Five best Forex Brokers and Platforms in Liberia – Comparisons and reviews

Table of Contents

Forex trading in Liberia has increased in volume in the past five years, and more people are joining the industry. Some leading forex brokers accept Liberian traders if you want to open a trading account with a forex broker.

See the list of the best Forex Brokers in Liberia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best forex brokers in Liberia:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has over 5 million traders registered on its platform since its launch in 2016. It offers trading instruments such as Indices, cryptocurrencies, stocks, shares, and commodities.

Capital.com has Cyprus Securities and Exchange Commission, Financial Conduct Authority, and Australian Securities and Investment Commission regulations.

Traders using this broker can choose between three accounts:

- The Plus account with a $2000 initial deposit.

- The Standard account has $20.

- The Premier account offers $10,000.

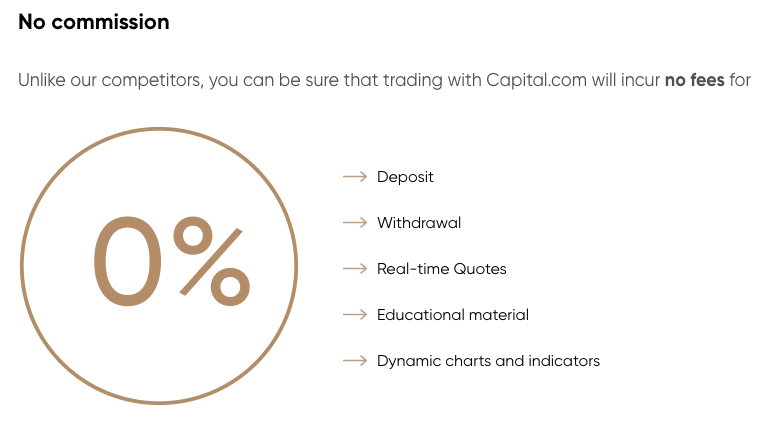

Forex spreads that start at 0.8 pips, and it has no commission.

Overview

- Minimum deposit – $20

- Licenses – FCA, ASIC, CySEC, NBRB

- Platforms – MT4, web-trader

- Spreads – from 0.8 pips on major pairs

- Support – 24/5

- Free demo – yes

- Leverage -1:30

Besides being a low commission broker, It has no inactivity costs and no deposits/withdrawals. Overnight charges apply depending on the trading size and the leverage used. It also has a wide range of educational resources that new traders can use to trade.

The trading platform is available through its mobile application the website versions, and it has the desktop platform. It also complies with investor protection rights and has negative balance protection.

Disadvantages of Capital.com

- Limited trading instruments. It has limited assets to trade, and some assets are not available in some regions. It also has limited minor currencies when trading forex pairs.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Since 2014 when it launched its operations, it has registered thousands of forex traders on its trading platform. It has regulation by the Financial Services Authority in Seychelles. Its traders can access indexes, metals, commodities, CFDs, energies, and shares.

BalckBull Markets is a trading broker that offers advanced trading platforms and supports the MT4 and MT5 trading platforms, which offer fast order processing rates, low spreads, and high leverage for forex brokers.

