The 4 best Forex Brokers in Switzerland – Comparisons and reviews

Table of Contents

Switzerland is a major forex trading hub, and the Swiss Franc (CHF) is a functional currency in the financial market. Some international brokers have a physical presence in the country, and many outside its borders welcome Swiss traders.

See the list of the best Forex Brokers in Switzerland:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

If you’re looking to start trading or wish to change your dealer, we recommend a few of the best online brokers in this article.

List of the 5 best forex brokers in Switzerland:

Here’s a preview of what they offer:

1. RoboForex

RoboForex is a famous online forex broker based in Belize. The company started operations in 2009 and now boasts 3 million+ active traders worldwide.

RoboForex is registered with North America’s acclaimed International Financial Service Commission (IFSC).

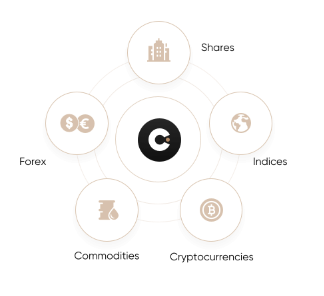

The broker provides access to trade thousands of instruments in the financial markets, such as currencies, CFDs, stocks, etc. Several account types and platform options allow traders to choose based on their style. The MT4, MT5, cTrader, and RoboForex rTrader are available for these accounts and the various tradable assets.

With $10, anyone can join the RoboForex platforms and enjoy its several bonus packages and conducive trading conditions. The broker offers zero-commission trading and raw ECN account with floating spreads and competitive commissions.

RoboForex demerit

RoboForex charges withdrawal fees.

(Risk Warning: Your capital can be at risk)

