NSBroker review and test – Is it a scam or not?

Table of Contents

Are you looking for a reliable Forex and CFDs broker? – If so, then you have come to the right place. In this review, we will discuss one of the top Forex and CFDs Brokers – NSBroker. You will find all the details and facts about this broker, including regulations, the number of tradable assets and instruments, the offered trading platforms, spreads, leverage, payment methods, and many more. Let’s start the journey to discover NSbroker!

| |

|---|---|

| REVIEW: |  (4.8 / 5) (4.8 / 5) |

| REGULATION: | MFSA (Malta) |

| DEMO ACCOUNT: | ✔ Free |

| MINIMUM DEPOSIT: | $250 |

| ASSETS: | 100+ (Forex, Indices, Stocks, Commodities) |

| LEVERAGE: | Maximum 1:100 |

| PLATFORM: | MetaTrader 5 (Mobile, Desktop) |

| SUPPORT: | 24/5 Phone, Email, Chat |

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

What is NSBroker? – The company presented

Founded in 2011, NSFX, the owner of the NSBroker trading brand, is an MFSA-licensed Forex and CFDs broker whose address is in Malta, 168 St Christopher Street, Valletta VLT 1467, MALTA. It offers the MetaTrader 5 trading platform with over 100 tradable assets and instruments, including FX currency pairs, company stocks, indices, commodities, and cryptocurrencies.

Thanks to its superior trading conditions, NSBroker has been constantly growing over the years. At present, it has more than 33,000 clients in 150+ countries and ranks among the fastest-growing Forex Brokers in the world.

Facts about NSBroker:

- Founded in 2011

- Regulated

- Offers Forex and CFDs trading services

- Offers services to clients in most countries except the US, Canada, and Japan

- Offers 24/7 customer support in several languages

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

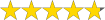

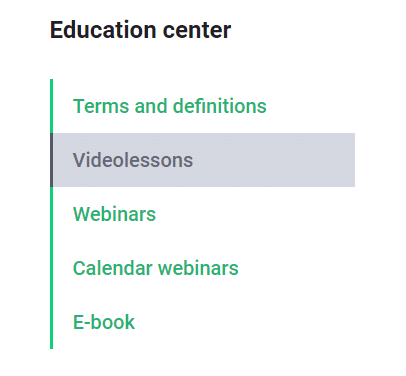

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Review of NSBroker trading conditions for tradersNSBROKER offers more than 100 financial products covering 5 different asset classes namely company stocks, indexes, Forex currency pairs, digital currencies, and commodities. Below are some of the tradable assets and instruments at this broker:  Company stocks: eBay Inc., Facebook, BANK OF AMERICA, eBay Inc., GOLDMAN SACHS, GOOGLE Inc., IBM, MICROSOFT Corp., TOYOTA, SONY, Twitter Inc, AT&T Inc, American Express, Amazon, Mastercard, MCDONALDS, COCA-COLA, VISA, NIKE, NETFLIX Inc, TESLA MOTORS Inc, Ferrari SpA, GENERAL ELECTRIC, INTEL Corp., UBS AG, ALIBABA, JPMorgan Chase & Co., Morgan Stanley, PayPal, Hewlett-Packard Enterprise Services, Lululemon, SHOPIFY, Go Daddy Inc… Indexes: CAC 40, NIKKEI 225, S&P 500, DJ 30, NASDAQ 100, FTSE 100, DAX 30, Hang Seng, DJ EURO STOXX50, India50… Forex currency pairs: EUR/USD, USD/CAD, USD/CHF, GBP/USD, EUR/CHF, EUR/JPY, EUR/GBP, AUD/USD, NZD/USD, EUR/CHF, AUD/CHF, AUD/CAD, AUD/JPY, AUD/NZD, CHF/JPY, EUR/AUD, EUR/NZD, EUR/CAD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, USD/INR, USD/CNH, GBP/TRY, USD/ILS, GBP/ILS, EUR/ILS… Digital currencies: Bitcoin, Bitcoin Cash, Ripple, Stellar, Ethereum, Litecoin, Cardano, DASH, EOS, Factom, MonaCoin, Monero, NEM… Commodities: Gold, Silver, Copper, Palladium, Platinum, Aluminum, Corn, Wheat… The most prominent point of NSBroker is the low spreads. The broker’s spreads start from 0.4 pips, which is much lower than the industry average (1.2 pips). Besides, NSBroker does not charge any commission on trades. This makes this broker an ideal place for scalpers and short-term traders. At NSBroker, traders can only trade on MetaTrader 5 (MT5). The broker offers 3 versions of this trading platform, including MT5 DESKTOP (for PCs), MT5 WEB (for browsers), and MT5 MOBILE (for iOS, Android, and Windows Mobile devices). This enables the clients to enter the market and to manage their accounts from anywhere and at any time.  At a glance, not providing MetaTrader 4 seems to be a big omission of NSBroker as most forex traders use this platform today. However, upon closer inspection, the MetaTrader 5 trading platform is no different from MetaTrader 4 except that it has more advanced functions and tools. The interface of MT5 is very similar to that of MT4, but it has been designed to be more user-friendly. We will dive into this platform in the section below. NSBroker gets quotes from various liquidity providers such as Dukascopy, PrimeXM, Barclays, UBS, Citigroup, Currenex, etc. This allows the broker to offer better prices and to execute the clients’ orders more flexibly.  The maximum leverage that NSBroker offers is 1:100 – relatively low compared to that of other brokers. However, according to professional traders, you should not use any leverage higher than 1:50 because it will increase the trading risks, so the leverage at NSBroker is acceptable. NSBroker’s customer support team is available from 08:00 to 20:00 (GMT+3) 5 business days a week in several languages. If you are a VIP client with an initial deposit of over $100,000, you will be supported 24/7. Another outstanding feature of NSBroker is that it provides a rich and comprehensive education center, where clients can access financial investment knowledge from basic to advanced. There are multiple ways for you to learn to trade at NSBroker such as reading e-books, articles, and analysis; watching videos; joining webinars, or following signals of top-performing traders or the broker’s market experts.  Learning directly from professional market analysts is the fastest way to improve your trading knowledge and skills. At NSBroker, you can join webinars hosted by the broker’s market experts and ask them directly about trading. You can also read their market insights and indicator instructions to better understand how they analyze market movements and use technical indicators. When learning new knowledge, you can apply it to trading using NSBroker’s free demo account. This account allows you to practice trading without risking a penny. Facts about NSBroker’s trading conditions:

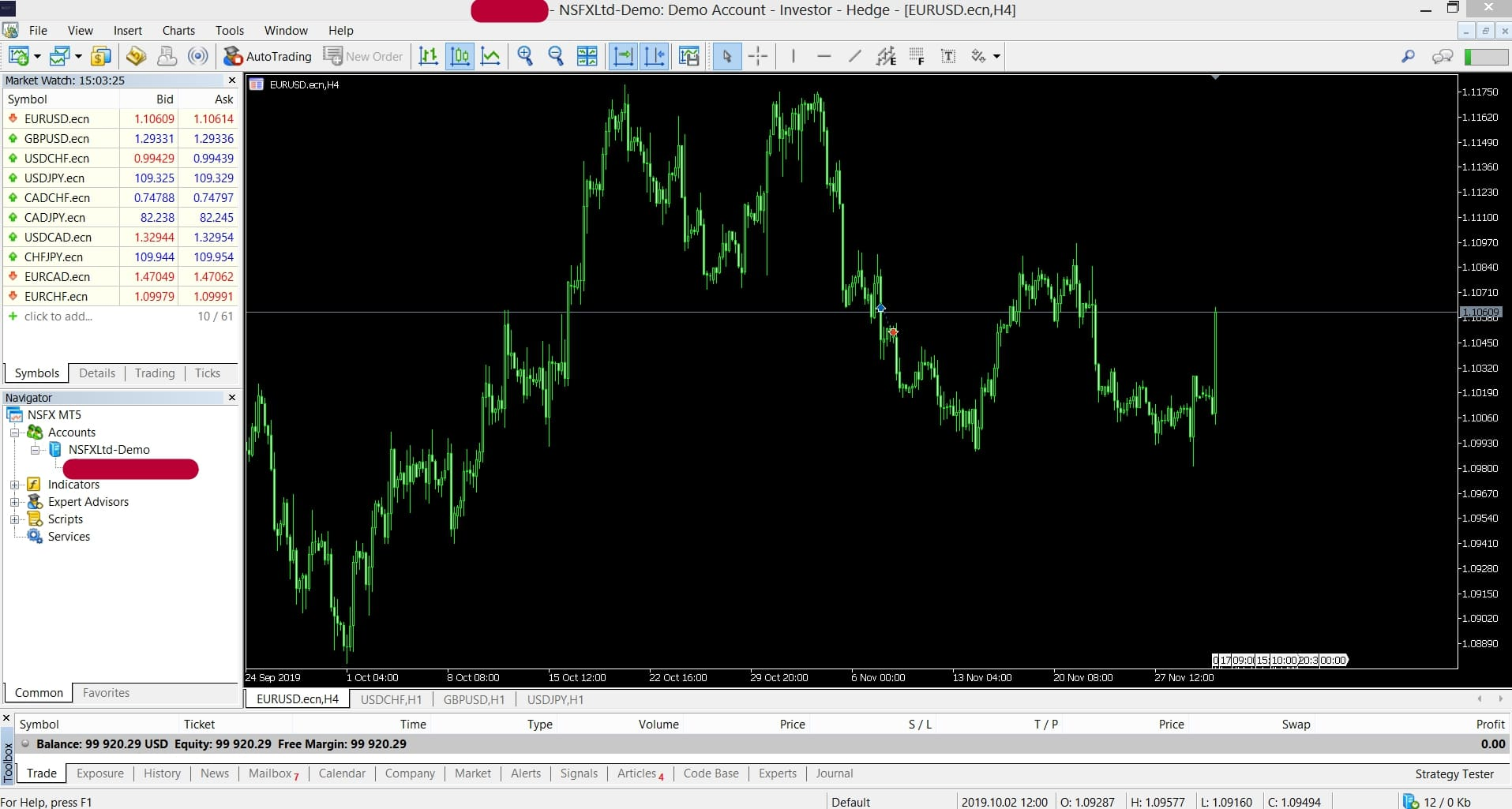

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Test of the NSBroker trading platformThe trading platform plays an extremely important role in a trader’s success. Professional traders always choose brokers that provide advanced and reputable trading platforms. MetaTrader 5 (MT5) is such a platform. It is a significantly upgraded version of the legendary trading platform MetaTrader 4. MT5 has a user-friendly interface and has all the necessary functions and tools for all levels of traders.  One of the most outstanding features of MetaTrader 5 is that it supports various time frames. Besides common time frames like 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, 1 day, 1 week, and 1 month, traders can also use time frames like 2 minutes, 3 minutes, 6 minutes, 10 minutes, 12 minutes, 20 minutes, 2 hours, 3 hours, 6 hours, 8 hours, and 12 hours. This enables traders to conduct technical analysis more meticulously. Besides, it’s impossible not to mention a new function on MetaTrader 5 that MetaTrader 4 does not have: the built-in economic calendar. The MT5’s economic calendar is similar to professional calendars on the market today; however, it updates actual data much faster. For news traders, knowing the information a few seconds ahead means they can act before thousands of other competitors do.  MetaTrader 5 WebTrader MT5 WEB is a version of the MetaTrader 5 platform; however, instead of being downloaded and installed on a computer like the MT5 DESKTOP version, it is used directly on browsers. MT5 WEB has all the tools and functions of the MT5 DESKTOP, but it allows traders to access their trading accounts on any devices on which browsers can run (computers, phones, or even TVs). We tried using NSBroker’s MT5 WEB on many different browsers. No errors or misalignments were detected. Facts about NSBroker’s MetaTrader 5 platform:

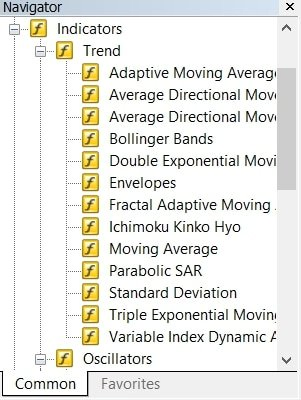

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Charting and Analysis90% of Forex traders start with technical analysis, so charting is one of the most important elements of a trading platform. Clear price charts will help traders conduct technical analysis better, and that can bring them more profitable trading opportunities. MetaTrader 4 and MetaTrader 5 are the trading platforms that have the clearest and easiest-to-use price charts today, so these platforms are commonly used by Forex traders. MT5 supports three types of charts namely Candlesticks, Bar Chart, and Line Chart. Among these types, the candlestick chart is the most used because it is intuitive and provides a lot of valuable information about price action in the market.  Reading candlestick patterns is the most effective technical analysis technique; however, it is difficult for beginner traders. Therefore, professional traders have created technical indicators to make it easier for newcomers to analyze market movements. MetaTrader 5 supports 38 different technical indicators, including well-known ones like Moving Average, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastic Oscillator, Average Directional Index ( ADX), and many more.  Test of the mobile trading platform (app)As mentioned, NSBroker also offers the MT5 MOBILE version, which is compatible with Android, iOS, and Windows Mobile devices. This version is integrated with all the tools and functions of the MT5 DESKTOP, allowing traders to trade on the move.  Features of NSBroker’s MT5 App:

MT5 App is available on Google Play and App Store. All you need to do is get on there, search “MetaTrader 5” then download and install it. After the app is ready, you just need to open it and search for NSBroker servers, then log in to your account and start trading. Below is the guide to trading on NSBroker’s MetaTrader 5: Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Trading Tutorial – How to trade on the MetaTrader 5:To start trading, you need to log in to your trading account first. After that, you will need to open a trade to be able to profit from the market movement. To do this, press F9 to open the order window, then choose the order type, market direction, trading volume as well as the expected stop loss and take profit levels.  There are two types of orders on the market, the market order and the pending order. If you choose to open a market order, your trade will be executed as soon as you press the Buy or Sell button. But, if you choose to open a pending order, your trade will only be executed when your selected target rate is reached. MT5 has 6 types of pending orders, including:

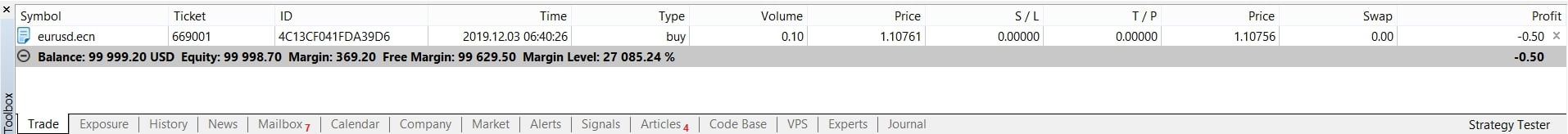

It’s important to set the stop loss and take profit levels when you trade. They will help you limit the risks if the market goes against your prediction, and protect the profits when your analysis is correct. After placing an order, you can track and manage it in the “Toolbox” section at the bottom of the trading platform.  Step by step tutorial:

How to open a trading account at NSBroker?Below are the steps to open a trading account at NSBroker:

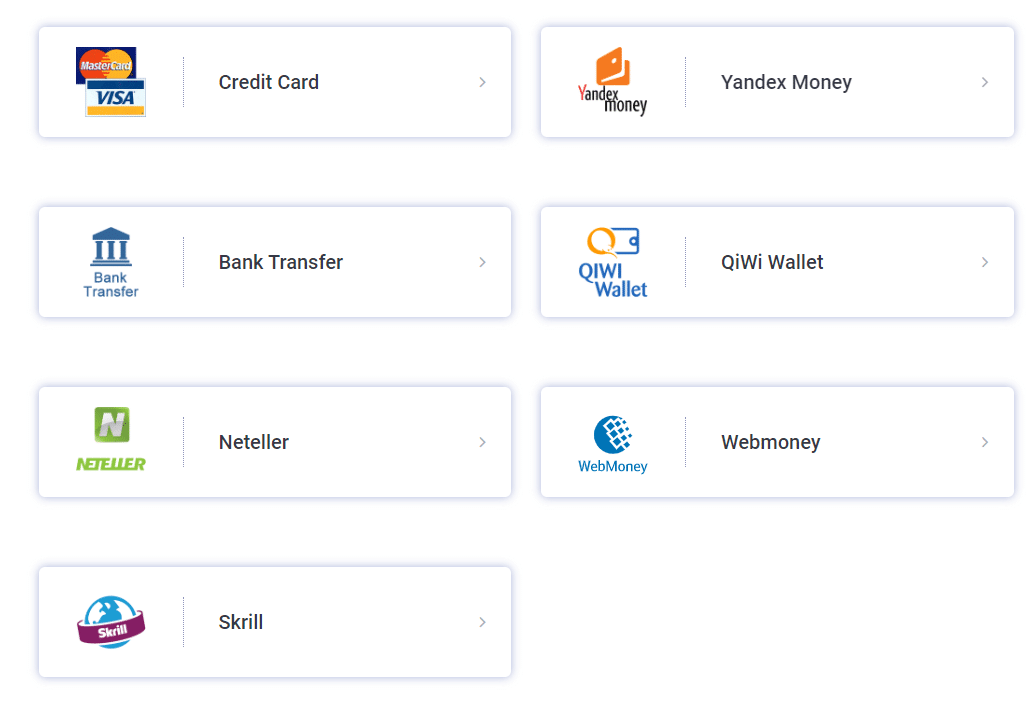

After you complete the above steps, a real trading account will automatically be created. You can make a deposit and start trading, or create a demo account to practice trading with virtual money first. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Free demo account:A demo account is an indispensable tool for traders. It allows them to get acquainted with the trading platform or to test trading strategies without any risk. At NSBroker, you can open a demo account for free. We recommend starting with this type of account before engaging in real trading. Account Types of NSBroker:NSBroker only offers 2 types of accounts: Demo and Real accounts. The broker’s real account is a type of Electronic Communication Network (ECN) account, but there’s no commission charged. The spreads of most assets are fixed, starting from 0.4 pips (EUR / USD). NSBroker does not limit the number of real accounts created, which means you can create as many real accounts as you want. Review of the deposit and withdrawalNSBroker’s deposit process is safe and simple. You can deposit via one of the following payment methods:

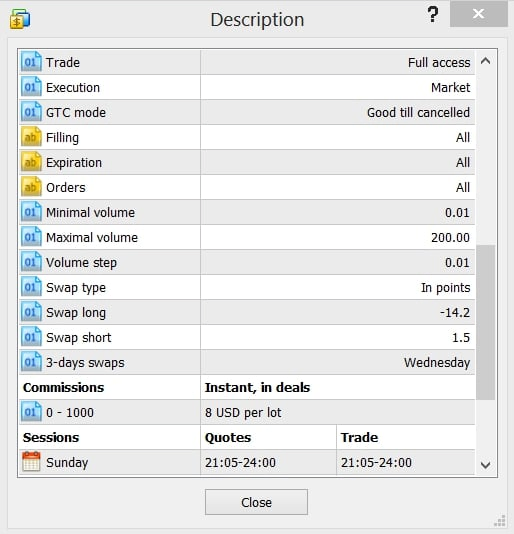

The minimum deposit at NSBroker is $250. The broker claims that it does not charge any fees on deposits, so if there is a fee, it must have been charged by a third party. Withdrawals at NSBroker start at $1 and are usually made within 2 business days via the payment method you used to make your deposit. The broker also claims that it charges no fees on withdrawals, except for those made through Skrill and Neteller. Important note: To request a withdrawal, you have to complete NSBroker’s account verification process by uploading the copy images of your Proof of Identity (National ID card, Driver License, Passport …) and Proof of Residence (utility bill, bank statement …). Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Fees and costs for NSBroker Traders:Opening an account with NSBroker is free, but you will be charged when you trade through spreads and swaps. As mentioned, spreads at NSBroker start from 0.4 pips (EUR / USD). To view swaps, you need to open the MetaTrader 5 software, right-click on the type of asset you want to trade and select “Specification.”  Support and service for traders:The support team plays a highly important role in your trading journey. Whenever you have a technical error or need to ask something urgently, it’s time to look to the broker’s specialists. NSBroker has a dedicated and professional customer support team that is available from 08:00 to 20:00 (GMT+3) 5 business days a week. Representatives speak English, Russian, German, Arabic, French, Spanish, and Italian. You can contact the broker’s specialists via telephone, Live Chat, and email. According to our tests, the response time of NSBroker support team is very fast so you can rest assured when trading here. Below are the contact details:

Accepted and forbidden countries:NSBroker accepts clients from most countries, except the US, Canada, and Japan. Is the a bonus for traders?Under MFSA regulations, NSBroker is unable to offer bonuses to clients. It can only provide trading assistance such as market analysis, educational courses, webinars, personal account management, or 24/7 support (for VIP clients only). Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Conclusion of the review: Is NSBroker safe and reliable?Definitely yes. NSBroker is a licensed broker and operates transparently. It offers superior trading conditions, including an advanced platform with rapid execution, super low trading fees, a variety of tradable instruments, great customer service, and many more. The only minus point of NSBroker is its low leverage; however, there is no need to use high leverage as it will significantly increase the risks in trading. All in all, we recommend NSBroker whether you are a beginner or an experienced forex trader. Advantages of NSBroker:

NSBroker is a safe and reliable broker. Trusted Broker ReviewsExperienced traders since 2013Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) FAQ – The most asked questions about NSBroker :Which trading instruments does NSBroker offer traders?There are several trading instruments that NSBroker offers traders. For instance, you can trade CFDs and forex on this trading platform. It offers you all the leading international currencies so that you can trade and earn profits. You will get the option to trade all the leading forex pairs on this trading platform. Is NSBroker a trustworthy trading platform?Yes, NSBroker is a trustworthy trading platform. It is reliable because several regulating agencies oversee its functioning. Besides, it has a good reputation among traders and has only positive reviews. The customer support of NSBroker is helpful at any time. So, there is no doubt that NSBroker is a trustworthy trading platform. Does NSBroker offer MetaTrader 4?Yes, NSBroker offers the MetaTrader 4 trading platform to traders. So you can customize your trading experience and trade well. MT4 offers you a chance to trade by conducting a customized technical analysis. You get this feature on NSBroker. How much minimum deposit amount does a trader need to sign up with NSBroker?To begin trading with NSBroker, a trader would need a minimum deposit of $250. The trader can initiate trading on this amazing platform by funding his account with this amount and using all the available features. See other articles about online brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2019-12-07 16:10:512023-01-27 18:48:01NSBroker |