Overview

- Minimum deposit – $200

- License – FSA

- Platforms – MT4, MT5

- Spreads – 0.0 pips

- Support – 24/5

- Free demo – yes

- Leverage – 1:30

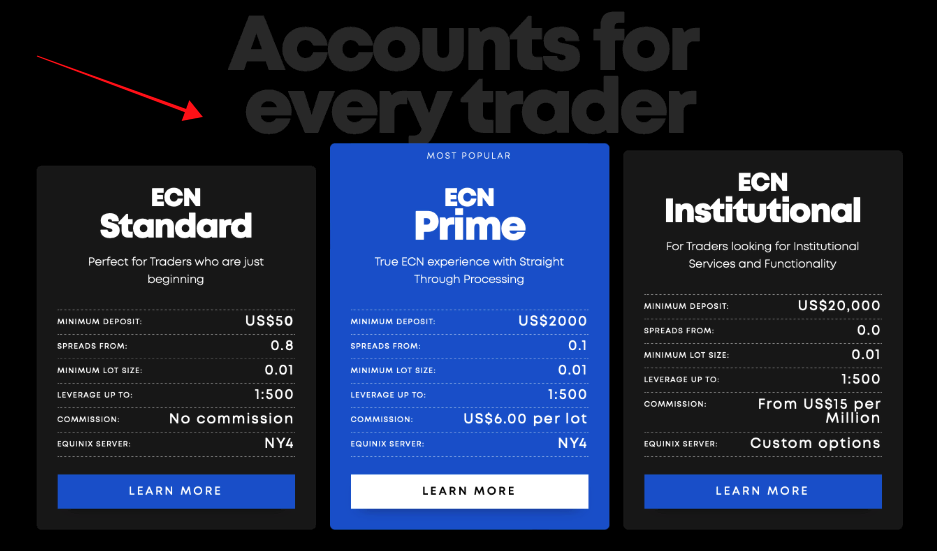

It offers three accounts, the ECN Standard account has an initial deposit of $200, the ECN Prime requires $2000, and the ECN Institutional has $20,000. Forex spreads in the ECN standard start at 0.8 pips, the ECN Prime from 0.1 pips, and the ECN Institutional starts at 0.0 pips.

The ECN Prime has commissions starting from $6 for every $100,000; the ECN Institutional varies, while ECN Standard has no commissions. It also has no inactivity costs, deposits and withdrawals are free, and the overnight charges apply.

A disadvantage of BlackBull Markets

- Limited learning resources. It has resources, but the resources are not as comprehensive as the standards of leading brokers in the financial markets.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

It has been trading financial markets since 2010 and has registered thousands of traders. Its users can access indices, shares, ETFs, commodities, and forex. It has the Financial Conduct Authority and the Australian Securities and Investment Commission.

Its traders can open the Razor or Standard accounts with an initial deposit of $200. Forex spreads on the Razor account start from 0.0 pips, and the Standard account starts at 1.3 pips. It also has low commissions where the Standard account has no commission, but the Razor account offers $7 per$100,000.

Overview

- Minimum deposit – $200

- License – ASIC, FCA

- Platform – MT4, MT5, c Trader

- Spreads – 0.0 pips on the Razor account

- Support – 24/5

- Free Demo – yes

- Leverage – 1:400

It has multiple regulations, which ensures a secure environment for forex traders. It also has negative balance protection for its traders and risk management tools like guaranteed stop-loss and take-profit orders.

It has no deposits, withdrawals, and inactivity costs, and the overnight rates vary with the trading instrument. It also has a variety of methods traders can transfer funds to their trading accounts. The platform accepts POLi, PayPal, Bpay, Skrill, UnionPay, Neteller, credit/debit cards, and bank transfers.

Disadvantages of Pepperstone

- Limited research materials. Traders require research materials such as daily news and announcements, videos, and analysis when they want to prepare to enter the market. Pepperstone has research materials, although it is limited to a few videos and some articles, which may not be enough for traders to use.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. RoboForex

Since 2009 when it started its operations, it has registered over one million forex traders. It offers trading instruments such as ETFs, indices, metals, CFDs, stocks, forex, Cryptocurrencies, and commodities.

