4 best Forex Brokers and platforms in Slovenia – Comparison and reviews

Table of Contents

If you’re looking to get into the world of forex trading, then it’s essential to do your research first. Not all brokers are created equal, and some are better suited for novice traders than others. In this article, we’ll look at the five best forex brokers and platforms in Slovenia.

See the list of the 4 best Forex Brokers in Slovenia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 76% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 76% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

See here the comparison of the best FX Brokers in Slovenia:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a broker that offers an innovative way to trade stocks and ETFs. Their platform uses machine learning to provide users with better investment opportunities. The company was founded in 2017 by a team of experienced professionals from the financial and technology industries. Capital.com is on a mission to make trading easy and accessible for everyone.

Capital.com is a London-based online broker established in 2016. The company offers a wide range of assets for trading, including Forex, indices, commodities, and stocks. Capital.com also has a mobile app that lets traders trade on the go.

Capital.com is a web-based broker that offers CFDs and Forex. The company is headquartered in London, England, with additional offices in Limassol, Cyprus.

Capital.com is a regulated company authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. The company is also a member of the Investor Compensation Fund (ICF) in the United Kingdom.

Benefits of Capital.com

- Traders on the Capital.com trading platform are provided educational materials.

- Capital.com traders trade at no commission rate.

- The account opening process is seamless.

- The customer support is excellent.

Drawbacks of Capital.com

- United States traders are not accepted on Capital.com.

- Capital.com’s web trading platform does not have a price alert.

(Risk warning: 76% of retail CFD accounts lose money)

2. BlackBull Markets

The company offers a wide range of products, including Forex, stocks, indices, commodities, and cryptocurrencies. The company is based in Auckland, New Zealand, founded in 2014. BlackBull Markets is licensed and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

BlackBull Markets is a registered and regulated investment services company with offices in New Zealand and Australia. They offer experienced traders an intuitive, feature-rich trading platform and access to global markets, including indices, commodities, shares, and Forex. The tight spreads and exceptional customer service provide investors with the best possible trading experience.

They offer a variety of account types, including a demo account, to find the one that best suits your needs. You can also open a real account with as little as $100.

Advantages of BlackBull Markets

- They offer traders a wide range of assets to trade.

- Advanced charting and analysis tools are available to traders on BlackBull Markets.

- BlackBull Markets offer traders high-quality education materials.

- Customer support is available five days a week.

Disadvantages of BlackBull Markets

- Traders are charged withdrawal fees every time they withdraw.

- The research material available to traders is limited.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is one of the world’s largest and most respected Forex brokers. Founded in 2010, the company has clients in over 150 countries. Pepperstone offers some of the lowest spreads and most competitive rates available. Clients have access to a wide range of tradeable assets, including Forex, commodities, indices, and stocks. In addition to its award-winning trading platforms and customer service.

Pepperstone is an Australian online forex broker that offers traders access to the global forex market through innovative and user-friendly trading platforms.

Pepperstone has won awards over the years, including ‘Best Forex Broker at the prestigious FX Empire Awards in 2016 and 2017. The company has also been awarded ‘Best Newcomer at the UK Forex Awards in 2014 and 2015.

Pepperstone is a Forex broker that provides online trading services to retail and institutional investors. The company is headquartered in Melbourne, Australia.

Pepperstone offers more than 100 instruments to trade, including 50 currency pairs, ten indices, six commodities, and 20 Cryptocurrencies.

Benefits of Pepperstone

- Traders are not charged withdrawal fees.

- Traders on the Pepperstone trading platform are not charged deposit fees as well.

- The customer support available to traders is outstanding.

- Opening an account is simple.

Drawbacks of Pepperstone

- Pepperstone offers its traders mostly CFDs.

- The MetaTrader trading platform available on Pepperstone is primary.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a regulated binary options (only for professional traders and outside EAA countries) broker owned and operated by IQOption Europe ltd. It is one of the most popular brokers globally, with more than 14 million registered traders. The company is CySec regulates it, and the platform offers a wide range of tradable assets, including stocks, indices, Forex, and commodities. IQ Option also has a user-friendly interface and offers a great mobile trading experience.

