The 5 best Forex Brokers & platforms in Serbia – Comparisons and reviews

Table of Contents

Strict financial regulations in the Republic of Serbia make it tough to find a forex dealer to trade with. Legal forex trading with local brokers is difficult because of the country’s stringent financial institution requirements.

See the list of the best Forex Brokers in Serbia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Many traders invest their funds with global forex brokers outside Serbia. This article introduces the best international brokers for Serbians if you’re new or changing your dealer.

The list of the 5 best forex brokers for Serbians:

- Capital.com

- Blackbull Markets

- RoboForex

- Pepperstone

- IQ Option

An introduction to the brokers’ offerings:

1. Capital.com

Capital.com is a famous online forex and CFD broker that started operating in 2016. The company is based in the United Kingdom and has a presence in different parts of Europe, including Cyprus, Belarus, and Gibraltar.

Capital.com operates under authorization from various top-rated European financial entities, such as:

- Cyprus Securities and Exchange Commission, CySEC

- Financial Conduct Authority, FCA

- National Bank of the Republic of Belarus, NBRB.

- Capital.com also holds an Australian license from Australia Securities and Investments Commission, ASIC.

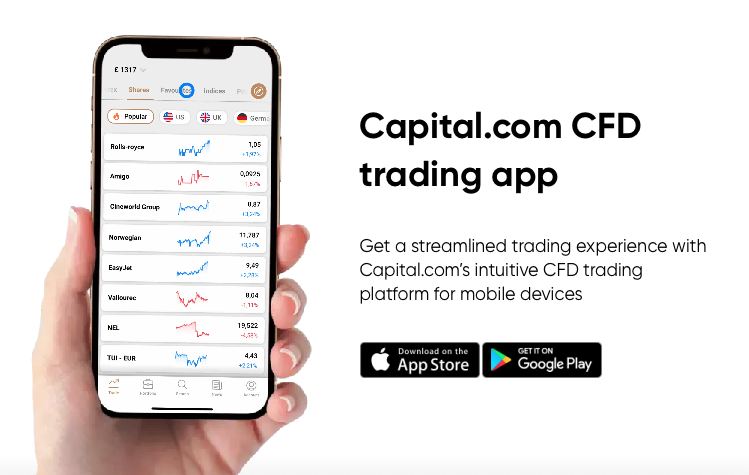

Capital.com only requires a $20 minimum deposit to trade on its platforms. Serbian traders can access hundreds of forex pairs and CFDs through this broker. Trading costs are highly competitive. Services are available on the MetaTrader 4, Capital.com app, and Tradingview for social trading. Clients can also access their accounts on mobile phones. All the necessary functionalities are available in the mobile version.

Capital.com offers commission-free accounts with low spreads averaging 0.80 pips on major pairs during active trading hours. There are no charges on withdrawals, deposits, or dormant accounts. The broker provides a free demo account and abundant educational resources for traders of all levels. Social trading gives customers access to a community of skilled traders, where they share experience and boost their trading skills.

The disadvantage of trading with Capital.com

Capital.com does not offer Islamic accounts. So their services are not suitable for Sharia-compliant investors.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Blackbull Markets allow global traders to buy and sell foreign exchange in the Electronic Communications Network (ECN).

The New Zealand Financial Service Provider’s Register (FSPR) regulates this broker. BlackBull Markets operates with a license from the Financial Markets Authority of New Zealand, FMA. They are also registered with the Financial Service Authority of Seychelles, FSA.

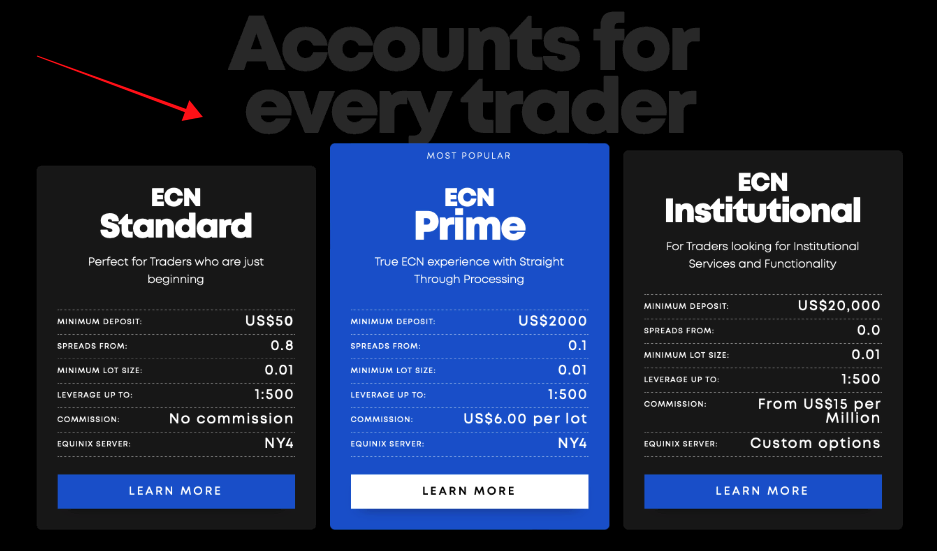

BlackBull Markets provides authentic ECN execution, allowing clients to get the best prices and the tightest spreads for the assets. Serbians can choose its STP commission-free standard account or the commission-based ECN type. The average spread on the standard is 0.8 pips on majors. In contrast, the average on the raw ECN account is around 0.4 pips, with a $3 per trade commission.

Traders can use the MetaTrader 4 and 5 or the broker’s app. Mobile trading is available. PAMM and MAM accounts are also provided, allowing efficient social and copy trading. The broker offers this service through Zulutrade and MyFxbook.

Demerit of trading with BlackBull Markets

Trading on this broker’s platform requires a minimum deposit of $200. Its competitors allow a much lower minimum deposit, making it easier for new traders to get into the market.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a popular global forex brokerage firm based in Belize. The company started offering brokerage services in 2009. They have offices in Cyprus, New Zealand, and the United Kingdom.

RoboForex operates with licenses from the IFSC. The International Financial Service Commission is Belize’s apex financial authority. Besides these licenses, the broker has built strong credibility in the industry and is now among the most trusted in Europe and the world.

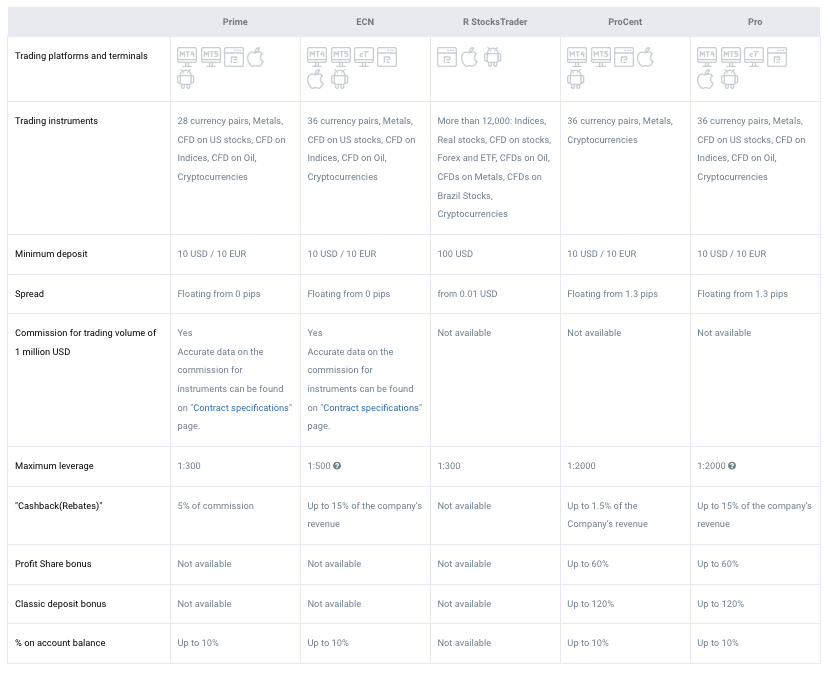

RoboForex offers customers different account types on several trading platforms. The account types are Pro standard, Pro cent, Prime, ECN, and RStocksTrader. Trading is conducted on MT4, MT5, cTrader, or the RTrader. These provisions allow diverse trading styles and welcome traders of any level.

The broker offers among the most competitive spreads and commissions. 0.1 pip is the lowest spread during peak hours on major crosses. The commission is $2 per side. The broker’s several bonus programs are also worth consideration. Newly registered clients get a $30 bonus. Deposit bonuses and rebates are also available for existing customers. The minimum deposit required is $10.

The disadvantage of using RoboForex broker

Traders must be aware that withdrawal fees apply with this broker. This is uncommon as many reputable brokers provide this service at zero charges.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a globally recognized brokerage firm and has offices in Germany, Cyprus, the United Kingdom, Kenya, and Dubai. Its headquarter is in Melbourne, Australia.

Several acclaimed financial bodies in Europe, Africa, and Asia regulate this broker, making them one of the most credible ones you’ll ever find.

Its regulators are:

Pepperstone offers ECN execution type on its razor account. Traders enjoy superfast order executions at less than 3 milliseconds. You get the best deals for the forex pair, no slippage, and added profits with more trades. Spreads on this account, on average, are 0.4 pips, and commission is charged at $3 per trade.

The standard account uses the STP execution model and is commission-free. The average spread on this account is 0.8 pips on major currency crosses like the EURUSD. This rate mostly applies to peak hour trading. The broker provides trading services on the MT4, MT5, and cTrader. Several plugins have been included to enrich trading and improve the users’ profitability. Among these are automated trading support, Autochartist, API, etc.

The drawback of using Pepperstone

Pepperstone offers rich education and research content. But users can not track their progress because they do not include tests and quizzes.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a leading binary option (only for professional traders and those outside of EAA countries) and forex broker in Europe. The company was created in 2013 in Cyprus and now has a physical presence in the United Kingdom and Seychelles.

IQ Option operates with licenses from two prominent financial bodies, the Cyprus Securities and Exchange Commission CySEC and the Financial Conduct Authority FCA.

The broker offers services on its in-house trading app. Traders can access binary options (only for professional traders and those outside of EAA countries), digital options, forex pairs, and other instruments on the app. A unique product was recently introduced called the FX option. Unlike binary options (only for professional traders and those outside of EAA countries), the FX option allows traders to exit positions before the transaction matures.

Serbians can choose from its standard or VIP account. The minimum deposit is $10 and $1900, respectively. These account types are all commission-free, and the average spread is 0.8 pips on majors.

The demerit of trading with IQ Option

The broker does not offer the MetaTrader suites. Therefore, some competitive trading tools might be missing. Many customers are more comfortable with the MetaTraders because of their numerous charts, indicators, and other helpful tools.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in the Republic of Serbia?

As a European Union member country, Serbia’s financial regulations conform to Europe’s Market in Financial Instruments Directives (MiFID).

The general overseer of the country’s financial market is the Serbian Securities and Exchange Commission (SEC). Brokers who wish to operate within Serbian borders have to adhere to stricter regulations by this entity.

The Serbian SEC is in charge of maintaining order in the country’s finance sector. The entity works hard to improve customer protection by maintaining integrity, transparency, and efficiency in its financial market.

The SEC regulates all market participants in the country, including brokerage firms, banks, investment fund companies, audit companies, and portfolio managers. The National bank of Serbia also regulates the banks.

The Serbian SEC issues licenses to any investment company that wishes to provide financial service in the country. These companies also include forex and CFD brokers. Such companies cannot operate without an SEC license.

Part of the SEC’s regulation is the requirement for a minimum capital investment ranging from €125000 to €730000. This makes it extremely difficult for forex dealers to operate within the country.

Many brokers who deeply wish to operate inside Serbia but do not want to fully engage the SEC often partner with other investment companies to obtain the license. The partnered companies can operate as one, offering different investment and trading services.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Serbian traders – Good to know

Serbia is a part of the EU, and besides a few regulations, other financial laws are per Europe’s regulations.

The implication is that Serbian traders can safely deal with other international brokers operating within the EU. The trader must confirm the broker’s license before signing up.

Serbian traders must trade forex within EU regulations regarding leverage and other rules. That is why they should trade with global brokers operating with a European recognized license.

Is it legal to trade Forex in Serbia?

Yes, it is legal to trade forex in Serbia. The trader must deal with a domestic broker authorized by the Serbian Securities and Exchange Commission (SEC). Or they must deal with a broker that operates with a license recognized in the EU regions.

How to trade Forex

There are three necessities to trade forex. They are:

- Reliable internet service

- A smartphone, tablet, or computer.

- A good forex broker account

Uninterrupted internet connection will ensure smooth trading. A bad connection means that the order will not get to the broker at the right time. You can lose money attempting to trade with a bad connection.

Another major requirement for trading forex is a broker account through which you access the foreign exchange market.

The online forex broker makes this available and offers their platforms for this service. The individual or company has to register with the broker to get such an account.

Trading attracts fees, which is how the broker gets paid for their service. Some brokers are more expensive than others. Traders seek low-fees brokers offering quality service. Fortunately, the market is highly competitive, and many renowned brokers offer first-rate service at reasonable fees.

How to identify a good broker:

- License

The broker should have one or more licenses from an acclaimed financial entity. Such an entity ensures your safety and fair business practice on the broker’s platforms.

- Competitive fees

There are many brokerage firms in the industry. The trader should compare the spreads and general trading costs, including non-trading expenses, before signing up to trade with a broker. Good brokers ensure their pricing is within or below the market average.

- Free demo account

Reputable brokers always give potential customers access to their trading platforms for testing and practice. Ensure you can access a free demo account with your broker of interest.

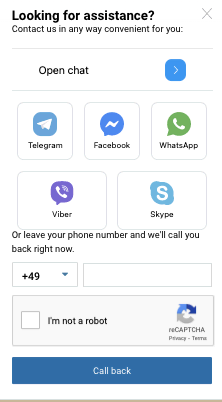

- 24 hours support

Customer service should be accessible any time during market days. Good brokers provide 24 hours through phone, live chat, or email. Some support services are available on social media chats.

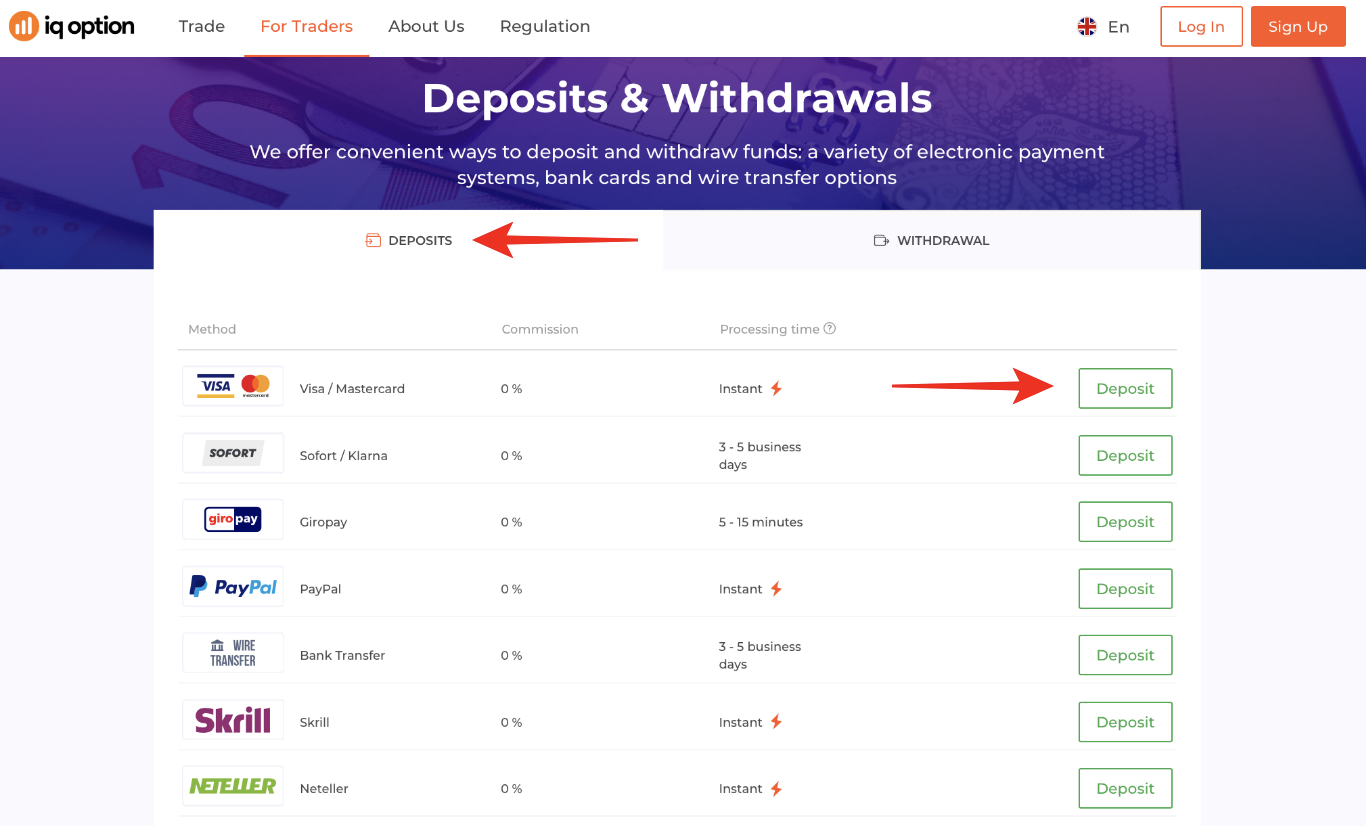

- Popular payment methods

Traders must be able to fund their accounts and withdraw profits easily. The broker must provide easy payment methods available in your country for this.

These points are what to expect from a good broker, and they are verifiable before depositing funds in the broker’s account.

Steps to trade forex in Serbia:

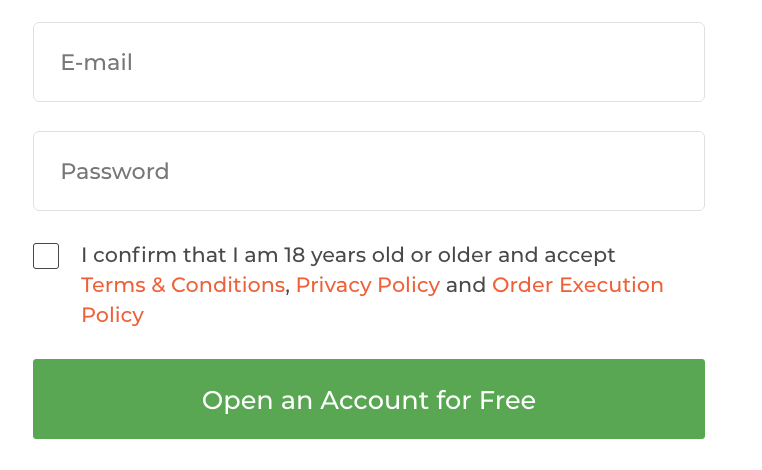

1. Open account for Serbian traders

Go to the broker’s website to signup for a new account. The create account tab is often displayed boldly on the landing page. Click on that and fill out the form that pops up.

Very few details are requested at this stage: your email, perhaps name, and phone number. Once you click submit, the system sends a verification email to your inbox.

Open your mailbox and click on this link to verify the details you provided. In most cases, you will be redirected to a page where you then complete the registration form.

Ensure you have a government-issued ID card and proof of address ready. The broker may request you upload these documents as KYC requirements. The process is complete once you do that, and the new account gets created.

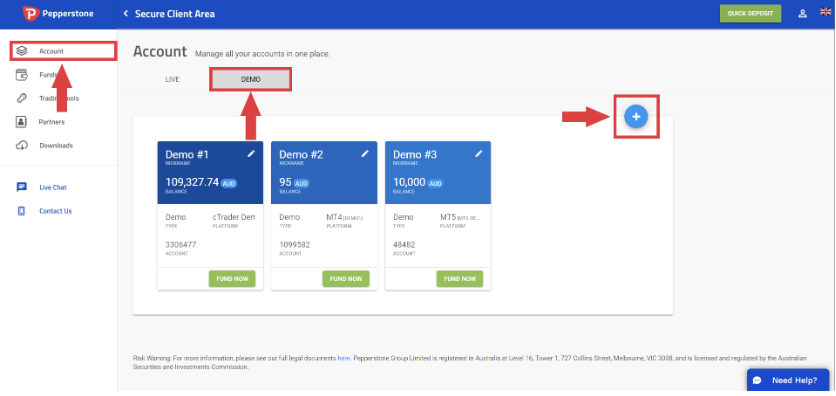

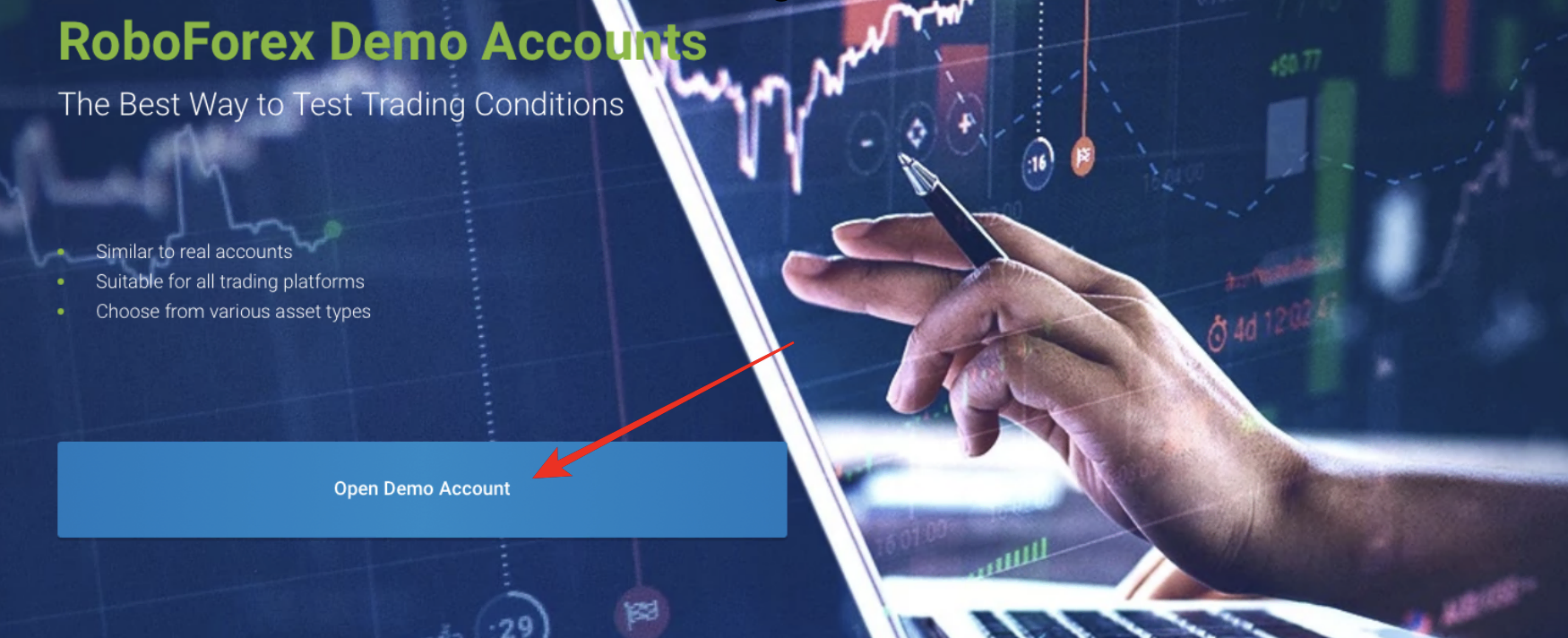

2. Start with a demo or real account

The next step is testing the broker’s trading platform. As we mentioned, the broker must provide a free demo for this. This free account must have enough virtual credit to carry out several test trades, usually $10000 credit.

The demo is extremely useful if you’re new and helps you get familiar with the forex trading environment before starting. Existing traders who are switching brokers can also use this account to test the broker’s platform. They may also test trading strategies to see if the broker is suitable.

3. Deposit money

After testing and practice, it is time to trade on a real account. This requires real funds. The FUNDS tab on the platform should include a deposit option.

The process should be easy as long as the broker provides common and simple payment methods. These often include Visa, MasterCard, Wire transfer, and PayPal. Other local PSPs may be available too.

The funds you transfer should reflect in full within minutes. Brokers hardly deduct fees for depositing funds. The trader must thoroughly research the broker’s fees before trading. You want to save costs while trading and many reputable brokers do not charge deposit fees.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

The next step before placing your first trade is market analysis. It isn’t easy to successfully trade the forex market without first analyzing it.

Market analysis gives you invaluable insight into the asset you wish to trade. It helps you understand the exchange rates’ past prices and makes it possible to predict future moves.

Successful investors conduct two crucial analyses before placing trades:

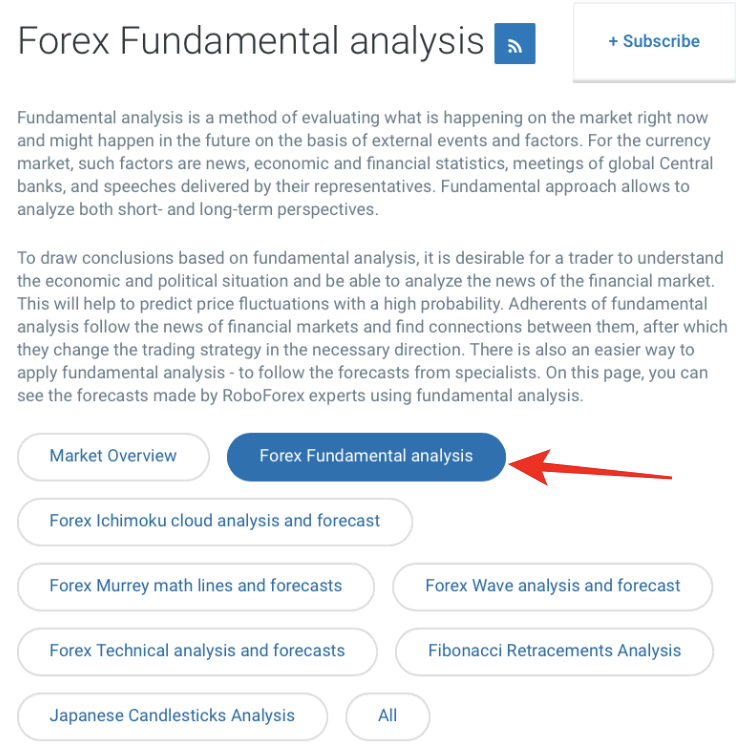

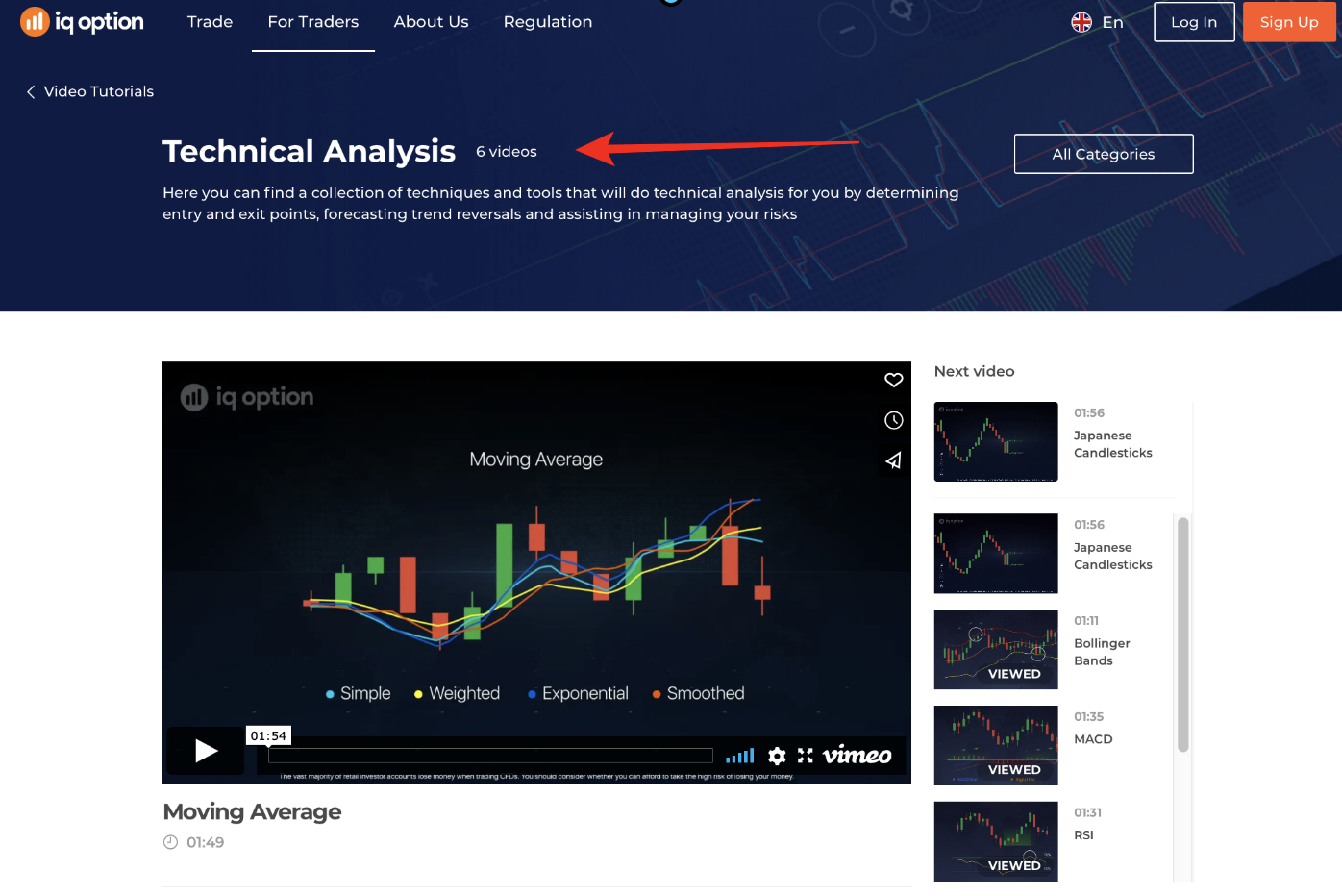

- Fundamental

- Technical analysis

Fundamental analysis involves the inherent factors that cause the exchange rate to move up or down. They form the country’s economy and include interest rate, inflation, gross domestic product (GDP), employment rate, etc. These factors are inescapable, so they are called forex fundamentals. The trader examines them to understand the currency’s status. This then helps them make the right trade decision.

Technical analysis is more commonly used in forex. The trader looks at the forex chart and spot price patterns containing important trading opportunities. Trading platforms always include many tools for this analysis, and the trader must learn to use and interpret the results. The patterns show the best entry and exit points that the trader must identify to trade profitably.

Forex trading strategies:

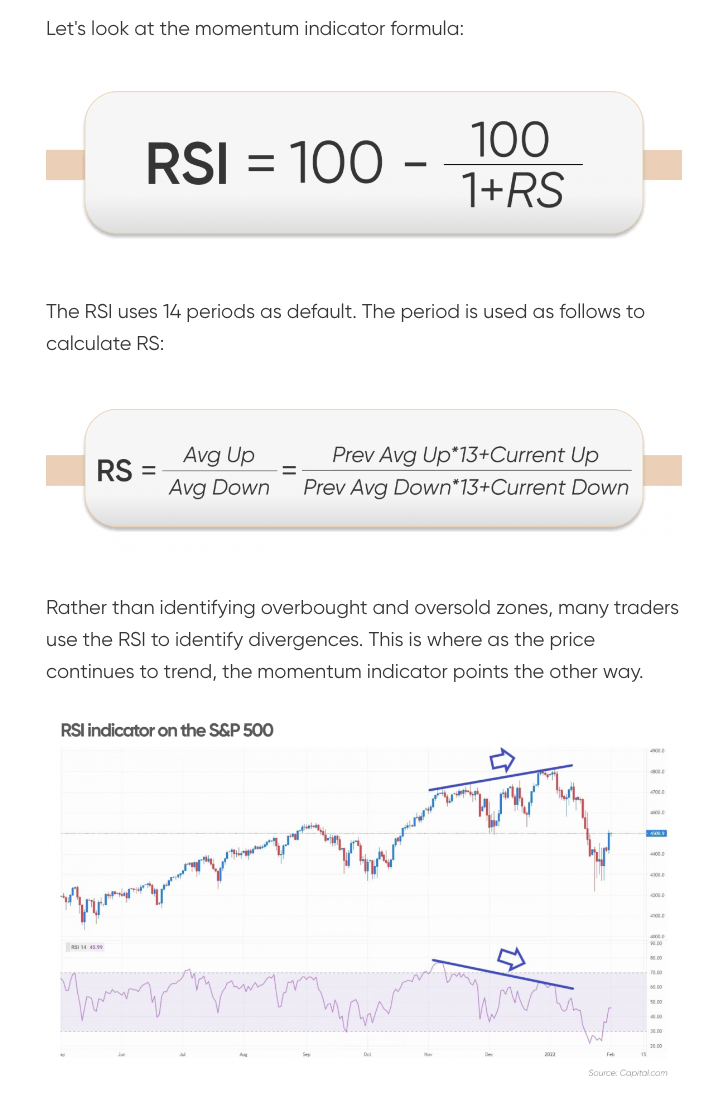

Momentum trading

The momentum strategy involves trading in the direction of the prevailing momentum. Usually, the trader believes the price will continue in this direction for some time. So they trade according. If the price falls, the trader goes SHORT on the currency pair. If it increases and shows a proven uptrend, the traders go LONG. Confirming the trend is essential to profit from this strategy. Brokers provide several indicators to help with this, including the RSI and Stochastic.

Other powerful forex trading strategies exist. The trader must study and understand these before using any of them.

These other forex strategies include:

- Range trading strategy

- Pullback strategy

- Breakout trading

- Price action

5. Make profit

Place your first trade according to the analysis and strategy you come up with. The proper analyses and an effective strategy will earn you profit for sure.

You can withdraw the gains or raise your capital. Withdrawal is as simple as a deposit with the right broker. Although transferring funds from the account takes more time to process.

The same deposit method is used for withdrawal. The average time length for processing is 48 hours. Some brokers take less time, and others take longer. The payment method also determines how long it takes before the money gets to you.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Serbia

Thousands of online brokers accept Serbian traders. But their offering differs, and the trader must examine these to choose the most suitable one. Our recommended brokers are worth considering. It helps to check out their demo accounts before making a final decision.

FAQ – The most asked questions about Forex Broker Serbia:

Are there any good forex brokers in Serbia?

There are plenty of brokers in Serbia that offer traders the best trading services. Five include IQ Option, RoboForex, Capital.com, Pepperstone, and BlackBull Markets.

These brokers operating in Serbia establish the definition of being the best. Besides, the brokers also offer a wide of forexes to users. So you never have to bother about skipping out on any amazing benefits when trading with these brokers.

How should a trader in Serbia plan his trading moves?

A Serbia trader should be cautious while placing his forex trades. He should remember that trading involves a massive fundamental analysis. In order to know what is going on in the currency market, one needs to follow the news. Besides, trend analysis is also an important factor in determining the performance of your trading decision. In addition, you should also keep trading tools and technical indicators handy.

Which forex brokers in Serbia charge low fees from traders?

Out of all forex brokers, these five brokers charge the lowest fees from brokers. Each of these brokers mentioned above allows you to trade with ease and has a lot to offer. These brokers make your trading experience worthwhile with low fees. Besides, their spreads are also the best in the market.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)