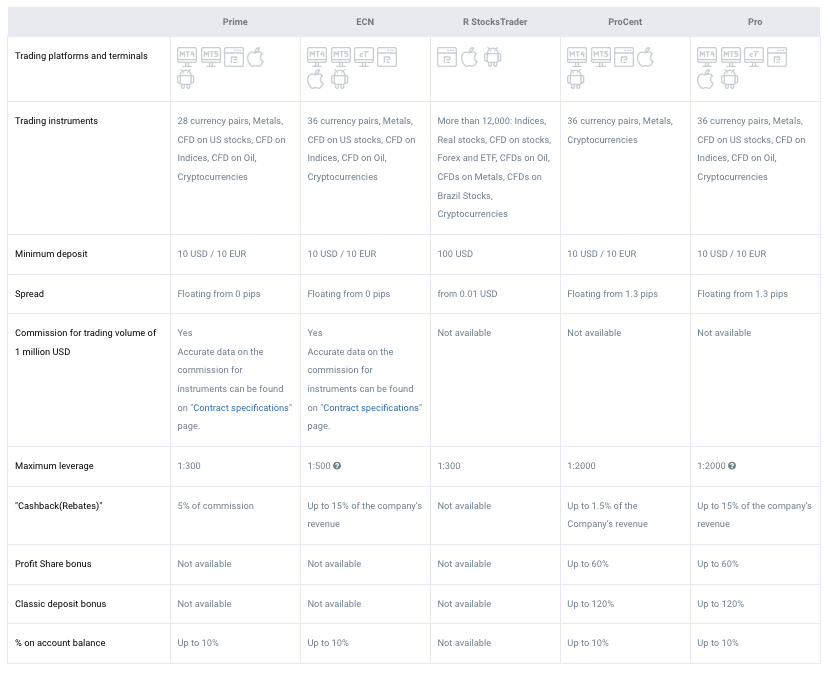

It has regulation from Financial Services Commission and offers five accounts, the R-stocks trader with a minimum deposit of $100. The Prime, ECN, Pro, and Pro-cent require $10. For forex spreads, Prime and ECN from 0.0 pips, R-stocks trader has forex spreads from $0.01, while the Pro and Pro-cent start at 1.3 pips.

Overview

- Minimum deposit – $10

- License – IFSC

- Platform – R-stocks trader, c Trader, MT4 and MT5

- Spreads – 0.0 pips

- Support – 24/7

- Free demo – yes

- Leverage – 1:2000

RoboForex is popular as a low-cost forex broker because the trading costs are low. It has a $10 inactivity cost for ten months of inactive accounts, it has no deposits and withdrawal fees, and overnight charges vary with the leverage, asset, and volatility.

When it comes to the commissions, the Pro and Pro-cent account have no commission, and the ECN has a commission of $20 for every $1 million, the Prime has $15 per $1 million, while the R-Stocks trader from $1.5.

If you are looking for a forex broker with low trading costs and industry-standard trading tools, you can start with RoboForex. It also has a copyFX platform for new traders who have no experience trading where they can learn and share trading ideas with expert traders.

Disadvantage of RoboForex

- It is not regulated by tire one or two. It has regulation from the FSC Belize, which is not considered tier one. Most forex brokers may not find it reliable enough to open a trading account. They prefer tiers one and two because of the strict regulation and emphasis on investor protection.

(Risk Warning: Your capital can be at risk)

5. IQ Option

It has been trading in the financial markets since 2013 and has registered over 40 million traders globally. It offers Digital Options, CFDs, cryptocurrencies, forex, commodities, binary options (only for professional traders and outside EAA countries), ETFs, and stocks.

Cyprus Securities and Exchange Commission regulates IQ Option‘s activities in the financial markets which means it can operate in multiple countries within the EU. Its regulation from CySEC, a tier-one jurisdiction, is one of the factors as to why it is a reliable and credible Forex broker.

Overview

- Minimum deposit – $10

- License – CySEC

- Platform – IQ Option trading platform

- Spreads – from 0.8 pips

- Support – 24/7

- Free demo – yes

- Leverage – 1:500

It offers two accounts. The VIP accounts have an initial deposit of $1900, while the Standard account has $10. Forex spreads vary with the liquidity and volatility of the trading instrument. It has no commission for most trading instruments, but cryptocurrency has a rate of 2.9%.

Apart from the low trading costs, it also has industry-standard trading resources, fast order processing speeds, and a user-friendly interface. Its platform is available as a mobile app, and it has a desktop version and the web version.

Disadvantages of IQ Option

- It does not support MT4 and MT5. It does not have the MT4 and MT5 trading platforms which most traders are using. Although the IQ Option trading platform is efficient, users prefer to choose to use other trading platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Liberia?

The bank of Liberia regulates forex trading in Liberia. The Ministry of Finance of Liberia has authorized the Central Bank of Liberia (CBL) to regulate the banking and non-banking sector.

The central bank of Liberia started its operations in 2000, but it was founded in 1999. It has the authority to regulate the financial institutions in Liberia, both the banking and non-banking sectors. It also ensures the Liberian Dollar is stable.

The Central bank of Liberia regulates forex by ensuring that forex dealers, brokers, and other financial intermediaries comply with the Financial institution’s act established in 1999, which has been amended severally.

Financial intermediaries such as forex dealers and forex brokers that engage in forex exchange or forex trading have to obtain a trading license from the Bank of Liberia to start trading in Liberia. The financial intermediary wishing to obtain a trading license should submit the relevant documents and ensure that they meet the stipulated requirements by the CBL.

The CBL can impose sanctions, fines, and penalties on any local financial institutions found carrying out banking or non-banking services within the jurisdiction of Liberia without a license. Non-banking financial institutions like forex brokers must comply with guidelines established to ensure investor protection and agree to disclose sufficient relevant information to the investors.

The CBL and the financial institution should appoint an external auditor to inspect and audit the activities of the institutions and submit a report to the CBL and the financial institution, including recommendations on how to improve service provision further.

Security for traders from Liberia – Good to know

The CBL has ensured the protection of investor rights by making sure that forex dealers comply with the laws and legislations that protect consumers. It also conducts inspections and collects reports of the financial institutions to monitor the activities of forex brokers.

It has ensured the safety of investors by issuing sanctions and high fines for brokers that violate the investor protector guidelines. It has also ensured that all local financial institutions get trading licenses to operate in liberal by the CBL.

It has the AML/CFT regulations market participants comply with to ensure the forex industry is secure and transparent. It has given the appropriate channels for forex traders to report any unusual or suspicious accounts from forex investors.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Liberia?

Yes, it is legal to trade forex in Liberia. The forex industry in Liberia is active. The Central bank of Liberia has the authority to ensure financial institutions are licensed to offer services for Liberian forex traders.

It has also established the legislation that forex traders, investor brokers, and other banks must comply with when trading in Liberia. These laws ensure forex traders can deposit and transact in the financial industry without losing their investments to forex scams.

How to trade Forex in Liberia

Open account for Liberian traders

Select a forex broker that accepts Liberian forex brokers. Currently, there are offshore forex brokers that accept Liberian traders. Choose a regulated forex broker to ensure your funds are safe and have a better trading experience.

You can check features such as the trading instruments offered, trading costs, demo account, the minimum deposit required, order execution speeds, and customer care. Besides that, ensure that the forex broker offers deposit methods available in your region.

Once you settle for a forex broker, register a trading account using the online registration form on their website. The online registration form requires your name, emails, date of birth, nationality, and telephone number; sometimes, they ask for your employment status and trading background.

The registration process is according to the AML/CFT regulations, in which the forex broker has to collect sufficient information to know their clients. You will also need to submit a copy of your national ID or any Utility statement that will verify these details.

Download a trading platform, and you can start by navigating their user interface. You can also change some features such as the technical indicators and time frames and select the trading instruments you want to trade.

Start with a demo or real account

The demo account offers an opportunity for forex brokers to test the trading platforms or the software of the forex broker. New traders who don’t have experience trading can build their experience by trading on the demo account.

The demo account offers features like a real account, and most forex brokers offer demo account versions for their accounts. It uses virtual funds, so traders don’t have to risk their real funds when trading. It is also a feature used to practice different trading strategies and learn how to trade different financial markets.

Traders who have experience trading can start trading on a real account.

Deposit money

Deposit funds on your trading account by linking your trading account to one of the payment methods supported. Offshore forex brokers that accept forex brokers from Liberia support payment platforms that Liberians use.

You can deposit using bank accounts; they accept credit/debit cards and electronic wallets such as Skrill or Paypal that many users have. Some forex brokers have conversion fees if you want to convert the Liberian dollars to the account’s base currency.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Before traders enter the financial markets, they have to check if the market conditions are favorable using analysis. Depending on your trading strategy, you can use technical analysis or apply fundamental analysis. Some forex brokers prefer to use one, but most use both.

Technical analysis is a trading strategy in which a forex trader uses technical tools such as indicators, trend lines, chart patterns, timeframes, and the candlestick patterns to study the price action. These tools enable the trader to see the volatility, the liquidity of the asset, trends, and momentum, which is useful when you want to enter or exit the financial markets.

Fundamental analysis works by evaluating the direct and indirect factors that affect the value of a trading instrument. These factors include the central bank’s interest rates, the status of the nation economically and politically, the GDP, employment and unemployment ratio, trading relationships with other countries, and prices of major commodities related to the trading instrument.

