How much does it cost to trade with Naga? – Spreads & Fees explained

Table of Contents

Trading is perhaps one of the oldest aspects of human civilizations. From the times people started to migrate for their survival and living, it has existed. During ancient times, people traded as a means to survive.

But it has now grown into a domain where everybody can fulfill their desire of getting rich. We cannot ignore that making money is a need for everyone. So, people often end up leading towards the wrong path. In contrast, trading offers a better way to provide faster returns in profits.

Moreover, online trading has taken over the world in the past few decades. It offers the chance to trade in various assets with the convenience of sitting before a device and a few clicks.

With the rise in digital technology, people are becoming aware of the potential that trading has and showing keen interest. However, the common factor which makes them hesitant to begin trading sooner is the costs.

It is a notion that trading may cost them a fortune. However, if you are aware of market spreads and broker fees, it may not be trouble. The role of a broker in online trading is immeasurable. They act as mediators and guides to every transaction you make. So, when you search for a reliable broker, NAGA is a name that deserves to be your partner.

With NAGA, you can trade in over 950 Instruments that extends to multiple markets like Forex, Real Stocks, Futures, Commodities, and Indices. You only have to open a NAGA account and try out the platform with $10,000 test funds. NAGA offers an all-in-one platform for investing, trading, and even copy-trading.

It joined the trading business recently with its launch in 2015. However, it has grown into one of the most significant finance apps within such a short period. Currently, NAGA has over 1 million registered clients who earn potentially high rates of returns with its help.

NAGA conducts millions of transactions daily and has numerous investors across the globe joining its online trading platform. It is a publicly registered company with transparent operating procedures.

Moreover, it offers a user-friendly interface that makes it easy for beginners to grasp the trading elements. But, as we mentioned earlier, we must be careful in choosing the broker and understand the spreads and fees it offers.

Therefore, once we get an insight into these two terms, we can move on to view the NAGA spreads and fees. It will help us know how much it will cost to trade with NAGA.

What do spreads and fees signify?

A spread signifies the distinction between two prices. We can see its application in the trading of assets, wherein the most well-known spread is the bid-ask spread. It denotes the difference between a security’s or asset’s bid (buyers) and asks (sellers) prices. Relative value trading is another name for spread trading.

On the other hand, fees are what the customers pay the broker for their services. Though most platforms make their money using spreads, some charge fees also. Fees are usually fixed charges and are rarely changed.

A Spread is how brokerages profit from a trader’s successful trade. It is what brokerages charge you to use their data to make trades. So, the understanding of spread is crucial for traders. The spread is usually expressed in percentage in points (pips). Pips are used mostly in Forex and refer to a minor shift in the price of a currency pair.

Most currency pairs are generally priced to four decimal places in Forex trading, with the pip change being the last decimal point. A pip, therefore, is equal to 1/100 of one percent for other brokers, unlike NAGA, where it offers 5 decimal points for a tighter spread.

The trader must always check the spread size and place the orders accordingly when dealing with spread. Market price should be above the spread price to make a profit. Moreover, a spread may be constant or variable.

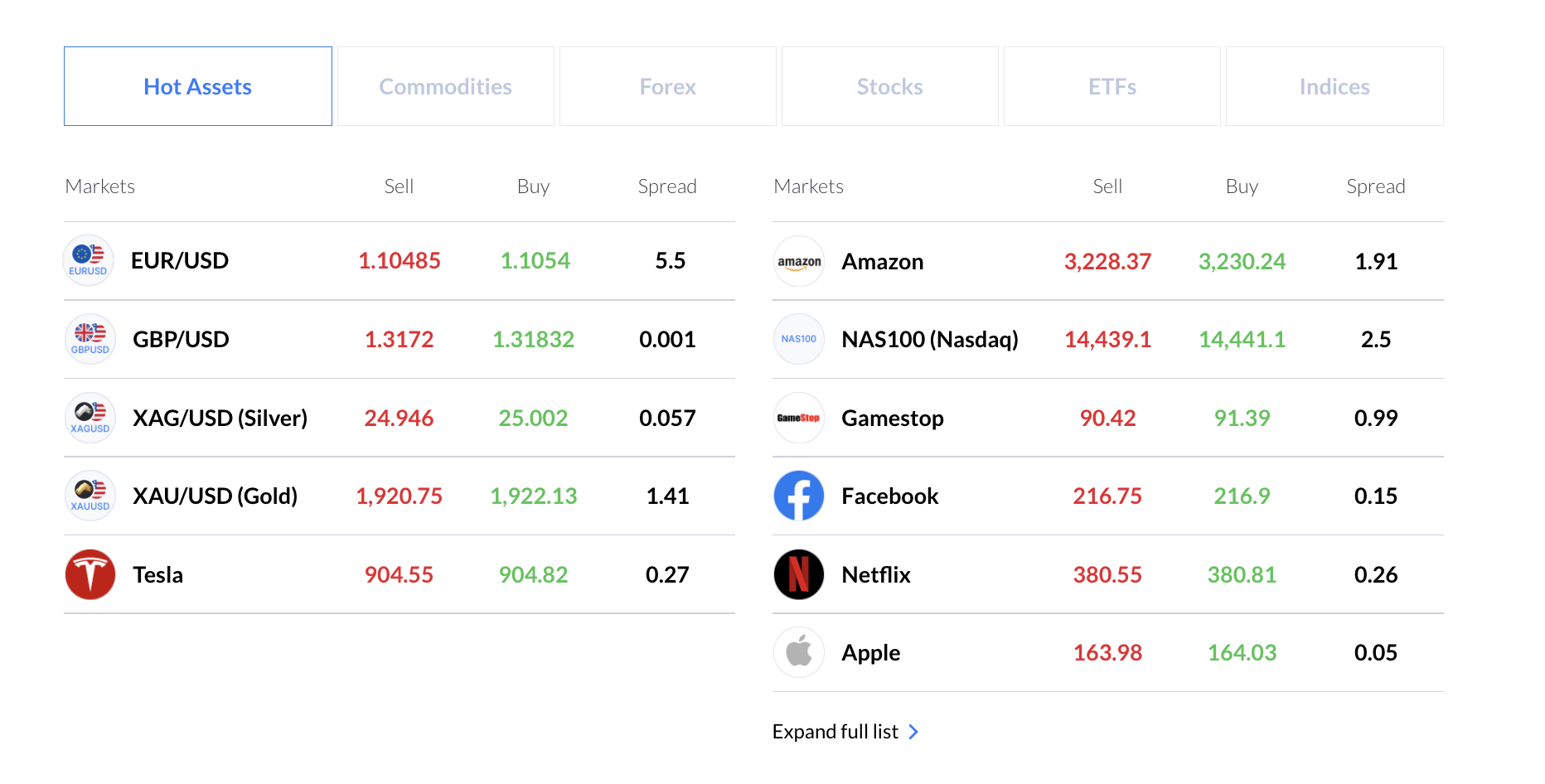

Traders should always note the spread rate of a broker before trading, as a spread can be fixed or floating. Moreover, it can change with the assets also. NAGA offers low market spreads to all customers, irrespective of their account types. Therefore, the users can expect efficient and attractive conditions at affordable costs.

We know that the bid-ask spread is the prevalent method, but a Credit spread is another type we can see. It is more commonly known as Yield spread. It is the ratio of returns on different investments with varying maturities or risk profiles. By subtracting the return of one asset from the return of the other, the trader can view the yield spread.

Brokerages make a profit through spreads. So we can view it as a charge that the brokerage issues for their services. The brokerage also creates the data provided for trades and the trading platform. However, it is not under their control entirely. Therefore, various factors can cause a change in the spread rate.

Knowing the spreads is a must-have for anyone planning to start trading. Going into a trade without knowing its spread rates can cause a trader to suffer an unexpected loss of funds.

It is often seen with beginners that they miss out on looking at a spread value, which results in losing money on trades. Therefore, even if your broker is reliable like NAGA, it is your responsibility to scrutinize the spread and fees that arise. NAGA is a broker that does not hide its spreads and fees, so we can view them and decide accordingly.

NAGA spreads

Before looking into the spreads, a new trader must know that NAGA operates with variable spreads and not fixed spreads. The fixed spreads are often higher than variable spreads, and they can cost you more than your budget can permit.

Many brokers offering fixed spreads also apply trading restrictions with it. However, NAGA is a platform that tries to maintain a narrow spread. Though, certain assets are too volatile, which causes their spreads to be wide. NAGA also recommends that the customers look at the spread rate before placing a trade.

NAGA also offers fractional pip pricing as opposed to its competitors. It helps to get the best prices from its various liquidity providers. Instead of the common 4-digit quoting prices, users can benefit from even the smallest price movements with an addition of a 5th digit.

