Can you incur debt on your brokerage trading account?

You may want to boost your purchasing power as a good trader to make more money. You might consider borrowing money to trade, which you can do by creating debt on the brokerage trading account. However, when choosing such a course of action, it’s crucial to comprehend the risks and consequences of this technique.

We will discuss the idea of taking on debt on the brokerage trading account in this post, along with any potential advantages and risks.

Can you incur debt on your brokerage trading account?

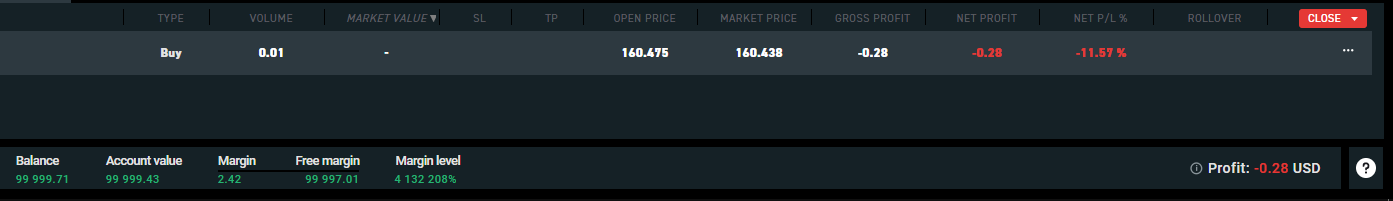

Yes, you can make debt on your brokerage trading account using margin trading. You can borrow money from your broker to improve your purchasing power and potentially increase your profits when trading on margin. In essence, leverage is a tool you use to increase the profits on your assets.

What exactly does it mean to incur debt on your trading brokerage account?

To enhance your purchasing power and potentially increase your profits, you can go into debt on your brokerage trading account by borrowing money from your brokerage company. A margin account is generally used, enabling you to borrow money from the broker to acquire assets. Your ability to borrow money is determined by the value of the securities you possess in your account. Your broker and the terms of your margin agreement will determine the interest rate you will pay.

For experienced traders wishing to leverage their positions and maybe make more gains, margin trading can be a potent instrument. However, big risks are also involved, so it must be done carefully. Before incurring debt on your brokerage trading account, it’s critical to have a clear understanding of the advantages and drawbacks of margin trading and a well-thought-out trading strategy.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Advantages of incurring debt in your trading account

- Improved purchasing power

- Flexibility

- Possible tax advantages

Improved purchasing power

One of the main advantages of taking on debt on the brokerage trading account is that it might improve your purchasing power, enabling you to take bigger positions in the market. If your trades are profitable, this could result in increased earnings.

Flexibility

Moreover, margin trading offers more flexibility and the capacity to seize transient trading chances. You can swiftly enter and exit positions by borrowing money from your broker, perhaps profiting from market changes.

Possible tax advantages

The interest on margin loans may occasionally be tax deductible. This may be advantageous for business owners who want to lessen their tax obligations.

Risks of incurring debt on your trading account

- Increased risk

- Margin calls

- Interest charges

Increased risk

Debt might raise your risk exposure, one of the major risks of trading on a brokerage account. If the market does not align with you, you will quickly suffer substantial losses that might be challenging to overcome.

Margin calls

You must keep a certain level of equity in your account when trading on margin. A margin call could occur if the value of your account drops below this threshold, in which case you would have to add more money into the trading account or risk having all positions liquidated.

Interest charges

Margin loans frequently have interest fees attached, and these costs can mount up quickly if you hold positions for a long time. This could reduce your trading profits and raise your overall costs.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Strategies for risk control when incurring debt on the brokerage trading account

When engaging in margin trading, it is crucial to have a sound risk management strategy in place, given the dangers associated with incurring debt on the brokerage trading account. Here are some pointers to help you efficiently manage your risk:

- Use stop-loss orders

- Increase portfolio diversity

- Manage your leverage

- Create a trading strategy

Use stop-loss orders

Stop-loss orders close your position automatically if the market moves against you, which can help you reduce your potential losses.

Increase portfolio diversity

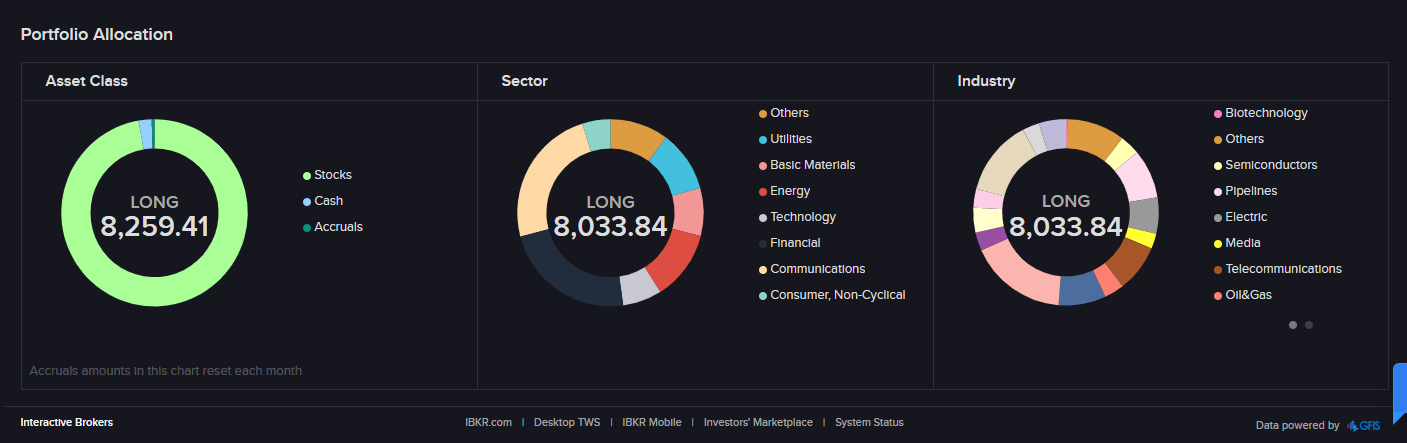

By diversifying your portfolio, you may spread out your risk and lessen your exposure to any specific security or industry.

Manage your leverage

It’s critical to manage your leverage wisely and limit your risk exposure. One approach to achieve this is maintaining a leverage ratio normally no higher than 2:1.

Create a trading strategy

You can stay focused and disciplined with a good trading plan and make better trading decisions as a result.

Conclusion about debt on your brokerage trading account

For investors aiming to boost their returns, margin trading may be a powerful instrument, but it’s crucial to comprehend the dangers and trading principles involved. Investors can borrow money to buy stocks by creating a margin account and preserving the necessary level of equity. Still, it’s essential to remember that if the securities’ value declines, you might be obliged to deposit more money or close some open positions.

The regulatory framework and the interest and costs related to margin trading should also be considered. It is important to realize that not all investors should engage in margin trading and that you should have sufficient expertise and knowledge of the dangers associated before doing so. Always read, comprehend, and abide by the brokerage firm’s terms and conditions and the applicable regulations.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Last Updated on June 18, 2023 by Yuriy Kunets