The 5 best Forex Brokers and platforms in Moldova – Comparison and reviews

Table of Contents

Moldova, a small landlocked country in Eastern Europe, quickly became a spot for forex trading. It can be quite tasking when looking for a reputable forex broker to trade. Especially when you want one that will allow trade with Moldova’s official currency Leu (MDL). Below are the details of the top five brokers in Moldova.

See the list of the best Forex Brokers in Moldova:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best forex brokers and platforms in Moldova includes:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a regulated broker, authorized and supervised by the Financial Conduct Authority (FCA) in the United Kingdom. Capital.com is a trading name of Capital.com Markets Ltd. Capital.com Markets Ltd is authorized and supervised in the UK by the FCA with reference number 727306.

Capital.com is a broker that offers contracts for difference (CFDs), which are derivative products that allow traders to speculate on the price movement of an asset. CFDs are not only popular among traders but also institutional investors, who use them to hedge their portfolios against risks or trade in different markets. Capital.com is one of the newer brokers in the industry, founded in 2017, and it has quickly become one of the most popular brokers thanks to its innovative trading platform and competitive spreads.

Capital.com is a broker that offers to trade in stocks, indices, commodities, and currencies. They offer a variety of account types, including a demo account, to help you get started. Their platform is designed to be easy to use, and they offer customer support 24/7.

Pros of Capital.com

- Capital.com offers its traders real-time quotes and market analysis.

- Traders get access to quality educational materials.

- The customer service department is available to attend to traders 24/7

- Capital.com provides a demo account for its traders. The demo account is free, and it does not expire.

Cons of Capital.com

- Capital.com provides its traders with a reasonable number of trading symbols, but it is small compared to other trading platforms.

- Capital.com does not offer its services to United States traders.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a global CFD and Forex broker. Specializing in online trading for private and institutional investors, BlackBull Markets has been providing quality services since its establishment in 2006. The company is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and is a member of the London Stock Exchange.

BlackBull Markets offers an intuitive and sophisticated trading platform with competitive spreads on more than 2,000 assets. BlackBull Markets caters to all levels of traders, from novice to experienced professionals.

Blackbull Markets is a regulated and award-winning Forex, indices, and commodities broker. Blackbull Markets offers access to advanced trading technologies, tight spreads, and superior liquidity from 0.1 pips on Forex, Indices, and Commodities products with no commission charged. Blackbull Markets offers a wide range of tradable assets, including Forex, Indices, Commodities, Stocks, ETFs, and Cryptocurrencies through its MT4 and MT5 platforms.

In addition to the standard trading services, BlackBull Markets also provides several unique features, including social trading, copy trading, and auto-trading.

Merits of BlackBull Markets

- BlackBull Markets does not charge its trader commission fee.

- No deposit fees are required on the BlackBull Markets trading platform.

- BlackBull Markets provides its traders API trading and free virtual private servers (VPS)

Demerits of BlackBull Markets

- BlackBull Markets charge its traders’ withdrawal fee.

- A minimum deposit of $10 is expected from every trader on that BlackBull Markets trading platform.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is an international broker providing online trading services on the Forex and CFD markets. RoboForex offers two types of accounts: a Classic account, which requires a minimum deposit of $10, and a VIP account, which has no minimum deposit requirement and offers several additional features. In addition, RoboForex offers the popular MetaTrader 4 platform, which allows traders to use Expert Advisors (EAs) for automated trading and customize their trading experience.

The company is regulated by the International Financial Services Commission (IFSC). RoboForex is also a member of the Financial Commission, an international organization that protects traders in the event of disputes with brokers.

Advantages of RoboForex

- The RoboForex withdrawal process is swift; it takes about a minute for some payment methods.

- The withdrawal system on the RoboForex trading platform works 24/7; the process is reliable and fast.

- Favorable trading conditions are available on this trading platform.

- RoboForex provides its traders with unique investment programs such as CopyFx.