The company provides services for trading in options contracts on the exchange. IQ Option offers its services to both individual traders and institutional investors. The company’s customers can trade through an online platform, which offers real-time quotes of financial assets and a variety of trade orders and strategies.

IQ Option is a well-known online broker that offers CFDs and forex trading. IQ Option offers a wide range of tradable assets and a variety of account types to suit the needs of individual traders. The broker also provides a comprehensive education center that helps traders better understand the financial markets and how to trade them profitably.

Pros of IQ Option

- IQ Option is a safe platform to trade on as a reputable body regulates it.

- IQ Option does not charge its traders’ withdrawal fees.

- To open an account on the IQ Option trading platform is easy.

- IQ Option provides its traders with various trading tools.

Cons of IQ Option

- MT5 and MT4 trading platforms are not available on IQ Option.

- Traders from Australia are not accepted.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Slovenia?

The Republic of Slovenia is a small country in Central Europe with just over 2 million people. Yet, its economy is relatively prosperous, and its financial sector is highly developed.

The banking sector in Slovenia is highly concentrated and dominated by two banks, holding more than three-quarters of the banking system’s assets.

Slovenia is a small, open economy highly dependent on foreign trade. The country has been a member of the European Union since 2004 and of the eurozone since 2007. Slovenia has also been a member of the OECD since 2010.

The financial crisis, which began in 2008, had a significant impact on Slovenia. The banking sector was particularly affected, with some banks requiring state intervention. In March 2013, the government of Slovenia agreed to an assistance package from the European Commission, the International Monetary Fund, and the European Bank for Reconstruction and Development.

The financial sector in Slovenia is regulated by the Bank of Slovenia, which is responsible for the overall supervision of the banking system, issuing bank licenses, maintaining public confidence in banks, and promoting a sound and efficient banking system. The supervisory authority is also responsible for preventing and suppressing money laundering and terrorist financing.

Several credit institutions operate in Slovenia, including commercial banks, savings banks, credit unions, and leasing companies. The largest of these is Nova Ljubljanska Banka d.d., which has a market share of around 25%.

(Risk warning: 76% of retail CFD accounts lose money)

Security for traders in Slovenia

Forex traders in Slovenia face a unique security challenge. Because they are not dealing with stocks or other traditional securities, they must take extra precautions to ensure the security of their funds. One standard method is to use a foreign exchange broker to hold the trader’s funds in a segregated account. Even if the broker becomes insolvent, the trader’s money remains safe and accessible.

Forex trading is a high-risk investment activity, and as such, traders in Slovenia need to take steps to ensure their security. There are several measures traders can take to protect themselves from online scams and cybercrime, including using strong passwords, installing anti-virus software, and being aware of the warning signs of a scam.

In addition, traders need to be aware of the risks associated with forex trading and only invest money they can afford to lose. Forex trading should not be seen as a way to make quick and easy money.

Is it legal to trade Forex in Slovenia?

The legal status of forex trading in Slovenia is a little ambiguous. The Central Bank of Slovenia has stated that foreign exchange trading is not illegal, but it hasn’t regulated the market either. This leaves room for unofficial forex trading, which can be risky because there’s no guarantee that your broker is legitimate or that your money will be protected in the event of a dispute.

There is no definitive answer to this question, as the legality of forex trading in Slovenia will depend on the specific legislation that is in place in the country at any given time. Generally speaking, forex trading is legal in most countries, but restrictions or conditions may apply. It is always advisable to seek legal advice before engaging in forex trading.

Slovenian law does not explicitly regulate forex trading, so it is technically legal to engage in this activity. However, forex trading can be risky, and it is essential to be aware of the potential risks involved before deciding whether to trade currencies. Additionally, it is essential to only work with reputable and licensed forex brokers to minimize the risk of fraud or other financial losses.

How to trade Forex in Slovenia – Tutorial

Forex trading is buying or selling currencies to make a profit. Slovenia is a great place to trade Forex because it has a stable economy, and it is easy to access information about the market.

The first step in forex trading is opening a trading account. There are many types of accounts, and you should choose one that fits your needs. Next, you need to fund your account with money you can afford to lose.

Once your account is funded, you can start trading. The most important thing to remember when trading forex is always to use a regulated forex trading platform.

Open an account

When you are ready to open a forex account, you will need to research to find the best forex broker for your needs. You will want to look for a broker that offers a wide range of currency pairs and has a low spread.

You will also need to decide what type of account you want to open. There are many Forex accounts, and each has its benefits and drawbacks. The most important thing is to find an account that matches your trading style and needs.

There are three main types of forex accounts: standard, mini, and micro. The standard account is the most popular type; it requires a minimum deposit of $200 and allows you to trade in large quantities. With a standard account, you can trade in both directions (up or down) and use leverage to increase your profits.

Another type of account is a mini account. This account has a minimum deposit of $50, and it offers limited leverage. The mini account is suitable for traders who are just starting.

To open a forex account, you will have to provide your personal information, proof of residency, and a valid identification card.

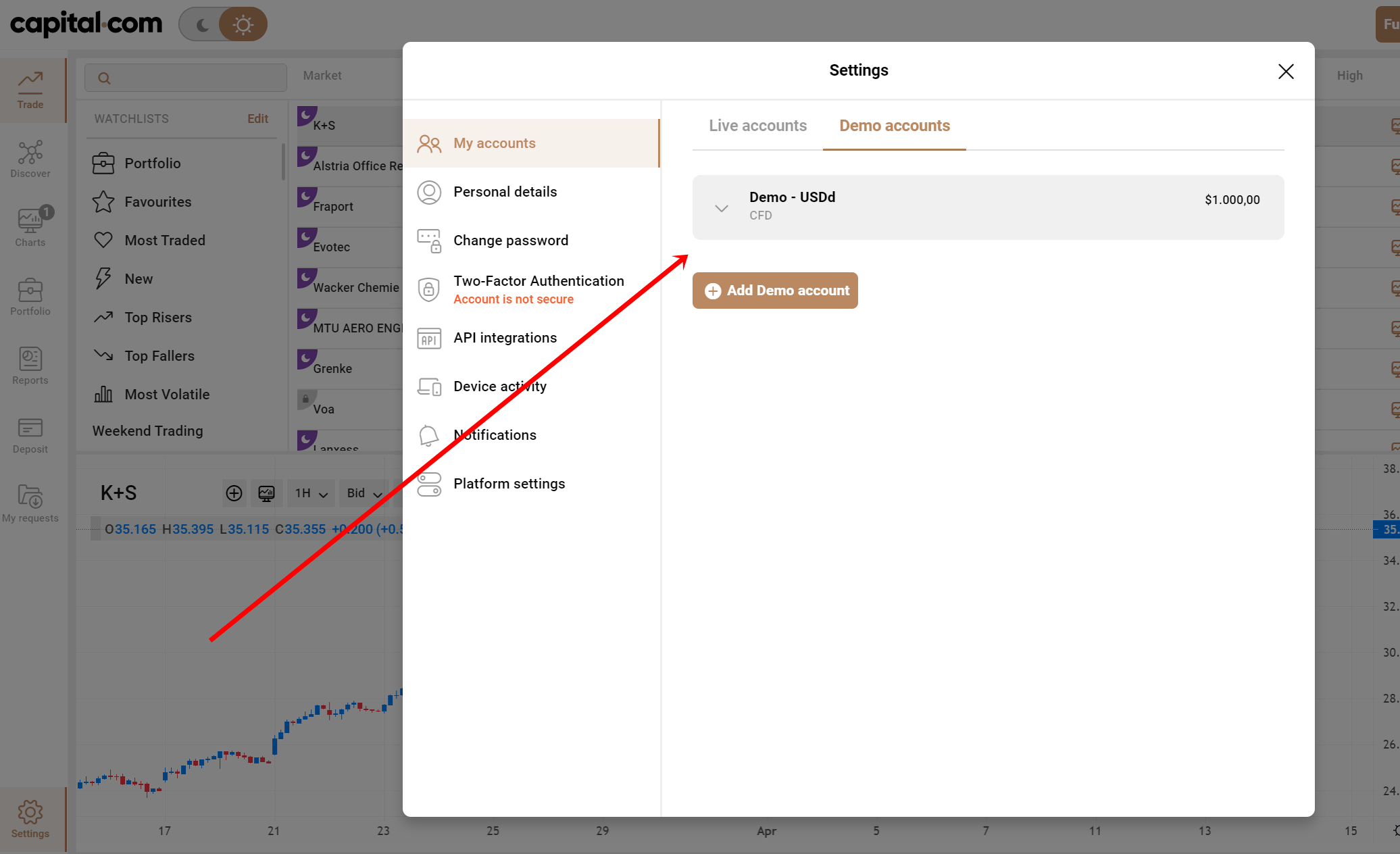

Start with a demo account or real account

When starting Forex trading, it is essential to start with a demo. A demo account will allow you to trade dummy currency for practice before trading with your own money. A real account allows you to trade actual currency and potentially make money. Be sure to research different brokers and find one that offers good customer service, low spreads, and reasonable commissions.

Deposit money

When you are ready to start trading Forex, you must first deposit funds into your account.

There are several ways you can deposit money into your forex account. The most common methods include wire transfers, credit cards, and debit cards. In addition, some brokers also offer e-wallet services like Neteller and Skrill.

Whichever payment method you choose, be sure to research the broker’s policies and procedures for depositing.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies to position trading

Position trading is a longer-term form of trading that takes advantage of small price moves to open and maintain trade with the expectation of a more significant move in the underlying security. Position traders hold their positions for weeks or months and usually have a target price in mind at which they will close the position.

Because position traders are not trying to take advantage of short-term price fluctuations, they generally do not use technical analysis to make their trading decisions. Instead, they use fundamental analysis to decide what stocks or commodities to trade and when to enter and exit the market.

Scalping

Scalping is a trading strategy where traders buy and sell stocks quickly and take advantage of small price movements. Many people think scalping is a high-risk trading strategy, but it can be very profitable if done correctly.

The key to successful scalping is finding stocks moving in the right direction and having enough liquidity. It would be best if you also had a good understanding of technical analysis to time your trades correctly.

