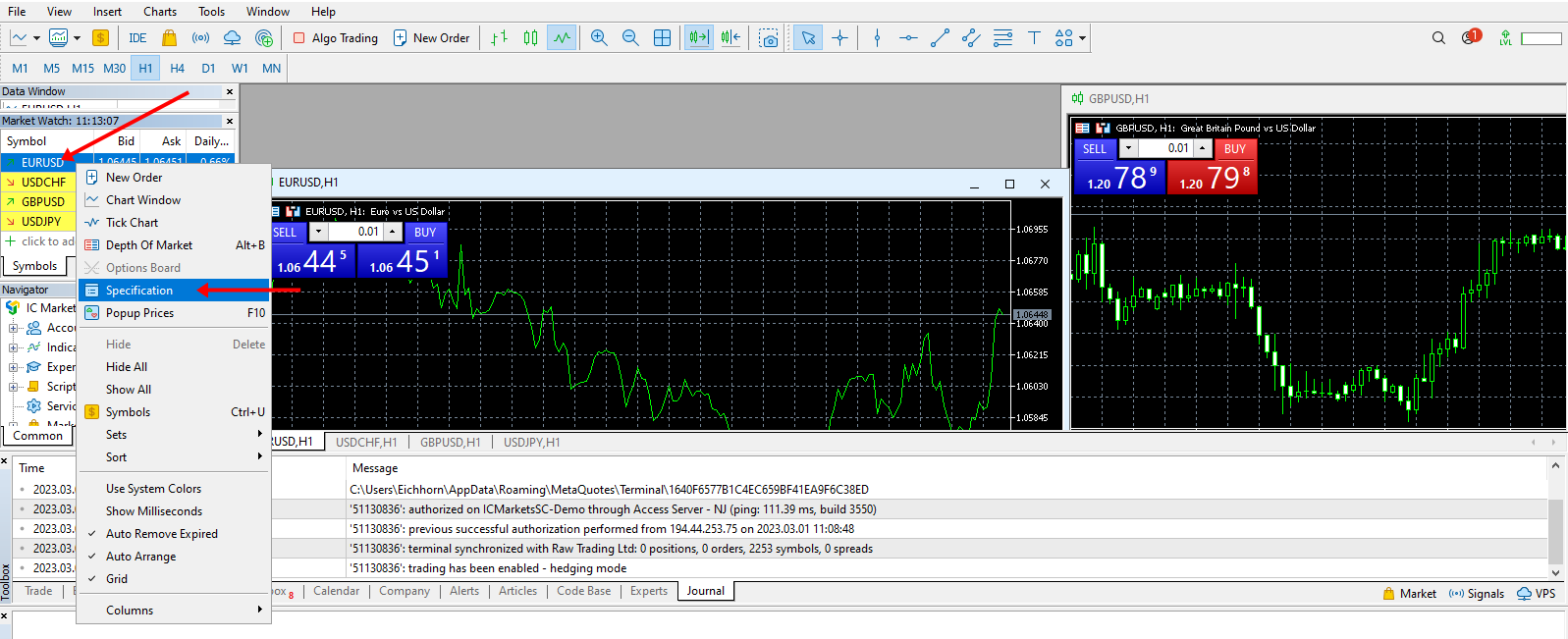

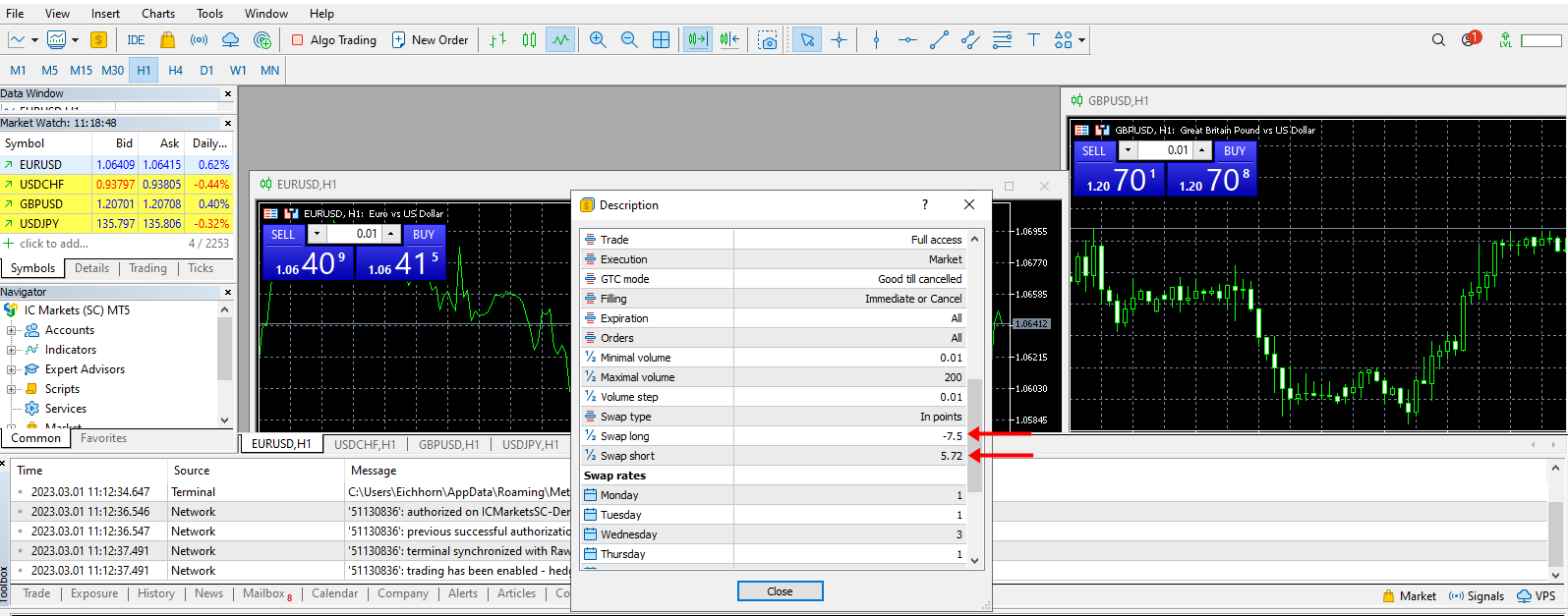

Where can I see the overnight fees of my online broker?

An overnight fee in the trading market is called a rollover fee. It’s a small payment, which only applies if you hold your CFD position overnight.

Remember that the rollover fees are not unique. They are a part of CFD trading because they reflect the force of supply and demand in the financial market. Also, the fee covers the cost linked to your position.

Depending on the buy or sell direction, the overnight fee can vary. The fee is ideally deducted from your available balance. Sometimes, you don’t have to pay a fee; instead, you receive a refund. That means your trading account is credited and not debited.

Read on to know more about overnight fees and where you can see them on your online broker.

Where can you see overnight fees?

Before opening a position and while your position is opened, you can view overnight fees or refunds at five different places:

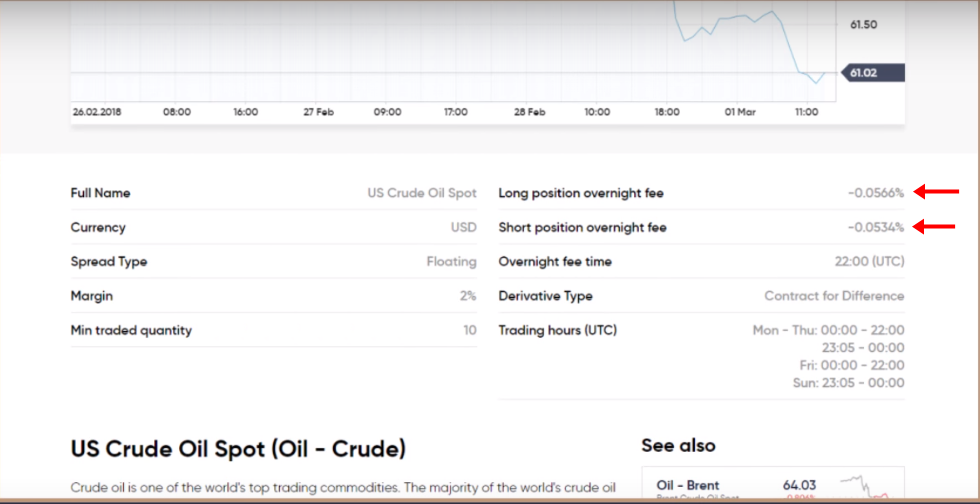

- On the fees page of the website: The most straightforward way to see your overnight fees is by visiting the fees page of your website

- Your account statement: No matter if your position is opened or closed, overnight fees can be easily viewed. Visit the Account Activity section under Rollover Fee

- Portfolio history page: To view the overnight fees or refunds paid during a chosen time by visiting the portfolio history page

- Portfolio page: You can also view the overnight fees under the ‘O/N fees’ column. This way, you can check the fees paid on each investment

- Trade summary screen: Under the trade screen summary, you can find the total fees or refunds you will pay, are paying, or have paid

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Why is overnight funding charged?

You use leverage to trade CFD. It means outside the initial deposit you have paid, you lent the money needed to open your position.

If you want to open your position after the daily cut-off time, an interest adjustment will reflect the cost of funding your position overnight. Also, you would have to pay a small admin fee.

