Can a broker lend trader’s shares for short-selling? – Risks and Benefits

Table of Contents

Stock lending has become a common thing in the trading world these days. There are many instances where the broker lends the shares of the traders. But traders often wonder if a broker can do it at all.

Lending shares to any trader is not an illegal practice. A lot of brokers indulge in share lending. However, in most cases, the traders are unaware that their broker has lent their shares. Undoubtedly, a trader can second-guess a broker with which he is trading.

So, let’s explore whether this practice, often called short-selling, is favorable.

Can the broker lend my shares?

A broker can lend a trader’s shares to any other trader. The practice of short-selling is highly prevalent within the trading community these days. Usually, a broker can only indulge in short-selling traders’ shares with their permission.

However, often, several traders report instances where their broker indulges in short-selling without the trader being informed. Traders must note that most brokers have a provision for short-selling mentioned in their terms and conditions. However, most traders skip reading the broker’s terms and conditions and become victims of short-selling.

Good to know!

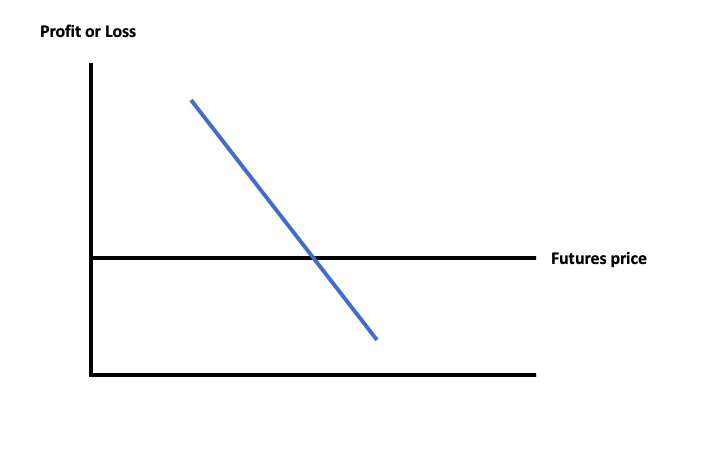

Short selling is based on mechanics; a trader should understand these mechanics well to know how short-selling works.

Why do brokers lend shares?

Several short-sellers exist in the market who borrow investments from brokers. These traders or short-sellers know nothing about the stock and investment. The basic information about who the stock belongs to or where it comes from.

The brokers allow short trades to indulge in short-selling to benefit from the short-term fluctuations in the asset’s price. Besides, brokers lend shares also because it helps increase their earnings.

Good to know!

In addition, the brokers lend shares also because it makes them a commission when they provide such services to traders. So, brokers benefit from share lending in two ways.

Short-selling or share lending is a favorable situation for both traders and brokers. The short-seller earns a considerable profit when he goes short with the lent shares. Here is how short-selling works for traders.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How does short-selling work?

Short selling enables traders or investors to bet against a certain asset. The trader who indulges in short-selling benefits when the investment goes off ‘short.’ Usually, traders make money from short-selling only when the price of the investment they borrowed goes down.

Traders can understand short-selling with the following example:

- Suppose a trader borrows stocks of Apple from a broker

- Let’s assume the trader/investor opts for borrowing 5 shares of Apple stocks priced at $200

- After having Apple shares with him, the trader will immediately sell the shares to another trader

- As soon as the short-seller sells the shares, he gets an amount of $1,000 at his disposal

- Now, the price of Apple shares has fallen further. Let’s assume that the price falls to $100 per share. So, the short-seller who previously sold these shares will buy them back

- Previously, the short-seller paid $1,000 for the borrowed shares. However, to acquire them again, the short-seller will need only $500

- Using the short-selling trading technique, the short-seller will have made a profit of $500. (Remember that the trader sold the shares for $1000 dollars and has this amount in cash.)

So, short-selling is a great trading practice for traders. Hence, traders from any experience level can indulge in short-selling. However, short-sellers must know the market conditions and trends of an asset’s price.

Good to know!

It makes their trading costs significantly higher as they also need to pay commission and interest on the borrowed shares.

Risks and chances of short-selling

Short-selling has several risks and chances for traders.

Risks of short selling

- According to several historical facts, short-selling might only sometimes work in the trader’s favor. Sometimes, the asset’s price might be contrary to what the traders expect, thus causing losses

- The interest payments and the short-selling commissions can be high for traders

- Traders might sometimes need help paying the interest on short-selling

Chances of short selling

Besides the disadvantages, short-selling offers traders several benefits. These include the following:

- Traders can trade with leveraged investments

- Short-selling doubles the profit-earning potential of a trader

- It presents several opportunities for traders

- Short-selling might sometimes offer traders additional risk protection

How do I stop my broker from lending my shares?

If a trader wishes to stop the broker from lending his shares, he can contact the broker’s customer support. Most brokers will always take permission from traders to lend their shares. However, if your broker does not take your advice, you can always initiate legal action against the broker.

Conclusion about short-selling of trader’s shares

A broker might indulge in lending the shares of any trader. No rules might keep a broker from lending shares to the trader. However, the trader should always know that his broker is lending their shares.

Some brokers might indulge in lending shares to enable traders to enjoy short-selling without the knowledge of the shareowner. However, sometimes, the broker might have it mentioned in his terms and conditions that they can practice short-selling.

Protecting yourself from your broker’s illegal share lending lies on a trader. A trader must be cautious while reading the terms and conditions of a trading platform.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQs – frequently asked questions about short-selling of trader’s shares

Is short selling worth it?

Yes, traders can practice short-selling if they have adequate knowledge about the trading industry. Also, a trader should be able to track the prices of an underlying asset when indulging in short-selling. Short-selling can be worth it if a trader is up to date with the market conditions.

Is lending of shares by the broker illegal?

No, lending of shares by the broker is not illegal as long as it is mentioned in his terms and conditions.

Does a broker need trader’s permission before lending their shares?

Yes, a broker needs the trader’s permission before lending their shares.

Last Updated on June 17, 2023 by Andre Witzel