XM trading minimum deposit: How to deposit money with the platform

Table of Contents

The XM broker started its trading operations in the year 2009. Clients across over 190 countries have been using their services since then. It has a customer service team that speaks more than 25 languages and is one of the most reputable brokers. As a trader, you might begin by using trading software that has a real account. If you wish to test the platform’s waters, you may open a demo account with USD 100,000 in virtual money and begin trading.

XM Trading allows traders from a wide range of countries. On the other hand, traders from nations such as the United States, Canada, Israel, and Iran, cannot trade on XM’s platform.

What is a minimum deposit?

A minimum deposit is the least amount of money that a person must deposit to start trading. It varies from the trading platform to platform. Minimum deposits guarantee that the money earned from the Client is enough to pay the administrative costs and other expenses involved with operating that particular account.

But do not be disappointed by the fact that certain brokers, such as XM, require a minimum deposit amount. Many Brokers require larger minimum deposits to provide additional premium services that are not available for free on other platforms. At the same time, the brokers with smaller minimum deposits aim for a more mainstream clientele who aren’t interested in some of the more technical services and research tools.

You may be charged a set fee when you deposit a certain fiat currency into your profile. For example, when putting money by a credit card, fees are well-known to be exorbitant. If the stockbroker allows you to fund your account using a credit card, this is a possibility.

With more online trading platforms joining the market, we can see a significant reduction in the minimum amount conditions.

What is the commission charged by XM?

On CFD instruments, XM does not charge a commission. The dealer may charge a brokerage fee as a service fee for enabling the purchase and sale of capital assets using your brokerage account. Most of a brokerage’s income comes from royalty fees. They charge it from registered traders on client transactions. Commission rates can vary depending on the trading style, financial product, and the degree of your trading account.

If the broker has to implement or cancel an order on your behalf, it will be charged a commission for the same. If your broker is not able to execute a market order, there won’t be a fee charged from you.

However, if you are new to trading, you must remember that your broker can levy a commission fee if your transaction is amended or canceled.

XM Rating | 4.5/5 |

Yes | |

Regulators | ASIC, CYSEC, FSC |

Minimum Deposit | $5 |

Demo Trading Cost | $0 |

Crypto | Yes |

Demo Account Activation Time | 24 Hours |

Total Pairs | 55 |

How much is the XM minimum deposit?

XM is far more popular than you may expect. Many investors start with XM since it allows them to trade micro-lots and tiny forex positions. The minimum deposit is something that may have a big impact on how you trade. XM’s minimum deposit differs between the individual’s type of account.

The smallest deposit you may make with XM is $5. That holds valid for both of the popular account types; the Standard and Micro accounts. Depending on your regulatory jurisdiction, you may be able to access alternative account types and minimum deposits that are far larger than the one we just discussed.

Though, XM does not usually charge a fee for the deposit. That is helpful to the trader since the broker will not take anything from your deposits, leaving you with simply the expenses imposed by the bank or third-party service provider via whom you transfer the money to calculate. XM offers you deposits and withdrawals that take as little as two or three days to process. When withdrawing money, this is critical as the user gets their money very quickly compared to other trading platforms.

XM offers four main types of accounts to its users. They are:

- Standard Account

- Micro Account

- Ultra-Low Account

- XM Zero Account

Standard account

The XM Standard Account is available in all countries, and with a low minimum deposit of $5, it’s clear to see why so many people want to trade with this. USD, EUR, GBP, JPY, CHF, AUD, PLN, RUB, and ZAR are among the most traded currencies in XM. The standard account also offers negative balance protection to its users, which is rare in these accounts. It also has an option to opt for an Islamic account if the user prefers so.

Micro account

The XM micro account’s minimum deposit is $5, which is a reasonable amount. These accounts allow traders to trade micro-lots at competitive rates and are open to all traders in all regulatory jurisdictions. Traders who follow the Islamic account are likewise accredited.

