Best Forex Brokers & platforms in Russia – Comparisons and reviews

Table of Contents

The many forex brokers in Russia can make it tough to choose. We have reviewed a number of them and come up with a list of 2 to narrow the choices.

See the list of the best Forex Brokers in Russia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1 BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

These 2 are among the best and low-fees brokers in Russia.

They are:

Here’s a summary of their offerings:

1. BlackBull Markets

BlackBull Markets is an ECN forex dealer based in New Zealand. The company was established in 2014 and now has offices in New York, the United Kingdom, and parts of Asia.

BlackBull Markets accepts traders from many parts of the world, including Russia. The broker holds licenses from its home-base regulator, the Financial Markets Authority. BlackBull Markets is also registered with the Financial Service Authority of Seychelles (FSA).

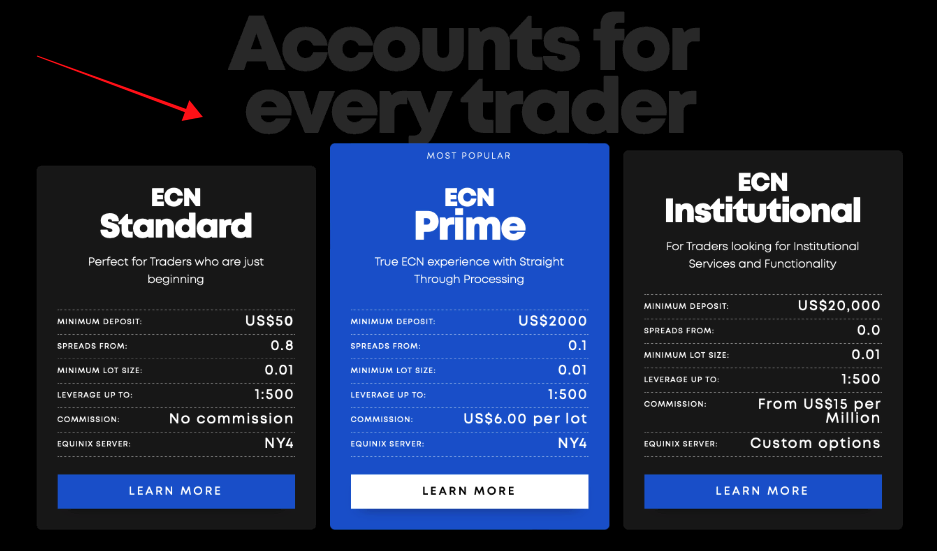

The broker offers three types of accounts, all of which enjoys ECN execution. These accounts are the Standard ECN, prime, and institutional accounts.

Russian traders can choose between the commission-free (Standard) and the commission-based account. At a $200 minimum deposit, you can start trading on the Standard ECN account. But you need $2000 to trade on the Prime account.

However, the trading costs are highly competitive, with the average spread being 0.2 pips on majors during active hours.

The broker offers quality research and education content for novice and experienced traders. Its platforms also come with a variety of special features, including a free VPS for smoother and faster order executions. However, the free VPS is not available for Standard account holders.

Russian traders can reach its outstanding customer support service via phone, live chat, or email. They’re available round-the-clock all through the weekdays (24-5 support).

The drawback of trading with BlackBull Markets

- No CySEC regulation

The FMA and FSA are well-known and credible financial bodies. But their protection may not extend to customers in Europe.

(Risk Warning: Your capital can be at risk)

2. Pepperstone

Pepperstone is an international broker founded in Australia in 2010.

The brokerage company is among the safest since three prestigious financial bodies license it in the UK, Europe, and Australia. These regulations are from the FCA, CySEC, and ASIC, respectively.

The broker also holds several other licenses from other jurisdictions, such as the UAE, South Africa, Kenya, Seychelles, Germany, and the Bahamas.

They are a trusted brokerage firm offering STP and ECN forex trading services. The recommended minimum deposit is $200, but Pepperstone allows trading with any amount lower than this.

Russian traders can choose its Standard account, which offers STP execution with an average spread of 0.6 pips and zero commission fee. Or the razor account with ECN execution and spreads averaging 0.3 pips. The broker charges a $6 commission per 100000 lots on its raw ECN account (razor).

