What are forex broker spreads? – Definition & examples

Table of Contents

Forex brokers act as the link between the forex trader and the market. They work by using trading platforms which is the forex market. A forex trader has to have a forex broker access the market.

They make money through forex spreads, commissions, and small charges for some services. But the prime way they make money is through forex spreads. In forex or any other market, the participants provide the prices for securities.

Forex brokers use these prices as a base for setting the forex spreads. There are factors in the market that affect liquidity and types of forex spreads that forex traders should know.

What are forex broker spreads?

A forex spread is a difference between the bid and asking price of a currency in forex. The bidding price is the price that a market participant offers to buy a forex currency or any other asset. The asking price is the amount that a market participant is willing to pay to sell the currency.

The spreads are in form of small units in forex known as pips, and it varies from one asset to another in the forex market. It is the fourth decimal digit you get after subtracting the bid from the asking price.

How do you calculate the forex spreads?

Forex spreads calculation is one of the fundamental knowledge forex brokers know. To calculate the forex spread, you need to get the bid and the asking price. For example, the EUR/USD has an ask price of 1.2500 and a bid price of 1.2496.

To get the forex spread, subtract the bidding price from the asking price. The difference is 0.0004, which is the forex spread at that moment. The forex spread gets expressed as 0.4 pips, but this calculation can be difficult, especially when you have a high volume to trade.

Forex brokers have a tool for this math called the forex spread calculator so, you don’t need to worry about all the calculations.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Types of forex broker spreads

There are two types of forex spreads, the fixed spread and the variable spread.

The fixed spread

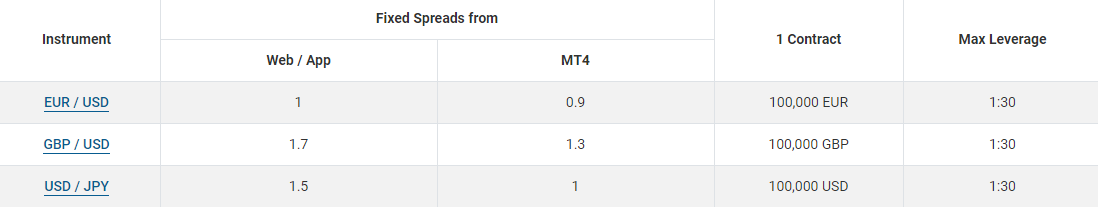

It is a forex spread set at a price and is not affected by the market forces. Fixed spreads don’t change and are offered by market makers or dealing desk brokers. These brokers buy the assets in large volumes and give them to forex traders in small quantities.

They can place the prices that forex traders can use, which is a reason they offer fixed spreads.

Advantages of fixed spreads

Low costs– They are a good option for new forex traders since they have low costs. They have low charges because forex traders can plan the strategy and the lot size they want to trade.

Transparency– fixed spreads have some form of transparency since traders know how much they pay for an asset. Forex traders can trade high volume forex trades, and factor in the forex spreads without the fear of the spreads changing.

It is consistent– it is an advantage for short-term forex traders like day traders and scalpers. It allows them to budget for the trade and calculates the outcome. The profits from small forex trades are usually within a small range, so having a fixed spread helps know how much to expect.

It is effective in a volatile market– forex traders have a hard time after the release of financial news. It is because the market becomes unpredictable. It is easier when using fixed spreads in such a market.

Disadvantages of fixed spreads

Re-quotes – it happens mostly on a volatile market. Since the forex broker has set a fixed spread, a highly volatile market could cause the asset prices to change drastically. The forex broker is unable to buy or sell the asset at the requested price.

So they send a re-quote which is a new asset price since the prices have changed. Most re-quotes are often a higher price of an asset which is why it is a drawback of fixed spreads.

Slippage– occurs when the forex broker is late in executing a buy or sell order at the requested price. When the forex broker uses a fixed price, they find it hard to process orders on a volatile market. Forex traders end up buying or selling assets at different prices.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Variable spreads

It is also known as floating spreads and are forex spreads that change according to the market conditions. They fluctuate with the movement of prices and get offered by none dealing desk brokers.

It is affected by the liquidity and volatility of the forex pair. They are widest when there is high volatility in the market and low liquidity.