Therefore, NAGA allows you to trade with tighter spreads with fractional pip pricing and enjoy the most accurate quoting possible. Moreover, it offers a decent spread structure starting from 1.3 Pip.

For forex

Instrument | Swap (long/short) | Avg. spread, pips |

-3.85/-3.1 | 1.7 | |

-1.21/-2.4 | 2.4 | |

-2.75/-3.7 | 1.6 | |

-3.56/-3.7 | 3.9 | |

-2.75/-2.29 | 1.3 | |

-1/-4.1 | 2.1 |

For commodities

Instrument | Swap (long/short) | Avg. spread, pips |

-2.1/-1.06 | 2.7 | |

-1.45/-1.05 | 35 | |

-0.7/-11.9 | 2.3 | |

-1.52/-15 | 2.3 |

For cryptos

Instrument | Swap (long/short) | Avg. spread, pips |

-25%/-20% | 8.45 | |

-25%/-20% | 55.1 | |

-25%/-20% | 62.5 | |

-25%/-20% | 4.35 | |

-25%/-20% | 3.42 |

Fees that can occur with NAGA

#1 Deposit fees

Deposit fees are the type of fees that accompany the initial deposit. We can say that brokers charge this fee as their non-trading fees since it is not directly involved in the transaction. It applies when a trader makes an initial deposit by sending the money to her trading account.

Charging an additional fee for depositing your own money is uncommon in online trading. But, many brokers require it. However, deposit fees are excluded when you are a trader using a NAGA account.

It means you don’t have to pay a single dollar while making an initial deposit. You can expect the same amount in your trading account, which you transferred from the bank.

However, if you are new to NAGA, you must remember that a minimum deposit amount must be transferred. But, that amount is cheaper as compared to many other brokers in the industry who cap it at $1000 or more. Instead, NAGA requires you to deposit only $250.

#2 Withdrawal fees

Trading account type | Withdrawal fees (USD or equivalent) |

Iron | 5 USD |

Bronze | 4 USD |

Silver | 3 USD |

Gold | 2 USD |

Diamond | 1 USD |

Crystal | 0 USD |

It is an amount that you need to pay while withdrawing your funds. Many brokers charge a withdrawal fee while withdrawing your profits or funds from the trading account. It is also kept as a non-trading fee as no trading transaction occurs through it. NAGA also charges a withdrawal fee from its customers.

However, the amount is kept to the lowest possible and would not cause a financial burden. A trader must remember that the standard withdrawal fee is $5 or equivalent. However, the withdrawal fee decreases with every upgrade.

So, when you upgrade to a higher VIP level, the fee would decrease and eventually be free when you reach the Crystal Trader account. Also, when you want to initiate a withdrawal, the methods play a significant role in deciding the fees at NAGA.

So, if you want all your withdrawals in cryptos, they are subject to up to a 20% withdrawal fee. If you are new to NAGA, you must also consider that it has a minimum withdrawal requirement.

It means you can withdraw any amount you wish for, but it has to be more than the minimum limit. However, it should not affect your trading plans as the amount is extremely nominal and kept at a mere $50.

#3 Copy trading fees

Copy-trading is a fruitful method of minimizing the risks and better familiarizing with the trading world. You can copy other traders blindly instead of social trading, where you mimic only the layout. Usually, it does not come at a cost when you wish to copy other traders.

But, when you copy trade in NAGA, fees are applied on the position that you copy from other users. It charges a fixed fee of €0.99, which applies to all copied trades.

Moreover, you may have to pay an additional 5% which applies to all trades that you win with a profit equal to or greater than €10. In addition to those fees, NAGA also charges an auto-copy fee that applies to the customers that are copying other traders in an automated manner.

#4 Network fee

You may be charged a network fee, especially while dealing in crypto. So when you wish to send cryptocurrencies from the NAGA wallet to other external wallets, a network fee occurs for the services.

We can infer that NAGA charges two types of network fees. So, when you send the cryptos to another blockchain address, you will be charged 0.99%. Whereas if you choose to send to another email address, the charge is 1%.

#5 Overnight fees

Overnight fees are classified as trading fees common to many Forex and CFD brokers. It signifies the charges that arise due to the extended holding of the same positions.

That means when a trader fails to close the position within the limited time, and the holding extends overnight within the same position, the broker charges an amount. Usually, the time is set at 22:00 GMT.

Many brokers levy high amounts for the overnight holding of positions with different names, such as a daily rollover or swap fees. NAGA is also among those CFD and Forex brokers who charge an overnight fee on almost every asset.

However, as standard market practice, these fees are charged every day at the closing market hour. Though they are charged daily, the trader must note that on Fridays, it triples. That means NAGA charges them daily at midnight for the last trading day.

But, after Friday midnight, the triple charge applies. It is meant to cover the upcoming weekend. However, there are no swaps for expiration futures. You must also keep the days in mind if you are new to NAGA as the swaps are applicable for FX / Metals / Spot Oil Commodities / Rolling Futures on Wednesdays and Fridays for cryptos and stocks.

#6 Currency conversion fees

Brokers may offer you choices in the base currencies for your trading account. However, many a time, a trader wishes to deal in a different currency other than the trading account’s base currency.

So, in such cases, a broker like NAGA must convert the currency as per the prevailing exchange rates. Such conversion comes at an additional cost which is the currency conversion fees.

It applies to all trades on instruments denominated in a currency different from the account. It is charged based on the exchange rate received from liquidity providers. So, a trader must verify whether it is a fee that the broker may waive off. However, currency conversion fees can also occur when you send the funds in another currency.

#7 Inactivity fees

If you are a trader, creating an account is the first step. But, it also encompasses a responsibility to keep it active for a long time. Often, traders avail themselves of the service of various brokers and open multiple accounts.

That leads them to forget to use some of the accounts. As a result, some accounts stay dormant for a long time. To avoid such scenarios, brokers levy an inactivity fee. They charge this fee for the maintenance, administration, and compliance management of the inactive accounts.

It compels the trader to trade or at least make a deposit before the expiry of the inactivity period. Many brokers offer 21 days usually, but you may get more depending on the broker.

At the same time, if you research well, you can avail of the broker that does not charge any such fees from their customers. NAGA is one such broker which excludes the inactivity fees from its customers. So, you have the freedom to trade as you wish without any compulsion from NAGA.

Conclusion

NAGA is one of the best brokers in trading that offers itself as an all-in-one financial platform. It also offers its app various features. However, a beginner and an expert trader must decide the broker based on its spreads and fees.

So, when we assess NAGA in that respect, we can safely say it has a low spread that starts from 1.3 pip. It also offers nominal fees for various trading services such as overnight swap, withdrawal copy trading, etc. Therefore, we can conclude that NAGA can serve as a reliable and deserving trading partner in your journey.

FAQ – The most asked questions about cost to trade with Naga :

Does Naga charge commission?

NAGA is a broker that does not charge any commission from its customers except for stock trading, which is set at €0.99 or equivalent for transactions in and out.

However, when you trade with NAGA, you must expect additional fees such as withdrawal fees, overnight fees, etc. Though it does not charge anything for making a deposit, other fees are applicable.

Is Naga free?

Like any CFD or Forex broker, NAGA also maintains a spread rate to make a profit. We cannot expect a broker to offer free services completely. However, you can create a demo account and get $10,000 in virtual funds, not requiring any spread or fees.

Moreover, NAGA also has additional fees such as withdrawal fees, overnight fees, and network fees. If you are looking for copy trading, you must also pay the copy trading fees. So we can say that NAGA is not free, but it excludes deposit and inactivity fees. Moreover, the spreads and other fees are relatively nominal.

Can I buy and sell underlying assets without paying Naga fees?

No, a trader cannot buy or sell underlying assets without paying Naga fees. The broker has a very nominal fee for trading on its platform. Thus, Naga is suitable even for beginners. Besides, this platform offers great trading services to traders, making it even more appealing to sign up with.

Can I access Naga without paying Naga fees?

Almost all CFD or Forex brokers try to gain profit. As a result, providing entirely free services is not feasible. However, by opening a demo account, you can receive $10,000 in imaginary money. There are no spreads or Naga fees necessary. Additionally, NAGA will impose extra fees such as overnight, withdrawals, and network costs. If you want to participate in copy trading, you will also incur copy trading costs. Additionally, there aren’t any deposits or dormancy charges.

Does a trader have to pay Naga fees for withdrawing funds?

No, a trader need not pay Naga fees for withdrawing funds from his trading account. You can withdraw funds without paying any charges. The only charges that accrue are what a trader has to pay to the bank to allow the bank transfers and settle the transactions.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller