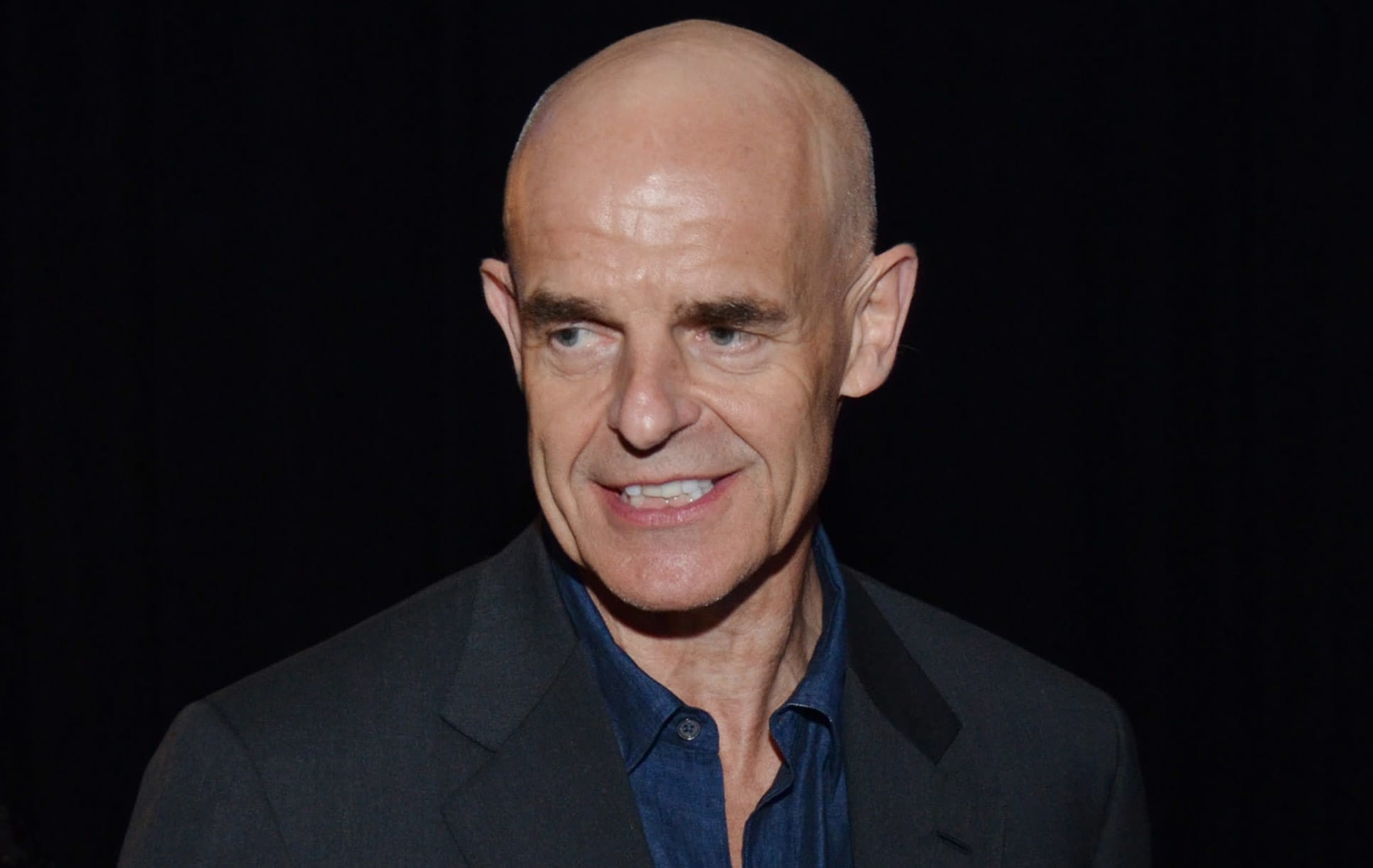

Who is Andrew Hall? – History of the trader & investor

Table of Contents

The trading world has had hundreds and thousands of investors. However, some investors lead the race. Andrew Hall is one such trader with immense capital management skills that brought him profits while trading online.

Andrew Hall made so much money that he opened his hedge fund – Astenbeck Capital. Most traders often wonder how Andrew Hall became the most successful trader. Here, all traders will find that out.

About Andrew Hall

Date of birth: | 1952 |

Wealth: | 3 billion USD |

Strategies: | – trading derivatives – buying oil contracts at a low price – proper trend analysis – taking risks – long-term views |

Website: | |

Interesting facts: | – studied chemistry at Oxford University – Phibro Energy’s member in 1990 – cofounder of the Hall Art Foundation |

Throughout his trading journey, Andrew Hall made immense wealth. He was successful in accumulating a hundred million dollars on Wall Street. He is the best commodity trader who has made a lot of wealth. Andrew Hall traded oil contracts, which made him rich.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Biography of Andrew Hall

Andrew Hall was born in 1952. He is an English hedge fund manager. His professional experience also includes serving as the commodities trading head at Phibro LLC. Apart from this, Andrew is also the head of his hedge fund.

Early life and education

Andrew Hall spent his life growing up in Feltham. He completed his education at Hampton grammar school. Further, he went on to study chemistry at Oxford University.

