The best 5 Forex Brokers and platforms in Mongolia – Comparison and reviews

Table of Contents

Mongolia’s FX market is growing at a rapid pace. Mongolia is an East Asian landlocked country that has about 3,17 million population when speaking of budding forex traders. Agriculture as well as the exploitation of significant mineral riches of tungsten, copper, tin, molybdenum, coal, and gold underpin Mongolia’s economy.

See the list of the best Forex Brokers in Mongolia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We’ve collected a list of the finest Mongolia brokers below to assist you in finding a reliable, respectable, and competent broker who can meet your online trading needs.

The list includes the following brokers and platforms:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

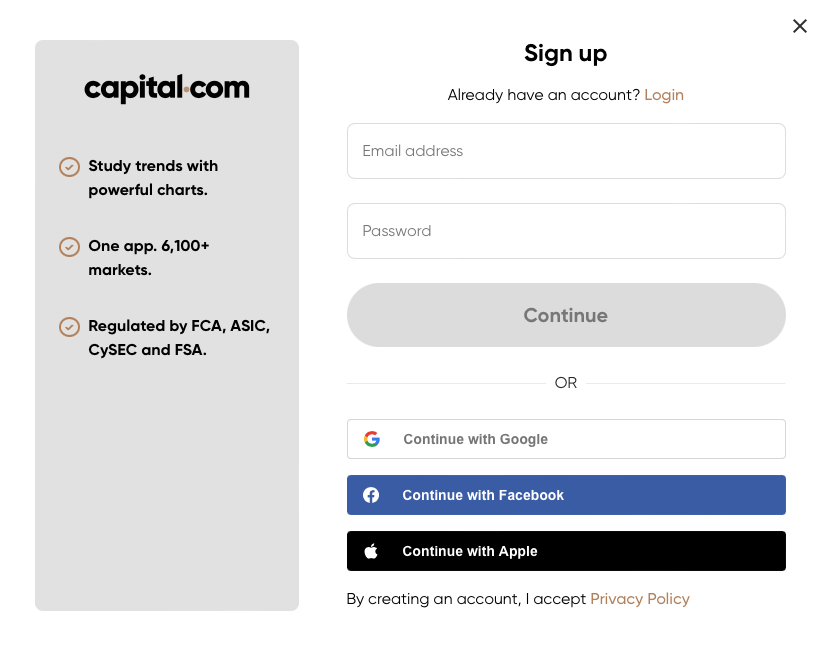

1. Capital.com

This brokerage firm has had approximately 500,000 registered users since its introduction in 2016. Capital.com is supervised by the FCA of the UK, the ASIC, and the NBRB.

For beginners, Capital.com gives a complete training program that includes academic help. This course consists of 28 classes separated from five sessions, then a test to evaluate your progress.

The company is a prominent broker, thanks to its technological interface. Traders can fully use the trading platform to trade because it delivers critical analysis.

Traders can make well-informed judgments on the platform by choosing from many assets. Crypto, commodities, and FX are some tradable assets. Capital.com customers are legally protected; this makes it a popular and well-regulated trading platform.

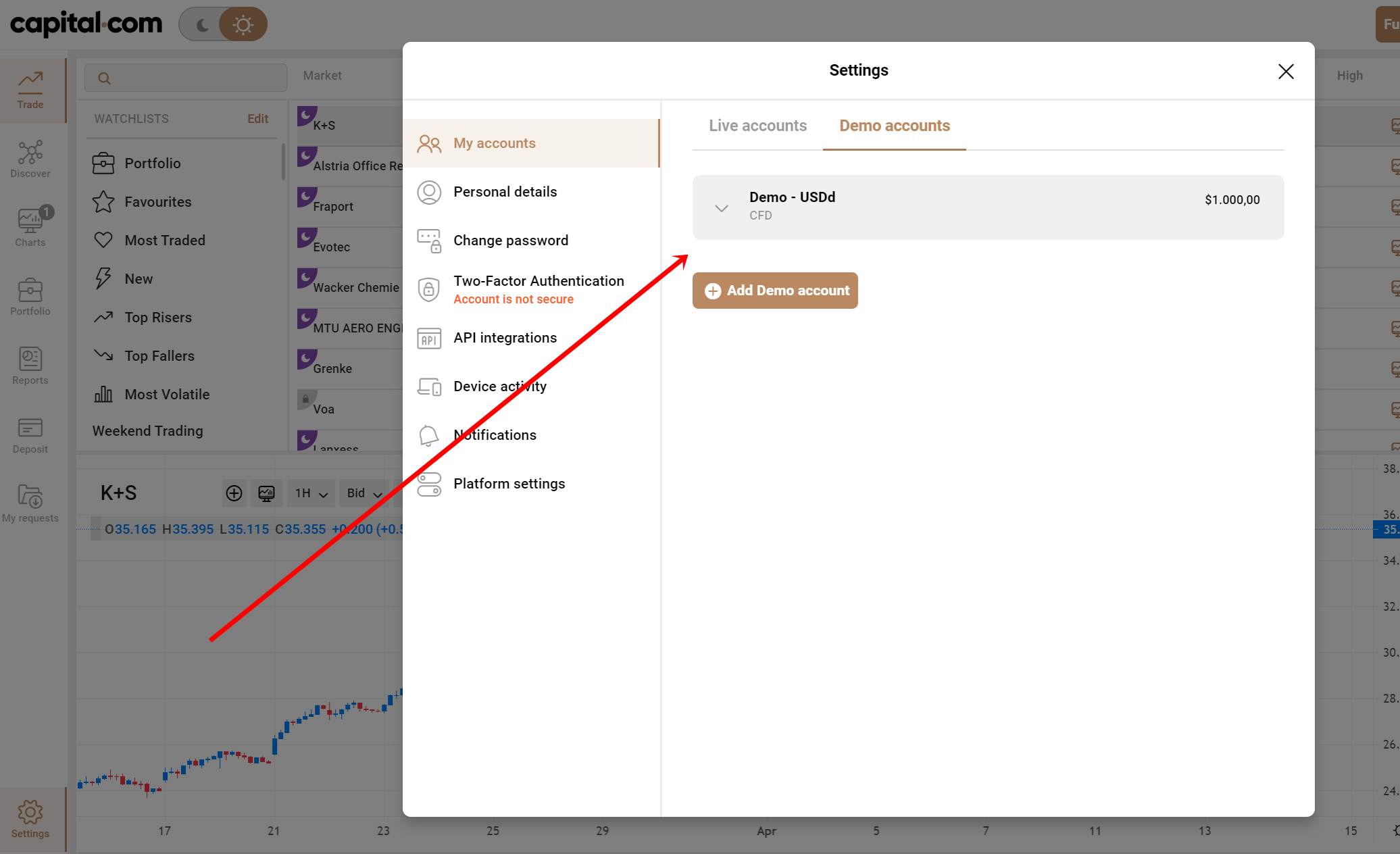

The process of creating an account is relatively easy. The $20 minimum deposit into your trading account is pretty low, compared to other platforms. The company also offers good customer service that answers quickly.

Pros of Capital.com

- Market-leading spreads

- The training materials and trade rules are all of high quality.

- There is a Demo account that will never expire.

Cons of Capital.com

- A low number of trading symbols

- Customers from the USA can’t trade on it.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

The FMA regulates BlackBull Markets’ trading platform. For traders who prefer to deal with small sums of money, BlackBull Markets should be considered. If you wish to trade indices or significant currency pairs, you must choose a broker.

In 2014, a small group of individuals, majorly Financial technology guys and former forex traders, started BlackBull Markets.

They are a well-known ECN broker who uses the NDD and STP methods. Global partners provide excellent liquidity sources for more liquidity and broader market breadth.

When you first start trading with BlackBull Markets, you will find out the broker platform has a fair pricing format and quick transaction execution. There are also free VPS and API.

