4 best crypto trading demo accounts for investing in digital currencies

Table of Contents

Cryptocurrency has slowly been gaining popularity since its conception. When it was still fairly new, people often thought of it as a scam or a joke. Now, crypto is one of the most famous tradeable assets in the market.

With intense volatility swings, this asset class has become a trading haven for those that want to get rich quickly. However, despite making hundreds and thousands of traders rich, there are a lot as well that have lost a lot in this exciting environment. Having a demo account dramatically increases your chances of survival for you to trade the next big bull wave.

So, if you want to jump in on the trend and invest in cryptocurrency, this review is for you. Here are the 4 best cryptocurrency trading demo accounts for investing in digital currencies. All the information on the different brokers on this list will help you decide which company best suits you.

You will also read about what exactly cryptocurrency is, how to trade it, and the benefits of practicing on a demo account before you start trading with your hard-earned cash.

See the list of the 4 best cryptocurrency trading demo accounts here:

Crypto Broker: | Review: | Crypto trading demo account: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. Binance | Available & free | Starting from 0.0 pips | 500+ | + High security + Beginner-friendly + Easy to create an account + Mobile app + Fast support | Free demo account(Risk warning: Your capital might be at risk) | |

2. Bitfinex | Available & free | Starting from 0.0 pips | 300+ | + High security + Supports the most cryptocurrencies + Derivates and margin trading + Lending/ borrowing + Professional trading platform | Free demo account(Risk warning: Your capital might be at risk) | |

3. Libertex | Available & free | Starting from 0.0 pips | 250+ | + Available in over eight languages + Multifunctional and user-friendly platform + The minimum deposit is € 100 + No deposit fees and reasonable trading fees + Offers several CFDs cryptocurrencies | Free demo account(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) | |

4. Capital.com | Available & free | Starting from 0.5 pips | 6,000+ | + Low spreads and no commissions + Professional trading platform + Mobile app + Personal support + Huge variety of educational material | Free demo account(Risk warning: 75% of retail CFD accounts lose money) |

Here is the list of our 5 best cryptocurrency trading demo accounts that you can use for free:

- Binance – Beginner-friendly

- Bitfinex – Professional trading platform

- Libertex – Offers several CFDs cryptocurrencies

- Capital.com – Huge variety of educational material

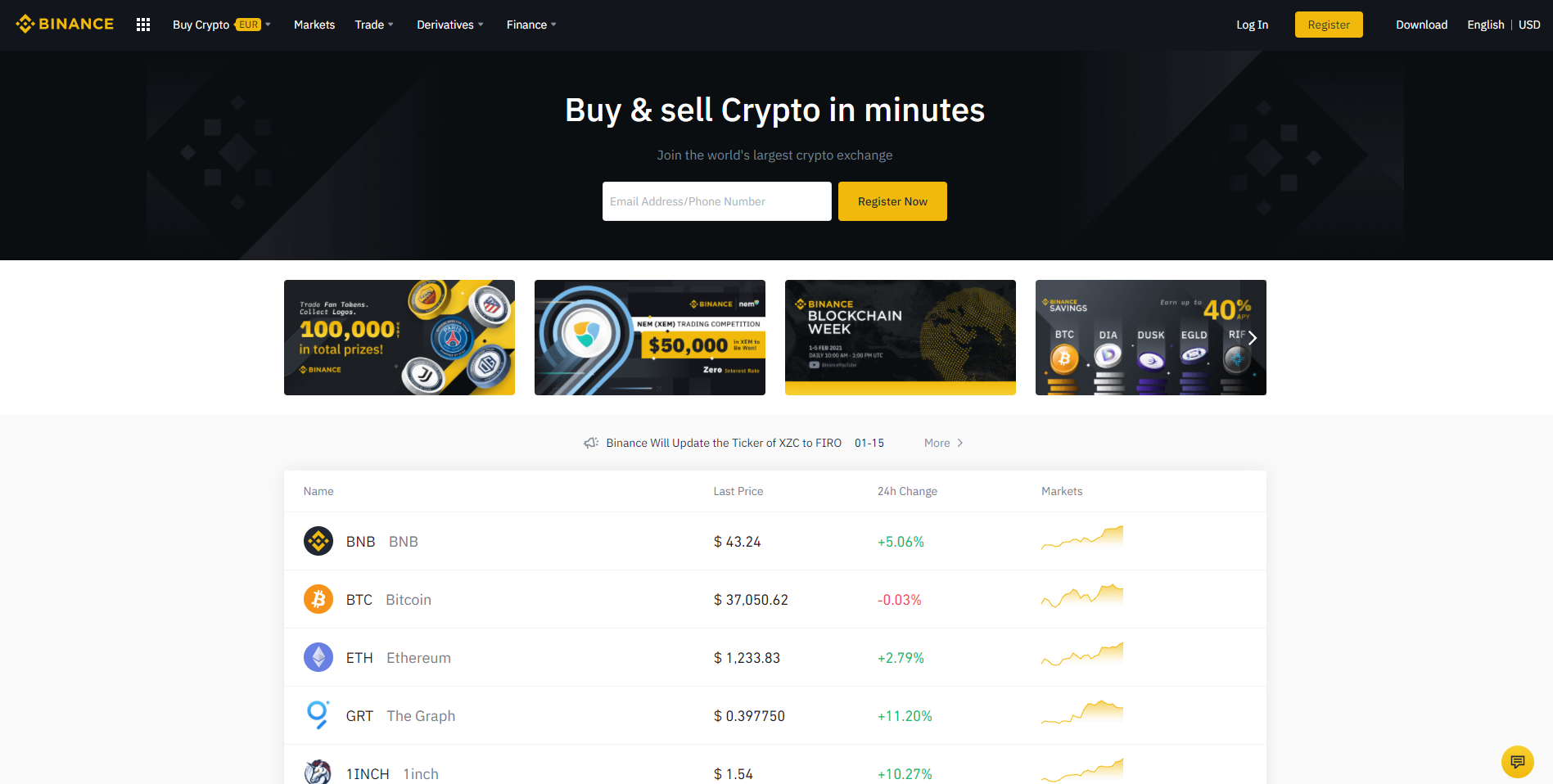

#1: Binance – Beginner-friendly

This company was founded in 2017 by a well-known developer that created high-frequency trading software, Changpeng Zhao. Despite only operating for over five years, Binance is currently the leading cryptocurrency exchange globally, with more than 1.4 million transactions per second and a daily trading volume of upwards of $2 billion.

The name Binance is a combination of “finance” and “bitcoin.” As the origin of the name suggests, Binance specializes in cryptocurrency, which makes it the perfect platform for newbie crypto traders to train on. With over 500 cryptocurrencies to choose from, you will surely be able to develop different strategies before investing real money. Bitcoin, Litecoin, Dogecoin, Ethereum, and even their own token, Binance Coin, are just a few of the well-known tradeable cryptos in Binance’s platform.

Using Binance Coin even has its own perks. Aside from rapidly gaining a lot of value during the start of the 2021 crypto bull run, BNB is used for transactions that involve cryptocurrencies that are just starting out and could also be used to lessen fees when using Binance’s platform.

Another great thing about Binance is they focus on educating new traders on how to handle the different kinds of cryptocurrencies properly. Binance Academy features beginner and intermediate courses and articles for would-be crypto traders. However, it’s tricky to start practicing on a demo account using their platform.

Binance’s main website does not allow you to open a demo account. To access this, type in testnet.binance.org on your browser’s URL tab and hit enter. This will direct you to their TestNet page. You can create a virtual wallet with $100,000 in virtual funds. This will allow you to practice trading the available cryptocurrencies in real time without risking your hard-earned cash.

You will need to download the software or browser extension before registering. To make the process easier, there are video tutorials for you to follow. The TestNet website supports English, Japanese, Korean, Indonesian, Russian, Turkish, Spanish, and Vietnamese.

The main website has a built-in live chat system that supports English, Russian, Chinese, Portuguese, Japanese, Turkish, Spanish, Vietnamese, French, Italian, and Filipino. Their customer service representatives can also be reached via their Telegram, Facebook, Twitter, Reddit, and Instagram accounts. This is available 24/7.

Due to regulatory concerns, Binance is not accessible from Zimbabwe, Yemen, Syria, South Sudan, Venezuela, Sudan, Somalia, Iraq, Iran, Kosovo, Liberia, Lebanon, Libya, Moldova, Macedonia, Cuba, Herzegovina, Cuba, Croatia, the Crimea region of Ukraine, The Democratic Republic of Congo, Democratic People’s Republic of Korea, Cote D’Ivoire, Central African Republic, Bosnia, Burma, Belarus, Albania, and the United States of America.