Disadvantages of RoboForex

- On RoboForex, you must deposit a minimum of $10 before you can start trading.

- Cryptocurrency tools are not available to traders on the RoboForex trading platform.

- On the RoboForex trading platform, a small number of currency pairs are available to traders.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a forex and CFD broker that offers clients access to the world’s largest financial market. The company has been in operation for over ten years. It is one of the most respected and well-known brokers in the industry.

Pepperstone offers a wide range of products and services to its clients, including Forex, CFDs, indices, commodities, and metals. The company also provides a wide range of platforms and tools to its clients, making it easy to trade the markets they want to sell.

Pepperstone offers a wide range of features, including competitive spreads, low commissions, and fast execution speeds. The company also provides various educational resources, including video tutorials, webinars, and e-books.

Merits of Pepperstone

- Pepperstone is a safe forex trading platform because it is a registered trading platform.

- Pepperstone offers traders dual platforms which are the MT4 and MT5.

- Multiple add-on platforms are also provided to traders to improve the MetaTrader experience.

- Competitive prices are offered to active traders.

- Pepperstone provides its traders with various social trading platforms.

Demerits of Pepperstone

- The educational material available to traders on the Pepperstone trading platform is below average compared to the industry’s standard.

- Pepperstone doesn’t provide assessment sections for traders to track how well they understand the trading platform.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option broker is a licensed and regulated binary options (only for professional brokers and outside EAA countries) broker owned and operated by IQ Option Europe Ltd. They are one of the most popular brokers globally, with over 14 million account holders.

IQ Option offers a wide range of tradable assets, including stocks, Forex, commodities, and indices. They also provide a variety of account types, including a demo account, to suit the needs of traders of all levels of experience. It also offers a variety of investment products, such as binary options (only for professional brokers and outside EAA countries) and CFDs. The minimum deposit amount is just $10, and the minimum trade size is $1.

IQ Option broker is one of the most popular online trading platforms. It was founded in 2013 and has been providing quality services ever since. IQ Option broker is a regulated company, which means that it meets all the required standards and is safe to use. IQ Option broker has a user-friendly interface that makes trading easy.

Benefits of IQ Option

- IQ Option is regulated by CySEC, which makes it safe for traders to trade on the platform.

- The account opening process is easy and convenient.

- As a trader on the IQ Option trading platform, you are not charged a deposit and withdrawal fee.

- Various trading tools are available on IQ Option.

Drawbacks of IQ Option

- MT5 and MT4 platforms are not available on the IQ Option trading platform.

- IQ Option doesn’t accept traders in the United States, Australia, Canada, Japan, and other countries.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Moldova?

Moldova is a country located in Eastern Europe. It shares its Ukraine to the north. Romania to the west and southwest, and the Republic of Georgia and Azerbaijan to the southeast. As of 1 January 2007, Moldova became a member state of the World Trade Organization (WTO). The government has made the country attractive to forex brokers and traders by creating a favorable regulatory environment.

Moldova, a landlocked country in Eastern Europe, is still reforming its financial system after the global recession of 2008. The government has made strides in repairing and developing the nation’s banking sector. However, there is still much work to be done regarding regulatory compliance and consumer protection.

The banking industry in Moldova is made up of two levels; the National Bank of Moldova and commercial banks. The National Bank of Moldova is the regulatory and authority body for banks in Moldova. The primary duty of NBM is to regulate financial institutions.

According to the banking legislation, the NBM created scrutiny and regulatory mechanism for activities in Banks by setting up some specific requirements that banks in Moldova must abide by.

To ensure that the banking practices are up to international standards, the National Bank of Moldova actively promotes the regulation and supervision of banks. The NBM regularly updates the requirements to reflect changes in the law and best practices, as recommended by organizations like the Basel Committee on Banking Supervision and European Union Directives.

The National Bank of Moldova actively promotes banking regulation and supervision in line with accepted standards by:

- Establishing criteria for the authorization of banks, capital requirements, and necessities for the owners and administrators of banks.

