How to buy Bitcoin Cash directly – Trading guide

Table of Contents

Bitcoin Cash was generated by the Bitcoin hard fork on the first of August 2017. This resulted in a fresh version of the blockchain with differing rules. It was generated to correct Bitcoin’s scalability issues. It functions by switching to the latest form on the original Bitcoin blockchain. Currently, the software can process more transactions per unit time compared to the mother blockchain. It can presently process up to 8 megabytes. Since the launch of the young cryptocurrency, its value has increased by more than 200 percent from the original Bitcoin Cash price of 300 USD to 600 USD. Investors are wondering if this could be called the “new king of cryptocurrencies”.

But initially, Bitcoin Cash started slowly. Without the bitcoin cash mining algorithm that brought new life to the new tool, it would not be attractive to profit-seeking computer miners. As soon as the financial markets recognized this outlook and the increase in hash rate or the rate at which new blocks were created, traders and investors started raising the price of BCH, gaining popularity.

What is Bitcoin Cash?

Bitcoin first emerged nearly nine years ago and is now stronger than ever. Today, it is not only the first in the world but also the most expensive, stable, and popular cryptocurrency. However, it is not perfect. One of cryptocurrency’s most urgent problems it is facing is scalability. In particular, the problem is that it was limited to the 1 MB block size of the transaction when it was first developed. This limitation significantly delays transaction times and limits the number of transactions the network can manage.

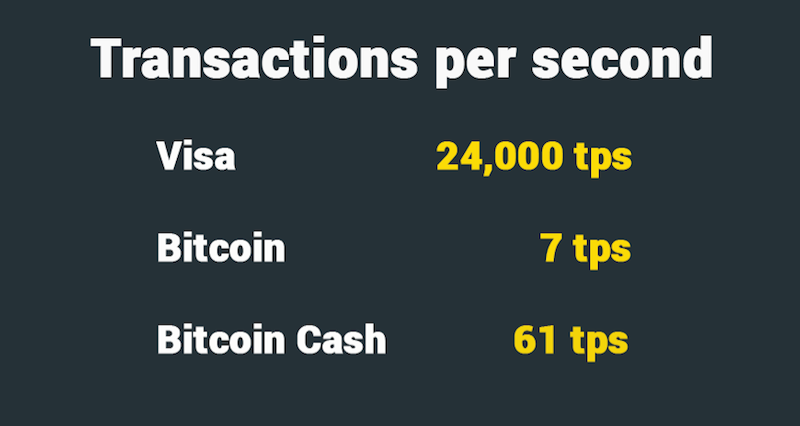

Bitcoin Cash differs entirely from the earlier version because the block size can be raised from 1 MB to 8 MB. The overall goal is to increase the number of transactions the network can manage, hoping that Bitcoin Cash will be able to compete with industry giants like PayPal and Visa. It was launched developed in August 2017 and has since then become the most successful Bitcoin fork.

As a result, a compromise protocol called SegWit2x was formulated and the protocol launch meant storing some information outside the blockchain and increasing the block size limit to 2 MB. The protocol was implemented on August 1, 2017, after 95 percent of miners voted in favor of the proposal. However, the network did not immediately increase the block size limit. For many, this meant slowing down the problem and not being able to solve it.

Additionally, the decision seemed to please those who saw Bitcoin as an investment opportunity rather than a generated payment system. At the Bitcoin Futures meeting in Arnhem, the Netherlands, former Facebook engineer Amaury Sechet offered the primary implementation of the Bitcoin Cash protocol known as Bitcoin ABC. Sechet and his developers decided to abandon the SegWit2x protocol and increase the block size limit to 8 MB. It was announced that a hard fork would occur on August 1st, 2017, as these shocking changes require the creation of a platform different from the original Bitcoin network.

In case you aren’t aware, a hard fork is presently the only way developers can update their bitcoin software. Developers share the network and will only generate fresh blockchains with altered rules. The original and mock-up versions of the cryptocurrency have the same blockchain until when the split occurred and the two networks became independent.

Post the separation of the two blockchains, all previous holders of bitcoin were given an equal amount of bitcoin cash tokens. The freshly created altcoin was almost adopted by investors. The rising bitcoin transaction fees have been one of the main reasons for Bitcoin Cash. According to a real-life review of the transactions carried out on the platform in December 2017, Bitcoin Cash transaction costs were 99.56 percent smaller than similar transactions on the mother blockchain network.