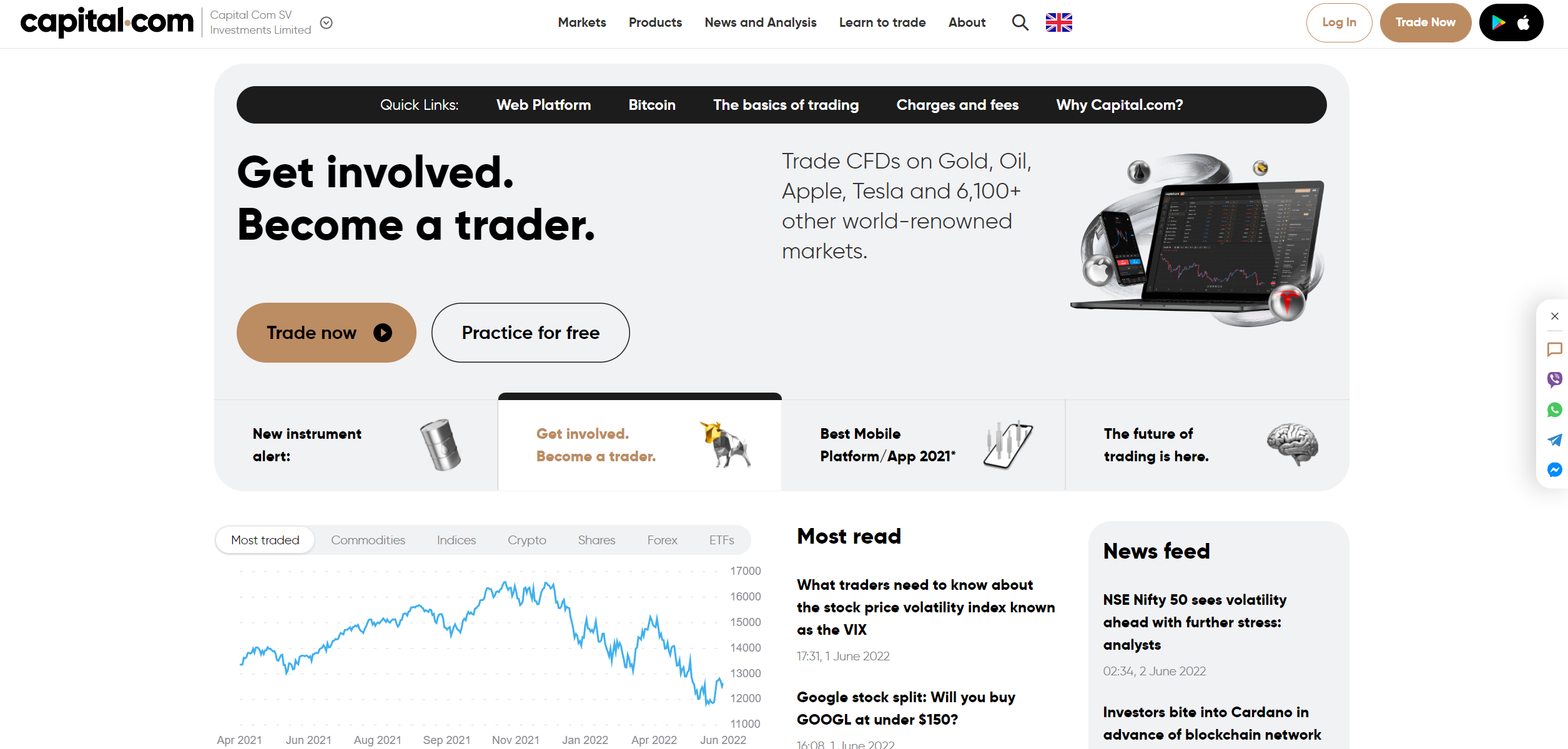

2. Capital.com

Capital.com is multiple award-winning brokerage firm headquartered in the United Kingdom. The company was founded in 2016 and now boasts more than 2 million active customers globally.

Capital.com is regulated in Europe by the CySEC, in the United Kingdom by the FCA, and in Australia by the ASIC. The broker is among the most trustworthy and offers the best trading services.

Capital.com makes forex and CFD trading easily accessible to everybody through its unique user-friendly trading platforms and a low minimum deposit of $20. Swiss traders can access various forex pairs, including CHF-paired ones and thousands of CFDs.

The broker provides commission-free trading at highly competitive spreads. There are no unnecessary fees, such as dormant accounts or withdrawal fees. According to European regulations, traders can access leverage up to 30:1 here. New customers can check out the broker’s trading environment through the free demo account.

Capital.com disadvantage

The MetaTrader 5 is not available with this broker. Traders can use the MT4 and the broker’s app for trading on mobile phones or computers.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. BlackBull Markets

Blackbull Markets is one of the well-known brokers in the Oceanic region. The brokerage was established in 2014 in New Zealand and has new offices in the United Kingdom, Japan, the United States, and Malaysia.

The company is registered with New Zealand’s Financial Markets Authority FMA and Seychelles’ Financial Service Authority FSA.

Blackbull Markets provides genuine ECN trading services on MT4, MT5, and its app. Swiss traders can speculate on their national currency and over 40 other forex pairs. Other instruments include CFDs, stocks, metals, ETFs, and oil and gas.

The broker’s trading fees are among the most competitive, with average spreads of 0.4 pips on its raw account. Swiss traders can choose a zero-commission or commission-based account and trade at the highest execution speed.

Blackbull Markets drawback

The minimum deposit to trade with this broker is $200. Other reputable brokers allow trading with a much lower amount than this.

(Risk Warning: Your capital can be at risk)

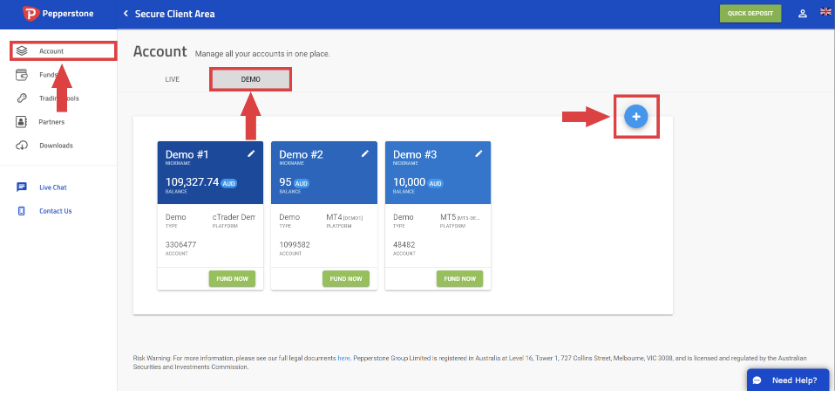

4. Pepperstone

Pepperstone is an Online ECN forex and CFD broker, offering among the lowest spreads in Europe.

The broker is considered one of the best because of its execution speed, low fees, and world-class trading environment.

Pepperstone operates with several European licenses, including CySEC, BaFin, and FCA. The broker is also authorized in several other top-tier regions, proving its credibility and service quality.

Pepperstone, like most ECN brokers, provides commission-free and commission-based trading, allowing different choices. It also gives beginners a chance to get acquainted with trading before raising their investments.

The broker offers MT4, MT5, and cTrader for trading, and these come with special add-ons to support important features. Automated trading is available, and so are social and copy trading. There is much support for traders of all levels through top-quality research, analyses, and education content.

The broker allows trading with any amount but recommends a $200 minimum deposit. Customers can conduct tests on the broker’s demo to see its offering.

Pepperstone drawback

The educational materials on the platform do not include quizzes. Users find it difficult to monitor their progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the financial regulations in Switzerland?

Forex trading is a popular investment in Switzerland, and it is well-regulated.

Swiss Financial Market Supervisory Authority FINMA is the country’s financial market regulator.

The body administers financial policies and regulations and is in charge of overseeing forex and CFD brokers.

FINMA also regulates other financial market sectors such as insurance and banking, stockbrokers, investment fund companies, and others.

FINMA is an adequately strict entity, requiring forex brokers within its borders to register their companies as banks. The implication is that the forex brokers have to operate a comparably high amount of capital investment. The aim is to ensure they are buoyant and will not go bankrupt soon.

Part of its strict regulation is that brokers are not allowed to operate a dealing-desk model, where they can sometimes be counterparties to customers’ positions. But they can act as liquidity providers, sending orders to the international liquidity pool and interconnected banks.

The body permits leverage up to 100:1. Brokers are required to offer negative balance protection and a 100,000 Swiss Franc compensation scheme per customer.

FINMA can and have been known to suspend brokers’ license who violate the operating policies. However, the body does not have the power to fine brokers.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Switzerland – Good to know

Swiss traders enjoy protection and insurance when they trade with domestic brokers. The major highlights of these protections are a mandatory insurance scheme and negative balance protection.

Many traders in Switzerland stick to local brokers because of this. But trading with licensed global brokers also offers protection.

Well-known brokers or those holding an EU-recognized license are equally safe. These often offer the same protection, including compensation, data safety, and negative balance protection.

So Swiss traders can choose a licensed Swiss-based broker or an internationally recognized one operating with an EU license.

Is it legal to trade Forex in Switzerland?

Absolutely! Forex trading is 100% legal here and safe. The trader must choose a FINMA-licensed broker or a global online one with an EU-recognizable license.

How to trade Forex in Switzerland – An overview

The major first step to trading forex in Switzerland is finding a good broker whose offering matches your objectives.

The Swiss Franc (CHF) presents reasonable opportunities, and Swiss traders love to speculate on the currency. To trade a pair containing your national currency, you must seek a broker that offers the instrument on their platforms.

That is the second thing to consider when choosing a broker.

Other important considerations for a suitable broker are:

- Regulations

Regulations protect you, the trader, from fraud or loss of funds due to the broker’s business failure. Swiss traders must use ONLY well-regulated brokers in their home country or abroad. The broker’s license is your consideration before investigating other things.

- Low fees

The trader must investigate the broker’s fees to determine the trading costs. The spreads, commission, overnight charges, and other non-trading fees are things to check on. The fees should be competitive. Otherwise, your profits will be affected.

- Free demo

Using the broker’s demo account helps you know them better and decide if they’re right for you or not. The free demo account is proof that the broker is confident in the quality of their service. Avoid brokers without a free demo.

- 24-hour customer service

Support should be accessible all the time during trading hours (weekdays). This is the industry standard, and a broker who does not provide round-the-clock support is operating below this standard. Multiple language support is an even better option.

- Available payment methods

The broker should provide several payment options that are available in your country. Deposits and withdrawals on their platforms should be seamless.

A broker who meets these requirements might be right for you.

Follow these steps to trade forex:

1. Open an account for Switzerland traders

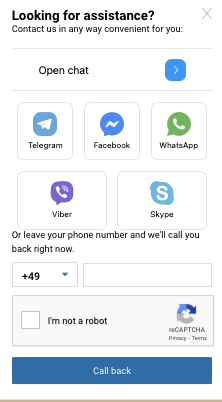

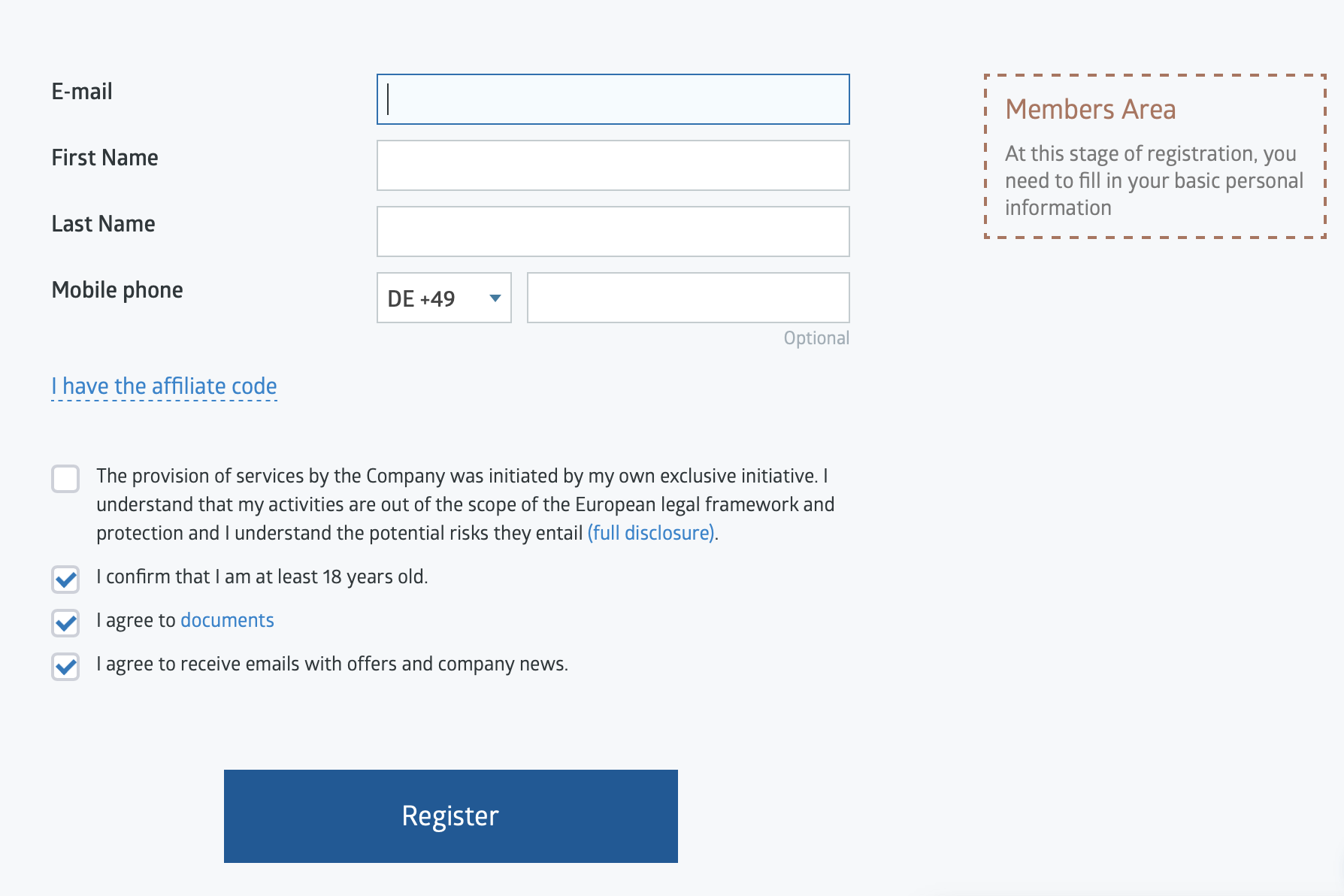

Visit the broker’s website and click on the create account button to begin the signup process.

The website will be for Swiss traders and may offer options to switch languages between English, German, Italian, French, and Romansh.

Input the requested details on the signup form. They could ask for your email, name, and maybe phone number. Click on submit and check your mailbox for a confirmation link from the broker.

Click on the link to confirm your details and continue the signup process. The broker may request a copy of your ID and utility bill to prove your address. Be prepared to scan and upload these. Some brokers may only request the ID number or AHV to confirm your identity.

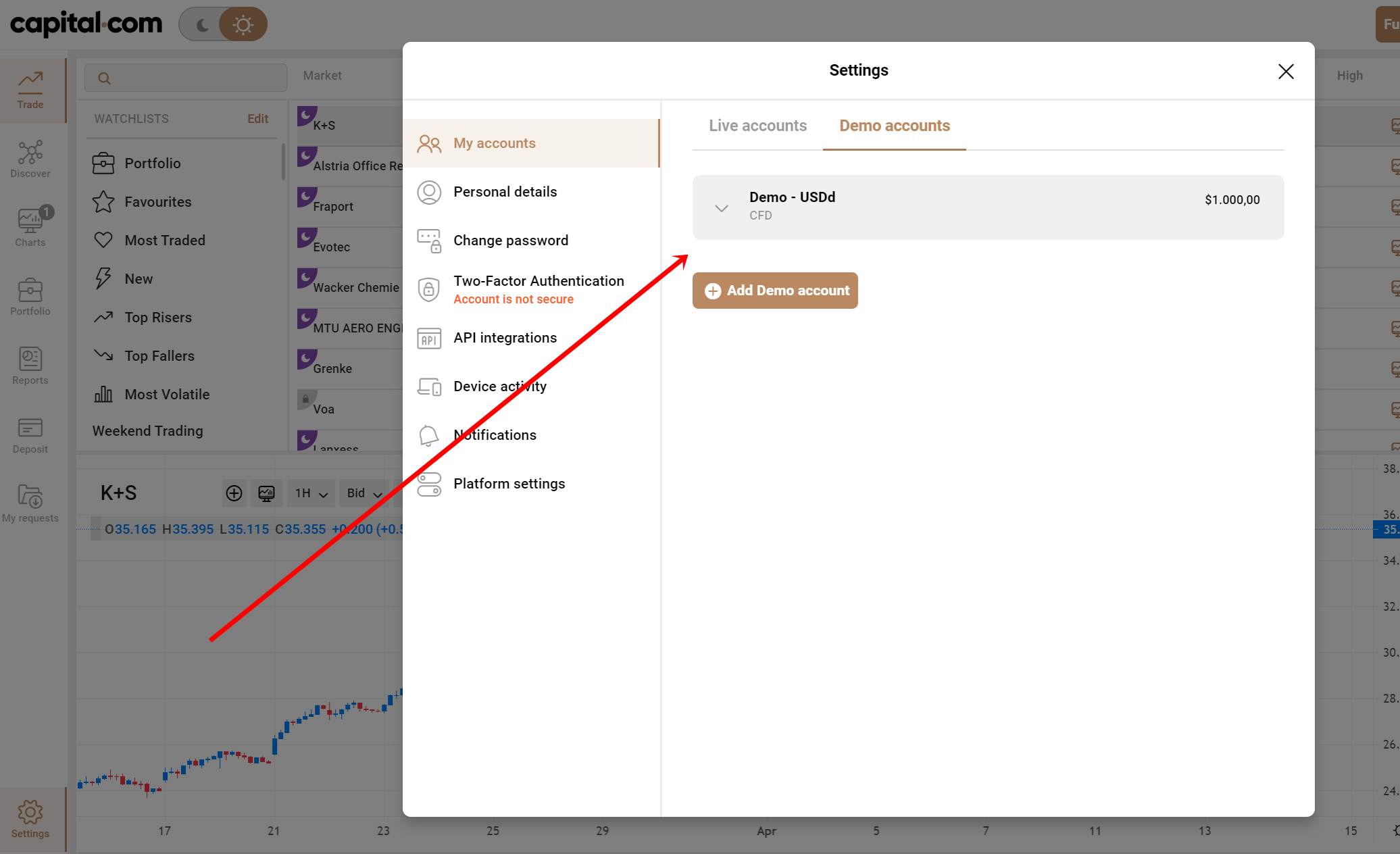

2. Start with a demo or real account

Once the registration is complete, your account is ready for live trading. But we recommend using the free demo before real trading.

The demo will come with enough cash for several test trades. You should practice trading with it if you’re new to forex.

The demo is also useful to exist and skilled traders. They can see what the broker offers or test their trading style on the platform without risking their funds.

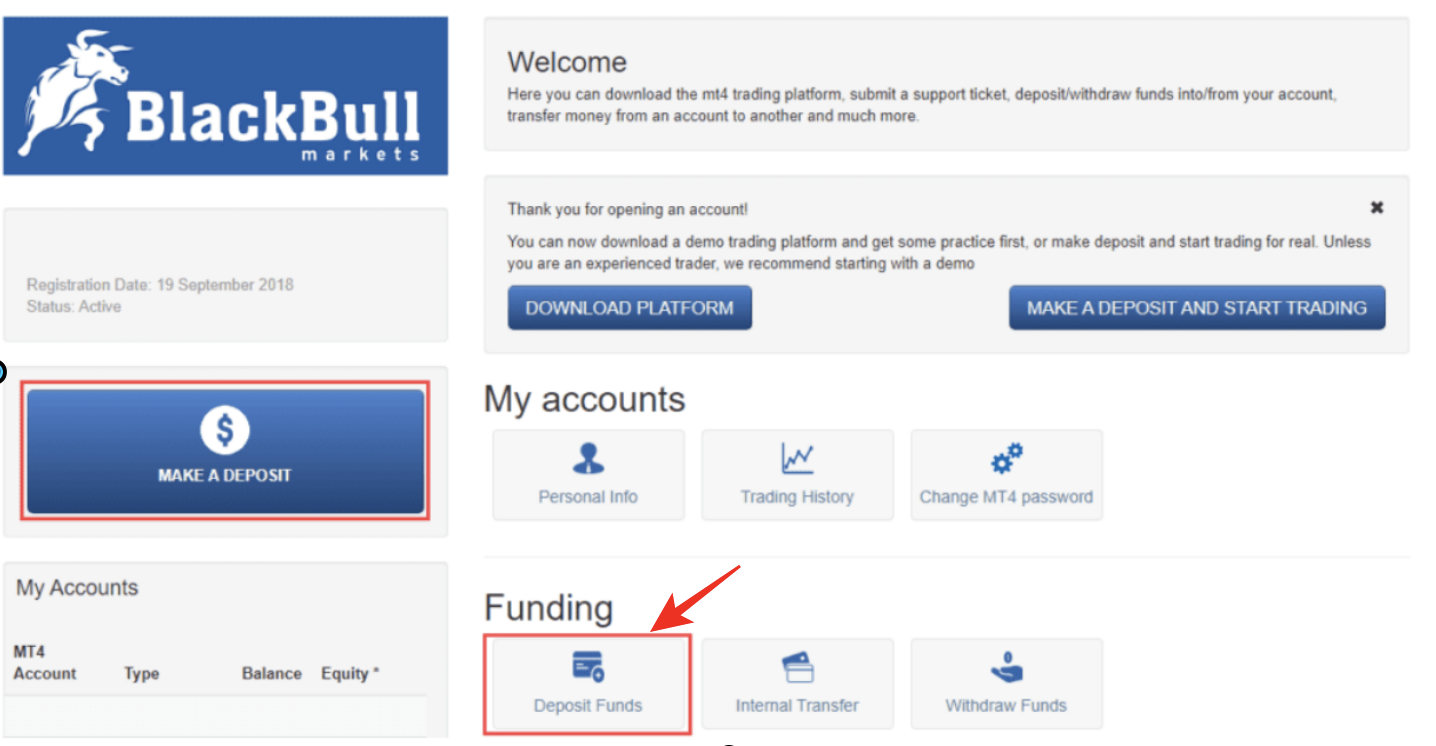

3. Deposit money

After practicing or testing on the free demo, it is time to fund your account to trade.

The platform will have a FUND tab which would have the deposit option. Click on the tab and select the appropriate option to fund the account.

The process should be easy as long as a popular payment method is listed. These methods can be any Swiss local PSP or bank transfer, MasterCard, Visa, Neteller, Paypal, etc.

A customer service rep may also be on hand to assist with this.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

Successful forex trading requires market analyses and a functioning strategy. The trader must first analyze the pair they wish to trade. It will help with understanding its past price movement and ascertaining future moves.

Market analyses also help you devise the best trading strategy for your chosen asset. When you can make better price forecasts, you determine the most profitable entry and exit points.

These are the most important analyses in forex:

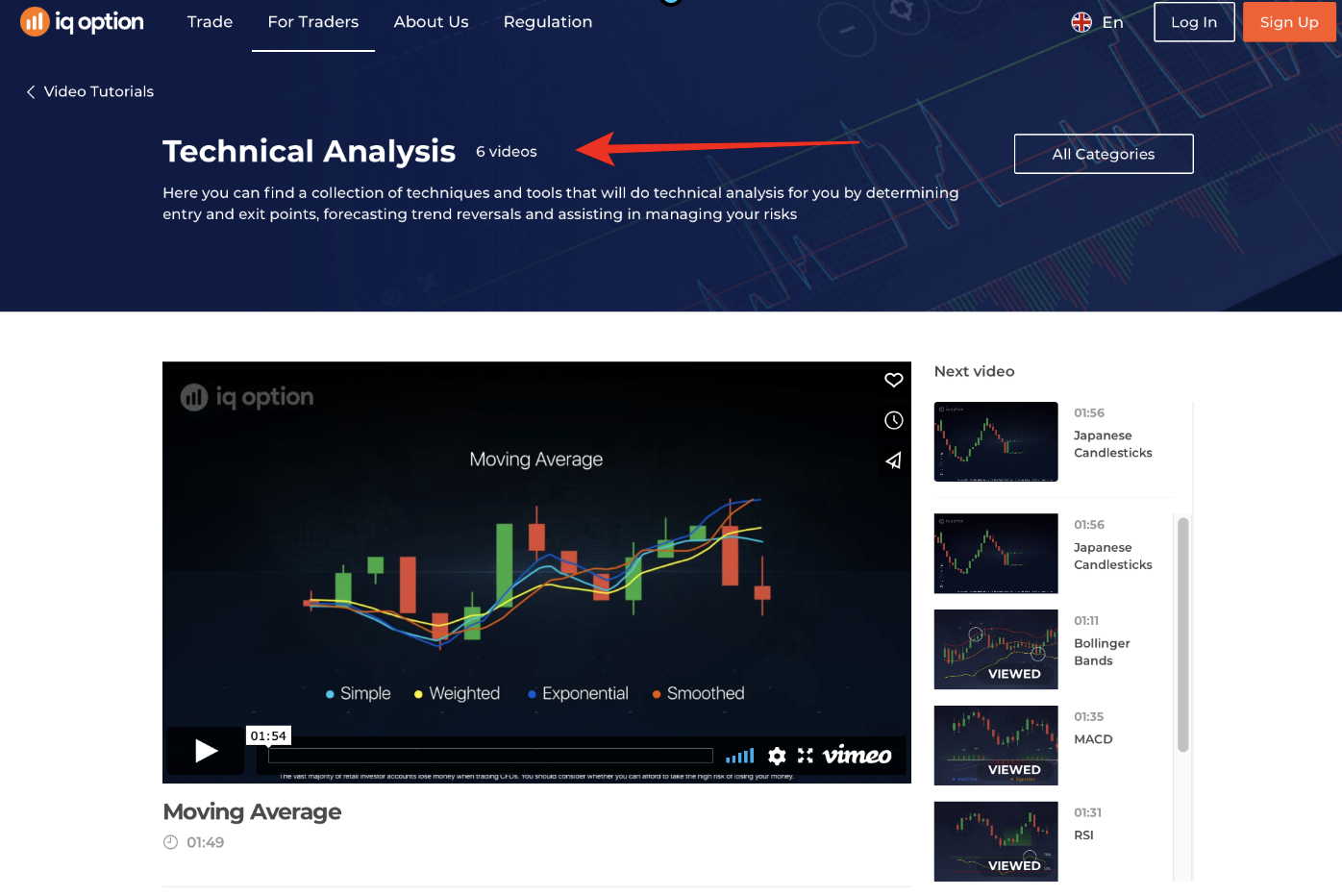

- Technical

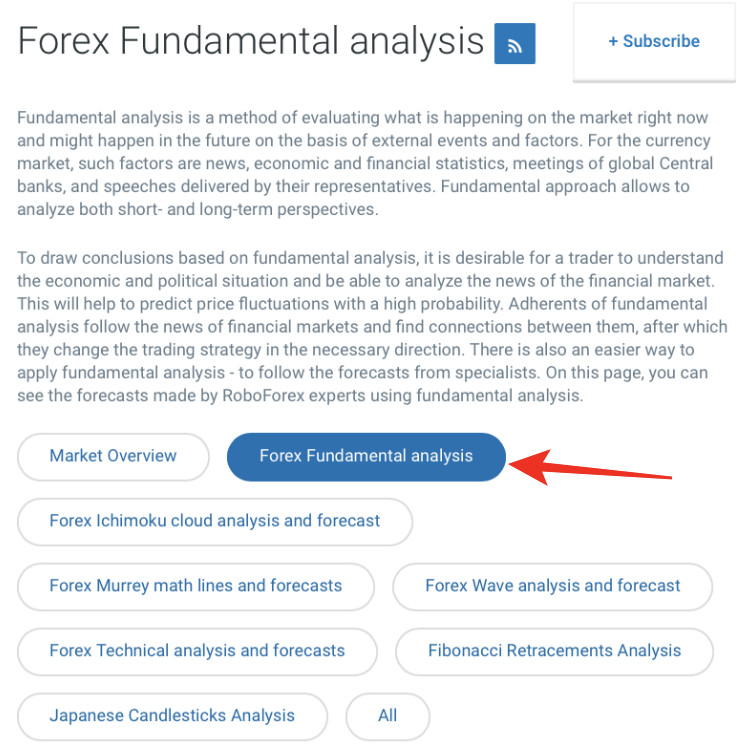

- Fundamental analysis

Technical analysis is crucial to trading forex and is widely used. It involves the study of patterns in the price chart. As price moves, patterns take shape. Traders look into these to understand the asset’s price behavior. It helps predict future moves and make profitable trading decisions. All trading platforms come with indicators, charts, and other tools for technical analysis. The trader must learn to use them, understand the patterns, and identify opportunities in the market. Technical analysis has an equally important twin.