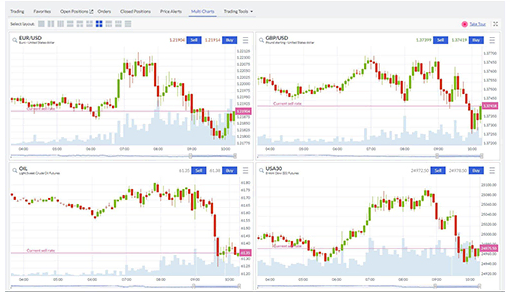

Pepperstone offers trading services on MT4, MT5, cTrader, and Tradingview. A free demo is available for 30-days. Social and copy trading is also supported on its platforms.

The products offered are currency pairs, major indices, commodities, CFDs, equities, and cryptocurrencies. These are traded at low fees and in a conducive environment with enriching educational content.

Deposits and withdrawals are free of charge, and the broker provides simple and popular payment methods for these. They include PayPal, bank wire, Visa, Mastercard, and Skrill.

Its customer service is available 24 hours a day in different languages, including Russian. Traders can reach them on live chat, phone, or email.

The disadvantage of the Pepperstone brokerage account

- No public listing

Pepperstone is not a publicly-traded company. They are listed on any stock exchange, so customers cannot view their financial information.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Security for Russian traders

The Central bank of Russia does not require forex brokers to have their licenses before accepting Russian traders.

However, Russian traders who wish to deal with brokers within their country should seek the ones with a Central bank’s license. This gives them more protection.

If dealing with a broker inside Russia, choosing an ADR member broker is also safer. Such a broker would be certified by the FMRRC, and the traders’ funds will be insured in case of bankruptcy.

Russian traders can sign up with brokers outside the country too. They must choose brokers with a globally recognized license from a reputable financial body.

These top-rated financial bodies are:

Is it legal to trade forex in Russia?

Yes, it is. A broker who wishes to operate in Russia must obtain a license from the Central bank. Russian traders dealing with brokers inside Russia must trade with one that holds the Central bank’s license.

How to trade forex in Russia – A detailed guide

Trading forex in Russia is easy if you choose the right broker. The first step in trading forex is to choose a suitable brokerage firm. Your success in forex trading largely depends on your dealer.

Here’s a checklist to ensure the forex broker checks out:

- Licensed by a globally known financial body.

- Authorized by Russia’s Central bank if inside the country.

- Competitive spreads and commission.

- Offering free demo for at least 30 days.

- 24-5 reachable multilingual support.

- Easy payment methods with PSPs are available in Russia.

- Quick withdrawal processing time with a 2-days maximum wait period.

If you tick all the items in the list, the broker is good to deal with.

Follow these steps to trade forex:

1. Open account for Russian traders

Go to the broker’s website to get a trading account. Clicking on the signup tab should bring a pop-up form where you need to input your name, email, and maybe phone number.

The broker then sends a link to your email for authentication. Clicking on the link verifies the email and may take you to the page where you enter further details that the broker requests.

Be prepared to scan and upload an ID card and proof of address to complete this registration.

Once you’ve done this, the trading should be ready to use.

2. Start with a demo or real account

The broker should offer a free optional demo to trade with at first.

This account, in most cases, will come with a $10000 credit. This money is a virtual fund that allows you to test the broker’s trading environment before going live.

New traders should use this free demo before depositing funds. That way, they can get acquainted with the forex market before starting to trade.

Many traders also use free demos to practice new strategies before using them to trade in a live account. It all depends on the trader. But the free demo is always useful one way or another.

3. Deposit money

Once you are satisfied with the tests, it is time to go live.

You need to deposit money into the trading account for this.

Many brokers who accept traders from Russia ensure they provide simple payment methods available in the country. So this part should be easy.

The broker might also assign an account manager that should be with you throughout the initial stage. This personnel should maintain contact with you and take you through the processing to fund your account.

Popular payment methods in Russia are Credit cards, debit cards, PayPal, Qiwi, and online banking.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

To trade successfully, you need to apply a reasonable strategy and do some market analyses.

Strategies involve entering and exiting the market at accurate points. Using the proper risk settings in the right place is also part of a good strategy.

Market analyses give you valuable insight into the assets you wish to trade.

Traders have carried out market analyses to understand price movements and the factors that cause them.

The two vital market analyses are:

- Fundamental analysis

- Technical analysis

Forex fundamental analysis refers to gathering data about the country’s economy. The reason is the economy drives the exchange rates. Therefore, economic data can indicate the price direction of a currency pair. These pieces of information include the country’s GDP, inflation rate, interest rate, and any other data that determines the country’s economic situation.

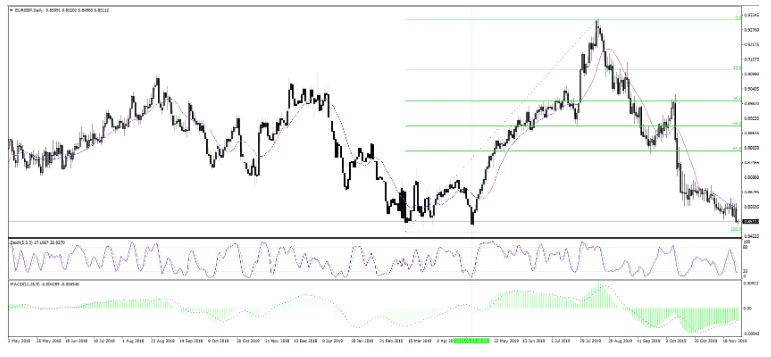

Technical analysis is the most common in forex and involves looking at price patterns. Most traders focus on this analysis because they believe it represents the results of the fundamental factors listed above (GDP, Inflation, etc.).

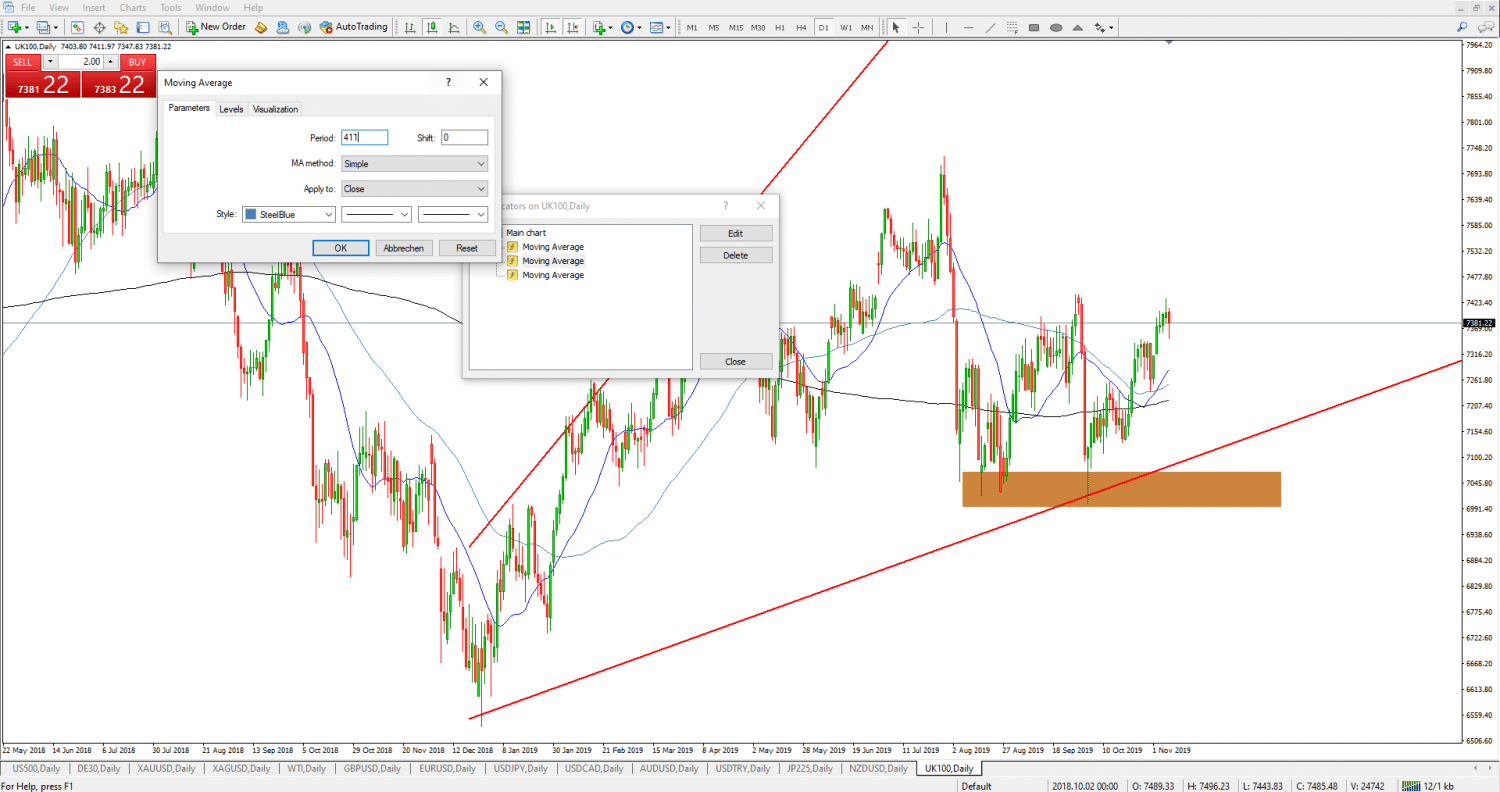

That is why brokers’ trading platforms usually come with technical analysis tools, which are embedded to help the trader.

Traders use these tools and indicators to study price patterns in the market and identify trading opportunities.

Though technical analysis is more popular, both are equally essential to the trader’s success. The trader must patiently learn about them to improve their skills and increase profits.

Successful traders use both analysis and the best strategies while trading forex.

Here are a few popular forex trading strategies for Russians:

Carry trading strategy

Every currency has an interest rate, and a trader earns interest when they hold or invest in a currency. Carry trading involves holding positions to earn the interest rate differences between both pairs.

As a high-interest-rate currency, the Russian ruble presents great carry trading opportunities. If you speculate on the Russian ruble, this strategy is effective and worth looking into.

It comes in two forms: positive carry and negative carry trading.

Positive carry trade means the traders assume the high-interest rate currency will remain the same. So, enter a buy trade and hold the position for specified periods. The difference between the interest rates on both currencies is paid into the trader’s account as long as the position remains open, and the interest rates remain the same.

A negative carry trading strategy involves expecting the low-interest-rate currency to rise. The trader then bets on the low-interest rate pair. They profit from the interest rate difference if it rises as expected.

Breakout trading strategy

Forex traders can watch for a breakdown or breakout in the price of their choice pair. Breaks occur during market conditions, including uptrends, downtrends, or ranging markets. It is a condition where the price breaks from its current path to another. The trader uses technical indicators to anticipate this move and profit from it.

Retracement trading

Retracements can happen in any trending market, be it a bullish trend, bearish, or sideways trend.

It is a condition where the trend makes a temporary reversal in the opposite direction. Retracement presents a profitable opportunity for day traders and scalpers to earn fast cash.

The trader has to foresee the price direction by studying past price behaviors. Brokers provide intelligent indicators to help study price patterns and make profitable predictions.

5. Make a profit

It is possible to profit from forex trading within a few weeks of beginning. Some start earning earlier than this.

It takes signing up with a good broker, using an effective strategy, and trading at the appropriate time to achieve this goal.

Once you start making a profit, you can raise your capital or withdraw the funds.

The broker should provide easy methods for withdrawals. Transferring your funds from the forex account should take no more than 48 hours. Many brokers process it within shorter periods.

Ensure you complete the registration by uploading all the necessary documents. This prevents unnecessary delays in withdrawal processing.

Conclusion: The best Forex Brokers are available in Russia

With our recommendations and the trading steps, forex trading in Russia should be easy for any newbie. Ensure you use all the risk and money management features that the broker provides. Forex trading involves risk, and you should only trade with the amount you can afford to lose.

FAQ – The most asked questions about Forex Broker Russia :

How can a Russian trader choose a forex broker?

You can choose a forex broker by keeping in mind several factors. For instance, the broker that you choose should be highly regulated. Also, it should have a good reputation. If your chosen broker does not have a good reputation, you can become a victim of suffering from losses. It can cause your investments harm.

Which brokers operate in Russia and extend the best services to forex traders?

There is more than one broker in Russia that offers traders the best trading services. They include BlackBulls Markets, Pepperstone. These brokers have a top-tier trading facility. In addition, they offer traders a lot of underlying assets that help them expand their trading reach. Besides, traders in Russia can diversify their trades when they use any of these trading platforms.

Which forex brokers in Russia allow traders to sign up with a low minimum deposit?

The 3 brokers here are the best when considering the minimum deposit amount. They allow you to begin forex trading with an amount as low as $10. Besides, the minimum withdrawal stipulation with these forex brokers is also less. So, you can withdraw an amount as low as $10 from your trading account. Furthermore, a trader in Russia can place a trade with just $1 on most of these trading platforms.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)