How to deposit funds to your online broker trading account?

Investing in the trading market is a fast way to increase your income. But you cannot start your trading journey without funding your account with the minimum deposit amount.

Depositing money in the trading account is fairly easy and can be done in no time. If you, however, find it confusing, we have got your back.

We have mentioned the steps that you can follow to fund your trading account in no time.

Table of Contents

How to deposit money in your trading account?

Depositing money to an online trading broker account is easier than many assume. The process takes place electronically and gets completed in no time.

Here’s how you can deposit funds to your broker account:

- Login to your trading account from where you want to withdraw the money

- Go to the transfer page and select the section that says funds or accounts

- Following this, you will have two choices, i.e., withdraw funds or add funds

- Click on add funds and choose the amount you wish to deposit to your bank account

Most brokers don’t charge a fee when you deposit money. But the third-party transaction method used during the process can charge a small amount.

Before you deposit funds to your trading account, compare different brokers in terms of the minimum deposit amount. Remember that not all brokers with a low minimum deposit amount are reliable. Likewise, brokers with high deposit amounts are not risky.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Best methods for depositing money

Online trading brokers offer many options to traders for depositing money in their trading accounts. While each method is quick and reliable, the deposit method that works for you might not be the best for other traders.

Scroll down to know the common methods.

Electronic funds transfer (EFT)

EFT is a fast and convenient way to transfer money from a bank account to an online trading account. Under this payment method, money is directly deposited to the receiver’s account in no time.

In most cases, the deposited money is reflected in the receiver’s account on the following business day. But under certain circumstances, a delay may occur. Also, you need to pay a small deposit fee while using this deposit method.

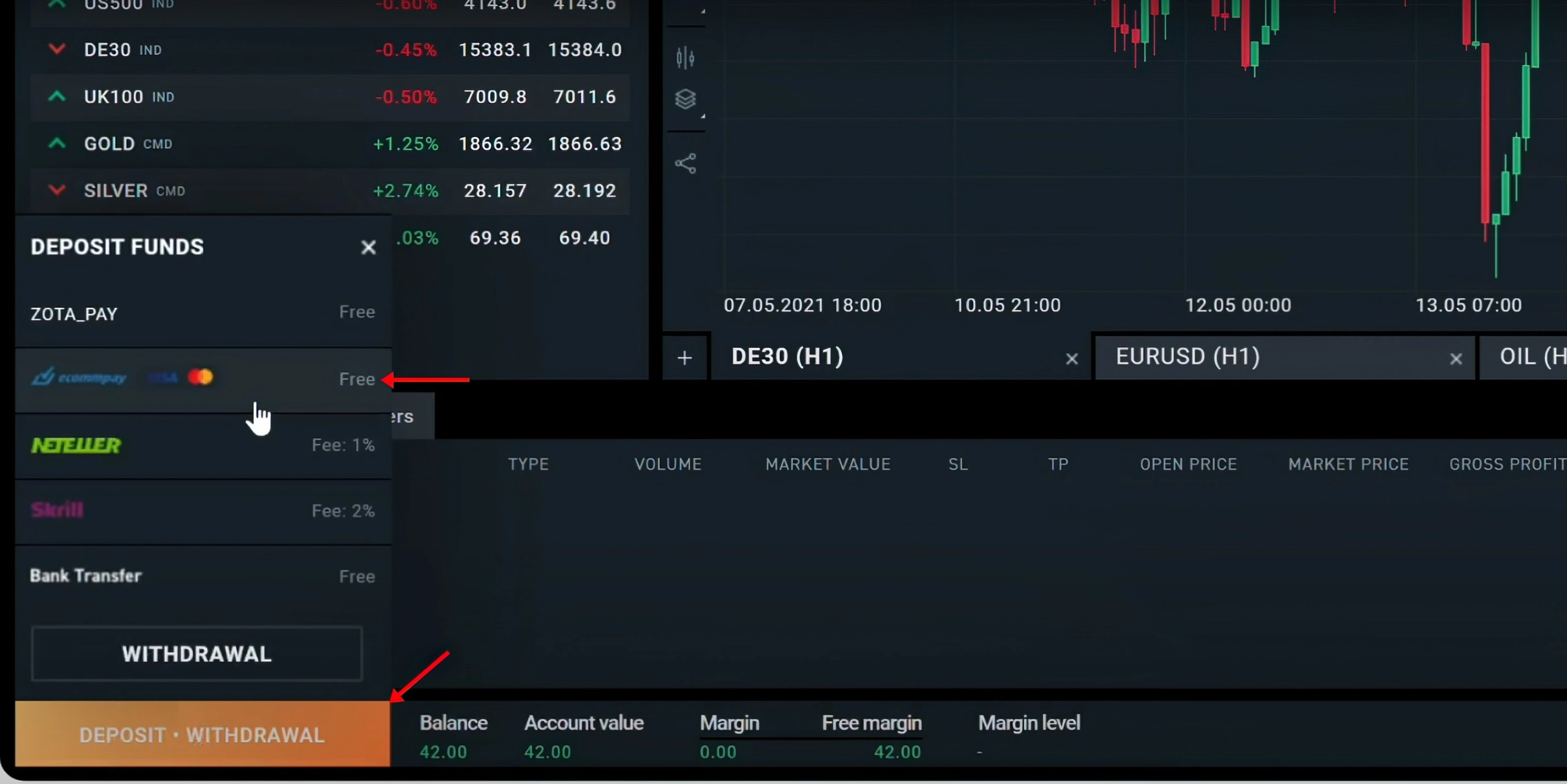

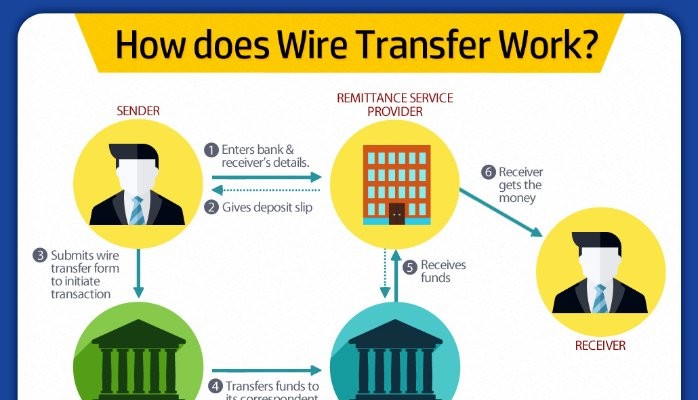

Wire transfer

Wire transfer is another reliable and convenient deposit method. It’s also called a bank transfer or credit transfer. It is considered one of the most expensive ways to fund your trading account because banks charge outgoing wire transfer fees.

As a wire transfer is considered a direct bank-to-bank transfer, money is deposited almost quickly. This payment method can be divided into two types, i.e., domestic wire transfer and international wire transfer.

Paperless money processing through wireless transfer is secure and offers high money transfer limits.

Asset transfer

Asset transfer is also an accepted way to fund online broker trading accounts. Under this money transfer method, individuals give ownership of their assets to other individuals.

This payment method is only acceptable if you transfer your current shares from another stockbroker. Assets transfer can be done in different ways, including fixed asset transfer, community asset transfer, and more.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Stock certificates

Stock certificates can also be used for funding an online broker trading account. The certificate needs to show ownership of the shareholder in a company.

A stock share provides important information like identification number, number of shares, signature, and date of purchase. The funds using stock certificates can be deposited to the brokerage account via mail.

Cheques

Cheques are also an accepted deposit method that many online trading brokers use. When you deposit a check, banks pay the specific amount from your account to the broker’s account. The acceptable check options might vary depending on the stockbroker.

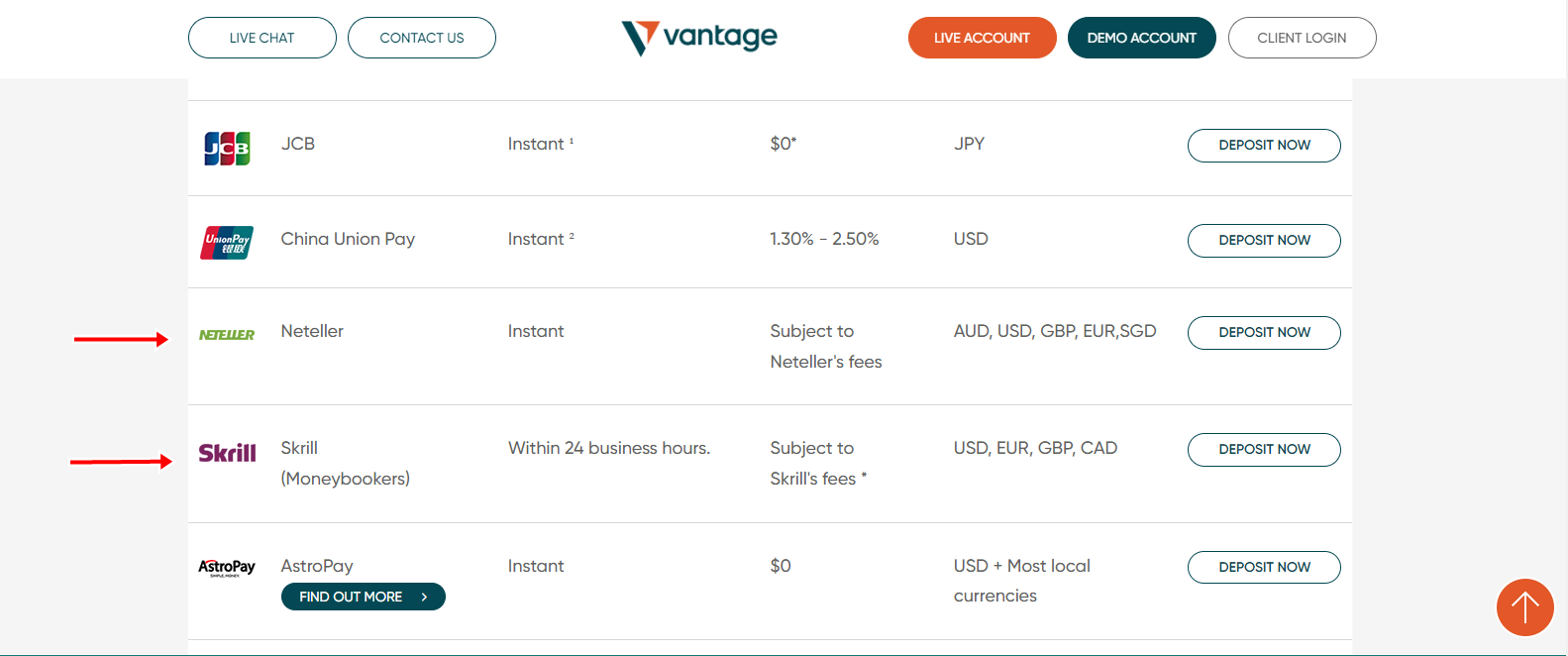

e-Wallet

E-wallets are one of the most popular ways to deposit the trading amount. Different trading brokers accept different e-wallet payment methods. So, before you use this method to fund your trading account, check whether or not your trading broker accepts it.

You can select any of the suggested payment methods to fund your trading broker with a certain amount. Make sure that the broker accepts the selected method.

What document audit you should maintain while funding your account?

You must follow some basic documentation when depositing funds into your online trading broker account.

Take a snapshot of the payment details after depositing money into your trading account. In addition, maintain copies of the check so you can fully control your fund flows.

Conclusion about how to deposit funds to your online broker trading account?

Now that you know the correct steps for funding money to the trading account, you can do it in no time. Before depositing money, check whether the broker charges a deposit fee and minimum deposit criteria.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Last Updated on June 4, 2023 by Yuriy Kunets