The five best Forex Brokers in Mauritania – Comparison and reviews

Table of Contents

Finding a reliable forex broker in Maur9itania can be a tiresome task as you have to research through thousands of forex brokers. We have made this task simple for you by researching and giving you a review of five of the best forex brokers you can open in Mauritania.

See the list of the best Forex Brokers in Mauritania:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 76% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 76% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 76% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best forex brokers in Australia:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has been Britain-based trading forex since 2016 and has registered over 5 million trading accounts. It has regulations from the Financial Conduct Authority, Australian Securities and Investment Commission, National Bank of the Republic Of Belarus, and the Cyprus Securities and Exchange Commission.

Capital.com is among the leading financial institutions because it has low trading costs; for example, it has no commission for most forex brokers. It complies with the ESMA regulations, which means it follows strict consumer protection policies.

It has three trading accounts, the standard account with an initial deposit of $20, the Plus offers $2000, and the Premium has $20,000. It also has low trading costs, such as the rollover costs that vary with the trading instruments, and has no inactivity costs.

Overview

- Minimum deposit – $20

- License – FCA, NBRB, ASIC, and CySEC

- Platform – Web trader and the MT4

- Spreads – forex spreads start at 0.8 pips

- Support – 24/5

- Free demo – yes

- Leverage – 1:30

It offers various trading instruments such as indices, stocks, commodities, cryptocurrencies, and shares. Forex traders can also access the trading platform through the desktop and the website version through the mobile application.

It offers educational materials such as video courses, lessons, and tests that forex traders can use to advance their trading knowledge on the demo account. It also has the Investmate app, which traders can download and access easily on their phones from wherever they are.

Disadvantages of Capital.com

It has a high initial deposit for the Premier account and limits most traders who may want to use it. It also offers limited tools for research.

(Risk warning: 76% of retail CFD accounts lose money)

2. BlackBull Markets

This forex broker has offered brokerage services to thousands of traders since its inception in 2014. It offers access to Forex, commodities, energies, CFDs, shares, metals, and indexes. It also has regulations from the Financial Services Authority.

Forex traders in BlackBull Markets can enjoy a brief account registration process and low trading costs. It offers three trading accounts the ECN standard, which has an initial deposit of $200, the ECN Prime with $2000, and the ECN Institutional with $10,000.

Furthermore, it has no inactivity costs, and the deposits and withdrawals are free. Forex traders using this platform can deposit their funds through bank transfers, credit/debit cards, and digital wallets such as Neteller, Skrill, and QIWI.

Overview

- Minimum deposit – $200

- License – FSA

- Platform – MT4, MT5

- Spreads – from 0.1 pips

- Support – 24/5

- Free demo – yes

- Leverage – 1:30

Forex traders using this forex broker enjoy fast execution speeds. It also has copy trading features such as My FX book Autotrade and Zulutrade. It offers a Virtual Private Server for its traders with an account balance of more than $2000.

It has research tools such as analysis from experts, the Auto-chartist, and the latest news from the markets that its traders can use for fundamental analysis.

Disadvantages of BlackBull Markets

It has a limited section for educational materials that new traders can use to learn to trade Forex, and its customer support is only available five days a week.

(Risk Warning: Your capital can be at risk)

