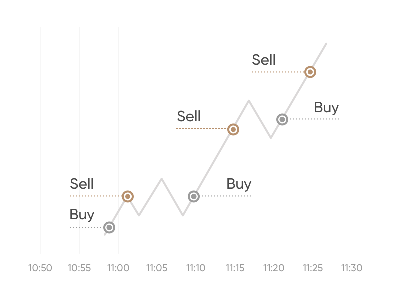

Scalping

Scalping involves the process of opening more than one trade-in market. It is a strategy that consists in opening trade for only a while. The trader does not spend up to a full day on one position, and the trader opens trade more than once within a short while.

The trader aims to make small profits from all the trades opened. This is a good strategy because traders can reduce risk while trading forex in the market.

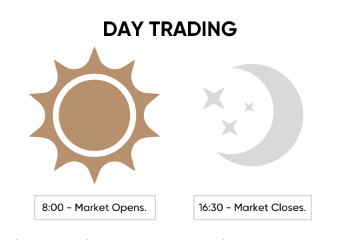

Day trading

Day trading is another strategy used by forex traders. It is not only used in day trading. It is also used in the general market. The technique involves the trader opening a single trade on the forex chart for a single day. The day trader monitors the forex market for a day to know how the market moves within 24 hours.

Position trading

Position trading is different from day trading. Unlike day trading, which is done daily, position trading can take more than one day. It can take weeks and months. Sometimes even years. The trader monitors how the market changes over a long period. The trader aims to know how they can place trades for a long time.

Make a profit

To make a profit, traders must be in the correct position on the chart. The profit made can be withdrawn later into your bank account. The forex trader can choose the payment method he would like to withdraw the money. Having a strategy that you use for trading is very good because it helps you plan and know the exact trading method that you want to use. This can help you maximize your profit while trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Kuwait

Forex is an integral part of the Kuwaiti economy. Some successful companies, such as Bianco Medical and Al-Madar Finance and Investment Company, are listed on the Kuwait stock exchange. The Kuwaiti dinar is also one of the most expensive currencies in the developed world, yet it is hard to come by at most forex brokers. That isn’t to say that Kuwaiti citizens can’t trade currencies.

If you are looking to work in the forex market, you should use the best forex brokers and platforms that are licensed and regulated by the country’s regulatory bodies.

FAQ – The most asked questions about Forex Broker Kuwait :

How long does a forex broker in Kuwait take to process the withdrawal request of a trader?

A forex broker in Kuwait can take up to 24 hours to process the withdrawal request of a trader. However, if you wish to sign up with a broker with a faster withdrawal process, you can choose BlackBull Markets, IQ Option, Pepperstone, Capital.com, and RoboForex. These brokers process your withdrawal requests at the earliest so that you can enjoy the fruits of your investment.

Does a forex broker in Kuwait charge you fees for making a withdrawal?

Some brokers operating in Kuwait might charge you fees for making a withdrawal. However, you can still pick a forex broker in Kuwait that does not charge you fees for withdrawing. The five brokers mentioned above have a free withdrawal process. Any trader wishing to avoid unnecessary fees and commissions can sign up with these brokers.

What should a trader keep in mind while choosing a forex broker in Kuwait?

A trader must ensure that the forex broker in Kuwait with which he wishes to trade is fully regulated. Besides, the broker should offer you a first-class trading experience. The broker should offer you all trading tools and technical indicators for a perfect trading experience.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)