The MetaTrader 4 platform in the BlackBull Markets platform connects to a server on Wall Street. Transactions can be completed in a matter of milliseconds. A trader can trade in marketplaces with various liquidity providers offering competitive buy and sell prices, minor slippage, and narrow spreads using multiple servers.

Advantages of BlackBull Markets

- BlackBull Markets accepts zero deposit fees.

- Traders get access to 3rd-party trading and free VPS and the whole MetaTrader suite.

- Offers a demo account

- The platform is on both phone and web

Disadvantages of BlackBull Markets

- Customer assistance isn’t always available.

- Traders are required to pay a withdrawal fee.

(Risk Warning: Your capital can be at risk)

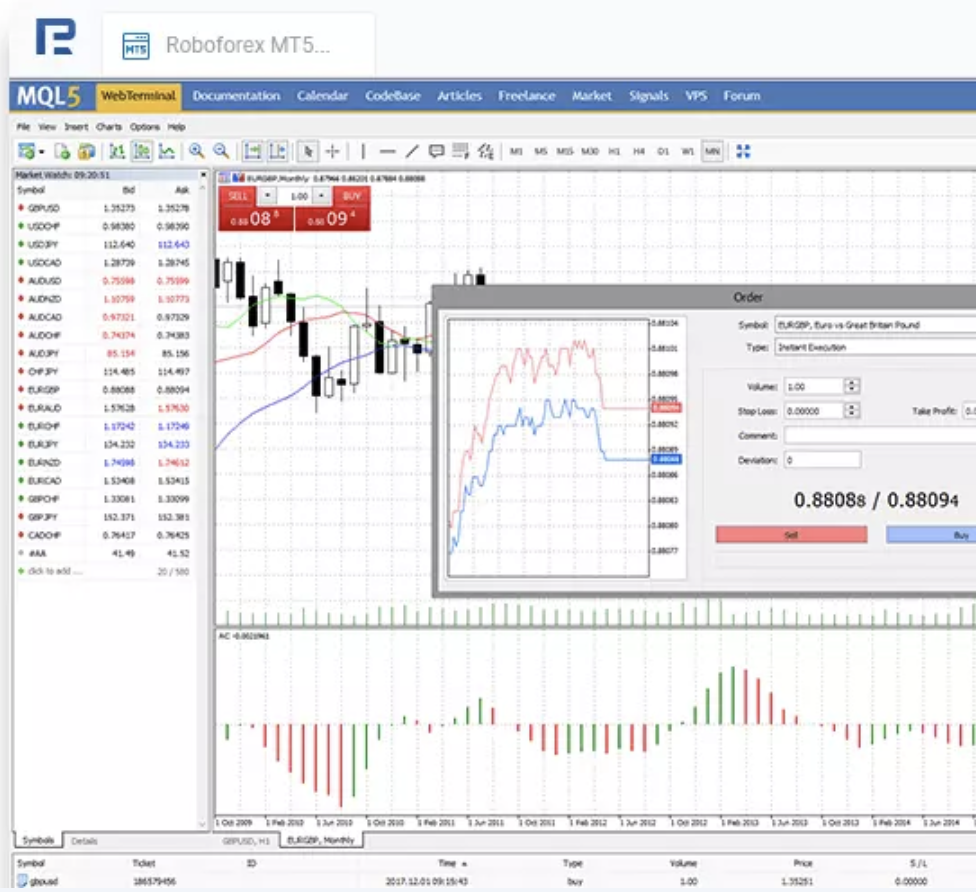

3. RoboForex

RoboForex is used by more than 800,000 clients from countries around the world. The language is not a problem because the brokerage has minimized this problem. The customer support offers 18 languages. This brokerage has gone to great lengths to remove barriers between clients.

RoboForex and Robomarkets ltd formed the RoboForex Group, founded in 2009. They offer services worldwide, while the latter serves just clients in the European Union and EEA.

RoboForex gives a wide range of options and the ability to improve your skills and participate in trading competitions, all of which will enhance your understanding of trading forex.