Career

- Once he obtained his MA degree in chemistry from Oxford University, he went on to join British Petroleum. He served in various posts and eventually became North America Trading in New York vice president

- Eventually, Hall left BP. He went on to become Phibro Energy’s member in 1990. Because of his caliber, Andrew was made to take charge of the energy unit of the company where he worked

- This company then stepped into the trading world by shifting its work. It moved physical cargo before, but now Phibro Energy was also into derivative trading

- However, some controversy about payroll emerged in the company. Due to this, the Citi Group had to sell off the unit. However, Andrew Hall made at least 100 million USD while selling the company

- Then, he set up his hedge fund. The hedge fund was popular with the name Astenbeck Hedge Fund. This fund was successful in raising almost 3 billion USD

- That is how Andrew Hall became rich. In addition, he was into oil trading and followed several tactics to place winning trades

Interests

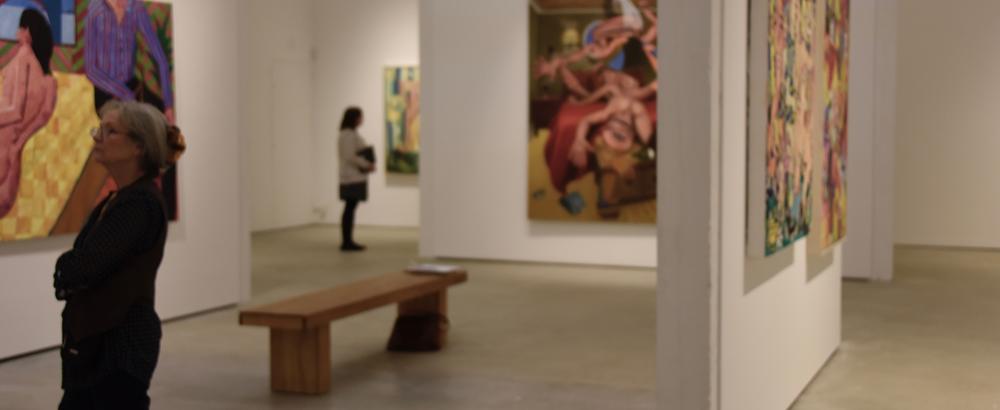

Besides trading, Andrew Hall is greatly interested in the art collection. He and his wife, Christine, are famous worldwide for their marvelous art collections. The couple also founded the Hall Art Foundation.

This organization aims to make contemporary artworks available to people for education and enjoyment.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

The net worth of Andrew Hall

Andrew Hall owns a wealth of about 3 billion USD as of 2009. A huge part of his net worth was because of his hedge fund.

Trading and investing strategies

Andrew Hall followed several trading strategies that earned him the net worth he owns today. He was an oil trader who invested in futures and whom people looked up to. In addition, he was also a great derivative trader.

The following strategies he followed are as follows.

Trend analysis

Andrew Hall kept a close eye on the prices of oil. When he headed the Phibro energy unit, he kept a close watch on the price trends of oil.

Good to know!

Market analysis

Andrew Hall considered the impact of the recession on the prices of oil. He knew that the world had just gotten out of the worst recession. Thus, it was evident that oil prices would see a hike nevertheless. So, he based his trading decisions and invested in oil derivatives considering that these prices might grow anytime soon.

Because of his market analysis, he successfully generated wealth from trading derivatives. He invested in most futures contracts that would benefit him monetarily when they expired.

Buy cheap and sell expensive

Andrew bought oil contracts when they were available at low prices. He further sold them when the prices became an all-time high. Thus, one trading strategy that worked wonders for Andrew Hall was buying contracts at their best price.

He further sold them when the oil prices took a jump. However, while buying oil contracts at a low price, Andrew also checked other factors that could affect the oil prices.

Taking risks

All trading strategies should involve some degree of risk. It was the basis of all trading strategies of Andrew Hall. Even though Andrew purchased oil at a low price, his contracts should be able to reach their expiry price to allow him to benefit.

Good to know!

After all, it would make them lose their entire investment if they didn’t. But Andrew Hall was lucky that oil prices crossed 100 USD per barrel in those days.

Long-term trading view

Andrew Hall’s trading strategies were mostly based on long-term views. Thus, if a trader kept in sight how an asset would perform in the coming days, years, or months, he could benefit immensely.

Good to know!

What can you learn from Andrew Hall?

So, Andrew Hall was a great trading mastermind having a lot of knowledge and expertise to offer traders. A few things that all traders can learn from Andrew Hall are as follows:

- First, a good trader must consider the choices that help him generate wealth. They could choose any underlying asset they think can perform excellently in the market. For instance, Andrew Hall chose oil contracts

- A trader should ensure that he conducts a proper trend analysis and also checks for the changes that take place in the market

- Activities such as recession or depression can have a great impact on any trading activity. Thus, traders must consider these phenomenal factors while conducting their trading analysis

- Finally, a trader must not abstain from taking risks. However, the degree of risk they wish to take depends upon their trading skills and expertise

Conclusion about Andrew Hall’s trading experience

So, trading can make a person rich, like Andrew Hall, a billionaire. However, a trader must be vigilant and be able to tap all opportunities that come his way. Andrew Hall is a great trader and the biggest wealth maker of his generation. He could do so only because of his knowledge and ability to take risks.

If a trader can learn anything from Andrew Hall, it is patience, perseverance, and the zeal to take risks.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – Frequently asked questions about Andrew Hall

Who is Andrew Hall?

Andrew Hall was a great trader who made immense wealth by trading futures. He was the founder of a hedge fund called the Asterback Hedge Fund. Andrew Hall was a remarkable trader who could generate wealth because of his ability to take risks.

Does Andrew Hall trade now?

Andrew Hall does not trade on a large scale as he did before. He traded many futures and derivatives that brought him immense wealth during his time.

What are Andrew Hall’s specialties?

As a trader, Andrew Hall has several specialties that can inspire any trader. For instance, Andrew Hall was an ultimate risk-taker. In addition, he also had plenty of patience to ensure that he waited until the contract expiry to check his profits. However, he was also a great market analyst, because of which he could generate the wealth he owned.

Last Updated on February 24, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)