Who is Benjamin Graham? – History of the trader and investor.

Table of Contents

Benjamin Graham is a famous trader who became remarkably rich with his investing tactics. Born in Britain, Benjamin is considered the father of value investing. He believes that if an investor follows the perfect investment psychology, he can generate immense wealth.

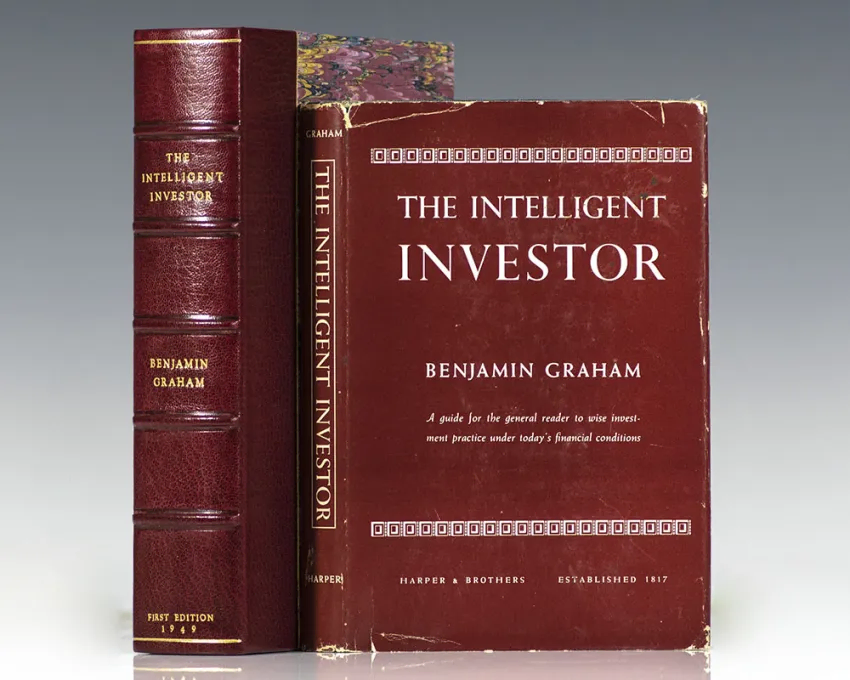

Benjamin Graham became widely known for his trading strategies. In addition, he also put down his thoughts about neo-classical investing. Security Analysis and The Intelligent Investor are the two remarkable publications of Benjamin Graham. These publications help traders make money even today.

So, what makes Benjamin Graham different from other traders? Let’s find out.

About Benjamin Graham

Date of birth: | 9 May 1894 |

Wealth: | 3 million USD |

Strategies: | – value investor – dirt-cheap stock prices – control your emotions – use market panics – follow the long-term approach |

Website: | no information |

Interesting facts: | – shifted to New York City – Benjamin’s father owned a furniture store – author of The Intelligent Investor |

Benjamin Graham is the trader who proposed a perfect definition of investment. He differentiated speculation and investment. His book, The Intelligent Investor, has helped many traders; even Warren Buffett regards this book as the best book ever written on investment.

Good to know!

Benjamin Graham claimed that defensive investors take every move very cautiously. He looks for value stocks. In addition, this kind of investor holds these value stocks for the long term.

Contrastingly, an active investor spends more time in the trading market. He also builds specialized knowledge to invest in such stocks that are truly exceptional.

Benjamin Graham explained well the meaning of value investor. Graham also suggested that a trader should do something foolish and creative daily.

Good to know!

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Biography of Benjamin Graham

Benjamin was born in London. His parents were Jewish. On growing up one year old, Benjamin shifted to New York City. Before shifting to New York City, the family had the surname of Grossbaum. However, they changed the name to Graham after shifting to New York. They did so to avoid any anti-German sentiments rising against them.

Benjamin’s father owned a furniture store. The family battled poverty. It was because of this poverty that Graham developed his investment theories. He developed the tactic of buying bargained items at an early age.

Good to know!

The net worth of Benjamin Graham

- When traders look at the net worth of Benjamin Graham, they get surprised. Benjamin had a very long investing career

- Additionally, his impressive trading strategies help to contribute to his wealth. Benjamin Graham was generous

- From his net worth of US$3 million, Benjamin made immense charities

- His trading strategies that helped them make this wealth were mostly centered around value trading

- These value trading strategies helped him generate high returns

Trading and investment strategies of Benjamin Graham

The trading and investment strategies of Benjamin Graham were the reason behind his earning immense wealth. In The Intelligent Investor, Benjamin Graham communicates several trading strategies that can help any trader go big time.

Graham did his research and knew many things that helped them make money. Benjamin’s trading strategies work perfectly for traders even today.

Here are some trading strategies by Benjamin Graham that you can incorporate into your trading regime.

Go for dirt-cheap stock prices

Sometimes, the market shows traders unique things. For instance, at any time in the 1930s, US stocks were available below the current as its value. Most traders wouldn’t invest in such businesses, thinking that they won’t be profitable.

However, according to Benjamin Graham, these dirt-cheap stock prices could help traders profit. Even if such businesses go bankrupt or liquidate the other day, a trader could still earn something.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Controlled emotions

The intelligent investor often conveys that traders control their emotions while trading. Having uncontrollable emotions is one bad trait that any trader should avoid. A trader should be clear-headed about how he wishes to trade.

Mechanical investing strategy

Through his research, Benjamin Graham developed the mechanical investing strategy. The strategy helps traders unbias their emotions. Graham believed that if a trader controlled his business, he could become a long-term speculator. Eventually, it would help a trader get higher returns on equity.

This trading strategy was perfect for small investors.

Value Investing

Another great trading strategy that Benjamin Graham followed himself was the value trading strategy. Benjamin believed that value investing that involved a proper fundamental analysis could help a trader place winning trades.

Good to know!

What can you learn from Benjamin Graham?

Benjamin Graham has focused on making traders aware of several things through his publications. He gives traders excellent lessons that they can incorporate while trading.

Interestingly, Warren Buffett, one of the richest men in the world, followed the trading tactics and advice of Benjamin Graham.

Prepare for market panics

The market sentiment never remains the same. The sentiments change according to the economic situation. In his intelligent investor, Benjamin Graham recommends traders recognize market panics.

If he does so, he can tap the opportunity to benefit from good companies’ great prices.

Investing does not equal gambling

Benjamin Graham has created a stark difference between investing and gambling. Most traders might consider investing as gambling.

However, Benjamin Graham changed the thought forever. He believed that a trader should undertake to invest by considering the return on the capital that he invests.

Consider the margin of safety

The trader also establishes that trading successfully requires a trader to manage risk well. When trading, a trader can never eliminate the risk. So, instead of avoiding risk, traders should know how to deal with it.

Follow the long-term approach

Benjamin Graham stressed market might undergo several ups and downs in the short term. The same as it that could bring your losses in the short-term might make you wealthy and the long term. So, a trader must follow the long-term approach.

However, the trader should also consider the macroeconomic events that could affect the market conditions.

Make your mistakes your teacher

Suppose you make a loss while trading. It is best not to overlook it. If a trader lets it go, it can amass huge losses. So the trader should track his mistakes and learn from them. Whenever trading, never miss technical research. It will help you place more winning trades.

Conclusion about Benjamin Graham’s investing experience

Benjamin Graham revolutionized the trading world for traders. This great investor developed various economic and reading theories that work for traders today. With the help of his publications, many investors have built their fortunes.

Warren Buffett was a great follower of Benjamin Graham’s writings. He publicly admits that he owes his wealth to the knowledge he assimilated from his books.

If a trader wishes to succeed while trading today, Benjamin’s advisers can work well for them. However, the success of trading will also depend upon the knowledge that a trader accumulates.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQs – Frequently asked questions about Benjamin Graham

Was Benjamin Graham a great trader?

Benjamin Graham was a great trader. Throughout his trading journey, Benjamin amassed enough wealth. He analyzed the market well, which helped them gather knowledge about the trading world.

Which is the best publication by Benjamin Graham?

The intelligent investor that guides traders through the trading journey is the best publication of Benjamin Graham.

Can I follow Benjamin Graham’s trading tactics?

Yes, any trader can follow Benjamin Graham’s trading tactics and benefit from them. These trading tactics help traders minimize losses and focus on long-term gains.

Last Updated on February 24, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)