Five best Forex Brokers and platforms in Peru – Comparison and reviews

Table of Contents

The first step to take if you want to start forex trading is to select a forex broker and open a trading account. We have researched if you are a forex trader based in Peru and looking for a forex broker that accepts Peruvian traders. We have compiled a list of five credible and internationally regulated and accredited forex brokers.

See the list of the best Forex Brokers in Peru:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The five best forex brokers in Peru

Capital.com

BlackBull Markets

RoboForex

Pepperstone

IQ Option

1. Capital.com

Capital.com started its operations in 2016 and has over five million registered traders globally.

Trading instruments – traders can trade indices, stocks, Forex, cryptocurrencies, commodities, and shares.

Regulation – it has FCA, NBRB, CySEC, and ASIC regulations.

Account types – Standard has a $20 initial deposit, the Plus has $2000, and Premier has $10,000.

Fees – forex spreads start at 0.8 pips.

Trading cost – it has no inactivity cost; deposits and withdrawals are also free. Overnight charges apply; their rates vary with the trading instrument and position size. It also has no commissions.

Leverage – the highest leverage for non-EU clients is 1:500, but for EU clients, it is limited to 1:30.

The demo account – it has a free demo account with $10,000 virtual funds.

Trading platforms – it supports the web trader and MT4.

Payment methods – Trustly, iDeal, ApplePay, Sofort, Multibanko, Giropay, 2c2p, bank transfer, and credit and debit cards.

Customer care – customer support is available 24/7 in 11 languages via email, phone calls, or live chat.

Pros

- Low trading costs

- Low initial deposit

- Negative balance protection

- Fast order processing speeds

Cons

- Limited learning resources

- Limited research tools

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets started its operations in 2014 and has thousands of traders using its platform.

Trading instruments – it offers metals, commodities, energies, indexes, CFDs, Forex, and shares.

Regulation – it has regulation from the Financial Services Authority in Seychelles.

Account types – it offers three ECN Prime with a minimum deposit of $2000, ECN Standard with $200, and ECN Institutional with $20,000.

Fees – forex spreads vary with accounts; The ECN Standard starts from 0.8 pips, the ECN Prime from 0.1 pips, and the Institutional account from 0.0 pips.

Trading costs – the Standard account has no commissions, Prime offers $6 for $100,000, and the Institutional account has varying commission rates. It also has no inactivity fee, and deposits and withdrawals are free.

Leverage – the highest leverage is 1:500

Demo account – it has a free demo account for registered users.

Trading platform – it offers MT5 and MT4.

Payment methods – it accepts bank transfers, FasaPay, Skrill, UnionPay, Neteller, debit, and credit cards.

The customer care – the support team is available 24/6 through live chat, emails, and phone calls.

Pros

- Quality trading resources

- Fast order execution speeds

- Low trading costs

- High leverage

- A fast account registration process

Cons

- Limited learning resources

- Customer support is only available 24/6

(Risk Warning: Your capital can be at risk)

3. RoboForex

It has been in the industry since 2009 and has registered over one million traders Globally.

Trading instruments – Its traders can access stocks, CFDs, energies, metals, commodities, stocks, ForexForex, cryptocurrencies, and ETFs.

Regulation – it has regulation by the International Financial Service Commission.

Account types – the R-stocks trader has an initial deposit of $100, while the Pro, Pro-cent, Prime, and ECN have $10.

Fees – forex spreads start at 1.3 pips for the Pro and Pro-cent accounts, 0.0 pips for the ECN and Prime account, and $0.01 for the R-stocks trader.

Trading costs – it has a low commission for the ECN, Prime, and R-stocks trader; it also has an inactivity cost of $10 for accounts dormant for over ten months. Overnight costs apply, and deposits and withdrawals are free.

Leverage – the highest leverage is 1:2000 for the Pro and Pro-cent account, the ECN has 1:500, and the prime and R-stocks trader with 1:300.

Demo account – it has a free demo account for registered traders.

Trading platforms – it has the R-stocks trader, cTrader, MT4, and MT5.

Payment methods – it has AdvCash, AstroPay, Perfect Money, Skrill, Neteller, NganLuong wallet, bank transfers, and credit and debit cards.

Customer care – it supports 11 languages and is available through; live chat, emails, and phone calls.

Pros

- Fast order processing speeds

- Low trading costs

- Low initial deposit

- Negative balance protection

- Fast deposits and withdrawals

- High leverage

Cons

- No fixed spreads

- Limited trading instruments

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone started its operations in 2010 and has thousands of clients registered.

Trading instruments – CFDs, ETFs, ForexForex, commodities, shares, and indices.

Regulation – it has regulations from the ASIC, FCA, and DFSA.

Account types – Standard and Razor accounts have two types with an initial deposit of $200.

Fees – forex spreads start from 1.3 for the Standard account and 0.0 for the Razor account.

Trading costs – the Standard account has no commission, but the razor account has $7 for every $100,000. It has no inactivity fee, overnight costs apply, and deposits/ withdrawals are free.

Leverage – the maximum leverage is 1:400.

The demo account – it has a limited account for thirty days with $50,000 virtual funds.

Trading platforms – it supports the cTrader, MT5, and MT4.

Payment methods – Poli, Skrill, PayPal, Neteller, UnionPay, Bpay, bank transfers, credit and debit cards.

Customer support – their customer support is available through phone calls, live chat, and email 24/5.

Pros

- Low trading costs

- Quality trading resources

- Fast order processing rates

- A fast account registration process

- Variety of payment methods

Cons

- Limited research and learning resources

- Customer care is only available 24/5.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option has been in the industry since 2013 and has registered thousands of traders from different continents.

Trading instruments – it offers Forex, options, commodities, ETFs, Stocks, and CFDs.

Regulation – it has regulation by Cyprus Securities and Exchange Commission.

Account types – it has the Standard with an initial deposit 0f $10 and the VIP account with a varying initial deposit.

Fees – forex spreads vary with the liquidity and the type of trading instruments.

Trading costs – the rollover costs range from 0.1 to 0.5%, while the commission varies, cryptocurrencies have 2.9%. It also has inactivity costs of $10 for inactive accounts for over three months.

Leverage – the highest leverage is 1:500.

The demo account – it has a free demo account with $10,000 of virtual funds.

Trading platforms – it has its proprietary IQ Option trading platform.

Payment methods – it supports Skrill, Webmoney, Neteller, MoneyBookers, bank transfers, and credit and debit cards.

Customer support – customer support is available through live chat and emails.

Pros

- Fast order processing speeds

- Low trading costs

- A fast account registration process

- Quality trading materials

Cons

- Limited trading instruments

- Limited research and educational materials

(Risk warning: Your capital might be at risk.)

Forex trading in Peru – What you need to know

The economy of Peru is among one of the fastest-growing in the world, with a GDP of 202 billion. The economy s growth is due to the trade between Peru and other foreign trading partners such as the USA, EU, Brazil, and China. Peru exports metals, Pharmaceutical products, and manufactured goods.

The Economy of Peru is growing; the securities and exchange markets are yet to catch up with the economic growth in Peru. When talking about Peruvian capital markets, you mention the Bolsa de Valores de Lima (BVA), also known as the Lima Stock Exchange.

The Peruvian government is placing the appropriate measures to increase liquidity in the capital markets of Peru. They plan to achieve this by giving the public and businesses within Peru get more information about investing in the capital markets.

Is it legal to trade Forex in Peru?

Yes, forex trading in Peru is allowed, and a special organization known as the Superintendecia del Mercado de Valores (SMV) has the responsibility to ensure that forex investors in Peru get fair and transparent treatment from financial issuers and forex brokers.

It also ensures effective service provision from financial institutions and compliance with the laws that regulate the financial industry in Peru.

Financial regulation in Peru

The SMV is a regulatory agency in Peru regulating the capital markets. It is a regulatory institution that works with the Ministry of finance in Peru. It started its operations in 1970 and was initially known as CONASEV or the National Supervisory Commission for Companies and Securities.

It changed to the SMV in 2011 and has been operating as the SMV since then.

Some functions the SMV has are:

- To ensure the transparency of the capital markets by monitoring the security prices offered by financial issuers and forex traders.

- Forex brokers looking to operate in Peru

- require a capital of 1 million Nuevos, and the equity of the entire firm has to be not less than this capital.

- Financial dealers such as forex brokers have to submit relevant reports of the operations done to the SMV for inspection.

- Agree to audits from the SMV to ensure the forex broker offers products and services according to international standards.

- Forex brokers are obligated to ensure they provide accurate information about the liquidity or status of the trading instrument.

- Forex brokers are prohibited from performing any operations on the trading account on behalf of an investor without consent.

- Ensuring market participants that are reported, investigated, and found guilty of breaking any of the regulations have to pay the fine or receive the penalties.

Security for traders from Peru

Traders have a secure environment trading forex by conducting inspections and audits to ensure that forex brokers offer standard trading features. Forex brokers require segregated accounts to separate investor funds and company funds.

Ensuring that forex brokers operating in the forex industry have a trading license from the SMV or international regulators’ regulations. Employees of financial advisors working in the capital markets regulated by the SMV require certificates that validate their professionalism in the finance sector.

(Risk warning: 78.1% of retail CFD accounts lose money)

Trading strategies and analysis that Peru Forex traders can use

Analysis

Any forex trader has to analyze the market before opening a position. Analysis helps traders to understand the market conditions and predict the price action. Forex trading has two types of analysis forex traders can apply, technical and fundamental.

Technical analysis is when you apply technical indicators such as the Moving average and the trend lines to evaluate the price market. These technical tools help you know the momentum of a trend, the general price direction, and the liquidity. Traders can also learn to predict the trend direction using price or candlestick patterns.

Fundamental analysis is also imperative as forex traders need to monitor the factors that influence the price movement of the underlying market. Such factors include the GDP, trade relations, employment, unemployment rates, and other factors that influence the interest rates.

Trading strategies

The best way to profit from any price movements is through developing a trading strategy that offers consistent returns and sticks to them. Trading strategies consist of entry and exit, risk management, and technical tools you apply during trading. Some trading strategies traders can apply to include;

Trading a trend reversal – is a popular trading strategy that consists of applying technical indicators that signal momentum and strength to predict when the trend is changing. You can open a trading position based on the trend direction. If the price action is headed towards an uptrend, you go long. If it is headed to a downtrend, you go short.

Trading a trend means you have to accurately predict the overall or the small trends. If the trend is a strong uptrend, you go long by buying low and selling high. If it is a strong downtrend, you go short by selling high and buying low. Trend trading depends on how well you can predict a trend, and it can take a few days to weeks.

Swing trading – is also a well-known trading strategy that involves trading the short swings in the price markets. It requires a slightly volatile market, and you can clearly define the swing highs and swing lows.

You can trade the swing highs in a trend or a swing low in a downtrend. Swing trading can take more than a day and requires the trader to be keen when trading to avoid losing more than profit.

How to trade Forex in Peru – A quick tutorial

Find a regulated forex broker

The decision to open a trading account requires you to research the trading broker that offers the trading features you want. A regulated forex broker should have a trading license from the SMV or credible regulators in the forex industry.

You can also look at other features such as the trading instruments like currency pairs, trading costs, trading platforms, demo accounts, payment methods, and customer support.

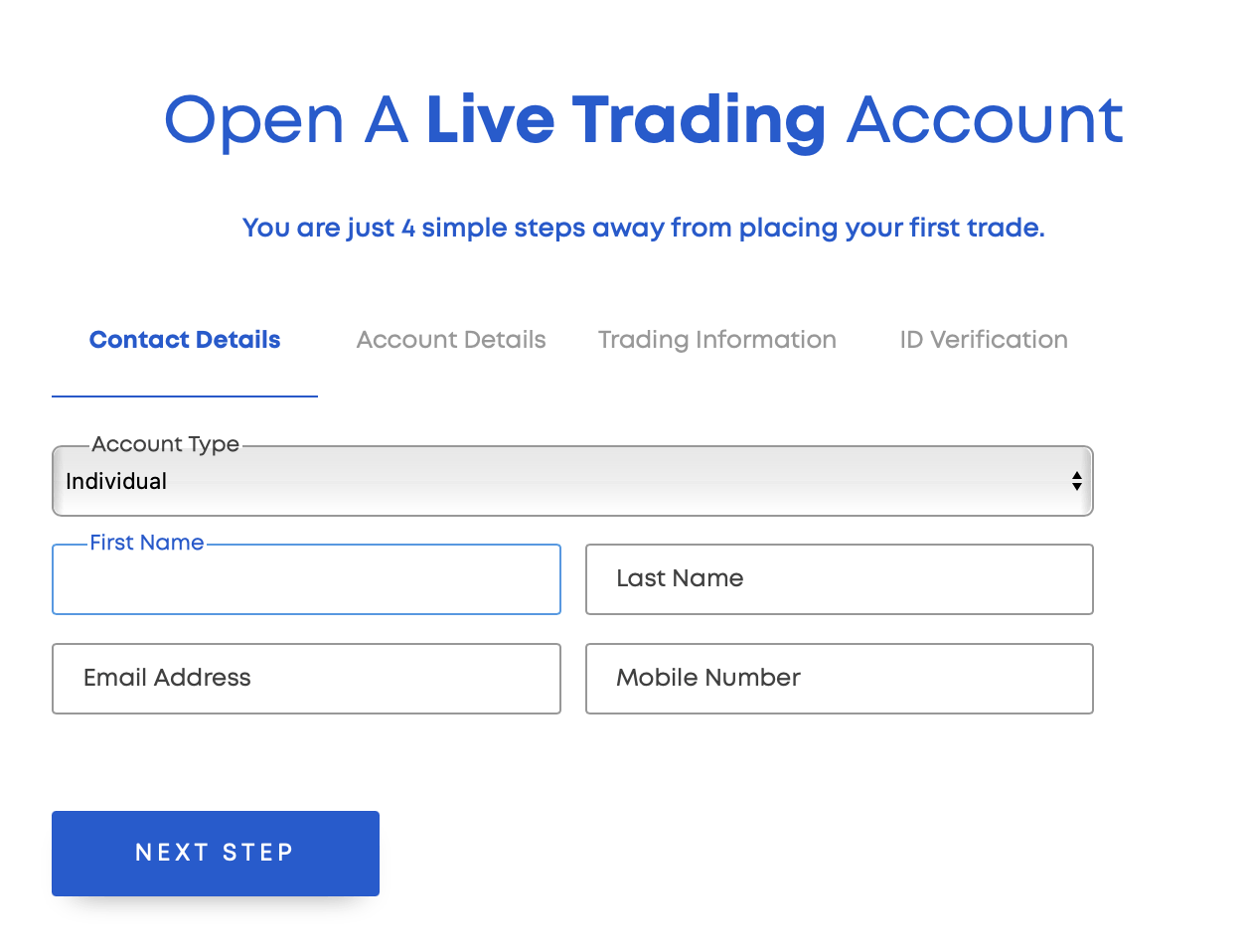

Register a trading account

Register a trading account with a forex broker you have selected. The registration form is found online since most forex brokers operate online. The registration process is secure if you have a regulated forex broker.

The forex broker will require some information to help them create the trading account. This information is also confidential and is only shared with third parties with the consent of the forex investor. The registration process is also short and easy and can take three to five minutes.

Download a trading platform

You can download a trading platform based on the type that the forex broker supports. There are a variety of trading platforms that forex traders can choose from, and some forex brokers have their trading platforms.

Different trading platforms have various features, and you can research to find one that is compatible o your trading objectives.

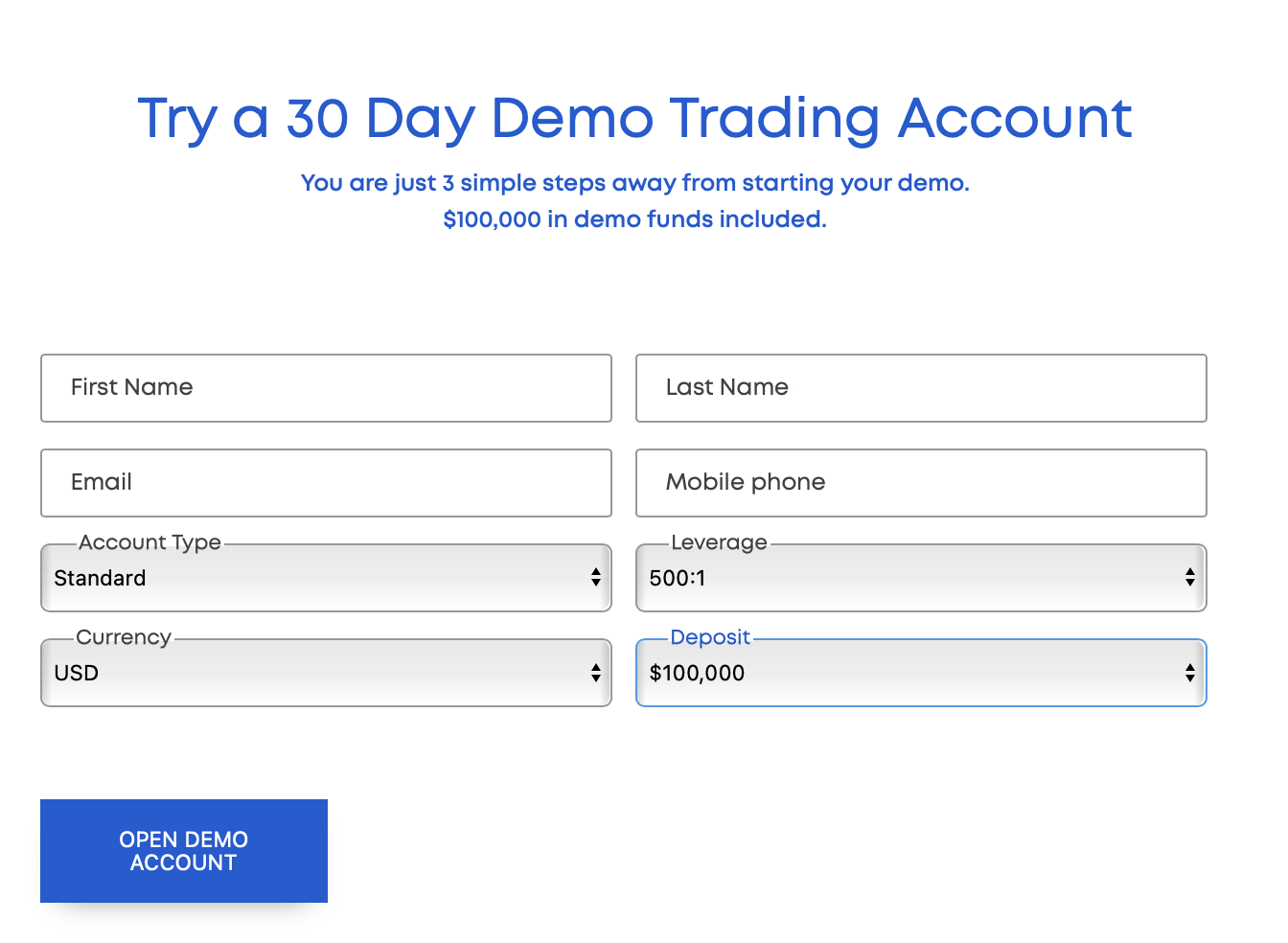

Start with a demo account

The demo account is like a live account, and the difference is that it uses virtual funds or fake money. This account is available in many forex brokers, and most of them have free demo accounts. Forex traders can use this account to develop and practice their trading strategies.

New traders can also use it to test the trading features and learn how to trade different currencies before using real funds. It will help them understand how to trade and know how to apply a trading strategy.

Deposit funds and start trading

If you have practiced trading and are ready to start trading, you can deposit funds to your trading account and start trading. To deposit, move to the deposit and withdrawals window and select payment methods you can easily use when transferring funds.

Link the trading account with the payment, methods, and deposit funds. The payment method you use to deposit is the same as that you will use to withdraw.

Conclusion: The best Forex Brokers are available in Peru

The government of Peru encourages foreign investors by removing some tough regulations, and more forex brokers can support Peruvian forex traders. Peruvian traders can Open trading accounts from regulated offshore brokers that offer more trading instruments and international standards trading conditions.

It is imperative to confirm the trading license to prevent you from becoming a victim of forex scams. It is also crucial to ensure that the forex broker offers the trading instruments you want to trade and has low trading costs to increase your profit margin.

(Risk warning: 78.1% of retail CFD accounts lose money)

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Peru:

Is the Peruvian Sol available in Forex?

The Peruvian Sol is available in Forex and has the currency code PEN. Peruvian forex traders can invest in Forex by taking advantage of the interest difference between the PEN and other major currencies such as the USD and the EUR.

The current exchange rate of the USD/PEN is 3.7851, and that of the EUR/PEN is 3.9835.

How is Forex taxed in Peru?

The securities and exchange income is taxed as ordinary income except for the capital gains from the Lima Stock exchange, which has a tax of 5%.

How does a trader in Peru trade forex?

Forex trading in Peru is possible for a trader using a well-established online platform. In addition, there are several brokers in Peru with which traders can trade to have a first-class trading experience. Traders can sign up with such brokers and choose a forex trading account. Then, they can fund it and start trading forex in Peru.

How can a trader in Peru make profitable forex trades?

A trader in Peru can make profitable forex trade if he is wise to conduct proper research. Proper research involves a trader doing a few things. For instance, a trader can develop a habit of conducting proper research. He should also monitor the forex prices from time to time. Besides, a trader should always use all the available tools and technical indicators to conduct a proper analysis.

Which broker should I choose in Peru for forex trading?

You can choose any of the available forex trading brokers in Peru. However, you must ensure that the broker is legit and offers good trading features. So, the five brokers discussed here are the top forex brokers in Peru. You can choose one of them.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)