Fundamental analysis means examining the elements that cause the exchange rate to fall or rise. These elements make up the country’s economy and determine the exchange rate. They include the interest rate, inflation, gross domestic product (GDP), deficit or surplus, etc. The trader studies these factors to understand the currency’s value and foretell its future exchange rate. Economic news releases and research content are a good source of education on forex fundamentals.

The trader has to mix these analyses with one or more effective trading strategies to trade the forex market successfully.

Common strategies for trading forex:

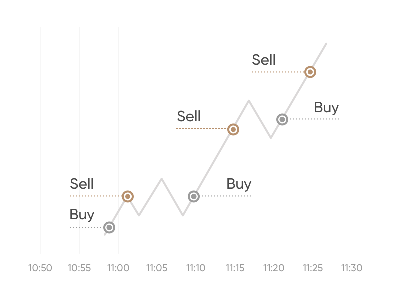

Scalping

Scalping is a form of day trading that uses short time frames. That is, positions are left open for nothing longer than a few minutes. The time can range from 1 minute to 15 minutes. The scalper seeks to make small gains in large quantities. They profit from the small pip movements that occur within short time frames. Some traders consider scalping less risky since positions are only open for a short time. Small profits also mean small losses if they occur. But the gains or losses can add up to a considerable amount.

News release trading

Some traders use economic news to trade the market. The trader combines fundamental and technical analyses and capitalizes on the great price shifts that take place during major economic news reports. This strategy may be unsuitable for novice traders since it requires a thorough understanding of forex fundamentals and market participants’ reactions to certain events.

Swing trading strategy

Swing trading is almost the opposite of scalping. The trader seeks to make a bigger profit on a larger market move. So they hold the trade for a longer period. Swing traders have to identify a solid trend before profiting from this strategy. The trader must consider overnight fees while using this approach. They must ensure the trend is confirmed before entering the trade.

Range trading

The breakout strategy is commonly used with pairs like the USDCHF. Since both currencies are relatively stable, traders identify specific price ranges and trade these points. A ranging market means that the price moves back and forth at certain points. The trader then identifies these points by finding the support and resistance levels.

The internet is filled with books and articles that explain various trading strategies and tools. It would greatly help you research different approaches. It is essential that you thoroughly understand the strategy you choose to use. The more you trade, the more you get better at it. You also keep learning different trading approaches as you go along. Social communities are another useful source of education in trading strategies.

5. Make a profit

Place your trade using a powerful strategy after proper analyses. It would be best if you started to make profits soon enough.

You can withdraw your gains or reinvest them if you choose. Withdrawal should be as easy as a deposit with a good broker. However, it takes longer for brokers to process.

Bank wire transfers may take a few days to settle. Debit or credit card mediums are fast. Online payments are faster in some regions.

The processing time usually depends on the payment method and the broker. But on average, the funds should hit the receiving account within two days.

Ensure your registration is complete to prevent any further delays with this. This means you should have done proper KYC and confirmed your identity with the broker at this stage.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final thought: The best Forex Brokers are available in Switzerland

The brokers recommended in this article are globally recognized and trustworthy.

They all meet the following essential requirements:

- Properly regulated brokers

- Competitive fees

- Free demo account

- 24-hour multilingual support

- Easy deposit and withdrawal methods.

Choosing whom to deal with should be easier after reading this guide. It is also helpful to compare the brokers by checking out customers’ feedback on Trustpilot.

FAQ – The most asked questions about Forex Broker Switzerland:

What is good about forex trading in Switzerland?

Traders in Switzerland can earn a lot of money when trading forex. It makes forex trading the best for traders in Switzerland. Investing your money in strong currencies will allow you to benefit in the long run. Swiss traders can trade all the leading forexes and make money to enhance their trading account balance. So, forex trading is full of rich experiences for traders in Switzerland.

Are there good forex brokers in Switzerland?

Thankfully, the best of all forex brokers extend their services to traders in Switzerland. As a trader in Switzerland, you can access a lot of forex brokers that give you a rich trading experience. You can enjoy trading in Switzerland with brokers such as BlackBulls Markets, RoboForex, Capital.com, and Pepperstone. These brokers are reputed and have a rich trading platform.

How can a trader in Switzerland trade forex?

A trader must sign up with a forex broker to trade in Switzerland. Then, he can learn to trade on the forex demo account offered by the broker.

Finally, he can switch to the live trading account and add funds. Then, he can place his trade.

Last Updated on March 3, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)