Ultra-low account

Traders in Australia and operating inside the XM Global Market regulatory framework can open an XM Low spread account. This account has extra-low forex spreads and no commissions to deal with. This account type has a $50 minimum deposit. Like the other types of accounts, ultra-low accounts also do not have a deposit fee, making it more beneficial.

XM zero account

For trading on these accounts, the XM minimum deposit is $100. That is a terrific deal because you get your own virtual private server. Although fees are required on trading, the spreads given by one of the top zero spread accounts here are incomparable, starting at 0 pips.

Account Type | Minimum Deposit |

Standard Account | $5 |

Micro Account | $5 |

XM Ultra | $5 |

Shares Account | $5 |

How can a person deposit money in their respective XM account?

Traders can deposit using a variety of XM deposit methods. These will be determined by the nation where the individual lives rather than the regulatory authority.

The most common deposit methods are:

- Credit/debit card

- Bank transfer

- Electronic wallets

Credit/debit card

Both Visa and MasterCard are accepted at XM for credit/debit card deposits. With a $5 minimum investment, they are available to traders worldwide.

Bank transfer

Of course, XM deposits by bank transfer are possible and popular. Traders worldwide can use this financing option, which requires a minimum deposit of $60.

Electronic wallets

The minimum electronic Wallet deposit for XM is a mere $5. That may be done using Neteller, Skrill, Perfect Money, or various other options, depending on your country. XM PayPal deposits are now unavailable but are expected to be available soon.

Brokers from any nation can participate in this trade because there are many alternatives. XM is a well-known and well-respected online broker in the industry. As a result, you can deposit using any method. You can deposit funds in any currency, which will subsequently be exchanged into your base currency for trading purposes on your account.

How to deposit money into an XM trading account?

You may make deposits to XM trading accounts in a variety of ways. Kindly follow the directions below to deposit into XM’s trading account.

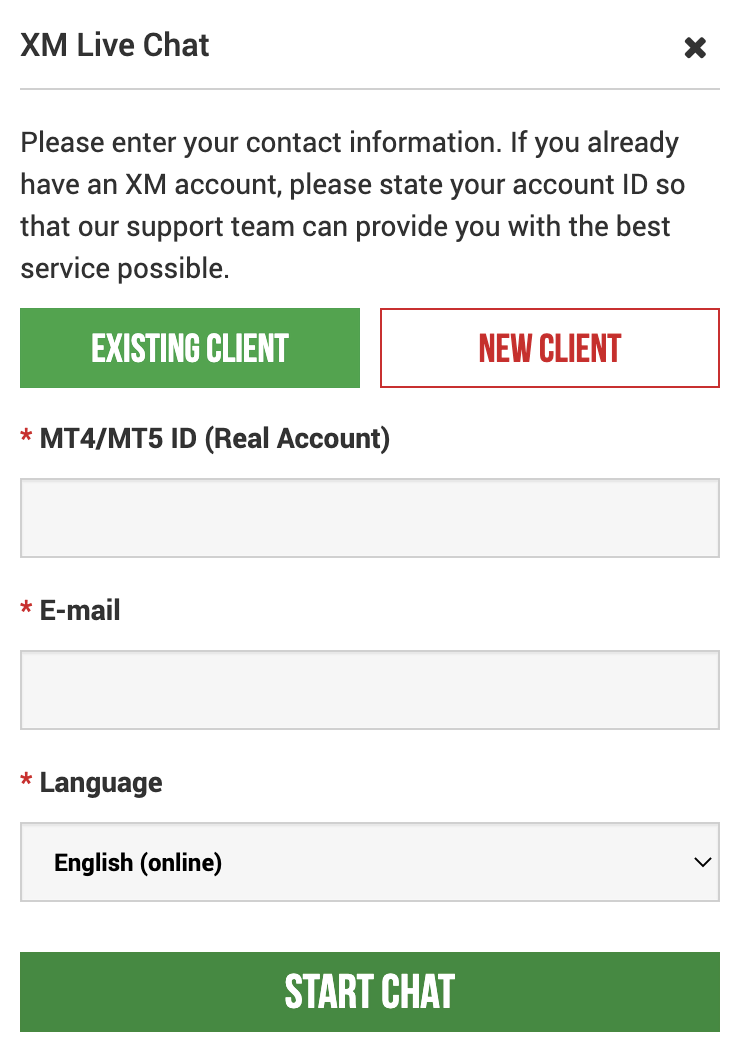

Depositing via a computer

- Visit the XM website.

- After that, click on “Member Login” in the options menu.

- You must enter your MT4/MT5 ID (Real Account) and password.

- Click the green “Login” button.

- Click “Forgot your password?” if you’ve forgotten your password.

- Enter your MT4/MT5 ID (Real Account) and password on the site’s home page. MT4/MT5 ID, which you should get from a mail you have received, you can search your inbox for the welcome email sent while you opened the account.

- Click on the “Deposit” button available at the top of the page.

- On the “Deposit Options” page, select your preferred payment method. For example, if you plan to do the deposit via your credit/debit card, select the option for cards on the screen. Similarly, select the respective option if you want to deposit using Skrill.

- Type in the sum of cash you would like to deposit into your account on the next screen.

- After that, you have to confirm the account number and deposit amount.

- To complete the deposit, enter all of the essential information. That is either your credit or debit card details. And click “Pay Now.”

The page will show your Deposit amount in your trading account immediately.

Remember: While making a credit/debit card deposit, please consider these points:

- Please make sure that all money is paid from a bank account that is linked to your XM account.

- All withdrawals, except profits, can only be refunded to the credit/debit cards used to make the deposit, up to the amount deposited.

- XM does not charge any commissions or fees if you deposit through credit or debit cards.

- XM will credit your account and send you an email within a few minutes, allowing you to begin trading right away.

- You allow your data to be shared with third parties. That includes payment service providers, banks, card schemes, regulators, law enforcement, etc.

Depositing via a mobile phone

- After signing into your official XM Group account, go to the menu on the left side of the page and select “Deposit.”

- Credit/debit cards are a preferred deposit method since they are convenient and quick. However, you may choose other methods as well as you see fit.

- Now, state the amount of your wish.

When opening an account, use the same currency with which you have opened the account. If you’ve chosen USD as your trading currency, you’ll need to input the deposit amount in USD as well.

Once you verify your XM Account ID and the deposit amount you wish for, the next step is to input the same amount. For that, you must click “Deposit,” after which you’ll be taken to the payment age.

- Confirm the deposit amount and account ID and click the “Confirm” button if the information you have entered is correct.

- Enter your card details.

- Since the system will immediately send you to the card information entry page, `simply insert your credit/debit card information.

- If your card has been charged before, some information should have already been input. Confirm details such as the expiration date and so on. Verify that the data is correct.

- When you’ve finished filling out the form, you must click on the “Submit” button. You will now get a screen saying, “please wait while we process your money.”

- Try not to press the browser’s back button while the payment is being completed.

- After that, the procedure is over, which should be reflected in your account instantly.

Deposits made using means other than credit or debit cards will not be reflected right away.

- If your payment has not yet been reflected in your account, please contact the XM Group support staff.

- Furthermore, suppose your account is deposited from a nation other than your registered permanent residence address. In that case, you must provide a credit/debit card data sheet and a credit/debit card image to the support staff for security reasons.

- Please keep in mind that the preceding rules will apply if your credit/debit card was issued in another country or if you are traveling overseas.

Conclusion

If you’re searching for a high-quality international broker, XM is the place to go. The broker is a well-known trading platform among international investors. Also, if you’re searching for a low-deposit broker, XM is a good choice. There are three sorts of acceptable accounts for traders in the market so that you may add this broker with confidence.

Because of the variations in trading accounts, you might accept several forms of leverage offers. In terms of offerings, XM trading remains at the top.

You can trade in numerous trading instruments with XM. However, those may vary depending on the Client’s country. Furthermore, the trading instruments offered by XM may differ based on the trading platform you choose. With XM, you may trade a large range of equities and commodities, in total over 1000.

FAQ – The most asked questions about XM trading minimum deposit:

How long will it take for the cash to arrive in my bank account?

It is dependent on the country to where the funds are being provided. Within the EU, a standard bank wire takes three business days. Some nations may take up to 5 working days to receive bank wires.

Is the option to withdraw my funds from XM at any time available?

Yes, as long as your trading account is confirmed, you may withdraw your cash whenever you wish.

That requires you first to upload your papers to our Members Area: Proof of Identity (ID, passport, driver’s license) and Proof of Residency (utility bill, telephone/Internet/TV bill, or bank statement), all of which must include your name and address and be no more than 6 months old.

You can request money withdrawal after receiving confirmation from XM’s Validation Department that your account has been verified by entering into the Members Area, selecting the Withdrawal option, and emailing us a withdrawal request.

You can use only the original source of deposit to send your withdrawal amount.

XM’s Back Office processes all withdrawals within 24 hours on business days.

How long would it take to deposit and withdraw money using a credit card, an e-wallet, or another mode of payment?

Except for the bank wire transfer, all deposits are immediate. On business days, XM’s back-office processes all withdrawals within a day. If you haven’t received your cash following the withdrawal, you should contact your banks or payment service providers to trace the money transfer. The procedure might take up to a week when withdrawing money using credit or debit cards, depending on the card company.

Is it possible to deposit using e-wallets (online wallets) and withdraw using credit or debit cards?

In order to protect all parties from fraud and comply with applicable laws and regulations for the prevention and suppression of money laundering, the XM company’s policy is to return customers’ funds to their source.

As a result, your withdrawal will be returned to your e-wallet account. That is true for all withdrawal methods, and the money must be returned to the source of the fund’s deposit. If you’ve made several deposits, please contact the XM support staff to determine which options are available for money withdrawals.

Does XM charge an inactivity fee?

Inactive accounts are liable for a fee from XM. The registered trading client will be levied an account inactivity fee. Clients may be required to meet particular trading activity criteria by brokers as part of the account’s terms and conditions. XM may charge an inactivity fee if a client’s account is inactive for a specific length of time as determined by the broker.

Terminate your brokerage account with the broker’s customer service if you no longer access it. Only under particular situations, depending on the sort of account you signed up for, may you be charged an inactivity fee. Any inactivity fees must be made known in accordance with a trader’s regulation.

Is it possible to transfer cash from my trading account to the account of another client?

No, that’s not going to work. Transferring monies between various clients’ accounts and using other parties are prohibited.

What is the XM minimum deposit amount?

The XM minimum deposit amount is 5 USD (or equivalent denomination). This is available for multiple payment modes and in all countries. Regardless, the amount can differ according to the payment method you choose. Also, it depends on your trading account validation status.

Is it possible to trade in XM without making an XM minimum deposit?

Yes, you can try it with the help of a feature in XM. There is a scheme called the “No Deposit Trading Bonus Scheme.” It allows you to trade without making an XM minimum deposit. Those who open real Accounts with XM can get access to this scheme. They can avail of trading bonuses and use them for trading purposes only. But they cannot withdraw that amount.

How much commission does XM ask to make the XM minimum deposit?

XM minimum deposit does not involve any fees or commissions. Traders can fund their trading accounts on XM without much problem. Besides, they don’t have to pay any XM fees for funding or withdrawing funding from their trading accounts. Features such as free deposits and withdrawals make XM a perfect trading platform for traders. It is an attractive feature of XM.

See more articles about forex trading:

Last Updated on May 25, 2023 by Andre Witzel