5 best stock trading platforms for investors in comparison

Table of Contents

Investing in stocks has the potential for huge payoffs, but it also carries a high level of risk. Beginners often find the trading process challenging, making them prone to more significant losses.

Luckily, a few best stock trading platforms help investors analyze investments quickly, reducing the risk involved in trading. Here are the five best stock trading platforms suitable for all types of traders.

The list of the 5 best stock trading platforms for investors includes:

Broker: | Review: | Stocks available: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. XTB | Yes | Starting 0.1 pips | 3,000+ | + More than 3,000 different markets + Very good trading conditions + Direct market access + Bonus Programm | Free demo account(Risk warning: 72% of retail CFD accounts lose money) | |

2. Markets.com | Yes | Starting 0.6 pips | 250+ | + Accepts international traders + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: 67% of retail CFD accounts lose money) | |

3. eToro  | Yes | Starting 0.0 Pips | 3,000+ | + A regulated and safe company + Social and copy trading + Innovative and user-friendly platform + Professional support + Minimum deposit of only $ 200 | Free demo account76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. | |

4. Admirals | Yes | Starting 0.0 pips | 4,000+ | + Wide range of markets + Quality support and services + Offers mobile trading + Regulated + Global | Free demo account(Risk warning: 76% of retail CFD accounts lose money) | |

5. Capital.com | Yes | Starting 0.5 pips | 6,000+ | + Multi-regulated broker + Low spreads and no commissions + Personal support + Huge variety of educational material + Free demo account | Free demo account(Risk warning: 78.1% of retail CFD accounts lose money) |

See the list of the 5 best stock trading platforms for investors:

- XTB – Excellent trading conditions

- Markets.com – Over 8,200 markets to trade

- eToro – Leverage up to 1:30 for European traders

- Admirals – Wide range of markets

- Capital.com – Multi-regulated broker

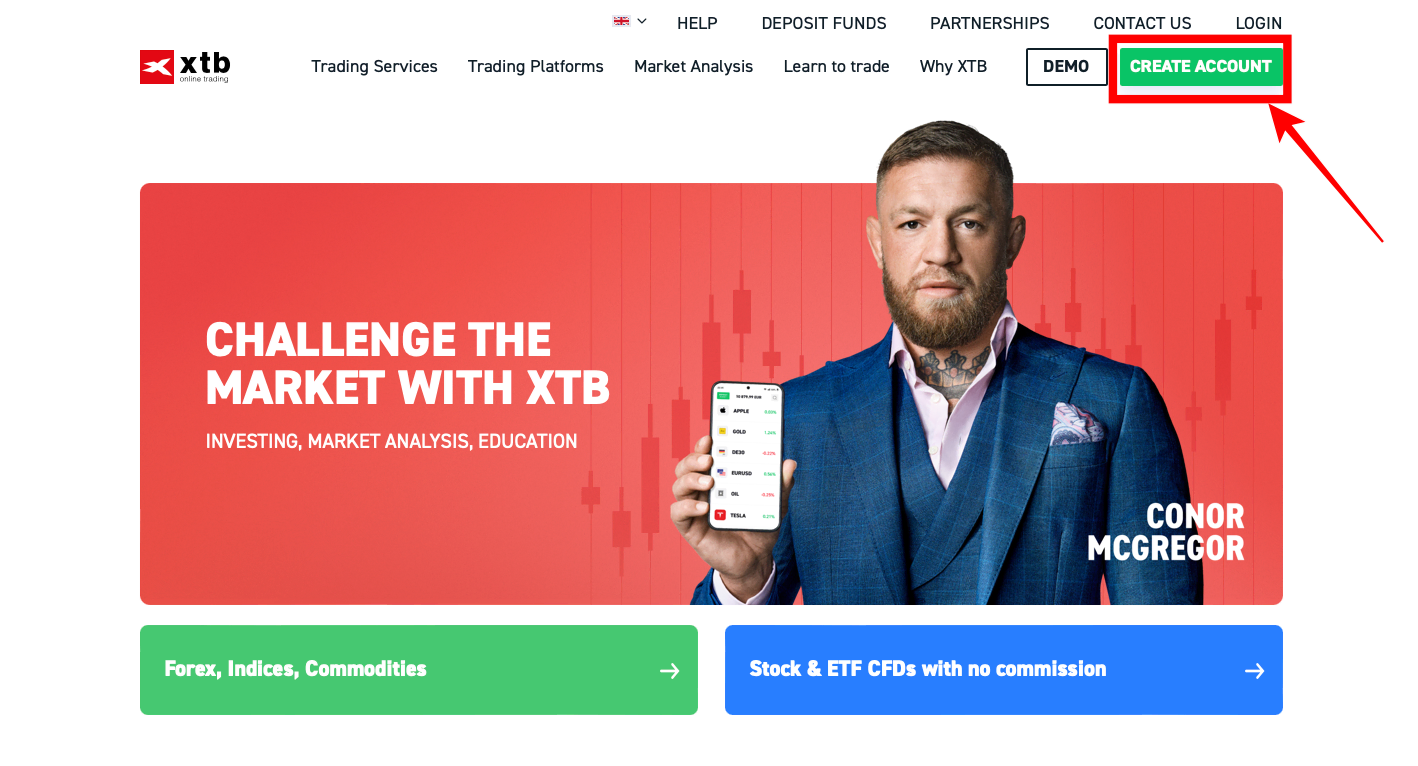

1. XTB – Excellent trading conditions

XTB is a well-established online stock broker located in Europe. Many traders utilize this broker to trade shares on global markets. Founded in 2010, XTB has grown to become one of the top online stock brokers.

The broker provides its services to US, UK, Portuguese, Polish, French, and Spanish traders. XTB is also active in the foreign exchange market, commodity, and cryptocurrency trading.

XTB subsidiaries have the approval of several regulatory bodies around Europe and the UK. The broker’s operation is regulated by the following:

- The CySEC: Cyprus Securities Exchange Commission in Cyprus

- The UK FCA: Financial Conduct Authority.

- The Polish Securities and Exchange Commission in Poland

- The National Securities Market Commission in Spain

XTB offers CFD trading on more than 2500 financial instruments. The brokerage firm also offers Forex trading on several currency pairs and commodities, such as gold, silver, and oil. ETFs are also available for trading, but they come with their own unique set of risks.

XTB’s unique platform, known as xStation 5 is packed with features perfect for your trading needs. The interactive and easy-to-use software provides you with free audio analysis and an innovative trading calculator.

xStation5’s layout is optimized to give traders a clear view of various markets and tools. Every unique technical tool on the platform is to aid you with your trade. You can download the award-winning software on your laptop, tablet, smartphone, and even your wristwatch.

You can open a demo account with XTB and test drive the platform. The virtual money provided by the demo account can be used to try out all the platform features. You can also use virtual money to trade stocks on a simulated trading platform.

There are various methods to deposit money in XTB’s trading platform without extra charges. One of them is by bank transfer. Another method of depositing funds is using a debit or credit card via a secured website for traders. You can also deposit through Skrill or Paypal, although there is a 2% processing fee for each deposit.

Withdrawn funds are processed on the same day via the payment used for the deposit. Note that you can deposit any amount on the XTB platform. Also, the brokerage firm only accepts USD, EUR, HUF, and GBP currencies.

XTB customer support is available 24 hours through five working days via telephone and email. The support staff has a vast knowledge of trading and execution matters. Their services are also helpful in understanding account funding and withdrawal procedures and regulatory questions, and policy-related issues. XTB offers several educational resources, including webinars, videos, and articles on trading-related matters.

Key features of the XTB stock trading platform include:

- XTB minimum deposit of $0

- Regulated by the FCA, IFSC, and CySEC.

- The unique trading platform is known as xStation 5

- Several educational resources and videos for new traders

- Stock spread is provided at 0.2%

(Risk warning: 72% of retail CFD accounts lose money)

2. Markets.com – Over 8,200 markets to trade

While many online stock trading platforms exist, few can compete with Markets.com regarding their offerings and features.

Markets.com started operating in 2008. Stock traders from the UK, Spain, Germany, and many parts of Europe can trade safely on the platform. The platform is regulated through the FCA and CySEC, which permits them to operate worldwide except for countries like the US, Belgium, and Japan.

Different assets are available in the Markets.com stock trading platform. The company offers stocks, futures, CFDs, and currencies to its users. Four Bonds, 66 ETFs, and 25 cryptocurrencies are part of the assets provided by Markets.com.

Markets.com has four different types of trading platforms for its users. These include the Marketsx, Marketsi, MT4, and MT5. Each platform has unique attributes that appeal to different types of stock traders.

Markets.com is a web-based platform with a simple interface. Traders have access to different technical analysis tools, and live trading feeds. You can also use the strategy builder that assists traders in analyzing worldwide equities and shares on the platform.

Traders using the Markets.com stock trading platform can download MT4 and MT5 platforms. Note that both Mac and PC users can get the software. The mobile application version is also available for iOS and Android users.

Markets.com offers a demo account that is accessible to anyone. The demo account is used to teach new traders the ins and outs of the platform without any risk or loss of capital. Demo trading accounts are also helpful for mentors and trainers who want to practice with live data before taking on clients.

To deposit funds on Markets.com, you need to create a Trading account and fund it with a certain amount of money. You can transfer funds from your bank and many other financial institutions after you have completed the verification process. You can also use a debit or credit card to fund your Markets.com account.

On Markets.com, you can deposit as low as 100 of your trading currency. Despite the low deposit, the brokerage firm charges zero dollars for deposits and withdrawals. However, you are likely to pay a processing fee when using Skrill and PayPal.

Markets.com has customer service available to its clients through phone, email, and live chat. The 24/5 customer service is one-on-one and open in more than ten languages. You can find details of its customer service on the website’s Contact Us section.

Key features of Markets.com include:

- Markets.com minimum deposit of $100

- 67 forex pairs and

- Over 2000 stocks and shares

- Regulated in South Africa, the UK, and Europe.

- Stock spread is offered at 4 pips

(Risk warning: 67% of retail CFD accounts lose money)

3. Etoro – Leverage up to 1:30 for European traders

Etoro was set up in 2007 to provide a wide variety of stock markets to traders worldwide. Thanks to licenses from regulatory agencies in the UK and Australia, the broker is safe for new and expert investors.

Etoro has a wide selection of assets, including stocks, ETFs, commodities, and indices. 53 forex pairings, 53 exchange-traded funds (ETFs), 12 market indices, seven commodity categories, and 957 CFDs are available on Etoro.

The online stock broker has also been a leader in CFD trading for years.

Users of Etoro will have a pleasing trading experience. This is due to CopyTrader, a new trading platform that integrates the old app with the web-based platform. You can also enjoy easy-to-use technical analysis, charting, live trends, and real-time prices.

EToro likewise provides free mobile trading applications that customers can download on their smartphones and tablets. This allows investors to trade or watch market movements while on the move. These applications are available on Google Play and Apple Store.

The Etoro demo account is an excellent choice for people who want to try out trading without risking their own money. The platform provides plenty of opportunities for users to practice their skills. This is because you can trade using virtual cash that has no financial value.

To start trading with a real account, you must deposit a minimum of $200. Deposits made using credit cards like Diners, VISA, or Mastercard are now authorized on Etoro. Traders can transfer their funds via eWallets like PayPal, Neteller, Webmoney, Skrill, Yandex, etc.

If you cannot pay via credit cards or eWallets, you can use the wire transfer options. Withdrawal applications are generally processed in three working days. Traders should guarantee that the money withdrawn is at least $50.

Etoro customer service is available 24 hours from Monday through Friday. There are several ways to reach customer service. This includes email, live chat, phone number, or web form. All these are available on the company’s website, including dedicated departments for resolving specific issues.

Key features of the Etoro stock trading platform are:

- Minimum trading of $1

- Regulated by FCA, ESMA, and CySEC

- Account types include STP and ECN

- Social trading, copy trading, and auto trading are allowed

- Stock spread is offered at 0.24% Var

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Admirals – Wide range of markets

Admiral Markets was established in 2001 to provide stocks for active investors worldwide. The Estonia-based brokerage firm is regulated by international agencies in the UK and Australia.

Admiral Markets focuses on providing a complete solution for beginner and expert traders. You can trade more than 3000 financial assets on the broker’s trading platform. This includes 50+ currency pairs, 30+ cryptocurrencies (Bitcoin and Ethereum included), and 25+ commodities.

Admiral Markets has teamed up with MetaQuotes to provide the unique MetaTrader interface. As such, Admirals MetaTrader platforms stand out in comparison to other brokers. The MT4 and MT5 platforms are accessible via web browsers or downloadable on mobile devices.

Admiral Markets trading platform is designed to help traders attain the highest possible level of success. The brokerage company provides access to charts with different technical indicators. These tools help traders develop unique trading strategies.

New investors just signing up with the Admirals market can start with the demo account. This is an excellent opportunity to test the stock trading platform without risking capital. The demo account comes with $10,000 in virtual funds that can be used on all assets.

The online stock broker makes it easy for traders to deposit and withdraw earnings anytime. To start trading a real account, you are required to make a minimum deposit of $100. Also, you can make a minimum withdrawal of $1 for free twice per month.

You can make payments via bank transfers, credit cards, PayPal, Swift, Wire Transfer, Skrill, and Neteller. You can also transfer your earnings via these channels. Note that all transactions are free of charge except for e-wallets like Neteller.

Although headquartered in Estonia, traders from anywhere can reach Admiral Market’s customer support. Customer service is available 24 hours, five days a week. Admiral’s customer service is multilingual, enabling it to answer all types of queries.

You can make your query known to customer service via email at [email protected] or call +442035041364. The firm also has a live chat option located at the bottom of the webpage. You can equally open the ‘Contact Us section to use the web form provided by the brokerage.

Key features of Admiral Markets trading platform include:

- Market leverage close to 1:30

- Regulated in the UK and Australia

- $100 Admirals minimum deposit

- $1 minimum withdrawal

- Stock spread is offered at 0.5 pips

(Risk warning: 76% of retail CFD accounts lose money)

5. Capital.com – Multi-regulated broker

Capital.com is an international CFD broker with more than one million clients across the globe. The broker started in 2016 and today is located in Belarus, Cyprus, and the UK.

Traders from more than 50 nations trust their funds with Markets.com. This is due to regulations from top-level agencies like the FCA and CySEC. The stock brokerage is also licensed by the National Bank of the Republic of Belarus.

Markets.com’s unique platform is reflected in its wide selection of financial instruments. Its comprehensive market includes over 100 major and minor fx pairs. Other tradable assets available via Markets.com are:

- 200+ cryptocurrencies

- 2000+ stocks and shares

- 40 commodities

- 28 indices and future contracts

Capital.com is a user-friendly trading platform thanks to its development crew that has put a lot of thought into the user interface. The transition from the web-based service to the mobile app is smooth. This provides a high degree of technical analysis without crowding the screen with redundant information.

Seasoned traders can use more extensive data, charts, and analytical tools. Beginners can also use the primary, easy-to-use interface as a good entrance into investing in stocks. Capital.com’s MT4 has many technical markers, charting choices, and experienced analyst assistance for auto trading (EAs).

The Cyprus-based broker offers a free trial account to new clients. Trial accounts contain virtual money suitable for beginners who wish to test the platform before depositing real funds.

Capital.com offers a variety of payment methods. You can check the FAQs section of Capital.com to view the complete list of acceptable payment channels. Generally, the brokerage accepts bank transfers, credit card, and debit card payments without additional fees. However, third-party payment channels like Webmoney, iDeal, ApplePay, etc., may charge extra processing fees.

You can open a trading account in the following currencies: Zloyts, GBP, EUR, or USD. Capital.com keeps broker and customer bank accounts independent, giving an added degree of protection. Withdrawals are not subject to a charge. After the initial transaction, Neteller may be used to make additional deposits.

Customers may contact customer service, which is based in Cyprus. This is achievable by filling out a web form, calling one of the eight phone lines given, or using the live chat feature. In general, the FAQ section answers the most frequently asked questions. Capital.com is a well-run brokerage where help is rarely needed but readily available when it is.

Key features of the Capital.com stock trading platform include:

- Minimum trading of $20

- FCA and CySEC regulated

- Stock spread is offered at 0.1% Var

- Capital.com demo account with $10,000 virtual funds

(Risk warning: 78.1% of retail CFD accounts lose money)

Why do you need a stock broker

Stock trading allows investors to buy and sell shares of stock to generate profits through capital gains, dividend income, and hedging. Generally, you need a stockbroker to help start trading and profiting from stocks.