Trading platforms offered by RoboForex include MetaTrader 4, MetaTrader 5, and cTrader. Most traders use MetaTrader 4 since it is widespread and can perform various functions. MT5 is not as recognized as MetaTrader 4, even though it’s better. The MT platforms provide superior trading capabilities. cTrader remains the most used of the three platforms.

Different locations have different minimum deposits. RoboForex, on the flip side, offers extensive options to help users learn how they can trade Forex on the platform.

RoboForex is free of risks for all investors. This makes clients on the platform trust the firm. The number of traders has continued to grow in recent years.

Members can easily access market resources, technical findings, professional trading research, and various tools in the users’ profiles.

Advantages of RoboForex

- Its trading platform includes a wide variety of software that can be used for all types of traders.

- Traders profit from inexpensive trading fees and fair trading conditions

- Traders can make the least deposit of $10

- The platform offers educative forex materials

Cons of RoboForex

- You must read various regulatory documents before trading on RoboForex.

- Its customer service department’s response time is not fast.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was established in 2010. The company offers a variety of trading assets to clients from cryptocurrencies, commodities, and stocks.

Pepperstone traders can access the market quickly. They are allowing clients to focus on earning profit. Pepperstone is suitable for traders looking for low-cost choices and selecting account types. Customer support is quick to respond.

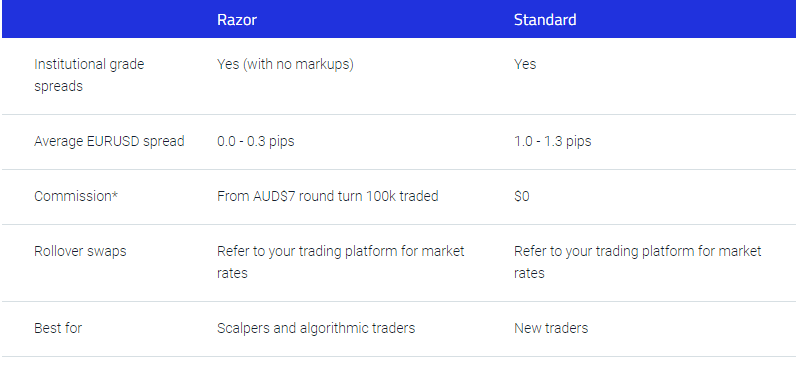

Traders can start with any of the two account types available for trade. The Standard account shows that the spread starts at one pip and no commission. The Razor account’s minimum spread starts from zero pip makes it very tight. The razor account traders have commissioned.

Benefits of Pepperstone

- There are many social-copy platforms on Pepperstone.

- Pepperstone offers plugins on MetaTrader.

- The platform offers a competitive spread for razor account owners

- Razor account owners get trading commissions

Pepperstone’s drawbacks

- There are no courses that help traders with forex knowledge.

- It is not a commission-free platform.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is not so old, and it started operating as a company in Cyprus in 2013. When it opened, the company only provided binary options (only for professional traders and outside EAA countries) for traders on its platform. But after an improvement in 2016, IQ Option went from just binary options to CFDs, stocks, and crypto.

The platform is available on both desktop and mobile to help investors evaluate markets and benefit from them. The interface is unquestionably simple and can even be customized by the user to suit his liking. The whole experience is unique on the platform.

The broker is award-winning, and it continues to perform good services to the traders on the platform.

IQ Option provides educational materials that traders can use for their improvement. This is done through articles and some videos. Aside from the educational materials, the platform has a forum that allows interaction among traders worldwide. Webinars are sometimes organized by IQ Option.

IQ Option is famous as a trading platform. It features a simple interface and can cater to even the pickiest traders’ needs.

Merits of IQ Option

- The customer support has ten languages that they speak in

- Webinars are available for traders to learn a thing or two about Forex from

- Registration is digital.

Drawbacks of IQ Option

- Bank-to-bank transactions take longer to complete.

- Withdrawal attracts a fee.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Mongolia?

