Who is David Tepper? – History of the trader and investor

Table of Contents

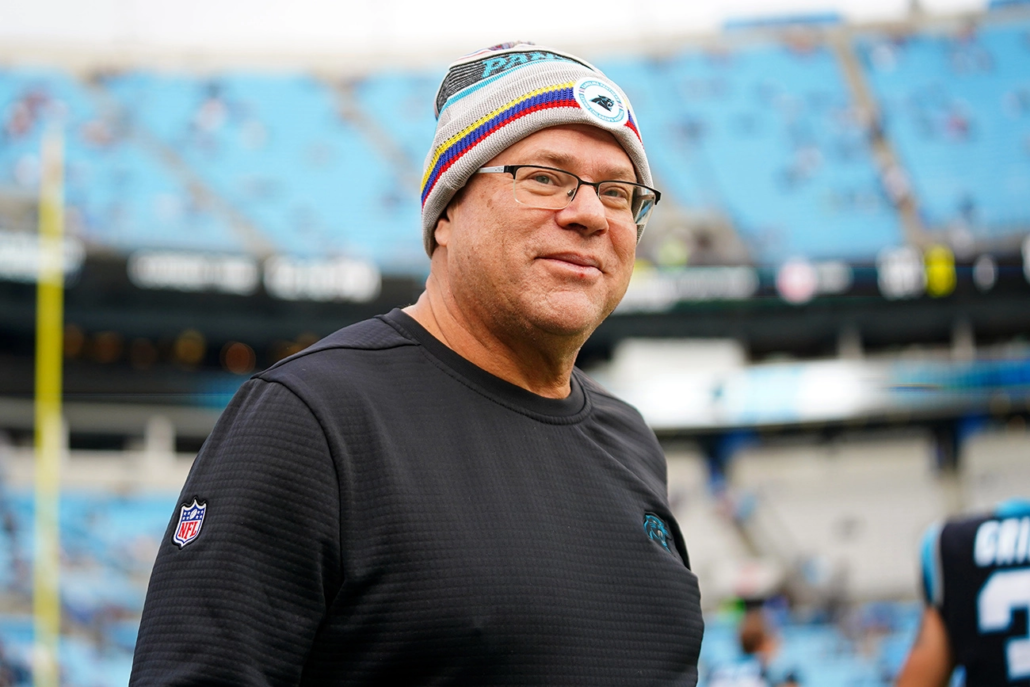

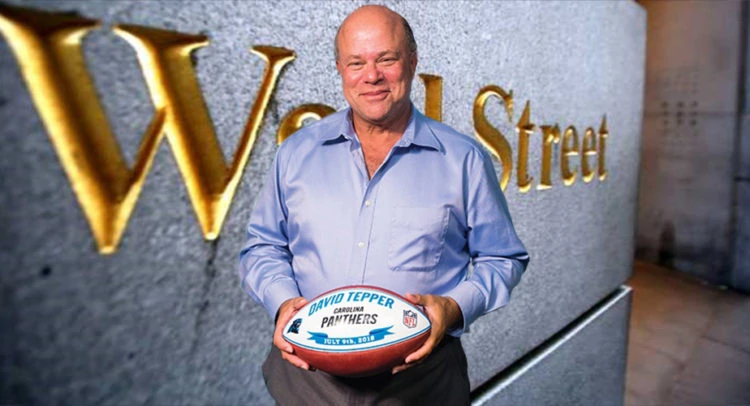

David Tepper is a billionaire investor and the owner of the Carolina Panthers. The investor rose to prominence by fetching himself great returns on investments.

David Tepper has a great trading journey with plenty of lessons for beginners. He is a great trader who started small and eventually accumulated profits to become a billionaire in America.

In addition, David Tepper also established the Appaloosa hedge fund. Mostly, David’s trading strategies revolve around event-driven trading. He is inspired by deep-value trading. Let’s explore David Tepper and his trading strategies.

About David Tepper

Date of birth: | 11.09.1957 |

Wealth: | 18.5 billion USD |

Strategies: | – event-driven trading – trading requires patience – researching the market will allow traders to spot the best opportunity – traders should keep their emotions separate when building trading strategies – trading only in the stock market might not reap traders the desired profit – stop trading for only money |

Website: | |

Interesting facts: | – highest-earning manager of any fund management service – President of Appaloosa management – he possesses a photographic memory – worked at Goldman Sachs – specialized in bankruptcy |

- David Tepper is a billionaire and the President of Appaloosa management

- David’s global hedge fund has its office in Miami Beach, Florida

- The trader is a bachelor’s in economics. He got his economics degree from the University of Pittsburgh

- David Tepper is also known for his great donations. He donated $67 million to a business school

- According to Alpha, David Tepper is a hedge fund manager. Even Forbes ranked David as the highest-earning manager of any fund management services

- The annual earnings of David’s hedge fund stand at US$1.5 billion

- David is nothing less than a hero in the trading industry

- Traders might even hear David is regarded as a golden god

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Biography of David Tepper

- The trader was born in 1957

- David Tepper hails from Pittsburgh, USA

- He completed his graduation in economics from the University of Pittsburgh

- David Tepper belongs to a Jewish family

- According to David, he possesses a photographic memory

- David Tepper began small-scale investing during his college time. He invested his money in various small markets

- Once David graduated, he took on to work in the finance industry. Equibank offered the trader the job of credit analyst. He worked in its treasury department

- However, David Tepper felt unsatisfied with his job. Finally, he enrolled at Carnegie Mellon University. Here, the perceived Master of science in industrial administration

- After the trader’s MBA or MSIA, Tepper started working at republic steel

- In 1984, David Tepper joined Keystone mutual funds

- By the year 1985, the trader had started working at Goldman Sachs. His position in this company was that of a credit analyst

- Because of his exceptional trading skills, David became this firm’s head trader. He had held this position for eight years

- During this time, David Tepper specialized in bankruptcy

- The credit for the survival of Goldman search stands for debit temper. The company suffered greatly after the 1987 stock market crash

- When the market sentiment was right, he invested the company’s money and some underlying bonds, which skyrocketed in value

- Finally, Tepper quit his job at the firm and started Appaloosa Management

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

The net worth of David Tepper

The traders stand among the wealthiest traders in America. As per Forbes, David Tepper owns a net worth of US$18.5 billion. The traders stand at 79th rank on the list of richest people in the world.

Good to know!

David Tepper leveraged other people’s capital. He implemented trading strategies on such capital and compounded the money. So, David Tepper contributed significantly to making the investors rich. His investing skills attracted more capital to his hedge fund.

Trading and investment strategies of David Tepper

David Tepper follows some trading strategies that come in handy to compound money while trading. All traders can learn significantly from David’s trading skills.

Here are David Tepper’s trading strategies that helped him achieve a net worth of US$18.5 billion.

Identify opportunities

It’s uncanny for traders to become rich with only one trading decision. Becoming rich by trading requires patience. Usually, it is arguable for any trader to devise the best trading idea at once.

Good to know!

Research well

A trader cannot spot opportunities in the trading world if he does not research well. Researching the market will allow traders to spot the best opportunity. Also, an investor can use his trading ideas in the best possible way.

Keep emotions away from investment strategies

Undoubtedly, feeling sentiments in a fearful economic environment is inevitable. However, these emotions can cloud traders’ judgments. Hence, traders should keep their emotions separate when building those trading strategies.

Making emotional decisions might push a trader into more losses.

Investment diversification

David Tepper thinks traders should look at more than just investing in stocks. Trading only in the stock market might not reap traders the desired profit. Traders must invest in more than one underlying market to get favorable returns.

Good to know!

Patience

Patience is any trader’s key to building the right trading strategies. Even when a trader wishes to earn substantial returns in the market, patience will help him succeed.

Often, doing nothing might be hard for traders, but in the long run, it proves beneficial. A trader should always make conscious trading decisions.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What can you learn from David Tepper?

Successful traders like David Tepper offer a lot of lessons to traders. However, trading lessons that work well for you might not work well for another trader. A trader must determine his trading goal to implement the lessons he gets from David Tepper:

- A significant and crucial lesson a trader can learn from David Tepper is to refrain from doing it for only money. A trader must also consider other reasons one trading decision must be beneficial

- A trader must try to become competitive, but he should also know when to take or implement a trading decision

- A trader must build smart trading strategies like David Tepper to excel in trading

- According to David Tepper, a trader must develop or find his trading style

- Any trader must endeavor to stay in front of the herd

- However, a trader should always stay open to accepting his trading mistakes. Staying firm or not, accepting changes can push into more losses

- Like David Tepper, a trader must learn how to make their way back into the market and life. Setbacks are a way of life. They are inevitable. So, a trader should quit being disheartened about small losses

- Under pressurizing circumstances, a trader should keep his emotions in check

- Whatever happens in the trading market, a trader should stay nimble

- A sustainable trading plan includes one in which a trader tries to stay optimistic in the long run

- Also, traders should have fun trading their favorite stocks or underlying assets

Conclusion about the investing experience of David Tepper

David Tepper has inspired many traders to increase their wealth. The trader has very simple trading strategies and follows an optimistic approach. His trading skills and optimism have helped him build his net worth.

David Tepper believes in bouncing back into the market even after suffering losses. The trader could succeed in making his company a profit after the stock market crash. It proves that David Tepper possesses some excellent trading skills.

David Tepper has built an amazing portfolio with a mix of assets. He believes and diversification to minimize the risk of financial losses while trading.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – frequently asked questions about David Tepper

What kind of trader is David Tepper?

David Tepper is a great trader who follows an optimistic trading approach. The trader accumulated a net worth of billions of dollars. Value investing and looking for stocks that can generate higher returns in the future.

What is the best trading lesson from David Tepper?

The best trading lesson from David Tepper that any trader can use is trade diversification. Trade diversification can help any trader make money while one asset makes losses. It helps balance the profit and loss situation for any trader.

How much net worth does David Tepper own?

David Tepper owns a net worth of US$18.5 billion. David accumulated this wealth because of his trading potential. His risk management skills that are excellent helped him amass this wealth.

Last Updated on February 26, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)