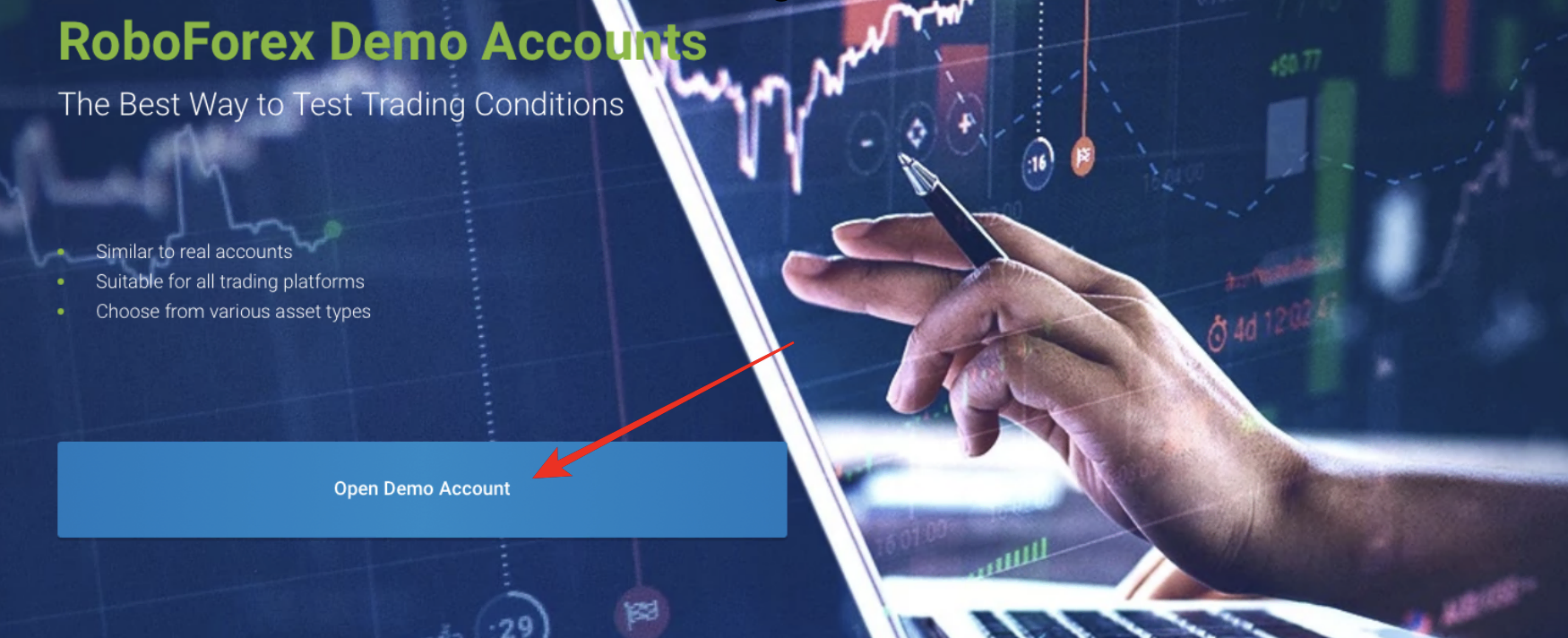

3. RoboForex

Since then this forex broker was established in 2009 and has registered over one million forex traders. It has regulations from the International Financial Service Commission in Belize. It offers trading instruments such as Commodities, Forex, ETFs, metals, CFDs, energies, and stocks.

It is known as one of the fore brokers that offer numerous trading accounts such as the Pro, ECN, Prime, and Pro-cent that all offer an initial deposit of $10. It also has the R-stocks trader, a trading account designed for trading stocks and indices, and has an initial deposit of $100.

The R-stocks trader offers low trading costs and has low commissions for most trading instruments. It has an inactivity cost of $10 if your account has no activity for ten months, but the deposits are free.

Overview

- Minimum deposit – $10

- License – FSC

- Platforms – R-stocks trader, c Trader, MT4, and MT5.

- Forex spreads – 0.0 pips on the ECN account

- Support – 24/7

- Free Demo – yes

- Leverage – 1:2000

It has a swap-free account for Muslim traders and offers industry-leading trading tools. Traders can transfer funds using bank transfers, credit and debit cards, and digital wallets such as Ngan Luong, MultiBanko, Trustly, and Apple Pay.

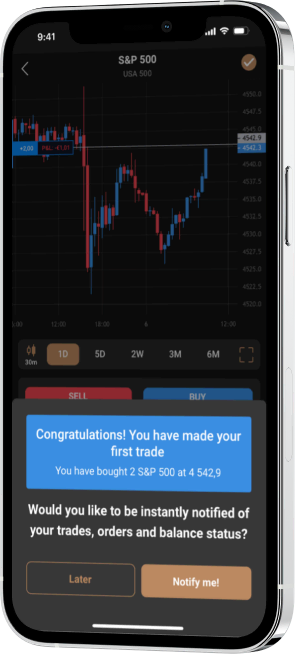

It also has welcome bonuses and high leverage for most forex brokers. It is available through a mobile application, the desktop version is compatible with all operating systems, or you can use the website version.

Disadvantages of RoboForex

It has a withdrawal cost for some payment methods like using bank wires can attract a withdrawal fee.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

It is a forex broker that has been in the financial markets since 2010 when it launched its operations. It has regulations from the Australian Securities and Investment Commission and the Financial Conduct Authority.