Day trading

Day trading is buying and selling stocks, shares, options, or any other security throughout the day. Contrary to what some people may think, it’s not all about making quick and risky moves in the market. Successful day traders often use a slower, more systematic approach to minimize risk and maximize profits.

There are a few key things to remember if you’re thinking about starting day trading. First, it’s essential to do your research and learn as much as you can about the market and the strategies that work best for you. Second, always trade with money that you can afford. Lastly, don’t let your emotions get the best of you. Stick to your trading plan.

Make profit

Forex trading is a great way to make extra money on the side or even a full-time job. It’s also one of the most popular methods of trading, with around $5 trillion traded every day. However, like any other form of trading, forex trading requires skill and practice to succeed.

To make profits trading Forex, you need to learn the basics of forex trading. This includes learning about the different currencies, how to read charts, and how to use indicators. You also need to develop a strategy that works for you and stick to it.

(Risk warning: 76% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Slovenia

This article provides a list of the 4 best forex brokers in Slovenia. If you are interested in trading forex, choosing a regulated broker with a good reputation is essential. This article provides a list of the best brokers available, so you can decide which one is right for you.

FAQ – The most asked questions about Forex Broker Slovenia :

How to safely trade through a forex broker in Slovenia?

Safety in forex trading requires you to look for a regulated, reputable, and licensed forex broker in Slovenia. Further, ensure to place only some of your money into trading and keep little margins because you never know when you will fall into debt. If possible, try practicing on a demo account to understand the risks and situations of real-life forex trading without actually spending your money.

How to limit your risks using a forex broker in Slovenia?

When you use a forex broker in Slovenia, understand the inherent risk levels properly. Further, consider the following points:

1. Look how you use your leverage. Accessing leverage as high as 30:1 can result in an immediate margin call.

2. Before spending your money on trading directly, practice on a demo account, and craft your unique trading strategy before entering the forex market.

3. Look after the major currency pairs to prevent the volatile market from making you lose money.

What to expect from a forex broker in Slovenia?

Keep the following expectations from the forex broker Slovenia:

1. They will open your trading account.

2. You need to prove your identity through documents asked by the broker.

3. Prove your funds and wealth source through KYC (Know Your Customer).

4. Maintain responsible trading, and the broker might check in with you frequently.

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)