Mongolia’s forex market is under the regulation of the Financial Regulatory Commission (FRC) and the Bank of Mongolia (Mongol Bank), the country’s central bank. Mongolia’s government created its one-stop support center in February 2019 to encourage foreign investment.

The center covers Mongolia’s legislative framework, social insurance, other foreign investment requirements, taxes, visas, and corporate incentives.

Mongolia has yet to attract a significant international investment bank, but it has several regional Asian banks. Since 2019, the Mongolian forex market has experienced an increase in interest and activity, with numerous forex brokers establishing offices in Ulaanbaatar, albeit most Mongolian traders will choose to use a well-regulated foreign broker instead.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Mongolia

Mongolia’s financial trading digitization has made it simpler to mislead naive investors online. For professional traders, it can be challenging to trade the financial markets with Mongolia Brokers. Ensure your broker is regulated and meets the most OK forex broker and platform criteria. Open a demo account if necessary before opening a real trading account to educate yourself as much as possible.

When trading, learn about leverage. Mongolian brokers who offer high leverage trading might have large profit margins. However, this can result in significant losses. Negative balance protection and stop-loss accounts are two types of protection offered by some Mongolian brokers. You may discover more about this tutorial lower down.

Aside from the teaching resources and other online materials, traders should look for Mongolia Brokers that offer a legit platform.

Choose Mongolia Brokers, which is on the front edge of innovation and is regarded as an industry leader. Mongolia Brokers that you can trust are required to gain access to the financial markets.

Before signing up with a new broker, any Mongolian trader should check to see if the broker is regulated. A regulated broker adheres to the forex authorities’ tight guidelines to avoid scams or illegal trading activities.

Is it legal to trade Forex in Mongolia?

Yes, it is. Forex Trading is legal in Mongolia because money exchange is required to conduct business. Mongolian traders can choose from Several forex brokers and platforms that welcome investors from Mongolia and are also regulated.

There is a common misperception that trading Forex on the Mongolian financial market is risky. This is not the reality; Mongolian forex traders are pretty active.

Mongolia allows forex trading since currency exchange is required to conduct business. Importation and exportation, with foreign investment, all require Forex. The most important thing to remember while trading Forex is to choose a licensed, safe, and reputed broker. Mongolia Forex trading is not prohibited, and numerous foreign online brokers give favorable trading terms.

Mongolians are becoming more interested in forex trading. Over the last five years, the number of Forex traded in Mongolia has surged a year. Forex trading has become more accessible and less expensive due to technological advancements in online technology, increasing internet penetration in Mongolia, and more competition among brokerages.

Every day, about USD 5.1 trillion is traded worldwide through forex brokers and platforms. In comparison to other financial market sectors, this is a significant sum.

Mongolia’s economy and population are expanding. Mongolia’s middle-class population is growing, suggesting a more extensive consumer base. Mongolia’s youth are well-versed in the internet and technology.

How to trade Forex in Mongolia – Guideline

Open an account for a Mongolian trader

There are several forex brokers that one can pick from to start trading Forex. Once you have selected the company’s platform, you will need to register with them. Registration is easy, and online to open your account quickly as a trader.

The broker will require you to submit certain documents to carry out certain verifications on your account. These documents are for identification and residency. The document for residence can be your utility bill, while that of identification can be your nation id card.

Start with a demo account or a real account

The demo account is to help you as a new trader have a feel of what it’s like trading forex on the platform. Demo accounts prove to be quite helpful because they can be used to practice strategies that you as a trader might have in mind.

On the brokers’ website, you can open a new account. Several FX brokers need the least amount of deposit to start an account. Such brokers provide some other account types.

In general, for the safety of your money, it is best to start out with a demo account and move on to a live account when your trading skills have gotten better.

