How to buy the EOS coin – Trading tutorial for beginners

Table of Contents

EOS (Ethernet over Sonnet) is a powerful blockchain-based infrastructure for developing, maintaining, and running decentralized applications. In this article, we will cover everything you need to know about EOS. It is important to have a clear understanding of what EOS is before you start buying EOS tokens.

What is EOS?

EOS (Ethernet over Sonnet) is a powerful blockchain-based infrastructure for developing, maintaining, and running decentralized applications. EOS is the idea of Dan Larimer, who founded Bitshares and Steemit. Like Ethereum, it provides an operating system that simplifies the process of building decentralized applications, commonly known as DApps. However, unlike Ethereum, EOS aims to increase scalability and flexibility to make it easier for developers to create decentralized applications.

Decentralized applications run on decentralized P2P network servers. Unlike other applications, there is no need for third parties or intermediaries to take action. Instead, they contact the seller’s consumer directly. EOS is the proprietary cryptocurrency for the EOS.IO blockchain protocol. Cryptocurrency promotes online transactions that developers can use to create decentralized applications called dapps programs that run on multiple computers.

The EOS.IO protocol was created by the private company block.one and launched as an open source network in June 2018. EOS.IO helps individuals and businesses develop blockchain-based applications and smart contracts. Create a secure and accessible online platform. For this reason, EOS.IO can be considered as the Apple App Store.

These are the main unique selling points of EOS:

- Scalability: The EOS network is scalable because it can support thousands of commercial decentralized applications at once. The network can also handle millions of transactions per second with asynchronous communication.

- No transaction fees: Unlike other blockchain projects that charge humans a transaction fee, EOS allows people to access blockchain resources based on their EOS token holdings. However, independent application developers generally record low transaction fees.

- Management: Block makers not only have the power to decide which transactions are confirmed on the blockchain, they can change the EOS system or the source code. This means that society can downgrade or repair faults in the system.

- Molding block: In the EOS network, a delegated block producer creates a block every 3 seconds. The fact that a limited member of the network representative produces blocks at any given time means that the blocks are resolved into 21 packages.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How does EOS work?

EOS.IO works by granting specific rights or shares to each member based on the number of EOS tokens held. This is called the ticket owner model. Each network member or “node” can choose a representative to deliver the blockchain using a system called Delegated Proof of Stake (DPoS). Individuals are recorded on one of several EOS blockchains after negotiations with EOS tokens and approval by DPoS.

Simply put, EOS is an internet-compatible architecture. It acts as software that allows developers to build decentralized applications with blockchain technology. The EOS network is designed to meet the performance requirements of decentralized applications in terms of interacting with millions of people at any given time. Unlike other platforms used for DApps, EOS does not charge any fees. It is also scalable and low latency, allowing transactions to be evaluated in the millions per second.

The EOS network uses DPOS as a consensus algorithm for blockchain protection along with Delegated Proof of Stake. Unlike proof-of-work (POW) or proof-of-stake (POS) algorithms, only those who hold tokens on the blockchain with EOS.IO software can vote for a block producer. Delegates can create blocks based on the number of votes received in relation to other producers.

Authorized manufacturers create a block on the EOS blockchain every 3 seconds. The network rewards the block producers with tickets instead of the transaction fee for each block created. Unlike miners who solve complex puzzles, EOS relies on people and voices to defend the blockchain.

EOS Tokens

In addition to open-source software, there are EOS tokens that power the network. Tickets were announced on Ethereum. You can use your own cryptocurrency and exchange it for other cryptocurrencies.

However, the main goal is to keep the EOS ecosystem running. Anyone who wants to develop decentralized applications with the EOS blockchain will need to own some EOS to manage their networking needs. To run the program, you will need disk space, processor, time, and RAM. Block makers must first purchase server time with EOS tokens to release capacity 3.

The EOS network is like a decentralized operating system that allows developers to create applications. It is powered by EOS coins that work with server resource requirements. Developers need EOS coins to access and use the EOS blockchain.

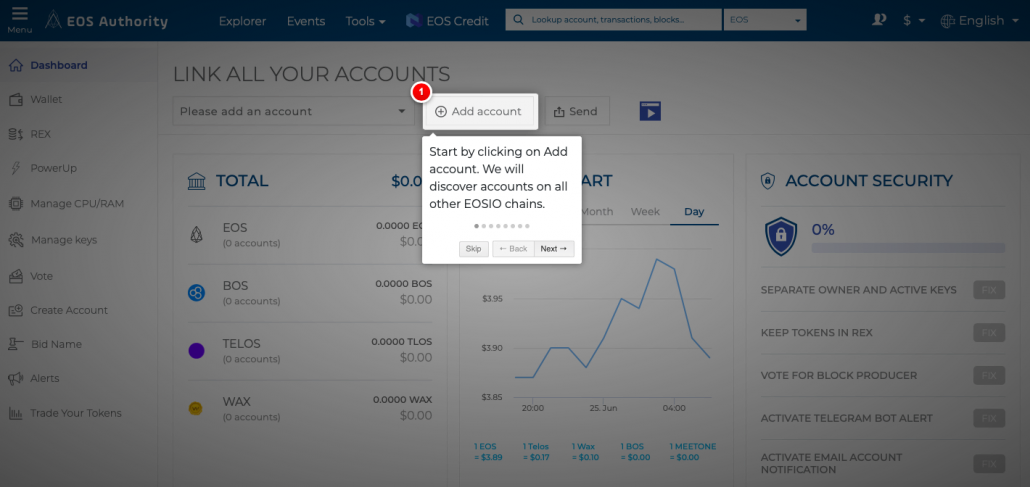

How to buy EOS

There are several ways to purchase EOS tokens to access the tools and resources needed to build decentralized applications on the EOS blockchain. The first step to owning an EOS is to own a functional digital wallet that can be used to store purchased assets. There is currently no official EOS wallet, so you will have to rely on third-party wallets.

Given that EOS uses ERC-20 tokens, tokens can be stored in any ERC-20 compatible wallet.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

EOS Desktop Wallet

Jaxx and Exodus are some of the most popular desktop wallets for EOS storage. The fact that both are wallets with multiple cryptocurrencies means they can be used on Windows, Mac, and Linux. Jaxx is also available for Android and iOS devices. Exodus is a free desktop wallet with convenient features. It comes with a live chat feature that allows you to quickly and easily check the value of your EOS assets.

On the other hand, Jaxx is suitable for beginners because it is flexible and easy to use. Compatible with iOS and Android devices and continues to be available through the Chrome browser extension. Jaxx also comes with a basic 12-word wallet for wallet recycling. Another important advantage of using two wallets is that they have a ShapeShift feature that makes it easy to trade human-obtainable ERC-20 tokens.

Web wallet

Web wallets are the best because you can safely store your tickets on your computer rather than on the Internet. MyEtherWallet is an EOS open-source wallet that stores a user’s private key on a computer. MyEtherWallet is one of the best because it gives users complete control over their information.

Mobile wallet

Mobile wallets are useful when someone wants to access EOS assets through their smartphone. The Jaxx wallet supports iOS and Android devices, so it is suitable for this case.

Hardware wallet

These types of wallets use hardware to protect tickets and provide some kind of cold storage. Trezor is perfect in this case because it has multiple security levels that can operate without certainty.

Trezor comes with a 4-digit PIN code designed to protect your personal property from unauthorized access. It also has 24 words that is useful in case someone loses their wallet or forgets their PIN. Other layers of security that may be useful include encrypted passwords and password deletion. It is one of the most expensive digital wallets, as you have to spend $104 to use this wallet.

What to look for in an EOS wallet:

- Security: In a world where hackers are constantly looking for niches to steal tickets, security should be paramount when choosing an EOS wallet. So anyway, it’s important to analyze what security features your wallet has. In this case, you need things like two-factor authentication and advanced encryption.

- Private key: EOS wallets must be able to support private keys to send and receive tickets. A good wallet is one that allows you to keep control of your private keys.

- Continuous development: A wallet that is constantly evolving with new features will be perfect given that the cryptocurrency environment is changing every day. Hackers are getting stronger every day, so you need to develop your wallet as well.

- Reviews: Before transferring your EOS wallet, it’s important to pay attention to what others have to say about your EOS wallet. Always pay attention to things like security flaws in your reviews and talk to your customer service and development team.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Look out for a cryptocurrency exchange

Cryptocurrency exchanges act like a stock market where you can buy and sell many digital currencies. After setting up your digital wallet, the next step in buying EOS tickets is to visit a cryptocurrency exchange.

Buy EOS on Binance

Binance is one of the largest and most respected cryptocurrency exchanges with a variety of altcoins, including EOS tokens. Unlike other trades, Binance accepts cryptocurrency only by buying other altcoins.

After opening a Binance account, check to see if you have Bitcoin or ETH to buy EOS.

Buy EOS on Kraken

Kraken‘s cryptocurrency accepts a wide range of payments, making it one of the best exchanges to buy EOS tokens. For example, you can purchase tickets in addition to other digital currencies using fiat currencies such as US dollars, euros, and pounds.

It is easy to register an account on a cryptocurrency exchange and charge low transaction fees.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Buy EOS with ShapeShift

ShapeShift provides an easy way to own EOS tickets anonymously. Unlike all other cryptocurrency exchanges, you don’t need to register an account with ShapeShift. You can choose the cryptocurrency you want to exchange on the exchange website, in this case, it could be Ethereum Bitcoin, etc.

Then you need to choose the cryptocurrency you want, in this case, it will be EOS. When everything is ready, ShapeShift will create a deposit address after the deposit.

Buy EOS with fiat currency

Currently, it is not possible to purchase EOS with fiat currency. All you need to do is visit an exchange like Coinbase and use your fiat currency to buy ETH or BTC. Once you receive BTC or ETH, you can use it to buy EOS on one of the major cryptocurrency exchanges.

Coinbase and CEX.IO are two exchanges where you can use your credit or debit card to purchase your chosen exchange rate. For example, you can buy EOS by buying BTC or ETH and then transferring them to another exchange such as Binance.

Please note:

After purchasing the desired number of EOS tokens on a cryptocurrency exchange, it is important to transfer them to a secure cryptocurrency wallet. Do not leave the exchange as it is most susceptible to hacker attacks. Cryptocurrency wallets protect your assets if the stock market goes bankrupt or gets hacked.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Ethereum Compared to EOS

Ethereum and EOS are very popular in their efforts to harness the power of blockchain technology, but they are also very different.

Programming language

Developers looking to develop decentralized applications on Ethereum must be aware of resilience, a programming language in which their applications run online. The limitations of programming languages are considered one of the reasons many developers avoid the web.

On the other hand, EOS is compatible with any programming language as long as it can be embedded in a web device. Most web developers use C++, an attractive and popular programming language.

Consensus Protocol

Ethereum runs on a proof-of-work consensus protocol that can process an average of 15 transactions per second. The downside of the protocol is that it is not possible to recover from a failed distributed application on the network. EOS, on the other hand, relies on decentralized sharing tests that eliminate many of the problems faced by the Ethereum network. This protocol allows developers to freeze the network when the application is not working.

One of the advantages of DPOS is that EOS can average 1,000 transactions per second.

Network economy

The EOS network operates on its own model in which EOS tokens provide a proportional share of network performance, storage and processing power. In addition, there are no transaction fees and there are no developer fees other than the original EOS token. Ethereum, on the other hand, works as a rental model where gas is billed in exchange for all decommissioning, storage, and bandwidth. Since miners can choose the highest paying transaction, the transaction fee is not fixed, as it constantly fluctuates.

What is the token owner model?

EOS.IO works through a symbolic ownership model called sharing, in which all block manufacturers participating in the EOS network receive resources equivalent to the number of EOS tokens owned. The EOS.IO platform does not require transaction fees. Instead of paying individually for each transaction, the block producer receives a set of bills based on the number of tickets he holds. Let’s say a block manufacturer holds 15 EOS tokens and is entitled to the number of transactions on the network proportional to this percentage. To get more transactions, all members need to do is buy more EOS tokens or create a blockchain for winnings.

Each transaction creates its own block on the blockchain network. Blocks are generated every 3 seconds in EOS and are generated in units of 21 blocks. Only one producer guarantees block generation at any given time, so if the transaction is not processed at the scheduled time, it will be canceled. Even if only 21 blocks are generated in one round, the platform can process thousands of transactions per second without the transaction cost of the chain, since the network operates on multiple blockchains.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

What is Delegated Proof of Stake (DPoS)?

Delegated Proof of Effort is an EOS network consensus mechanism, which is how transactions are approved on the network and added to the blockchain. The difference between EOS and other platforms is that consensus users are responsible for consensus. Blockchains such as Bitcoin and Stellar require most participants to approve transactions, but on the EOS network, only 21 blockchain vendors can edit the chain.

EOS makers can claim to be block makers. The EOS network randomly selects 21 candidates during the selection process. Anyone with a ticket on the blockchain using EOS software can vote at any time, but the voting strength of each EOS investor depends on the stake and the timing of issuance. Votes less than a week have the highest weight, and votes longer than two years are not weighted.

When these 21 block vendors are selected, they are responsible for network security and transaction authorization. It will be replaced if the block generator does not work fast enough or if network support fails or is lost.

Why are there multiple blockchains on EOS?

EOS has multiple blockchains, such as a public ledger that records transactions, allowing the network to operate quickly and efficiently. The stock chain, called the side chain, uses the same software and cryptocurrency as EOS.IO. This creates a network of interconnected ledgers that can send information together, allowing transactions to be recognized on one chain or another.

Many other cryptocurrencies only work on one chain, so transactions can block the network and cause scalability issues. Because EOS uses multiple chains, this problem is greatly reduced and dApps can run smoothly. With multiple side chains, thousands of transactions can be performed simultaneously and the process is smoother (unlike most nodes) as only 21 participants are required to authorize the blockchain.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

4 steps to EOS trading

Deciding how to trade EOS

There are two ways to take an EOS ticket sales position. It is a purchase on the stock exchange or exchange for a derivative price. When buying EOS, you can buy cryptocurrency directly, expect the price to rise, and sell at a higher price. For this you will need an account with a cryptocurrency exchange, this process can be time-consuming and may include the cost of running the account or completing the transaction.

If you choose to trade EOS, you will be guessing the price movement without taking ownership of the underlying currency. You can do this with derivatives like CFDs. Both can take positions in rising and falling prices referred to as “long” and “short”. When trading CFDs, it is agreed to exchange the EOS price difference from the start of the operation until the closing. Profits or losses depend on accurate market direction forecasts.

What are CFDs?

CFDs are leveraged products, so you only need a few deposits to get a full market position. Leverage can increase your profits, but it can also increase your losses, so it’s important to have an appropriate risk management strategy in place.

Develop a trading plan and describe your strategy.

Before opening a job on EOS, it is important to have a trading plan that will help you determine the direction of the market. Your plan should be unique to you, but most trading systems include:

- Goal: Your plan should take into account the daily, weekly, and monthly goals of the transaction and decide exactly what you want to get from each job.

- Market: Whether it’s EOS, another cryptocurrency, or a completely different asset class, you should list all the markets you’re interested in or are comfortable with.

- Dangers: The plan should also include a risk profile, including the amount of capital you have and how ready you are to take on each transaction.

You also need to develop a trading strategy that explains exactly how to get into and out of your business. When choosing a trading strategy, you need to consider the type of trading you prefer: same-day trading, scalping, swing trading, position trading. The cryptocurrency market is well known for its volatility that can create an interesting trading environment, but it also requires a risk management strategy.

Creating strategies to help manage risk and reduce unnecessary losses is an important step for any trader. This should include adding stops and restrictions to your work to protect your business.

First open the website and track it.

It’s time to open your first job at EOS. If you choose to trade EOS instead of buying on the stock exchange, you can buy or sell. If you think the price of EOS will go up, you open a place to “buy” EOS, and if you think EOS will collapse, you “sell” cryptocurrencies.

The decision on which position to take should be based on market research and analysis, as well as the strategy adopted. Once you start working, it’s important to track your progress and be aware of anything that could affect EOS prices.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What factors influence the price of EOS?

EOS quantity

Initially, a total of 1 billion EOS tokens were created. 10% of these were still in the way. Twenty percent were sold during the first coin offering (ICO), and the rest was distributed through current sales. Total EOS token offers are steadily increasing by 5% annually.

The infinite nature of the EOS offering means that the token has not reached as high a rating as some major cryptocurrencies. Even outside the crypto sphere, finite resources such as gold are generally more valuable than resources with unlimited access. However, if the demand for EOS token increases, the market price may rise.

Public opinion

In general, public perception of EOS and the cryptocurrency space can have a major impact on market prices. Media reports that EOS is useful and stable creates a perception that EOS is valuable, and therefore the market price is likely to rise further. Negative reports can undermine public awareness of EOS and lower prices. Check out the latest news and events from the cryptocurrency market in the News and Trading Ideas section.

Increased adoption

As the use of blockchain expands and more companies start adopting this technology, the market price of cryptocurrency may rise. And if EOS successfully positions itself as a leading platform for decentralized applications, the token could get more attention.

The cryptocurrency market is still very young and little known to most people. However, if more financial institutions and large corporations support the cryptocurrency market, it could affect the price of numerous coins. The opposite is also true. If the EOS platform does not trigger market interest or does not meet the increased regulation, it can negatively impact EOS prices.

Other cryptocurrencies

EOS is called the “Ethereum Killer” because it competes for decentralized application developers and projects like Ethereum. More established blockchains, including Bitcoin and Ethereum, suffer from transaction speed issues, but EOS has high scalability. Indeed, EOS aims to address these issues by providing support to millions of users without excessive transaction fees.

If EOS attracts the attention of Ethereum users or other users of the decentralized application platform, it could be more widely accepted. But the market value remains in the ether, so it’s still a long way.

Summary on EOS transaction

Trading in the cryptocurrency market requires careful planning and preparation. Here are a few important things to remember before shopping with EOS:

- EOS is the proprietary cryptocurrency of the EOS.IO network, a blockchain platform that allows developers to create decentralized applications.

- EOS.IO works according to the ticket holder model. Each user purchases a certain number of EOS tokens, which corresponds to the “interest rate” that determines the number of transactions.

- EOS transactions are approved using a proportional delegation model in which blockchain manufacturers vote for 21 representatives to support the blockchain.

- EOS works with multiple block chairs to avoid scalability issues.

- Before starting a job on EOS, you need time to decide whether to buy or exchange cryptocurrency and plan your trading.

- When trading with EOS, you can manage your risk with stops and limits.

- Key factors such as EOS adoption, public opinion, widespread use, and popularity of other cryptocurrencies can affect EOS price.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about EOS :

Can EOS be considered as a good cryptocurrency?

EOS is one of the greater cryptocurrencies with a good supply of over 1 million tokens native to the EOS. It has a good ranking of currently being in the top 23 cryptocurrency assets when measured by market capitalization, which makes it enter into the stage of one of the top cryptocurrencies that are operational in the world. EOS has the most positive growth, and it is expected to do extremely well in the long term.

What is the average price of EOS?

EOS is currently rising at steady growth with a positive outlook for the long term. Its current value is 0.88 US dollars. It is marked as one of the best cryptocurrencies in the world, with a positive future.

What is the purpose of EOS?

EOS.IO is a digital blockchain that houses EOS as its cryptocurrency. It is a platform based on smart contract technology that wants to process a huge number of transactions per second, and it also aims at eliminating any transaction fees. It offers clients great features like secure access and authentication, usage management, permissions, communication between the internet and apps, and data hosting. A web toolkit supports EOS that wants to provide app development functions without any hassle.

See our similar articles about trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)