Admiral Markets minimum deposit – Methods and tutorial

Table of Contents

Admiral Markets is one of the leaders in online trading. Many traders want to use this broker for investments but how high is the minimum deposit for a trading account? – In this article, we want to highlight how much money do you need for starting with Admiral Markets. Learn about the conditions, payment methods, and how to deposit on this trading platform.

How high is the minimum deposit on Admiral Markets?

The Admiral Markets minimum deposit amount varies, depending on which funding method and account type you choose.

There is a general minimum deposit amount of $0 when funding your Admiral Markets account via bank transfer in your chosen account currency. Funding your account via any of the other deposit and withdrawal methods, however, will see varying minimum deposit levels imposed, each starting from $50 USD.

The minimum deposit for the Invest account is $1 and the minimum for a forex and CFD trading account is $100. In the following table, you will see the details.

If your account is denominated in a currency other than USD, then the Admiral Markets minimum deposit amount will be the USD equivalent of your account currency. For the purpose of this guide, keep in mind that we’ll be speaking in terms of USD. The broker accepts EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

See the table below for account types and minimum deposits:

| Account: | Trade.MT5 | Invest.MT5 | Zero.MT5 | Trade.MT4 | Zero.MT4 |

|---|---|---|---|---|---|

| Minimum deposit: | $100 | $1 | $100 | $100 | $100 |

| Markets: | 4500+ | 4,500+ | 50+ | 110+ | 50+ |

| Platform: | MetaTrader 5 | MetaTrader 5 | MetaTrader 5 | MetaTrader 4 | MetaTrader 4 |

| Execution: | Market | Exchange | Market | Market | Market |

| Spreads from: | 0.5 pips | 0.0 | 0.0 pips | 0.5 pips | 0.0 pips |

| Commissions: | No | $0 – $0.02 per share | $1.8 – $3.0 per one lot trade | No | $1.8 – $3.0 per one lot trade |

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

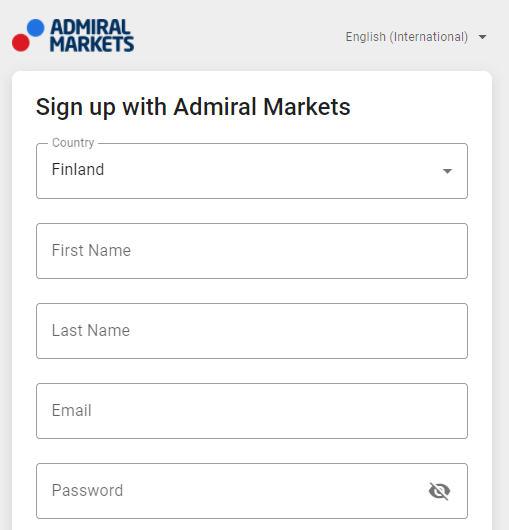

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) How to make a deposit on Admiral Markets – Step by stepIn this section of our Admiral Markets minimum deposit guide, we’re going to walk you through making a deposit step by step. Before we start the first step, we’re obviously assuming that you’ve opened a live account. If you haven’t yet opened a live account with Admiral Markets, then click here to begin the process. Step 1: Ensure your personal data is up to dateThe first step toward depositing Admiral Markets is getting your live trading account verified. Ensure your name and address match your identity documents to avoid any verification issues. As Admiral Markets are regulated forex brokers, they must follow strict anti-money laundering procedures which require all names on accounts to match your ID.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Step 2: Choose your Admiral Markets deposit methodThe second step is to choose which deposit method best suits your needs. Consult the list of funding methods available to Admiral Markets clients, in the section above. Which deposit method you choose is entirely up to you, but remember for the lowest Admiral Markets minimum deposit of $0, you’re going to have to choose a bank transfer. For an instant or at least same day deposit, choosing Visa/Mastercard, Skrill or Neteller will require a $50 minimum deposit. If you’re looking to deposit an amount lower than $50 into your trading account, then time is the trade-off. Step 3: Start live tradingAdmiral Markets does everything they can to process deposits and withdrawals on the same business day, but sometimes there are hold-ups at your bank or payment merchant’s end, which is out of their control. After waiting for the required processing time, which varies from instant to 3 days depending on which deposit method you chose, you’re then able to start live trading. On your MT4/MT5 terminal, you’ll then see your available balance, equity, and margin within the trade window at the bottom. Admiral Markets Withdrawal and Deposit FeesThere are zero Admiral Markets withdrawal and deposit fees. No matter which deposit method you use to fund your Admiral Markets trading account, you will not be charged fees from the broker. Depending on which funding method you chose, there may be third-party fees and charges. To avoid these, however, simply fund your trading account with the best Admiral Markets minimum deposit method – A bank transfer with no minimum amount. It’s also worth noting that there are zero fees or charges involved with opening both demo and live accounts. There is, however, an account inactivity fee of $10 per month. Admiral Markets is a trusted, regulated forex brokerAdmiral Markets have one of the best reputations in the forex broker industry. With operations spanning across multiple continents and numerous regulations to match each jurisdiction they operate within, Admiral Markets can be trusted with your funded trading account. Major Admiral Markets regulatory licenses:

While these cover the big 3 forex broker regulations, Admiral Markets are also allowed to legally operate across numerous other regions and countries. How much money should you deposit?One question that often arises surrounding Admiral Market’s minimum deposit, is should we fund the bare minimum or go higher? No matter which forex broker you’re choosing to open an account with, the answer is always the same. The deposit amount doesn’t matter, because your risk management plan should always be focused on percentages rather than dollar amounts. For example, if your risk management plan says to only risk 2% of your account per trade, then it doesn’t matter whether you have a $50 account or a $500,000 account. The percentages remain the same. The broker’s MT4/MT5 platform allows you to adjust your trade size through lot sizing in order to stay safe, even if you’ve made only the Admiral Markets minimum deposit. Final thoughts on Admiral Markets minimum deposit amountsBy choosing to fund your Admiral Markets trading account by a bank transfer, you’re able to pay zero fees and have no minimum deposit amount. As a result, there’s no denying that if you’re looking for a low minimum deposit forex broker, then Admiral Markets is one of the best. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about Admiral Markets minimum deposit:On which factors will the Admiral Markets minimum deposit depend?The Admiral Markets minimum deposit depends on two prime factors, and every trader and investor should be aware of these. For instance, the account type and funding method are the two most crucial factors that will impact the minimum deposit the trader or investor must make without compromise. What is the Admiral Markets minimum deposit based on account type?The Admiral Markets minimum deposit depends on the account type the trader will choose. For instance, if the trader wants to invest in the forex or CFD account, they must make a minimum deposit of $100. On the other hand, the trader opting for the Invest account type should make a minimum deposit of $1. What are the different Admiral Markets payment methods that one can avail of?The traders can use different types of Admiral Markets payment methods. The most common payment methods are bank and electronic transfers. In addition to this, other approaches include Skrill, Bitcoin, Poli, and Neteller. Is Admiral Markets platform trustworthy?Yes, the Admiral Markets platform is trustworthy for traders and investors. Three top-tier regulatory bodies regulate it: The Financial Conduct Authority, CySEC, and the ASIC. See other articles about online brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2020-12-07 15:51:372023-01-27 19:19:48Admiral Markets minimum deposit |