Strategies

Forex traders can apply various trading strategies when trading forex in Liberia. Some trading strategies include:

Position trading – involves using technical and fundamental analysis to speculate on a trading instrument or a stock of a company that you predict will increase value within a certain time. Buy the trading instrument and hold your position until the value increases to sell it at a higher price.

Scalping – this trading strategy requires the trader to have a forex broker with fast order execution rates. It involves trading the small waves on price action and relies on technical analysis. The trader opens short positions that can take thirty seconds to one minute and makes numerous trades. It works by entering and exiting the trade and requires the trader to have a fast exit strategy.

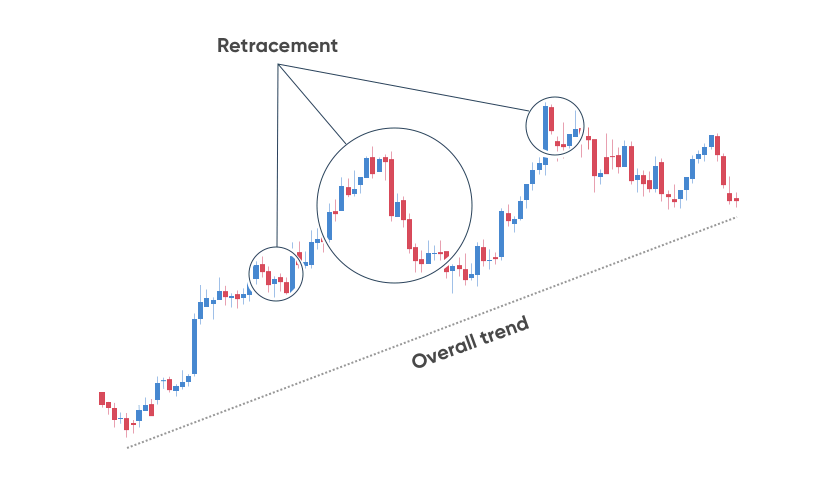

Swing trading – involves trading swings that form on price action. The forex trader identifies a trend, finds the swing highs and swing lows using technical indicators such as trend lines and opens trading positions on the swing highs or the swing lows. It requires the trader to be fast and monitor the trade’s trend and momentum.

Trend trading – this trading strategy identifies the market’s overall trend. Open a trading position based on the trend; if it is an uptrend and the momentum is strong, go long; if it is a downtrend, you go short. Trend trading can work on the lower or higher time frames and can take days to even a month if you are trading the overall trend as they take longer to form.

Make profit

It is not traders who can profit from trading on the financial markets by having a trading strategy that produces consistent results, as no trading strategy can only produce winning trades. You also need to develop a trading discipline and follow your trading strategy during the trade.

Use the risk management tools in every trade to limit the losses, and don’t risk more than you can afford to trade. Ensure to practice trading on the demo account before opening a trading position.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Liberia

Forex trading in Liberia is growing, and more forex traders register trading accounts on local and offshore brokers. Forex traders can ensure the safety of their capital by registering a trading account with a regulated forex broker that offers industry-standard trading features.

Liberian forex traders can check out some of the recommended offshore brokers that offer international forex services and have regulations from some leading regulatory jurisdictions.

FAQ – The most asked questions about Forex Broker Liberia :

Where can I locate the finest Forex brokers in Liberia?

When choosing a forex broker, accessibility and safety are the most vital considerations. Choose brokers only if they have been approved by a key regulator, such as the SEC in the US, BaFin in Germany, or the FCA in the UK, by virtue of their licence or supervision.

Check out our broker discovery tool to save hours of searching and get the best forex broker for you.

How can I find a reliable forex broker in Liberia?

You should consider your intended market while selecting a forex trading platform for scalping in Liberia. While Liberian Forex scalpers favor trading tick or one-minute charts, Liberian investors frequently employ five-minute or thirty-minute charts.

Catching high-velocity movements surrounding economic news or data, such as GDP estimates, is a common scalper method used by Liberians. In other words, they trade during periods of considerable market fluctuation and close out their holdings fast.

Even though scalping is a challenging investing technique, it has great potential in Liberia. You can make more consistent and successful transactions by selecting a reputable Liberia Forex traders Forex trading platform.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)