How do brokers take overnight fees?

For manual traders, the overnight fee is taken from the available balance. But if traders don’t have funds in their available balance, the fee will create a negative balance. Lastly, for the copied position, the overnight fee is taken from copy balance.

Advantages of overnight funds

Below are some of the benefits of overnight funds:

- Ease of liquidity: While overnight trading funds, there are no entry or exit loads. For this reason, overnight funds are highly liquid. So, as an investor, you can quickly redeem your investment without any compromise

- Better Use of surplus funds: Traders who want to use their surplus cash find overnight funds as a good investment option. It improves their returns at no extra risk. What’s more? Well, overnight funds allow you to generate profits in a shorter tenure

- Low-risk factor: As overnight funds have a low-risk factor, traders with a low-risk appetite like the idea of trading them. Also, traders have a conservative outlook toward investments like overnight funds

- Safety against market volatility: Overnight funds offer safety against market volatility. That means any changes related to credit ratings have no impact on the overnight funds. Traders are cushioned against the risks, and the short investment horizon of overnight funds protects them from market volatility

- Low cost: Overnight funds are low-cost because their debt holdings are passively managed.

- Safe security: With trading, there is always a risk of losing money. But overnight trade reduces the risk to a minimum with almost zero interest rate. In fact, the risk linked with overnight funds is lowest in debt funds because they will not default on interest payments after they mature

Conclusion about the overnight fees of the online broker

If you are investing overnight funds and want to see where overnight fees are, you have five options. You can view it on the website’s fees page, portfolio history page, account statement, trade summary screen, and portfolio page.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on May 29, 2023 by Yuriy Kunets