How much does it cost to trade with AXI? – Spreads & fees explained

Table of Contents

They may levy huge amounts in the name of fees and brokerages. Moreover, while trading in Forex, it is necessary to remember that the spreads compensate for the trading charges.

So a trader must always choose a broker which offers a low spread. Finding a broker with the best user experience and a low spread structure can be difficult. But, AXI differs from them in offering affordable charges.

Therefore, experienced traders and beginners can trade with AXI without worrying about the spreads and fees. But before going into the details of AXI fees and spreads, we must understand the fundamentals of those terms.

(Risk warning: 73.4% of retail CFD accounts lose money)

What does a spread signify?

A spread may often give a new trader a hard time in the trading world. They might be hearing it for the first time. But after forming an understanding of spreads, we will know how a broker like AXI uses them. To begin with, we must know that a forex broker does not target making profits through commissions like others.

The main way they get their profits is through a spread. We can often see the brokers fix a minimum spread that they charge while compensating the fees for a trade. The size of the spread determines the potential profit they will get. However, a spread can depend on various factors, like the size of the trade, demand, market volatility, etc.

The term spread in trading has many definitions, but we can understand it simply as the difference between prices, rates, or even yields. So, there are always two price values in a spread called a Bid and Ask price.

For instance, in the context of Forex, it suggests the buying and selling prices of currency pairs. In other words, the difference in the price values of such currency pairs is a forex spread. However, many trading experts define it as a gap between the bidding and asking prices for a security or asset.

That is why it is also called a bid-ask spread in the trading world. We understand that a bid-ask spread is the most common way of explaining the spread. However, it has other names such as bid-offer spread, a buy-sell spread, etc., all of which represent the same meaning.

We can simplify it further through various other definitions. But, the closest answer would be that it can also refer to the gap in trading positions. The gaps between a short and long position of one asset, which could be a currency or a futures contract, have the same meanings as the gaps in selling and buying prices. We call the entire process a spread trade.

When it comes to the securities such as futures contracts, options, currency pairs, stocks, etc., we must know that a bid-offer spread is nothing but the difference between the prices given for immediate trade. It is essentially the difference between an immediate order, the asking price, and the immediate sale, the bid price.

However, it is not the same in the case of other assets, such as a stock option. In a trade involving stock options, the spread can be defined as the difference between the strike price and the market value.

(Risk warning: 73.4% of retail CFD accounts lose money)

A bid-ask spread has many uses, but it is particularly useful to measure the market’s liquidity. It also allows us to measure the size of the transaction cost of the asset. Now, liquidity is nothing but the efficiency or ease with which a trader can convert the asset or the security into ready cash.

However, the conversation should take place without affecting the market itself. So we can say that the most liquid asset is cash itself. That is one of the main reasons for the Forex market to be the most liquid and largest trading market.

We can understand the use of a bid-ask spread from a simple example. For instance, if the bid price of a company is $2,790.86 and the asking price is $2,795.47, then we can infer that the spread is $4.61. Therefore, indicating that the company has a highly liquid stock with a significant volume.

Moreover, it is noteworthy that spreads are priced as a unit or as pairs in future exchanges. It ensures the concurrent buying and selling of a security. Moreover, doing that eliminates the execution risk as well.

(Risk warning: 73.4% of retail CFD accounts lose money)

Types of spreads with AXI

Depending on the type of trading account, we can see that AXI charges some fees. However, it is charged as a part of the spread it offers its customers. Each trading account offers a different spread in AXI, so let us get an insight into the various types of spread you can expect from AXI.

Fixed spread and variable spread

As the name suggests, a fixed spread is decided by the broker. It does not change according to the market fluctuations or any other conditions. At the same time, we can understand a variable spread as those that move along the best bid and offer prices at a particular time.

The amount of variability depends on the instrument traded by the trader. It also depends on the broker used as well. However, when we see the spreads offered by AXI, it is only concerned with variable spreads.

The spreads at AXI start from 0.0 pips to 0.4 pips. Such a distribution is dependent on the type of account used, wherein the pro account offers a 0.0 pip and 0.4 pips for the standard account.

AXI is a broker that allows you to trade in more than 130 different products. It makes it one of the most diverse brokers out there. AXI offers a variety of trading instruments that are not limited to only currencies or CFDs. It also offers commodities, cryptocurrencies, stock indices, etc., to its customers.

So, when it comes to the spreads, it differs for the standard account and the pro account, depending on the instruments as well. The standard account charges no commission for trading, but the pro account offers a spread that starts at 0.0 pips. Moreover, the pro account also charges $7 as a round trip commission.

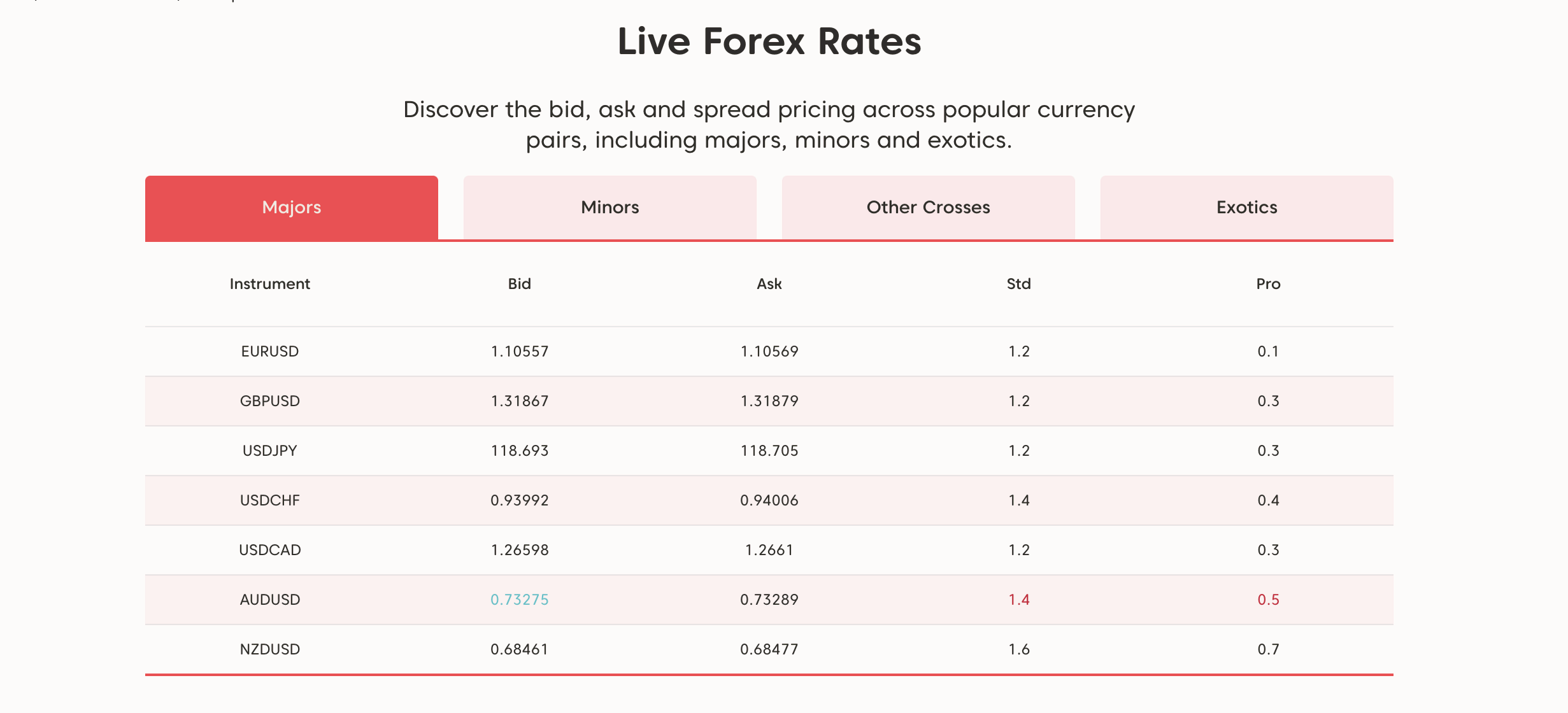

AXI Forex spread

AXI Forex Spread | Standard Account | Pro Account | Admin Fee per Lot |

EURUSD | 1.1 | 0.1 + $7 round trip/lot | Long 60 Short 0 |

USDJPY | 1.0 | 0.1 + $7 round trip/lot | Long 0 Short 15 |

GBPUSD | 1.2 | 0.2 + $7 round trip/lot | Long 30 Short 0 |

As a beginner Forex trader, you must always look for a broker that offers a low spread. A spread is what you pay to the broker for a successful trade.

Therefore, choosing AXI might be helpful as it is one of the best low spread forex brokers. It offers more than 70 currency pairs in assets with variable spreads. They are dependent on the market conditions.

We can analyze the table and know that the standard account offers a more competitive spread. Moreover, there are no other trading commissions applied to trades in it. In contrast, the pro account charges a trading fee of $7. However, the raw spreads are a lucrative feature that starts at 0.0 pips.

(Risk warning: 73.4% of retail CFD accounts lose money)

AXI Commodities spread

AXI Commodities Spread | Standard Account | Pro Account |

GOLD | 0.16 | 0.16 |

US OIL | 3 | 3 |

UK OIL | 3 | 3 |

AXI is a broker that offers premium trading services, especially in Forex and CFD. So it is not surprising that it offers more than 10 CFD commodities instruments to trade with. It includes oil, gold, and silver. However, an overnight charge may be applicable if a trader holds the CFD positions overnight.

AXI Indices spread

AXI Indices Spread | Standard Account | Pro Account |

US500 | 0.45 | 0.45 |

NASDAQ | 1.6 | 1.6 |

FTSE100 | 2 | 2 |

The trader must know that AXI offers 17 index CFDs for the indices spread. Also, you can trade in many forex pairs and other asset classes alongside that. The list of indices at AXI includes the most popular indices such as DOW E-mini, NIKKEI 225, EURO STOXX 50, etc. However, the swap rates are applicable for holding the positions overnight in this case.

(Risk warning: 73.4% of retail CFD accounts lose money)

AXI fees

The fees at AXI can be classified into two groups:

- Trading fees are the fees that a broker charges while a trading activity is done. It includes deposit fees, forex fees, overnight funding fees, etc.

- Non Trading fess is the type of fee concerned with non-trading activities such as withdrawal. It includes the withdrawal fees and inactivity fees.

#1 Deposit fees

A deposit fee is a type of trading fee that is charged while depositing your funds. However, unlike many CFD and Forex trading brokers, AXI does not charge any deposit fee from its customers. Another feature that builds trust among the customers is that AXI does not have any condition of a minimum deposit.

#2 Transaction or trading fees

AXI offers a transparent trading fee. However, as a reputed Forex broker, it does not charge a fee per se. Instead, it compensates for the trading costs in spreads that start from 0.0 pips to 0.4 pips. The spread costs are dependent on the type of account.

#3 Overnight funding

The broker charges overnight funding fees when the trader fails to close the position by the fixed time limit. It incurs when the trader holds the same position overnight. AXI charges an overnight funding fee that is according to the swap rates.

#4 Forex fees

AXI is a broker that offers low forex fees. It charges the forex fees according to the account types. Therefore, it levies a charge of $3.5 per traded lot and a low spread cost for the Pro accounts, as we saw earlier in the tables. However, the standard accounts offer a wider spread that starts at $3.2 -$6.8.

#5 Withdrawal fees

Many brokers levy a withdrawal fee. It is a common way to add on the charges to the customers after they have traded. But, unlike the majority of the online brokers, AXI excludes a withdrawal fee and does not charge anything. It implies that you can see the same amount of money on your bank account that you transferred from your broker’s account.

(Risk warning: 73.4% of retail CFD accounts lose money)

#6 Inactivity fees

An Inactivity is a non-trading fee that a customer has to pay for not using the account enough times. Many of the reputed online trading brokers levy high inactivity fees for a period that may not be too long.

However, AXI also applies an inactivity fee, but the difference comes from the amount. It charges $10 per month for being inactive for a year. Such an amount for the time limit that extends to a year is justified and much lower than others.

But it is always advisable to be strategic about your trading activity. That can help avoid getting charged after a long time of no trade.

Conclusion: Low fees and spreads with AXI

AXI is, without a doubt, one of the best brokers out there in both Forex and CFD trading. It can perhaps be viewed as the best broker for a new trader.

Through the fees and spreads that we have discussed before, it is now clear that it charges very low compared to other traders. So, a new trader can trade with AXI to reap the most out of her trading journey.

(Risk warning: 73.4% of retail CFD accounts lose money)

FAQ – The most asked questions about AXI fees :

Does AXI charge commissions?

AXI offers a free deposit and withdrawal. Moreover, it charges a low spread that starts from 0.0 pips. However, it does charge a commission of $7 per round turn. Moreover, it only applies to the pro account, whereas the standard account is free from the commission.

Is AXI free?

We can say yes and no as well. AXI does offer a demo account with which new traders can trade without any costs. Moreover, it does not charge many conventional charges such as deposit fees, withdrawal fees, etc. However, it offers a low spread that is charged depending on the account and the asset.

Does AXI offer an Islamic account with additional fees?

AXI offers an Islamic account for the followers of the Muslim faith as well. The Islamic account offers certain exclusive benefits for its users. For example, it is available without any minimum deposit, unlike other accounts where the user must deposit a minimum amount.

Moreover, the Islamic account at AXI does not charge any swap fees. However, a new trader must be careful to note that it charges an administration fee of $60 per lot for holding the position overnight without closing it by the fixed time limit. But, the admin fee can also vary depending on the currency pair as well.

Are there any additional AXI fees for the Islamic account?

There is an Islamic account for the Muslim faith as well. Also, it is available without any additional AXI fees. You can get these features on AXI. In addition, AXI traders do not have to pay any kind of charge or swap fees. They have to pay an administration fee of $60 per lot for holding the position overnight. But, the admin fee can differ on the currency pair as well.

What category of AXI fees is available?

There are two available categories for AXI fees: Trading and non-trading fees. You have to pay trading fees while a trading activity is done. It consists of forex fees, overnight funding fees, deposit fees, etc.

Another is the non-trading fees. They are for all non-trading activities. You will have to Pay for the withdrawal as well. Further, it counts both withdrawal fees as well as inactivity fees.

Are there any AXI fees for standard accounts?

Luckily, there are no AXI fees and commissions for the standard accounts. That’s a plus point for the customers. On the other hand, the pro account holders will have to pay for every trade. For every 1 standard lot of trade, you must pay 7 USD roundtrip ($3.50 per lot).

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller