The 5 best Forex Brokers in Laos – Comparisons and reviews

Table of Contents

Forex trading is gaining increasing popularity, and thanks to the internet, it is springing up in places that had little access to the market in the past.

Laos is one of the regions where people avoided forex trading in the past because of the lack of proper regulation. But easy access to the market is now changing this fact.

See the list of the best Forex Brokers in Laos:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article shares the best and safest brokers for Laotians looking to enter the market or change their broker.

The list of the 5 best forex brokers for Laotian traders:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

An overview of the brokers:

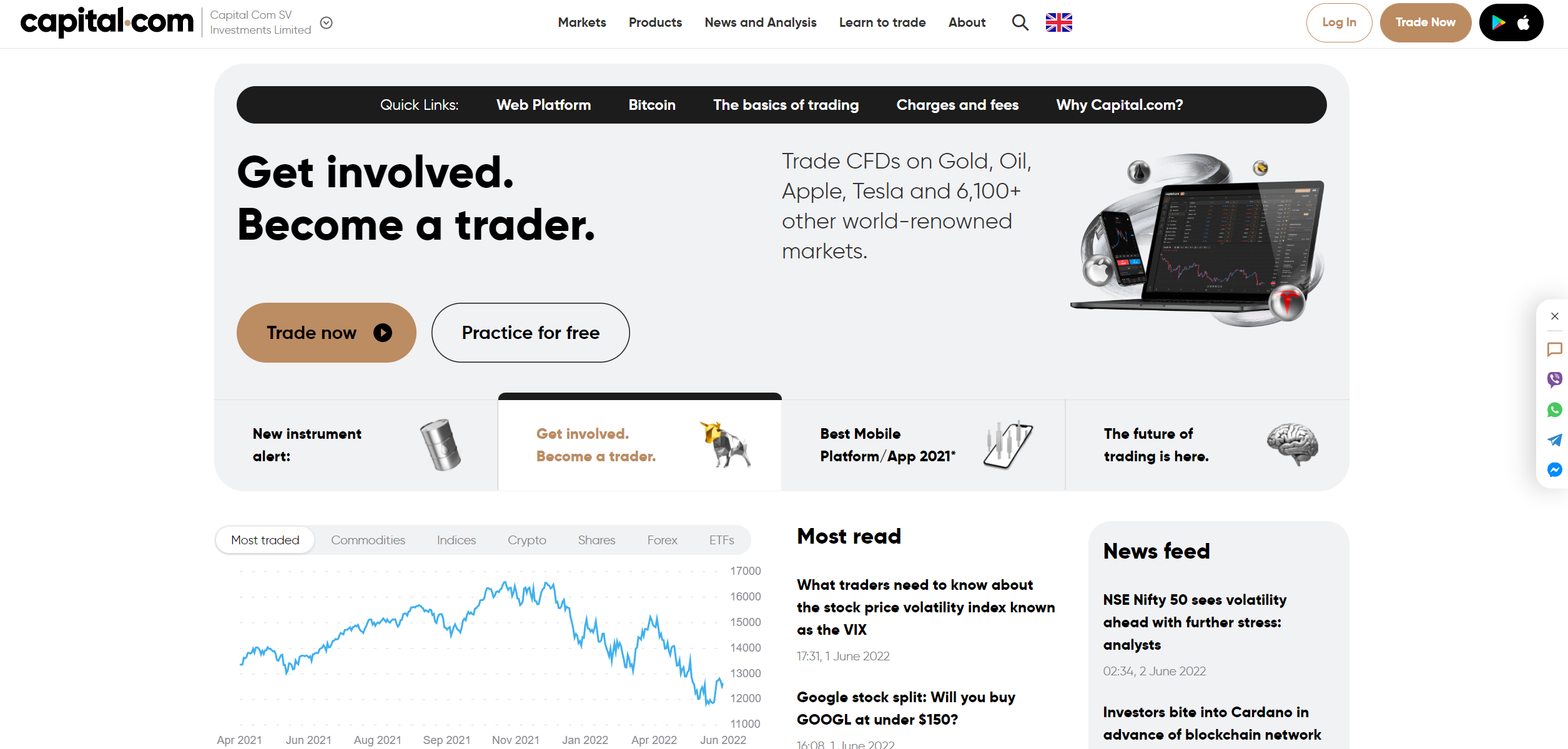

1. Capital.com

Capital.com forex and CFD broker is based in the United Kingdom and founded in 2016. In the few years of its operation, the broker has gained over 300000 active customers worldwide.

Capital.com operates with licenses from CySEC, ASIC, and the FCA. The company is now among the trusted and well-respected brokers.

With a minimum deposit of $20, Laotian traders can join this broker and access hundreds of forex pairs, CFDs, stocks, indices, and commodities. Trading with the broker is at zero commission and spreads start from 0.7 pips for major currency pairs.

Its MetaTrader 4 and inhouse trading app are user-friendly and come with valuable tools for beginners and experienced traders. The platforms are accessible on mobile phones with full trading features. Support is available 24-5, and the broker provides a free demo account.

Capital.com drawback

The broker does not provide the complete MetaTrader platforms. The MT5 is not offered.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is among the well-liked brokers in the Oceanic regions. The broker is based in New Zealand and has offices in Indonesia, Malaysia, the United Kingdom, and the United States.

BlackBull Markets hold licenses from New Zealand’s well-known regulator, the Financial Markets Authority (FMA), and Seychelles’ Financial Service Authority (FSA). The broker’s credibility and trust are mainly built on its quality ECN trading services.

Lao traders need a $200 minimum deposit to trade on the broker’s platform. However, its spreads and fees are competitive, and the trading conditions here are among the best. The average spreads on its raw account amount to 0.4 pips during peak periods for major crosses. The commission on this account is $3.

The broker offers the ECN services on its app and MetaTrader 4 and 5. Users enjoy the full MetaTrader features that include many indicators and tools to improve the traders’ experience.

BlackBull Markets drawback

The minimum deposit is too high compared to other acclaimed brokers.

(Risk Warning: Your capital can be at risk)

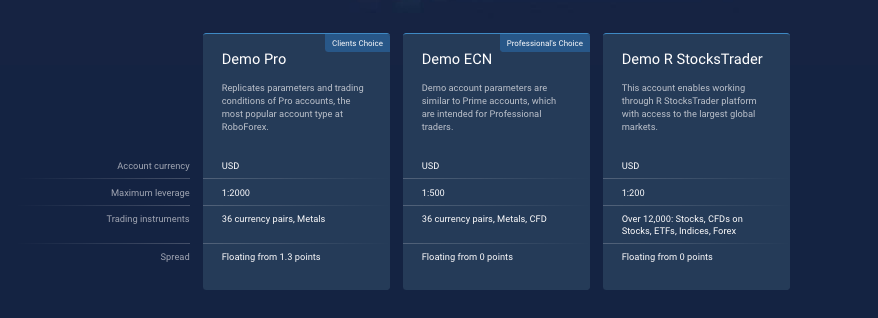

3. RoboForex

RoboForex was established in 2009 and provides low-cost online forex trading for customers in 180+ countries. The company is based in Belize and is regulated by the IFSC (International Financial Service Commission).

The broker is a credible online forex dealer, offering access to thousands of other markets, including stocks, groceries, indices, energies, commodities, metals, and ETFs.

Traders who love a range of choices can select among its several account types and platforms. Various market instruments also provide several portfolio options to choose from. $10 is the broker’s required minimum deposit, and new customers get a welcome bonus to trade with and keep the full profit.

Trading costs are highly competitive with this broker. Spreads start from 0.1 pip on its raw ECN account, and the commission is $2.

RoboForex disadvantage

RoboForex charges withdrawal fees, and it is quite high.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is among the largest and most trusted online forex broker. The company started operations in Australia and now has offices in Europe, the United Kingdom, Africa, and Asia.

Pepperstone operates with several licenses, including ASIC, BaFIN, DFSA, CMA, FCA, and CySEC. The broker is among the most regulated and genuine ECN forex dealers.

The broker provides low-fees trading services and fast ECN order executions on the MetaTrader 4, 5, and the cTrader. These platforms have been specially customized to support several enriching features, such as automated trading, VPS, and Autochartist. Social and copy trading is available through its partnered platforms, Zulutrade, Duplitrade, MyFxbook, and Tradingview.

Laotians can start trading on Pepperstone platforms with any amount. However, the broker suggests traders start with $200. This rate is optional, and many traders in Southeast Asia started with less sum than this. The spread on its razor account, the raw ECN, starts from 0.1 pip, with a commission of $3. Orders get executed under 3 milliseconds, and traders can access valuable content to increase their trading profitability.

Pepperstone drawback

The broker’s demo expires after 30 days of use. Some competitors offer longer access periods.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an award-winning binary option and forex broker, operating with a CySEC license and based in Cyprus.

The broker provides services on its proprietary trading app, which is easy to use and comes with several helpful tools for trading. Laotian traders can invest in binary options (only for professional traders and outside EAA countries) and digital options. Other tradable products are ETFs, equities, index CFDs, and commodities.

IQ Option offers low fee service, with an average spread of 0.8 pips on its zero commission account types. The minimum deposit for trading is $10. Traders can upgrade to a VIP account by depositing $1900. The account gives access to lower fees and other benefits.

IQ Option disadvantage

IQ Option offers a trading service on its platform. The MT4 and MT5 are not available to trade with.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Laos?

Laos is a relatively small country located in Southeast Asia. The country shares borders with China, Thailand, and Vietnam. Its economy depends on trade with its neighbors, investment, and tourism. Foreign exchange is necessary for the country, but online forex trading is only starting to pick up.

Bank of the Lao, the Central bank, is the nation’s top financial regulator. The bank regulates the nation’s reserve and currency supply and oversees the banking sector. The central bank was founded in 1968 and has since been the apex regulator of Laos’ finance industry.

Laos citizens and investors have to use the Lao kip, its national currency, to make payments for products and services as part of the bank’s regulation. However, businesses that deal with foreign companies find ways to bypass this law and use foreign currencies where necessary.

The online forex trading environment is hardly regulated, and many brokers welcome Laos traders into their trading platforms.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Laos – Good to know

Forex trading in Laos is not regulated. Many forex brokers welcome Laos traders, including unregulated brokers and fraudsters.

The Laotian who wishes to start forex trading should carefully choose their broker. Dealing with a globally known broker having a license from an internationally recognized entity is the safest.

These entities can be the following:

- CFTC, the United States.

- FCA, the United Kingdom.

- CySEC, Cyprus

- SCB, Bahamas.

- ASIC, Australia.

- FSA, Seychelles.

- IFSC, Belize.

Brokers having one or a combination of any of these licenses are genuine. They adhere to fair business practices mandated by these organizations.

Is it legal to trade Forex in Laos?

Yes, forex trading is permitted in Laos. The Bank of Laos does not have any rules against online forex and CFD trading. Therefore, forex trading is legal. Remember, though, that there is a law against paying with foreign currencies. Laotians, both individuals, and businesses, must conduct business using the Lao kip. So, the trader must make deposits and withdrawals in the national currency. The broker often provides currency conversion means for traders, so no worries.

How to trade Forex in Laos – Tutorial

To trade forex in Laos, three basic things must are necessary:

- Reliable internet connectivity

- Internet-enabled device; phone or laptop

- A trusted brokerage company

These items must be in place before beginning forex trading. Stable internet is necessary so that you don’t lose out on profitable trades or lose profits when the connection gets disrupted. Disruptions make it tough to enter or exit trades when you wish to. This can be bad for this business.

The broker is another essential first consideration when starting forex trading.

How to identify a trusted broker:

- A proper license

The broker must operate with a license from any acclaimed entities listed above. It would be best to investigate the license validity by checking the issuer’s website to confirm that the broker is on their list.

- Low fees

The broker’s spreads and commission should fall within the industry average or below. Investigating different reputable brokers’ fees will give you an idea of the acceptable range.

- Free demo account

Trustworthy brokers provide free demos to allow customers to see their trading platforms before fully registering. The demo access must be available for no less than 30 days and must come with sufficient virtual cash to practice or test the market.

- Easily accessible support service

Credible brokers ensure their support service is available 24 hours during trading days (weekdays). They provide live chat support on the platform or website. Phone and email support should also be offered. Multiple language customer service that includes Lao is an even better consideration.

- Accessible payment methods

Good brokers accepting traders from certain regions always ensure the payment options are accessible for the traders. Deposits and withdrawals should be hassle-free and take as little processing time as possible.

These are a MUST for a credible broker. A broker lacking any of these points is not worth considering.

Steps to trade forex in Laos:

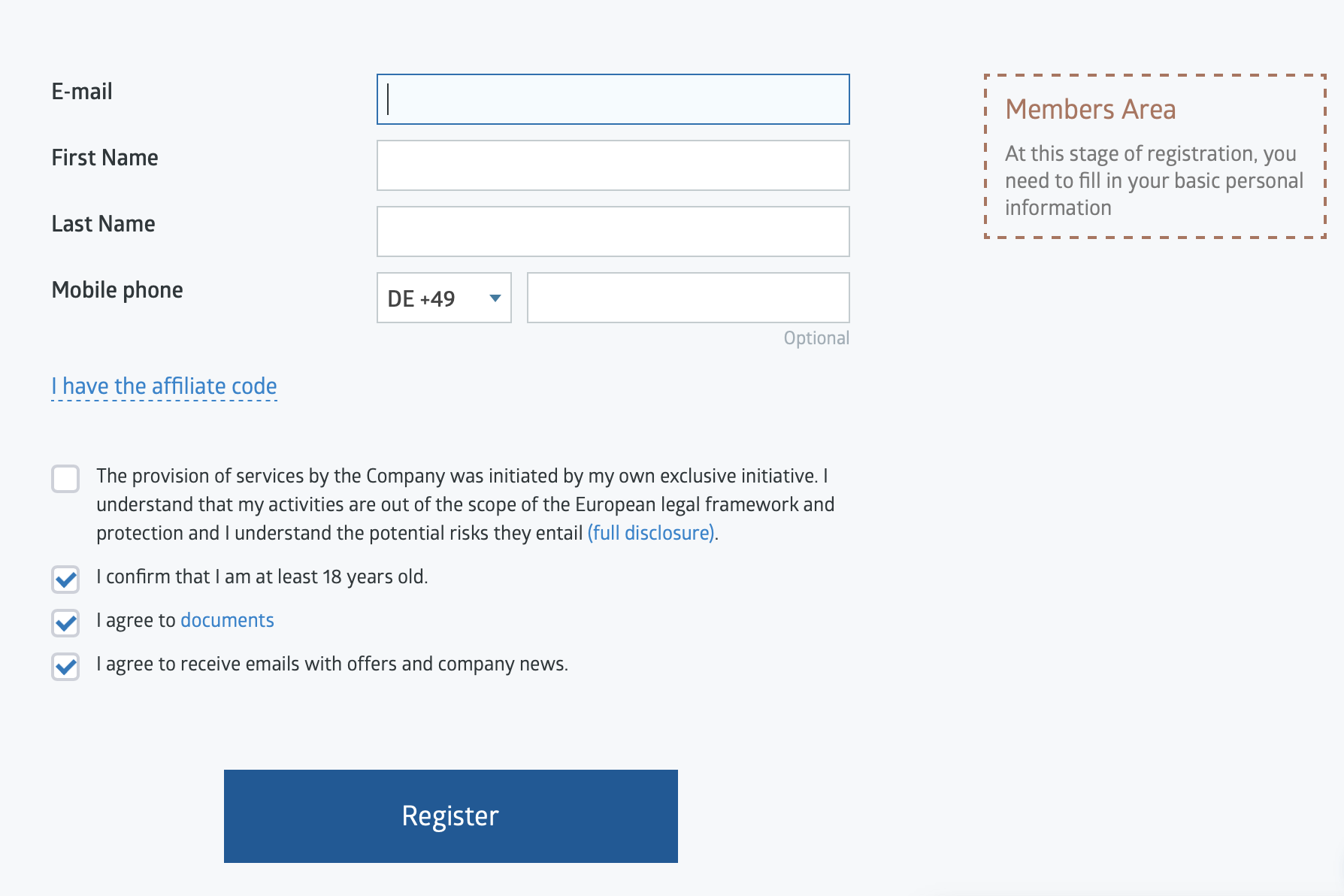

1. Open account for Laos traders

Enter the broker’s website to create a forex trading account. The site may support several languages, and if Lao is one of them, the page will load in the language.

Click on the create account button, usually at the top right or the middle of the page. The form will require your email and maybe your name and phone number.

Type this information in the appropriate column and click on OK. The system sends a link to the email address you gave. Open your mailbox and click on the link to verify the details and continue the signup process.

The broker may ask for an ID and utility bill carrying the address you provided. Scanning and uploading this document should complete the registration.

2. Start with a demo or real account

The broker provides a free demo for tests. You must take advantage of this account to get fully acquainted with the forex trading environment.

The virtual cash should be sufficient to conduct several trades and test the platform’s features before starting. Some brokers allow you to request more funds if you exhaust the initial balance.

Even if you are already familiar with the forex trading environment, the demo is still recommended before going live with a broker. It helps you see the broker’s environment before beginning to trade with them.

3. Deposit money to trade

The next step is to deposit money in the live account for real trading. This step comes after deciding you’re satisfied with the broker’s platform through the demo tests.

Click on the FUND MANAGER tab on the trading platform to access the deposit options. The payment methods should be available in your region to make this process easy. Popular options are MasterCard, Bank transfer, Visa, and Unionpay.

Some brokers may assign a support rep to assist with the process. The funds transferred should display in the account balance within minutes. Brokers hardly charge a fee for this, but third-party charges may apply.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before conducting live trades, market analysis is necessary. The trader must analyze the asset as much as possible before trading.

People who succeed in forex trading combine thorough analysis with an effective strategy to trade the market. The trader must first understand the factors affecting the currency pair’s price, causing it to move up or down.

It gives the trader insight into emerging price patterns and helps them make profitable trade decisions.

2 important market analyses:

- Fundamental analysis

- Technical analysis

The fundamental analysis is necessary for the trader to understand the country’s economic status. The economy determines the exchange rate. So the trader analyzes economic factors, such as the interest rate, inflation, gross domestic product (GDP), trade surplus or deficit, etc. These factors show the economic state and indicate the forex pair’s future price moves.

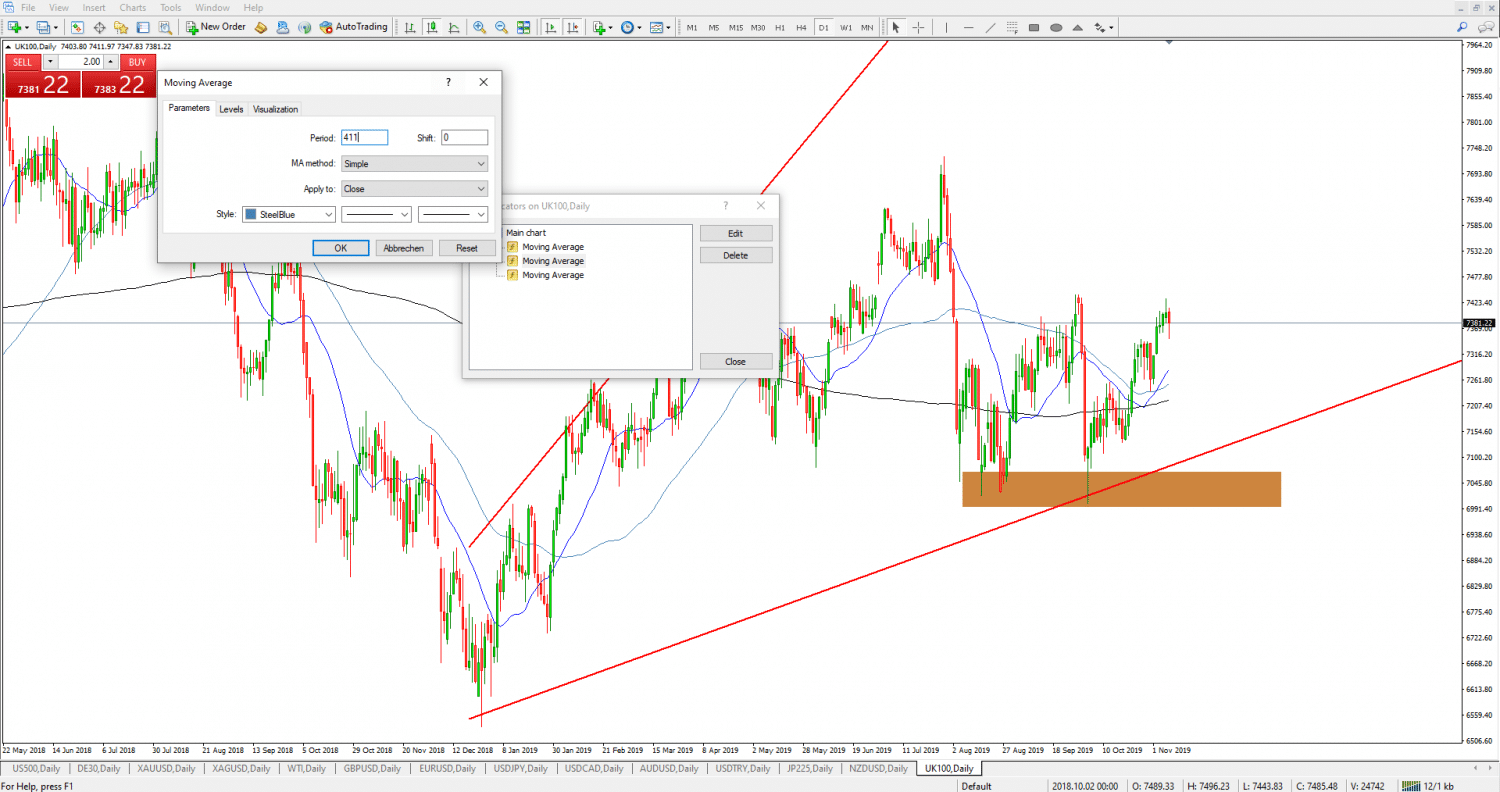

Technical analysis is more commonly used and involves the forex chart. Traders study this price chart to identify the patterns that form from price movements. These patterns show the best trading opportunities. However, the trader has to interpret them correctly to trade successfully. Trading platforms usually come with indicators embedded in them. These indicators are technical analysis tools that help the trader identify the patterns and provide triggers when there’s an opportunity.

These analyses should follow one or more effective trading strategies that suit the forex pair you choose.

Effective forex trading strategies:

- Price action

Price action trading is among the simple strategies that involve less technical tools. The trader examines the price chart and places trade based on the current price moves they can see. Successful use of this strategy depends on the traders’ knowledge of candlestick movement in the forex chart. But the strategy is effective if applied correctly.

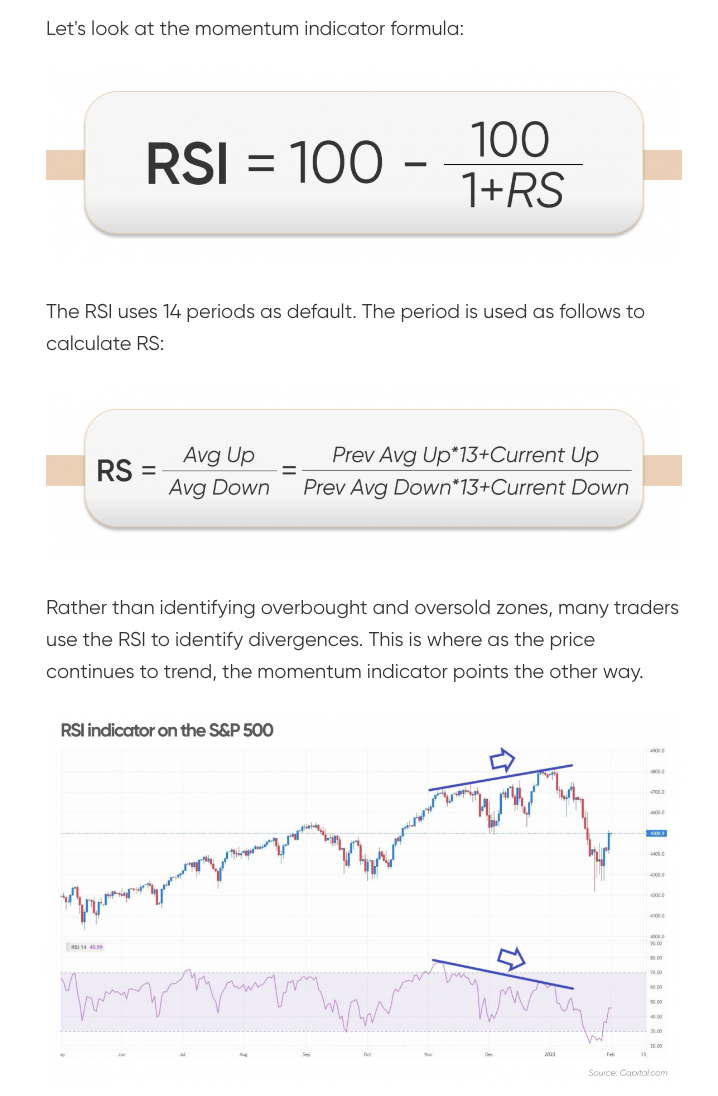

- Momentum trading

Momentum trading is between a short and long-term trading approach. The trader has to identify a trend that should continue for longer than a few days. The trader believes the trend will continue for a certain period. So they enter a position in the same price direction.

- News report trading

Trading strategy based on the news involves listening for economic reports that impact the currencies. The market reacts to economic news, and the trader can anticipate this reaction and capitalize on it.

5. Make profit

Place your trades based on proper analyses, using a functioning strategy. These two items always result in profitability. Once you start to make a profit, you may reinvest or withdraw the gains from the platform.

Withdrawals should be as hassle-free as depositing funds. But it usually takes longer to hit the receiving account. The average processing time is 48 hours. It may take less time or longer. It all depends on the payment method and the broker’s service.

The same FUNDS MANAGER tab should contain the option for the withdrawal request form. Ensure you have uploaded your ID and utility bill, which completes the KYC requirements during the signup process. The broker may delay the withdrawal process if you fail to do this.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Laos

Fortunately, many forex traders accept Laos traders. Choosing one can be tough, but it should be simpler to find the most suitable broker for your trading objectives with this article.

FAQ – The most asked questions about Forex Broker Laos:

Do forex brokers in Laos operate within a regulated environment?

Even though forex trading was not regulated in Laos earlier, traders can safely trade it now. Traders in Laos don’t need to hesitate to trade forex because the brokers operate within a regulated environment; if a trader in Laos is cautious while trading forex, he can avoid getting scammed and enjoy trading with maximum profits.

What happens if a trader is not cautious about choosing the best forex broker in Laos?

If a trader is not cautious about choosing the best forex broker in Laos, he might make losses. An unregulated forex broker might make it a challenge for traders to deposit or withdraw their funds. Therefore, forex brokers in Laos who offer traders a regulated trading service should be the only pick of the traders.

Can a trader trust forex brokers in Laos?

Yes, traders can trust forex brokers in Laos that offer regulated services. The five brokers- BlackBull Markets, Pepperstone, IQ Option, RoboForex, and Capital.com excel in offering traders the best services. These brokers are trustworthy because several regulating agencies oversee their functioning. Besides, these forex brokers also offer world-class trading services to traders. So, they can be the best pick for any trader.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)