Five essential facts about Bitcoin Cash:

- The Bitcoin Cash generation based on the Bitcoin hard fork which resulted in a faster transaction response took place at block 478,559.

- Regardless of the reason and origin of creation, BCH coins are currently regarded as separate altcoins. It is different from bitcoin and is not directly link to it or has any effect on the value of bitcoin.

- At the same time, Bitcoin Cash is a separate cryptocurrency and is beneficial because it functions similarly to Bitcoin, but it is faster because it contains a larger block size.

- When it was created initially it had zero value and investors were offered “free coins”. However, Bitcoin Cash has gone through a key market shift and has successfully positioned itself among the top list of crypto coins against its position in the market when it was first created in 2017.

- Investors speculated that bitcoin could be destroyed because of high fees and slow transactions.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How to buy Bitcoin Cash and trade it

So, you would like to trade Bitcoin Cash (BCH) to make money. While the idea of the transaction is simple, it is a little more difficult to implement.

There are several ways to trade Bitcoin Cash. If you’re lucky, you can exchange it for another altcoin, or you can even exchange profits on Bitfinex or Bitmex. A few tips on how to buy Bitcoin Cash and how to do it. Bitcoin Cash is a fork of Bitcoin due to debate over evaluation solutions. BCH decided to create a larger block to make BCH a widely used “peer-to-peer electronic money”.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) Bitcoin Cash buying guideIf you want to buy and sell Bitcoin Cash (BCH), there are a few ways you can do this. However, the first step is to get your wallet as explained in the upper section. When you have done that, you can have a look at the exchanges on the table below. Because it is still a comparatively new altcoin, Bitcoin cash is not yet supported by all major exchanges. The table below represents the global crypto exchange that supports buying and selling of Bitcoin cash:

You can equally trade Bitcoin Cash on Changelly and ShapeShift. These are sites that allow investors to quickly exchange different crypto coins. LocalBitcoinCash is a peer-to-peer crypto trading platform, users can buy and sell Bitcoin cash in a direct manner through the escrow service they provide of through a person-to-person meetup. How to get Bitcoin CashThose who had bitcoins before the first of August 2017 that the Bitcoin Cash fork occurred, can get back an equal amount of tokens in Bitcoin Cash, no matter how long it has taken. However, how you get your tokens depends on the wallet you’re using. For a full-featured wallet like Bitcoin Core or Bitcoin Knots (you need to download the whole blockchain), go to the “Backup Wallet” tab to back up your wallet. This will create a wallet.dat file that can be imported into Bitcoin Cash’s cash denominated wallet like Bitcoin ABC, which makes your Bitcoin cash token available to you.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money)

Bitcoin Cash walletsThe first thing you want to do if you plan to trade bitcoin cash is to secure storage for your fun also known as the wallet. There are 2 groups of extensive randomly generated numbers and letters in the wallet. The first one is the public address of the wallet that other peers will utilize to transfer bitcoin cash to you, the other is the private key used to provide access to funds and for approving transactions. Note: If you lose or forget your private key, you will not be able to gain access to your fund again. Also, anybody that gets your private key can easily steal your money. Therefore, always make sure you keep it safe.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Paper walletPaper wallets are public and private keys and are normally printed in QR format concurrently for convenience. Paper wallets are a form of “cold storage”, the most secure way to store cryptocurrency because they are not linked with the internet. This makes it impossible to hack paper wallets. After printing the output, you can do whatever you want. You can put it in a safe, store it under a pillow, or did a hole and hide it in the garden. This way, your funds are safe until you want to use them. The simplest method for creating a paper wallet is to save the wallet.dat file from the wallet that stores your private key on your PC, print it, and then delete the real one when you are done out of your PC.

Software WalletSoftware wallets work by installing them on your PC or mobile device, and unlike the wallets offered by crypto exchanges, the majority of them save their private keys offline on the device with the software installation. To create a client for yourself, simply download it to your device and implement the prompted guide. The majorities of software wallet clients provide support for multiple crypto coins and can generate multiple wallets. Also, firms like Exodus and Jaxx incorporate ShapeShift to enable instant exchange between multiple major crypto coins inside the client.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Hardware Bitcoin Cash walletsIn the crypto market, hardware wallet safety depends on the storage option. It resembles a transferable hard disk but is specially made for the storage of cryptocurrencies. You use them to create off-net transactions, which makes them handy when out-and-about. You can readily link it up to your PC to place either your sell or buy order.