(Risk warning: Your capital can be at risk)

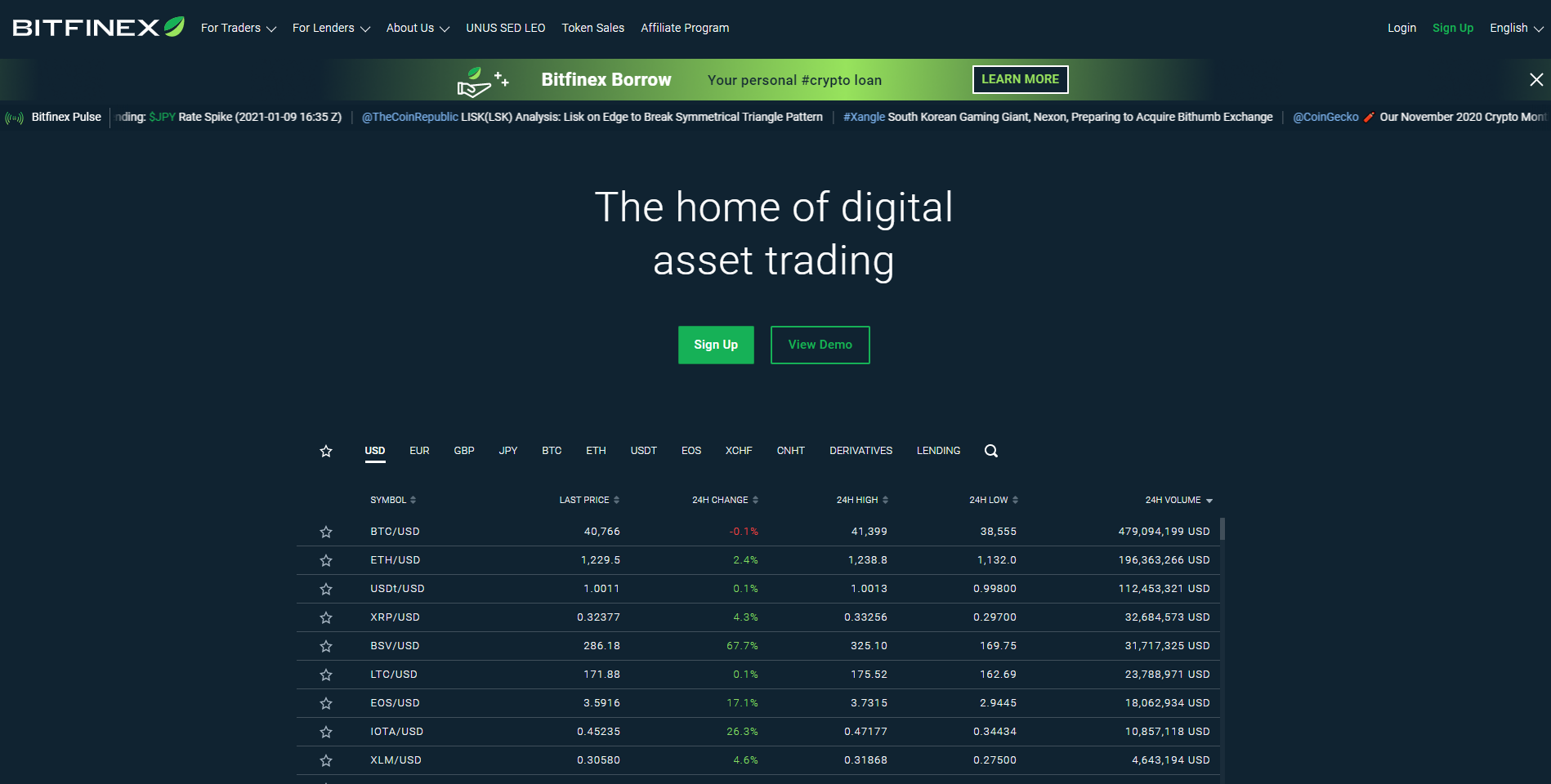

#2: Bitfinex – Professional trading platform

Bitfinex, as their website describes, is the go-to exchange to trade cryptocurrency. This company was founded in 2012 in the British Virgin Islands. It is currently based in Hong Kong, and by the year 2020, its net worth skyrocketed to more than $800 million. It is one of the largest crypto exchanges right next to Binance.

Their trading platform allows their clients to trade smoothly and efficiently. It has a customizable interface and a ton of tools that would help traders in every scenario. Below is a list of tradeable cryptocurrencies in Bitfinex’s platform.

- Bitcoin

- Ethereum

- EOS

- Ripple

- Litecoin

- Bitcoin Cash

- Ethereum Classic

- NEO

- IOTA

- Monera

- OmiseGo

- Bitcoin Gold

- Dash

- TRON

- Zcash

- Santiment

- Qtum

- 0X

- QASH

- ETP

- Eidoo

- RCN

- YOYOW

- Time New Bank

- Status

- iExec

- Golem

- Augur

- SpankChain

- Streamr

- Basic Attention Token

- aelf

- FunFair

- SingularDTV

- AidCoin

- Decentraland

- Aventus

- Ethfinex Nectar Token

Bitfinex features a paper trading account. This is basically a demo account. This allows you to practice trading risk-free in a simulated environment. To get started, open an account via their website. You will need to input your username, email address, password, and timezone. Once you have completely registered, log into your account and click on the sub-account tab.

If you encounter any problems, Bitfinex has a help center that contains answers to frequently asked questions. You may also contact their support system via their “Contact Bitfinex Support” tab. Their website supports English, Russian, Chinese, and Spanish.

Traders from the United States of America, Bosnia and Herzegovina, Iran, Iraq, Korea, Uganda, Syria, Vanuatu, Yemen, and Ethiopia are not eligible to open an account with Bitfinex.

(Risk warning: Your capital can be at risk)

#3: Libertex – Offers several CFDs cryptocurrencies

Libertex has been around for more than 20 years and has, to date, over 2.2 million clients from more than 120 countries. This Cyprus-based broker has won over 40 international awards, including Best Trading Platform of 2020.

With Libertex, you can trade some of the most famous cryptocurrencies in the market. Below is a list of all the tradeable cryptos in Libertex’s platform.

- 0x

- Ark

- BitConnect

- Bytom

- Dogecoin

- Factom

- Golem

- Komodo

- Loopring

- Populous

- SALT

- Status

- VeChain

- Waltonchain

- Zclassic

- Aion

- Augur

- BitShares

- Dentacoin

- Dragonchain

- FunFair

- Hshare

- KuCoin Shares

- Monacoin

- QASH

- Siacoin

- Steem

- Verge

- Waves

- Ardor

- Bata

- Bytecoin

- DigiByte

- Gas

- ICON

- Kyber Network

- PIVIX

- Rchain

- SmartCoin

- Tether

- Veritaseum

- WAX

You can practice trading these products on MetaTrader 4, MetaTrader 5, or Libertex’s own trading platform. These three platforms are also available on mobile devices. You can download them on the Google Play Store or Apple App Store.

With Libertex’s demo account, newbie traders can develop appropriate strategies for trading the different types of cryptocurrencies. The demo account comes equipped with €50,000 in virtual funds and full access to their trading platforms.

It’s important to note that you will also be signing up for a real account when you sign up for a demo account. But keep in mind that you won’t be able to access your live account without making a deposit first.

If you need more information or you encounter any problem, you can get in touch with their support team by sending them an email or contacting them via telephone (+35722 025100). You may also send them a message via Facebook or Twitter. Rest assured that your query will be answered within an hour if you decide to contact them via email or social media.

Libertex is accessible by traders worldwide except for clients from the European Economic Area or EEA.

(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.)

#4: Capital.com

Capital.com is a Forex and CFD Broker platform where users can trade CFDs on the basis of cryptocurrencies, foreign exchange, forex, where you can trade real stocks and stock CFDs, and also different kinds of markets. Capital.com was founded in 2016 and is authorized and regulated by the CySEC, FCA, ASIC, and FSA. Its users can trade on more than 6,000+ different financial CFD instruments. It provides its users and traders to learn at the same time by providing technical analysis and AI-based reviews on their trades.

In trading, it is the difference between the buy (offer) and sells (bid) prices quoted for an asset.capital.com has a policy of charging users on the basis of spread. Spread betting (only for traders from the UK) is also used to speculate on upward and downward market moves. Appreciate the opportunity to go long or short on a wide range of markets, including forex, shares, commodities, and indices, with leverage and tight spreads. People that are new are correctly trained by the great platform. Minimum spreads for various markets start from 0.004 in stocks, 0.07 in indices, commodities 0.018, and currencies 0.7 pips. (Tested on 13.01.2022)

- Spread depends on the market you trade

- No commissions on Capital.com

The following markets are available with Capital.com:

- Forex (currencies) CFDs

- Commodities CFDs

- Metals CFDs

- Stocks CFDs and real Stocks for the UK and some EU countries

- Indices CFDs

- Cryptocurrencies CFDs

- Bonds CFDs

(Risk warning: 75% of retail CFD accounts lose money)

What is a cryptocurrency demo account?

A cryptocurrency demo account allows you to trade different cryptocurrencies through test-nets and demo accounts using virtual funds from your selected broker. Depending on your chosen broker, the cryptocurrencies available will vary. Still, usually, you will be given access to the more popular coins such as Bitcoin, Ethereum, Litecoin, Binance Coin, Cardano, Dogecoin, and many more.

Keep in mind that although a lot of brokers offer many more asset classes to trade, there are some crypto exchanges that only exclusively offer cryptocurrency as products.

As mentioned, these exchanges sometimes use test-nets or website extensions that would act as your demo accounts. You will be asked to create a virtual wallet that is similar to the crypto wallets of live accounts, and you’ll be making your trades from there.

Test-net accounts function like regular demo accounts. That means you’ll be incurring no losses on your trades, and you’ll still have full access to whatever your broker or chosen exchange offers. Even if trading apps and trading platforms differ from one another, it is a standard that services such as charting and cryptocurrency exchanges are easily accessible.

Why should you use a cryptocurrency demo account?

There are a lot of traders and investors that are skeptical about trading cryptocurrencies. One reason is that they are, for the most part, unregulated and sometimes even associated with money laundering.

Demo accounts give a bit of confidence to those interested since it gives the full experience of what it means to use cryptocurrency in the form of trading. If you believe in the future of a cashless society in which we’ll be making transactions through Bitcoin, Ethereum, or probably even Dogecoin, then the best time to start learning more about cryptocurrencies is now.

With demo accounts, you get unprecedented access to hundreds and thousands of cryptocurrencies ranging from the popular ones like Bitcoin to the unheard “shitcoins” or “meme-coins.” With the rising popularity of this asset class and its monetary value, it will not hurt to start learning more about how to trade these and learn about the function of each cryptocurrency. Some are even classified into subclasses, such as “DeFi” and “BSC,” depending on their function.

With demo accounts, you get a live experience of practicing with leverage and margin. Depending on the broker, you can also trade BTC futures. The volatility of cryptocurrencies may seem daunting to beginners since their price movements could multiply up to thousands depending on the hype and the potential of a specific cryptocurrency.

As mentioned, some exchanges only offer cryptocurrencies, but for brokers and exchanges that offer other asset classes, one might encounter a problem with spreads. Having a demo account will allow you to test out if you are willing to handle the spreads of your chosen exchange since these could reach more than 5% in some.

Advantages and Disadvantages of a cryptocurrency demo account

A lot of cryptocurrency traders lose a lot of money if they jump in with both feet into trading such that they lose the opportunity to gain a lot during crypto bull runs or uptrends. Having a demo account fixes this by letting you save your hard-earned cash while practicing and, furthermore, improving your trading skills once you think you’ve practiced enough.

For beginners and new users alike, exchanges like Binance offers a lot of guides that can be used for trading. Topics covered include futures, leverage, spreads, bids and asks, satoshis, and many more. The knowledge gained from these can even be used in demo accounts, as real-time transactions would be reflected in your account. You’ll realize that from the plethora of cryptocurrencies available. A lot are illiquid, and some move quickly. Knowing what to trade and when to trade them is a great skill that you can develop with your demo account.

Even though trading cryptocurrencies might sound difficult because of all the new terminologies and jargon you’ll read, brokers and exchanges that offer demo and live accounts to trade usually have simple interfaces and applications. Learning how to trade with cryptocurrency is actually a great start because of the volatility. Trading using charts for cryptocurrency that moves ten times faster than stocks allows one to familiarize themselves with patterns and even risk management quickly.

One of the few disadvantages of a cryptocurrency demo account is that instead of building confidence, you might get too careless, given that that is what usually happens to cryptocurrency traders. Having win streaks don’t mean that you’ll continue them until the end of the trend. A lot of traders lose money overleveraging and using too much margin, thinking that they won’t ever be wrong.

Although an advantage to some, the volatility that crypto pairs innately have due to small market float can have a negative effect, and this affects the patience of traders that are planning to trade less volatile assets in the future. It would cause them to either exit or enter a trade earlier than usual, which could cost them added losses.

Out of the thousands of possible cryptocurrencies available, it is a fact that you cannot trade every single one of them on a single broker simply because some cryptocurrencies are just being established and can only be purchased through an unregulated third-party website. This applies to both live accounts and demo accounts.

How to trade cryptocurrencies

When trading cryptocurrencies, it is best to start fresh since, usually, you won’t be using terms such as lots and pips that are used a lot in trading stocks and forex, respectively. One of the major differences in trading this asset class compared to the rest is the existence of crypto pairs which will be discussed later on.

To start trading using a demo account, you need first to ensure that your chosen broker or exchange provides a test-net or demo account because you also need to create a virtual cryptocurrency wallet that you will use to hold your virtual currencies. Once you already have a wallet, you’ll be given virtual cash in the form of either Tether, Bitcoin, Binance Coin, or another cryptocurrency, depending on your chosen broker.

As mentioned earlier, in the cryptocurrency world, crypto pairs are a common sight. Traders are able to trade multiple cryptos against other major cryptocurrencies such as Bitcoin, Ethereum, and Binance Coin. If you prefer to trade using USD, exchanges offer Tether, the cryptocurrency version of the US Dollar. There are other variations of financial currencies, so explore them when you can.

Trading cryptocurrencies vary a bit depending on the kind of trade you’re going to do. The most common type of trade is spot trading, in which you buy the underlying cryptocurrency and hope it goes in your favor. Some offer cryptos as CFDs in which you can either go long or short, depending on your outlook. Exchanges like Binance offer perpetual contracts as futures aside from quarterly contracts.

Despite all the confusing terms and types of trades, trading these are relatively simple. The interface usually shows the market depth or the bid and ask table in which real-time traders put in their orders. To place your own order, you must first decide what crypto pair you want to trade. It could be against the tether, BTC, or something else but be sure to have that currency. For example, if you want to trade ETH/BTC, you must have BTC. Although some exchanges automatically convert the equivalent currency, you should be sure if your chosen broker offers that service.

After that, you could set your desired leverage for your trade. You’re also able to use a margin that could be either cross margin or isolated margin.

The price of the crypto you want to buy should be dependent also on the currency it is measured against. Double-check if you have selected the crypto pair before you input the desired volume of your purchase or trade. Once you have confirmed that all details are correct, enter your trade.

Tips and tricks

Crypto pairs give an advantage to those that would like to hold these significant cryptos in the long run while gaining more of the same coin. Aside from this, one can easily find strong trends by looking at charts that are in an uptrend against the mentioned coins.

For illiquid crypto pairs and for brokers that only offer cryptocurrencies as an added asset class, spreads could be large and could burn a hole through your crypto wallet. It would be best to trade through an exchange that specializes in cryptocurrency, as they have enough liquidity to handle your trades.

Since crypto markets are so volatile, you must be prepared mentally for whatever downsides may occur to prevent you from making unplanned trades. Most crypto pairs also move when Bitcoin moves, so you can use that as a gauge to go long.

One of the biggest downsides to trading cryptocurrencies is their bear market. Once Bitcoin enters the bear territory, it usually takes months to years to recover, and during this period of time, altcoins also have very little movement and are choppy. These will lead to a lot of trades that are just ranging rather than the usual uptrends that crypto traders love.

During bull runs, it is best to trade only the top 20 coins by trade volume. This ensures that you are trading with the crowd rather than against it. Your chances of gaining improve exponentially, and there are lesser chances of a flash crash happening.

FAQ – The most asked questions about cryptocurrency demo accounts:

What is the purpose of opening a cryptocurrency demo account?

A cryptocurrency demo account is essential for beginners like you who want to boost their trading knowledge. You can try the efficiency of your trading strategies before you trade. Professional traders may also need a demo account to fine-tune their trading strategies.

Does a professional trader need a demo account to trade cryptocurrencies?

A cryptocurrency demo account is essential for both novices and experienced traders. If you are new to the trading world, a demo account can help you start trading cryptocurrencies confidently and without risking your money. If you are an experienced trader, the demo account can help you hone your trading skills further without taking risks.

How can a cryptocurrency demo account help me in crypto trading?

A cryptocurrency demo account can help you learn trading skills in a secure environment. You can trade cryptocurrencies with fake funds and hone your trading skills at your speed, making you completely equipped for live crypto trading.

Will a cryptocurrency demo account provide me with any valuable experience?

A cryptocurrency demo account can help you acquire a live market experience before you trade with real money.

Last Updated on November 11, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.6 / 5)

(4.6 / 5)