- The supervision of compliance with prudential requirements is essential to ensuring that banks are appropriately limited in their exposure to risk.

- Banks are required to establish high-quality internal control systems to ensure proper functioning and prevent money laundering. Procedures should be in place to ensure compliance with these requirements.

- Banks with increased vulnerability will be subject to corrective measures, sanctions, or special surveillance.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Moldova?

Moldova is a small country in Eastern Europe. The foreign exchange market in Moldova is regulated by the National Bank of Moldova (NBM), which oversees Forex Brokers and Trading Platforms that offer services to customers in Moldova. The NBM has issued several regulatory guidelines for FX Brokers and Trading Platforms.

Forex trading is legal in Moldova. It is regulated by the National Bank of Moldova. The country’s forex market is small but growing, and there are several brokers and exchanges operating in the country. To trade Forex in Moldova, you must be over 18 years of age and have a valid passport or ID card, and you must be licensed to trade Forex in Moldova.

However, it is essential to be aware of the potential risks involved in forex trading before starting to trade. It is also essential to find a reputable and reliable forex broker to work with.

How to trade Forex in Moldova – Tutorial

To trade forex in Moldova, first, you have to do adequate research about the broker you want to trade with. Make sure the broker is regulated. Also, make sure it is well recognized outside Moldova.

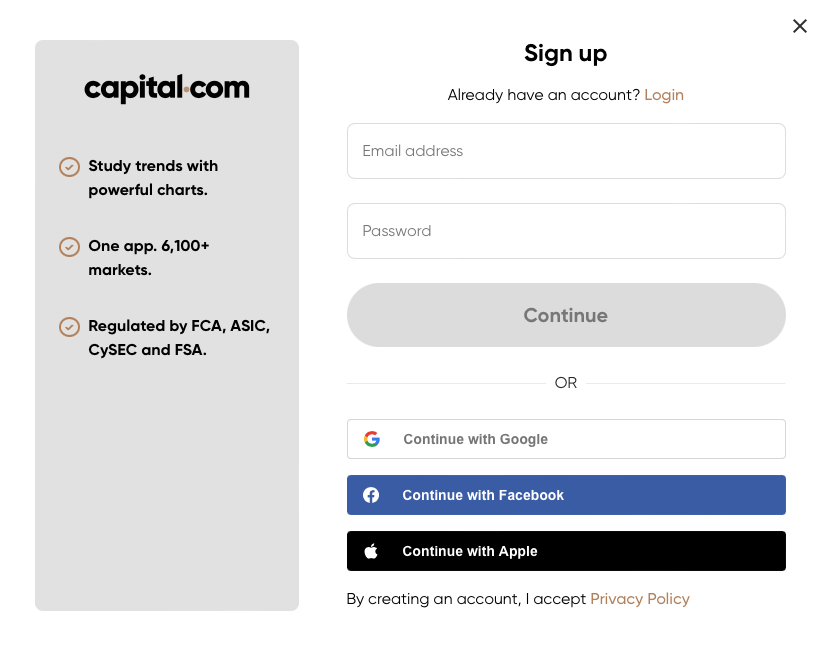

Open account for Forex traders

Opening an account with a forex dealer is relatively easy and can be done in simple steps. The main challenge for prospective traders is to find the right broker that meets their needs and offers a trading platform and features that fit their trading style. Most dealers require a minimum deposit.

Some trading platforms also offer demo accounts that allow you to trade using virtual money to get a feel of the trading platform and the markets without risking any real money.