Peer to peer transactions with Bitcoin CashYou can choose to trade with your peers. LocalBitcoinCash is one instance of firms that originally provides support for BCC. It offers a playing ground for consumers to trade BCH one-to-one with peers in fiat currency. Users can use the platform itself as an escrow service to propose a buy price and look for a response or complete someone else’s order. However, it has yet to be confirmed the reliability of the exchange. If you choose to use the exchange, remember that you are doing transactions with individuals rather than trusted companies. The implication that fraudster will use the platform are much higher. For P2P transactions, check the amount, present exchange rate, payee wallet, and wallet address. Finally, this ought to be clear. Do not give your private key to anyone under any circumstances. You can also create a personal face-to-face transaction. You can do this using LocalBitcoinCash, which a Bitcoin Cash forum. Besides, you can visit Meetup.com to discover BCH-associated events close to you. When purchasing Bitcoin Cash outside the internet, ensure you organize your meeting in a public location. It would also be nice to bring a friend. You may want to tell the seller in advance. Besides, you must have an active internet network to verify the most up-to-date exchange rates before registering the transaction.  Crypto exchange for buying Bitcoin CashBitcoin Cash is currently the fourth largest cryptocurrency after Bitcoin, Ethereum, and Ripple in terms of market value, but not all major cryptocurrency exchanges support it. Although the exchange is growing in popularity, it is currently possible to purchase Bitcoin Cash through fiat currencies on all globally operated exchanges, only GDAX, Kraken, and Cex.io listed. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Selling in exchange for Bitcoin of altcoinsSince Bitcoin Cash is a relatively new cryptocurrency, the large international exchanges supporting it are very limited, especially when sold as a fiat currency. It may be easier to exchange Bitcoin Cash tokens for other cryptocurrencies. Note: In general, if you are not a fan of the exchange or don’t want to link your bank account and verify your identity, you can always use services like Changelly and ShapeShift, which offer instant exchanges between multiple cryptocurrencies. Both of these platforms support Bitcoin Cash. Selling on exchanges for cashThere are currently three major global stock exchanges that allow you to trade Bitcoin Cash for fiat currencies: Coinbase, Kraken, and Cex.io. With Coinbase, you can only sell Bitcoin Cash in USD. Kraken also supports Euros and Cex.io supports US Dollars, Euros, and British Pounds. To exchange BCH tokens for cash, you need to connect your bank account to the stock exchange and go through a lengthy identification process. Having done all this, you can withdraw money in cash. Most exchanges only allow withdrawals to linked bank accounts. This can be done by bank transfer, SEPA to European customers, SWIFT to customers in almost any country, and other options around the world. Also, Cex.io allows you to withdraw money directly with VISA or MasterCard in US dollars, Euros, or Russian rubles. Depending on where you are and which withdrawal method you choose, it can take up to a week to transfer money to your account. If you withdraw money from the stock exchange, you will be charged a fee according to the exchange. Some platforms like Kraken, for example, charge 0.09 Euro for SEPA sockets and 60 Euro for SWIFT sockets. Others, like Coinbase, automatically calculate fees for each specific withdrawal. Safety precaution to keep in mindKeep your money safe. Most importantly, don’t store too much of the money you receive in your wallet. The history of cryptocurrencies is full of instances of hacked and closed transactions without repaying customers. Also, if you use an exchange wallet, you are effectively transferring control of your private keys to a third party. Keep most of your money in your wallet that always stores your private keys offline, or consider investing in a hardware wallet, the most secure option currently available. Also, all bitcoin cash transactions are irreversible, so double-check the amount you send and the addresses of you and the recipients. Protect your exchange account with a strong password. It is also a very good idea to use different cryptocurrencies for different websites and services related to cryptocurrency trading.  Finally, if you’ve created an offline face-to-face meeting, you’ll need to meet in a public place like a coffee shop or a busy park. Do not go to the seller, especially if you have a big deal. Also, active internet access is required to register transactions and check current exchange rates. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Should you sell Bitcoin Cash?Sadly, there is no ultimate answer to this question. The cryptocurrency market is still unpredictable and volatile. In a few years, the cost of BCH can range from zero to almost any number imaginable. However, Bitcoin Cash is one of the best cryptocurrencies in terms of market value and capitalization and is growing steadily. However, every business is in jeopardy, so you have to do your research when making a decision. Why you want to trade Bitcoin CashThere are several reasons to invest in this cryptocurrency and we have presented a few of them below:  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) A reduced transaction processing feeThe Bitcoin Cash blockchain works on a much larger blockchain compared to that of Bitcoin. The benefit of this is that it can accommodate extra transactions in a specific block, unlike the block size of the mother blockchain, which has a limit and is not easily available. Because of this, consumers have far less competition to transfer transactions to the following block. Hence, they don’t have to interfere with each other at excessive rates. While bitcoin transaction fees presently are high and in dollars, Bitcoin cash charge is below 20 cents. A fast developing cryptocurrencyBitcoin Cash is built on the most popular cryptocurrency, Bitcoin. All holders of bitcoin before the division were offered the same amount of bitcoin cash. While listing new altcoins on exchanges takes months and sometimes even years to occur, Bitcoin cash became available for trading on exchanges immediately after the announcement of the fork. A lot of famous Bitcoin figures have supported Bitcoin Cash from the start. Early Bitcoin preacher Roger Ver and one of Bitcoin’s first core developers, Gavin Andriesen, were directly undertaken by Satoshi Nakamoto, who was responsible for the development of the Bitcoin protocol. These benefits have led to the fast growth of Bitcoin Cash, as evidenced by volume and the overall market cap.  The larger the block size, the higher the transaction volumeThe larger block size than that of the original Bitcoin implies that Bitcoin Cash can process more numbers of transactions per second. While Bitcoin processes roughly three transactions per second when the network is completely loaded, the Bitcoin Cash blockchain can carry out roughly 24 transactions within the same amount of time. The creators of Bitcoin Cash are trying out the Gigabyte blockchain as part of a roadmap to meeting up with popular payment systems like the VISA network. Bitcoin Cash supports on-chain scalingBitcoin Cash supporters propose a fundamental layer scaling of Bitcoin Cash protocol and believe this is the safest thing to do. This is in contrast to bitcoin advocates, who argue that the security of the base layer ought to be enhanced as much as possible. They believe that the scaling should be implemented on the higher protocol layer, which is yet to be created. However, after the establishment of the off-shoot platform, investors have discovered that scaling the new blockchain is possible. Conclusion of Bitcoin CashSince BCH is one of the most common cryptocurrencies, there are many ways to trade for commodities or earn more money. Bitcoin extremists can mock BCH, but many altcoin traders continue to trade BCH. There are many traders, but many have avoided trading in the hope that their prices will rise in the long run. This is a much simpler and less risky way to play with cryptocurrency, but we can’t guarantee it. Anyone who says otherwise will try to trick you. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about Bitcoin Cash :Is Bitcoin Cash a good investment?If you invested in bitcoin cash, there’s a potential that your money may increase in value by twofold annually. The experts of Bitcoin cash aim to cross the $1100 mark by 2026. According to WI, if you are searching for a long-term investing strategy, Bitcoin Cash is a smart choice. What are the prospects of Bitcoin Cash?In 2022, it is a good deal. The experts of Bitcoin Cash predict that it is going to bring rapid growth in the future. For instance, the value of Bitcoin cash goes high every year; say, in 2023, it can go to $1000, with the potential to grow more every year. Can Bitcoin Cash reach $10000?With the growth Bitcoin cash is attaining, the time is not very far when it will reach possibly reach $10000. The professionals will need to put in a lot of time and energy to accomplish this, though. What is the downside to Bitcoin Cash?Bitcoin Cash needs less time to process its transactions as compared to Bitcoin. This results in fewer transactions in bitcoin cash than in bitcoin. The reason why people choose Bitcoin over bitcoin cash is that Bitcoin cash needs less mining power to verify new blocks, which makes the system unsafe. However, Bitcoin Cash uses a blockchain proof-of-work system. Learn more about trading: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Bitcoin-Cash.png 347 578 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-02-28 16:06:042023-01-27 20:02:28Bitcoin Cash |

Leave a Reply

Want to join the discussion?Feel free to contribute!