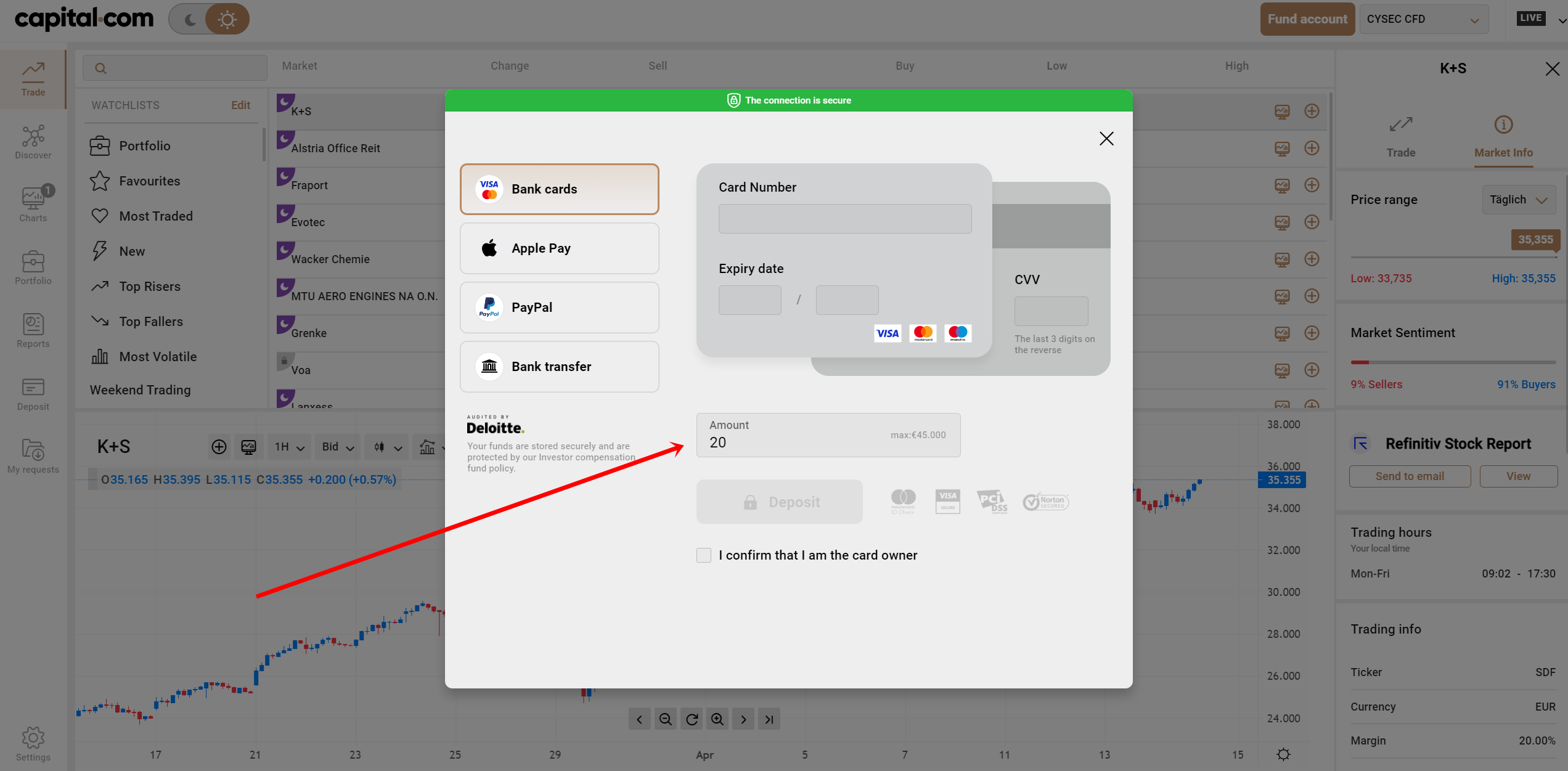

Deposit money

Depositing money into your trader account is the next thing you need to do. You can choose to fund your trading account with any payment method available on the broker. This payment method can be through direct bank transfer, credit card, or debit cart.

There is a minimum amount you can fund your trading account with on the different trading platforms. So if you try to deposit anything lower than the minimum deposit, it will not go through.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

Every trader should have a strategy for trading. Trading without proper market analysis is a recipe for huge losses. Every trader needs to understudy the market behavior before going in for a sell or a buy.

Forex traders employ different analyses and strategies to know whether to purchase or sell forex pairs. The following are the strategies:

Scalping

Scalping is a forex trading technique that concentrates on small price changes. By opening many trades, you can make a minute profit from them.

Since scalpers aim to have profited by amassing many little earnings, they do not hold trading positions for even up to a whole day, much less a week or year.

As a result of the liquidity of the FX market, scalping is mainly used. Investors prefer markets with continually changing price fluctuations because they can make them again from slight variations.

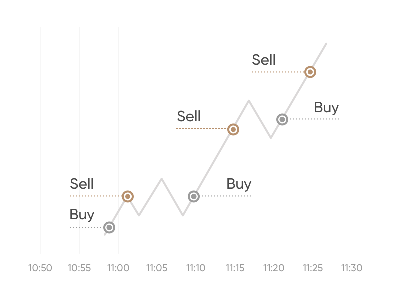

Day trading

This strategy involves exchanging currencies just in a day. Day trading is used in the forex market and used in other needs. But it is most popularly known to be a forex trading technique.

Traders are advised not to open any trade at night or before the forex market opens for the day. In opposition to scalping, which has to deal with staying in a position for a short while, day trading involves monitoring and managing open positions for a whole day.

Position trading

Traders who maintain positions for a lengthy period, from weeks to years, adopt this trading technique. As a protracted trading style, this method encourages traders to have an extensive view of how the market works.

Position trading is when traders maintain their positions for a lengthy period.

As a long-term trading strategy, this method requires traders to have a comprehensive view of the forex market and withstand small forex market swings that contradict their position.

Make profit

When trading, have it in mind as a trader to trade carefully. Usually, traders have a particular strategy to approach the market that makes enough profit while trading.

If the trading conditions or the market competition seems too harsh for you, it is better not to trade for that day. Forex trading requires a thoughtful and careful trader.

It is important to note that it is unsafe to trade when feeling too emotional. Maybe too happy or sad. It is safer to take trades with a clearer head and a ready mindset.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Mongolia

Mongolian people can register and trade with thousands of Forex brokers worldwide. Although many Forex brokers appear to be similar, subtle variations make each broker suited for a specific type of trader.

We’ve compiled a list of the best brokers and trading platforms where you may trade Indices, Forex, Stocks, ETFs, Binary Options (only for professional traders and outside EAA countries), CDFs, and cryptocurrencies like Ethereum and Bitcoin as a Mongolian trader.

These brokers also offer payment methods that allow you to deposit and withdraw your profits quickly as a Mongolian trader. They have the lowest fees and support the trading platforms cTrader, MT4, and MT5.

FAQ – The most asked questions about Forex Broker Mongolia:

How to begin operating in forest trading with a forex broker in Mongolia?

To begin trading with a forex broker in Mongolia, ensure to follow the steps mentioned below:

1. Start by connecting to the web. Ensure to have a reliable internet connection with no interruptions.

2. According to the regulations, get a registered forex broker.

3. Open a trading account with a reliable online broker.

4. Put money in your account to start transacting.

5. Select a trading platform to access the forex market

6. Now, begin with your first trade.

What are forex trading strategies preferable to apply with the help of a forex broker in Mongolia?

The suggested forex trading strategies to implement with the assistance of a forex broker in Mongolia are as follows:

1. Day trading focuses on short-term chart patterns and the actual risk events relating to the currency pair being traded.

2. Swing trading relies on momentum indicators and technical analysis to see when the exchange rate of a currency will go up or down.

3. Position trading considers long-term events and requires traders to hold their position for an extended time.

What are some trading techniques to use with a forex broker in Mongolia?

Let your forex broker Mongolia make you profit through the following techniques of trading:

1. Shorting

2. Contracts for difference

3. Binary options

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)