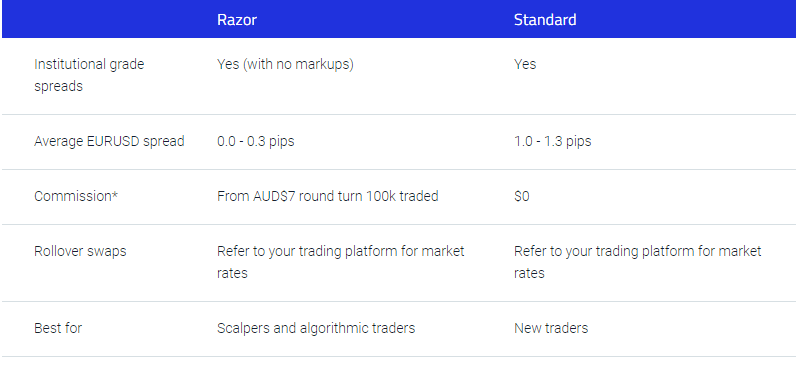

Users can access its trading platform using a mobile application, the website, and the desktop versions. It offers two types of trading accounts, the Standard and the Razor account, with an initial deposit of $200 and low trading costs.

The Standard account has no commissions, but the Razor account has commissions of $7 per round turn for every $100,000. It has various trading instruments such as commodities, ETFs, shares, indices, and Forex.

Overview

- Minimum deposit – $200

- License – FCA, ASIC

- Platform – c Trader, MT4, MT5

- Forex spreads – 0.0 pips on the Razor account

- Support – 24/5

- Free Demo – no

- Leverage – 1:400

It offers analysis for most of the trading instruments from its expert analyzers. It also has trading signals and publishes daily financial news on its platform. Furthermore, it has educational resources such as trading videos, articles, and guides on trading Forex.

Traders can also trade using the automated trading platforms offered on three of its trading platforms. It has Quality trading tools for traders to use as the risk management tools, such as guaranteed stop-loss, limit orders, and take profits.

Disadvantages of Pepperstone

It has a limited demo account that traders can only use for 30 days after registering a trading account. Its customer support is also limited to five days a week.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

It is a trading platform with over 4 million forex traders using the platform since its inception in 2013. The Cyprus Securities and Exchange Commission regulates it. It offers various trading instruments such as binary options (only for professional traders and outside of EAA countries), stocks, commodities, CFDs, Forex, FX Options, and digital options.

Its users can choose between the Standard account, which has an initial deposit of $10, and the VIP account, with $1900. It also has no commissions for most of its trading platforms, but cryptocurrencies attract a commission starting at 2.9%.

Overview

- Minimum deposit – $10

- License – CySEC

- Platform – IQ Option trading platform

- Spreads – from 0.8 pips

- Support – 24/7

- Free demo – yes

- Leverage – 1:500

Its traders in Australia can access its various trading tools available on the trading platform. It has a simple interface for its trading platform that you can customize. It also offers a fast registration process when opening a trading account.

Disadvantages of IQ Option

It has limited payment methods for depositing and withdrawing funds. It does not support the MT4 and MT5 trading platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Mauritania?

The Central Bank of Mauritania regulates the financial markets in Mauritania. The forex markets of Mauritania are active. Although it has low liquidity, it has increased operations in the past five years. Mauritania’s finance ministry establishes laws and policies to increase liquidity in its financial markets.

The Central Bank of Mauritania regulates the banking sector and ensures the efficient running of operations within the banking and non-banking sector. It also has a council that ensures the stability of the national currency of Mauritania, the Ouguiya.

The Central bank of Mauritania has the authority to make sure market participants within Mauritania comply with the exchange regulations imposed on buying and selling of foreign exchange. The exchange regulations are to ensure the forex markets of Mauritania are safe and transparent for investors.

It also has policies against money laundering and continues to amend the financial policies to keep up with new trends in the forex markets. Since the forex market of Mauritania is still developing and the financial system is still not strong enough, the monetary policies regarding forex exchange are not stringent enough.

For regulation, forex traders in Mauritania rely on other regulatory institutions from other jurisdictions. By opening forex accounts on offshore forex brokers regulated in tier one or two jurisdictions such as the FCA, ASIC, NFA, etc.

Security for traders from Mauritania

The central bank of Mauritania has the rules and guidelines that ensure that investor protection is upheld in the financial markets. Forex brokers in Mauritania must have a trading license from the Central Bank of Mauritania to allow inspections and supervision of financial activities.

It also ensures the trading instruments or tradable assets in Mauritania are listed according to their level of risk. It creates awareness for investors to know the risk and apply the appropriate measures when trading, as well as it helps them make insightful investment choices.

The Central bank of Mauritania also ensures that the financial markets are safe by conducting audits on the licensed financial providers. It helps them monitor and supervises the operations to ensure the products and services offered are according to international standards and that these institutions are compliant with investor protection laws.

(Risk warning: 76% of retail CFD accounts lose money)

Is it legal to trade Forex in Mauritania?

It is legal to trade Forex in Mauritania, and some laws help regulate the financial sector and ensure the financial markets are fair and transparent. Financial providers based in Mauritania have to get a trading license from the Central Bank of Mauritania to offer services to investors.

How to trade Forex in Mauritania

Open account for Mauritanian traders

Find a forex broker that accepts Mauritanian traders. To ensure your investments are safe, find a regulated forex broker in Mauritania or other accredited institutions.

Some other factors to research when choosing a trading broker are the speed of execution, the trading assets available, trading costs such as forex spreads, commissions, trading resources available, and customer care.

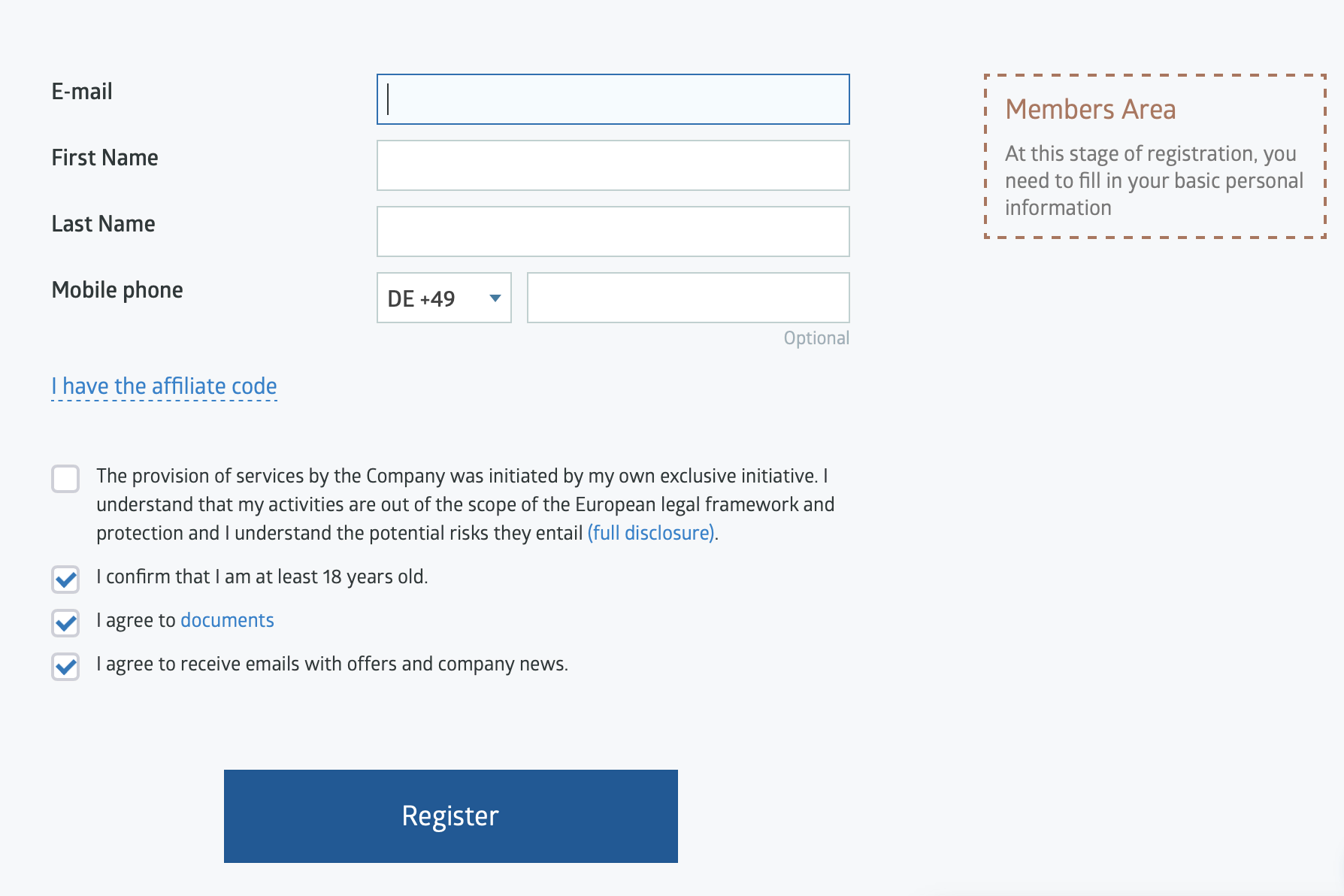

After choosing a forex broker, register a trading account on its website; technology and fast internet connections now allow forex traders to register for a trading account and trade online. Ensure you have fast internet speeds if you want to start trading.

The registration process should be short and simple, and they require some information such as your names and financial details and verifications of this information. It is according to the anti-money laundering regulations.

After successful registration, download the trading platform your trading broker offers and customize some of the settings according to your trading objectives.

Start with a demo or real account

You can start with a demo account, and the demo account uses virtual funds, which enables traders to practice trading without risk. It has trading features like the real account, and new traders use it to familiarise themselves with the trading tools and different trading instruments.

The demo account is especially useful for new traders who can start learning trading strategies and how to trade different financial markets by practicing on the demo account.

A demo account is also a tool for experienced traders to test out the features the forex broker offers. Some forex traders can also start on the real account, y depositing funds on the mini accounts to test its platform.

Deposit money

Deposit funds on the trading platform using the payment methods the forex brokers offer. Forex brokers Accepting Mauritanian traders support payment methods such as bank transfers, wire transfers, debit, and credit cards.

Other common means that are gaining recognition are digital wallets such as PayPal, Skrill, Neteller, and many others still emerging. You must link your trading account with one of these trading methods that you will use to deposit or withdraw.

This process is easy, and you can make your first deposit as long as it is above the required initial deposit to be allowed to trade. If you get any difficulty, call customer support to assist you.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Before entering any financial market, you have to prepare and understand how the market is moving. Traders can do it by applying technical or fundamental analysis. These methods enable traders to find opportunities that can make more profit.

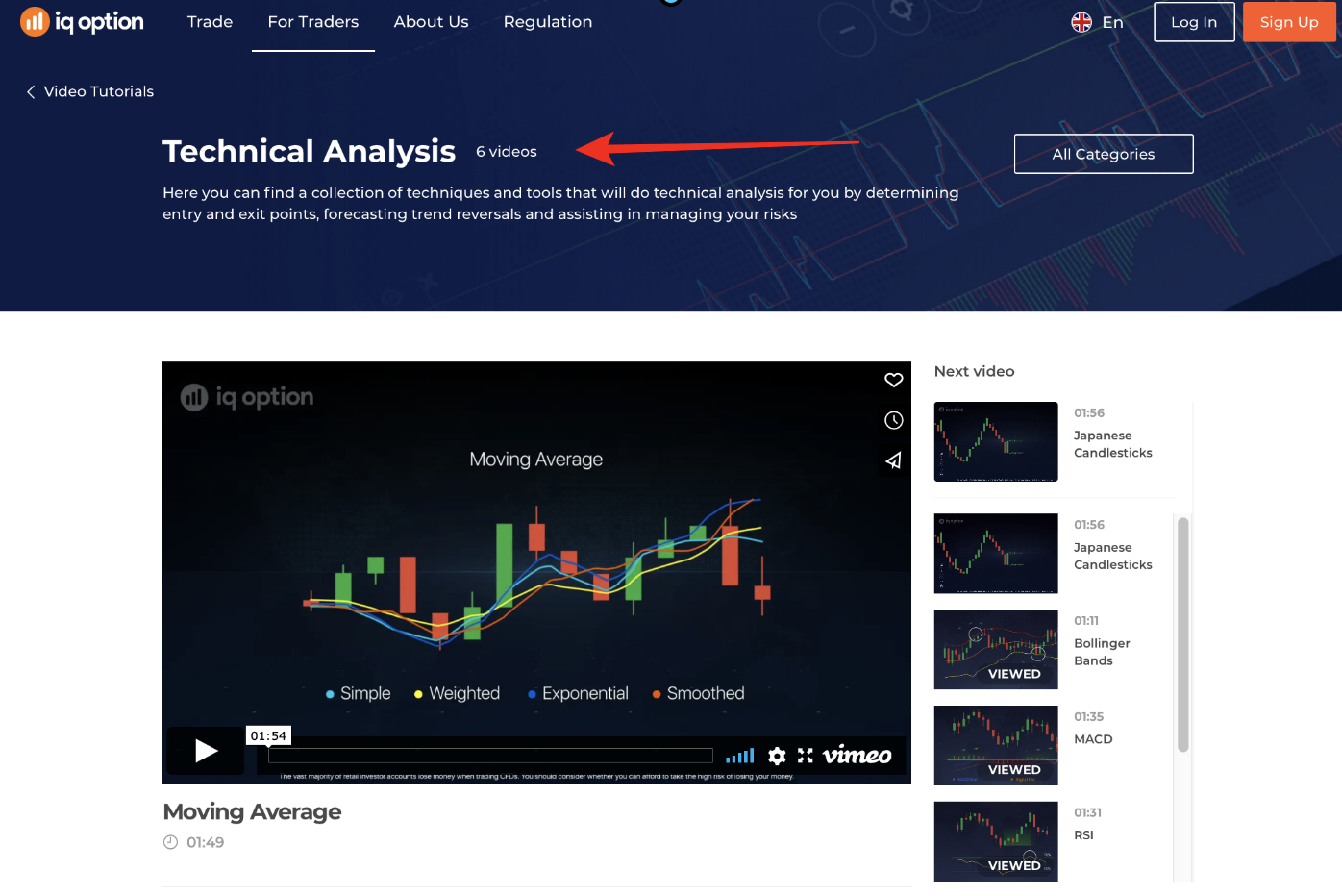

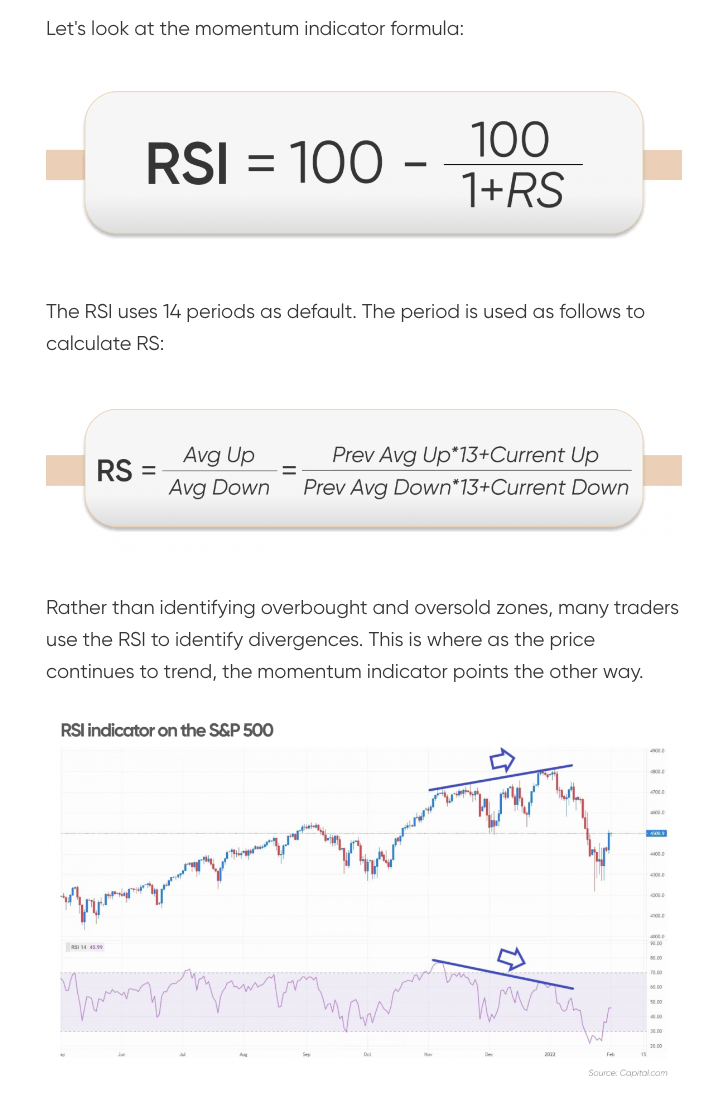

Technical analysis involves using price charts and patterns to understand the price movements in different conditions. Technical analysis requires the trader to apply technical tools such as the indicators, trend lines, and different time frames to understand the overall trend, the momentum of the trend, volatility of the market, and the level of liquidity in the market at a particular time.

Fundamental analysis uses other factors to predict price movements. There are other external influences on the prices of trading instruments, such as the prices of trading goods, the interest rates of central banks, the GDP of a related country, and the economic and political policies. All these and many others influence the prices of commodities, affecting the volatility and liquidity of a market.

Strategies

Traders can use a variety of trading strategies depending on their trading strategies. There are trading strategies for short-term traders that trade part-time or traders that trade full-time. Here are some common trading strategies that you can easily learn and apply in the financial markets.

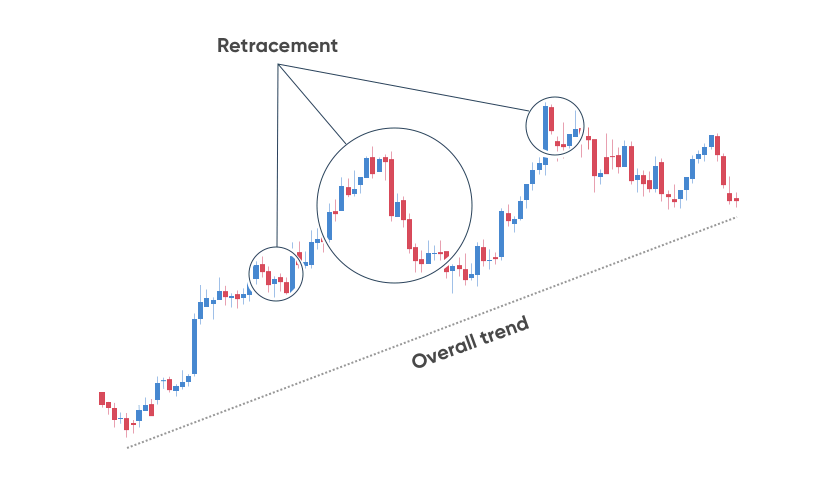

Trend trading – is a trading strategy in which traders use fundamental and technical analysis to predict the trend of the price action of an asset. The trend will determine how you will trade. If it is an uptrend, you can enter the market by going long and short in a downtrend. This trading strategy also needs the trader to constantly monitor the market conditions to allow them to see when they can exit.

Position trading – is a simple trading strategy but requires the trader to evaluate the market and ensure they make accurate predictions of the price action. The forex trader has to assess the different trading instruments and find one likely to increase value within a period. They then invest in the trading instrument and wait until its value increases to sell and profit.

Momentum trading – relies on both fundamental and technical analysis to predict the momentum of price action. If the market has strong momentum, open a trading position and check other factors such as liquidity and volatility. If the momentum begins to decline, it could mean a shift in the trend direction, which means you exit the market.

Make profits

Make profits by ensuring you follow your trading strategy. Avoid making impromptu decisions based on the market movements as there is a high chance of making the wrong decision. Ensure to use the risk management strategies in your trading strategy to limit losses.

Have an exit strategy that you can easily use in any financial market.

(Risk warning: 76% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Mauritania

With a fast internet connection, capital, and a reliable forex broker, Forex trading in Mauritania is possible. Ensure you research a forex broker before opening a trading account, and you can start with the forex brokers we have recommended.

FAQ – The most asked questions about Forex Broker Mauritania :

How do I open a trading account with a forex broker in Mauritania?

Several factors, including the platform’s usability and the minimum deposit amount, can affect the trading account registration process. Let’s take a closer look at these.

Opening an account normally takes between a few minutes and a few weeks. Identity verification differs among brokers. Most brokers offer a fully online account opening process, although others still require clients to transmit a copy of their identification documents. A typical document is a national ID, bank statement, passport, bills like electricity or gas, driver’s license, and so on.

To activate your trading account, some brokers demand a minimal deposit.

How do I transfer funds to a Mauritania forex broker?

After you’ve validated your trading account, the next step is to fund it, which means depositing money you’ll use to buy stocks. Some brokers ask for a minimum deposit when registering an account, but most do not, letting you take your time before investing any money.

For both withdrawals and deposits, bank transfers are accepted. It’s a straightforward, generally free, albeit occasionally slow, strategy. Withdrawing money from your bank account can take up to three days.

Many brokers also accept cash deposits made using credit or debit cards.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)