The broker will request two primary documents from you while opening an account. These documents include a valid identification card and proof of residency (which can be your bank statement or your utility bill)

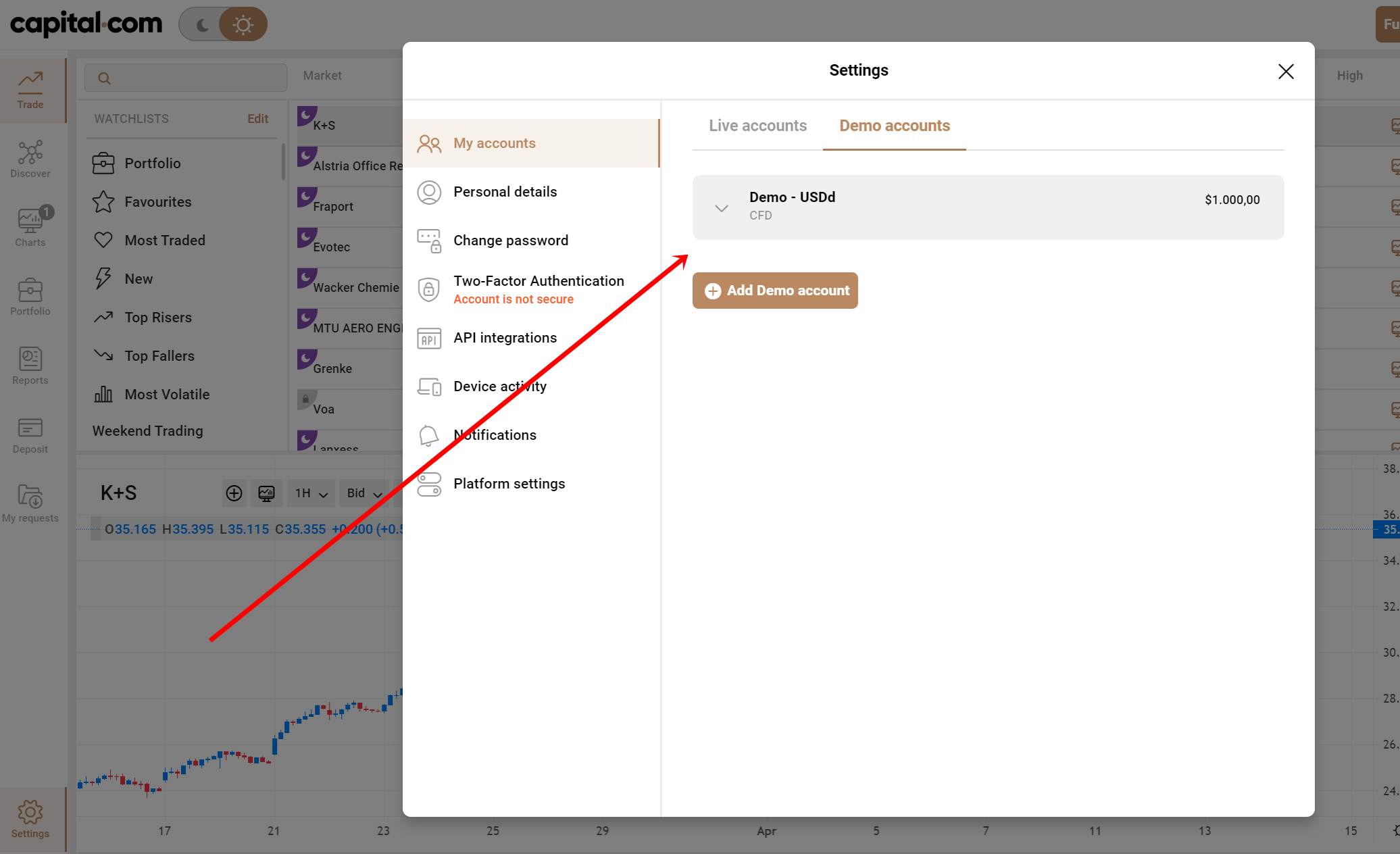

Start with a demo account or real account

When starting forex trading, it is crucial to do so with a demo account. A demo account allows for simulated trading with virtual money. Using a demo account is vital because it will enable a trader to get comfortable with the platform and understand how the forex trading platform works before risking any actual money. It also allows beginners to learn without losing any real money.

A real account is a live account where you can trade with the market and see your results in real-time. A real account allows you to trade stocks, Forex, and commodities with actual money. It is important to remember that real accounts involve risks.

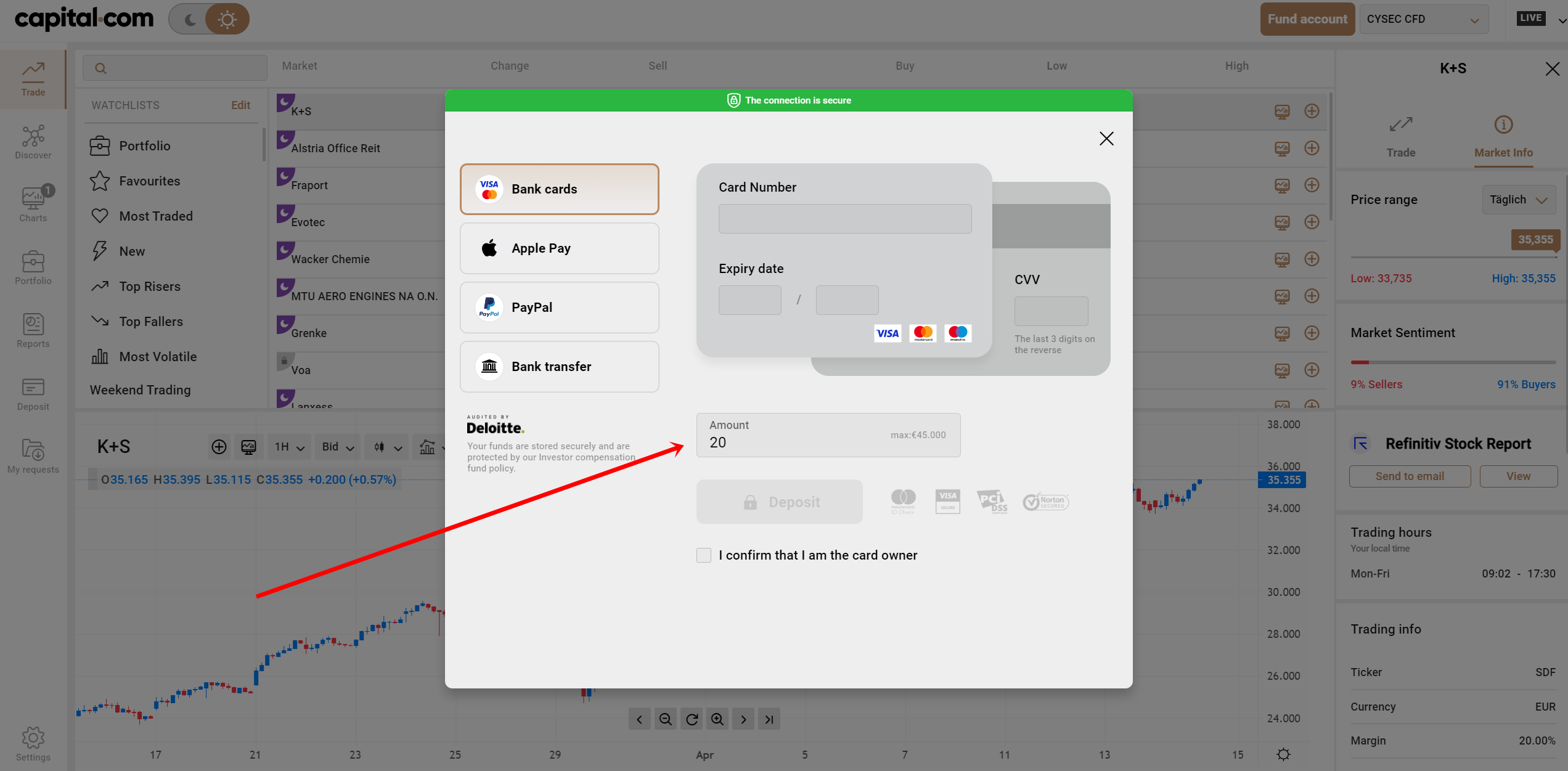

Deposit money

When you open a forex account, you will need to deposit money to begin trading. The amount that you deposit will determine the size of your margin and the leverage that is available to you. In most cases, you will be able to choose from several different payment methods.

One option is to wire the money directly from your bank account. This method is the most common way to deposit money into a forex account. You will need to provide your broker with your bank account information, including the routing number and the account number.

Another option is to use a credit card. Using a card is a quick and easy way to get started trading Forex. You can also use any significant payment platforms such as Skrill and PayPal.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Forex trading, or foreign exchange, can be described as a global market created for traders to sell and buy currency pairs. Forex traders use technical and fundamental analysis to decide what currencies to trade and when to trade them to make profits. Some of the strategies used are explained below.

Position trading

In forex trading, position trading is a type of trading strategy where the trader holds a position for an extended period (for months, at times a year or more) with the expectation that the price will move in a particular direction. The trader buys the currency and holds it until the desired price is reached, then sells it.

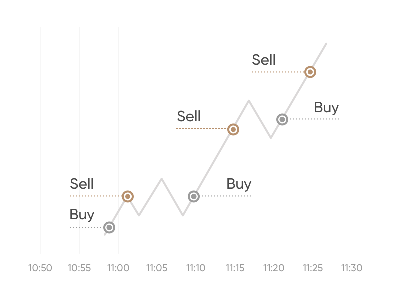

Scalping

Scalping is a trading technique that attempts to make many small profits off large numbers of trades by taking advantage of price differences between markets. It usually involves buying Forex and then selling it shortly after a higher price. Scalping generally relies on quick decisions and a high degree of market knowledge.

Day trading

Day trading is buying and selling stocks, cryptocurrencies, or other securities within the same day. It usually involves a great deal of risk and is not recommended for everyone.

The goal of day trading is to make a profit by buying low and selling high. This can be done by analyzing market trends and making predictions about where the prices of certain assets will go. It’s important to remember that even if a trade goes well, it’s still possible to lose money if the market moves unfavorably.

Make profit

Forex trading is a great way to make money, but it’s essential to understand the risks. To make a profit trading forex, you need to be aware of the following:

- The different types of orders and how they can be used to your advantage

- What indicators help predict price movements

- How to use risk management tools to protect your profits.

These will help you make informed decisions that will make a profit.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Moldova

This article lists the five best forex brokers and platforms in Moldova. If you are looking to invest in the Moldovan currency or are interested in forex trading, this is a great resource. Be sure to research any broker or platform you are considering before investing.

FAQ – The most asked questions about Forex Broker Moldova:

What are the essential characteristics to consider in a forex broker in Moldova?

A trader looking for the best forex broker in Moldova, consider the following characteristics:

1. Their country’s regulation agency should regulate them to protect the investors’ interests.

2. The platform should offer a demo account for trading.

3. See the range of assets and currency pairs they offer

4. Seamless and stressful online trading with an intuitive interface and mobile app for on-the-go trading

5. Hassle-free deposit and withdrawal mechanism

6. Effective customer service and query satisfaction

What is the tax situation on trading with a forex broker in Moldova?

Forex trading with a forex broker in Moldova attracts taxes on gains. Once a particular income level is reached, the trader needs to consult the tax professionals and ensure they abide by the country’s taxation rules. Even trading losses must be filed with the proper government agency in Moldova.

What benefits accrue for forex trading with a forex broker in Moldova?

A forex broker in Moldova takes care of the transactions on the traders’ behalf and becomes the middleman for seamless transactions between the parties. Many of these brokers offer risk-free demo accounts and low costs of maintenance and transactions on the account.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)