Advantages of variable spreads

It is cheaper – variable spreads are affordable, especially when there is high liquidity. High forex activities mean there are more forex traders. It means the forex spreads are affordable.

Transparency – variable spreads are transparent because forex traders can get the best prices. The forex traders can access prices from different market participants and get favorable prices.

They have no re-quotes– the forex spreads that get displayed might change if the market is volatile. But in most cases, the orders get executed at the bid and ask prices. There are no chances of getting requites.

They have a fast execution– it has a fast execution rate since the forex spreads are consistent with the market prices. Forex brokers don’t have to check if they are profiting. Because the forex spreads are moving according to the direction of the forex market.

Disadvantages of variable spreads

They widen quickly– when the forex market becomes volatile. It is not an option for short-term forex or volume traders because the spreads could cost the profits. It could make more losses than profits.

They are unpredictable– this factor makes using a variable spread hard to apply for trend traders. The forex spreads change when there are announcements in the forex market.

They require a high capital– when dealing with variable spreads, you have to factor in the costs of the forex spreads. Since variable spreads change, they could widen in the middle of a trade and cause you to get a margin call. They require high capital to open any positions.

Which Forex spread is better, variable or fixed?

The forex trader has to decide which is suitable for them between the variable and fixed spreads. They are practical for different situations and different traders. Forex traders should weigh the advantages and disadvantages when choosing which spreads they want to use.

What factors affect Forex spreads?

Liquidity

It is when there is a high volume of traders in the market. When there are many traders, the offer for buying or selling security varies. Forex traders can find traders that accept their bidding prices or selling prices.

Currencies that have liquidity like the major pairs have a low forex spread. The exotic and minor currency pairs have high forex spreads since it is harder to match order prices.

It is crucial to know the time when the forex markets open. Because this is the time when there is high liquidity as the market is very active. There are four sessions in the forex market, which open at different times.

The four are the Sydney, New York, London, and the Tokyo session. Whenever these forex markets open, currencies traded in these countries experience high liquidity. Which causes low forex spreads on these currency pairs.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Political and economic issues in a country

In countries having unstable political climates, effects are felt in the forex market. Because the economic and political unrest affects the economy of that country. The currency could experience fluctuating interest rates.

The forex pairs that trade with a currency where there is economic and political strife get wider forex spreads. Forex brokers set the forex spreads wide because it is unpredictable. So they have to factor in the costs of the risks that can occur.

Volatility

Forex currencies from countries that have stable monetary policies are less volatile. Because there are rare cases that cause major changes in the currency value. It might have small spikes from other currencies, but it is stable.

These are like the USD, The Euro or the British Pound. Their bid and ask prices are stable, which means the spreads are also low. Volatility plays a role in the case of forex spreads.

Financial events and announcements

Forex traders have to keep up with the economic news. Especially the trend traders and scalpers, any new announcements could create activity in the forex market. It is hard for forex brokers to foretell how forex traders will react to any news.

This is why after any major announcements, forex brokers will brace for any outcome by widening the forex spreads. The spreads could narrow if the volume of traders increases. It solely depends on how the market will react.

The news could also be political news like Brexit. The British Pound became more volatile, which caused an increase in volatility and the forex spreads widened.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex broker spreads :

What are the benefits of fixed spreads in forex broker spreads?

Given their minimal fees, spreads are a suitable choice for inexperienced forex traders. Since traders are aware of the price they are paying for a trade, fixed spreads offer some level of transparency. For short-term forex traders, it is a boon as it computes the results and enables them to budget for the trade.

What are the drawbacks of fixed spreads in forex broker spreads?

Requoting primarily occurs in a volatile market, which can cause asset prices to move significantly since the forex broker has set a fixed spread. The asset cannot be purchased or sold by the forex broker at the asked price. Slippage happens when a forex broker takes too long to carry out a buy or sell order at the desired price.

How are forex broker spreads determined?

You must obtain the bid and asking prices in order to calculate the Forex spread. For instance, the bid price for the EUR/USD is 1.2397, and the asking price is 1.2400. Subtract the asking price from the bid price to obtain the currency spread. The difference is 0.0003, which represents the current Forex spread.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)