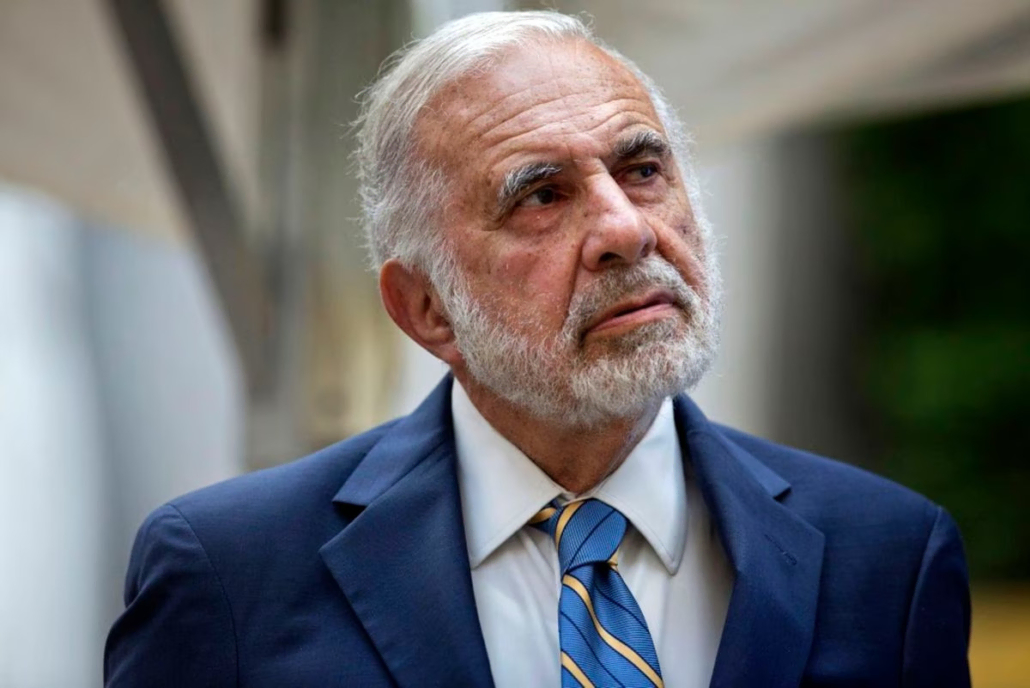

Who is Carl Icahn? – History of the trader and investor

Table of Contents

All aspiring traders must have heard the names of many great traders. Carl Icahn is one such name that has attracted many traders. The credit owes to Carl’s amazing trading skills throughout his career.

There are many reasons why traders must learn the investment strategies of Carl Icahn. After all, he could build a fortune using the same trading skills. Before learning some trading lessons from Carl Icahn, let’s look at his life.

About Carl Icahn

Date of birth: | 16.02.1936 |

Wealth: | 17 billion USD |

Strategies: | – Ichan likes to invest in big corporate companies – options trading – never invest in any company without assessing it – take note of the corporate policies of a company – trend analysis – avoid impulsive behavior |

Website: | |

Interesting facts: | – Carl’s father was an atheist – Icahn got into military service – degree in Princeton University – got into military service – working as a stockbroker – runs his company Icahn Enterprises |

- Carl Icahn belongs to America and is a very reputable American financer

- He runs his company, called the name of Icahn Enterprises. He has a great hold on that company

- His company is a conglomerate that has very diverse operations

- Carl likes to trade or invest in the shares of big corporate companies

- His trading decisions revolve around believing that these companies might appreciate once they change their corporate management. After all, plenty of corporate management decisions lead to appreciating the company’s intrinsic value

- Because Carl Ichan likes to invest in the shares of big corporate companies, he is often called the ‘corporate raider‘

Good to know!

- Carl Icahn has also been involved in several hostile takeovers that earned him the reputation of a corporate raider

So, Carl Icahn has a very strong reputation in the financial world. He is known to create immense wealth through his corporate investment strategies.

Let’s look at Carl Icahn’s biographical information to learn about his early days.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Biography of Carl Icahn

- Carl Icahn was born and brought up in Brooklyn

- Icahn’s family was a Jewish family

- He attended Far Rockaway High School

- Carl’s father was an atheist. His mother taught in a school

- Carl got his degree from Princeton University

- After that, he dropped further education and got into military service

Career

- After quitting the Military service, Carl started his trading journey by working as a stockbroker

- Later on, Carl became an options manager. At this time, he worked for Tessel, Patrik, and Co.

- He switched his company and worked for Gruntel & Co.

- Here, he built his trading abilities in risk arbitrage. Also, he brushed up on his knowledge about options trading

- Carl’s first takeover was Tappan. After getting a hold of Tappan, Carl made the board sell the company to Electrolux. This selloff brought Carl Icahn a profit of $2.7 million

- After this, his list of corporate takeovers continues. His right analytical skills in determining the inner potential of a company made him make immense money. Because of his sound trading decisions, he could accumulate the great net worth he owns today

The net worth of Carl Icahn

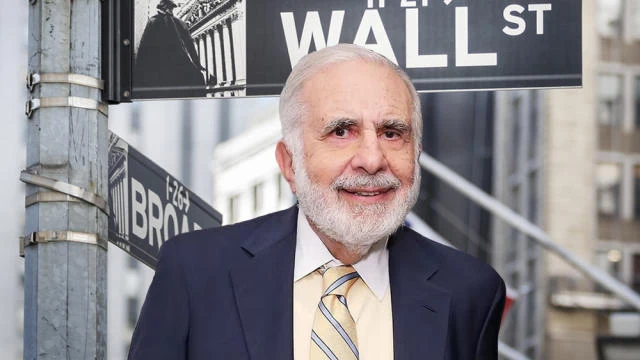

The investor’s net worth is remarkably high. Carl Icahn holds wealth amounting to 17 billion USD. He follows amazing investment strategies for hedge funds. Also, his high net worth makes him a strong personality on Wall Street.

Good to know!

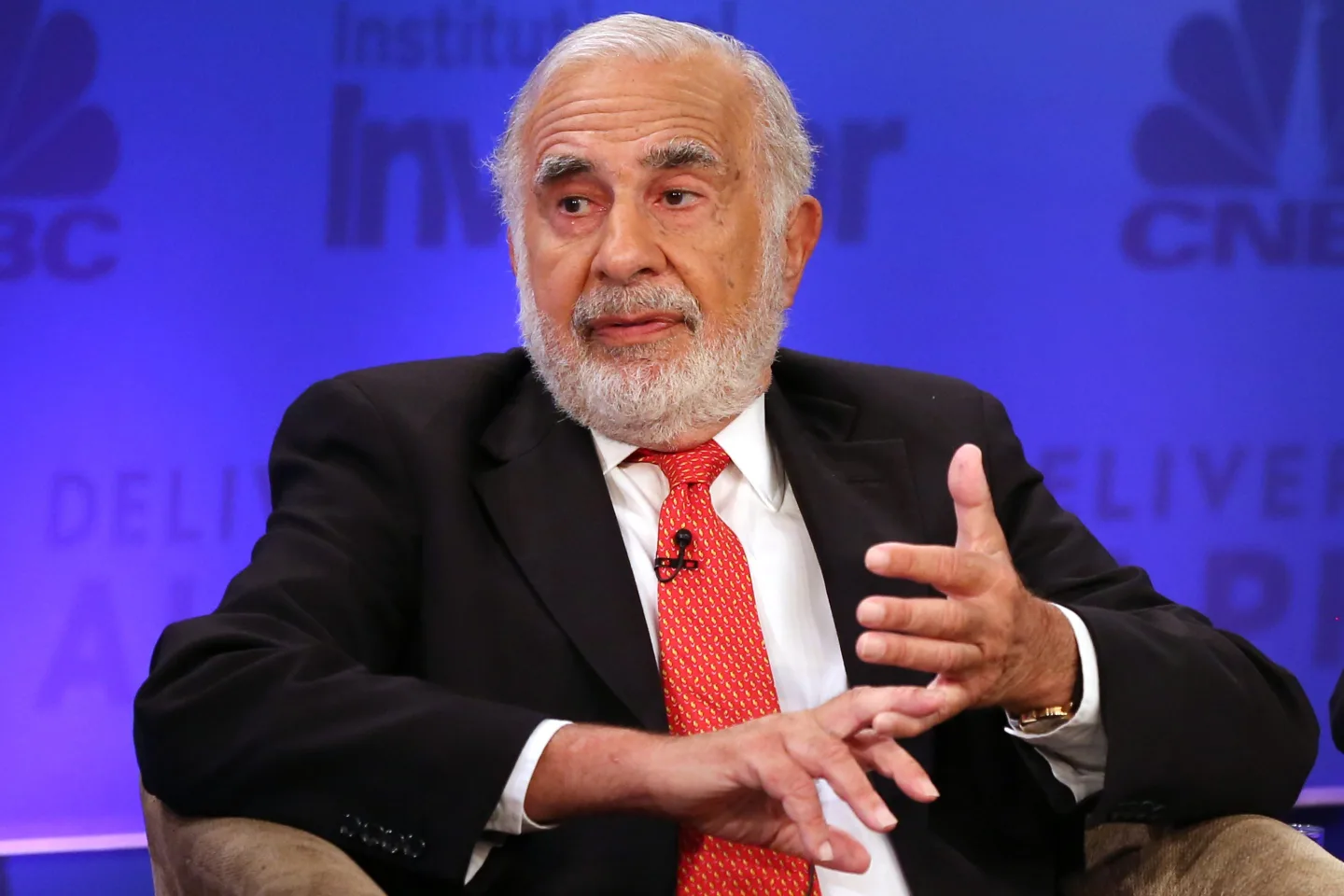

Trading and investment strategies of Carl Icahn

Having the right trading and investment strategies is the key for anyone to become rich through trading. Carl Icahn is a great corporate trader who follows a set of practices while investing in any company.

Carl Icahn’s trading strategies are definitely worth the look.

Assessment of the company

Carl would never invest in any company without assessing it. Even though he is known for his hostile takeovers, Carl does not put his money into something he does not believe.

Good to know!

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Looking into corporate policies

A company’s functioning is important if a trader wishes to benefit by buying its shares. Carl Icahn takes note of the corporate policies that a company follows. Further, he looks into the situation that might arise if they change the company’s corporate policy.

If his research is affirmative, he buys a great shareholding of that company. Then, Carl asks the company’s corporate managers to change their policies. These policies hike the market share price of such companies.

Finally, Carl and other shareholders of the company earn huge profits.

Trend analysis

Carl cannot judge a company’s stock or valuation if he does not consider analyzing the trend. Thus, trend analysis is a great part that contributes to helping Carl Icahn build his trading strategies.

Less impulsive trading behavior

Having impulsive behavior can make any trader lose his funds. Carl believes a good trader should develop good trading practices and avoid the temptation of impulsive behavior.

Thus, if a trader wishes to benefit in the long run, Carl Icahn’s trading strategies are the perfect roadmap to helping them do that. However, Carl’s trading strategies are more inclined towards corporate takeovers.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What can you learn from Carl Icahn?

Unarguably, Carl Icahn’s trading personality is a perfect one. Traders look up to Carl Icahn as an inspiration to fulfill their trading goals. Here are a few lessons Carl Icahn’s trading journey leaves for traders:

- A trader should look for long-term goals and indulge in value investing. So, being a speculator is good, but it does not help a trader build a fortune in the long run

- If a trader invests in the company’s shareholding, they will reap the maximum benefits if he indulges in the company’s regular activities

- Carl invests in only those companies or assets that he thinks are productive

- A trader must refrain from acting impulsively when trading in the market

- According to Carl Icahn, something popular in the trading market is not always true

- Carl Icahn is an active trader and also a long-term investor. So, he proves that any trader can be both if he has the right thought process to tap the market opportunities

- Look for undervalued assets that you think might appreciate anytime soon

- Don’t trade or invest in any stock without having a plan at your disposal

- Care less for the reward and try to hunt down companies that can substantially grow in value

Conclusion about Carl Icahn’s trading and investing experience

Overall, Carl Icahn is a great trader with a great investment philosophy. Carl Icahn has had a great Wall Street career. By making trading decisions in the right direction, he has become wealthy.

With an accumulated net worth of 17 billion USD, Carl makes it to the list of the Forbes richest men. In addition, he is an active trader and a big shareholder in several corporate units. A trader can learn plenty of things from Carl Icahn’s trading career.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – frequently asked questions about Carl Icahn

How does Carl Icahn make companies change their corporate policies?

Carl Icahn finds companies that he thinks are valued lower than their potential. Then, he invests in those companies and purchases a major chunk of their stocks. Finally, Carl becomes the biggest shareholder of that company and makes the board and other shareholders change their corporate management policies.

How can I trade like Carl Icahn?

A trader can trade like Carl Icahn by finding companies where he can indulge in value investing. He must also ensure that he conducts a proper analysis before investing or purchasing the stocks of any company. A trader should look for undervalued companies that have the potential to grow in value in the future.

What is the core trading principle of Carl Icahn?

Even though Carl Icahn is a long-term investor, he trades actively. Besides, his core trading principle is value investing. It means that a trader finds a stock of any company that he thinks is valued lower than what it should be on the stock market. Then, a trader purchases that asset and keeps it long-term till it generates profit.

Last Updated on February 24, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)