4 best Forex Brokers in Norway – Comparison and reviews

Table of Contents

The Norway forex trading industry has developed, and many forex traders have registered more trading accounts past five years. It has attracted forex scams that target new traders and steal their investments. We have a list of 4 reliable forex brokers that accept Norwegian traders.

See the list of the best 4 Forex Brokers in Norway:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB, SCA | Starting 0.3 pips variable & no commissions (other fees can apply) | 3,000+ (70+ currency pairs) | + User-friendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers in Norway:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

It has more than 580,000 registered accounts since its launch in 2016. It offers trading instruments such as indices, cryptocurrencies, shares, commodities, and stocks via CFDs.

Regulation is from the Financial Conduct Authority, Australian Securities and Investment Commission, SCA in the UAE, and Cyprus Securities and Exchange Commission.

Forex spreads start at 0.8 pips, and it has no commissions for most trading instruments.

Overview

- Minimum deposit-$20

- Licenses-FCA, ASIC, CySEC, SCB, SCA

- Platforms-MT4, web-trader

- Spreads from 0.2 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

It has low overnight costs, and overnight charges depend on the size of the trade and the number of nights; deposits and withdrawals are free. Traders within the European economic zone leverage 1:30.

Traders using this trading platform also have negative balance protection that prevents a highly leveraged trade from wiping out their account balance if it goes against the trader’s prediction.

Disadvantages of Capital.com

- The platform has limited trading instruments. Capital.com has a limited number of trading instruments. It also limits the forex traders who prefer to invest in different trading assets on its trading platform.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

It has been in the forex trading industry since 2014, with thousands of registered traders on its platform. It offers trading Instruments such as metals, Commodities, energies, shares, energies, indexes, and CFDs

It has three accounts; the ECN Standard account requires a minimum deposit of $200, the ECN Prime with $2000, and the ECN institution requires $20,000. Forex spreads start at 0.0 pips in the ECN Institutional account; the ECN Prime starts from 0.1 pips, while the ECN Standard has 0.0 pips.

BlackBull Markets is a forex broker that offers fast account processing speeds and supports MT4, MT5, and c Trader. It is also a regulated forex broker offering low trading costs. Traders can easily understand how to use its simple and easy user interface.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

It also offers low commissions. The ECN Prime account has commissions of $6 per $100,000, the ECN Institutional account has varying commissions, and the ECN Standard account has no commission.

Its users can deposit and withdraw funds on the trading platform using bank transfers, credit/debit cards, QIWI, WebMoney, Neteller, and Skrill. The Support team is available 24/6 through email, phone calls, and live chat.

Disadvantages of BlackBull Markets

- It has limited trading instruments. This forex broker offers a variety of trading instruments that traders can use. However, the number of assets traders can use is limited compared to the standards of international forex brokers.

(Risk Warning: Your capital can be at risk)

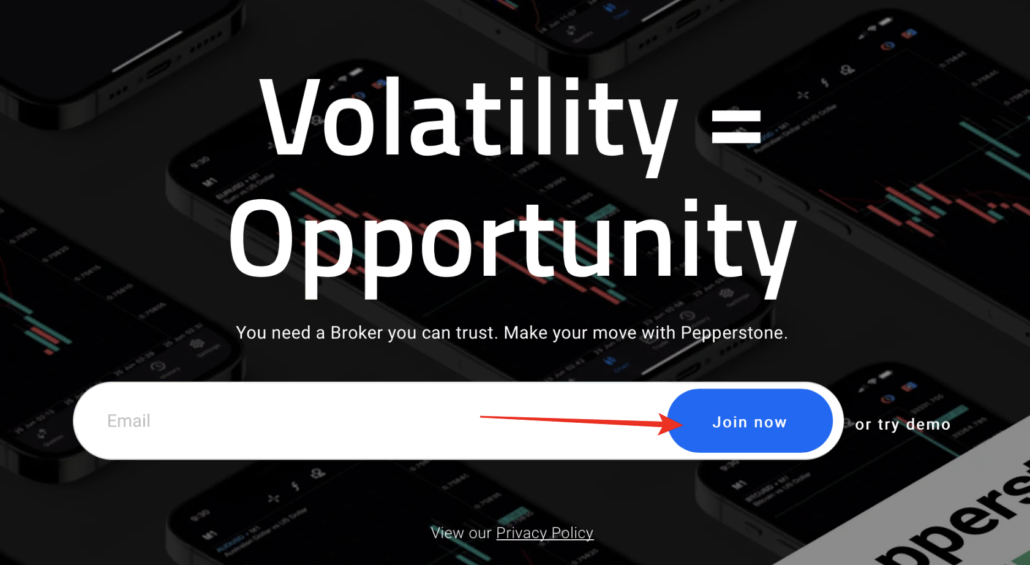

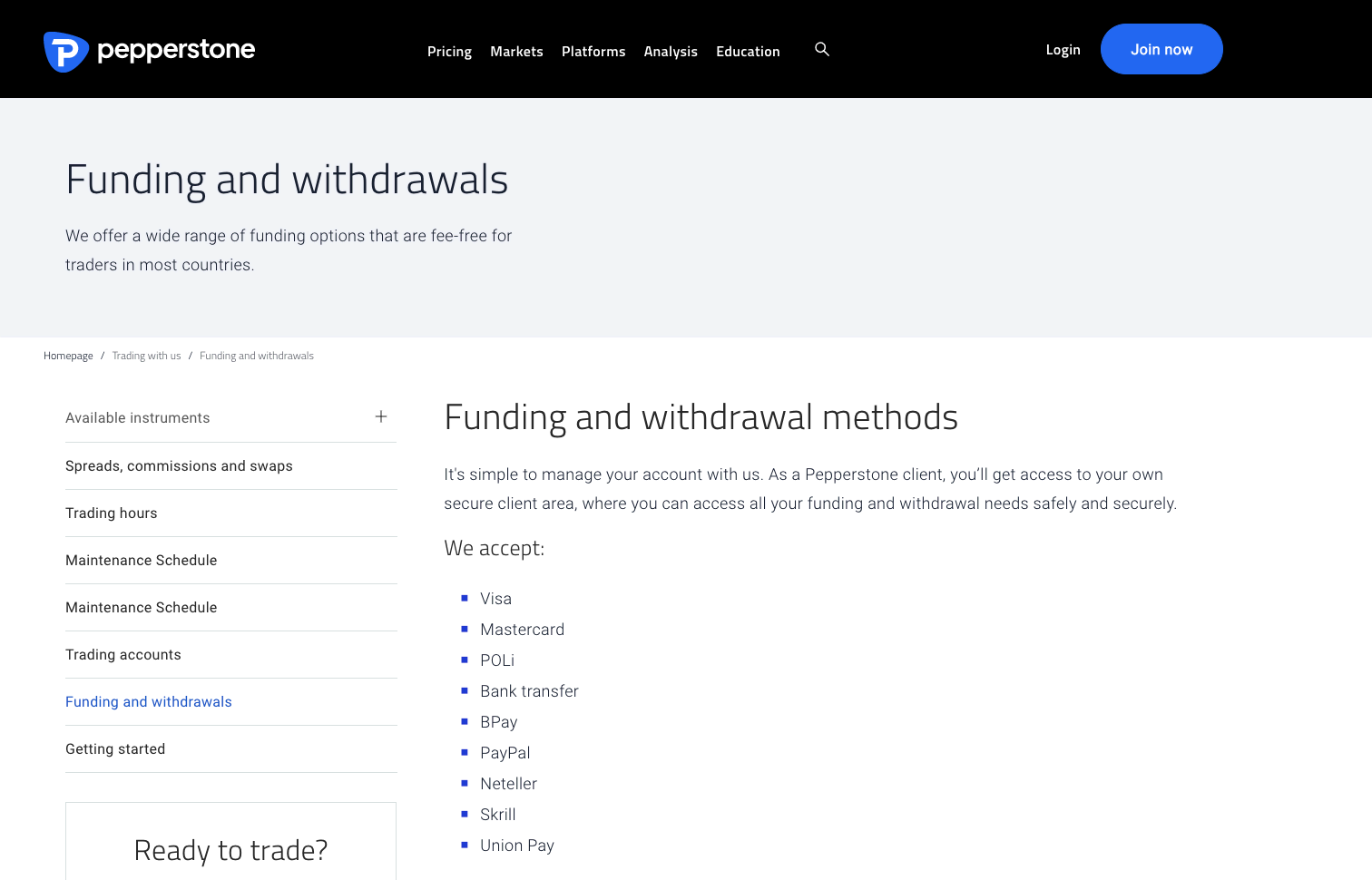

3. Pepperstone

Since it launched its operations in 2010, it has registered thousands of forex traders. Trading instruments offered on this platform include shares, commodities, indices, ETFs, and forex. It is licensed by the Financial Conduct Authority and the Australian Securities and Investment Commission.

It offers two trading accounts, the Standard and Razor account, with initial deposits of $200. The standard account has 1.0 pips, while the Razor account starts at 0.0 pips. Commissions also depend on the account type. The Razor account has a commission of $7 per $100,000, while the standard account is commission-free.

Overview

- Minimum deposit-$200

- Licenses-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

It has a limit on the leverage that forex traders can access. Due to ESMA regulations, retail traders within the EU can access leverage of 1:30 for forex, while professional traders can access up to 1:400.

It also has standard trading features required from traders regulated by the FCA and complies with investor protection rights. It offers segregated accounts and has a negative balance protection feature to ensure investor funds are safe.

Disadvantages of Pepperstone

- Pepperstone has limited research materials. Its traders require news, announcements, and current trends in the market when they want to start trading. Although Pepperstone offers analysis and news in articles and videos, it is not sufficient for forex traders to base their trading decisions on.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

Since its inception in 2013, it has registered over 80 million forex traders on its platform. Trading instruments-forex, CFDs, commodities, Digital options, cryptocurrencies, Binary Options (only for professional traders and outside EAA countries), and Stocks

It has a trading license from Cyprus Securities and Exchange Commission. Although it has also started offering other trading instruments, it is an options trading broker that offers options.

It offers two types of trading accounts the VIP account with a varying initial deposit, and the Standard account has $10. Forex spreads vary with the volatility and liquidity of the trading account. Cryptocurrencies have a commission of 2.9%, but other trading instruments are commission-free.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

Its trading platform has won multiple awards for best performance and because it is easy to navigate, even for new traders. It has a multi-charting feature, various indicators, and analysis in the form of videos and articles.

It is also available as a mobile application, a desktop version compatible with IOS and windows. Traders can access their trades anywhere or monitor their open positions, even using their phones.

Disadvantages of IQ Option

- IQ Option has limited educational resources. Forex trading requires trader to keep learning as they grow. It is crucial, especially for new traders, to trade. The platform does not have sufficient materials for training new traders on how to trade, even though the materials are present.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Norway?

The securities and exchange industry in Norway is one of the largest forex trading industries. The Oslo stock exchange has contributed to the growth of forex trading and was established in the 1800s. The economy of Norway is strong, and its currency is stable, which has also contributed to the development of its capital market.

Although it has a strong economy and currency, the Norwegian Krone is not one of the major currencies. However, forex traders from other foreign countries invest in Norwegian Krone due to the stability it offers.

The Norwegian forex industry has strict regulations for market participants. Norway’s forex traders can start trading by registering trading accounts from regulated forex brokers. You can open a trading account on a forex broker regulated in Norway or regulated within any of the jurisdictions within the European Economic Zone.

Norway is part of the European Economic Zone, and therefore it has to comply with the ESMA rules as well as the regulations of the FSA when regulating the finance sector. Forex brokers don’t need to be licensed by the FSA to operate in Norway.

Forex brokers licensed in the European economic zone can register as Norwegian forex traders. Regulations that forex brokers licensed by ESMA and FSA are like. Forex brokers must ensure they have segregated accounts for investor funds and corporate funds to secure investor funds if the forex broker becomes bankrupt.

Forex brokers have to issue a limit of 1:30 for the leverage forex traders in Norway can access according to ESMA guidelines. This leverage limit is imposed on forex pairs considered highly volatile and has a high risk. The FSA is also in charge of ensuring the stability and efficient functioning of activities of the financial markets of Norway.

FSA licenses forex brokers and financial dealers that want to operate within Norway. It also offers the conditions for financial institutions that want to get a license required to get a license of operation.

Security for traders from Norway – Important information

Forex brokers ensure investor protection by offering segregated accounts for forex brokers and forex traders. Limits on trading instruments are considered to carry a higher risk for investors, such as Binary options and CFDs.

Market participants have a channel to report suspicious trading activities, which the FSA investigates and reports. The FSA also supervises and monitors the operations of financial institutions that are licensed under it to ensure fairness and transparency for investors.

The Ministry of Finance and the FSA establish laws that impose penalties against financial institutions engaging in illegal trading activities, including money laundering. These laws also ensure that forex brokers comply with investor protection rights.

(Risk warning: 67% of retail CFD accounts lose money)

Is it legal to trade Forex in Norway?

Yes, it is legal to trade in securities and stocks in Norway. The forex trading industry is well regulated, and offshore forex brokers can register a trading account for Norway traders. The Finance Ministry oversees establishment the regulations of the financial markets.

The Finanstilsynet or the Financial Supervisory Authority (FSA) of Norway operates under the Ministry of finance in Norway. It is a government organization tasked with the mandate to ensure the regulation of the financial sector in Norway.

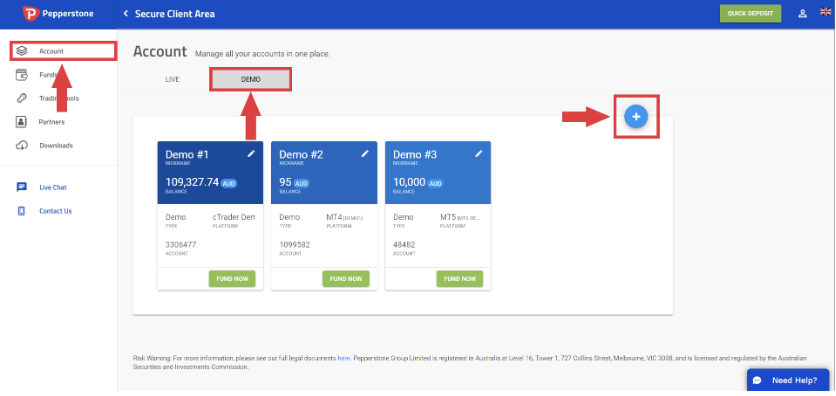

How to trade Forex in Norway – Tutorial

Open account for Norwegian traders

The Norwegian forex industry is advanced, and many financial institutions are looking to profit from the liquidity and volume of traders. Forex traders need to be careful when opening trading accounts, as many forex frauds are stealing from unknowing traders.

You can open a trading account from our recommended forex broker or research a regulated forex broker that offers low trading costs and complies with ESMA standards.

Open a trading account on your selected broker using the online registration form available on its website. The forex broker will need some details about you and verify these details. Their information includes name, nationality, date of birth, email, account types, and password.

The verification process requires you to offer a softcopy of some documents, such as an identification card verifying the details you provided. Some forex brokers request your trading background and employment status for risk assessment.