One significant role of the stockbroker is to help you find the right type of company for your investment. Brokers also offer different types of services according to what your preferences are in trading. Brokers can help individual investors with shares and bonds listed on public exchanges.

Brokers are classified as full-service or discount. A full-service broker is more expensive than a discount broker. The latter offers only entry to the markets, which can be a good option for beginner investors who want to avoid commissions and management fees from brokers.

Discount brokers provide a free trial period of up to six months, after which there are usually no fees. These firms may charge some of the same commissions as full-service firms, though they are often cheaper. You must have a basic knowledge of trading and computer web tools to thrive with discount brokers.

A broker can provide you with educational resources. This allows you to become informed about stocks and the stock market in general. Brokers will also advise on how best to invest your money or investment portfolio to grow in value.

Types of stock trading:

Different types of stock trading are available to investors looking to make a profit on the market. Understanding the kind of stock trading will help you decide which one will suit your needs best. There are five main types of stock trade: Day trading, scalping, swing trading, buy&hold, and hedging. Each type of stock trading offers different opportunities and carries a different set of risks.

Day Trading

Day traders are investors who make trades that typically last for a day or less, though some may last longer if the trader chooses. Day trading is one of the riskiest types of stock trading. Most new investors often stay clear because they have little experience with their chosen market.

Since day traders are active throughout the day, they are exposed to price fluctuations throughout their working hours. As each period ends, day traders look for an opportunity that will help them make a profit. Since trades are short, the amount of money you can make with day trading is limited, making it inappropriate for most investors.

Scalping

In scalping, traders can buy and sell as many stocks as they want per day. Since scalping involves trading in small quantities, it is much riskier than day trading. The amount of profit that can be made from scalping depends on the period and the number of stocks traded.

Buy and hold trading

Buy and hold trading is a stock trading method that involves buying stocks and holding onto them until the stock’s value increases. This type of stock trading is very profitable if you can pick the right stocks. To make money with buy and hold trading, you must have a large sum of money that you can afford to invest.

Swing trading

Swing trading is very common among active investors. It works by taking advantage of short-term market swings, which are known as “swings.” Because the holding period for these trades is more extended, swing traders typically have larger profit margins than day traders.

Hedging

Hedging is another type of stock trading that can be rewarding; however, it also carries some risks. Hedging is typically used by investors who own large amounts of stock or options contracts. By hedging, the investor will buy “puts” or “calls” to guard against potential losses.

How to select the best stock trading platform

Although there are several good trading platforms online, you should keep in mind that the right broker is the one that meets your needs. There’s no perfect broker for everyone. But, here are some of the essential factors to consider when selecting the best online stock broker for you.

Trading platform:

Some brokers have a pricey desktop application, while others offer mobile apps and web platforms. You should pick a stockbroker that has the proper application that functions efficiently with your devices.

Regulations:

Regulation of stock brokerage platforms is different in every country. The US FINRA (Financial Industry Regulatory Authority) regulates all stock brokerage firms that trade with the general public in the US. Foreign brokers are regulated by the FCA (Financial Conduct Authority) in the UK and CySEC (Cyprus Securities and Exchange Commission).

Regulation of stock brokerage firms is essential because it protects investors and the firms themselves. Regulating brokerage firms ensures that individuals are not deceived by their information and assures investors that they are given a fair chance to participate in this highly lucrative industry.

Trading tools:

Some brokers offer charting and technical analysis in their software, which can be a nice feature for more serious traders. If you’re a new trader, you might prefer platforms that make it easy to buy stocks or build a portfolio. Some brokerages have research reports, corporate news, and market data all accessible in one place. Others may provide financial information or market research as separate services that cost extra.

Customer service:

It’s always important to speak with someone if issues arise or you need help with any part of your account. Some brokers only offer email support, while others have social media channels or phone representatives. The more you’re able to communicate with your brokerage, the better off you’ll be.

The broker’s selection:

Not all brokers offer every publicly traded company available to sell online, but many do. It’s crucial to find a platform that lets you invest in the companies you want without having to jump to a different broker. Also, some companies might not be available for trading on all platforms.

How to open a stock trading account

Opening a stock trading account can be daunting for a beginner. The first step is to find an excellent regulated brokerage company. Once you’ve chosen your company, open an account through their website or with a broker of your choice.

Before opening an account, understand that there are two types of stock trading accounts. The first is called a regular account, and the second is called a margin account.

The regular account allows traders to purchase stocks and offset losses by selling stock when it goes up in value. However, with the margin accounting system, traders can borrow money from the broker to help them buy stocks at higher prices or sell stocks when they are cheaper. With this system, traders can start with very little money invested but grow exponentially as they increase their loans.

If you have an IRA (Individual retirement account), it’s recommended that you open a regular account with a broker who offers investment support. With this type of account, the broker will deal with the paperwork and even help out by managing the process (like filling out forms). To set up an IRA, you’ll need to use a trustee.

Before you can open a trading account, you must provide required documents mandated by your broker. When you’re dealing with a broker, the process can take anywhere from 3 minutes to 12 hours. Acceptable proof of identification is a passport, driver’s license, or other official documents. When the brokerage account is opened, you’ll need to provide a bank statement or two as well as your Social Security Number.

(Risk warning: 72% of retail CFD accounts lose money)

How stock trading commissions are working

New traders are often surprised to realize that they can buy or sell shares before the stock purchase becomes official. This can only work with the commissions provided by most stock trading platforms.

Commission trading fees can vary widely depending on the broker you select. Some online brokers charge as little as 1 cent per trade; others charge more than $5 per trade.

If you’re looking for the lowest possible commission trading fees, check out our list of the most affordable online brokers. Most of these brokers provide low-cost or no commissions. As a general rule of thumb, though, it’s best to avoid any broker with commission rates above 5%. Otherwise, you’re likely to pay too much for your trades.

A lower commission can help offset the higher cost of an account or possibly even net you a slight profit over time. However, if you’re planning on making frequent trades, then the cheaper brokerage may not be worth it, depending on your specific circumstances. For example, if you’re investing for retirement in high-frequency trading strategies like day trading or scalping, then this might not matter at all to you.

Conclusion – Take advantage of our comparisons and pick one of the best stock trading platforms!

Many investors have found a successful way to trade and exchange stocks with the best trading platform for investors. There are several factors to put in mind when selecting the right trading platform, but this article has made it possible to select the one that will work best for you.

A stock brokerage like Etoro can help you invest in various markets and assets, which is vital for diversifying risk. They also provide access to the derivatives market, allowing traders to profit from an enhanced strategy, especially in a volatile market.

In general, we have given you a comprehensive review of some of the leading stock brokerage services available in the world. These platforms have established a reputation for fairness and trustworthiness. With these two qualities, stock traders can be more productive and successful.

FAQs – Most asked questions about stock trading accounts:

Which is the best stock trading platform?

You can find the best stock trading platform from the list above. All these platforms offer great features that one would expect from a stockbroker. This includes a wide range of financial instruments, including currency pairs (FOREX and stock pairs), commodities, gold, and silver. The best stock trading platform is easy to use and available in different languages for traders worldwide.

What is the best stock broker for beginners?

The best stock broker for beginners is XTB. The XTB trading platform has many features that improve the quality of its trading experience. It has a beginner-friendly website, which makes it easy to navigate and start trading right away. XTB also offers beginners webinars and educational resources. The copy trading feature also allows new traders to begin profiting from professionals.

How much money do I need to open a brokerage account?

Some brokerage houses may require a minimum deposit of $100 to $200. Others may enable you to create an account with a lower investment, provided you consent to have money transferred regularly. Some online brokers now require no minimum deposit at all.

Is my money safe with a stockbroker?

Yes, every transaction made with a regulated stockbroker is safe and risk-free. A top international body regulates all stock trading platforms listed in this review. Traders are generally advised to open an account with brokerage firms that do not have a valid license.

What stock trading platform offers the lowest minimum deposit?

XTB offers the lowest costs when it comes to purchasing stocks online, according to our review. XTB Markets is the only online brokerage that offers no-cost stock transactions and does not charge for order flow. Hidden expenses are essential since every broker provides free stock trading.

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)