Everything you need to know about the Purple Trading regulation

Table of Contents

Before beginning to trade with a broker, you need to be sure about the regulation status. It is perhaps the most significant aspect of a broker. A broker may provide you with world-class features and benefits. You can even win trades with such a broker’s help. However, the regulation will ultimately determine whether your funds are safe or not.

Various agencies regulate brokers due to the increase in fraudulent activities. Since trading is a technical game that many new traders are unaware of, they fall into the trap of canvassing brokers. Later they realized that the trades they made were illegal since the broker is not even regulated. So, to stay away from such a scenario, you must always be wary of the regulation of your broker.

(Risk warning: 63% of CFD account lose money)

Is Purple Trading regulated?

When it comes to choosing a regulated broker, traders often face a dilemma. However, Purple Trading does not fall under the list of unregulated brokers, and you can choose it freely.

Purple Trading is a broker that believes in fair trading. That is why it takes market regulations seriously. It aims at providing the customer’s safety and assurance. That is why it is a regulated broker that comes under the jurisdiction of top regulating agencies. Such a regulatory status makes it reliable and safe for long-term trading.

Overview about regulations

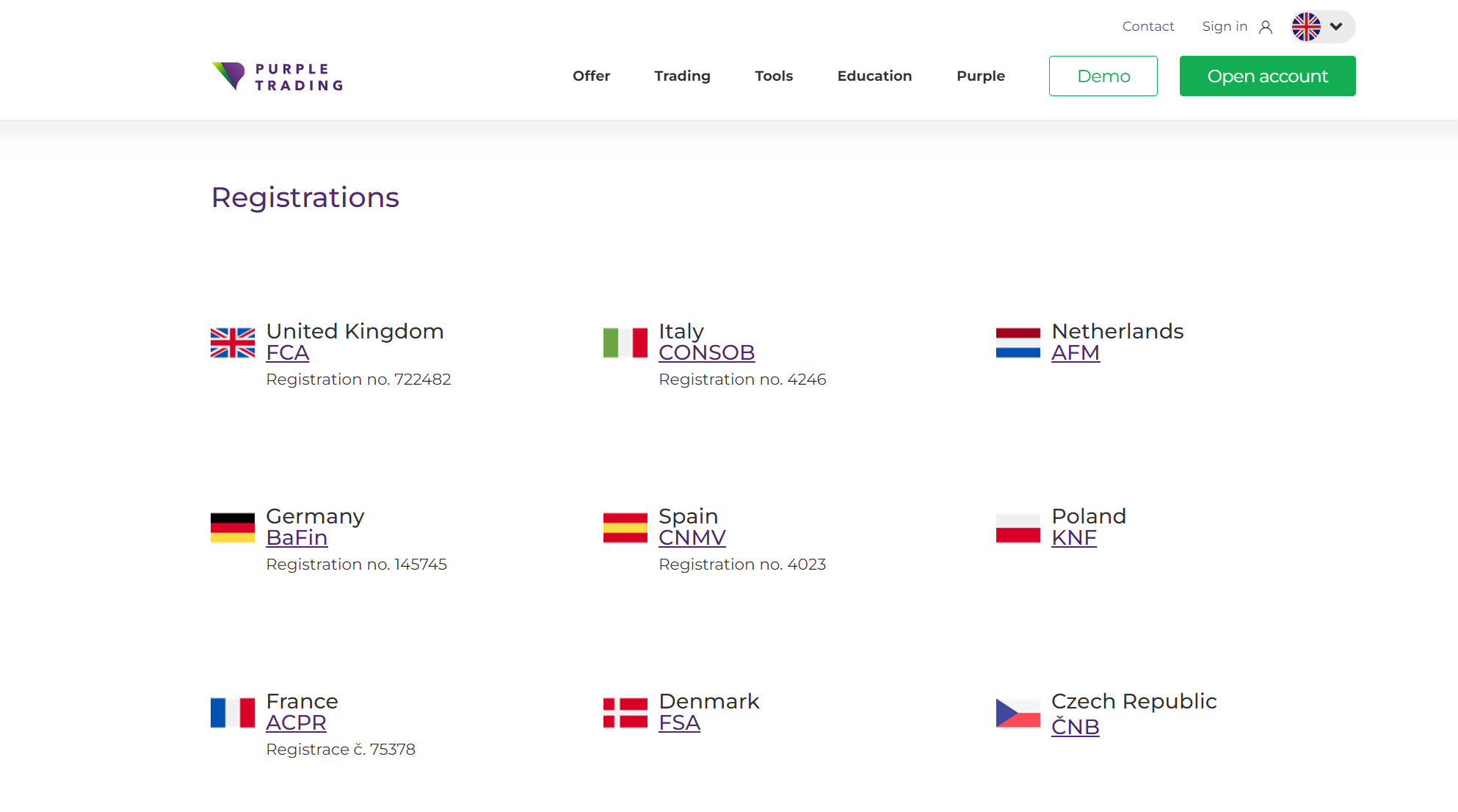

It is mainly regulated by two regulatory agencies, CySEC and ESMA. The regulation from these two agencies makes it the safest broker in entire Europe. However, the regulation and licensing range to many more countries other than Cyprus. It includes the UK, Spain, Germany, Italy, Denmark, Seychelles, etc. They regulate this broker under their own regulatory agencies.

Therefore, it must abide by the conditions of all such countries where its services are licensed. If Purple Trading fails to adhere to its conditions, these agencies can bring it to the unregulated category. That will cause a loss of a significant number of customers. Since such a strict reason persists, we can be sure of the safety standards of this broker.

(Risk warning: 63% of CFD account lose money)

How does Purple Trading ensure security for traders?

Just the regulation from top agencies alone may not convince wary traders to join Purple Trading. That is why it leaps forward in providing security to traders through its legal infrastructure.

Purple trading does not shy away from joining hands with trusted external bodies for client safety. Hence, it offers a robust safety mechanism to its clients that distinguishes it from other brokers.

The highlights of its safety features include:

- ICF Funds

- Negative Balance Protection

- External and Internal Audits

Security through ICF funds

Purple trading possesses membership from the ICF. It stands for the Investor Compensation Fund. Being a member of the ICF is a regulatory requirement for Purple Trading.

The ICF signifies compensation that a trader can receive due to the sudden losses of funds. Since trading is a risky and unpredictable game, sudden loss of funds is a common phenomenon. However, not many brokers give the privilege of ICF to their customers.

Purple trading is an exceptional broker that can guarantee the safety of its client’s funds through the ICF. It offers a EUR 20000 ICF to its customers. So, a trader who suffers a sudden loss of an amount within that range is free from any risk of loss and can receive compensation.

Safety through Negative Balance Protection

This feature is a requirement for all the brokers falling under the ESMA & CySEC jurisdictions. Being a strict follower of guidelines Purple Trading also offers Negative Balance Protection to its clients.

The NBP is a feature that prevents the clients from losing additional funds than what they already lost. In many cases, a trader might get stuck in a situation where a sudden price change may arise. That can significantly increase the chances of losing. If the sudden price change surpasses a limit, it can even overpower the stop-out function of the platform.

That will cause a cessation in the automatic closing of trades to prevent losses. So, a trader who is dependent on the stop-out function will lose her funds significantly in such a scenario. To prevent that from happening, NBP is essential.

The primary function of this feature is to prevent the trader’s loss from exceeding the total capital. So, when the losses start crossing the amount of capital, NBP will bring it to a halt. Therefore, with the help of Negative balance protection, a trader can be safe from incurring additional liabilities that may arise because of her trading moves.

External and Internal Audit

Along with various security features, Purple Trading also assures its clients of safe governance. That means it conducts periodical audits from time to time to eliminate any illegal activities. The audits are performed by both external and internal authorities to ensure maximum transparency.

Conclusion: Purple Trading is strictly regulated

The regulation and safety standards are among the most disputed aspects of trading. Brokers often fail to convince experienced traders about their safety features.

However, Purple Trading offers maximum safety to its traders through multiple features. It does not limit its safety standards to the regulations alone. Therefore, any trader can join it without a second thought about the safety of their funds.

(Risk warning: 63% of CFD account lose money)

FAQ – The most asked questions about Purple Trading regulation :

Does Purple Trading regulation allow it to have a license to offer trading services?

Yes, Purple Trading is one of those regulated brokers that excel in offering the best services to traders. It has a brokerage license and is also overseen by several regulating agencies. Thus, trading on this trading platform that follows Purple Trading regulations is the best for any trader. They can access high-quality services at a low price.

Can I trust Purple Trading regulations to fulfill my trading requirements?

Yes, traders can trust Purple Trading regulations to fulfill their trading requirements. The broker offers a lot of trading assets to traders. Besides, they can access trading tools and technical indicators that make trading more fun for them. They can also use the Purple Trading demo account to plan and strategize their trading moves. It helps them develop a perfect technical analysis that one other platform can support.

Is Purple Trading safe under the Purple Trading regulation?

Yes, Purple Trading is the safest trading platform. Purple Trading regulation governs it. If you research, you will find only positive reviews about this trading platform that supports its legitimacy. Besides, Purple Trading has a very big clientele, proving it is a safe trading platform. So, if a trader is looking for a reliable platform, he can choose Purple Trading.

See article about other online brokers:

Last Updated on January 27, 2023 by Arkady Müller