Download a trading platform that is compatible with your forex broker. The trading platform allows you to access financial markets remotely. After downloading a trading platform, you can navigate its interface to ensure that you are familiar with the trading features.

Start with the demo or real account

Start trading using the demo account, which uses virtual funds. The demo account helps traders practice their trading accounts and test the trading platform’s features. The demo account is crucial, especially for new traders, as it offers a platform for new traders to learn how to trade.

You can also start on the real account if you are an experienced trader. The real account requires you to fund your account to start trading.

Deposit funds

Deposit your capital into your trading account and start trading. You can deposit to your real account using the payment methods supported by your forex broker. Forex brokers support various payment methods, such as bank transfers, credit/debit cards, and digital wallets like Skrill.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Analysis forms the backbone of preparations when you want to start trading. It helps the trader to have a better insight of the price action to know how to enter or exit the market. There are two types, technical and fundamental analysis.

Short-term traders commonly use technical analysis, which is easier and faster to understand. It entails using technical tools, the price patterns on the charts, and candlestick patterns to predict the market’s price movement, momentum, and liquidity.

Fundamental analysis requires the trader to evaluate the financial reports, interest rates, and economic and political policies. These factors contribute to the fluctuation of commodity prices and investments, affecting the prices of securities in the financial markets.

Trading strategies

Some trading strategies to apply when trading forex includes;

Swing trading-it involves trading the swing highs and swing lows of a trend. Identify a trading instrument that has average volatility with well-defined swings. Find the trend and trade on the swings by going long on the swing low and short on the swing highs.

Position trading is a trading strategy that involves the speculation of trading instruments that have fallen in price, which will increase in value after a period. You can open a position by buying the trading instrument or stocks of a company and holding it until its value appreciates and selling it at a higher price.

Trend trading requires the trader to know how to determine the trend direction and the momentum. The direction and strength of the trend will guide the trader to know if they should go long or go short. It also needs the trader to be keen and follow the trend to avoid losing trade when the trend changes.

Make profits

Make profits by using technical and fundamental analysis to find accurate signals you can use to predict the financial markets. Forex traders should also practice different trading strategies with different trading instruments to diversify their portfolios.

Understand the financial markets and the asset you are trading. If it is a currency pair, ensure to learn more about its history and how it has performed in the previous years. It will help you to know how to predict the price action better.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Norway

Finding a forex broker is a long process, especially in a developed forex market like Norway. You have to research many forex brokers to find a credible forex broker that is regulated. We recommend offshore forex brokers that have worked in the industry for more than a decade.

A forex broker is the first step; you also need to learn how to trade different financial instruments and apply different trading strategies to profit. Be consistent with your trading strategy and ensure you protect your trading position with stop-loss strategies.

FAQ – The most asked questions about Forex Broker Norway:

What types of accounts are available to trade as a forex broker in Norway?

The biggest Forex dealers on the Norwegian market provide a wide range of account types to accommodate both experienced and retail trader demands. The minimum deposit amounts, minimum lot sizes, and trading volume restrictions vary depending on the kind of account.

During the registration process, prospective customers frequently have to complete a quick questionnaire to ascertain their degree of expertise and experience. Before making real-money bets, new traders are typically encouraged to continue in demo mode. There are numerous brokers who provide mini, micro, regular, and professional accounts. Swap-free trading is also frequently accessible.

How can I select the top forex brokers in Norway?

The top brokers for international trading are ultimately determined by who has the most items in the markets, but we also evaluate the best international trading platforms based on their quality and tools. In the categories of best online broker for non-US investors and best online broker for international trading, which it has dominated for years, Interactive Brokers (IBKR) wins overall once more.

International investors will discover that each of these platforms provides direct access to assets on global markets as well as coverage of the international exchange-traded fund (ETF) and American depositary receipt (ADR) universes.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)