The 4 best Forex Brokers and platforms in Somalia – Comparison and reviews

Table of Contents

Forex trading in Somalia is straightforward. The only problem you might face as a Somalian Forex trader is finding a credible forex broker to trade with. Somalia is a country that does not have any local regulatory body that guides Forex brokers. Somalians usually trade with those brokers that have international regulatory bodies instead.

See the list of the best Forex Brokers in Somalia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Suppose you are new to Forex trading and do not know where to start. In that case, this article is for you because the article provides you with the five best Forex brokers with international regulatory bodies, how to begin your forex journey and strategies you can use to make you a very skilled Forex trader in Somalia.

The list of the 4 best brokers platforms in Somalia is including the following brokers:

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. BlackBull Markets

BlackBull Markets has its headquarters in New Zealand. The company is both a Forex and Fintech-based one that has existed since 2014. The broker is appropriately regulated by the Financial Markets Authority (New Zealand) and the Financial Service Authority (Seychelles). Traders can trust the broker because of its regulatory bodies that are internationally recognized and based.

The platform is Forex, CFDs, and Commodities based, which provides its clients with in-house market information. The information provided by the platform helps traders to take careful and strategic steps in positioning themselves when the market starts.

When traders want to open an account on BlackBull, they will notice two account types available. The standard account, and then there is an ECN prime account. Traders that select the standard account start trading with a minimum deposit of $200, and the standard account also has a Forex spread that starts at 1.3 pips. Traders with the ECN prime account enjoy a certain amount of commission at every trade they make, and there is a minimum deposit of $2000 that has to be made to start trading.

The platform is made available for both web and mobile devices. Traders can make trade anywhere they wish because of this. The process is fast and smooth if you also want to open an account on BlackBull Markets. And it offers its clients good customer service response.

Pros of BlackBull Markets

- The platform is a MetaTrader platform. This means that it is well-improved

- They offer low CFDs and Forex fees

- Transactions are fast on BlackBull Markets, thanks to its servers

- Offers good market resources

Cons of BlackBull Markets

- There is an amount fee that is attracted when you want to withdraw

- It does not provide educational resources

- It does not accept clients from the US

(Risk Warning: Your capital can be at risk)

2. RoboForex

RoboForex came about in 2014 and had since then been growing. Today RoboForex has a valuable range of about 2.5 million around the world. The security of the traders is well in place because the IFSC regulates the FX broker. The platform offers over 11000 trading instruments that allow traders to select from a wide range of instruments to trade with.

The platform offers three different trading platforms to its traders. MetaTrader platforms consist of MT4 and MT5 and then cTrader platforms too. MT4 is an excellent platform for new and old traders because it offers outstanding technology, and traders can create a bot that can strategize for them. The MT5 platform is even more improved than the MT4 platform.

The broker platform allows flexibility because traders who own a laptop or a phone can still use it and get the same experience. The mobile version still has available the MetaTrader platforms and cTrader.

To begin trading on RoboForex, traders must, first of all, make a minimum deposit of $10. Traders who want to experiment with Forex trading can start with such a small amount with the live account. If it is favorable to them, they may continue and even deposit a higher amount if they like the market turnout. There is also a demo account available on the platform for traders.

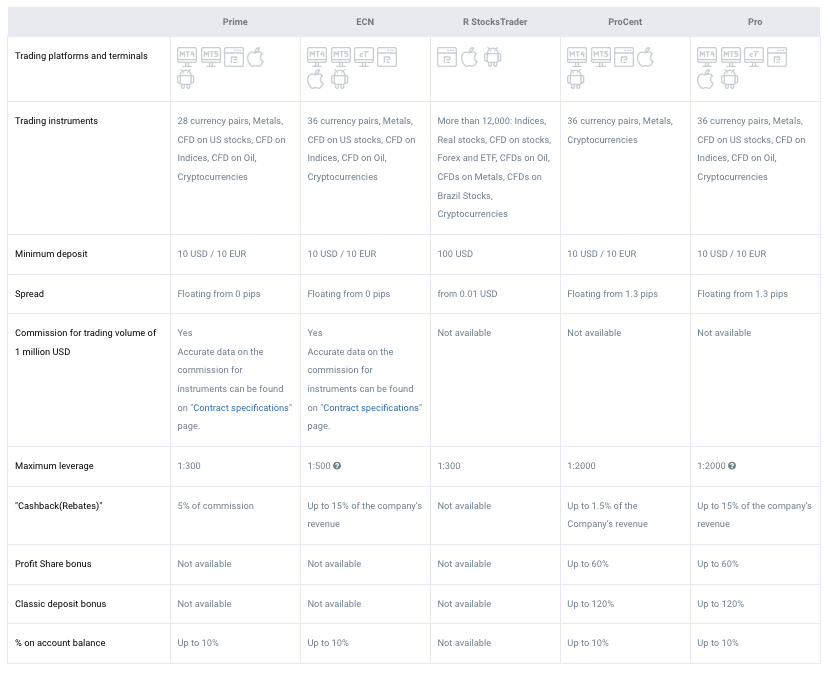

RoboForex offers five different account types – Prime account, ECN account, R StocksTrader, Pro-Cent account, and Pro-Standard account.

All except the R Stocks Trader account offer the same minimum deposit amount to the traders. The R Stocks Trader starts from $100.

Advantages of RoboForex

- The platform has a Copytrade investment platform

- It offers MetaTrader and cTrader platforms

- The trading platform is flexible because there is both a phone app and a web version.

- It is a commission-free market zone

Disadvantages of RoboForex

- US and Canadian traders are not accepted on the platform

- The spread is not fixed

- Slow customer service response

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone started in 2010 but established its office in London in 2016. The Forex broker is well regulated by international regulatory bodies in Europe, Kenya, Dubai, the Middle East, and other African markets. These international regulatory bodies make Pepperstone accountable to its clients worldwide.

The platform is a broker of various assets, including gold, commodities, metals, and crypto. Traders can easily trade with any of the assets on the platform.

Pepperstone has two account types available for users to choose from. A standard account that traders can start trading on with a deposit of $200 and a market spread that operates at 1.3 pip. Traders with the standard account receive no commission on their trades.

The other account is the razor account, and traders need to make $2000. The spread of this account is at 0 pip, but there is a commission that traders have on their trade.

Pepperstone is a MetaTrader and cTrader platform. Traders enjoy secure trade and technologically developed trading platforms. Traders can easily navigate the platform and easily open and close their trade, among other things. Pepperstone MetaTrader platform is equipped with plug-ins that quickly make trading and positioning on the chart. Some bots help traders properly strategize their market moves.

Merits of Pepperstone

- Various payment methods are available for depositing funds into your account.

- There is a competitive market for traders with razor account

- Availability of plug-in that improves the trading experience

Demerits of Pepperstone

- Limited trading instruments

- The platform does not provide its traders with educational resources.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a financial services firm managed and controlled by IQ Options Europe Ltd. They’ve been providing e-commerce assistance for several years and continue to do so. The platform started up in 2013 in Cyprus, where it has its headquarters.

The platform is used for trading CFDs and binary options (for professional traders and those outside of EAA countries only). The site is user-friendly and has a huge chart that is useful for investors who want to keep an eye on market circumstances. With some instruments, margin trading is possible on the platform.

The company is regulated by the CySEC (Cyprus Securities and Exchange Commission). IQ Option is a winner of multiple awards that has to deal with providing good services for its traders. Its market competition is relatively moderate, and any trader can cope with it.

The platform offers a demo account to its traders. The demo account can be used to practice trading on the platform and know how the spread is. To begin trading with your real account, a trader must make a deposit of $10 which is affordable for most people that want to start forex trading.

The platform is available for mobile and desktop users, not leaving anybody who wants to start forex trading out of the picture.

Beneficial in IQ Option

- You can start trading with a deposit of just $10 on the platform

- There is a mobile version and web version available for users

- Demo account loaded with $10000

- Interactive forums and webinars

Drawbacks in IQ Option

- Withdrawal of money directly into your bank takes some time to reflect

- Bank transfers have worth a $31 withdrawal fee

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Somalia?

The Central Bank of Somalia regulates the financial situation of the country. It is responsible for handling all other financial institutions in Somalia, including the commercial banks, and microfinance banks, among other financial institutions in the country. This authority is available to the central bank as provided under section 120 of the Somalian Constitution.

The constitution states that every owner of money transfer businesses must register under the country’s central bank. The central bank of Somalia regulates these financial institutions, and those that do not follow the rules laid down by the CBS can be punished under the law.

Any regulatory framework does not cover forex trading in Somalia. So, for financial regulation that has to deal with Forex in Somalia, Somalian traders have to deal with brokers with international regulatory bodies.

The Central bank of Somalia and the FRC has stated that it does not give any regulation to local Forex platforms. It warns its citizens to desist from trading forex locally. It also warns that any Local Forex broker caught faces penalties for fraud and cybercrime.

Security for traders from Somalia – Facts and information

The Central Bank of Somalia has stated that there is no accredited Forex broker platform in the country because there is no framework that provides for their existence or their functioning in the country. Traders can only assure security for themselves when they trade with international forex brokers that have international licensing bodies.

Organizations from around the world regulate international licensed forex brokers. These organizations put these brokers under careful watch by ensuring that they follow the rules stipulated by the organizations.

The licenses give more credibility and assurance to the Forex broker platforms.

Some international regulatory bodies you should check for before opening an account with any forex broker are:

Most of the time, those forex broker platforms under the regulation of these bodies offer a better trading experience to their traders because the regulators make them do so. An example of this benefit is preventing fraudulent activities on the broker platform.

Is it legal to trade Forex in Somalia?

Forex trading in Somalia is legal. Citizens of Somalia can trade forex in the country. The Central bank of Somalia does not give any regulation for retail and online forex trading in the country.

It states that it is not liable to any citizen who wants to trade forex with any local broker platform. This is so because many local brokers in the country are set up, and most of them can be set up for fraudulent acts. The government warns Somalian traders to be aware of trading locally.

Traders who want to trade should make sure that international regulators internationally recognize the Forex broker they are using. This makes it legal and assures security to the Forex traders in the country.

How to trade Forex in Somalia – Overview

Open account for Somalian trader

You must first open an account for Somalian traders to begin trading on any platform. Usually, the Forex broker will ask you to provide certain information to prove your identity and location to open an account. Forex broker platforms ask new registering traders to give any of the following documents – national identification card, national passport, or a driver’s license for proof of identity. Utility bill for proof of residency.

Start with a demo account or real account

After opening an account with the Forex broker, a demo account is the first thing you will have to use for trading. The demo account is helpful if you are a new trader. Traders can use it to train themselves and know how the forex spread of that platform works. The real account is used only when you are ready to start trading live.

Deposit money

If you start trading on your real account, you will need to deposit it into your account. Traders must first fund their accounts with money. The minimum amount to be deposited to start trading varies according to the platform you’re using and the account you’re using to trade on a particular platform.

Different payment methods are available to deposit money into your live forex account.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Good traders have strategies that they use while or before they begin trading. These strategies help them to notice how the Forex market moves and where they can place their market.

Strategies used by Forex traders include:

Scalping

This strategy involves opening more than one market position in a day. The trader wants to make multiple profits from all the opened markets when they close. The profit that the trader makes is not necessarily much.

Day trading

This strategy involves noticing how the market functions in a day. It consists in opening trade in a particular position for a whole day before the market closes. The position of the trader remains the same for that day.

Position trading

In opposition to day trading, position trading involves a trader being in the same position for more than a week and can sometimes elongate into years. This is an excellent strategy if you want to know how the market works for an extended period.

Make profit

Making a profit is the end goal of every trader. Making a profit in forex depends on your position on the chart when the forex market closes. Profit-making is quite easy, but so is it to make a loss. If you’re in a not attainable position before the market closes, you will surely make a loss.

Conclusion: The best Forex Brokers are available in Somalia

The first step to trading Forex in Somalia is to open an account. Opening an account in the above forex broker platforms is easy to execute. After opening an account, you will want to deposit money into your real account and start trading. Check or learn how to master Forex trade through videos or live sessions that the broker platform may provide for you as a trader.

Trading with locally-based Forex brokers can be dangerous to you because nobody regulates them. They can be fakes and only want to make away with your money. To ensure your safety as a Somalian trader, you will want to trade with platforms that have international licensing organizations.

FAQ – The most asked questions about Forex Broker Somalia :

Which forex broker in Somalia offers the highest number of currency pairs?

There are a lot of brokers in Somalia that offer the highest number of currency pairs. However, a trader must also consider the kind of services that the forex broker offers. You can choose brokers such as IQ Option and BlackBull Markets if you want maximum forex pairs and good features. These brokers leave no stone unturned in making their clients satisfied.

How does a trader in Somalia signup for a trading account?

A trader in Somalia can sign up for a trading account simply by choosing a broker. The broker will allow him to sign up and trade. However, before you place your forex trade, you must conduct a proper technical analysis. Conducting a proper analysis will allow you to place winning forex trades.

Which forex brokers in Somalia offer the best charts and trading indicators?

The brokers that offer leading charts and technical indicators in Somalia include the following.

RoboForex

These brokers are highly efficient. Besides, they offer traders the best services that make their trading journey the best. In addition, these brokers also offer faster execution. So, a trader misses out on nothing while trading.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)